Global Alcohol Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-068

June 2025

90

About the Report

Global Alcohol Market Overview

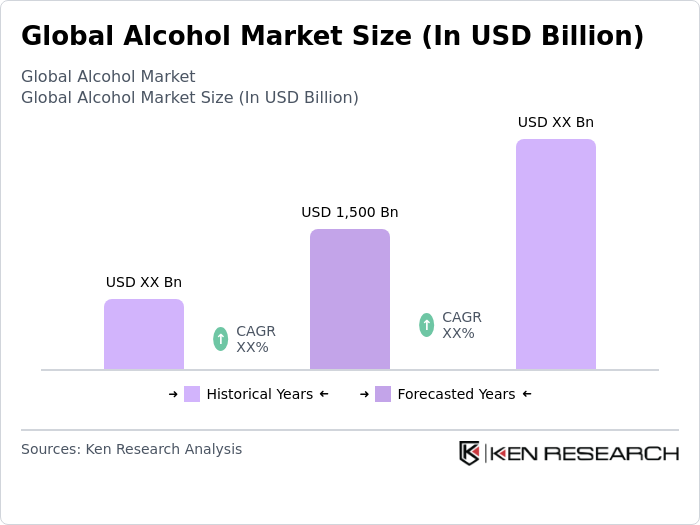

- The Global Alcohol Market was valued at USD 1,500 billion, driven by increasing consumer demand for alcoholic beverages, particularly in emerging markets. Factors such as changing lifestyles, social acceptance of alcohol consumption, and the rise of e-commerce platforms for alcohol sales have significantly contributed to this market size.

- Countries like the United States, China, and Germany dominate the Global Alcohol Market due to their large consumer bases and established production facilities. The U.S. is known for its diverse range of alcoholic beverages, while China has seen a surge in wine consumption, and Germany is famous for its beer culture, all contributing to their market leadership.

- In 2023, the EU implemented Regulation (EU) 2021/2117, requiring mandatory labelling of ingredients and nutritional information on wines and aromatised wines to promote informed and responsible consumption. While no binding EU-wide advertising restrictions targeting youth were introduced, voluntary guidelines by the European Advertising Standards Alliance recommend protecting minors from alcohol ads.

Global Alcohol Market Segmentation

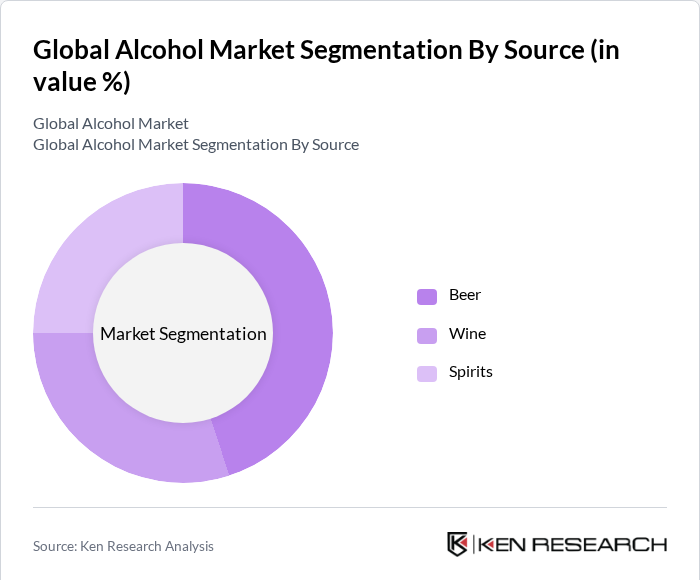

By Source: The Global Alcohol Market can be segmented into various sources, including beer, wine, and spirits. Among these, beer remains the dominant sub-segment, accounting for a significant portion of the market. This is largely due to its widespread popularity and cultural significance in many regions, particularly in Europe and North America. The craft beer movement has also contributed to the growth of this sub-segment, as consumers increasingly seek unique flavors and local products. Wine and spirits are also growing, but beer's established market presence keeps it at the forefront.

