Global Transjugular Intrahepatic Portosystemic Shunt Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD9328

December 2024

83

About the Report

Global Transjugular Intrahepatic Portosystemic Shunt (TIPS) Market Overview

- The Global Transjugular Intrahepatic Portosystemic Shunt (TIPS) Market is valued at USD 1.5 billion based on recent analysis, highlighting a consistent demand for advanced shunt technologies. Market growth is primarily driven by an increase in liver cirrhosis cases and the demand for minimally invasive procedures that reduce patient recovery time and hospital stays. Additionally, innovations in shunt material and design have made TIPS procedures more accessible and safer, thus supporting market growth.

- The market sees a high concentration in countries like the United States and Germany, where advanced healthcare infrastructure, high healthcare expenditure, and access to skilled medical professionals support the adoption of TIPS. The presence of key medical device manufacturers and high prevalence of liver disease in these countries further drives their market dominance.

- FDA approvals and guidelines play a crucial role in shaping the TIPS market. The FDAs rigorous regulatory standards ensure that only the safest and most effective shunt devices are available in the market, as detailed in recent FDA reports. These guidelines help maintain high procedural standards and patient safety.

Global Transjugular Intrahepatic Portosystemic Shunt (TIPS) Market Segmentation

By Product Type: The TIPS market is segmented by product type into stent-based systems, balloon catheters, and accessory kits. Stent-based systems hold a dominant market share due to their effectiveness in creating a long-lasting shunt and minimizing post-procedure complications. The adoption of self-expanding stents, especially in North America and Europe, contributes to the significant market share of this sub-segment.

By Application: The market segmentation by application includes portal hypertension, variceal bleeding, ascites management, and Budd-Chiari syndrome. Portal hypertension is the leading application segment, driven by the high prevalence of cirrhosis-related complications. TIPS is increasingly preferred for managing portal hypertension, providing a minimally invasive solution with sustained effectiveness.

By Region: Geographically, the TIPS market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates due to high healthcare spending, the prevalence of liver disease, and advanced interventional radiology infrastructure. Europe closely follows with significant market penetration due to supportive reimbursement policies and technological advancements.

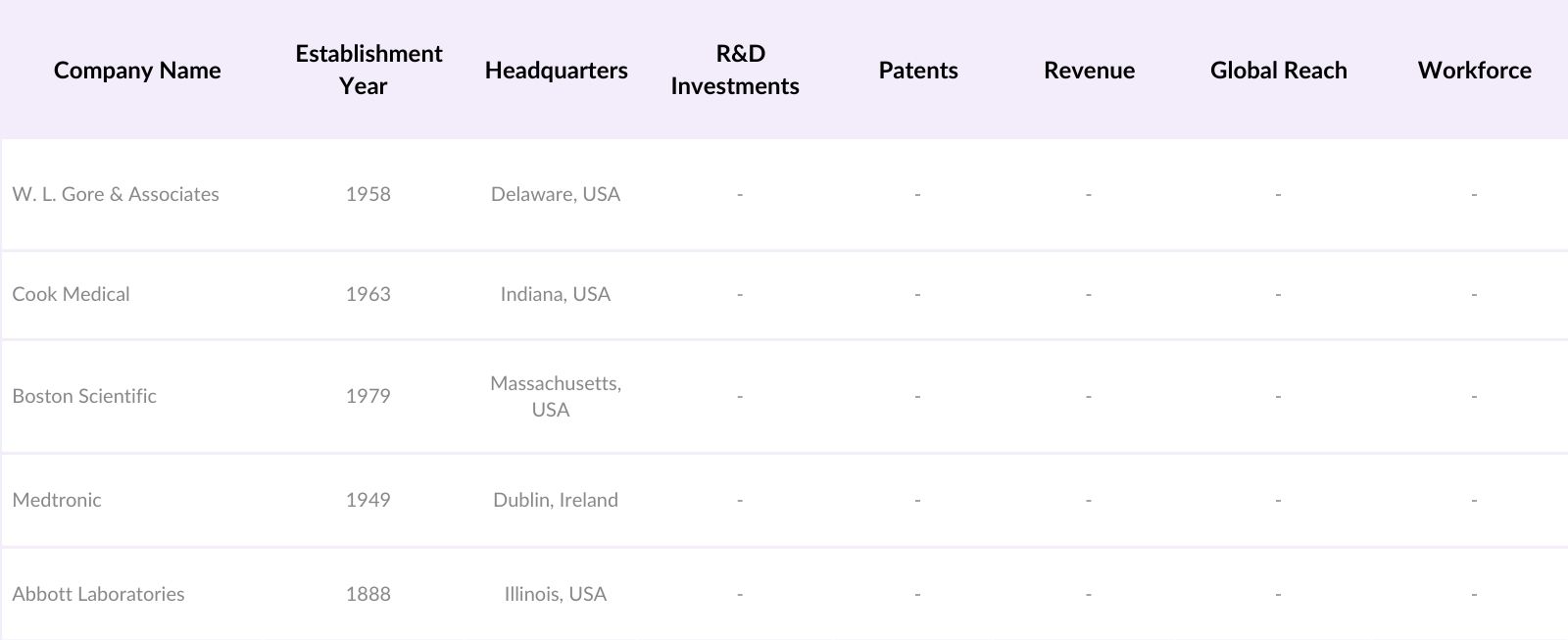

Global Transjugular Intrahepatic Portosystemic Shunt (TIPS) Market Competitive Landscape

