Asia Pacific Water and Wastewater Treatment Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD8668

December 2024

86

About the Report

Asia Pacific Water and Wastewater Treatment Market Overview

- The Asia Pacific Water and Wastewater Treatment Market is currently valued at USD 152 billion, driven by increased industrial activities, urbanization, and heightened awareness of water conservation needs. This sector is strongly supported by governments implementing stringent water management policies to address pollution and ensure water availability. The growing industrial sectors, particularly in developing countries, contribute significantly to the market expansion.

- China, India, and Japan are among the dominant countries in this market, benefiting from their vast industrial infrastructure and substantial investments in water treatment technologies. China leads due to its strong policy mandates around wastewater treatment, while India's extensive water resource challenges have driven significant government-led initiatives. Japan, with its advanced technology and infrastructure, remains a crucial player, especially in developing efficient, sustainable water treatment processes.

- Asia Pacific countries are aligning water quality standards with WHO guidelines, prompting infrastructure upgrades. Indias Bureau of Indian Standards implemented stricter drinking water standards in 2024, influencing compliance measures across 75 cities. Additionally, Thailand's Department of Industrial Works has updated effluent standards for industrial sectors, affecting nearly 500,000 facilities. These regulations drive market demand for compliant wastewater treatment solutions.

Asia Pacific Water and Wastewater Treatment Market Segmentation

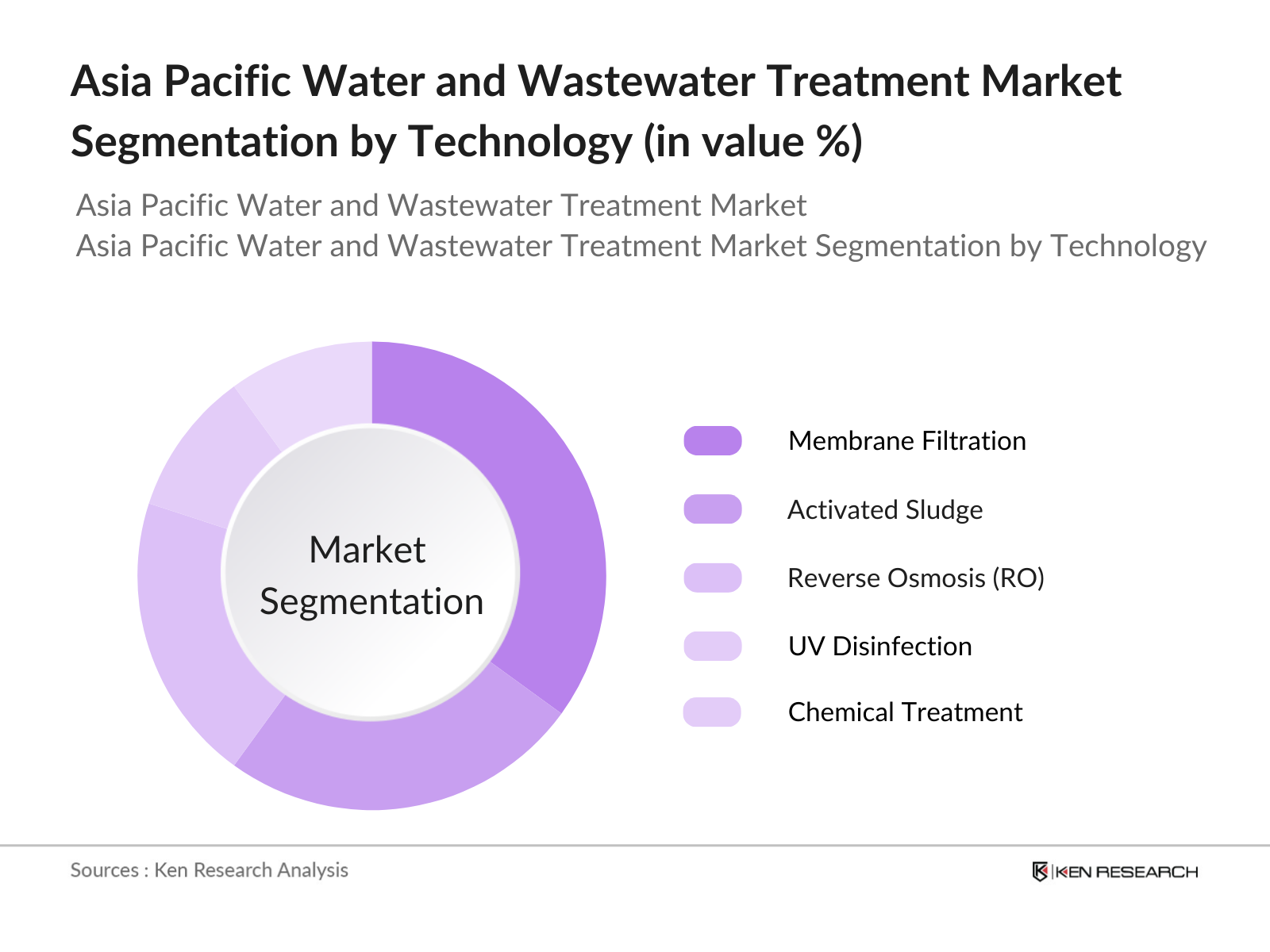

By Technology: The market is segmented by technology into membrane filtration, activated sludge, reverse osmosis (RO), UV disinfection, and chemical treatment. Membrane Filtration dominates this segment due to its high efficiency in removing contaminants, making it an essential technology for both municipal and industrial applications. The demand for cleaner water sources and the increasing prevalence of pollutants further bolster the preference for membrane filtration systems, especially in regions where water quality is a growing concern.

