Global Airport Duty-Free Liquor Market Outlook to 2030

Region:Global

Author(s):Shreya

Product Code:KROD7870

December 2024

87

About the Report

Global Airport Duty-Free Liquor Market Overview

- The Global Airport Duty-Free Liquor Market is valued at USD 7.5 billion, underpinned by a steady five-year historical analysis reflecting continuous growth driven by increased air travel and a rising preference for premium and exclusive products. The market is highly driven by travelers' demand for luxury and unique products not available elsewhere, coupled with the rise in international passenger traffic. Strategic airport expansions and developments in major international hubs further support the availability and accessibility of duty-free liquor options, promoting significant sales growth within this market.

- Leading countries in the duty-free liquor market include the UAE, Singapore, and South Korea, where major airports such as Dubai International Airport, Changi Airport, and Incheon International Airport serve as international hubs with high passenger footfall and strong consumer spending. These airports have extensive duty-free spaces, with high-end liquor selections tailored to affluent travelers. Moreover, these regions boast well-established retail infrastructures and regulatory frameworks that foster seamless operations for duty-free liquor sales, enhancing market strength and dominance.

- Brand loyalty plays a significant role in consumer purchasing decisions within the duty-free liquor market. A 2024 survey by the Duty Free World Council revealed that 65% of travelers prefer purchasing familiar liquor brands when shopping at duty-free outlets. This loyalty is often influenced by consistent quality, brand reputation, and previous positive experiences

