Global EPDM Market Outlook to 2030

Region:Global

Author(s):Meenakshi Bisht

Product Code:KROD1642

October 2024

97

About the Report

Global EPDM Market Overview

- The Global Ethylene Propylene Diene Monomer (EPDM) Market was valued at USD 3.7billion in 2023. The market is primarily driven by the increasing demand from the automotive industry, particularly in the production of weather-stripping, seals, and gaskets due to EPDM's excellent resistance to heat, weather, and ozone. Additionally, the rising demand for sustainable and durable roofing systems in the construction sector further propels market growth.

- The key players in the global EPDM market include LANXESS AG, ExxonMobil Chemical Company, Lion Elastomers, Sumitomo Chemical Co., Ltd., and Mitsui Chemicals, Inc.. These companies have a strong foothold in the market due to their extensive product portfolios, innovative research and development initiatives, and strategic expansions. They play a pivotal role in driving the market dynamics through continuous advancements in EPDM formulations and applications across various end-use industries.

- In April 2023, LANXESS established a joint venture with Advent International, combining its former high-performance Materials business with DSMs Engineering Materials business. This move is part of LANXESS's strategy to streamline operations and focus on high-growth areas, which includes EPDM rubber production. The joint venture aims to enhance operational efficiencies and expand market presence, particularly in North America and Asia, which are key markets for EPDM rubber.

