Discover the pulse of your target audience and make data-driven decisions with our tailored surveys without the fear of missing on accurate, unbiased, and valuable insights.

We specialize in decoding your customers/ employees pain points, needs, and desires, empowering you to outshine your competitors.

Congrats! You are just one step away from becoming an informed business decision maker.

Trusted by 2,000+ Brands & Startups in over 100 countries

What will you get by engaging with us?

- Tailor-made to fit your business like a bespoke suit.

- Go beyond just presenting data to receive powerful actionable recommendations.

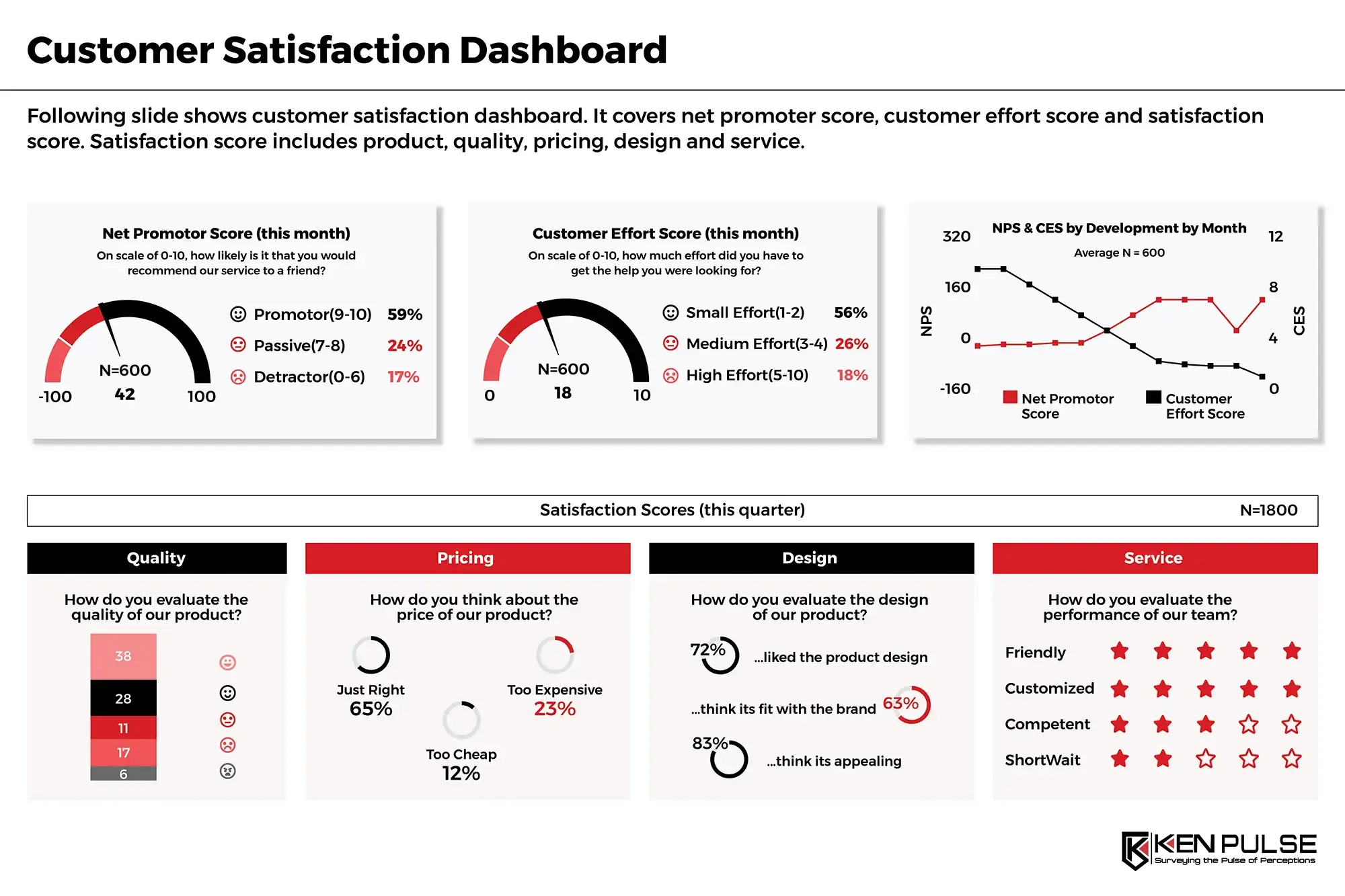

- Learn from Powerful Power Bi Dashboard to track all your KPIs in one place

- Prioritize your confidentiality & ensure accuracy without judgement bias

- Compare all your KPIs from previous surveys with the controls to slice and dice

- Obtain a high-octane ROI that makes you the informed decision marker in your team

Limited mandates can be onboarded this month!

***Be Quick, connect with our consultant today***

Please Check All Boxes Where Your Answer is YES

If you checked ANY of the boxes above, then you’re invited to join a discovery call with Ken Pulse consultant.

Unlock the power of data with our survey pulse and visualize, analyze, and conquer as you gain valuable insights.

-

Customer Satisfaction

Customer Satisfaction

-

Employee Engagement

Employee Engagement

-

Attrition Analysis

Attrition Analysis

-

Ad Campaign effectiveness

Ad Campaign effectiveness

-

Social Media

Social Media

-

Brand Awareness

Brand Awareness

Here is how your Engagement journey is going to be:

Phase 1: Transparent Data Collection & Reporting

- We will collaborate closely to understand your objectives and provide necessary background information.

