Global Cryptocurrency Market Outlook to 2030

Region:Global

Author(s):Rohan and Anurag

Product Code:KENGR033

October 2024

88

About the Report

Global Cryptocurrency Market Overview

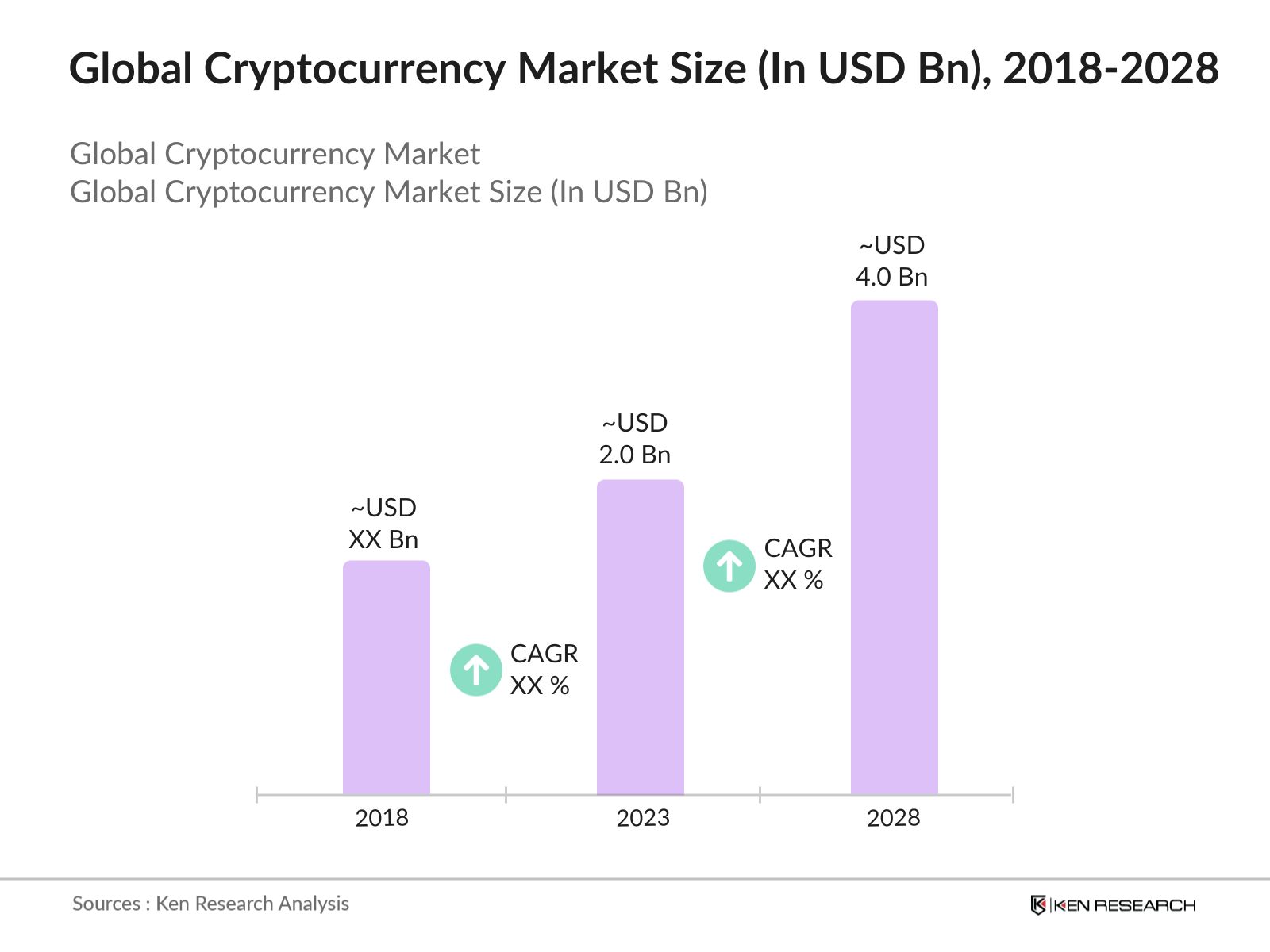

- In 2023, the global cryptocurrency market is valued at USD 2 billion, driven by several key factors. Innovations in scalability and security, such as layer 2 solutions and proof of stake mechanisms, enhance transaction efficiency and protect against cyber threats. Mainstream adoption is bolstered by user-friendly wallets and increased acceptance by businesses and consumers, making cryptocurrencies more accessible.

