Asia Pacific Acetone Market Outlook to 2030

Region:Asia

Author(s):Sanjana Verma

Product Code:KROD8713

December 2024

91

About the Report

Asia Pacific Acetone Market Overview

- The Asia Pacific acetone market is valued at USD 3.2 billion based on a five-year historical analysis. This growth is primarily driven by increased demand from industries such as pharmaceuticals, chemicals, and personal care products. Acetone is a key solvent used in the production of various chemicals, including Bisphenol A (BPA) and Methyl Methacrylate (MMA), which further drive its market demand. Moreover, expanding industrial applications in the region contribute to its growing market size.

- In the Asia Pacific region, countries like China, India, and Japan dominate the acetone market due to their massive chemical and pharmaceutical manufacturing industries. China leads with its large-scale production of acetone, driven by high demand from downstream sectors like electronics and automotive industries. India and Japan follow closely, owing to the robust pharmaceutical sectors and increased manufacturing capacities.

- The Environmental Protection Act in countries like India and Japan plays a critical role in regulating acetone production. In 2023, India tightened its environmental standards under the Environmental Protection Act, requiring chemical manufacturers to adhere to stricter guidelines for waste disposal and emissions control. Non-compliance with these regulations can result in fines or the closure of production facilities. This regulatory framework is driving companies to invest in greener production technologies and adopt sustainable practices to meet the governments environmental goals.

