Throughout the history of capital markets, the nature of information available to those seeking to gain a competitive edge has evolved immensely. Sources that were once unique are now part of the first year curriculum in undergraduate finance classes. Company reports and stock fundamentals were once considered visionary; now they are a rudimentary and universal aspect of stock valuation.

The quest for the next untapped source of information for investment professionals is firmly underway. Luckily, we now find ourselves in a climate of data ubiquity, and that could lead to success for the investors who know how to extract signal from the considerable noise.

Alternative data is data that is not traditionally financial in nature, and has not been commoditized in the form of stock prices or fundamentals. This is raw data that is often produced as a byproduct of a company’s effort to track every aspect of production, and has the potential to be utilized by quantitative analysts to draw conclusions about the health of a stock or a sector of the economy.

The emergence of the Internet of Things has also created an immense amount of data that has the ability to reflect consumer behavior. Wearable technology and smart devices track user decision-making processes, which creates a sea of data comprised of consumer decisions. With the right analysis, this information can be used to determine behavior trends and extract trade signals, leading to more accurate and temporal predictions of market sentiment.

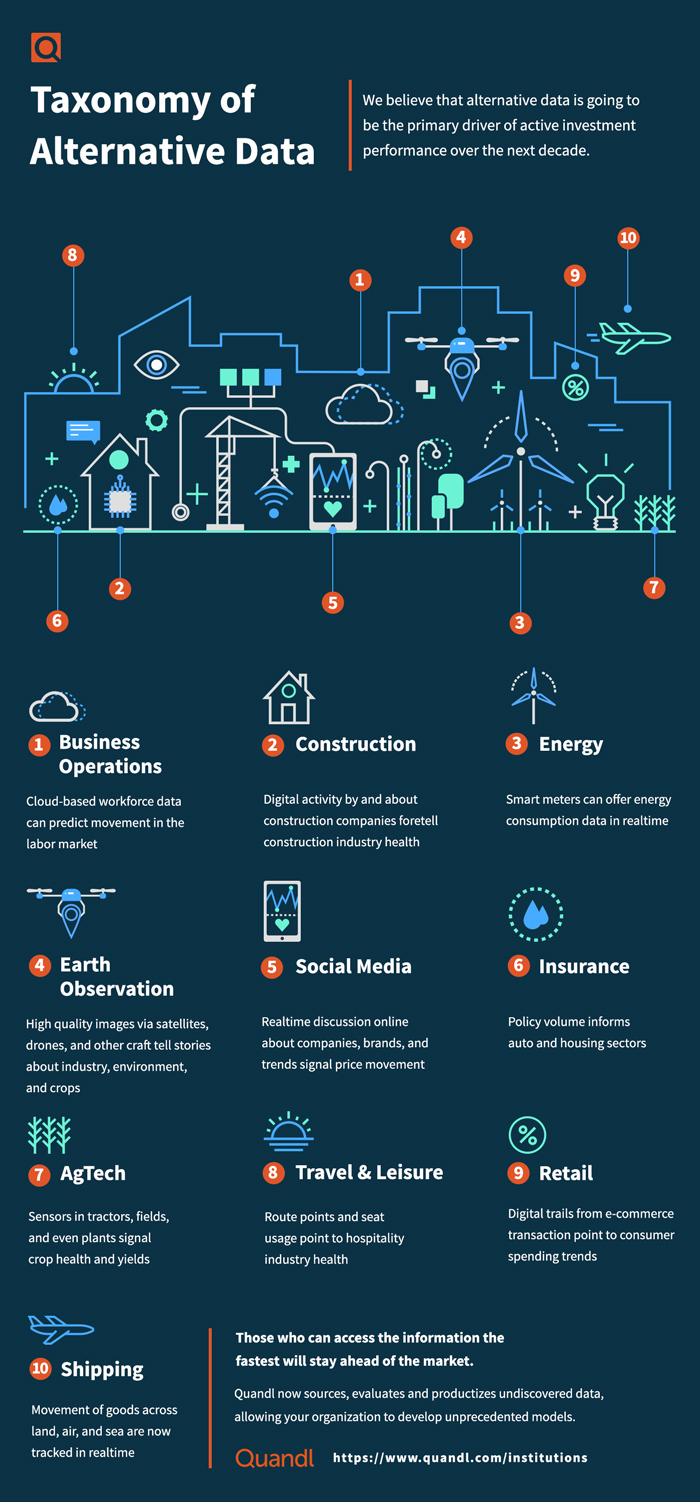

There are a number of industries that are currently producing streams of alternative data, all of which hold enormous potential for investors. This infographic displays the taxonomy of alternative data, illustrating 10 key industries producing data that stands to benefit investors.