- Stay in the loop with transparent updates. We will keep you informed, like your own personal satisfaction and loyalty news channel.

- Brace yourself for a comprehensive dashboard that brings satisfaction levels, loyalty drivers, and improvement areas to the forefront. It is like reading the interesting insights but with fancy graphs and charts with slicer and dicer.

Phase 2: Strong Diagnosis, Root Cause, Bucketing & Recommendations

- Get ready to solve the mysteries behind customer/employee satisfaction and loyalty. We'll work together to identify the root causes and categorize them into actionable buckets.

- Our recommendations will hit the bullseye, aligned with your organization's goals and values. We're all about bespoke recommendations, just for you.

- We'll guide you through strategies and interventions, empowering you to address the root causes and transform satisfaction and loyalty levels. Prepare for success!

Phase 3: Change Management in Process, System, Structure, and Strategy

- Buckle up, because change is coming! Our change management plan will be your trusty roadmap to navigate the process.

- Clear communication will be our superpower as we spell out the steps, resources, and timelines required for smooth sailing. We speak your language, not some confusing jargon.

- We'll help you rally your team and ignite excitement about the need for change. Together, we'll break barriers and build a united front. Go team!

- Equipping your teams with the necessary skills and knowledge? Consider it done. Our training programs will turn them into rockstars of change. Lights, camera, action!

Throughout the Engagement Journey:

- We're like a dynamic duo, collaborating and valuing your input every step of the way. Your satisfaction is our mission.

- Expect regular updates on the project's progress. We won't keep you in the dark. Knowledge is power, after all!

- Monitoring the impact of our initiatives? You bet! We'll track and measure the results like detectives on a case. Let the data speak.

- We're committed to your success, even after the project wraps up. We're in it for the long haul, like a trusty sidekick by your side.

More than 2,000 clients have conveyed engaging with Ken is the best way to seek accurate, customisable, detailed and timely industry data to optimize market entry, expansion opportunity, sourcing, marketing and operational business strategy.

Shweta Barupal

Lead UX Researcher | Glance InMobi Pte Ltd

We are pleased of the work carried out by Ken Research team to get better understanding Indonesia users; the process-driven approach managed by the team with open communication and flexibility during the engagements producing research deliverables with actionable insight and a lot of key take away emerged as a result of detailed attention to research process, and providing us solution-oriented with actionable suggestions.

Siya Sood

Senior Manager Strategic Initiatives | Harappa Learning Private Limited

Working with your team was a great experience. The research you undertook is very insightful and helping us shape our strategy. Your team's prompt support made working together a breeze. We look forward to partnering with you again!

Avnish Patankar

Commercial Director | BDx Data Center Pte Ltd

We worked with Ken Research on a research project to gauge the potential of data center colocation services and competition analysis in Indonesia. We have been so impressed with the standard of work delivered by Ken Research. They are offering a quality service, and we have found them to be responsive, informed, thorough, and personable. The final presentation of results was incredibly well put together, delivered with clarity, and gave us more insight than we had hoped for.

Frequently Asked Questions

We have tried our best to answer all the frequently asked questions. If you still have more questions, please write to us at arunesh.bakshi@kenresearch.com (Give us 8 working hours to respond back). My awesome support team will get back to you.

Conducting these surveys allows you to gain valuable insights into your customers' experience and satisfaction levels, enabling you to identify areas for improvement and enhance customer loyalty. Similarly, employee engagement surveys help measure satisfaction, identify pain points, and foster a positive work environment. Ultimately, these surveys drive business growth, customer retention, and employee productivity.

On top of this, we aid you not just in sharing observations as datapoints but root cause analysis with 5Why technique and post which the recommendation implementation strategy with process, system and structure creation.

Our survey process is simple and efficient. We collaborate with you to define objectives, customize survey questions, and determine the target audience. We collect data through various methods, such as online surveys, indepth interviews or interviews. Once collected, our expert team analyzes the data and provides comprehensive reports with actionable insights and recommendations.

Confidentiality is of utmost importance to us. All responses are treated with the highest level of confidentiality and anonymity. We adhere to strict data protection policies and ensure that individual responses are aggregated and presented in a way that ensures privacy and confidentiality.

Absolutely! We understand that each business is unique. Our surveys can be fully customized to align with your specific goals, industry, and target audience. We work closely with you to design survey questions that capture the insights you seek and address your specific concerns. Our question bank built over the period will aid you in select and choose and built the journey as per your requirement.

Our reports are comprehensive and insightful. We use advanced statistical analysis techniques to derive meaningful insights from the collected data. The reports include key metrics, charts, and graphs that visually represent the findings. We present the results in a clear and concise manner, making it easy for you to understand and act upon the insights gained. We utilize robust power BI dashboards to learn and correlate information with the controls and slicer required.

Our market research agency has extensive 12 years of experience in customer satisfaction/loyalty surveys and employee engagement surveys trusted by 2000+ clients. We have a team of 100+ skilled researchers and analysts who are well-versed in survey methodology and data analysis. Our expertise ensures that you receive accurate, reliable, and actionable insights to drive positive change in your business.

Certainly! We have numerous success stories, case studies, and testimonials that demonstrate the positive impact of customer satisfaction/loyalty surveys and employee engagement surveys. These surveys have helped businesses improve customer retention, enhance employee satisfaction, boost productivity, and achieve sustainable growth. We would be happy to share specific examples that align with your industry or business objectives.

Limited mandates can be onboarded in this month. Register before