Global Artillery Systems Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10788

December 2024

91

About the Report

Global Artillery Systems Market Overview

- The global artillery systems market is valued at USD 10.2 billion, driven by escalating defense budgets and evolving military strategies that prioritize advanced, long-range artillery. The need for modernized artillery capabilities and technological advancements, such as precision guidance, is also critical as countries strengthen their ground combat readiness. These developments reflect the broader defense sector's response to increased geopolitical tensions and the imperative for more sophisticated ground warfare tools.

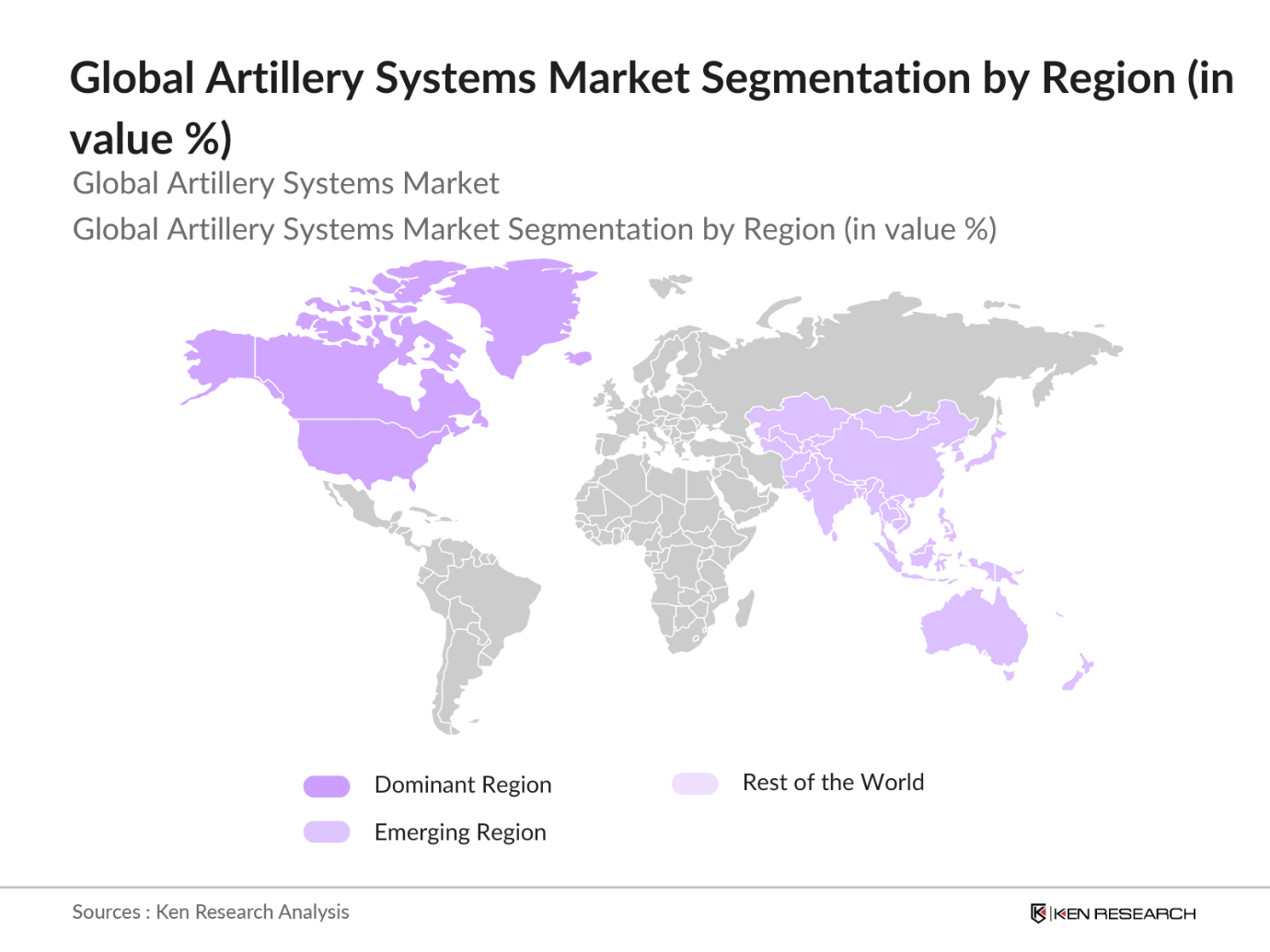

- Regions like North America and Asia-Pacific hold dominant positions in the artillery systems market, largely due to extensive defense spending and advanced R&D capabilities. North America, particularly the United States, leads in technological advancements, while Asian countries, led by China and India, are enhancing artillery systems to bolster their defense infrastructure against regional threats. This strategic focus on artillery underscores the critical role of regional and global security policies.

- New arms trade regulations in 2023 affected artillery imports/exports, with the UN Arms Trade Treaty tightening compliance standards for heavy artillery. Import-export documentation now requires verification of humanitarian end-use in conflict zones, as seen in recent German exports to Eastern Europe. NATO members and allied nations align with these regulations to mitigate risks of arms proliferation. This regulatory framework is essential for establishing a transparent international market for artillery systems.

Global Artillery Systems Market Segmentation

By Artillery Type: The global artillery systems market is segmented by artillery type into towed artillery, self-propelled artillery, mortars, howitzers, and rocket artillery. Self-propelled artillery leads this segment due to its superior mobility, speed, and ease of deployment in various terrains. Militaries worldwide prioritize self-propelled systems to improve operational flexibility and adaptability in response to the dynamic nature of modern warfare.

By Region: The market is segmented regionally into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America leads due to its unmatched defense spending and innovative research and development efforts. The U.S. Armys focus on long-range precision fire capabilities, paired with substantial R&D investments, reinforces North Americas dominant market share. Meanwhile, Asia-Pacifics growth is propelled by increasing defense budgets and the development of indigenous artillery systems in countries such as China and India.

