Global Chocolate Market Outlook to 2030

Region:Global

Author(s):Dev

Product Code:KROD-040

June 2025

90

About the Report

Global Chocolate Market Overview

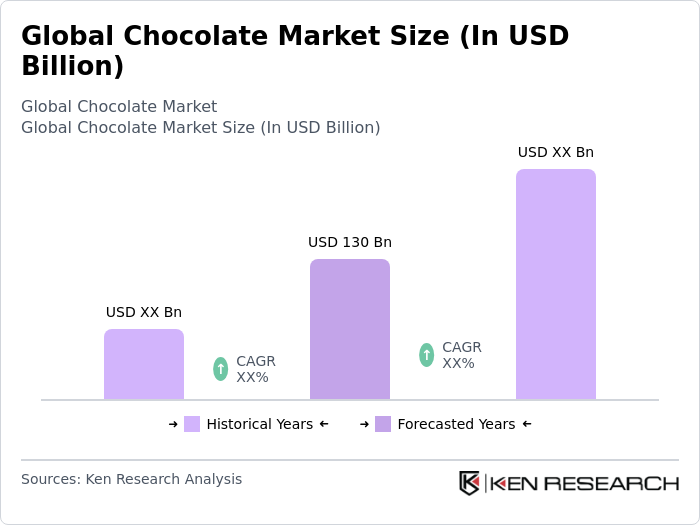

- The Global Chocolate Market was valued at USD 130 billion. This growth is primarily driven by increasing consumer demand for premium and artisanal chocolate products, along with the rising popularity of dark chocolate due to its perceived health benefits. Additionally, the expansion of e-commerce platforms has made chocolate products more accessible to consumers worldwide, further fueling market growth.

- Countries such as the United States, Germany, and Switzerland dominate the chocolate market due to their strong manufacturing capabilities and high per capita consumption rates. The U.S. is known for its innovative product offerings and extensive distribution networks, while Germany and Switzerland are recognized for their high-quality chocolate production and strong brand loyalty among consumers.

- The European Commission has promoted a voluntary framework for sugar reduction across various food categories, including confectionery and chocolate products. This initiative encourages manufacturers to reformulate products to reduce added sugars gradually. This framework is part of the broader EU Action Plan on Childhood Obesity 2014-2020 and the Farm to Fork Strategy under the European Green Deal, aiming to improve the nutritional profile of foods and promote healthier diets.

Global Chocolate Market Segmentation

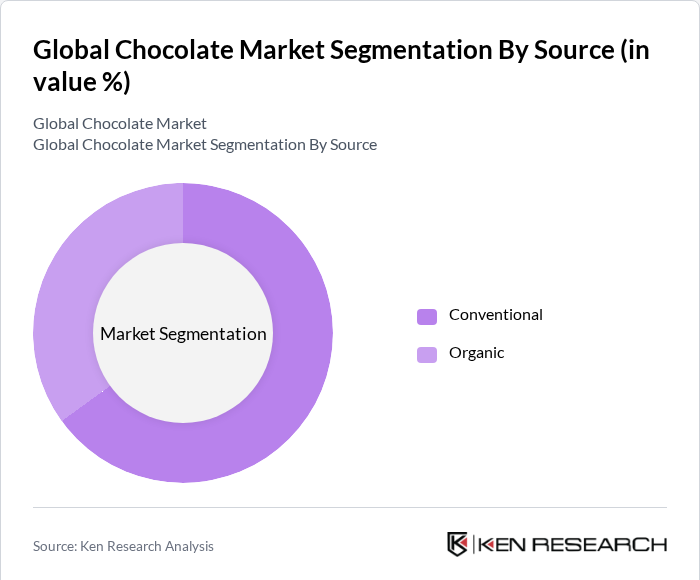

By Source: The chocolate market can be segmented based on the source of cocoa used in production, primarily categorized into conventional and organic sources. The organic segment has been gaining traction due to increasing consumer awareness regarding sustainable farming practices and health benefits associated with organic products. Organic chocolate is perceived as a premium product, attracting health-conscious consumers willing to pay a higher price for quality and sustainability. This trend is further supported by the growing number of certifications and labels that emphasize organic sourcing, which enhances consumer trust and brand loyalty.

