The Indonesia data center market was observed to grow with a stable growth pattern in the review period 2014-2019. Factors such as the government’s data localization law, adoption of AI, IoT & big data, rising e-commerce and SME industry, rising demand for the local data centers, and others have helped the data center industry to grow in Indonesia in terms of revenue.

The data center and cloud services market in Indonesia is highly poised to witness positive double-digit growth in the coming years. In this segment, we have highlighted the major reasons and supporting factors that will assist the market to boom in Indonesia.

Market Stage

Market Stage

Cloud Penetration

Cloud Penetration

Competition Structure

Competition Structure

Major Players

Major Players

The Cloud Services Market is at a Nascent stage and was observed to grow at a double digit growth rate during the review period 2014-2019

Major Challenges: Low speed of internet connection in rural areas, Lack of awareness, lack of resources, security concerns, Loss of Control, Weak ICT Infrastructure

Cloud adoption growth is fast in less regulated sectors and is very slow in heavily regulated industries such as financial services. Local companies are quickly embracing cloud technology to cut their cost of operations in Indonesia.

The competition in Indonesia cloud service market has been observed to be concentrated with few pure cloud providers. DC companies are providing private cloud to customer as a value added service to the customers

Cloud service providers: Alibaba cloud, Google Cloud, AWS, Indonesia Cloud

Indonesia cloud services market would substantially increase in terms of revenue. The cloud services market is anticipated to grow with a CAGR of ~36% during 2019-2024

Indonesia witnessing the entry of hyper cloud providers such as Alibaba, Azure, AWS, Googles cloud which would result in an increased demand for cloud services.

Indonesia rapidly moving towards utilizing cloud in both the govt. and private sectors to increase the transparency and offer fastest access.

Governments plan to turn large cities such as Jakarta into smart cities would contribute in the growth of the cloud industry in the next few years.

The upcoming data startups such as Snapcart, Kata.ai, Bjtech, Nodeflux and others in the county would be a contributing factor for the growth of this industry.

Indonesia’s GDP anticipated to witness a contribution of around $ 40 Bn from the use of Public cloud service1 during 2019-2023

Rising demand in the cloud industry in Indonesia has contributed in the growth of cloud computing consulting market which is being provided by companies such as AGIT, Oracle and VMWare

Indonesia cloud industry grew with a stagnant growth rate during 2014-2019 owing to the low adoption in the country.

Growing mobile consumption and increasing demand for disaster recovery services driving the cloud market in Indonesia.

Indonesia’s plan to have a digital economy would create $ 172 Bn1 worth of economic opportunities by 2030 thereby helping the cloud industry grow.

Global cloud providers are developing their own data center in Indonesia as the end users are insecure due to the protection of govt. regulations.

Indonesia’s “Making Indonesia 4.0” Initiative to contribute to the growth of the cloud computing industry in Indonesia.

Target Audience of Cloud Companies: Indonesia’s 41 million SME’s2 including businesses such as e-commerce, B2B, Manufacturing, Retail and others

Booming Public Cloud Services: Public cloud services market size in Indonesia was witnessed to be $ 278 mn in the yr 2019 and is anticipated to grow with a CAGR of 25% by 2023

The low cost of operations in Cloud services is attracting the local companies of Indonesia leading to increased demand for data center space by cloud service providers

Increasing security features and introduction of private cloud services to escalate the cloud service industry in the country.

The demand for cloud services is the highest among the manufacturing sector. Whereas, SMBs and large enterprises are also adopting cloud computing to cut their operational costs.

The entrance of global cloud providers such as Alibaba cloud, Microsoft (Azure), Amazon Web Services (AWS), Google cloud is contributing to the growth of the cloud service industry.