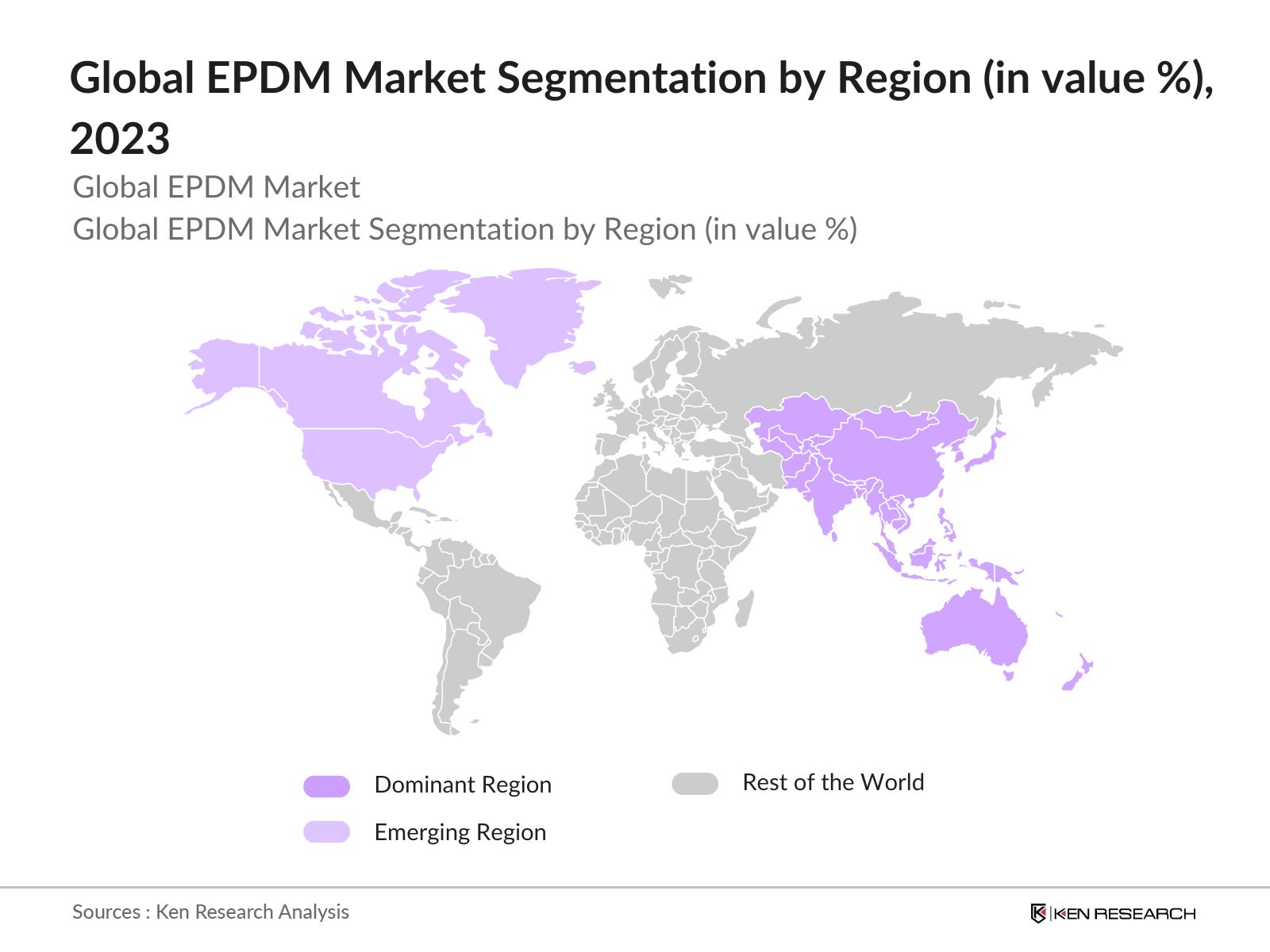

- China dominated the market, due to its attributed to the region's rapid industrialization, growing automotive industry, and increasing investments in infrastructure projects. The country's strong manufacturing base, coupled with government initiatives to promote sustainable and energy-efficient materials, is expected to further drive the demand for EPDM in the coming years.

Global EPDM Market Segmentation

The Global EPDM Market is segmented into different factors like by product, by application and region.

By Product Type: The global EPDM market is segmented by product type into Solution Polymerization and Suspension Polymerization. In 2023, Solution Polymerization was dominating the market, due to its ability to produce EPDM with superior properties such as higher molecular weight and better mechanical properties. This process is favored in applications requiring high-performance materials, particularly in the automotive and construction industries. The increasing demand for lightweight and durable materials in these industries has significantly contributed to the dominance of solution polymerization in the EPDM market.

By Region: The global EPDM market is segmented by region into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. In 2023, Asia-Pacific dominated the market in 2023, driven by the robust growth of the automotive and construction industries in countries like China and India. The region's large population base, rapid urbanization, and increasing industrial activities have been key factors contributing to the high demand for EPDM. The presence of major automotive manufacturers and ongoing infrastructure development projects further support the dominance of Asia-Pacific in the global EPDM market.

By Application: The global EPDM market is segmented by application into Automotive, Building & Construction, Electrical & Electronics, Plastics, and Others. In 2023, Automotive application was dominating the market due to its extensive use of EPDM in automotive weather-seals, hoses, and gaskets, driven by the increasing production of vehicles, especially electric vehicles, has been a key factor in the dominance of this segment. The industry's focus on lightweight and durable materials for fuel efficiency and performance further bolsters the demand for EPDM in automotive applications.

Global EPDM Market Competitive Landscape

Global EPDM Market Major Players

|

Company |

Established Year |

Headquarters |

|---|---|---|

|

LANXESS AG |

2004 |

Cologne, Germany |

|

ExxonMobil Chemical Company |

1911 |

Texas, USA |

|

Lion Elastomers |

1987 |

Louisiana, USA |

|

Sumitomo Chemical Co., Ltd. |

1913 |

Tokyo, Japan |

|

Mitsui Chemicals, Inc. |

1997 |

Tokyo, Japan |

- Sumitomo Chemical Co., Ltd.: Sumitomo Chemical announced the termination of its EPDM production at its Chiba Works in Japan, effective by the end of March 2023. This decision was driven by increasing maintenance and repair costs for aging production facilities, which had been in operation for over 50 years. The company concluded that securing stable profits in the medium to long term was becoming increasingly challenging under these circumstances.