- The market is highly consolidated with a few prominent players dominating the landscape. This consolidation reflects both the competitive nature of the market and the significant resources that leading firms can leverage to establish and maintain their positions. Some of the prominent players of the market are Binance, OKX, Bitget, Bybit, Gate.io, HTX, and Coinbase.

- At the Blockchain Life 2023 event in Dubai, the Whatsminer M60 series was unveiled, priced at USD 3,800. This new series features cutting-edge mining technology, reflecting ongoing advancements in efficiency and performance within the cryptocurrency mining sector. The launch underscores the markets competitive and innovative nature.

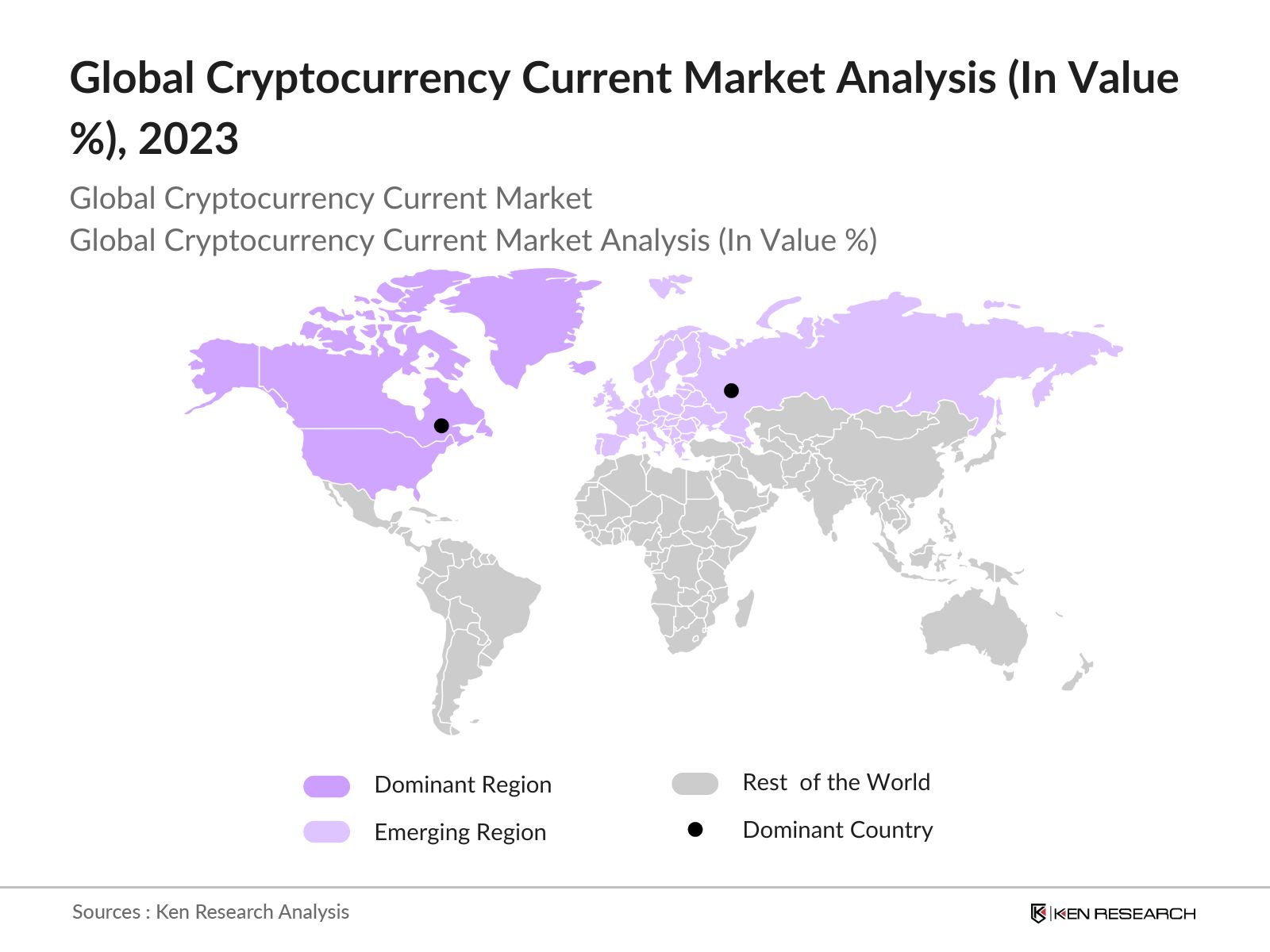

Global Cryptocurrency Current Market Analysis

- North America as dominant region: North America is the dominant region in the market, propelled by a supportive regulatory framework providing clarity and fostering innovation, high adoption rates among both individual and institutional investors, and significant institutional investment enhancing market stability.North America accounted for 24.4% of all value received on-chain between July 2022 and June 2023, translating to USD 1.2 trillion in global crypto transactions. Notably, over USD 1 trillion of this activity originated in the United States alone.A staggering 76.9% of transaction volume in North America is driven by institutional activity, specifically transfers of USD 1 million or more. This highlights the dominance of institutional investors in the region's cryptocurrency market.

- Europe as emerging region: Europe is becoming a key player in the cryptocurrency market due to progressive regulations that ensure security and transparency, rising adoption by businesses and consumers, and significant investments in blockchain technology.In the first quarter of 2024, USD 386 million was invested in 68 European blockchain startups, signaling a rebound in private investment. Furthermore, the European Union plans to allocate 20% of its 750 billion ($887 billion) pandemic recovery fund to technology development, including blockchain, starting in 2021.

- USA as dominant country: The USA dominates the global cryptocurrency market due to substantial institutional investment from major financial firms and venture capitalists, advanced technological infrastructure, and a strong presence of top cryptocurrency exchanges.As of 2023, the U.S. hosts 600 cryptocurrency exchanges, including both centralized and decentralized platforms. From July 2022 to June 2023, the USA accounted for over USD 1 trillion of North America's total USD 1.2 trillion in cryptocurrency transactions, reflecting a vigorous trading environment fueled by both retail and institutional investors.