Global Airport Duty-Free Liquor Market Segmentation

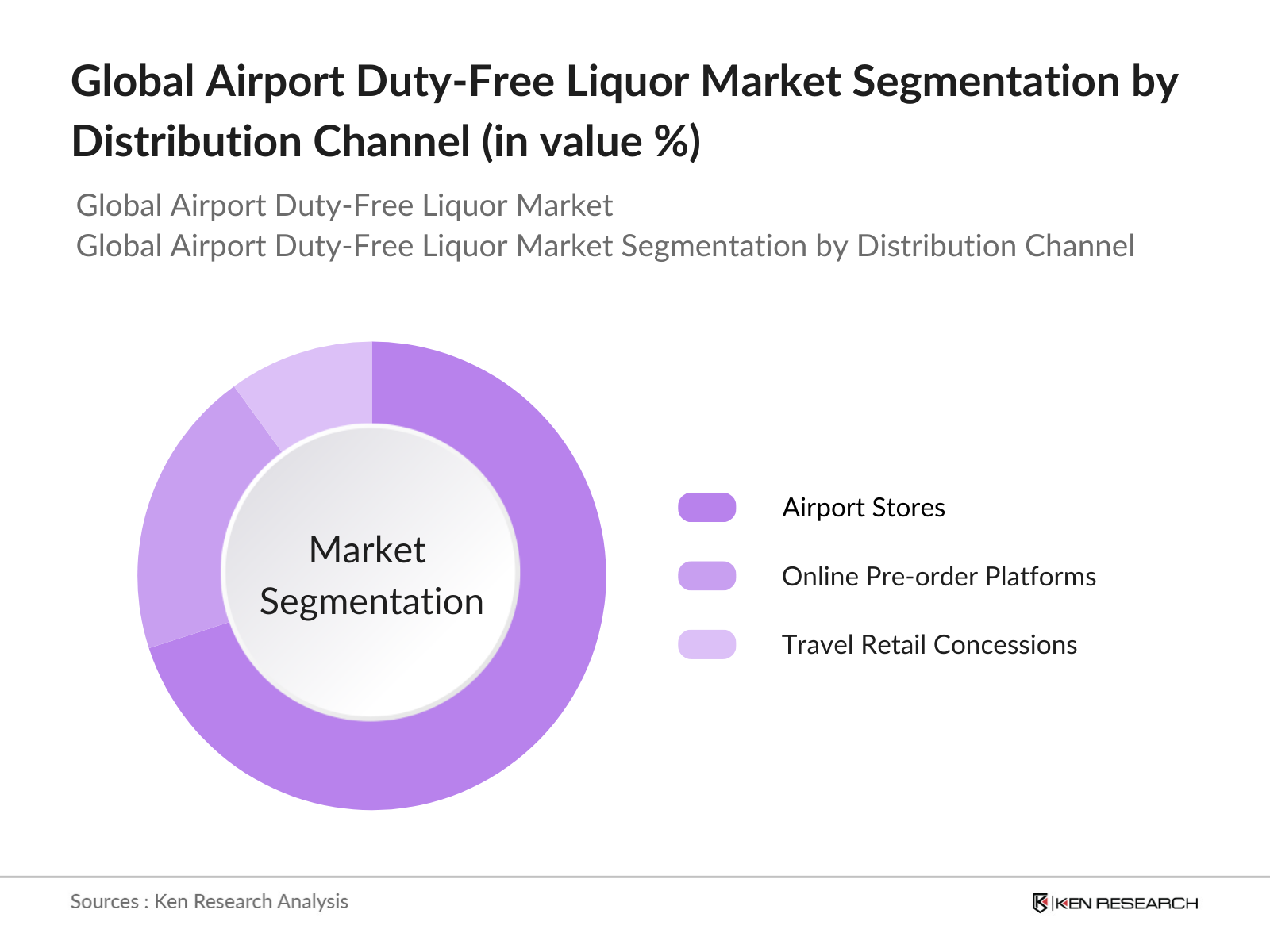

By Distribution Channel: The Market is also segmented by distribution channel into airport stores, online pre-order platforms, and travel retail concessions. Airport Stores are the primary distribution channel, holding the largest market share within this segment due to the convenience they offer to travelers. These stores provide a wide range of duty-free liquor options, allowing passengers to make last-minute purchases and benefit from tax-free pricing. Additionally, airport stores capitalize on high foot traffic in major terminals, creating an attractive environment for consumer spending.

By Product Type: The Market is segmented by product type into spirits, wines, whiskeys, liqueurs, and non-alcoholic alternatives. Spirits hold a dominant share within the product type segment due to their popularity among travelers seeking high-quality, unique blends exclusive to duty-free shops. This category includes premium brands and limited-edition products, which appeal to collectors and consumers looking for unique travel souvenirs. The duty-free segment is a strategic channel for spirit brands to capture international consumer interest through exclusive offerings and competitive pricing.

By Region: The Market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America holds a dominant share within the regional segment, driven by its high volume of international travel and the presence of major airports with substantial passenger footfall, especially in countries like China, South Korea, and Singapore. The appeal of duty-free liquor offerings in this region is also strengthened by competitive pricing, which is attractive to travelers who frequently seek tax-free savings and exclusive product options.