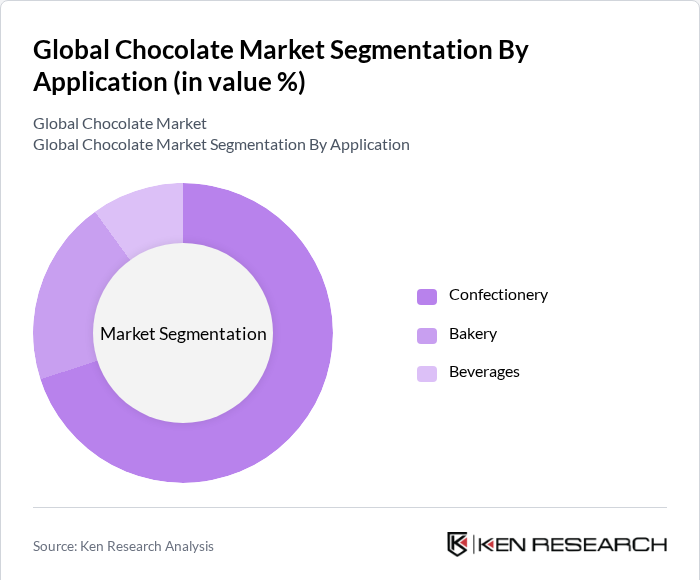

By Application: The chocolate market is also segmented based on application, which includes confectionery, bakery, and beverages. The confectionery segment dominates the market due to the high demand for chocolate bars, pralines, and seasonal products like Easter eggs and Christmas chocolates. This segment benefits from continuous product innovation, including the introduction of unique flavors and textures, which cater to diverse consumer preferences. Additionally, the rise of gifting culture during holidays and special occasions significantly boosts sales in the confectionery segment, making it a key driver of market growth.