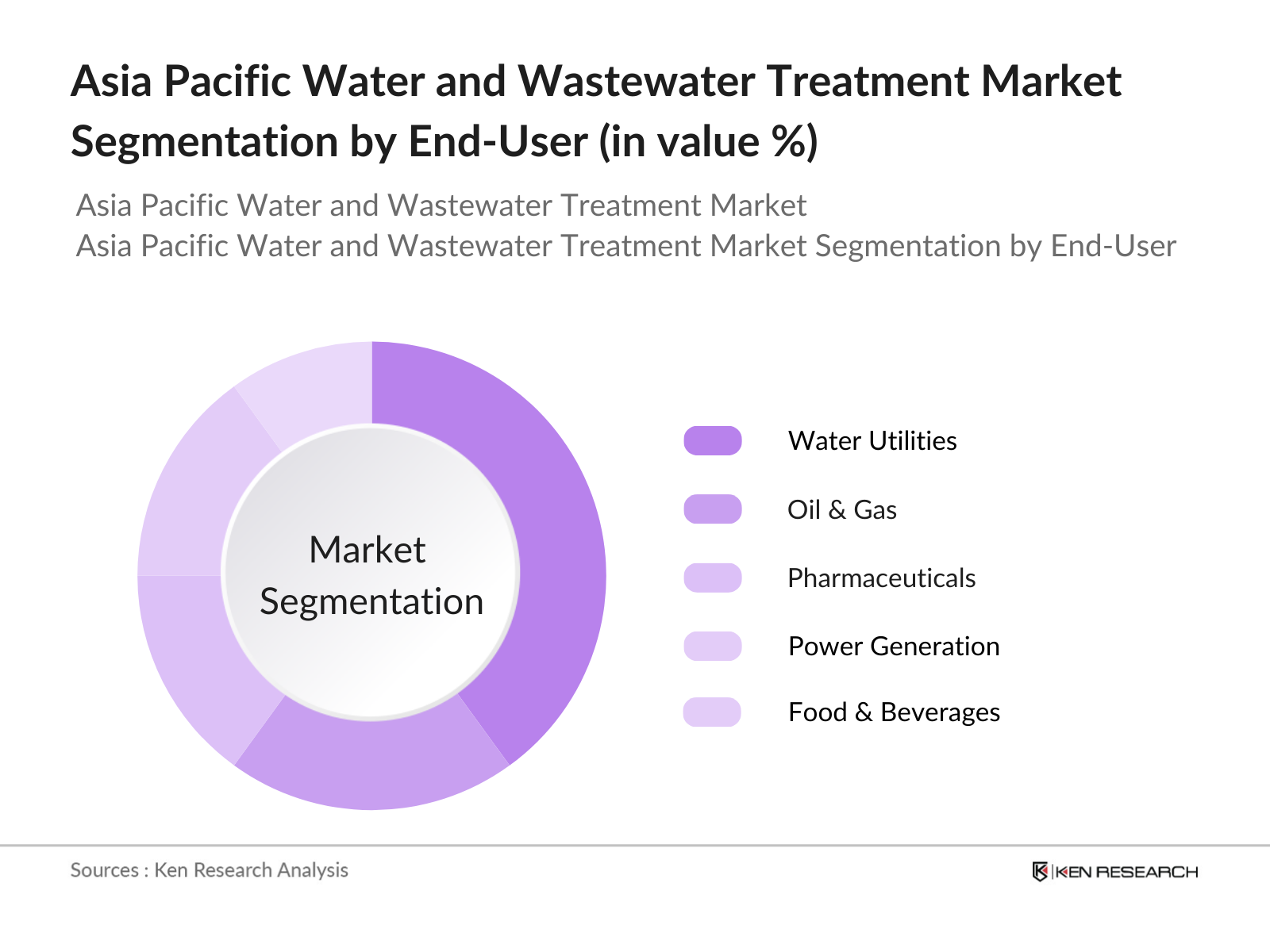

By End-User: The market is segmented by end-user into water utilities, oil & gas, pharmaceuticals, power generation, and food & beverages. Water Utilities hold the largest market share under this segmentation due to increasing water quality regulations and the continuous need to manage municipal water resources effectively. Governments and local authorities are prioritizing wastewater treatment as urban populations grow and freshwater resources deplete, pushing water utilities to adopt comprehensive water management solutions.

Asia Pacific Water and Wastewater Treatment Market Competitive Landscape

The Asia Pacific Water and Wastewater Treatment market is characterized by the presence of major industry players with advanced technologies, broad service portfolios, and strong market positions. Companies like Veolia and Suez dominate due to their extensive experience and innovation in sustainable water treatment solutions, whereas regional players continue to grow their market share through competitive pricing and local expertise.

Asia Pacific Water and Wastewater Treatment Industry Analysis

Growth Drivers

Rapid Urbanization and Industrialization: As urban areas expand across the Asia Pacific, industrial activities are intensifying, leading to a significant increase in wastewater generation. In 2024, China's urban population reached 919 million, contributing heavily to municipal wastewater output, with the daily volume of discharged wastewater surpassing 69 billion liters. Similarly, India saw an urban population rise to 484 million, generating approximately 41 billion liters of wastewater per day. This spike necessitates advanced treatment facilities to manage the rising wastewater volume effectively.

Stringent Government Regulations on Water Quality: Governments in the Asia Pacific region have introduced stringent water quality regulations to address pollution concerns. In Japan, the Water Pollution Control Act mandates strict standards, leading to significant investment in treatment technology. Australia also updated its National Water Quality Management Strategy, aiming to reduce industrial effluent impacts across 300 regulated catchments.

Public Health Awareness and Demand for Safe Drinking Water: Public health campaigns across Asia Pacific have raised awareness of the health risks associated with untreated water, increasing demand for safe drinking water. Indonesia, for example, reported that 73 million people lacked access to safely managed water sources in 2024, prompting government initiatives to improve access to treated water. Additionally, Vietnam reported increased demand in urban areas where 17% of households are actively investing in water purification systems, driven by concerns over waterborne diseases.

Market Challenges

High Operational and Maintenance Costs: Operational costs for advanced water treatment systems remain a barrier in the Asia Pacific region. For instance, Australias advanced desalination plants report annual operational costs exceeding $200 million, a burden on public utilities. Similarly, Thailand has indicated that maintaining wastewater treatment facilities across its 150 industrial estates costs over $800 million per year. These high costs discourage some municipalities and industries from investing in advanced systems, creating a challenge for broader market growth.