Global Airport Duty-Free Liquor Market Competitive Landscape

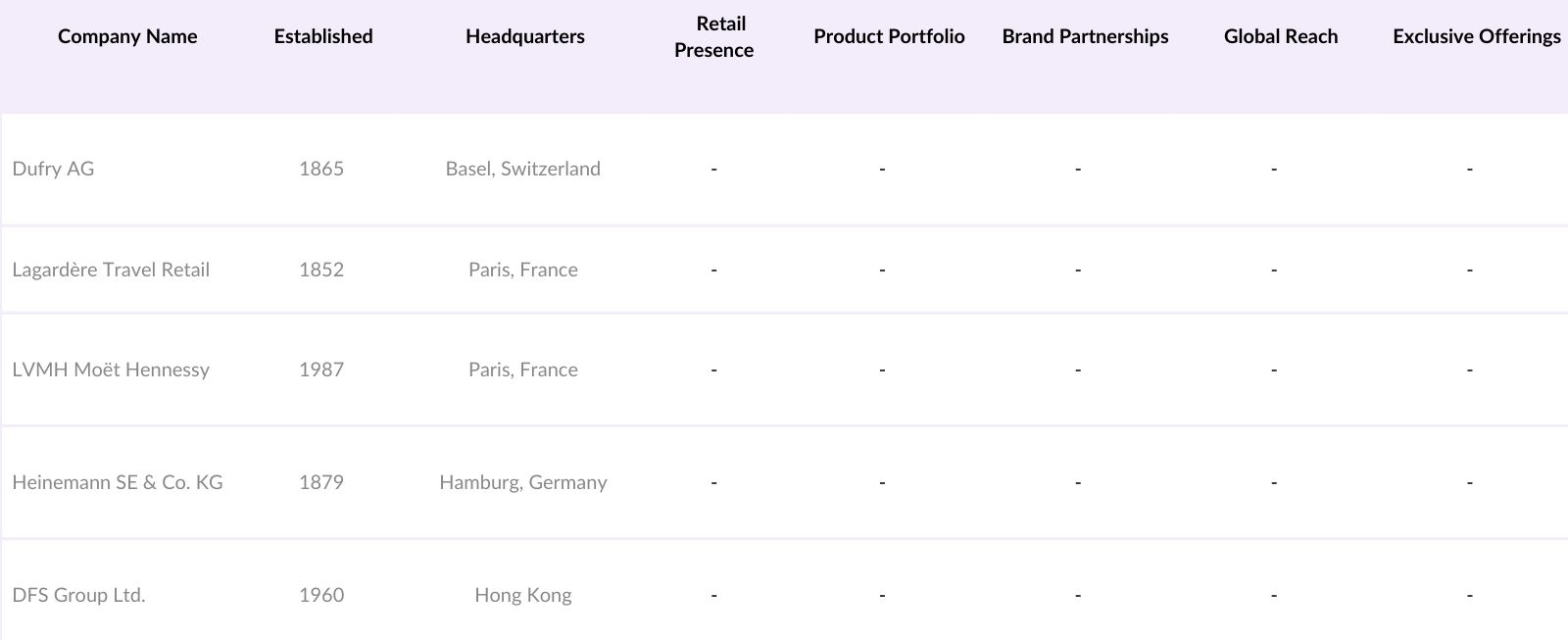

The Global Airport Duty-Free Liquor Market is characterized by a mix of local and international players that leverage strong brand partnerships, exclusive product lines, and strategic retail placements at major airports to capture a significant portion of market share.

Global Airport Duty-Free Liquor Market Analysis

Growth Drivers

Rising Passenger Traffic: In 2024, global air passenger numbers are projected to reach 9.4 billion, surpassing pre-pandemic levels. This surge is attributed to the easing of travel restrictions and a resurgence in international tourism. The International Air Transport Association (IATA) reports that international passenger demand has increased by 7.5% compared to 2023, indicating a robust recovery in global air travel.

Airport Retail Expansion: Airports worldwide are investing in retail infrastructure to enhance passenger experience and boost non-aeronautical revenues. For instance, Changi Airport in Singapore expanded its retail space by 15% in 2024, introducing new duty-free outlets to cater to the growing demand. Similarly, Dubai International Airport reported a 12% increase in retail sales, reaching $2.3 billion, driven by the addition of luxury duty-free stores.

Increasing Disposable Income: The World Bank indicates that global gross national income (GNI) per capita rose to $12,500 in 2024, up from $11,800 in 2022. This increase in disposable income has led to higher consumer spending on luxury goods, including duty-free liquor. In China, household consumption expenditure grew by 8% in 2024, reflecting a stronger purchasing power among consumers.

Market Challenges

Regulatory Barriers: Varying duty regulations and tax policies across countries pose challenges for the airport duty-free liquor market. For instance, the European Union's revised excise duty rates in 2024 have affected pricing strategies for duty-free retailers. Additionally, countries like India have imposed stricter import duties on alcohol, impacting the profitability of duty-free liquor sales.