Global Chocolate Market Competitive Landscape

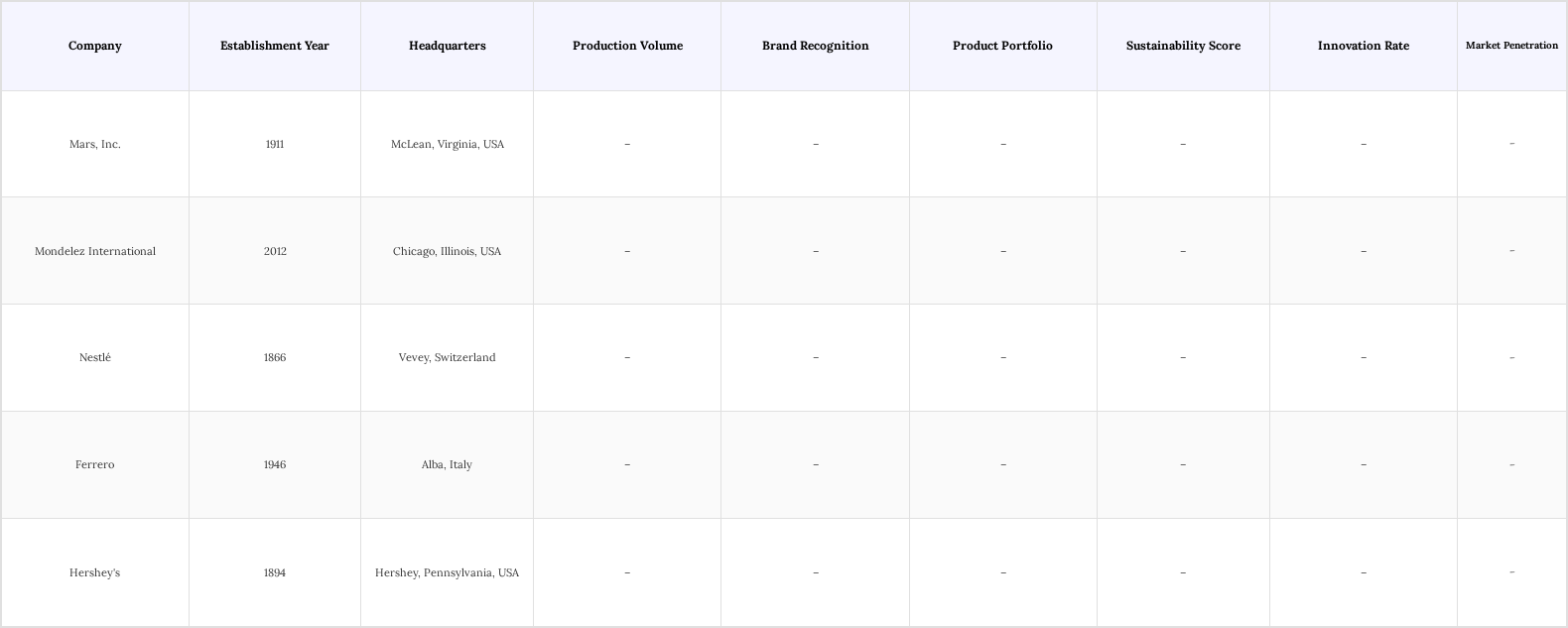

The Global Chocolate Market is characterized by intense competition among key players such as Mars, Inc., Mondelez International, Nestlé, and Ferrero. These companies dominate the market through extensive product portfolios, strong brand recognition, and innovative marketing strategies. The competitive dynamics are further influenced by the growing trend of health-conscious consumption, leading to the introduction of healthier chocolate options and sustainable sourcing practices.

Global Chocolate Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Premium Chocolate Products: Increasing consumer demand for premium chocolate products is a major growth driver in the confectionery industry. Consumers are willing to pay a premium for chocolates made with high-quality ingredients, unique flavor profiles, and artisanal production methods. The rise of gourmet chocolate brands emphasizing craftsmanship and ethical sourcing has further fueled this trend. Additionally, growing disposable incomes, especially in urban centers, are encouraging consumers to seek indulgent and experiential treats, making premium chocolates a popular choice.

- Rising Health Consciousness and Demand for Dark Chocolate: Rising health consciousness among consumers is driving increased demand for dark chocolate, which is recognized for its high antioxidant content and potential cardiovascular benefits. This shift in consumer preference is reflected in the growing sales of dark chocolate products, as more people seek healthier alternatives to traditional sweets. Supported by scientific research highlighting its positive health effects, manufacturers are expanding their dark chocolate offerings and emphasizing these benefits in marketing campaigns.

- Expansion of E-commerce Platforms for Chocolate Sales: The expansion of e-commerce platforms has become a significant growth driver for chocolate sales, with online purchases reaching approximately USD 12 billion in 2023. The convenience of shopping from home, combined with shifts in consumer behavior accelerated by the COVID-19 pandemic, has propelled this trend. Major retailers and specialty chocolate brands are increasingly investing in digital channels, enhancing customer experiences through personalized marketing, targeted promotions, and subscription services.

Market Challenges

- Fluctuating Cocoa Prices Affecting Profit Margins: The chocolate industry is heavily influenced by volatility in cocoa prices, which can significantly impact production costs. As cocoa is a primary raw material, any upward shift in its price directly affects profit margins. Manufacturers must carefully manage this volatility while upholding product quality and affordability. In many cases, this results in increased retail prices, which can challenge demand—especially among price-sensitive consumers.

- Stringent Regulations on Food Safety and Quality: Chocolate manufacturers must also comply with a complex landscape of food safety and quality regulations. These regulatory requirements differ across regions, compelling companies to invest in robust quality control measures and supply chain traceability. Failure to meet these standards can lead to product recalls and reputational damage. Navigating this regulatory environment is critical for maintaining brand integrity and consumer trust.

Global Chocolate Market Future Outlook

The future of the chocolate market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape purchasing decisions, the demand for organic and ethically sourced chocolate is expected to rise. Additionally, advancements in technology and e-commerce will facilitate greater accessibility to diverse chocolate products, enhancing consumer engagement. Companies that adapt to these trends and invest in sustainable practices are likely to thrive in this dynamic market landscape.

Market Opportunities

- Growing Market for Organic and Fair-Trade Chocolate: The growing market for organic and fair-trade chocolate is a key driver in the confectionery industry, fueled by rising consumer awareness of sustainability and ethical sourcing. Increasingly, consumers are seeking products that align with their values, favoring chocolates that carry organic certifications and fair-trade labels. This trend reflects a broader shift toward responsible consumption, where buyers prioritize environmental impact and social justice alongside quality and taste.

- Innovations in Chocolate Flavors and Formats: Innovations in chocolate flavors and formats are driving significant market growth by attracting adventurous and diverse consumer segments. The introduction of unique flavor combinations and novel product formats is projected to contribute an additional USD 4 billion in sales by 2025. Collaborations with culinary experts and the incorporation of exotic, premium ingredients enable brands to differentiate their offerings, catering to evolving taste preferences and enhancing the overall appeal of chocolate products.

Scope of the Report

| By Source |

|

| By Application |

Confectionery Bakery Beverages |

| By Product Type |

Dark Chocolate Milk Chocolate White Chocolate Ruby Chocolate |

| By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Consumer Type |

Adults Children Health-Conscious Consumers |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food and Drug Administration, European Food Safety Authority)

Manufacturers and Producers

Distributors and Retailers

Importers and Exporters

Industry Associations (e.g., International Cocoa Organization)

Financial Institutions

Packaging Suppliers

Companies

Players Mentioned in the Report:

Mars, Inc.

