Global Infrared Sensors Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD545

December 2024

92

About the Report

Global Infrared Sensors Market Overview

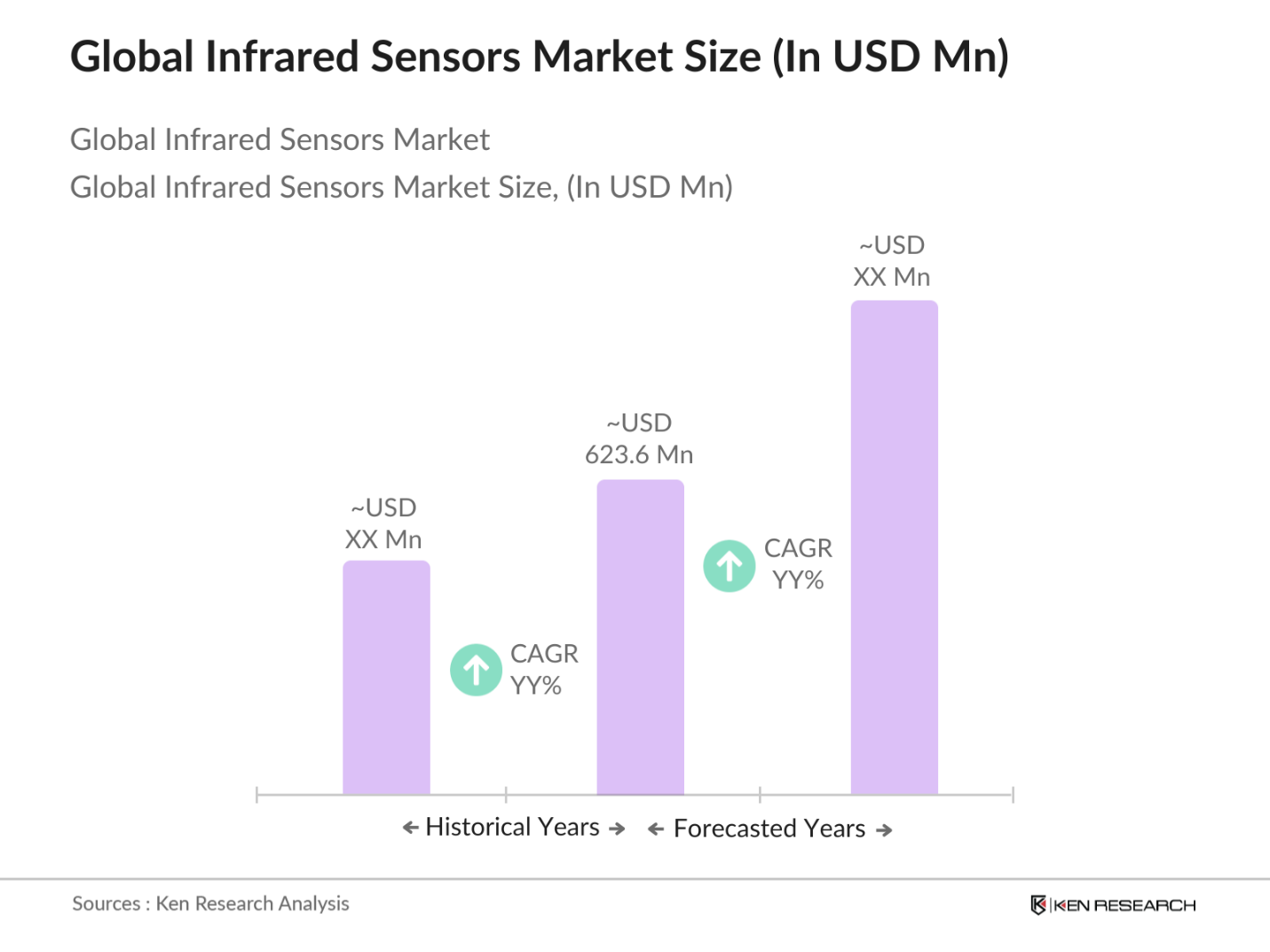

- The Global Infrared Sensors Market is valued at USD 623.6 million, based on a comprehensive five-year historical analysis. This market is primarily driven by the increasing adoption of infrared sensors across sectors such as home automation, healthcare, and automotive. The growing integration of sensors in Internet of Things (IoT) devices, including smart home systems, has amplified demand. Additionally, the use of infrared sensors in gas detection and fire safety systems has become a critical component in industrial applications, further boosting market size.