Asia Pacific Acetone Market Segmentation

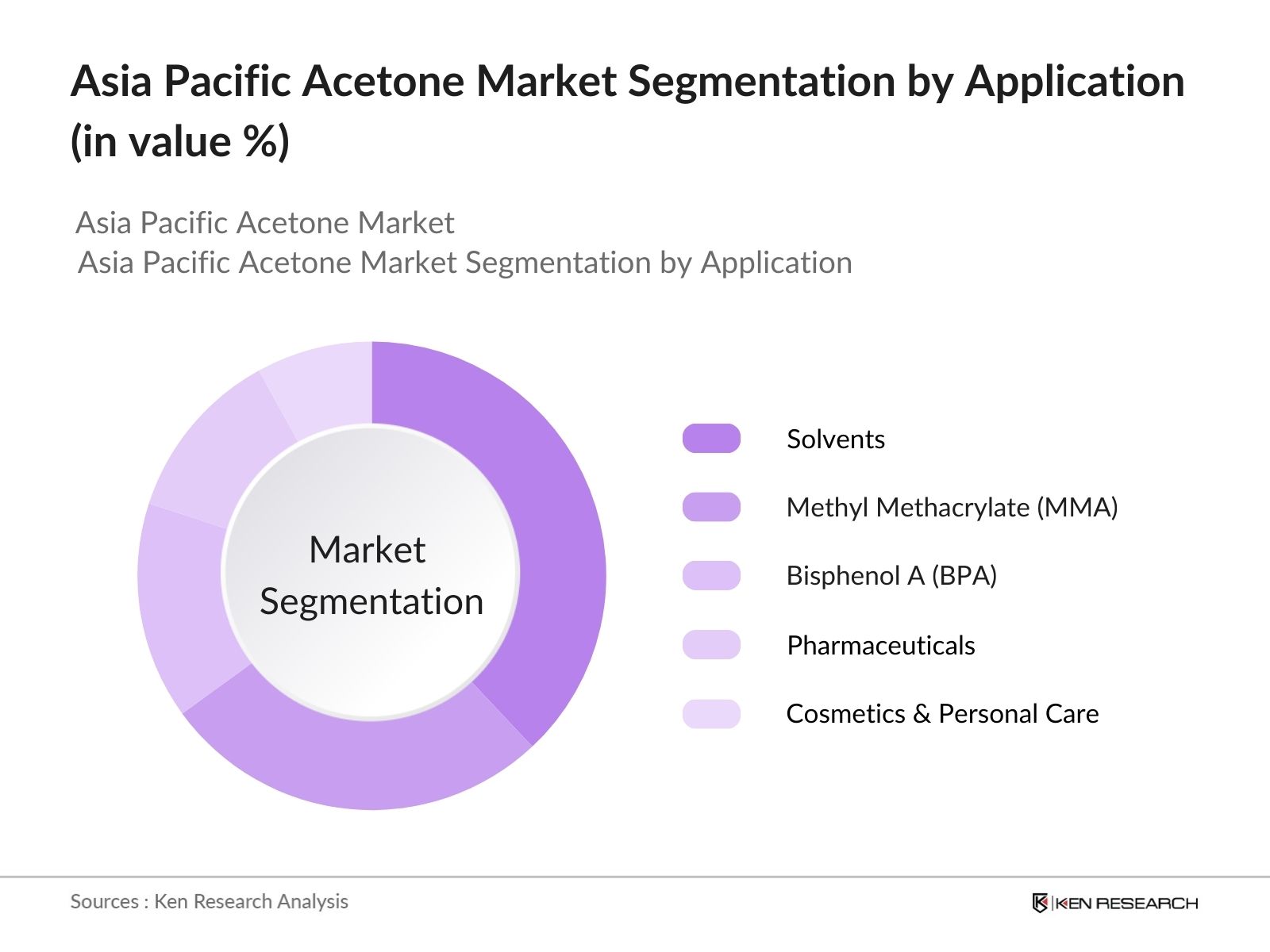

By Application: The Asia Pacific acetone market is segmented by application into solvents, Methyl Methacrylate (MMA), Bisphenol A (BPA), pharmaceuticals, and cosmetics & personal care. Solvents dominate the market share due to their extensive use in industries like paints, adhesives, and coatings. The versatility of acetone as a solvent and its effectiveness in dissolving organic compounds makes it highly sought after across multiple industries. Furthermore, the increasing demand for acetone-based products in industrial cleaning agents also supports the growth of this segment.

By Production Method: The Asia Pacific acetone market is segmented by production method into the cumene process, isopropanol process, and bio-based acetone.

The cumene process holds a dominant market share, as it is the most widely adopted method for producing acetone. This process is economical and efficient, producing both acetone and phenol as co-products, which further enhances its widespread use across the region. The cumene process continues to be the preferred production method, as it supports large-scale acetone production in high-demand industries.

Asia Pacific Acetone Market Competitive Landscape

The Asia Pacific acetone market is dominated by major global and regional players who are driving innovation and maintaining strong production capacities. The competitive landscape is characterized by key players focusing on sustainability, capacity expansions, and strategic mergers.

The Asia Pacific acetone market is dominated by a few key players, including multinational corporations like Dow Inc., and regional players like Formosa Chemicals and Reliance Industries. These companies benefit from strong manufacturing capabilities, widespread distribution networks, and advancements in chemical production technologies, which allow them to maintain a competitive edge.

|

Company Name |

Established Year |

Headquarters |

Production Capacity |

Feedstock Dependency |

R&D Investment |

Distribution Network |

Sustainability Initiatives |

Global Presence |

|

Dow Inc. |

1897 |

Midland, USA |

- |

- |

- |

- |

- |

- |

|

Formosa Chemicals |

1954 |

Taiwan |

- |

- |

- |

- |

- |

- |

|

Reliance Industries Ltd. |

1973 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

|

LG Chem |

1947 |

Seoul, South Korea |

- |

- |

- |

- |

- |

- |

|

SABIC |

1976 |

Riyadh, Saudi Arabia |

- |

- |

- |

- |

- |

- |

Asia Pacific Acetone Market Analysis

Growth Drivers

- Demand from Downstream Industries: The demand for acetone in the Asia Pacific region has seen substantial growth due to its extensive use in downstream industries such as plastics, solvents, and adhesives. Acetone is a crucial component in the production of polycarbonate plastics, which have wide applications in electronics, automotive, and construction industries. In 2023, the automotive production volume in China alone reached 25.3 million units, driving the demand for acetone-based products. This increased industrial demand highlights the expanding role of acetone in multiple manufacturing processes.

- Chemical Industry Expansion: The Asia Pacific region has been experiencing rapid growth in the chemical industry, with China, India, and Japan leading the market. In 2023, Chinas chemical industry was valued at $2 trillion, making it one of the largest global chemical producers. Acetone, being a key intermediate in the production of several chemicals, benefits from this expansion. The rise in chemical production also aligns with government-backed initiatives like Indias $26 billion Production Linked Incentive (PLI) Scheme for chemicals. This initiative has led to increased investments and expansion, further driving acetone production.

