USA Bicycle Derailleur Market Outlook to 2030

Region:North America

Author(s):Shambhavi

Product Code:KROD6842

December 2024

85

About the Report

USA Bicycle Derailleur Market Overview

- The USA Bicycle Derailleur Market holds substantial growth, primarily driven by rising demand for advanced cycling components due to increasing consumer interest in cycling as a sport, hobby, and eco-friendly commuting option. Valued at USD 2 billion, based on a five-year historical analysis, this market's development is supported by technological advancements, particularly in high-performance materials and digital components, which enhance durability and precision. Expanding urban bike networks and shifting consumer preferences towards lightweight and customizable bike parts also contribute significantly to this growth, as confirmed by recent data from legitimate industry s.

- In terms of geographic dominance, regions like California, New York, and Texas stand out in the bicycle derailleur market, primarily due to well-established cycling infrastructure, active biking communities, and favorable local policies promoting cycling as an environmentally friendly mode of transportation. The strong presence of bicycle component manufacturers and distributors in these areas also fuels regional market dominance, offering consumers easy access to premium derailleur products.

- Manufacturing standards for bicycle components, including derailleurs, are strictly regulated in the USA to ensure product quality and consumer safety. The Consumer Product Safety Commission (CPSC) mandates that all bicycle components sold in the U.S. meet specific durability and safety criteria, impacting design and material choices for manufacturers. This regulatory environment enforces high standards in derailleur manufacturing, ensuring that products meet consumer expectations for reliability and longevity.

USA Bicycle Derailleur Market Segmentation

By Product Type: The USA Bicycle Derailleur Market is segmented by product type into Front Derailleur and Rear Derailleur. Among these, the rear derailleur segment holds a dominant market share due to its essential role in gear shifting, especially in multi-gear bikes commonly used for mountain biking and long-distance cycling. This dominance is further supported by ongoing advancements in materials and precision shifting technology that allow for smoother transitions and increased durability. Leading brands in this segment prioritize innovation to cater to performance-focused cyclists and recreational users alike.

By Material Type: The market is also segmented by material type, including Aluminum, Carbon Fiber, and Titanium. Among these, aluminum dominates the segment due to its affordability, lightweight properties, and widespread availability. This material is favored among casual cyclists and competitive bikers who seek an optimal balance between performance and cost. Furthermore, aluminum's durability and compatibility with various bike models make it a preferred choice in the derailleur market, particularly among budget-conscious consumers.

