KSA Cardiac Rhythm Management Devices Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD3567

December 2024

83

About the Report

KSA Cardiac Rhythm Management Devices Market Overview

- The KSA cardiac rhythm management (CRM) devices market is valued at USD 249 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of cardiovascular diseases, advancements in medical technology, and substantial investments in healthcare infrastructure. The government's commitment to enhancing healthcare services, coupled with a rising geriatric population, has further propelled the demand for CRM devices.

- Within KSA, major urban centers such as Riyadh, Jeddah, and Dammam dominate the CRM devices market. This dominance is attributed to their advanced healthcare facilities, higher population densities, and greater awareness of cardiovascular health. These cities have seen significant investments in medical infrastructure, leading to increased adoption of CRM technologies.

- The SFDA has implemented stringent guidelines for the approval and monitoring of medical devices, including CRM devices, to ensure patient safety and product efficacy. In recent years, the SFDA has increased inspections and compliance checks on imported and locally manufactured devices. This regulatory framework is designed to ensure that only high-quality, reliable CRM devices are available in the market, boosting public confidence and supporting market growth. The SFDA's oversight aligns with Vision 2030s goal to establish high standards in healthcare services.

KSA Cardiac Rhythm Management Devices Market Segmentation

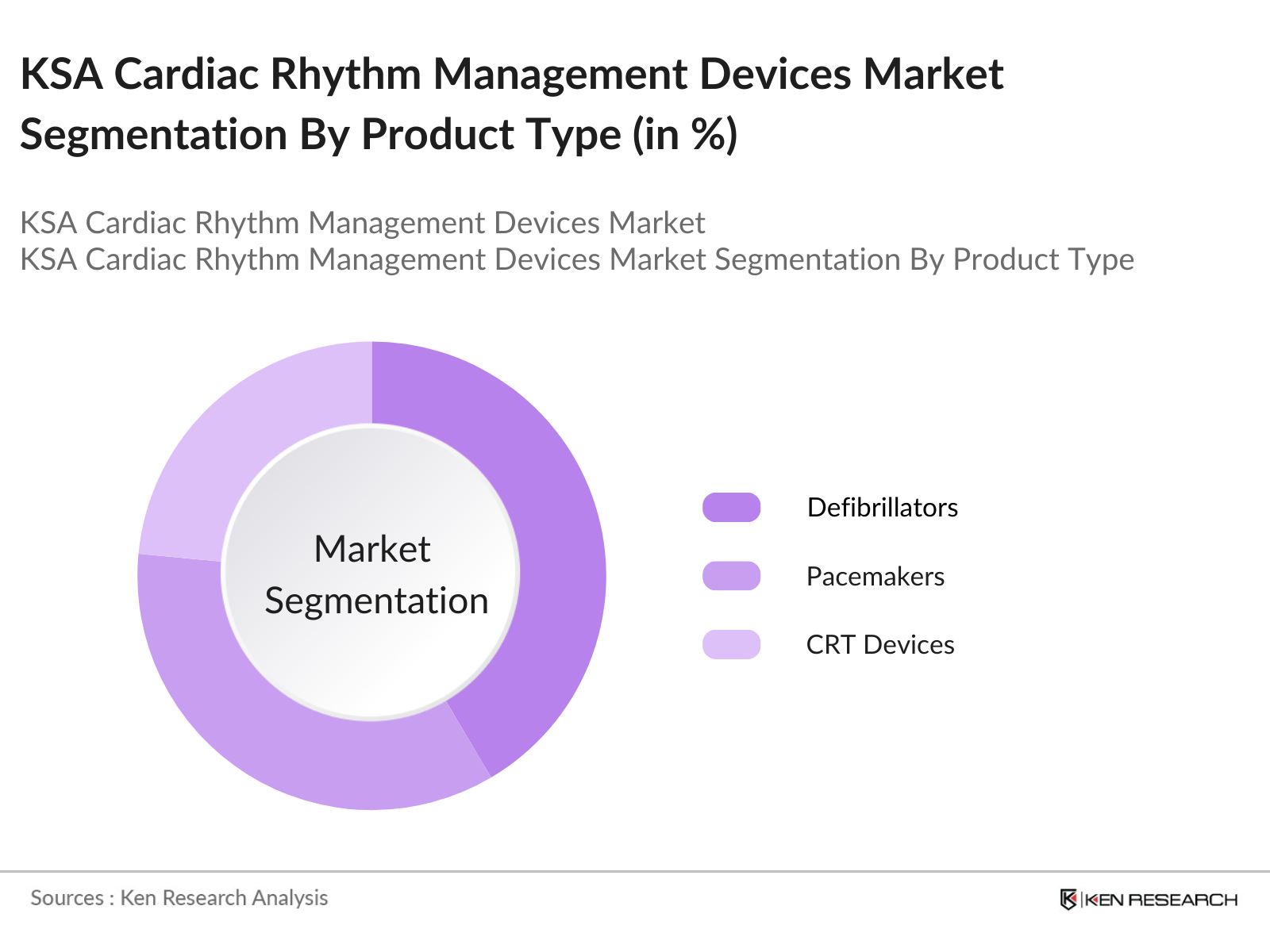

By Product Type: The market is segmented by product type into pacemakers, defibrillators, and cardiac resynchronization therapy (CRT) devices. Recently, defibrillators have a dominant market share in KSA under the segmentation product type, due to their critical role in preventing sudden cardiac arrests and enhancing patient survival rates. The segments growth is further propelled by advancements in technology, making these devices more effective and user-friendly.