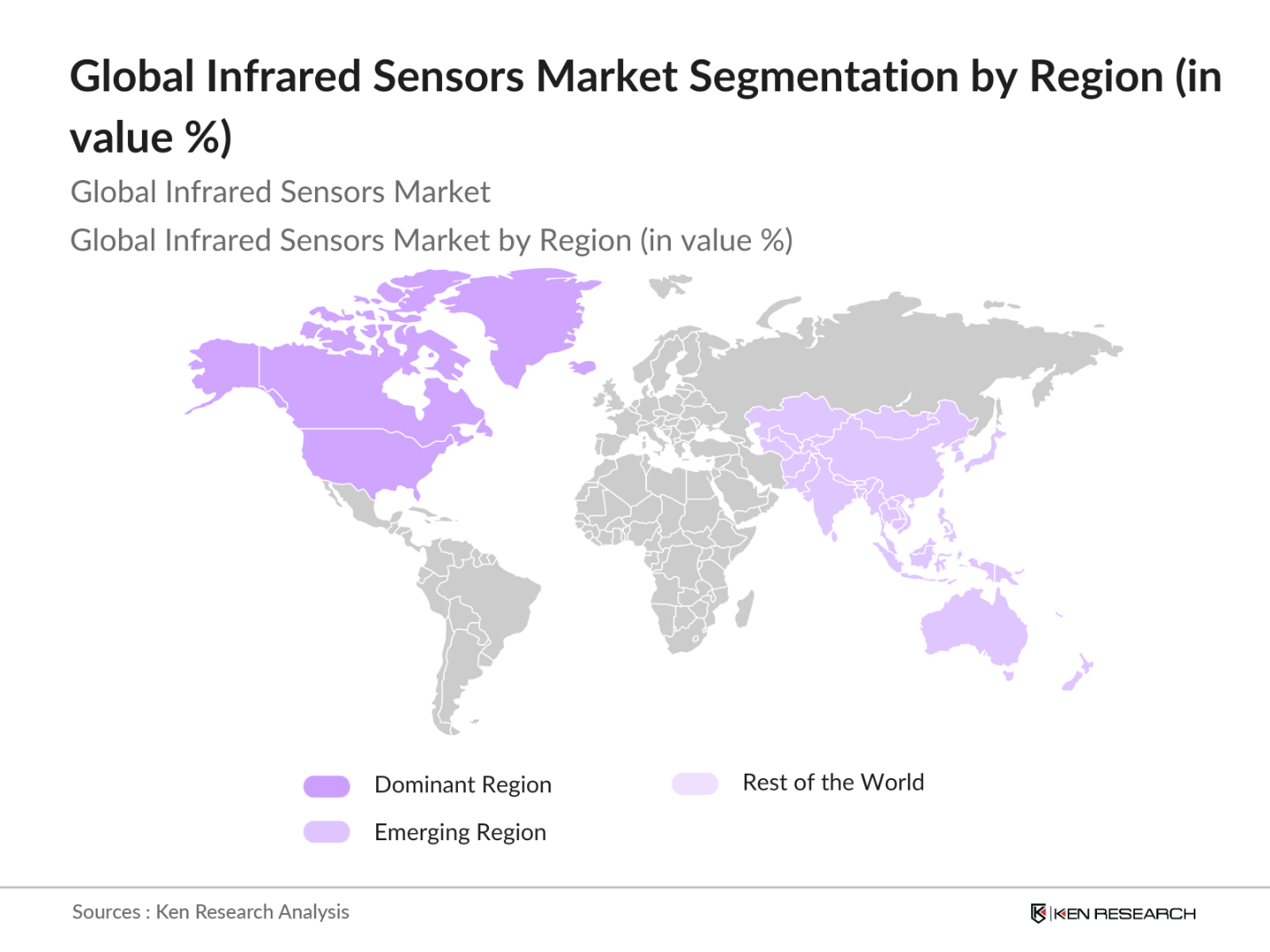

- The dominant regions in the infrared sensor market include North America and Asia-Pacific. North America's leadership is driven by robust technological advancements and extensive use in defense and aerospace applications. Asia-Pacific, especially countries like China and India, is seeing rapid industrial growth and integration of these sensors in manufacturing and consumer electronics, largely due to the regions growing smart infrastructure investments.

- Manufacturers of infrared sensors are subject to stringent environmental and safety regulations. For instance, the U.S. Environmental Protection Agency (EPA) has implemented policies requiring sensor manufacturers to reduce the carbon footprint associated with production processes. Similarly, the European Chemicals Agency (ECHA) enforces restrictions on the use of hazardous materials in sensor components, particularly for applications in healthcare and food safety. Compliance with these regulations is mandatory for manufacturers to avoid penalties and sanctions.