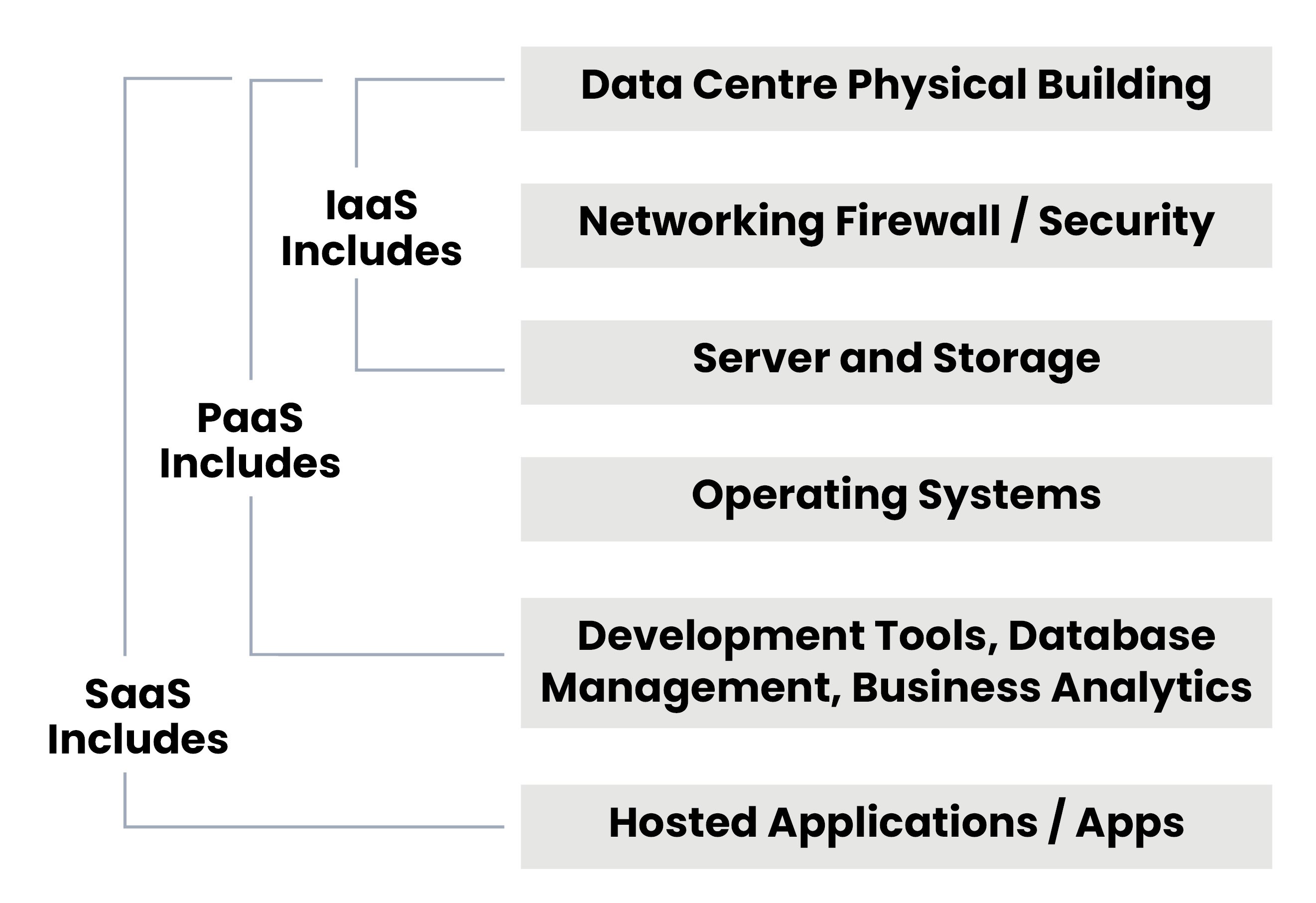

SaaS and IaaS models are the largest segments of the public cloud market, but PaaS is anticipated to be the fastest growing segment with a CAGR averaging 25% (2019-2023)

Data centers in Indonesia are adopting the solutions such as AI, IoT and Big data to drive up the efficiency and cut down the cost.

According to the Indonesian Minister of Industry, the value of IoT in Indonesia is anticipated to reach $ 30 bn by 2022.

Increasing amount of data in the country is leading to the traditional data centers to operate with a slower pace and also resulting in an inefficient output.

The Indonesian Government declared AI as one of the strategic technologies of its “Making Indonesia 4.0” roadmap, as a part of the fourth industrial revolution.

AI start-ups in Indonesia are following the concept of made in Indonesia by Indonesians for Indonesians which is contributing to the “Making Indonesia 4.0 roadmap”.

Alibaba Cloud established their data center in Indonesia in 2018 and provides big data offering called MaxCompute.

The internet penetration grew from 32% in 2017 to 56% in 20191 which has bolstered the customer base for e-commerce companies. The number of internet users in Indonesia reached 171 mn2 in the yr 2019.

The increased use of smart phones and penetration of Internet coincides with the growth in e-commerce transactions and social media in Indonesia.

According to the industry articles, the Indonesia E-commerce industry is anticipated to reach $ 47 bn by 2023.

The high adoption of mobile services is driving content providers to deliver their content within the country leading to an increase in the demand data center space.

Distribution of Internet Users in Indonesia, 2019

Introduction of the Government’s regulation 82 and the deployment of 5G have led to an increase in the demand for the local data center services.

Under GR 82, Electronic System Operators that provide public services were required to have data centers and disaster recovery centers in Indonesia by October 2017.

Indonesia is the fourth largest cellular market in the world with more than 330 million subscribers.

According to the Association of Indonesian Cellular Operators (ATSI), the 5G services will be implemented in the country by 2022 bring huge opportunity in the telecom and data center industry.

Rising data in the country and the data localization law leading to the increased demand for the local data centers and is anticipated to grow in the next few years.

Government regulations such as Data Localization law, Personal Data Protection Act, Energy Conservation Regulation and Cyber security & Resilience is has increased the trust of the customers on the data center services in Indonesia.