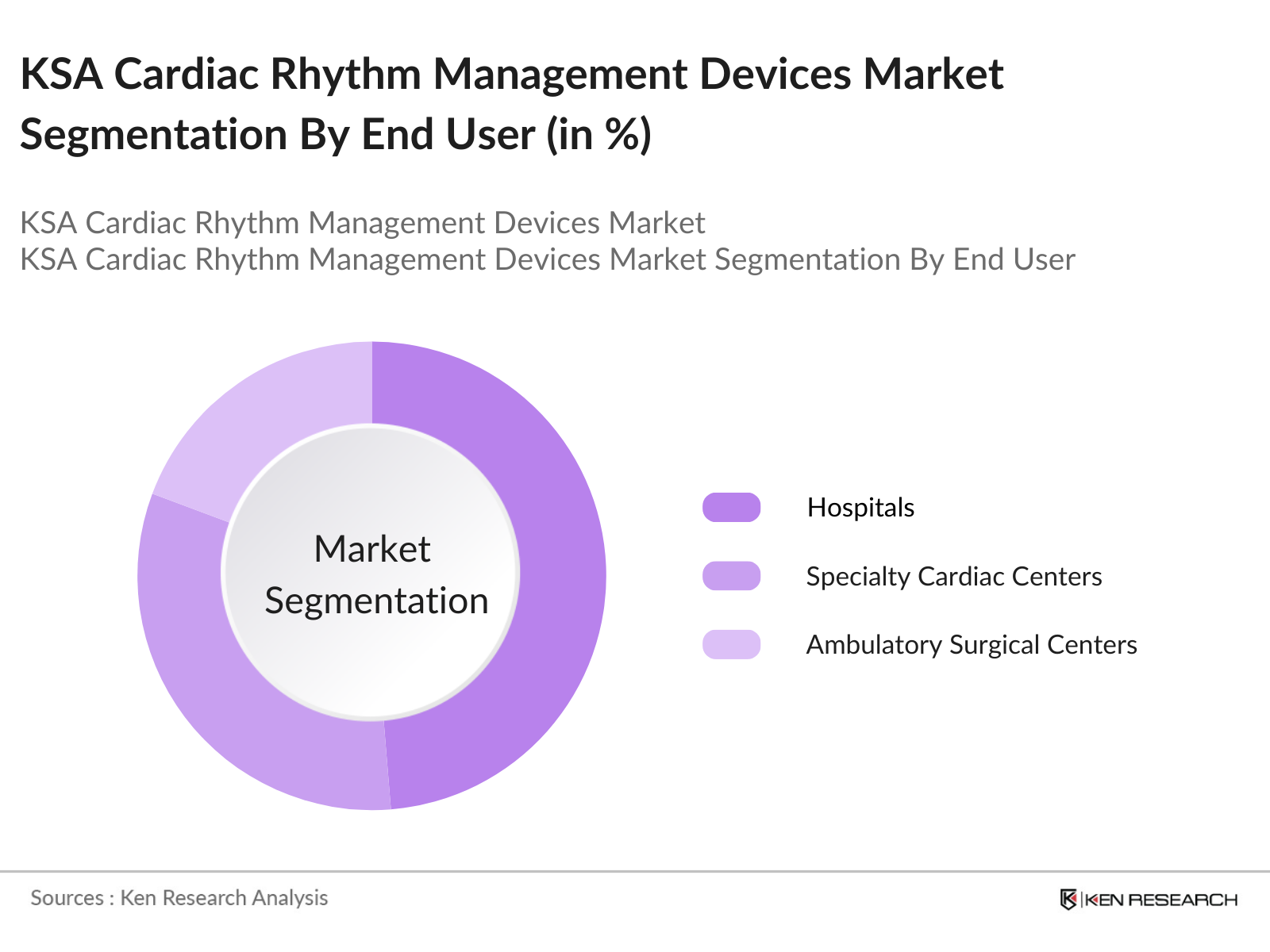

By End User: The CRM devices market is also segmented by end users, including hospitals, specialty cardiac centers, and ambulatory surgical centers. Hospitals have a dominant market share in KSA under the segmentation end user, due to their comprehensive healthcare services and the availability of specialized cardiac care units. The presence of skilled healthcare professionals and advanced medical equipment in hospitals further contributes to their leading position in the market.

KSA Cardiac Rhythm Management Devices Market Competitive Landscape

The KSA CRM devices market is characterized by the presence of both global and regional players, contributing to a competitive environment. Key companies are focusing on technological advancements, strategic partnerships, and expanding their product portfolios to strengthen their market positions.

KSA Cardiac Rhythm Management Devices Industry Analysis

Growth Drivers

- Increasing Prevalence of Cardiovascular Diseases: Cardiovascular diseases (CVDs) are a leading cause of mortality in Saudi Arabia, with the Ministry of Health reporting that heart diseases accounted for approximately 37,000 deaths in 2022. The World Health Organization (WHO) indicates that non-communicable diseases, including CVDs, contribute to 73% of all deaths in the country. This high prevalence underscores the urgent need for effective cardiac rhythm management (CRM) devices to diagnose and treat heart rhythm disorders.

- Technological Advancements in CRM Devices: The CRM devices market in Saudi Arabia is experiencing growth due to technological advancements such as the development of leadless pacemakers and subcutaneous implantable cardioverter-defibrillators (S-ICDs). These innovations offer improved patient outcomes and reduced procedural risks. For instance, the introduction of MRI-compatible pacemakers has enhanced diagnostic capabilities for patients with implanted devices. Such technological progress is propelling the adoption of advanced CRM devices in the country.

- Rising Geriatric Population: Saudi Arabia's population is aging, with individuals aged 60 and above constituting approximately 5% of the total population in 2023. The United Nations projects that this demographic will increase to 10% by 2030. An aging population is more susceptible to cardiac arrhythmias, necessitating the use of CRM devices for effective management. This demographic shift is expected to drive demand for CRM devices in the coming years.

