KSA Video Conferencing Market Outlook to 2030

Region:Middle East

Author(s):Shambhavi

Product Code:KROD4787

December 2024

119

About the Report

KSA Video Conferencing Market Overview

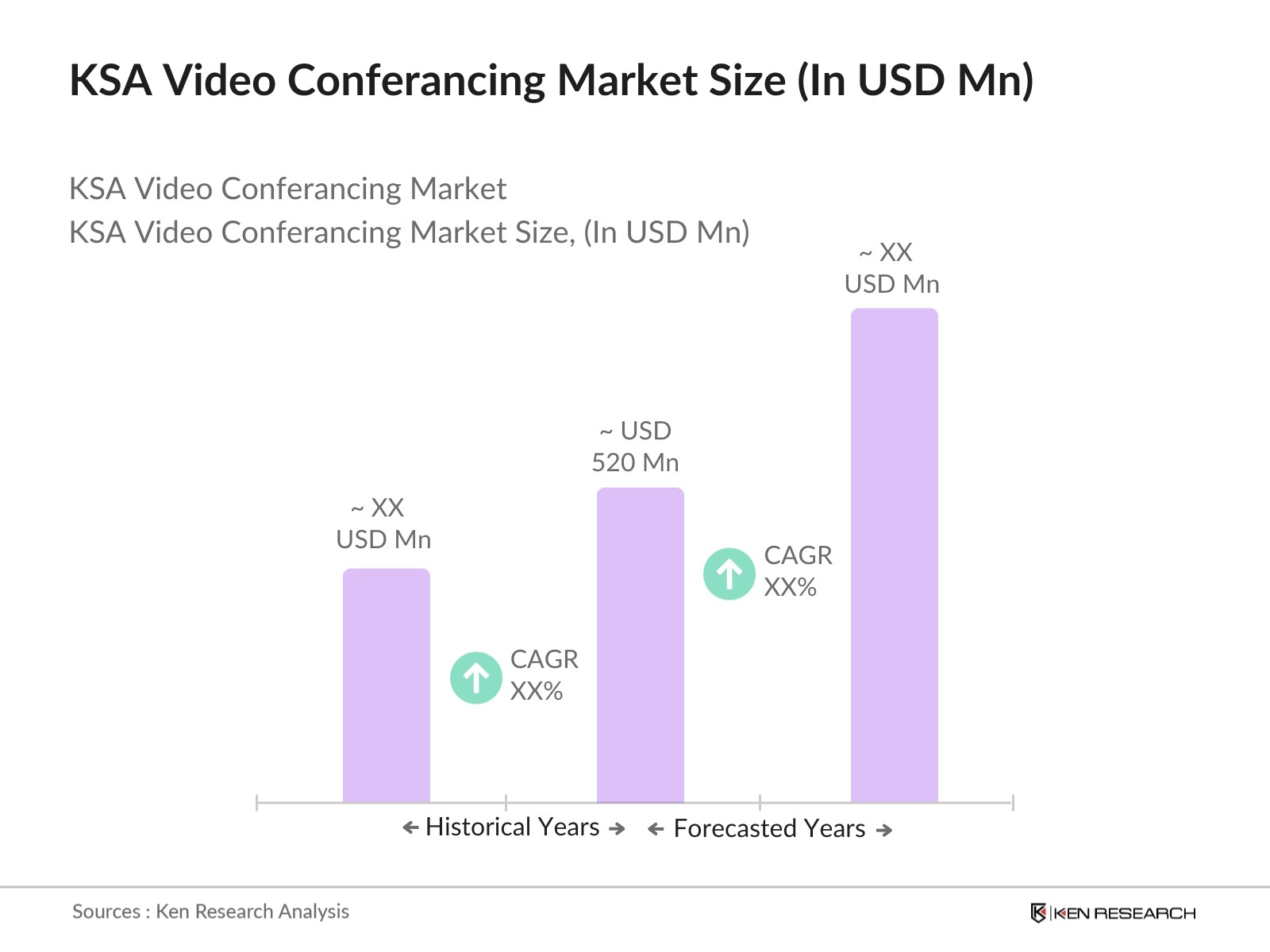

- The KSA video conferencing market is valued at USD 345 million, driven by the increasing demand for remote communication solutions, spurred by the digital transformation initiatives from the government and the rise of hybrid work models across industries. Government-led projects such as Saudi Vision 2030 are pushing organizations to modernize their communication infrastructures, while businesses increasingly invest in cloud-based video conferencing platforms to maintain seamless virtual collaboration. Additionally, the pandemic significantly accelerated the adoption of video conferencing solutions, establishing a firm foundation for long-term growth.

