Region:Global

Author(s):Rebecca

Product Code:KRAB0215

Pages:85

Published On:August 2025

By Type:The non-dairy milk market is segmented into various types, including almond milk, soy milk, oat milk, coconut milk, rice milk, cashew milk, hazelnut milk, hemp milk, and others. Among these, almond milk and oat milk have gained significant popularity due to their taste, versatility, and perceived health benefits. Almond milk is often favored for its low calorie content, while oat milk is appreciated for its creamy texture and sustainability. The increasing consumer preference for plant-based diets and the expansion of oat milk offerings in retail and foodservice channels have contributed to a surge in demand for these alternatives .

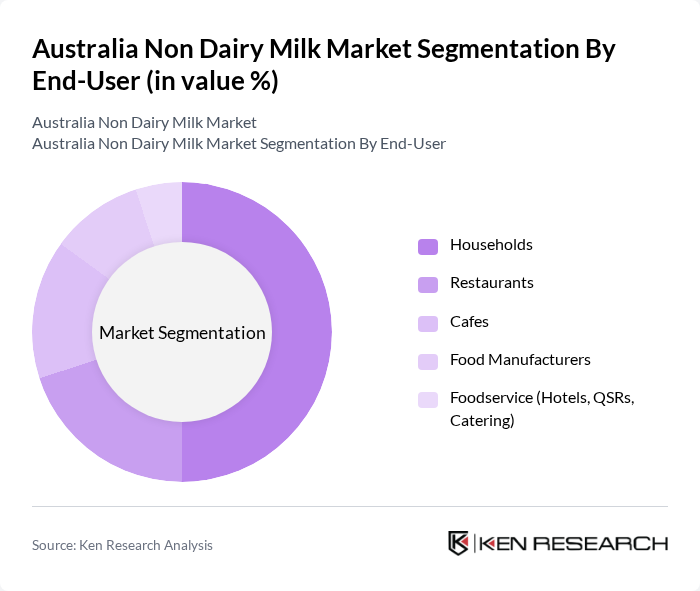

By End-User:The end-user segmentation includes households, restaurants, cafes, food manufacturers, and foodservice sectors such as hotels and quick-service restaurants (QSRs). Households represent the largest segment, driven by the increasing trend of health-conscious consumers opting for non-dairy alternatives in their daily diets. Restaurants and cafes are also significant contributors, as they adapt their menus to include plant-based options to cater to the growing demand for vegan and lactose-free products. The off-trade channel, which includes supermarkets and grocery stores, dominates distribution, while on-trade channels such as cafes and restaurants continue to expand their plant-based offerings .

The Australia Non Dairy Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blue Diamond Growers (Almond Breeze), Sanitarium Health and Wellbeing Company (So Good), Vitasoy Australia Products Pty Ltd, Oatly Group AB, Pureharvest Pty Ltd, Bonsoy (Musashi Foods Pty Ltd), Milkadamia (Jindilli Beverages Australia Pty Ltd), Australia's Own (Noumi Ltd), Coles Group Limited (Coles Brand), Woolworths Group Limited (Woolworths Brand), Nutty Bruce (Inside Out Nutritious Goods Pty Ltd), Califia Farms, LLC, Ripple Foods PBC, Alpro (Danone S.A.), Chobani Global Holdings, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the non-dairy milk market in Australia appears promising, driven by ongoing health trends and environmental awareness. As consumers increasingly seek sustainable and health-oriented products, the market is expected to adapt with innovative offerings. Additionally, the rise of e-commerce platforms is likely to enhance product accessibility, allowing brands to reach a broader audience. Companies that effectively leverage these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Almond Milk Soy Milk Oat Milk Coconut Milk Rice Milk Cashew Milk Hazelnut Milk Hemp Milk Others |

| By End-User | Households Restaurants Cafes Food Manufacturers Foodservice (Hotels, QSRs, Catering) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Health Food Stores Specialty Stores |

| By Packaging Type | Cartons Bottles Pouches Cans |

| By Price Range | Premium Mid-Range Budget |

| By Flavor | Original Vanilla Chocolate Coffee Berry/Other Flavors |

| By Nutritional Content | High Protein Low Sugar Fortified (Calcium, Vitamins, Omega-3, etc.) Organic |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Health-conscious Consumers, Plant-based Diet Adopters |

| Food Service Sector Analysis | 80 | Restaurant Owners, Menu Planners |

| Market Trends and Innovations | 60 | Product Developers, Marketing Managers |

| Distribution Channel Effectiveness | 90 | Logistics Managers, Supply Chain Analysts |

The Australia Non Dairy Milk Market is valued at approximately USD 325 million, reflecting a significant growth trend driven by increasing health consciousness, lactose intolerance, and a shift towards plant-based diets among consumers.