The TIPS market is dominated by key players that bring a combination of innovation and wide distribution networks. This consolidation highlights the influence of companies with expertise in interventional radiology and minimally invasive solutions.

Global Transjugular Intrahepatic Portosystemic Shunt (TIPS) Market Analysis

Market Growth Drivers

- Increasing Incidence of Liver Cirrhosis: Liver cirrhosis has been identified as a critical driver for the Global TIPS market due to its rising incidence. According to the World Health Organization, liver cirrhosis accounts for approximately 1.2 million deaths globally each year. This prevalence underpins the growing demand for effective management options such as TIPS, especially in regions with higher alcohol consumption and hepatitis infections. These macroeconomic health indicators highlight the urgency and demand for advanced liver disease management solutions.

- Advanced Diagnostic Imaging Integration: The integration of advanced diagnostic imaging techniques, crucial for precise TIPS procedures, continues to drive market growth. As per data from the International Finance Corporation, investment in healthcare infrastructure including diagnostic services in emerging markets was slated to exceed $250 billion by the end of 2023. This substantial investment supports the adoption of high-end imaging technologies essential for TIPS, enhancing the procedural accuracy and outcomes, thus propelling the market forward.

- Rise in Minimally Invasive Procedures: The shift towards minimally invasive procedures globally acts as a significant growth driver for the TIPS market. Data from governmental health bodies suggest that minimally invasive surgeries are preferred due to lower infection risks and quicker recovery times, accounting for over 65% of all surgical interventions in developed countries. This trend is supporting the uptake of TIPS procedures, which are less invasive compared to traditional open surgeries for portal hypertension.

Market Challenges

- Complication Rates and Safety Concerns: Despite technological advancements, the TIPS procedure is associated with high complication rates, such as shunt dysfunction and hepatic encephalopathy, which poses challenges. Statistics from health regulatory bodies show that complication rates can affect up to 30% of patients undergoing TIPS, highlighting the need for ongoing improvements in procedure planning and execution.

- High Initial Costs for Specialized Equipment: The high cost of specialized equipment necessary for TIPS procedures remains a major market challenge. Government reports indicate that the initial setup cost for TIPS-capable facilities can be prohibitive, with investments often exceeding several million dollars, which limits the procedure's adoption, particularly in lower-income regions.

Global Transjugular Intrahepatic Portosystemic Shunt (TIPS) Market Future Outlook

Over the next few years, the Global TIPS Market is expected to experience significant growth due to continuous advancements in shunt materials, increased demand for minimally invasive treatment options, and the rising prevalence of liver diseases worldwide. Enhanced awareness among healthcare providers about the benefits of TIPS procedures is likely to drive adoption further.

Market Opportunities

- Growth in Emerging Markets: Emerging markets present substantial growth opportunities for the TIPS market due to increasing healthcare investments and rising healthcare standards. Investments in healthcare infrastructure and training in regions such as Asia and Africa are enhancing access to advanced medical treatments including TIPS, as supported by recent funding data from international development banks.

- Partnerships for R&D in Novel Shunt Materials: Partnerships between academic institutions and industry players for R&D in novel shunt materials are paving the way for next-generation TIPS solutions. Collaborative projects funded by government grants are focusing on developing more durable and biocompatible materials, as evidenced by recent publications from major research institutes.

Scope of the Report

|

Product Type |

Stent-Based Systems Balloon Catheters Accessory Kits |

|

Application |

Portal Hypertension Variceal Bleeding Ascites Management Budd-Chiari Syndrome |

|

End-User |

Hospitals Ambulatory Surgical Centers Specialty Clinics |

|

Material Type |

Nitinol Stainless Steel Polymer-Coated Materials |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EMA)