- Regulatory Influence on Acetone Production: Countries like Japan have stringent policies, such as the Chemical Substances Control Law, which regulates acetone production to reduce volatile organic compound (VOC) emissions. This regulatory oversight encourages cleaner production techniques, leading to higher quality acetone products. The Indian government also enforces acetone handling guidelines under the Environmental Protection Act, which has led to a rise in investments in advanced production technologies by companies to comply with regulations.

Challenges

- Fluctuating Raw Material Prices: In 2023, crude oil prices varied between $72 and $95 per barrel, which directly affected the cost of acetone production. This volatility makes it challenging for acetone producers in the Asia Pacific region to maintain stable profit margins. Additionally, import costs of propylene from oil-exporting countries like the Middle East also influence raw material prices in the region, adding to production challenges.

- Environmental Concerns and Regulation: Environmental regulations aimed at reducing emissions and promoting sustainable practices have placed significant pressure on acetone producers in the Asia Pacific region. Governments, particularly in countries like China and Japan, have implemented strict VOC emission standards. For example, in 2023, Chinas Ministry of Ecology and Environment introduced new standards for chemical emissions, requiring manufacturers to upgrade their facilities.

Asia Pacific Acetone Market Future Outlook

The Asia Pacific acetone market is expected to experience steady growth over the next five years, driven by increasing demand in the chemical, pharmaceutical, and cosmetics industries. Rising industrialization, along with a focus on bio-based acetone production, will also contribute to market expansion. The region's large manufacturing base, coupled with government incentives for sustainable chemical production, will further strengthen the market's future trajectory.

Future Market Opportunities

- Emerging Applications in Pharmaceuticals and Personal Care: Acetone is increasingly being used in the pharmaceutical and personal care industries, particularly for manufacturing antiseptics, skin creams, and oral care products. The pharmaceutical sector in India, valued at $50 billion in 2023, heavily relies on acetone as a solvent for drug formulation and manufacturing. Similarly, the growing personal care market in China, estimated at $69 billion, is fueling the demand for acetone-based products.

- Development of Bio-based Acetone: The shift toward sustainable production practices has led to the development of bio-based acetone, which is produced using renewable resources like biomass. In 2023, Japans government allocated $2.5 billion to support the development of bio-based chemicals, including acetone, as part of its sustainability initiative. Bio-based acetone offers a greener alternative to petroleum-based acetone and reduces carbon emissions, aligning with global sustainability goals.

Scope of the Report

|

By Application |

Solvents Methyl Methacrylate (MMA) Bisphenol A (BPA) Pharmaceuticals Cosmetics and Personal Care |

|

By Production Method |

Cumene Process Isopropanol Process Bio-based Acetone |

|

By Distribution Channel |

Direct Sales Distributors |

|

By End-User Industry |

Chemical Industry Pharmaceutical Industry Cosmetics Industry Paints and Coatings Industry Automotive Industry |

|

By Region |

China India Japan South Korea Australia |

Products

Key Target Audience

Chemical Manufacturing Companies

Solvent Producers

Automotive Component Manufacturers

Cosmetics & Personal Care Product Manufacturers

Pharmaceutical Manufacturers

Paints & Coatings Industry

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Chemicals and Fertilizers, Environmental Protection Agencies)

Companies

Players Mentioned in the Report

Dow Inc.

Formosa Chemicals

Reliance Industries Ltd.

