See your brand the way your customers do.

Rated by 1K+ Industry leaders

Use real feedback from real audiences to understand what drives decisions and act with confidence.

0+

Respondents Engaged Across 50+ Markets

0+

Brand Perception Survey Conducted

0+

C-Suite & Industry Experts in Our Network

Your Brand positioning

What people think you do?

What you do?

What It Means for the Brand

Perception gaps create distrust, limiting customer advocacy and partner confidence.

How Ken Solves It

Identify root causes of negative sentiment and reshape perception through data-backed repositioning.

Pain points

Problem

Perception gaps create distrust, limiting customer advocacy and partner confidence.

Solution

Identify root causes of negative sentiment and reshape perception through data-backed repositioning.

Identify Brand Essence

Define the brand’s unique purpose, personality, and core message to establish a strong foundation.

Step 01

Identify Brand Essence

Map Audience Voices

Gather insights from your audience to understand their preferences, emotions, and engagement levels.

Step 02

Map Audience Voices

Perceptions in Real-Time

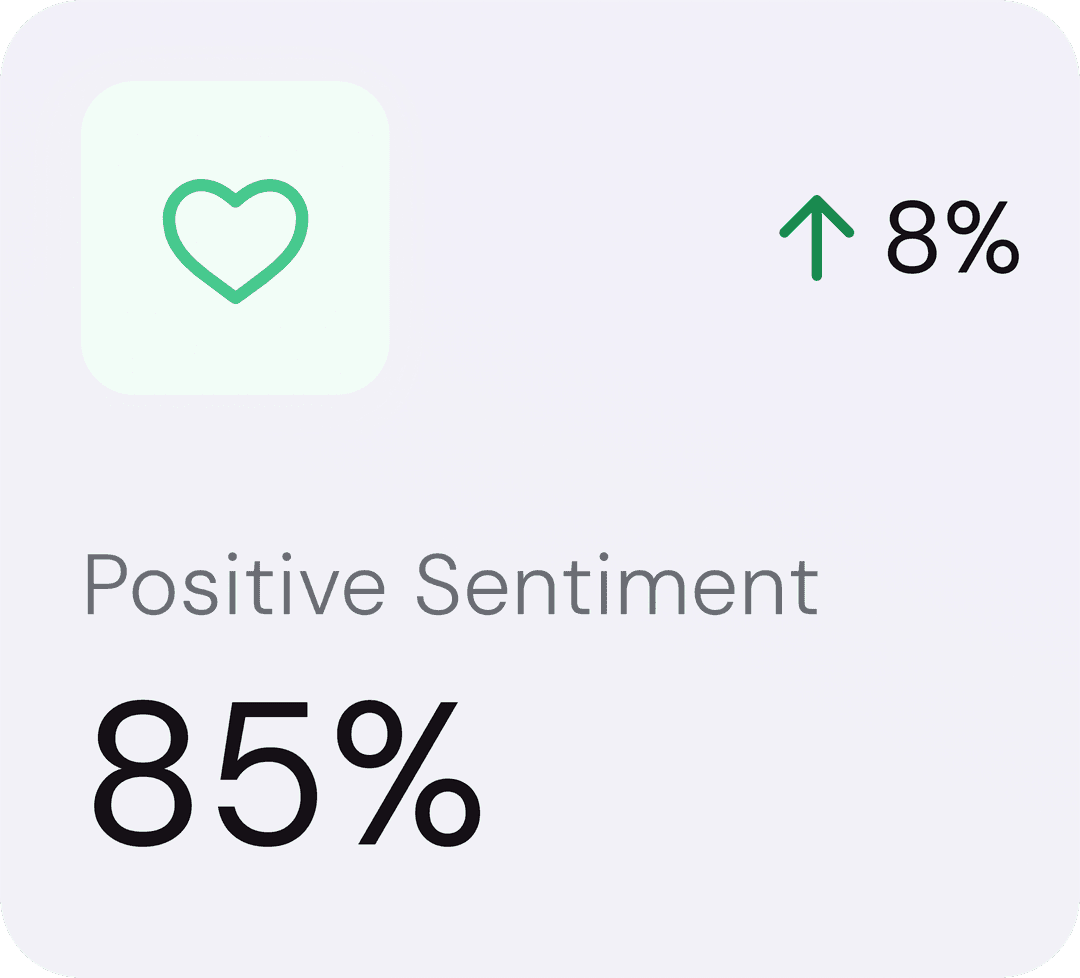

Monitor how customers perceive your brand using live data and sentiment analysis.

Step 03

Perceptions in Real-Time

Analyze Brand Metrics

Evaluate key performance indicators to measure awareness, loyalty, and overall brand strength.

Step 04

Analyze Brand Metrics

Compare Market Positioning

Benchmark your brand against competitors to identify unique strengths and opportunities.