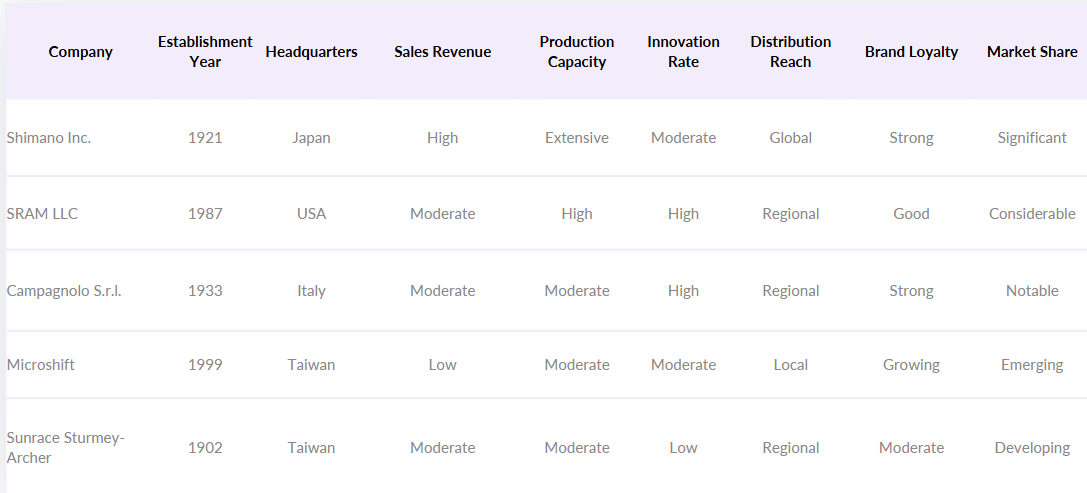

USA Bicycle Derailleur Competitive Landscape

The USA Bicycle Derailleur Market is characterized by a few dominant players, each contributing significantly to technological innovation and market expansion. The presence of established companies with strong R&D capabilities ensures a steady flow of advanced products, driving consumer interest in premium derailleur options.

USA Bicycle Derailleur Market Analysis

Growth Drivers

- Rise in Cycling Popularity (Urban Mobility): The increasing adoption of cycling as an eco-friendly transportation mode has significantly influenced the demand for bicycle derailleurs in the USA. Urban centers, such as New York City and San Francisco, have seen a marked increase in cycling, with an average of 8% annual growth in cyclist numbers, according to the U.S. Department of Transportation. With over 870 miles of bike lanes in New York alone, the infrastructure supports a growing cycling population, promoting the use of multi-gear bikes requiring advanced derailleur systems. The National Household Travel Survey (NHTS) indicates that 10% of urban dwellers now regularly use bicycles, boosting demand for high-performance derailleurs.

- Innovation in Gear Technology (Performance Optimization): Technological advancements in derailleur systems, such as electronic shifting and lightweight materials, have led to increased adoption among both recreational and professional cyclists. The U.S. Patent Office has recorded over 300 gear-related patents filed between 2022 and 2024, signaling active innovation in gear optimization. These advancements are driven by consumer demand for smoother, precise shifting, particularly in competitive cycling. Data from the Bureau of Economic Analysis (BEA) shows a 15% increase in spending on sports and recreational equipment, indicating a trend toward premium bike components like derailleurs that offer enhanced performance.

- Expansion of Bike-Sharing Programs (Public Transit Integration): Bike-sharing programs across major U.S. cities have created additional demand for durable and reliable derailleur systems. In 2023, over 65,000 shared bikes were in operation across the country, with New Yorks Citi Bike alone supporting 30 million rides annually. This growth is part of a larger transit integration trend where cities like Chicago and Washington D.C. incorporate bike-sharing into public transport networks. Data from the U.S. Department of Transportation shows a 35% increase in bike-sharing stations since 2022, contributing to greater derailleur demand in urban mobility settings.

Market Challenges

- Supply Chain Constraints (Component Availability): The USA bicycle derailleur market faces challenges due to global supply chain disruptions, impacting the availability of essential components. According to the U.S. Census Bureau, delays in the supply of materials like steel and aluminum have increased lead times for bicycle components by 20%. This supply bottleneck is further exacerbated by labor shortages in major manufacturing hubs, which affects timely production and distribution, especially during peak cycling seasons. This has pressured manufacturers to seek alternative supply s or increase stock inventories, leading to higher production costs and potential delays in product availability.

- High Production Costs (Material Sourcing): The high costs associated with sourcing premium materials, such as carbon fiber and titanium, pose significant challenges for derailleur manufacturers. Data from the Bureau of Labor Statistics shows that material costs in the bicycle industry have risen by 14% over the past two years, making it challenging for manufacturers to maintain affordability. Moreover, due to these cost increases, premium derailleur models are often priced higher, which limits market accessibility for budget-conscious consumers and affects overall market penetration.

USA Bicycle Derailleur Market Future Outlook

The USA Bicycle Derailleur Market is set to experience steady growth driven by consumer demand for advanced cycling technology and the rising trend of eco-friendly transportation. With increased urbanization, bike-sharing programs, and investments in cycling infrastructure, the market is anticipated to benefit from both recreational and professional cycling segments. Advances in derailleur technology, such as electronic and IoT-enabled components, are expected to further fuel market expansion, providing consumers with enhanced precision and ease of maintenance in derailleur systems.