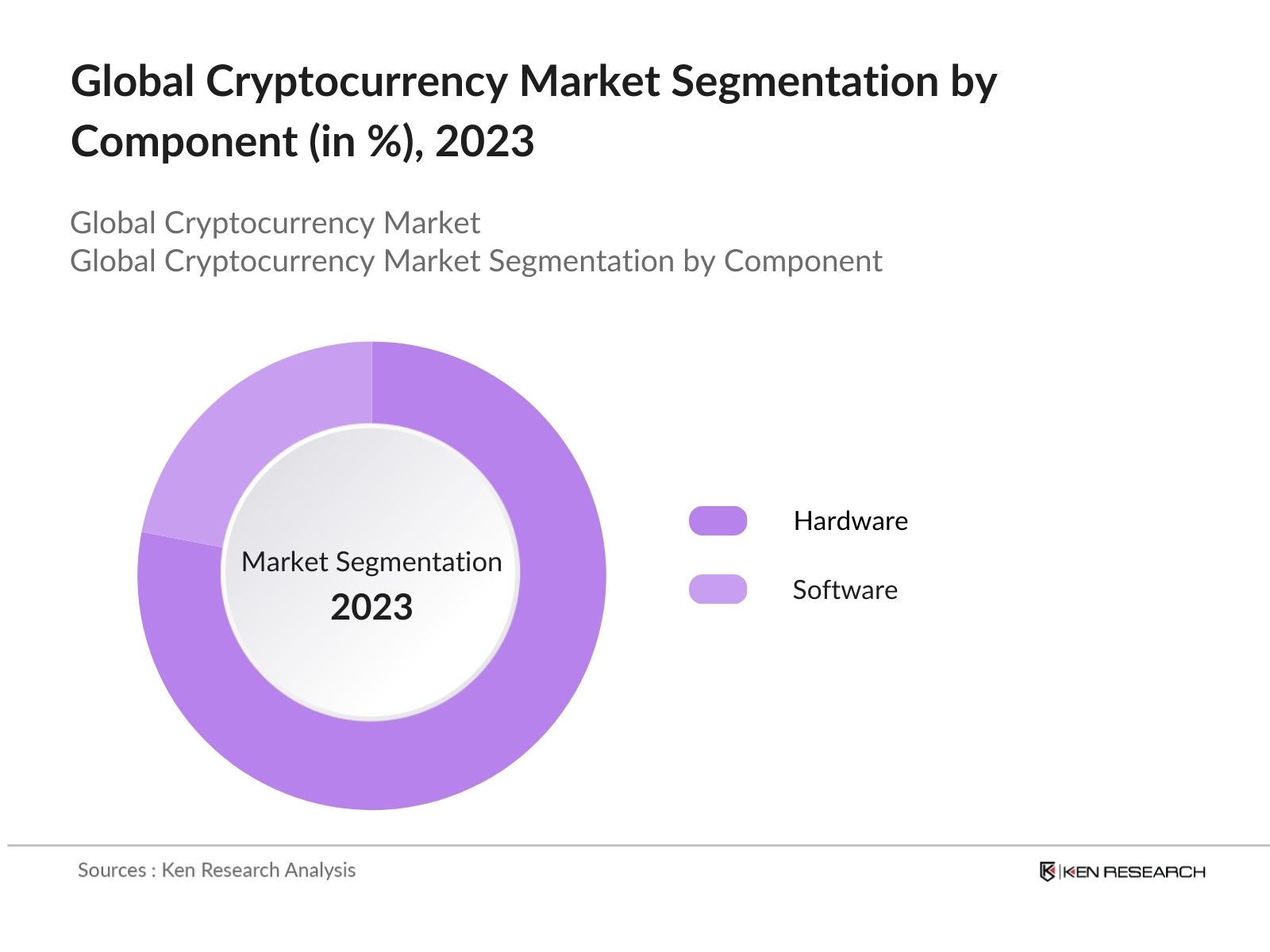

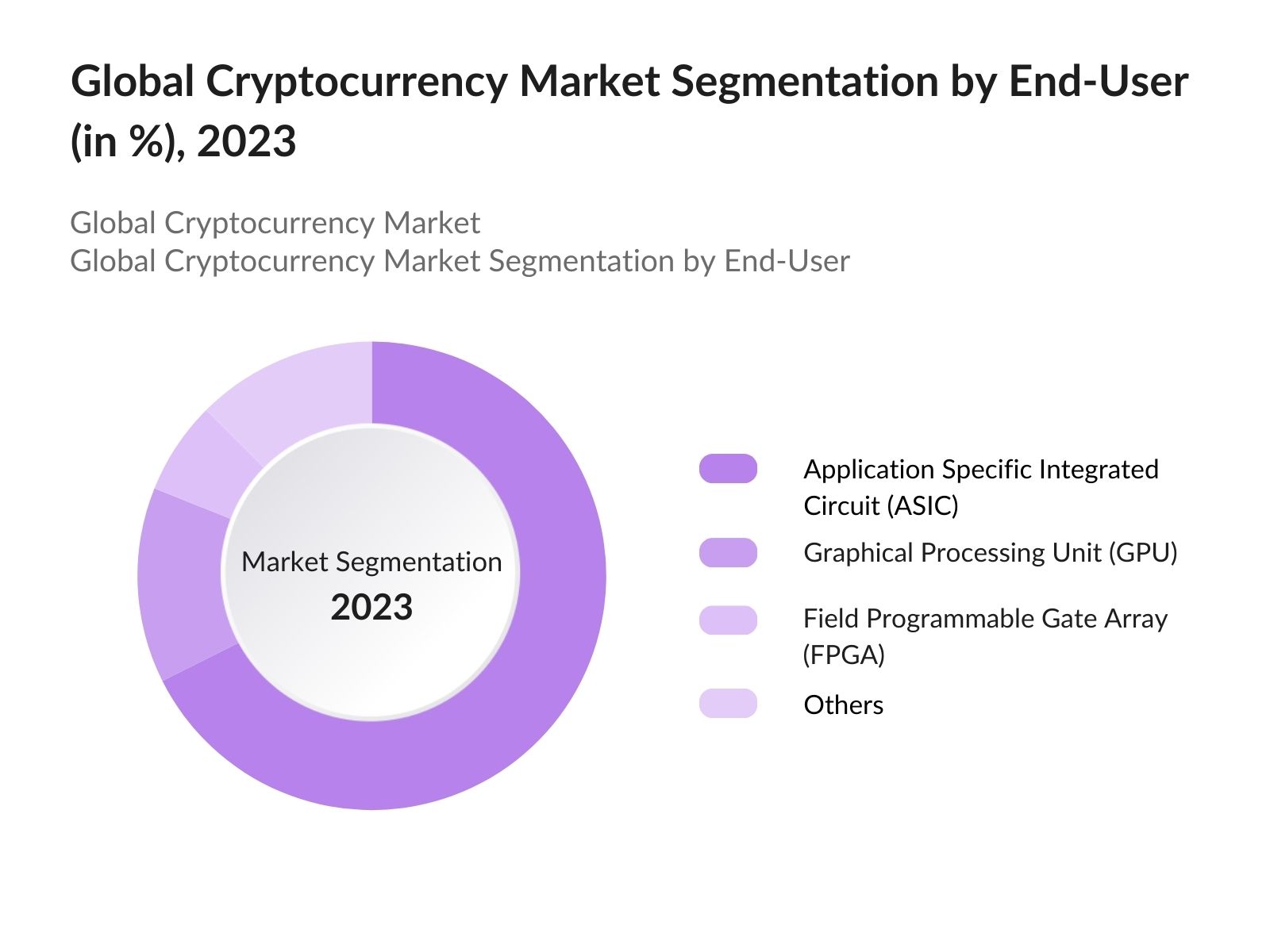

Global Cryptocurrency Market Segmentation

The Global Cryptocurrency Market can be segmented based on several factors:

- By Component: The cryptocurrency market segmentation by component is divided into hardware and software. In 2023, the hardware leads the market by component, accounting for the largest value share. This is driven by the increasing demand for specialized hardware like ASIC miners and GPUs that are crucial for efficient cryptocurrency mining and trading.

- By End-User: The cryptocurrency market segmentation by end-user is divided into Application Specific Integrated Circuit (ASIC), Graphical Processing Unit (GPU), Field Programmable Gate Array (FPGA), and Others. In 2023, the ASIC dominated the market by end-user, accounting for the largest value share. This is driven by the high efficiency and performance of ASICs in mining operations, which are essential for large-scale cryptocurrency mining enterprises.

- By Type of Coin: The cryptocurrency market segmentation by type of coin is divided into Bitcoin, Ether, Ripple, Doge, Binance Coin, and Others. In 2023, the Bitcoin dominated the market. This is driven by Bitcoins status as the pioneer and most widely recognized cryptocurrency, which continues to dominate in terms of market value and adoption.