By Component: The artillery systems market is further divided by component into platforms, ammunition, and fire control systems. Platforms hold the largest market share due to ongoing modernization efforts, with militaries investing heavily in advanced platforms that integrate new technologies for precision targeting and real-time data processing. These platforms allow for seamless interoperability and improved battlefield communication, critical for coordinated ground operations.

Global Artillery Systems Market Competitive Landscape

The global artillery systems market is dominated by established companies with extensive expertise in defense technology. This consolidation emphasizes the technological leadership and extensive manufacturing capabilities of these players.

Global Artillery Systems Industry Analysis

Growth Drivers

- Increasing Defense Budgets: Global defense spending increased substantially from $1.92 trillion in 2022 to $2.02 trillion in 2023, reflecting rising military investments across major economies (World Bank data). Specifically, the U.S., China, and Russia collectively allocated $1.35 trillion to defense, accounting for over 60% of the global total. This increase signals enhanced financial capacity for advanced artillery systems to address modern threats and border defense initiatives. According to NATO, European allies have committed an additional 2% of GDP to defense, prioritizing long-range artillery and missile defense systems. This surge in military expenditures underscores the growing strategic emphasis on artillery systems.

- Rise in Territorial Disputes: Current data from the United Nations Geopolitical Risk Index shows a 15% rise in territorial disputes globally between 2022 and 2023, driven by boundary conflicts in Eastern Europe, East Asia, and the South China Sea. In Asia, military confrontations along the Indo-China border and maritime disputes in the South China Sea have catalyzed artillery system investments. Government budgets and force deployments in these regions have shifted towards advanced artillery acquisition, evident in Chinas recent $12 billion allocation for border defense, with a focus on long-range artillery. This trend aligns with the global push for artillery modernization amid regional tensions.

- Advancements in Artillery Technology: ecent innovations in autonomous targeting, projectile guidance, and GPS-integrated tracking systems have revolutionized artillery, leading to systems capable of striking at 70+ km. The U.S. Army's development of the Extended Range Cannon Artillery (ERCA) project in 2023 targets rapid deployment capabilities for potential NATO engagements. Globally, 11 countries have reported adopting precision-targeting systems in artillery since 2022, marking a critical shift in deployment strategies, per data from the U.S. Department of Defense. These advancements, widely funded, are transforming operational standards across military artillery systems.

