Region:Middle East

Author(s):Shubham

Product Code:KRAC4231

Pages:80

Published On:October 2025

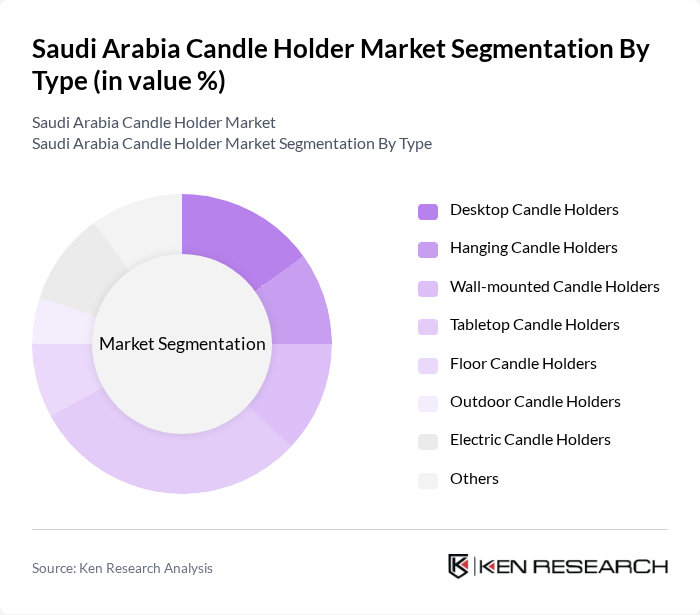

By Type:The candle holder market can be segmented into various types, including Desktop Candle Holders, Hanging Candle Holders, Wall-mounted Candle Holders, Tabletop Candle Holders, Floor Candle Holders, Outdoor Candle Holders, Electric Candle Holders, and Others. Among these, Tabletop Candle Holders are currently leading the market due to their versatility and aesthetic appeal in home décor. Consumers prefer these holders for their ability to enhance the ambiance of living spaces, making them a popular choice for both everyday use and special occasions. This trend is reinforced by the rising popularity of interior styling and DIY home décor, as well as the influence of social media platforms that showcase creative uses of tabletop candle holders .

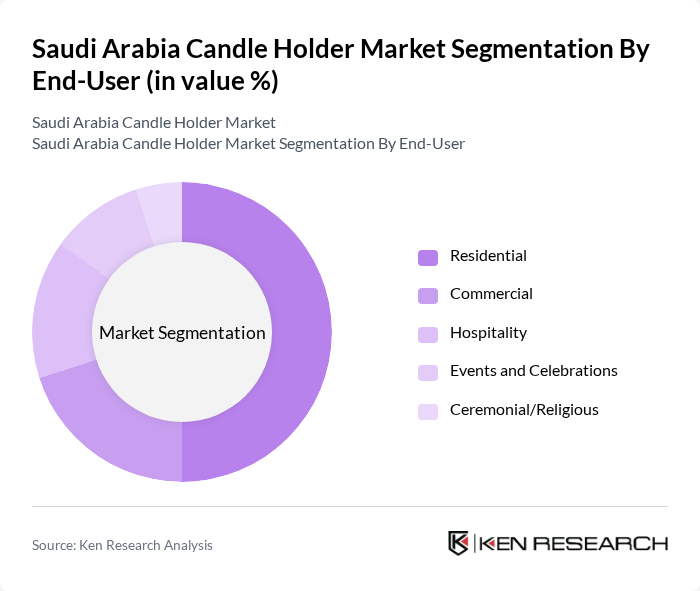

By End-User:The market can be segmented based on end-users into Residential, Commercial, Hospitality, Events and Celebrations, and Ceremonial/Religious. The Residential segment is the largest, driven by the increasing trend of home decoration and the use of candles for personal enjoyment, relaxation, and wellness. Consumers are increasingly investing in home aesthetics, leading to a higher demand for decorative candle holders in residential settings. The commercial and hospitality segments are also growing, with restaurants, hotels, and event venues using candle holders to enhance ambiance and guest experience .

The Saudi Arabia Candle Holder Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Saudi Arabia, Home Centre (Landmark Group), Pottery Barn KSA, West Elm Saudi Arabia, Danube Home, Huda Lighting, Almutlaq Furniture, Crate & Barrel Saudi Arabia, Aura Living, Nice Stores, Al Rugaib Furniture, Silsal Design House, The Candle Studio KSA, Muji Saudi Arabia, Zara Home Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia candle holder market is poised for significant growth, driven by evolving consumer preferences towards home decor and sustainability. As the trend for eco-friendly products gains traction, manufacturers are likely to innovate with sustainable materials. Additionally, the rise of e-commerce platforms will facilitate wider distribution, allowing consumers to access a diverse range of candle holders. These trends indicate a dynamic market landscape, with opportunities for growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Desktop Candle Holders Hanging Candle Holders Wall-mounted Candle Holders Tabletop Candle Holders Floor Candle Holders Outdoor Candle Holders Electric Candle Holders Others |

| By End-User | Residential Commercial Hospitality Events and Celebrations Ceremonial/Religious |

| By Distribution Channel | Online Retail Specialty Stores Supermarkets/Hypermarkets Home Decor Stores Department Stores Company-Owned Outlets |

| By Material | Metal Glass Wood Ceramic Plastic Bamboo/Recycled/Eco-friendly Materials |

| By Price Range | Budget Mid-range Premium |

| By Occasion | Weddings Festivals Home Decor Corporate Events Religious Ceremonies |

| By Style | Modern Traditional Ornamental Minimalist |

| By Brand | Local Brands International Brands Artisan Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Candle Holder Sales | 100 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 120 | Homeowners, Interior Decorators |

| Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Online Sales Channels | 90 | E-commerce Managers, Digital Marketing Specialists |

| Market Trend Analysis | 60 | Market Analysts, Industry Experts |

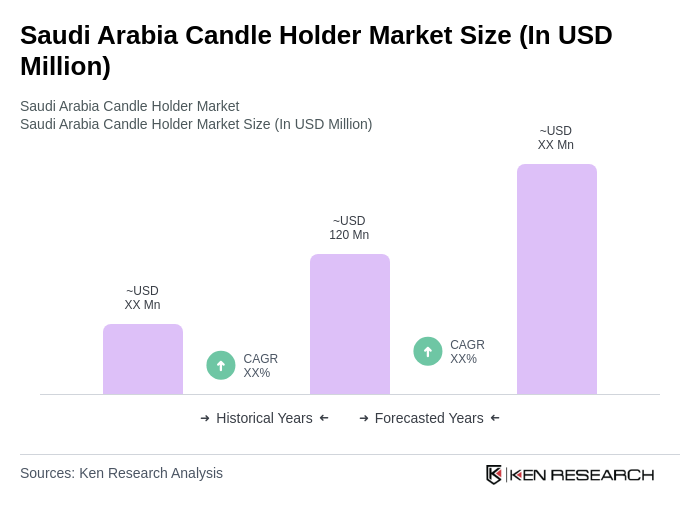

The Saudi Arabia Candle Holder Market is valued at approximately USD 120 million, reflecting strong demand for decorative and functional candle holders driven by trends in home décor and consumer spending.