Global Cryptocurrency Market Competitive Landscape

|

Hardware Companies |

||||||

|

Company |

Headquarter |

Establishment Year |

Employees |

Number of products variants |

Top Product |

|

|

Beijing, China |

2013 |

1500 |

62 |

Bitmain Antminer KS5 Pro |

|

|

Shenzhen, China |

2016 |

128 |

28 |

MicroBT Whatsminer M63S Hydro |

|

|

Beijing, China |

2013 |

541 |

14 |

Canaan Avalon 1466 |

|

|

Zhejiang, China |

2010 |

297 |

10 |

Ebang EBIT E11++ |

|

|

Shanghai, China |

2017 |

NA |

32 |

Goldshell AL-BOX |

|

|

Newport Beach, California |

2023 |

NA |

8 |

Iceriver KS5L |

|

- Bitmain: The Antminer T21, released at around $3,200, features impressive computing power of 190 TH/s and an energy efficiency ratio of 19 J/TH. This advanced mining hardware is designed to deliver enhanced performance and efficiency, addressing the growing demands of high-performance cryptocurrency mining.

- Ebang: In April 2021, the company launched its cryptocurrency exchange, marking a significant expansion into the trading space. This move aims to provide users with a comprehensive platform for trading and investing in various cryptocurrencies, further strengthening its position in the digital asset market.

- Goldshell: The company introduced new miners, including the MINI DOGE II ($649), MINI DOGE III ($1,000), and HS BOX II ($500), each offering improved speed and efficiency. Additionally, they rolled out the Goldshell Zone App, which simplifies user experience and enhances functionality for mining operations.

Global Cryptocurrency Industry Analysis

Global Cryptocurrency Market Growth Drivers:

- Scalability and Security Enhancements: Innovations such as layer 2 solutions (e.g., Lightning Network for Bitcoin) and proof of stake (PoS) mechanisms are transforming the scalability and security of blockchain networks. Layer 2 solutions enhance transaction throughput by processing transactions off-chain and settling them on-chain, significantly improving scalability without compromising security. PoS mechanisms, on the other hand, provide an energy-efficient alternative to proof of work (PoW) by allowing validators to create new blocks based on their stake in the network, thus enhancing security and reducing energy consumption.