Limited Access to Advanced Technology in Remote Areas: The deployment of advanced wastewater treatment technologies remains limited in remote areas of the Asia Pacific. In rural India, only 31% of households have access to piped water, and access to treatment facilities is even lower. Papua New Guinea faces similar challenges, where approximately 87% of the population resides in rural areas with limited access to centralized wastewater treatment solutions. This technological gap poses challenges in effectively managing wastewater in less accessible regions.

Asia Pacific Water and Wastewater Treatment Market Future Outlook

The Asia Pacific Water and Wastewater Treatment market is set to experience substantial growth, driven by increasing water scarcity issues, stringent environmental regulations, and technological advancements in treatment solutions. With continuous government support and a shift toward sustainable and digital water management technologies, the sector is expected to see expanded applications across various industries.

Future Market Opportunities

Technological Advancements: The adoption of AI and IoT in water treatment processes offers efficiency improvements and cost savings. In 2024, South Korea implemented IoT sensors across 45 water treatment facilities, enabling real-time monitoring and reducing energy use by 15%. Similarly, Chinas use of AI in predictive maintenance within treatment plants saved an estimated $30 million annually. These advancements support growth in the Asia Pacific market by offering municipalities and industries cost-effective solutions to meet regulatory demands.

International Collaborations for Improved Infrastructure: Collaborations between Asia Pacific countries and international organizations are strengthening water treatment infrastructure. In 2024, Japan and Indonesia signed a $1.2 billion agreement to enhance wastewater facilities in Jakarta, benefiting over 10 million residents. Similarly, the Asian Development Bank and India partnered on a $500 million project focused on wastewater treatment in 20 cities, providing critical support to rapidly urbanizing regions.

Scope of the Report

|

By Technology |

Membrane Filtration Activated Sludge Process Reverse Osmosis UV and Ozone Treatment Desalination |

|

By Application |

Municipal Water Treatment Industrial Wastewater Treatment Residential Water Solutions Agricultural Water Management |

|

By End-User |

Municipal Utilities Manufacturing Industries Food and Beverage Industry Healthcare Facilities |

|

By Equipment Type |

Filtration Equipment Disinfection Systems Sludge Treatment Equipment Pumps and Valves |

|

By Region |

China Japan India Australia Southeast Asia |

Products

Key Target Audience

Water Treatment Facility Operators

Industrial Manufacturers

Government and Regulatory Bodies (Ministry of Water Resources, Environmental Protection Agency)

Municipal Water Utilities

Investment and Venture Capital Firms

Construction and Infrastructure Companies

Agriculture & Irrigation Departments

Oil & Gas Companies

Companies

Players Mentioned in Report

Veolia Water Technologies

Suez Environment

Xylem Inc.

Kurita Water Industries

Evoqua Water Technologies

Dow Water & Process Solutions

Pentair PLC

GE Water & Process Technologies

Aquatech International LLC

DuPont Water Solutions

Hitachi Aqua-Tech Engineering

Mitsubishi Chemical Corporation

Ecolab Inc.

IDE Technologies

Thermax Limited

Table of Contents

1. Asia Pacific Water and Wastewater Treatment Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Water and Wastewater Treatment Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Water and Wastewater Treatment Market Dynamics

3.1 Growth Drivers

3.1.1 Urban Population Growth (Population Dynamics)

3.1.2 Industrial Effluent Treatment Needs (Industrial Demand)

3.1.3 Environmental Regulations (Government Initiatives)

3.1.4 Technological Advancements (Innovation)

3.2 Market Challenges

3.2.1 High Infrastructure Costs (Financial Barrier)

3.2.2 Limited Skilled Workforce (Labor Shortage)

3.2.3 Aging Infrastructure (Systemic Weakness)

3.3 Opportunities

3.3.1 Green Technologies in Wastewater Treatment (Sustainability)

3.3.2 Private-Public Partnerships (Collaborative Models)

3.3.3 Emerging Markets in Developing Regions (Expansion)

3.4 Trends

3.4.1 Digital Water Technologies (Automation)

3.4.2 Smart Water Management Systems (Digitalization)

3.4.3 Reuse and Recycling of Treated Water (Resource Recovery)

3.5 Regulatory Landscape

3.5.1 Compliance Standards (ISO, WHO, EPA Guidelines)

3.5.2 National Policies (Country-Specific Regulations)

3.5.3 Environmental Protection Acts (Regional Guidelines)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Asia Pacific Water and Wastewater Treatment Market Segmentation