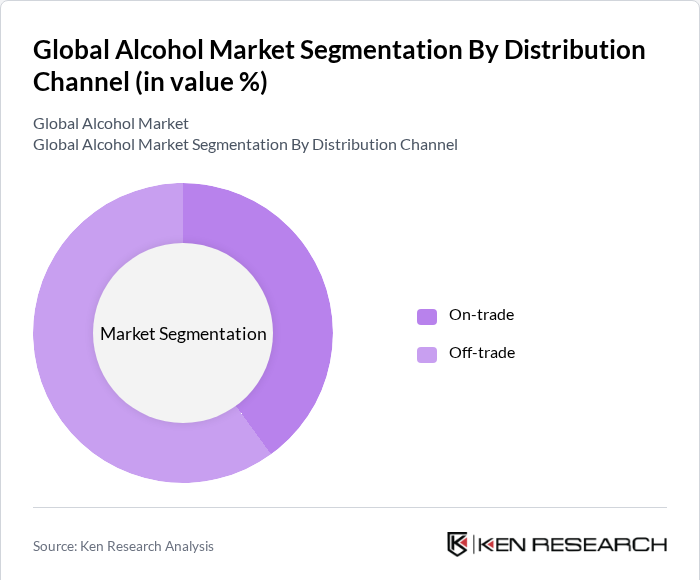

By Distribution Channel: The distribution channels for alcoholic beverages include on-trade (bars, restaurants) and off-trade (retail stores, e-commerce). The off-trade segment is currently dominating the market, driven by the convenience of online shopping and the increasing number of retail outlets. The COVID-19 pandemic accelerated the shift towards e-commerce, as consumers sought safer shopping options. On-trade sales are recovering but still lag behind, as many consumers prefer the convenience and variety offered by off-trade channels.

Global Alcohol Market Competitive Landscape

The Global Alcohol Market is characterized by a competitive landscape with several key players, including Anheuser-Busch InBev, Diageo, Heineken, Pernod Ricard, and Constellation Brands. These companies dominate the market through extensive product portfolios, strong brand recognition, and significant distribution networks. The competition is intense, with companies continuously innovating to meet changing consumer preferences and expanding their market presence globally.

Global Alcohol Market Industry Analysis

Growth Drivers

- Increasing Consumer Spending: In 2024, global consumer spending on alcoholic beverages is projected to approach $1.3 trillion, driven by a strong preference for premium and craft products. This trend is especially pronounced in North America and Europe, where consumers are willing to pay a premium for quality, authenticity, and unique flavors. Rising disposable incomes, particularly among millennials and Gen Z, are fueling demand for innovative and high-end drinking experiences, including craft spirits, artisanal wines, and specialty beers.

- Popularity of Craft Beverages: The craft beverage segment is experiencing remarkable growth, with the number of craft breweries in the U.S. alone exceeding 10,000 in 2024. This surge reflects a consumer shift towards artisanal and locally produced drinks, which are perceived as more authentic. The craft beer market is expected to generate over $35 billion in revenue, highlighting the increasing consumer interest in unique flavors and brewing techniques, which is a key driver for the overall alcohol market.

- Expansion of E-commerce Channels: The rapid growth of e-commerce channels is significantly transforming consumer access to alcoholic beverages, driving market expansion. Online sales of alcoholic beverages are projected to exceed $64 billion in 2024, growing at a CAGR of over 15%, fueled by regulatory changes, evolving consumer preferences, and expanded distribution networks. The convenience of online shopping and home delivery services is particularly appealing to urban consumers with busy lifestyles, enabling easier access to a wider variety of premium and niche products that may not be available locally

Market Challenges

- Stringent Regulations: The alcohol industry is increasingly challenged by stringent government regulations and evolving taxation policies. Stricter advertising and distribution laws are being introduced across major markets, which can limit accessibility and market expansion—particularly for new entrants. Navigating these regulations often requires substantial compliance investments, which can hinder innovation and slow overall market momentum for both emerging and established players.

- Health Concerns: Rising health consciousness among consumers is reshaping alcohol consumption patterns, particularly within younger demographics. A growing preference for healthier lifestyles is driving a noticeable shift away from traditional alcoholic beverages. This evolving consumer mindset is prompting brands to diversify their product portfolios, yet presents a considerable challenge for companies that remain heavily reliant on conventional alcohol offerings.

Global Alcohol Market Future Outlook

The future of the alcohol market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to rise, brands are likely to invest in low and no-alcohol alternatives, catering to a broader audience. Additionally, the integration of technology in marketing and distribution will enhance consumer engagement and accessibility. The focus on sustainability will also shape product development, as consumers increasingly favor brands that prioritize eco-friendly practices, ensuring a dynamic market landscape ahead.

Market Opportunities

- Emerging Markets Growth: Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities. With rising disposable incomes projected to increase by 6% annually, these regions are becoming key targets for alcohol brands looking to expand their market presence. The increasing urbanization and changing lifestyles in these areas further enhance the potential for market penetration and revenue growth.