- Riyadh and Jeddah dominate the KSA video conferencing market due to their well-established IT infrastructures, higher concentration of corporate offices, and government institutions. Riyadh, being the capital, houses many government offices that have increasingly adopted video conferencing platforms for inter-departmental communication, while Jeddah's business ecosystem further supports the demand for such solutions. The cities' progressive business environments and the adoption of advanced technology make them key hubs for video conferencing solutions in the region.

- Saudi Arabias government has prioritized digital transformation, allocating over SAR 93 billion in 2023 to enhance the country's digital infrastructure as part of its Vision 2030 objectives. Government programs like the Digital Government Authority's "Unified Digital Platform" aim to boost the adoption of advanced communication tools. These initiatives have stimulated demand for high-quality video conferencing solutions, particularly in government offices, universities, and hospitals. Such efforts aim to create an interconnected, efficient, and transparent digital ecosystem, facilitating the growth of video conferencing platforms across the nation.

KSA Video Conferencing Market Segmentation

By Platform Type: The KSA video conferencing market is segmented by platform type into Cloud-Based and On-Premise. Cloud-based platforms are increasingly dominating the market share in KSA due to their scalability, flexibility, and lower operational costs. As businesses shift towards digital infrastructure, the appeal of cloud-based video conferencing solutions, such as Microsoft Teams and Zoom, lies in their ease of integration with existing IT systems and the ability to support remote work environments. Furthermore, the increasing reliance on cloud technologies, driven by government initiatives, has propelled the demand for cloud-based platforms.

|

|

|---|

By End-User Industry: The KSA video conferencing market is segmented by end-user industry into IT & Telecommunications, Education, Healthcare, and BFSI (Banking, Financial Services, and Insurance). The IT & Telecommunications sector leads in market share as this industry is at the forefront of adopting cutting-edge technologies to support both internal and external communication. The necessity for real-time collaboration in tech projects and client interactions has made video conferencing a vital tool in this sector. Additionally, with rapid advancements in telecommunications infrastructure, particularly in Riyadh, this industrys demand for video conferencing continues to grow.

KSA Video Conferencing Market Competitive Landscape

The KSA video conferencing market is dominated by global players with strong brand presence and local adaptability. Companies like Cisco and Microsoft lead the market with their cloud-based platforms that offer flexibility and comprehensive features. The competitive landscape is characterized by the presence of both multinational corporations and emerging regional players, driving innovation and partnerships with local telecommunications providers.

|

Company |

Established |

Headquarters |

No. of Employees |

Revenue |

Product Portfolio |

R&D Investments |

Partnerships |

Regional Presence |

|

Cisco Systems, Inc. |

1984 |

USA |

||||||

|

Microsoft Corporation |

1975 |

USA |

||||||

|

Zoom Video Communications |

2011 |

USA |

||||||

|

Huawei Technologies |

1987 |

China |

||||||

|

Avaya, Inc. |

2000 |

USA |

KSA Video Conferencing Market Analysis

Growth Drivers

Remote Work Trends: The rise in remote work is significantly influencing the video conferencing market in KSA. A 2024 report by the Saudi General Authority for Statistics notes that nearly 22% of Saudi professionals now regularly work from home. This shift is further supported by initiatives under Saudi Vision 2030, which promote flexible work arrangements as part of broader labor market reforms. Additionally, many private sector companies, especially in industries like finance and technology, have embraced remote work to increase productivity and employee satisfaction. This sustained demand for remote work solutions continues to drive the adoption of video conferencing tools across various sectors.

Cloud Adoption and IT Infrastructure Enhancement: Saudi Arabias aggressive push toward cloud adoption is a major driver of the video conferencing market. The Ministry of Communications and Information Technology reported a 35% increase in cloud infrastructure spending between 2022 and 2023. Major tech firms like Oracle and Amazon Web Services have expanded their local cloud services, improving accessibility and reliability. The enhanced cloud infrastructure supports seamless video conferencing capabilities, particularly for businesses and educational institutions, which benefit from lower latency and improved video quality.