Banks and Financial Institutions

Hospitals and Healthcare Providers

Ambulatory Surgical Centers

Interventional Radiologists and Hepatologists

Medical Device Manufacturers

Research and Development Institutions

Distributors and Suppliers in Medical Devices

Companies

Players Mentioned in the report

W. L. Gore & Associates

Cook Medical

Boston Scientific

Medtronic

Abbott Laboratories

Merit Medical Systems

Becton, Dickinson and Company

Terumo Corporation

Teleflex Incorporated

Biotronik SE & Co. KG

Table of Contents

1. Global TIPS Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Performance Indicators (KPIs) in the TIPS Market

1.4 Market Segmentation Overview

2. Global TIPS Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Developments and Milestones in TIPS Procedures

3. Global TIPS Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Incidence of Liver Cirrhosis

3.1.2 Advanced Diagnostic Imaging Integration

3.1.3 Rise in Minimally Invasive Procedures

3.1.4 Technological Advancements in Shunt Devices

3.2 Market Challenges

3.2.1 Complication Rates and Safety Concerns

3.2.2 High Initial Costs for Specialized Equipment

3.2.3 Skilled Workforce Shortage

3.3 Opportunities

3.3.1 Growth in Emerging Markets

3.3.2 Partnerships for R&D in Novel Shunt Materials

3.3.3 Rising Adoption of TIPS for Refractory Ascites

3.4 Trends

3.4.1 Preference for Non-Surgical Interventions

3.4.2 Integration of AI in Imaging for Procedure Guidance

3.4.3 Expansion in Geriatric Liver Disease Management

3.5 Regulatory Landscape

3.5.1 FDA Approvals and Guidelines for TIPS

3.5.2 EU Medical Device Regulations (MDR) Impact

3.5.3 Role of ISO Standards in Device Quality Assurance

3.6 SWOT Analysis

3.7 Supply Chain Ecosystem (Manufacturers, Suppliers, Distributors)

3.8 Porters Five Forces

3.9 Competitive Landscape Analysis

4. Global TIPS Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Stent-Based Systems

4.1.2 Balloon Catheters

4.1.3 Accessory Kits

4.2 By Application (In Value %)

4.2.1 Portal Hypertension

4.2.2 Variceal Bleeding

4.2.3 Ascites Management

4.2.4 Budd-Chiari Syndrome

4.3 By End-User (In Value %)

4.3.1 Hospitals

4.3.2 Ambulatory Surgical Centers

4.3.3 Specialty Clinics

4.4 By Material Type (In Value %)

4.4.1 Nitinol

4.4.2 Stainless Steel

4.4.3 Polymer-Coated Materials

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global TIPS Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 W. L. Gore & Associates, Inc.

5.1.2 Cook Medical LLC

5.1.3 Boston Scientific Corporation

5.1.4 Medtronic plc

5.1.5 Abbott Laboratories

5.1.6 Merit Medical Systems, Inc.

5.1.7 Becton, Dickinson and Company

5.1.8 Terumo Corporation

5.1.9 Teleflex Incorporated

5.1.10 Biotronik SE & Co. KG

5.1.11 Edwards Lifesciences Corporation

5.1.12 BD Bard

5.1.13 Cardinal Health, Inc.

5.1.14 MicroPort Scientific Corporation

5.1.15 Elixir Medical Corporation

5.2 Cross-Comparison Parameters (R&D Investments, Technology Patents, Revenue, Market Reach, Headquarters, Number of Employees, Product Portfolio Depth, Regulatory Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Key Venture Capital and Private Equity Funding

5.8 Strategic Alliances

5.9 Product Launches and Innovations

6. Global TIPS Market Regulatory Framework

6.1 Compliance Requirements by Major Health Authorities

6.2 FDA & CE Marking Guidelines

6.3 Certification Processes for Device Approval

7. Global TIPS Market Future Market Size (In USD Bn)

7.1 Projected Growth Drivers

7.2 Key Indicators for Future Market Expansion

8. Global TIPS Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Material Type (In Value %)

8.5 By Region (In Value %)

9. TIPS Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Clinical End-User Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We begin by mapping the TIPS market ecosystem, covering primary stakeholders and data points crucial for understanding market dynamics. This step involves extensive desk research utilizing proprietary databases to identify key market variables.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical data, including patient demographics, TIPS procedure growth, and healthcare spending. Market segmentation by product type and region is also evaluated for revenue trends.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through expert consultations, offering insights into industry challenges and opportunities. These discussions help refine our data analysis.

Step 4: Research Synthesis and Final Output

The synthesis phase integrates insights from medical professionals and industry experts, ensuring a comprehensive understanding of market dynamics and potential growth drivers for the Global TIPS Market.

Frequently Asked Questions

01. How big is the Global TIPS Market?

The Global TIPS Market was valued at USD 1.5 billion and has shown steady growth due to increasing cases of liver diseases and advances in interventional radiology techniques.

02. What are the challenges in the Global TIPS Market?

Challenges in this market include the high cost of equipment, potential procedural complications, and a shortage of trained professionals skilled in TIPS procedures.

03. Who are the major players in the Global TIPS Market?

Major players include W. L. Gore & Associates, Cook Medical, Boston Scientific, Medtronic, and Abbott Laboratories, leading due to their strong R&D and product portfolios.

04. What are the growth drivers for the Global TIPS Market?

Growth is primarily driven by the rising prevalence of liver cirrhosis, demand for minimally invasive procedures, and technological advancements in shunt design.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.