Market Restraints

- High Procurement Costs: Artillery system procurement costs have risen by nearly 8% between 2022 and 2023, with the average cost per unit in advanced systems exceeding $4 million, based on recent Pentagon assessments. These costs are compounded by the requirement for specialized components, materials, and logistical support. Countries with smaller defense budgets face financial constraints in updating aging artillery arsenals, leading to a potential market limitation. The financial barrier has prompted nations like Canada and Italy to implement phased modernization programs, spreading costs over several fiscal cycles.

- Complex Maintenance Requirements: Modern artillery systems demand specialized maintenance involving a higher number of technical personnel and spare parts. NATO reports indicate a 20% rise in artillery system downtime in 2023 due to complex maintenance, especially for electronically controlled self-propelled units. The cost of spare parts for artillery platforms has increased by 5% annually from 2022, impacting operational efficiency for smaller countries. Furthermore, a shortage of skilled technicians has led countries like Japan to invest over $100 million in training programs for artillery maintenance personnel.

Global Artillery Systems Market Future Outlook

Over the next five years, the artillery systems market is anticipated to witness substantial growth driven by heightened defense expenditures, emerging threats, and technological advancements in precision and range capabilities. Governments are increasingly adopting advanced artillery technologies to enhance their national security infrastructure, reflecting a strong commitment to maintaining territorial integrity and regional stability.

Market Opportunities

- Autonomous Artillery Systems: The autonomous military systems market saw investments of over $15 billion in 2023, up from $12.5 billion in 2022, with artillery emerging as a prominent area. AI integration in targeting systems, evidenced by the U.K.s Ministry of Defense pilot programs, promises enhanced artillery precision. The U.S. has allocated $3 billion for autonomous artillery R&D, expected to drive adoption across NATO allies. This trend toward autonomy aligns with the growing need for enhanced operational efficiency in high-risk territories and cost-effective deployment.

- Growth in Emerging Regions: Defense spending in emerging markets increased by 7% in 2023, reaching $430 billion, with Latin American and African nations making artillery procurement a priority. Brazils 2023 defense budget includes $450 million for artillery modernization, a 9% increase from 2022, while South Africas defense allocations rose by 6%, focused on border security enhancements. Emerging economies are shifting investments towards cost-effective artillery systems, aiming to secure their strategic interests with modern artillery capabilities.

Scope of the Report

|

Type |

Towed Artillery |

|

Range |

Short-Range |

|

Component |

Platforms |

|

Caliber |

Light Caliber (20mm-75mm) |

|

Region |

North America |

Products

Key Target Audience

Defense Ministries (U.S. Department of Defense, UK Ministry of Defence)

Military Procurement Agencies

Armament Manufacturers

Defense Technology Integrators

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (NATO, EU Defense Agency)

Aerospace and Defense Contractors

Private Defense Investors

Companies

Players Mentioned in the Report:

BAE Systems plc

General Dynamics Corporation

Rheinmetall AG

Hanwha Defense

Lockheed Martin Corporation

Elbit Systems Ltd.

Nexter Group

Leonardo S.p.A.

Raytheon Technologies Corporation

Krauss-Maffei Wegmann GmbH

Table of Contents

1. Global Artillery Systems Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Artillery Systems Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Artillery Systems Market Analysis