Intense Competition: The duty-free liquor market faces intense competition from domestic retailers and online platforms offering competitive prices. In 2024, e-commerce alcohol sales grew by 15%, providing consumers with convenient alternatives to airport purchases. Moreover, local retailers in countries like the United States have introduced tax-free zones, further intensifying competition for duty-free shops.

Global Airport Duty-Free Liquor Market Future Outlook

The Global Airport Duty-Free Liquor Market is expected to grow considerably in the coming years, driven by increased passenger volume, expanded airport facilities, and rising consumer preference for premium alcoholic beverages. As the travel and tourism industry continues to recover, the duty-free liquor market stands to benefit from a resurgence in international travel, particularly within Asia Pacific and the Middle East, where high passenger turnover and tourism hubs support steady market growth.

Future Market Opportunities

Product Innovation and Exclusivity: Introducing exclusive products and innovative offerings can attract travelers seeking unique experiences. In 2024, several duty-free retailers launched limited-edition liquor collections, resulting in a 12% increase in sales. Collaborations between liquor brands and duty-free shops to create travel-exclusive products have also proven successful in capturing consumer interest.

Digital Transformation in Duty-free Shopping: The integration of digital technologies in duty-free shopping enhances customer engagement and streamlines operations. In 2024, 60% of duty-free retailers implemented mobile apps for pre-ordering, leading to a 15% increase in sales. Augmented reality (AR) experiences and personalized marketing campaigns have also been adopted to attract tech-savvy travelers.

Scope of the Report

|

By ProductType |

Spirits |

|

By DistributionChannel |

Airport Stores |

|

By Region |

North America |

|

By PriceSegment |

Premium |

|

By TravelerType |

Business Travelers |

Products

Key Target Audience

Duty-free Retail Operators

Liquor Manufacturers and Distributors

Airport Management and Operations

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Customs Authorities, Tourism Boards)

Luxury Goods Retailers

E-commerce and Pre-order Platforms

Marketing and Branding Agencies

Companies

Players Mentioned in the Report

Dufry AG

Lagardre Travel Retail

LVMH Mot Hennessy Louis Vuitton

Heinemann SE & Co. KG

DFS Group Ltd.

Japan Airport Terminal Co., Ltd.

The Shilla Duty-Free

Lotte Duty-Free

Flemingo International Ltd.

Aer Rianta International

China Duty-Free Group

Duty-Free Americas, Inc.

WHSmith PLC

Sky Connection Limited

King Power International

Table of Contents

1 Global Airport Duty-free Liquor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Passenger Volume, Duty-free Sales)

1.4. Market Segmentation Overview

2 Global Airport Duty-free Liquor Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Airport Expansion, Retail Innovations)

3 Global Airport Duty-free Liquor Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Passenger Traffic

3.1.2. Airport Retail Expansion

3.1.3. Increasing Disposable Income

3.1.4. Traveler Demand for Premiumization

3.2. Market Challenges

3.2.1. Regulatory Barriers (Duty Regulations, Tax Policies)

3.2.2. Intense Competition

3.2.3. Impact of Economic Downturns

3.3. Opportunities

3.3.1. Untapped Markets (Emerging Airports, Low-Cost Carrier Terminals)

3.3.2. Product Innovation and Exclusivity

3.3.3. Digital Transformation in Duty-free Shopping

3.4. Trends

3.4.1. Expansion of E-commerce in Duty-free Liquor

3.4.2. Growth of Non-alcoholic Alternatives

3.4.3. Increasing Popularity of Travel Retail Exclusives

3.5. Consumer Preferences

3.5.1. Brand Loyalty

3.5.2. Product Mix Preferences (Spirits, Wine, Whiskey)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4 Global Airport Duty-free Liquor Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Spirits