Global Infrared Sensors Market Segmentation

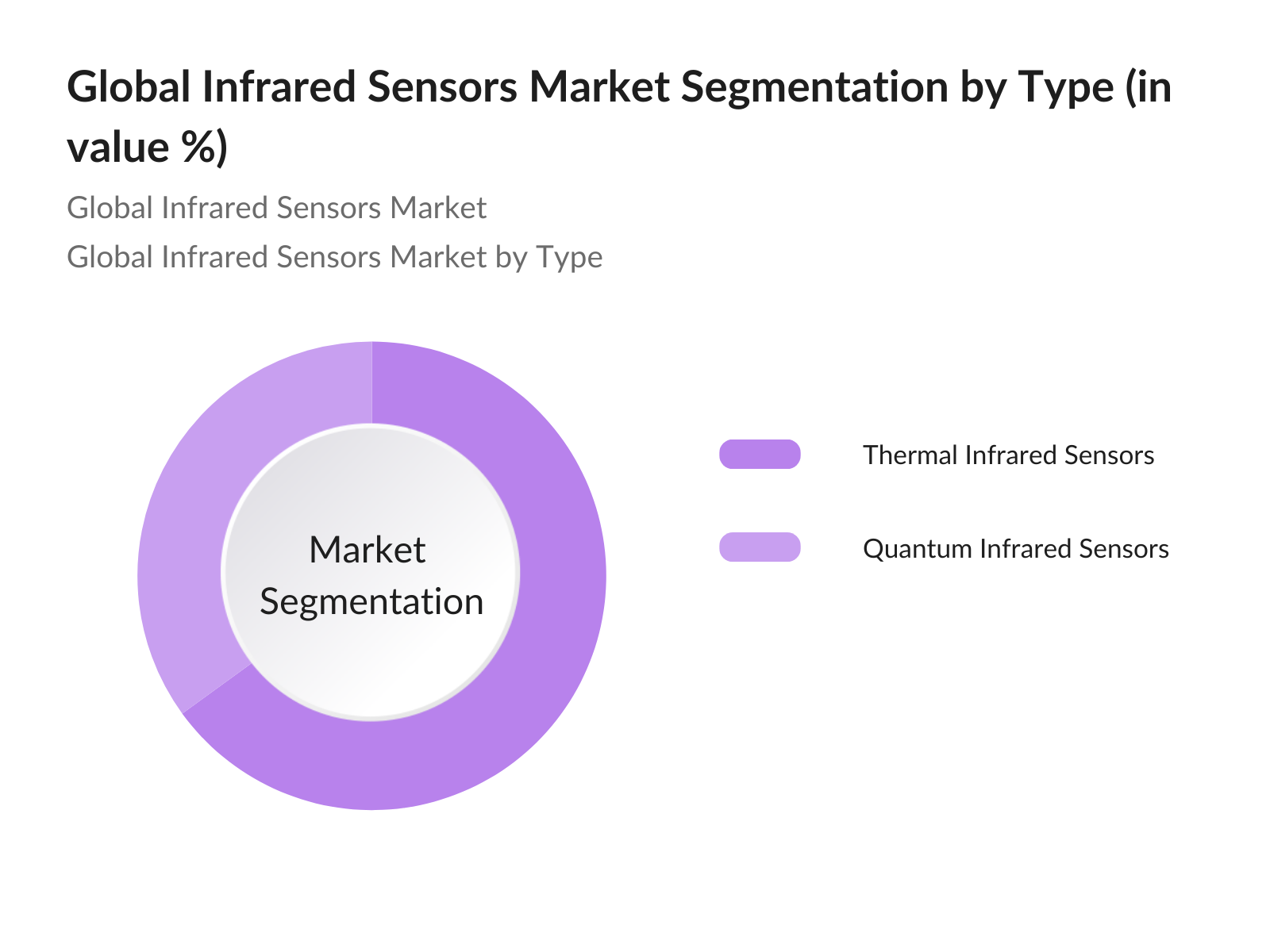

By Type: The infrared sensor market is segmented by type into thermal infrared sensors and quantum infrared sensors. Thermal infrared sensors are currently dominating the market, as they are widely used for temperature measurement, night vision, and gas detection. Their dominance is due to their lower cost and simpler operational mechanism compared to quantum sensors. Quantum infrared sensors, while offering higher sensitivity, are primarily used in defense and aerospace applications, requiring high precision and performance.

By Region: The regions dominating the market include North America, Europe, Asia-Pacific, Middle East & Africa, and South America. North America leads the market due to substantial investments in defense and aerospace, along with technological advancements in sensor manufacturing. However, Asia-Pacific is experiencing the fastest growth, driven by industrial automation and smart city projects in countries like China and India.

Global Infrared Sensors Market Competitive Landscape

The Global Infrared Sensors Market is dominated by several key players that drive innovation and market growth. These players focus on expanding product portfolios, strategic collaborations, and technological advancements to maintain their competitive edge.

|

Company Name |

Established |

Headquarters |

Market Parameters |

|

Murata Manufacturing Co. Ltd |

1944 |

Japan |

- |

|

FLIR Systems Inc. |

1978 |

United States |

- |

|

Honeywell International Inc. |

1906 |

United States |

- |

|

Excelitas Technologies |

2010 |

United States |

- |

|

Teledyne Imaging Inc. |

1960 |

United States |

- |

Global Infrared Sensors Market Analysis

Market Growth Drivers