3.1 Growth Drivers (Strategic Relevance, Technological Advancements, Geopolitical Factors)

3.1.1 Increasing Defense Budgets

3.1.2 Rise in Territorial Disputes

3.1.3 Advancements in Artillery Technology

3.2 Market Challenges (Operational Efficiency, Tactical Limitations)

3.2.1 High Procurement Costs

3.2.2 Complex Maintenance Requirements

3.3 Opportunities (Emerging Markets, Technological Integration)

3.3.1 Autonomous Artillery Systems

3.3.2 Growth in Emerging Regions

3.4 Trends (Integration with UAVs, Precision Targeting Systems)

3.4.1 Shift Towards Self-Propelled Artillery

3.4.2 Increase in Long-Range Artillery Capabilities

3.5 Government Regulation (Compliance Standards, Import/Export Policies)

3.5.1 Defense Acquisition Guidelines

3.5.2 Arms Trade Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Global Artillery Systems Market Segmentation

4.1 By Type (in Value %)

4.1.1 Towed Artillery

4.1.2 Self-Propelled Artillery

4.1.3 Mortars

4.1.4 Howitzers

4.1.5 Rocket Artillery

4.2 By Range (in Value %)

4.2.1 Short-Range

4.2.2 Medium-Range

4.2.3 Long-Range

4.3 By Component (in Value %)

4.3.1 Platforms

4.3.2 Ammunition

4.3.3 Fire Control Systems

4.4 By Caliber (in Value %)

4.4.1 Light Caliber (20mm-75mm)

4.4.2 Medium Caliber (76mm-120mm)

4.4.3 Heavy Caliber (Above 120mm)

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Artillery Systems Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BAE Systems plc

5.1.2 General Dynamics Corporation

5.1.3 Lockheed Martin Corporation

5.1.4 Elbit Systems Ltd.

5.1.5 Rheinmetall AG

5.1.6 Hanwha Defense

5.1.7 Nexter Group

5.1.8 China North Industries Corporation (NORINCO)

5.1.9 Leonardo S.p.A.

5.1.10 Raytheon Technologies Corporation

5.1.11 Krauss-Maffei Wegmann GmbH

5.1.12 Huta Stalowa Wola (HSW)

5.1.13 KMW+Nexter Defense Systems (KNDS)

5.1.14 Israel Military Industries (IMI) Systems

5.1.15 United Technologies Corporation

5.2 Cross Comparison Parameters (Production Capacity, Strategic Alliances, Regional Focus, Revenue, Manufacturing Facilities, Product Innovation, Market Share, Workforce Size)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Artillery Systems Market Regulatory Framework

6.1 Defense Standards Compliance

6.2 Import/Export Control Regulations

6.3 Certification Processes for Defense Suppliers

7. Global Artillery Systems Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Artillery Systems Future Market Segmentation

8.1 By Type (in Value %)

8.2 By Range (in Value %)

8.3 By Component (in Value %)

8.4 By Caliber (in Value %)

8.5 By Region (in Value %)

9. Global Artillery Systems Market Analysts Recommendations

9.1 Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An ecosystem map of key stakeholders in the artillery systems market was constructed, focusing on primary stakeholders, including manufacturers, government bodies, and defense technology integrators. This phase involved extensive desk research utilizing secondary and proprietary databases.

Step 2: Market Analysis and Construction

Historical data was compiled for market penetration rates, artillery production and usage, and revenue generation. Analysis of service quality and product lifecycle metrics ensured accurate estimates of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts from prominent defense companies. Insights gained from these discussions were instrumental in corroborating market data.

Step 4: Research Synthesis and Final Output

Direct interactions with defense manufacturers provided detailed insights into production capabilities, sales trends, and customer requirements. This final validation ensured a comprehensive and accurate analysis of the artillery systems market.

Frequently Asked Questions

01. How big is the Global Artillery Systems Market?

The global artillery systems market was valued at USD 10.2 billion, driven by heightened defense investments and advancements in artillery technology.

02. What are the challenges in the Global Artillery Systems Market?

Challenges include high procurement costs, complex maintenance requirements, and regulatory hurdles, which can impact operational efficiency and deployment.

03. Who are the major players in the Global Artillery Systems Market?

Key players in the market include BAE Systems, General Dynamics, Rheinmetall AG, Lockheed Martin, and Hanwha Defense, known for their advanced production capabilities and extensive defense networks.

04. What factors drive the growth of the Global Artillery Systems Market?

The market is driven by defense sector demands for modernized artillery systems, increased government defense spending, and advancements in long-range, precision-based artillery technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.