Step 05

Compare Market Positioning

Track Brand Shifts

Observe changes in brand perception over time to adapt strategies and maintain relevance.

Step 06

Track Brand Shifts

Consulting Beyond Data

Turn insights into strategic actions with expert consulting and long-term growth planning.

Step 07

Consulting Beyond Data

Identify Brand Essence

Define the brand’s unique purpose, personality, and core message to establish a strong foundation.

Step 01

Identify Brand Essence

Map Audience Voices

Gather insights from your audience to understand their preferences, emotions, and engagement levels.

Step 02

Map Audience Voices

Perceptions in Real-Time

Monitor how customers perceive your brand using live data and sentiment analysis.

Step 03

Perceptions in Real-Time

Analyze Brand Metrics

Evaluate key performance indicators to measure awareness, loyalty, and overall brand strength.

Step 04

Analyze Brand Metrics

Compare Market Positioning

Benchmark your brand against competitors to identify unique strengths and opportunities.

Step 05

Compare Market Positioning

Track Brand Shifts

Observe changes in brand perception over time to adapt strategies and maintain relevance.

Step 06

Track Brand Shifts

Consulting Beyond Data

Turn insights into strategic actions with expert consulting and long-term growth planning.

Step 07

Consulting Beyond Data

01

North Star Anchoring

North Star Anchoring

Every insight is tied to business KPIs like sales uplift, NPS retention, or share of voice, making perception directly measurable against growth.

02

Competitor Benchmarking in the Same Dashboard

Competitor Benchmarking in the Same Dashboard

View your brand alongside 8–10 competitors on recall, equity, and consideration, all in one unified dashboard.

03

Always-On Brand Tracking

Always-On Brand Tracking

Move beyond one-time surveys with continuous micro-pulses and real-time dashboards that keep brand health visible year-round.

04

Layered with Social and Search Intelligence

Layered with Social and Search Intelligence

Blend survey data with social sentiment and search trends to create a 360° view of what audiences say and do.

05

Persona-Level Insight Mapping

Persona-Level Insight Mapping

Translate perception into segmented personas by age, income, and mindset, revealing who connects most and where you’re losing traction.

06

Predictive Perception Modeling

Predictive Perception Modeling

Use data to forecast outcomes, linking trust lifts to market-share growth or intent-to-buy probabilities.

07

Action-Ready Playbooks

Action-Ready Playbooks

Every study ends with a “What Now” roadmap with clear priorities for messaging, audience, and channels to act on immediately.

08

Storytelling-Ready Outputs

Storytelling-Ready Outputs

Boardroom-friendly dashboards, infographics, and short videos — designed so insights can be shared, not reworked.

09

Integrated Employee Perception Layer

Integrated Employee Perception Layer

Measure how employees view the brand versus customers, closing the inside-outside perception gap that shapes authenticity.

Real examples of how data and our strategies shaped stronger brands.

We analyze three layers together:

If perception drops while the category grows then it’s a brand issue. If perception is strong but conversions lag then it’s pricing, distribution, or product.

Our survey isolates perception as a variable so you know whether the brand is the bottleneck or not.

Yes, often very clearly. Campaigns fail not because of execution, but because they conflict with existing brand beliefs.

If your communication claims something people do not already associate with your brand, it creates friction.

Brand perception surveys reveal this misalignment before significant media budgets are wasted.

Yes. Using indirect questioning, association testing, brand mapping, and sentiment analysis, we decode latent biases people don’t openly express such as:

We uncover what people think, not just what they say.

We measure each component with multi-dimensional indicators:

Then we link each score to sales uplift, market share, customer lifetime value, and switching behavior.

This makes perception actionable and not theoretical.

Absolutely. People may like your brand emotionally but choose competitors for functional reasons like:

We map the difference between emotional liking and actual buying reasons, so you see where the real drop-off happens.

Yes, in fact, new brands benefit the most. You learn:

Yes. We can benchmark against:

Perception benchmarking doesn’t require competitors to be large but only relevant.

These frameworks show precisely where your brand is losing or gaining ground.

Perception is broader and includes non-users, competitors, and market views.

Yes. It gives you a data-backed blueprint for:

Repositioning without perception insights is guesswork.

Yes. We map perception scores by channel to show:

This tells you where to invest, reduce, or recalibrate visibility.

It acts as your brand control center.

Featured Post

India luxury perfume market is booming, set to nearly double from INR 953 Cr in 2023 to INR 1,824 Cr by 2029, as consumers seek exclusivity and sensory experiences.

Understand how your people feel, what keeps them motivated, and what they need to do their best every day.

Hear directly from your customers about what they love and what you could do better.

Get honest feedback from your channel partners to build stronger relationships and smoother operations.

Find out what your customers really want next and how you can make their experience better.