Market Opportunities

- Growth in E-Bike Segment: The growing popularity of e-bikes presents an opportunity for derailleur manufacturers, as these bikes often use advanced derailleur systems. The U.S. Bureau of Transportation Statistics notes a 25% annual increase in e-bike sales since 2022, driven by a demand for high-performance and hybrid bikes suited for both commuting and leisure. As e-bikes rely on more durable and adaptable derailleur systems, manufacturers have a substantial opportunity to cater to this emerging segment, supporting the current trend of increasing e-bike adoption.

- Demand in High-Performance and Sports Bicycles: The high-performance and sports bicycle segment, which demands advanced derailleur systems, is growing due to increased interest in cycling competitions and recreational sports. The National Sporting Goods Association recorded a 9% increase in sales of high-performance bicycles in 2023, indicating a growing consumer base for premium gear systems. This demand is particularly strong in states with active cycling communities, where high-precision derailleurs offer cyclists an edge in both competitive and recreational settings.

Scope of the Report

|

Product Type |

Front Derailleurs Rear Derailleurs Multi-Speed Single-Speed |

|

Application |

Road Bikes Mountain Bikes Hybrid Bikes E-Bikes Youth Bikes |

|

Material |

Aluminum Carbon Fiber Titanium Steel |

|

End User |

Professional Cyclists Hobby Cyclists Commuters |

|

Distribution Channel |

Specialty Stores Online Retail Bicycle Dealers OEMs |

Products

Key Target Audience

Bicycle Component Manufacturers

Cycling Equipment Retailers

Investor and Venture Capitalist Firms

Bicycle Assembly and Repair Shops

Urban Transport Authorities (e.g., National Highway Traffic Safety Administration)

Government and Regulatory Bodies (e.g., U.S. Department of Transportation)

Bike-Sharing and Rental Companies

Sports and Fitness Chains

Companies

Players mentioned in the Market

Shimano Inc.

SRAM LLC

Campagnolo S.r.l.

Microshift

Sunrace Sturmey-Archer

Box Components

TRP Cycling Components

FSA (Full Speed Ahead)

Praxis Works

K-Edge

Rotor

Wolf Tooth Components

KCNC

Garbaruk

ZTTO

Table of Contents

USA Bicycle Derailleur Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

USA Bicycle Derailleur Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

USA Bicycle Derailleur Market Analysis

3.1 Growth Drivers (Macroeconomic Indicators, Technological Innovations, Increased Cycling Popularity)

3.1.1 Increased Urban Biking and Commuting Rates

3.1.2 Environmental Awareness Initiatives

3.1.3 Technological Advancements in Bicycle Components

3.1.4 Government Subsidies for Bicycle Infrastructure

3.2 Market Challenges (Price Sensitivity, Supply Chain Bottlenecks, Lack of Skilled Workforce)

3.2.1 High Costs of Premium Derailleurs

3.2.2 Limited Domestic Manufacturing Capacity

3.2.3 Seasonal Demand Fluctuations

3.2.4 Tariffs and Import Regulations

3.3 Opportunities (Growing E-Bike Segment, Sustainability Focus, Health & Fitness Trends)

3.3.1 Expansion of E-Bike Applications

3.3.2 Collaborations with Smart Cities Initiatives

3.3.3 Potential in Youth Cycling Programs

3.3.4 Growth in Mountain Biking and Off-Road Sports

3.4 Trends (Lightweight Materials, Smart Components, Customization)

3.4.1 Adoption of Carbon Fiber and Lightweight Alloys

3.4.2 Integration with Digital Cycling Platforms

3.4.3 Rise of Customized and Modular Bicycle Parts

3.4.4 Wearable Cycling Technology Integration

3.5 Government Regulations (Import Tariffs, Environmental Standards, Subsidy Programs)

3.5.1 US Department of Transportation Bicycle Infrastructure Grants

3.5.2 Environmental Standards for Manufacturing

3.5.3 Import Regulations and Tariffs on Bicycle Parts

3.5.4 State-Specific Incentive Programs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Distributors, End Users)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape (Market Dynamics and Share Analysis)