Rising Demand for Virtual Collaboration Tools: A growing demand for virtual collaboration tools in sectors like healthcare, education, and retail is driving the video conferencing market. In 2024, more than 7,000 schools and universities in KSA integrated online platforms for virtual learning, according to the Ministry of Education. In the healthcare sector, telemedicine consultations increased by 200% between 2022 and 2023, as reported by the Saudi Health Council, further boosting the need for reliable video conferencing solutions.

Market Challenges

Network Connectivity Issues: Despite rapid IT infrastructure developments, network connectivity remains a challenge in rural areas of Saudi Arabia. According to the Communication and Information Technology Commission (CITC), approximately 27% of rural households still lack access to high-speed internet. This limits the expansion of video conferencing solutions in these areas. Businesses and educational institutions in these regions face challenges in maintaining stable connections for virtual meetings, thereby hindering widespread adoption of video conferencing tools.

Data Security and Privacy Concerns: Data privacy concerns have been highlighted as a major challenge for video conferencing platforms. In 2023, KSA enacted its Personal Data Protection Law, which includes stringent rules on cross-border data transfers. Companies using video conferencing tools are required to adhere to strict data protection standards, especially when handling sensitive business or government communications. The complexities and costs associated with compliance create barriers for smaller businesses looking to adopt advanced conferencing tools.

KSA Video Conferencing Market Future Outlook

The KSA video conferencing market is poised for substantial growth over the coming years, driven by continuous advancements in technology and the increasing integration of AI, machine learning, and cloud services in video conferencing platforms. The expansion of telecommunications infrastructure, bolstered by Saudi Vision 2030 initiatives, is expected to further enhance the adoption of video conferencing technologies, particularly in sectors like education and healthcare. Moreover, the growing focus on secure communication solutions and data privacy regulations will also shape the future landscape of the market.

Market Opportunities

- Integration with AI and Machine Learning: The integration of AI and machine learning into video conferencing tools represents a significant growth opportunity for the market. AI-powered features such as automated meeting transcription, real-time language translation, and virtual background enhancements have already been incorporated into platforms used in KSA. The Ministry of Communication reported in 2024 that approximately 18% of businesses using video conferencing tools are now deploying AI-driven solutions to improve productivity and user experience. This trend will likely encourage the adoption of smarter conferencing tools across multiple sectors.

- Expansion into SME Sector: Small and medium-sized enterprises (SMEs) represent a largely untapped market for video conferencing platforms in KSA. According to the Saudi Industrial Development Fund, SMEs accounted for 99% of businesses in the country in 2024. However, only about 38% of these SMEs use video conferencing tools for day-to-day operations. The governments commitment to digitization and the introduction of subsidy programs for SMEs make this sector a prime opportunity for video conferencing providers to expand their offerings and drive growth.

Scope of the Report

|

Platform Type |

Cloud-Based On-Premise |

|

Application |

Corporate Enterprises Educational Institutions Healthcare Sector Government Organizations |

|

Component |

Software Solutions Hardware Components Services |

|

End-User Industry |

IT & Telecommunications BFSI, Education Healthcare |

|

Region |

Riyadh Jeddah Dammam Other Regions |

Products

Key Target Audience

IT & Telecommunications Companies

Government and Regulatory Bodies (Saudi Communications and Information Technology Commission)

Healthcare Providers

Educational Institutions

Corporate Enterprises

BFSI Sector

Investor and Venture Capitalist Firms

Telecom Providers (STC, Mobily)

Companies

Players Mentioned in the Report

Cisco Systems, Inc.

Microsoft Corporation

Zoom Video Communications

Google (Alphabet Inc.)

Huawei Technologies Co., Ltd.

Avaya Inc.

BlueJeans Network (Verizon)

LogMeIn, Inc.

Lifesize, Inc.

Polycom, Inc.

Pexip AS

Adobe Systems Inc.

Kaltura, Inc.

StarLeaf Ltd.

RingCentral, Inc.