4.1.2. Wine

4.1.3. Whiskey

4.1.4. Liqueurs

4.1.5. Non-alcoholic Alternatives

4.2. By Distribution Channel (In Value %)

4.2.1. Airport Stores

4.2.2. Online Pre-order Platforms

4.2.3. Travel Retail Concessions

4.3. By Region (In Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Middle East & Africa

4.3.5. Latin America

4.4. By Price Segment (In Value %)

4.4.1. Premium

4.4.2. Super Premium

4.4.3. Ultra Premium

4.5. By Traveler Type (In Value %)

4.5.1. Business Travelers

4.5.2. Leisure Travelers

4.5.3. Transit Passengers

5 Global Airport Duty-free Liquor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dufry AG

5.1.2. Lagardre Travel Retail

5.1.3. LVMH Mot Hennessy Louis Vuitton

5.1.4. Heinemann SE & Co. KG

5.1.5. DFS Group Ltd.

5.1.6. Japan Airport Terminal Co., Ltd.

5.1.7. The Shilla Duty-Free

5.1.8. Lotte Duty-Free

5.1.9. Flemingo International Ltd.

5.1.10. Aer Rianta International

5.1.11. China Duty-Free Group

5.1.12. Duty-Free Americas, Inc.

5.1.13. WHSmith PLC

5.1.14. Sky Connection Limited

5.1.15. King Power International

5.2. Cross Comparison Parameters (Product Portfolio, Duty-free Presence, Brand Partnerships, Revenue Share by Region, Retail Footprint, Digital Integration, In-store Experience, Customer Loyalty Programs)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Strategic Partnerships

5.8. Government Grants and Concessions

5.9. Private Equity Investments

6 Global Airport Duty-free Liquor Market Regulatory Framework

6.1. Tax and Customs Policies

6.2. Duty-free Regulations (Import/Export, Licensing Requirements)

6.3. Compliance Requirements (Health, Safety, Labeling Standards)

6.4. Alcohol Licensing Standards

7 Global Airport Duty-free Liquor Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8 Global Airport Duty-free Liquor Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Price Segment (In Value %)

8.4. By Traveler Type (In Value %)

8.5. By Region (In Value %)

9 Global Airport Duty-free Liquor Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Airport Duty-Free Liquor Market. This step is supported by extensive desk research and secondary database sources to identify critical factors influencing market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on sales, pricing, and distribution patterns within the duty-free liquor market are compiled and analyzed to build a comprehensive view of market penetration and revenue streams across key regions.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed and validated through direct consultations with key industry experts, ensuring data accuracy and relevance. Computer-assisted telephone interviews (CATIs) are conducted with stakeholders across the supply chain for qualitative insights.

Step 4: Research Synthesis and Final Output

The final step synthesizes all research findings into an in-depth analysis of the Global Airport Duty-Free Liquor Market, cross-validated with data from primary interviews and refined to ensure a reliable forecast and strategic recommendations for industry stakeholders.

Frequently Asked Questions

01 How big is the Global Airport Duty-Free Liquor Market?

The Global Airport Duty-Free Liquor Market is valued at USD 7.5 billion, driven by increasing air travel and demand for premium products.

02 What are the challenges in the Global Airport Duty-Free Liquor Market?

Major challenges in the Global Airport Duty-Free Liquor Market include regulatory restrictions, high competition among duty-free operators, and economic downturns that affect international travel.

03 Who are the major players in the Global Airport Duty-Free Liquor Market?

Key players in the Global Airport Duty-Free Liquor Market include Dufry AG, Lagardre Travel Retail, LVMH Mot Hennessy, Heinemann SE & Co. KG, and DFS Group Ltd., known for their extensive retail networks and exclusive product offerings.

04 What drives growth in the Global Airport Duty-Free Liquor Market?

The Global Airport Duty-Free Liquor Market is driven by rising international travel, expansion of duty-free areas at airports, and consumers growing preference for luxury goods, including exclusive liquors

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.