- Rising Adoption in Home Automation and Security Systems: The infrared sensor market is being driven by the increasing adoption of smart home automation and security systems. According to data from the International Energy Agency (IEA), there were over 500 million connected devices in households globally in 2022, with the trend expected to continue as smart technologies become more affordable. Infrared sensors are integral to these systems for motion detection and thermal imaging, enabling enhanced security and energy efficiency. Additionally, governments like the U.S. Department of Energy are promoting smart home initiatives to reduce energy consumption in residential sectors.

- Expansion of Infrared Sensors in Drone and IoT Applications: The proliferation of drones and Internet of Things (IoT) technologies has escalated the demand for infrared sensors, especially for navigation and data collection. In 2023, the U.S. Federal Aviation Administration (FAA) recorded over 870,000 drones registered for commercial and recreational use. Infrared sensors, which are crucial for night-time and obstacle detection, have become essential in drone manufacturing. Moreover, IoT applications in industrial monitoring, where infrared sensors provide accurate temperature readings, are also contributing to this growth.

- Increasing Demand in Healthcare for Non-Invasive Diagnostics: The demand for infrared sensors is rising in healthcare due to their application in non-invasive diagnostics, particularly in detecting temperature anomalies in patients. The World Health Organization (WHO) reported that the global market for medical devices used for non-invasive diagnostics, including infrared thermometers, reached a record 700 million units in 2023. Hospitals and clinics are increasingly adopting infrared-based technologies for early detection of diseases, monitoring patient conditions, and improving diagnostic accuracy, especially in fields like oncology and neurology, where precise temperature monitoring is critical.