- Innovative Product Development: The demand for innovative and unique alcoholic beverages is on the rise, with consumers seeking new flavors and experiences. Brands that invest in product innovation, such as flavored spirits and ready-to-drink cocktails, are likely to capture a larger market share. The introduction of limited-edition products and collaborations with local artisans can also create excitement and drive sales, presenting a lucrative opportunity for growth.

Scope of the Report

| By Product Type |

Beer Wine Spirits |

| By Source |

Grain Fruit Vegetable |

| By Distribution Channel |

On-trade Off-trade |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Alcohol Content |

Low Alcohol Medium Alcohol High Alcohol |

| By Packaging Type |

Bottles Cans Boxes |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Alcohol and Tobacco Tax and Trade Bureau, Food and Drug Administration)

Manufacturers and Producers

Distributors and Retailers

Importers and Exporters

Industry Associations (e.g., Distilled Spirits Council, Brewers Association)

Financial Institutions

Market Analysts and Industry Experts

Companies

Players Mentioned in the Report:

Anheuser-Busch InBev

Diageo

Heineken

Pernod Ricard

Constellation Brands

Molson Coors Beverage Company

Brown-Forman Corporation

Campari Group

Asahi Group Holdings

Treasury Wine Estates

Table of Contents

1. Global Alcohol Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Alcohol Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Alcohol Market Analysis

3.1. Growth Drivers

3.1.1. Increasing consumer spending on premium alcoholic beverages

3.1.2. Rising popularity of craft and artisanal products

3.1.3. Expansion of distribution channels including e-commerce

3.2. Market Challenges

3.2.1. Stringent government regulations and taxation policies

3.2.2. Health concerns and changing consumer preferences

3.2.3. Competition from non-alcoholic beverages

3.3. Opportunities

3.3.1. Growth in emerging markets with rising disposable incomes

3.3.2. Innovations in product offerings and packaging

3.3.3. Increasing demand for low and no-alcohol alternatives

3.4. Trends

3.4.1. Shift towards sustainable and eco-friendly production practices

3.4.2. Growing interest in flavored and infused alcoholic beverages

3.4.3. Rise of social media marketing and influencer partnerships

3.5. Government Regulation

3.5.1. Licensing requirements for production and distribution

3.5.2. Advertising restrictions and labeling requirements

3.5.3. Health warnings and age restrictions on sales

3.5.4. Import/export regulations affecting international trade

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Alcohol Market Segmentation

4.1. By Product Type

4.1.1. Beer

4.1.2. Wine

4.1.3. Spirits

4.2. By Source

4.2.1. Grain

4.2.2. Fruit

4.2.3. Vegetable

4.3. By Distribution Channel

4.3.1. On-trade

4.3.2. Off-trade

4.4. By Region

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Alcohol Content

4.5.1. Low Alcohol

4.5.2. Medium Alcohol

4.5.3. High Alcohol

4.6. By Packaging Type

4.6.1. Bottles

4.6.2. Cans

4.6.3. Boxes

5. Global Alcohol Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Anheuser-Busch InBev

5.1.2. Diageo

5.1.3. Heineken

5.1.4. Pernod Ricard

5.1.5. Constellation Brands

5.1.6. Molson Coors Beverage Company

5.1.7. Brown-Forman Corporation

5.1.8. Campari Group

5.1.9. Asahi Group Holdings

5.1.10. Treasury Wine Estates

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. Brand Recognition

5.2.6. Innovation Rate

5.2.7. Customer Loyalty Metrics

5.2.8. Sustainability Initiatives

6. Global Alcohol Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Alcohol Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Alcohol Market Future Market Segmentation

8.1. By Product Type

8.1.1. Beer

8.1.2. Wine

8.1.3. Spirits

8.2. By Source

8.2.1. Grain

8.2.2. Fruit

8.2.3. Vegetable

8.3. By Distribution Channel

8.3.1. On-trade

8.3.2. Off-trade

8.4. By Region

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.4.5. Middle East & Africa

8.5. By Alcohol Content

8.5.1. Low Alcohol

8.5.2. Medium Alcohol

8.5.3. High Alcohol

8.6. By Packaging Type

8.6.1. Bottles

8.6.2. Cans

8.6.3. Boxes

9. Global Alcohol Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Alcohol Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Alcohol Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Alcohol Market.

Frequently Asked Questions

01. How big is the Global Alcohol Market?

The Global Alcohol Market is valued at USD 1,500 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Alcohol Market?

Key challenges in the Global Alcohol Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Alcohol Market?

Major players in the Global Alcohol Market include Anheuser-Busch InBev, Diageo, Heineken, Pernod Ricard, Constellation Brands, among others.

04. What are the growth drivers for the Global Alcohol Market?

The primary growth drivers for the Global Alcohol Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.