- Lion Elastomers: InFebruary 2024, Lion Elastomers announced a partnership with Emulco NV to develop water-based EPDM emulsion products, expanding its product offerings in sustainable materials. And InFebruary 2023, the company signed a distribution agreement with Prime Plastics, enhancing its market presence in the European Union. This partnership is expected to improve access to Lion's products for European customers.

Global EPDM Market Analysis

Global EPDM Market Growth Drivers

- Automotive Industry Expansion: The global EPDM market is significantly driven by the expansion of the automotive industry, particularly in the production of electric vehicles (EVs). In 2024, EV sales are around 17 million units globally, up from 14 million units in 2023. The increasing production of EVs in key markets like China, the USA, and Germany is pushing the demand for high-performance EPDM materials, particularly due to their superior resistance to temperature fluctuations and electrical insulation. With the global EV market expected to grow by an additional 15 million units by 2025, the demand for EPDM in automotive applications is set to rise steadily.

- Growth in the Construction Sector: The construction industrys expansion, particularly in Asia-Pacific and North America, is a critical driver for the EPDM market. EPDM is widely used in roofing membranes and waterproofing systems due to its durability and resistance to extreme weather conditions. In the United States alone, new residential construction projects reached over 1.3 million units in 2024, many of which incorporate EPDM-based products, further driving the markets growth.

- Growing Renewable Energy Sector: The renewable energy sector, particularly solar energy, is a key driver for EPDM demand. EPDM is used in solar panel sealants due to its UV resistance and long lifespan, aligning with the global shift towards sustainable energy solutions. The ongoing investments in renewable energy projects are further propelling the market's growth.

Global EPDM Market Challenges

- Raw Material Price Volatility: The EPDM market faces challenges due to the volatility of raw material prices, particularly ethylene and propylene, which are derived from crude oil. Fluctuations in oil prices can significantly impact production costs, making it difficult for manufacturers to maintain stable pricing and profitability. This unpredictability adds pressure on companies to manage costs effectively.

- Stringent Environmental Regulations: Environmental regulations, especially in regions like Europe and North America, pose a challenge for EPDM manufacturers. Compliance with these regulations often requires significant investments in cleaner production technologies and processes. This can increase operational costs and create barriers for smaller manufacturers who may struggle to meet the stringent standards.

Global EPDM Market Government Initiatives

- European Green Deal: The European Green Deal, launched in 2019, aims to make Europe the first climate-neutral continent by 2050. As part of this initiative, the European Union has implemented regulations promoting the use of sustainable materials in construction and automotive sectors, which directly impact the EPDM market. The Sustainable Europe Investment Plan aims to attract at least1 trillionin investments over a decade, which includes various initiatives under the Green Deal.

- China's New Energy Vehicle (NEV) Program: China's government continues to boost the NEV sector with significant initiatives. In June 2024, NEV retail sales reached 864,000 units, reflecting the impact of supportive policies, such as subsidies for consumers, tax incentives, and investment in charging infrastructure. The governments emphasis on reducing carbon emissions and promoting green technology has propelled NEV adoption, aligning with their broader environmental goals. This initiative is a key driver for Chinas rapidly growing NEV market.

Global EPDM Market Future Outlook

The global EPDM Market is growing continuously by 2028. The market will likely witness robust demand from the automotive, construction, and electrical industries, with a significant contribution from emerging markets such as India, China, and Southeast Asia. The ongoing advancements in EPDM technology, focusing on enhancing its environmental profile and performance attributes, are expected to drive its adoption in new applications, further expanding the market horizon.

Market Trends

- Expansion of Electric Vehicle (EV) Market: The EPDM market is expected to see significant growth driven by the expansion of the electric vehicle (EV) market. By 2028, global demand for EVs increases, particularly in regions like Asia-Pacific and Europe, the need for high-performance materials like EPDM in automotive components will rise. EPDMs durability, resistance to extreme temperatures, and electrical insulation properties make it an ideal choice for EV manufacturers.