Market Challenges:

- Technological Limitations of Uncooled Sensors: Uncooled infrared sensors, despite being cost-effective, face performance challenges, particularly in high-temperature environments. Data from the U.S. National Institute of Standards and Technology (NIST) indicate that uncooled sensors tend to have lower resolution and sensitivity compared to cooled sensors, limiting their application in precision-required industries like aerospace and military. This technological limitation hampers broader adoption in sectors where high sensitivity and accuracy are critical.

- Stringent Regulatory Frameworks: Stringent government regulations related to the manufacturing and export of infrared sensor technologies pose a significant challenge to market growth. The U.S. Bureau of Industry and Security (BIS) imposes export control restrictions on infrared technologies used in military applications due to national security concerns. Additionally, the European Unions Restriction of Hazardous Substances Directive (RoHS) limits the use of certain materials in electronic components, including those used in infrared sensors, making compliance costly and complex for manufacturers.

Global Infrared Sensors Market Future Outlook

Over the next few years, the Global Infrared Sensors Market is expected to witness significant growth driven by advancements in sensor technologies, increasing demand for smart infrastructure, and growing industrial automation. The development of AI-powered infrared sensors for surveillance, smart homes, and healthcare applications will further boost market growth. Additionally, increasing investments in defense across countries such as the U.S., China, and India will sustain demand for high-performance infrared sensors.

Market Opportunities:

- Growth in Automotive Safety Systems: The automotive industry is experiencing increased demand for advanced driver-assistance systems (ADAS), in which infrared sensors are used for night vision and pedestrian detection. The International Organization of Motor Vehicle Manufacturers (OICA) reported that approximately 82 million vehicles were produced globally in 2023. Infrared sensors play a crucial role in enhancing road safety, especially in low-light conditions, where they improve visibility and reaction time. These sensors are becoming integral to ADAS technologies, helping reduce accidents and improve pedestrian safety by detecting objects and individuals in dark or poor weather conditions.

- Adoption of Infrared Sensors in Industrial Automation: The adoption of infrared sensors in industrial automation is accelerating, particularly in sectors such as manufacturing and energy. The International Federation of Robotics (IFR) reported that over 2.5 million industrial robots were deployed globally by the end of 2023, with a significant portion utilizing infrared sensors for thermal monitoring and quality control. Infrared sensors ensure operational efficiency by providing continuous monitoring of equipment temperature and preventing machinery breakdowns.

Scope of the Report

|

By Type |

Thermal Infrared Sensors Quantum Infrared Sensors |

|

By Spectrum Range |

Short-Wave IR (SWIR) Mid-Wave IR (MWIR) Long-Wave IR (LWIR) |

|

By Working Mechanism |

Active Passive |

|

By End-Use Industry |

Aerospace and Defense Healthcare Automotive Commercial Applications Manufacturing Oil & Gas |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa South America |

Products

Key Target Audience

Infrared Sensor Manufacturers

Aerospace and Defense Contractors

Government and Regulatory Bodies (U.S. Department of Defense, European Space Agency)

Automotive OEMs

Smart Home Device Manufacturers

Healthcare Device Manufacturers

Oil and Gas Companies

Investment and Venture Capital Firms

Companies

Players Mention in the Analysis

Murata Manufacturing Co. Ltd

FLIR Systems Inc.

Honeywell International Inc.

Excelitas Technologies

Teledyne Imaging Inc.

Omron Corporation

L3Harris Technologies

Melexis NV

Parallax Inc.

Raytheon Technologies

STMicroelectronics NV

Mitsubishi Electric Corporation

Nippon Ceramic Co. Ltd.

Texas Instruments Inc.