Market Challenges

- Limited Reimbursement Policies: Saudi Arabia's healthcare system offers limited reimbursement for CRM devices. While government hospitals provide free healthcare services, private sector patients often face out-of-pocket expenses for advanced CRM devices, as insurance coverage may not fully reimburse these costs. This limitation affects the affordability and accessibility of CRM devices for many patients.

- Lack of Skilled Healthcare Professionals: There is a shortage of specialized healthcare professionals trained in the implantation and management of CRM devices in Saudi Arabia. The Saudi Commission for Health Specialties reported that, as of 2023, there were approximately 500 certified cardiologists in the country, which is insufficient to meet the growing demand for cardiac care. This shortage hampers the effective utilization of CRM devices and limits patient access to specialized treatments.

KSA Cardiac Rhythm Management Devices Market Future Outlook

Over the next five years, the KSA CRM devices market is expected to show significant growth driven by continuous government support, advancements in CRM technology, and increasing consumer demand for advanced cardiac care solutions. The integration of artificial intelligence and remote monitoring capabilities into CRM devices is anticipated to enhance patient outcomes and streamline healthcare services.

Market Opportunities

- Untapped Rural Markets: Rural areas in Saudi Arabia have limited access to advanced cardiac care. The General Authority for Statistics indicates that approximately 16% of the population resides in rural regions. Expanding healthcare services and introducing CRM devices in these underserved areas present significant growth opportunities for the market. Improving healthcare infrastructure in rural regions can enhance patient outcomes and broaden the market reach for CRM devices.

- Integration of AI and IoT in CRM Devices: The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into CRM devices is gaining traction in Saudi Arabia. These technologies enable real-time monitoring and predictive analytics, improving patient management. For instance, AI algorithms can detect arrhythmias with high accuracy, while IoT connectivity allows for remote monitoring of patients' cardiac health. Adopting these technologies can enhance the functionality and appeal of CRM devices in the market.