4.1 By Technology (In Value %)

4.1.1 Membrane Filtration

4.1.2 Activated Sludge

4.1.3 Reverse Osmosis (RO)

4.1.4 UV Disinfection

4.1.5 Chemical Treatment

4.2 By Application (In Value %)

4.2.1 Municipal

4.2.2 Industrial

4.2.3 Residential

4.2.4 Agricultural

4.3 By End User (In Value %)

4.3.1 Water Utilities

4.3.2 Oil & Gas

4.3.3 Pharmaceuticals

4.3.4 Power Generation

4.3.5 Food & Beverages

4.4 By Equipment Type (In Value %)

4.4.1 Pumps

4.4.2 Membranes

4.4.3 Aeration Systems

4.4.4 Sedimentation Tanks

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Southeast Asia

4.5.5 Rest of Asia Pacific

5. Asia Pacific Water and Wastewater Treatment Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Veolia Water Technologies

5.1.2 Suez Environment

5.1.3 Xylem Inc.

5.1.4 Dow Water & Process Solutions

5.1.5 Pentair PLC

5.1.6 GE Water & Process Technologies

5.1.7 Aquatech International LLC

5.1.8 DuPont Water Solutions

5.1.9 Hitachi Aqua-Tech Engineering Pte Ltd.

5.1.10 Kurita Water Industries Ltd.

5.1.11 Evoqua Water Technologies LLC

5.1.12 Mitsubishi Chemical Corporation

5.1.13 Ecolab Inc.

5.1.14 IDE Technologies

5.1.15 Thermax Limited

5.2 Cross Comparison Parameters (Employee Count, Revenue, Market Position, Headquarters, Core Product, Innovation Capabilities, R&D Investments, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Water and Wastewater Treatment Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Water and Wastewater Treatment Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Water and Wastewater Treatment Future Market Segmentation

8.1 By Technology (In Value %)

8.2 By Application (In Value %)

8.3 By End User (In Value %)

8.4 By Equipment Type (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Water and Wastewater Treatment Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping major stakeholders in the Asia Pacific Water and Wastewater Treatment market. It includes thorough desk research utilizing secondary and proprietary databases to collect and define critical industry metrics influencing the market.

Step 2: Market Analysis and Construction

Here, historical data is compiled to assess market penetration, customer segments, and revenue generation by different treatment technologies. This phase ensures accuracy in market estimations through comprehensive analysis of existing data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are established and validated through interviews with industry experts from leading companies, providing valuable insights into technology, consumer preferences, and operational challenges.

Step 4: Research Synthesis and Final Output

The final stage entails consolidating findings from manufacturers and stakeholders, thereby verifying data accuracy and ensuring a validated and comprehensive market analysis output.

Frequently Asked Questions

01. How big is the Asia Pacific Water and Wastewater Treatment Market?

The Asia Pacific Water and Wastewater Treatment Market is valued at around USD 152 billion, largely driven by industrial demands and water management policies.

02. What are the challenges in the Asia Pacific Water and Wastewater Treatment Market?

Key challenges in the Asia Pacific Water and Wastewater Treatment Market include high costs of infrastructure development, regulatory compliance, and a lack of skilled workforce needed for advanced treatment technologies.

03. Who are the major players in the Asia Pacific Water and Wastewater Treatment Market?

Leading players in the Asia Pacific Water and Wastewater Treatment Market include Veolia, Suez, Xylem, Kurita, and Evoqua, known for their innovative technologies and extensive market presence.

04. What drives growth in the Asia Pacific Water and Wastewater Treatment Market?

The Asia Pacific Water and Wastewater Treatment Market 's growth is driven by rising industrialization, government regulations for water quality, and the increasing need for sustainable water management solutions.

05. Which countries dominate the Asia Pacific Water and Wastewater Treatment Market?

China, India, and Japan lead the Asia Pacific Water and Wastewater Treatment Market, driven by regulatory support, industrial expansion, and significant investments in water treatment infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.