SABIC

LG Chem

Mitsui Chemicals

Kumho P&B Chemicals

Honeywell UOP

PTT Global Chemical

INEOS Phenol

Table of Contents

Asia Pacific Acetone Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Asia Pacific Acetone Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Asia Pacific Acetone Market Analysis

3.1. Growth Drivers

3.1.1. Demand from downstream industries

3.1.2. Chemical industry expansion

3.1.3. Regulatory influence on acetone production

3.1.4. Technological advancements in production techniques

3.2. Market Challenges

3.2.1. Fluctuating raw material prices

3.2.2. Environmental concerns and regulation

3.2.3. High capital investment

3.2.4. Supply chain volatility

3.3. Opportunities

3.3.1. Emerging applications in pharmaceuticals and personal care

3.3.2. Development of bio-based acetone

3.3.3. Growth in APAC chemical exports

3.3.4. Increasing investments in production capacity

3.4. Trends

3.4.1. Shift towards bio-based acetone

3.4.2. Expansion in APAC petrochemical industry

3.4.3. Rising demand for specialty acetone

3.4.4. Sustainability initiatives by manufacturers

3.5. Government Regulations

3.5.1. Regulation on VOC emissions

3.5.2. Environmental Protection Act

3.5.3. APAC regional regulatory bodies

3.5.4. Compliance with import/export norms

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Asia Pacific Acetone Market Segmentation

4.1. By Application (In Value %)

4.1.1. Solvents

4.1.2. Methyl Methacrylate (MMA)

4.1.3. Bisphenol A (BPA)

4.1.4. Pharmaceuticals

4.1.5. Cosmetics and Personal Care

4.2. By Production Method (In Value %)

4.2.1. Cumene Process

4.2.2. Isopropanol Process

4.2.3. Bio-based Acetone

4.3. By Distribution Channel (In Value %)

4.3.1. Direct Sales

4.3.2. Distributors

4.4. By End-User Industry (In Value %)

4.4.1. Chemical Industry

4.4.2. Pharmaceutical Industry

4.4.3. Cosmetics Industry

4.4.4. Paints and Coatings Industry

4.4.5. Automotive Industry

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

Asia Pacific Acetone Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dow Inc.

5.1.2. SABIC

5.1.3. LG Chem

5.1.4. INEOS Phenol

5.1.5. Honeywell UOP

5.1.6. Formosa Chemicals

5.1.7. Mitsui Chemicals

5.1.8. Kumho P&B Chemicals

5.1.9. Reliance Industries Ltd.

5.1.10. PTT Global Chemical

5.2. Cross Comparison Parameters (Production capacity, Feedstock dependency, Market presence, Strategic partnerships, Acetone pricing trends, Technological advancements, Regulatory compliance, Sustainability initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Asia Pacific Acetone Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

Asia Pacific Acetone Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Asia Pacific Acetone Future Market Segmentation

8.1. By Application (In Value %)

8.2. By Production Method (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

Asia Pacific Acetone Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the Asia Pacific acetone market, which identifies key stakeholders such as chemical manufacturers, solvent producers, and end-use industries. Extensive desk research and data collection from proprietary databases will form the basis for understanding the markets critical variables.

Step 2: Market Analysis and Construction

This step includes an in-depth analysis of historical and current data for the Asia Pacific acetone market. Key parameters such as production volumes, export-import dynamics, and raw material supply chains will be studied to construct a detailed market overview.

Step 3: Hypothesis Validation and Expert Consultation

We validate the market hypotheses through interviews with industry experts from key chemical manufacturing companies. These consultations provide essential insights into the operational and financial challenges that manufacturers face, further refining the data collected during previous phases.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all the data and producing a comprehensive analysis. This output is validated through direct consultations with acetone manufacturers, ensuring the accuracy of the statistics and market insights provided.

Frequently Asked Questions

01. How big is the Asia Pacific Acetone Market?

The Asia Pacific acetone market, valued at USD 3.2 billion, is driven by its significant role in chemical production and increasing demand from various downstream industries, such as pharmaceuticals and personal care.

02. What are the challenges in the Asia Pacific Acetone Market?

Challenges in Asia Pacific acetone market include fluctuating raw material prices, stringent environmental regulations, and high capital investment requirements for production capacity expansion.

03. Who are the major players in the Asia Pacific Acetone Market?

Key players in the Asia Pacific acetone market include Dow Inc., Formosa Chemicals, Reliance Industries Ltd., SABIC, and LG Chem. These companies dominate due to their extensive production capacities and robust supply chain management.

04. What are the growth drivers of the Asia Pacific Acetone Market?

Growth drivers in Asia Pacific acetone market include increasing demand for acetone in downstream industries, advancements in production technology, and government initiatives supporting chemical sector growth in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.