Region:Asia

Author(s):Harsh Saxena

Product Code:KR212

Pages:104

Published On:July 2014

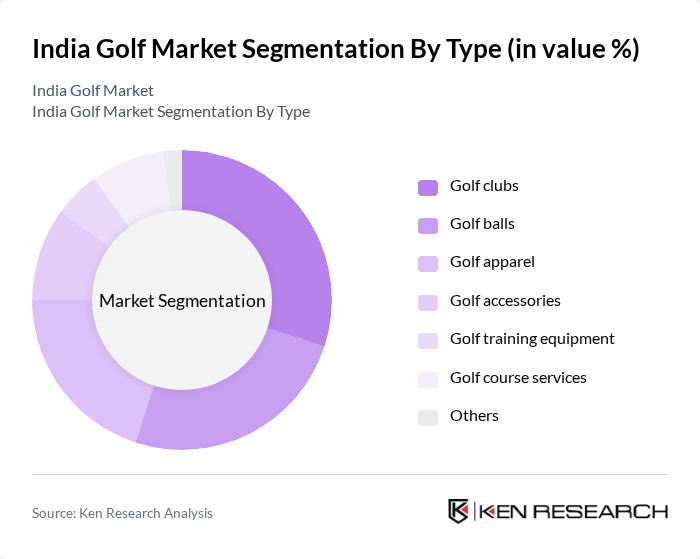

By Type:The market is segmented into various types, including golf clubs, golf balls, golf apparel, golf accessories, golf training equipment, golf course services, and others. Among these, golf clubs and golf balls are the leading subsegments, driven by the increasing number of golfers and the demand for quality equipment. Golf apparel is also gaining traction as more individuals take up the sport, leading to a rise in fashion-conscious golfing attire.

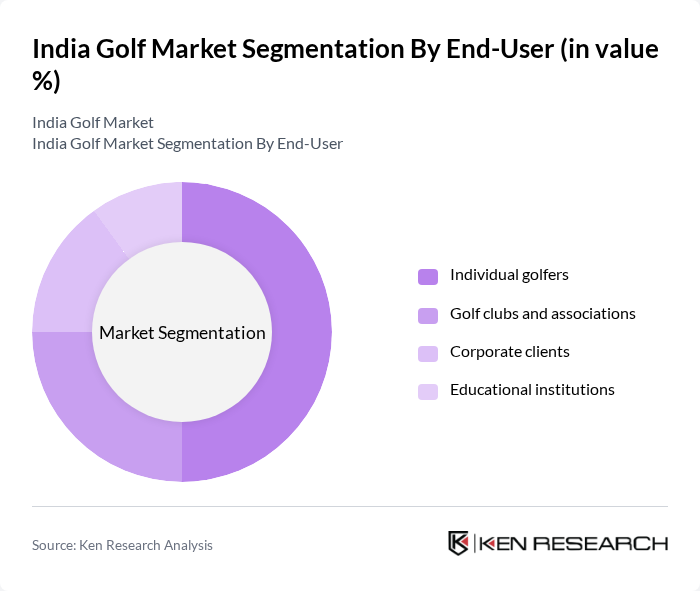

By End-User:The end-user segmentation includes individual golfers, golf clubs and associations, corporate clients, and educational institutions. Individual golfers represent the largest segment, as the sport continues to attract a diverse range of players, from beginners to seasoned professionals. Corporate clients are also significant, as many companies organize golf events for networking and team-building purposes.

The India Golf Market is characterized by a dynamic mix of regional and international players. Leading participants such as Callaway Golf Company, TaylorMade Golf Company, Titleist, Ping, Mizuno Corporation, Cobra Golf, Srixon, Wilson Sporting Goods, Adams Golf, Cleveland Golf, PXG (Parsons Xtreme Golf), Bridgestone Golf, Odyssey, Nike Golf, Under Armour contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India golf market appears promising, driven by increasing participation rates and a growing middle class. As more individuals seek leisure activities, golf is likely to gain traction, particularly among women and younger demographics. The integration of technology in training and equipment is expected to enhance the golfing experience, making it more appealing. Additionally, government support for sports development will likely foster a more conducive environment for golf, encouraging further investment and participation.

| Segment | Sub-Segments |

|---|---|

| By Type | Golf clubs Golf balls Golf apparel Golf accessories Golf training equipment Golf course services Others |

| By End-User | Individual golfers Golf clubs and associations Corporate clients Educational institutions |

| By Region | North India South India East India West India |

| By Application | Recreational play Professional tournaments Training and coaching |

| By Sales Channel | Online retail Physical retail stores Golf course pro shops |

| By Price Range | Budget Mid-range Premium |

| By Customer Segment | Beginners Intermediate players Advanced players Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Golf Course Management | 100 | Golf Course Managers, Operations Directors |

| Golf Equipment Retail | 80 | Store Owners, Sales Representatives |

| Golf Training Services | 70 | Golf Instructors, Training Facility Managers |

| Golf Tourism Insights | 60 | Tour Operators, Travel Agents |

| Corporate Golf Events | 50 | Event Planners, Corporate Executives |

The India Golf Market is valued at approximately USD 1 billion, reflecting a significant growth trend driven by increased participation, rising disposable incomes, and the sport's growing popularity among urban populations.