- Mainstream Adoption and User Experience: The cryptocurrency market is experiencing significant growth in mainstream adoption, driven by an increasing number of businesses accepting cryptocurrencies as payment and a rising number of consumers investing in digital assets. Advances in user-friendly wallets and payment systems are making it easier for individuals to buy, store, and use cryptocurrencies. As of 2023, 30,000 merchants worldwide accept Bitcoin as a form of payment. Notable brands that have adopted this payment method include Subway, Starbucks, BMW, and Microsoft, highlighting the increasing acceptance of cryptocurrencies in various sector.

- Institutional Engagement and Market Legitimacy: The involvement of institutional investors such as hedge funds, venture capital firms, and corporate entities represents a key factor in the maturation and legitimacy of the cryptocurrency market. These institutional players bring substantial capital and long-term investment perspectives, which help stabilize the market and mitigate its inherent volatility. As of August 2024, the total market capitalization of the global cryptocurrency market stands at around USD 1.89 trillion, despite experiencing fluctuations and downturns. This figure indicates a substantial investment landscape, with Bitcoin holding a significant market share of 56.56%.

Global Cryptocurrency Market Challenges:

- Regulatory Uncertainty: The cryptocurrency market faces significant challenges due to regulatory uncertainty, which varies widely across different jurisdictions. Recently, China has taken a hard stance against cryptocurrency trading and mining, citing financial risks and energy consumption concerns. This fragmented regulatory landscape can create confusion and hinder innovation by imposing unclear or inconsistent rules. Businesses and investors may be hesitant to engage in the market without a clear understanding of the legal framework, which can limit adoption and slow down-market growth. Moreover, this uncertainty can sometimes lead to market manipulation and exploitative practices, as the lack of standardized regulations.

- Market Volatility: Cryptocurrency markets are characterized by extreme volatility, with prices often experiencing dramatic fluctuations over short periods. One major volatility was observed in May 2021, when the price of Bitcoin fell by nearly 30% in a single day, partially triggered by regulatory concerns in China and others counties. This volatility is driven by a range of factors, including speculative trading, where investors buy and sell based on market trends rather than fundamental value. Additionally, the relatively low liquidity of some cryptocurrencies can lead to significant price swings when large trades are executed.

Global Cryptocurrency Market Government Initiatives:

- The European Union's Markets in Crypto-Assets (MiCA) Regulation: The EU's MiCA regulation aims to create a comprehensive regulatory framework for cryptocurrencies and digital assets across member states. By establishing clear guidelines for the issuance and trading of crypto-assets, including stablecoins and utility tokens, MiCA seeks to enhance consumer protection, ensure market integrity, and foster innovation within a unified regulatory environment.

- The U.S. Securities and Exchange Commission (SEC) Initiatives: The SEC has been actively working to develop and enforce regulatory measures for the cryptocurrency market, focusing on investor protection and market integrity. Recent initiatives include the SEC's efforts to regulate initial coin offerings (ICOs) and cryptocurrency exchanges under existing securities laws. The SEC has also been involved in creating guidelines for digital asset custody and addressing concerns related to market manipulation.