Scope of the Report

|

Product Type |

Pacemakers |

|

End User |

Hospitals |

|

Technology |

Implantable Devices |

|

Application |

Bradycardia |

|

Region |

Central Region |

Products

Key Target Audience

Hospitals and Healthcare Providers

Medical Device Distributors

Cardiologists and Cardiac Surgeons

Government and Regulatory Bodies (Saudi Food and Drug Authority)

Health Insurance Companies

Medical Research Institutions

Investment and Venture Capitalist Firms

Medical Equipment Manufacturers

Companies

Players Mentioned in the Report

Medtronic PLC

Abbott Laboratories

Boston Scientific Corporation

BIOTRONIK SE & Co. KG

Stryker Corporation

Koninklijke Philips N.V.

ZOLL Medical Corporation

LivaNova PLC

Progetti Medical

SCHILLER AG

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Cardiovascular Diseases

3.1.2 Technological Advancements in CRM Devices

3.1.3 Government Initiatives and Healthcare Investments

3.1.4 Rising Geriatric Population

3.2 Market Challenges

3.2.1 High Cost of Devices

3.2.2 Limited Reimbursement Policies

3.2.3 Lack of Skilled Healthcare Professionals

3.3 Opportunities

3.3.1 Untapped Rural Markets

3.3.2 Integration of AI and IoT in CRM Devices

3.3.3 Strategic Collaborations and Partnerships

3.4 Trends

3.4.1 Adoption of Wearable Cardiac Devices

3.4.2 Shift Towards Minimally Invasive Procedures

3.4.3 Emphasis on Remote Patient Monitoring

3.5 Government Regulations

3.5.1 Saudi Food and Drug Authority (SFDA) Guidelines

3.5.2 National Health Transformation Program

3.5.3 Vision 2030 Healthcare Objectives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Pacemakers

4.1.2 Defibrillators

4.1.3 Cardiac Resynchronization Therapy (CRT) Devices

4.2 By End User (In Value %)

4.2.1 Hospitals

4.2.2 Specialty Cardiac Centers

4.2.3 Ambulatory Surgical Centers

4.3 By Technology (In Value %)

4.3.1 Implantable Devices

4.3.2 External Devices

4.4 By Application (In Value %)

4.4.1 Bradycardia

4.4.2 Tachycardia

4.4.3 Heart Failure

4.5 By Region (In Value %)

4.5.1 Central Region

4.5.2 Western Region

4.5.3 Eastern Region

4.5.4 Northern Region

4.5.5 Southern Region

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Medtronic PLC

5.1.2 Abbott Laboratories

5.1.3 Boston Scientific Corporation

5.1.4 BIOTRONIK SE & Co. KG

5.1.5 Stryker Corporation

5.1.6 Koninklijke Philips N.V.

5.1.7 ZOLL Medical Corporation

5.1.8 LivaNova PLC

5.1.9 Progetti Medical

5.1.10 SCHILLER AG

5.1.11 Nihon Kohden Corporation

5.1.12 MicroPort Scientific Corporation

5.1.13 Edwards Lifesciences Corporation

5.1.14 Terumo Middle East FZE

5.1.15 GE Healthcare

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Regulatory Framework

6.1 SFDA Approval Processes

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By End User (In Value %)

8.3 By Technology (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the KSA Cardiac Rhythm Management Devices Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the KSA Cardiac Rhythm Management Devices Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple CRM device manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the KSA Cardiac Rhythm Management Devices Market.

Frequently Asked Questions

01. How big is the KSA Cardiac Rhythm Management Devices Market?

The KSA cardiac rhythm management (CRM) devices market is valued at USD 249 million, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of cardiovascular diseases, advancements in medical technology, and substantial investments in healthcare infrastructure.

02. What are the challenges in the KSA Cardiac Rhythm Management Devices Market?

Challenges include high device costs, limited reimbursement policies, and a lack of skilled healthcare professionals. Additionally, the market faces regulatory compliance hurdles, which can hinder the entry and adoption of advanced CRM devices.

03. Who are the major players in the KSA Cardiac Rhythm Management Devices Market?

Key players in the market include Medtronic PLC, Abbott Laboratories, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, and Stryker Corporation. These companies dominate due to their technological advancements, strategic collaborations, and established brand presence.

04. What are the growth drivers for the KSA Cardiac Rhythm Management Devices Market?

The market is driven by the growing prevalence of cardiovascular diseases, technological advancements in CRM devices, and increasing government initiatives. Additionally, the rising geriatric population and the availability of better healthcare facilities have fueled market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.