Table of Contents

1 KSA Video Conferencing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2 KSA Video Conferencing Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3 KSA Video Conferencing Market Analysis

3.1 Growth Drivers

3.1.1. Digital Transformation Initiatives

3.1.2. Remote Work Adoption

3.1.3. Government Vision 2030

3.1.4. Technological Advancements

3.2 Market Challenges

3.2.1. Infrastructure Limitations

3.2.2. Security and Privacy Concerns

3.2.3. Cultural Preferences for In-Person Meetings

3.3 Opportunities

3.3.1. Expansion into SMEs

3.3.2. Integration with AI and IoT

3.3.3. Localization of Services

3.4 Trends

3.4.1. Hybrid Work Environments

3.4.2. AI-Powered Collaboration Tools

3.4.3. Mobile-Friendly Applications

3.5 Government Regulations

3.5.1. Data Protection Laws

3.5.2. Compliance Requirements

3.5.3. Certification Processes

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competitive Ecosystem

4 KSA Video Conferencing Market Segmentation

4.1 By Deployment Model (In Value %)

4.1.1. On-Premise

4.1.2. Cloud-Based

4.2 By Enterprise Size (In Value %)

4.2.1. Small Enterprises

4.2.2. Medium Enterprises

4.2.3. Large Enterprises

4.3 By Industry Vertical (In Value %)

4.3.1. Education

4.3.2. IT and Telecom

4.3.3. Healthcare and Life Sciences

4.3.4. Banking, Financial Services, and Insurance (BFSI)

4.3.5. Media and Entertainment

4.4 By Component (In Value %)

4.4.1. Hardware

4.4.2. Software

4.4.3. Services

4.5 By Region (In Value %)

4.5.1. Central Region

4.5.2. Western Region

4.5.3. Eastern Region

4.5.4. Southern Region

4.5.5. Northern Region

5 KSA Video Conferencing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

Adobe Inc.

Avaya LLC

BlueJeans Network, LLC

Cisco Systems, Inc.

Google LLC

Huawei Technologies Co., Ltd.

LogMeIn, Inc. (GoToMeeting)

Microsoft Corporation

Zoom Video Communications, Inc.

Lifesize, Inc.

Polycom, Inc.

Fuze, Inc.

Vidyo, Inc.

Pexip AS

RingCentral, Inc.

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Offerings, Regional Presence, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6 KSA Video Conferencing Market Regulatory Framework

6.1 Data Protection Laws

6.2 Compliance Requirements

6.3 Certification Processes

7 KSA Video Conferencing Market Future Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8 KSA Video Conferencing Market Future Segmentation

8.1 By Deployment Model (In Value %)

8.2 By Enterprise Size (In Value %)

8.3 By Industry Vertical (In Value %)

8.4 By Component (In Value %)

8.5 By Region (In Value %)

9 KSA Video Conferencing Market Analysts’ Recommendations

9.1 Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying key stakeholders and variables within the KSA video conferencing market. This includes extensive desk research and secondary data collection from proprietary databases and trusted governmental sources. Variables such as platform adoption rates, sector-specific demand, and infrastructure capacity are considered.

Step 2: Market Analysis and Construction

This stage involves historical data analysis, focusing on market penetration in various sectors, such as IT, healthcare, and education. Additionally, the growth of cloud-based solutions is assessed based on actual user adoption data across corporate entities in Riyadh and Jeddah.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts from telecommunications companies, video conferencing software providers, and cloud technology specialists. These insights help refine market estimates and understand key operational dynamics within the market.

Step 4: Research Synthesis and Final Output

A final synthesis of data is conducted to ensure comprehensive coverage of the market's key aspects. The report is then subjected to internal validation through engagement with multiple video conferencing solution providers to verify its accuracy and completeness.

Frequently Asked Questions

01 How big is the KSA Video Conferencing Market?

The KSA video conferencing market is valued at USD 345 million, driven by increased digital transformation and government initiatives such as Saudi Vision 2030.

02 What are the challenges in the KSA Video Conferencing Market?

Key challenges include network connectivity issues in rural areas, data privacy concerns, and the high initial cost of advanced video conferencing systems, which can limit adoption.

03 Who are the major players in the KSA Video Conferencing Market?

The market is dominated by Cisco, Microsoft, Zoom, Huawei, and Avaya, with these companies holding significant influence due to their strong product portfolios and partnerships with local telecom providers.

04 What are the growth drivers of the KSA Video Conferencing Market?

The market is driven by factors such as the shift to hybrid work models, government digital transformation programs, and the growing demand for secure, cloud-based collaboration tools

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.