Mondelez International

Nestlé

Ferrero

Hershey's

CacaoCraft Co.

ChocoSphere Ltd.

SweetHarvest Chocolates

DivineCocoa Enterprises

Artisan Chocolate Collective

Table of Contents

1. Global Chocolate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Chocolate Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Chocolate Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Demand for Premium Chocolate Products

3.1.2. Rising Health Consciousness and Demand for Dark Chocolate

3.1.3. Expansion of E-commerce Platforms for Chocolate Sales

3.2. Market Challenges

3.2.1. Fluctuating Cocoa Prices Affecting Profit Margins

3.2.2. Stringent Regulations on Food Safety and Quality

3.2.3. Competition from Alternative Snacks and Confectionery

3.3. Opportunities

3.3.1. Growing Market for Organic and Fair-Trade Chocolate

3.3.2. Innovations in Chocolate Flavors and Formats

3.3.3. Expansion into Emerging Markets with Untapped Potential

3.4. Trends

3.4.1. Increasing Popularity of Vegan and Plant-Based Chocolate Options

3.4.2. Rise of Artisan and Craft Chocolate Brands

3.4.3. Focus on Sustainable Sourcing and Eco-Friendly Packaging

3.5. Government Regulation

3.5.1. Compliance with International Food Safety Standards

3.5.2. Regulations on Labeling and Nutritional Information

3.5.3. Environmental Regulations Impacting Cocoa Farming Practices

3.5.4. Trade Policies Affecting Cocoa Import and Export

4. Global Chocolate Market Segmentation

4.1. By Source

4.1.1. Conventional

4.1.2. Organic

4.2. By Application

4.2.1. Confectionery

4.2.2. Bakery

4.2.3. Ice Cream

4.2.4. Beverages

4.3. By Product Type

4.3.1. Dark Chocolate

4.3.2. Milk Chocolate

4.3.3. White Chocolate

4.3.4. Ruby Chocolate

4.4. By Distribution Channel

4.4.1. Supermarkets/Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Retail

4.4.4. Specialty Stores

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

4.6. By Consumer Type

4.6.1. Adults

4.6.2. Children

4.6.3. Health-Conscious Consumers

5. Global Chocolate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mars, Inc.

5.1.2. Mondelez International

5.1.3. Nestlé

5.1.4. Ferrero

5.1.5. Hershey's

5.1.6. CacaoCraft Co.

5.1.7. ChocoSphere Ltd.

5.1.8. SweetHarvest Chocolates

5.1.9. DivineCocoa Enterprises

5.1.10. Artisan Chocolate Collective

5.2. Cross Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. Pricing Strategies

5.2.5. Distribution Network Efficiency

5.2.6. Brand Loyalty Metrics

5.2.7. Innovation Rate in Product Development

5.2.8. Sustainability Initiatives

6. Global Chocolate Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Chocolate Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Chocolate Market Future Market Segmentation

8.1. By Source

8.1.1. Conventional

8.1.2. Organic

8.2. By Application

8.2.1. Confectionery

8.2.2. Bakery

8.2.3. Ice Cream

8.2.4. Beverages

8.3. By Product Type

8.3.1. Dark Chocolate

8.3.2. Milk Chocolate

8.3.3. White Chocolate

8.3.4. Ruby Chocolate

8.4. By Distribution Channel

8.4.1. Supermarkets/Hypermarkets

8.4.2. Convenience Stores

8.4.3. Online Retail

8.4.4. Specialty Stores

8.5. By Region

8.5.1. North America

8.5.2. Europe

8.5.3. Asia-Pacific

8.5.4. Latin America

8.5.5. Middle East & Africa

8.6. By Consumer Type

8.6.1. Adults

8.6.2. Children

8.6.3. Health-Conscious Consumers

9. Global Chocolate Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Chocolate Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Chocolate Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Chocolate Market.

Frequently Asked Questions

01. How big is the Global Chocolate Market?

The Global Chocolate Market is valued at USD 130 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Chocolate Market?

Key challenges in the Global Chocolate Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Chocolate Market?

Major players in the Global Chocolate Market include Mars, Inc., Mondelez International, Nestlé, Ferrero, Hershey's, among others.

04. What are the growth drivers for the Global Chocolate Market?

The primary growth drivers for the Global Chocolate Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.