Global Cryptocurrency Future Market Outlook

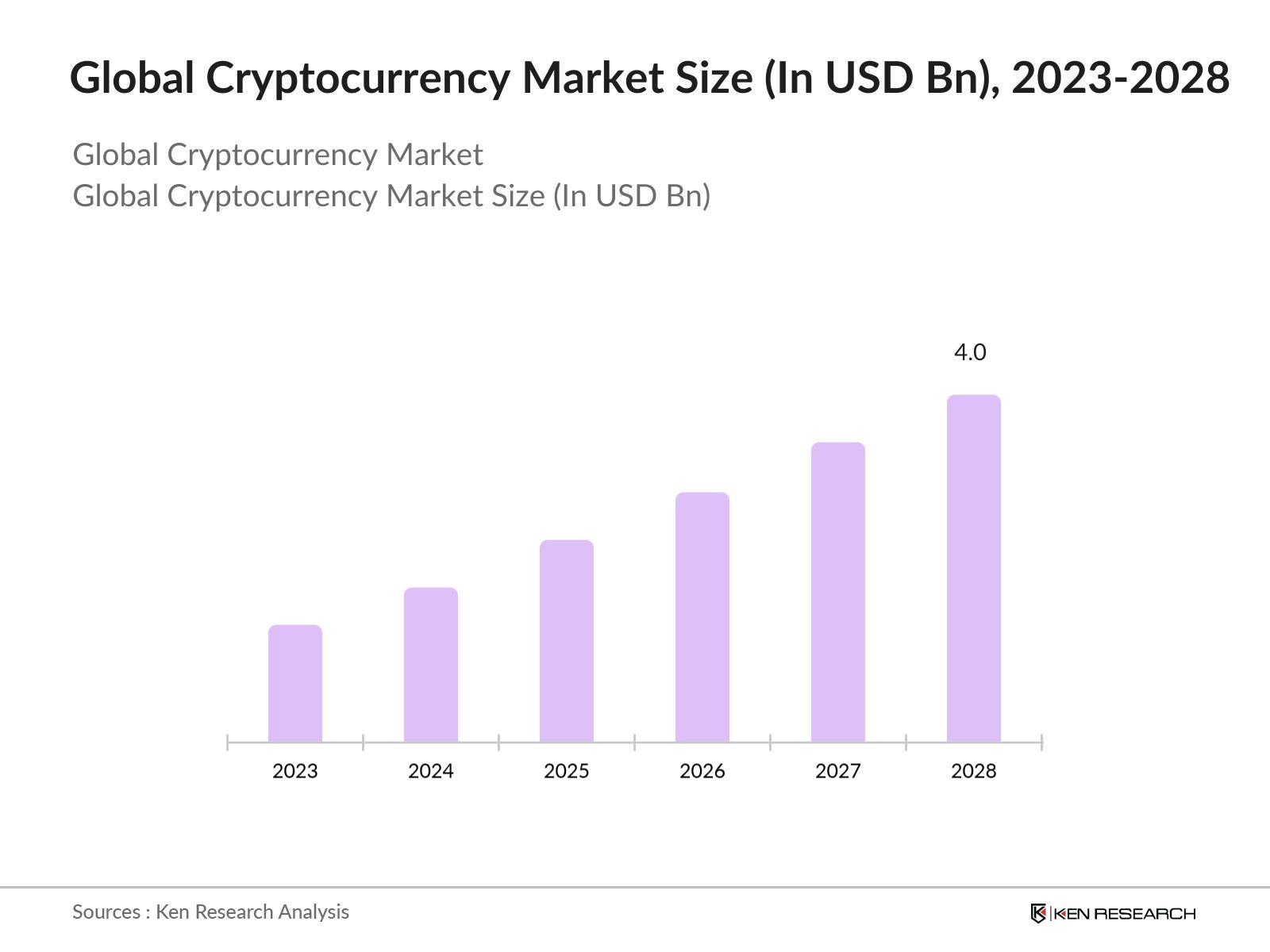

The global cryptocurrency market is predicted to grow exceptionally in the forecasted period of 2023-2028 reaching a market size of USD 4 Bn driven by diversification of cryptocurrency offerings, integration with traditional finance, increased focus on scalability and security, and rise of decentralized finance (DEFI).

- Diversification of Cryptocurrency Offerings: The cryptocurrency market is increasingly witnessing the diversification of its offerings, moving beyond traditional cryptocurrencies like Bitcoin and Ether. This trend includes the development and introduction of a wide range of digital assets, such as stablecoins, decentralized finance (DeFi) tokens, non-fungible tokens (NFTs), and various utility and security tokens. Diversification allows investors to access new investment opportunities and financial products, each with unique features and use cases.

- Integration with Traditional Finance: The integration of cryptocurrencies with traditional financial systems is a significant future trend that aims to bridge the gap between digital and conventional finance. This integration is evidenced by several developments: major financial institutions and banks are increasingly offering cryptocurrency trading and investment services; traditional payment systems are beginning to support cryptocurrency transactions; and financial products such as Bitcoin futures and exchange-traded funds (ETFs) are being introduced.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Component |

Hardware Software |

|

By End-User |

ApplicationSpecificIntegratedCircuit(ASIC) GraphicalProcessingUnit(GPU) Field Programmable GateArray(FPGA) Others |

|

By Type of coin |

Bitcoin Ether Ripple Doge Binance Coin Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Cryptocurrency Exchanges and Trading Platforms