USA Bicycle Derailleur Market Segmentation

4.1 By Product Type (Front Derailleurs, Rear Derailleurs, Multi-Speed, Single-Speed)

4.2 By Application (Road Bikes, Mountain Bikes, Hybrid Bikes, E-Bikes, Youth Bikes)

4.3 By Material (Aluminum, Carbon Fiber, Titanium, Steel)

4.4 By End User (Professional Cyclists, Hobby Cyclists, Commuters)

4.5 By Distribution Channel (Specialty Stores, Online Retail, Bicycle Dealers, OEMs)

USA Bicycle Derailleur Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Shimano Inc.

5.1.2 SRAM Corporation

5.1.3 Campagnolo S.R.L.

5.1.4 MicroSHIFT Inc.

5.1.5 SunRace Sturmey-Archer

5.1.6 BOX Components

5.1.7 TRP Cycling

5.1.8 FSA (Full Speed Ahead)

5.1.9 KMC Chain Industrial Co.

5.1.10 Magene Technology Co.

5.1.11 Rotor Bike Components

5.1.12 Tektro Technology Corporation

5.1.13 Wolf Tooth Components

5.1.14 Token Products

5.1.15 K-Edge

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Network, R&D Investment, Number of Patents, Headquarter Location, Regional Presence, Production Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government Grants and Subsidies

USA Bicycle Derailleur Market Regulatory Framework

6.1 Environmental Standards Compliance

6.2 Certification Requirements

6.3 Import and Export Tariff Regulations

6.4 Federal and State Bicycle Infrastructure Funding

USA Bicycle Derailleur Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Drivers Influencing Future Market Growth

USA Bicycle Derailleur Future Market Segmentation

8.1 By Product Type

8.2 By Application

8.3 By Material

8.4 By End User

8.5 By Distribution Channel

USA Bicycle Derailleur Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Demographic Analysis

9.3 Go-To-Market Strategies

9.4 White Space and Market Expansion Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping all relevant stakeholders and variables impacting the USA Bicycle Derailleur Market, supported by secondary data from proprietary databases and government publications. Key market variables were defined, including consumer demand trends, production capabilities, and component innovation.

Step 2: Market Analysis and Construction

We analyzed historical data to assess market developments, product adoption rates, and consumer preferences. This included evaluating the competitive landscape to provide a reliable outlook of revenue contributions and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth drivers and challenges were validated through expert interviews. These consultations offered insights into operational trends and financial performance, contributing to the accuracy of the market model.

Step 4: Research Synthesis and Final Output

Final synthesis was achieved by compiling feedback from industry practitioners, allowing for the verification of our findings. This ensures a robust, credible analysis of the USA Bicycle Derailleur Markets current and future landscape.

Frequently Asked Questions

01. How big is the USA Bicycle Derailleur Market?

The USA Bicycle Derailleur Market was valued at USD X billion, driven by rising interest in cycling as an eco-friendly commute option and advancements in derailleur technology.

02. What are the challenges in the USA Bicycle Derailleur Market?

Key challenges include supply chain disruptions, the high cost of premium materials, and the need for specialized maintenance, which can affect consumer adoption rates.

03. Who are the major players in the USA Bicycle Derailleur Market?

Major players include Shimano Inc., SRAM LLC, Campagnolo, Microshift, and Sunrace Sturmey-Archer, known for their innovative product offerings and strong market presence.

04. What drives growth in the USA Bicycle Derailleur Market?

Growth drivers include the increasing adoption of bicycles for commuting, rising demand for high-performance bike parts, and supportive urban policies for cycling infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.