- Advancements in Sustainable Manufacturing: By 2028, the EPDM market will be shaped by innovations aimed at reducing environmental impact. Manufacturers are expected to develop new production processes that minimize waste and energy consumption, aligning with global sustainability goals. The adoption of bio-based raw materials and the integration of circular economy practices will likely become more prevalent, helping companies to meet stricter environmental regulations while maintaining product quality.

Scope of the Report

|

By Product Type |

Solution Polymerization Suspension Polymerization |

|

By Application |

Automotive Building & Construction Electrical & Electronics Plastics Others |

|

By Region |

North America Europe APAC MEA Latin America |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this report:

Automotive Manufacturers

Construction Companies

Electrical & Electronics Companies

Chemical Companies

Infrastructure Development Companies

Renewable Energy Companies

Industrial Equipment Manufacturers

Transportation and Logistics Companies

Investors and VC Firms

Banks and Financial Institutions

Government Regulatory Agencies (U.S. Environmental Protection Agency (EPA), European Chemicals Agency (ECHA))

Companies

Players Mentioned in the Report:

LANXESS AG

ExxonMobil Chemical Company

Lion Elastomers

Sumitomo Chemical Co., Ltd.

Mitsui Chemicals, Inc.

Dow Inc.

Kumho Polychem

Versalis S.p.A.

SK Global Chemical Co., Ltd.

JSR Corporation

Sinopec Corporation

Arlanxeo Holding B.V.

SABIC

LG Chem Ltd.

Trinseo S.A.

Table of Contents

1. Global EPDM Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global EPDM Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global EPDM Market Analysis

3.1. Growth Drivers

3.1.1. Automotive Industry Expansion

3.1.2. Construction Sector Growth

3.1.3. Renewable Energy Investments

3.1.4. Technological Advancements

3.2. Restraints

3.2.1. Raw Material Price Volatility

3.2.2. Environmental Regulations

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Emerging Markets Demand

3.3.2. Technological Innovations

3.3.3. Expansion in Renewable Energy Applications

3.4. Trends

3.4.1. Increased Use in Electric Vehicles

3.4.2. Sustainable Manufacturing Practices

3.4.3. Growth in Solar Energy Applications

3.5. Government Regulation

3.5.1. European Green Deal

3.5.2. China's NEV Program

3.5.3. US Infrastructure Investment and Jobs Act

3.5.4. Indias Solar Mission

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global EPDM Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Solution Polymerization

4.1.2. Suspension Polymerization

4.2. By Application (in Value %)

4.2.1. Automotive

4.2.2. Building & Construction

4.2.3. Electrical & Electronics

4.2.4. Plastics

4.2.5. Others

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Middle East & Africa

4.3.5. Latin America

5. Global EPDM Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. LANXESS AG

5.1.2. ExxonMobil Chemical Company

5.1.3. Lion Elastomers

5.1.4. Sumitomo Chemical Co., Ltd.

5.1.5. Mitsui Chemicals, Inc.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global EPDM Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global EPDM Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global EPDM Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global EPDM Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. Global EPDM Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step 2: Market Building

Collating statistics on Global EPDM Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for global EPDM Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach fromsuch industry specific firms.

Frequently Asked Questions

01 How big is the Global EPDM Market?

The Global Ethylene Propylene Diene Monomer (EPDM) Market was valued at USD 3.7billion in 2023, driven by demand from automotive, construction, and renewable energy sectors.

02 What are the challenges in the Global EPDM Market?

Challenges in Global EPDM Market include fluctuating raw material prices, stringent environmental regulations, supply chain disruptions, and competition from alternative materials like thermoplastic elastomers.

03 Who are the major players in the Global EPDM Market?

Key players in Global EPDM Market include LANXESS AG, ExxonMobil Chemical Company, Lion Elastomers, Sumitomo Chemical Co., Ltd., and Mitsui Chemicals, Inc., known for their extensive production capacities and innovative product offerings

04 What are the growth drivers of the Global EPDM Market?

The Global EPDM Market is driven by the expansion of the automotive industry, growth in the construction sector, advancements in EPDM manufacturing technology, and increasing demand from the renewable energy sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.