Banks and Financial Institutions

Investors and VCs

Regulatory Bodies (EMA, ISO)

Regulatory and Compliance Bodies

Technology and Blockchain Companies

Financial Analysts and Market Researchers

Institutional and Retail Investors

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Bitmain

MicroBt

Canaan

Ebang

Goldshell

Binance

OKX

Bitget

Bybit

Gate.io

HTX

Coinbase

Table of Contents

1. Executive Summary

1.1 Global Digital Currency Market

1.2 Global Cryptocurrency Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Cryptocurrency Industry

2.3 Global Cryptocurrency Revenue

2.4 Global Cryptocurrency Infrastructure

3. Global Cryptocurrency Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

4. Global Cryptocurrency Market Size (in USD Bn), 2018-2023

5. Global Cryptocurrency Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Component (Hardware and Software) in value%, 2018-2023

5.3 By End-User (ApplicationSpecificIntegratedCircuit(ASIC), GraphicalProcessingUnit(GPU), Field Programmable GateArray(FPGA), and Others) in value %, 2018-2023

5.4 By Type of coin (Bitcoin, Ether, Ripple, Doge, Binance Coin, and Others) in value %, 2018-2023

6. Global Cryptocurrency Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis (By Hardware)

6.3 Market Heat Map Analysis (By Software)

6.4 Market Cross Comparison

6.5 Comparison Matrix

6.6 Investment Landscape

7. Global Cryptocurrency Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Cryptocurrency Future Market Size (in USD Bn), 2023-2028

9. Global Cryptocurrency Future Market Segmentation (in value %), 2023-2028

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2028

9.2 By Component (Hardware and Software) in value%, 2023-2028

9.3 By End-User (ApplicationSpecificIntegratedCircuit(ASIC), GraphicalProcessingUnit(GPU), Field Programmable GateArray(FPGA), and Others) in value %, 2023-2028

9.4 By Type of Coin (Bitcoin, Ether, Ripple, Doge, Binance Coin, and Others) in value %, 2023-2028

10. Analyst Recommendations

Research Methodology

Step 1: Hypothesis Creation

The research team had first framed a hypothesis about the market through analysis of existing industry factors, obtained from company reports and from magazines, journals, online articles, ministries, government associations and data from industry reports. We have used both public and proprietary databases to define each market and collect data points about the same.

Step 2: Hypothesis Testing

Conducted interviews with the management of the companies (C-level executives, Director, Country Head, Product Heads, Head of Sales, Business Development Executives, Operations Supervisors and others). Computer assisted telephonic interviews (CATIs) were conducted to get their insights on the market onboard and to seek justification to thehypothesisframed by the team.

Step 3: Market Sizing Approach

The market size has been curated through a top-to-bottom approach by identifying the major players operating in the Global Cryptocurrency Market, understanding their revenue and sales for each type of product, price points and contribution to the total market to arrive at the revenue generated in the entire market. Market size has been cross-checked through various secondary sources.

Step 4: Interpretation and Future Forecasting

Future has been estimated through identifying a set of macro and industry level parameters like technological development, number of enterprises, number of SMEs, number of large conglomerates among others to frame a hypothesis for future prediction along with the views of the industry experts. The final analysis was then interpreted in the research report by our expert team well versed with video conferencing market.

Frequently Asked Questions

01 How big is the global cryptocurrency market?

In 2023, the global cryptocurrency market is valued at USD 2.0 Bn driven by scalability and security enhancements, mainstream adoption and user experience, institutional engagement and market legitimacy, and decentralization and financial independence.

02 What are the challenges in the global cryptocurrency market?

Challenges in the global cryptocurrency market include regulatory uncertainty, market volatility, and security concerns. The fragmented regulatory landscape can stifle innovation, while extreme price fluctuations and cyber threats pose significant risks.

03 Who are the major players in the global cryptocurrency market?

Major players in the global cryptocurrency market include Binance, Coinbase, Kraken, and Bitfinex. These companies lead the market due to their extensive trading platforms, high liquidity, and wide range of supported cryptocurrencies.

04 What are the growth drivers of the global cryptocurrency market?

Key growth drivers in the global cryptocurrency market include innovations in blockchain technology, increasing mainstream adoption, and institutional investment. The rise in user-friendly digital wallets and payment systems also boosts market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.