Zhengzhou Winsen Electronics

Table of Contents

1. Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Segmentation Overview

1.4. Market Growth Rate

2. Global Infrared Sensors Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Market Dynamics

3.1. Growth Drivers

3.1.1. Rising Adoption in Home Automation and Security Systems

3.1.2. Expansion of Infrared Sensors in Drone and IoT Applications

3.1.3. Increasing Demand in Healthcare for Non-Invasive Diagnostics

3.2. Market Challenges

3.2.1. Technological Limitations of Uncooled Sensors

3.2.2. Stringent Regulatory Frameworks

3.3. Opportunities

3.3.1. Development of Smart Cities and Infrastructure

3.3.2. Growth in Automotive Safety Systems

3.4. Trends

3.4.1. Integration with AI for Enhanced Detection

3.4.2. Miniaturization and Energy Efficiency

3.4.3. Adoption of Infrared Sensors in Industrial Automation

3.5. Government Regulations

3.5.1. Environmental and Safety Compliance in Manufacturing

3.5.2. Import and Export Regulations for Infrared Technologies

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Stakeholder Ecosystem

3.9. Competition Ecosystem

4. Global Infrared Sensors Market Segmentation

4.1. By Type (In Value %)

4.1.1. Thermal Infrared Sensors

4.1.2. Quantum Infrared Sensors

4.2. By Spectrum Range (In Value %)

4.2.1. Short-Wave IR (SWIR)

4.2.2. Mid-Wave IR (MWIR)

4.2.3. Long-Wave IR (LWIR)

4.3. By Working Mechanism (In Value %)

4.3.1. Active

4.3.2. Passive

4.4. By End-Use Industry (In Value %)

4.4.1. Aerospace and Defense

4.4.2. Healthcare

4.4.3. Automotive

4.4.4. Commercial Applications

4.4.5. Manufacturing

4.4.6. Oil & Gas

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. South America

5. Competitive Landscape and Market Share Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Murata Manufacturing Co. Ltd.

5.1.2. FLIR Systems, Inc.

5.1.3. Excelitas Technologies

5.1.4. Teledyne Imaging Inc.

5.1.5. Honeywell International Inc.

5.1.6. Omron Corporation

5.1.7. Raytheon Technologies

5.1.8. STMicroelectronics NV

5.1.9. Mitsubishi Electric Corporation

5.1.10. Nippon Ceramic Co. Ltd.

5.1.11. L3Harris Technologies

5.1.12. Melexis NV

5.1.13. Parallax Inc.

5.1.14. Zhengzhou Winsen Electronics

5.1.15. Texas Instruments Inc.

5.2. Cross Comparison Parameters

5.2.1. R&D Investments

5.2.2. Regional Presence

5.2.3. Technological Innovations

5.2.4. Market Penetration

5.2.5. Strategic Partnerships

5.2.6. Revenue Growth

5.2.7. Number of Patents Held

5.2.8. Product Portfolio Breadth

5.3. Market Share Analysis

5.4. Strategic Initiatives (M&A, Joint Ventures)

5.5. Investment and Funding Analysis

5.6. Government Grants and Policies

6. Regulatory Framework

6.1. Global Certification Standards

6.2. Safety and Environmental Regulations

6.3. Compliance and Trade Barriers

7. Future Market Size Projections (In USD Million)

7.1. Market Drivers for Future Growth

7.2. Factors Influencing Future Market Expansion

8. Future Market Segmentation

8.1. By Type

8.2. By Spectrum Range

8.3. By Working Mechanism

8.4. By End-Use Industry

8.5. By Region

9. Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation

9.3. Marketing Strategies

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map of the infrared sensor market, identifying key stakeholders like manufacturers, end users, and regulatory bodies. This step uses extensive desk research and databases to gather comprehensive market data.

Step 2: Market Analysis and Construction

This phase compiles historical data on market penetration, revenue generation, and technological adoption in the infrared sensor market. Service quality and reliability are analyzed to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts, providing operational and financial insights. These consultations refine the analysis.

Step 4: Research Synthesis and Final Output

The final phase involves consulting infrared sensor manufacturers to validate product segment data, consumer preferences, and technological trends. This ensures the data's accuracy and comprehensiveness.

Frequently Asked Questions

01. How big is the Global Infrared Sensors Market?

The global infrared sensors market is valued at USD 623.6 million, driven by rising adoption in industrial automation, defense, and healthcare applications.

02. What are the challenges in the Global Infrared Sensors Market?

Key challenges include high manufacturing costs for advanced quantum infrared sensors and stringent regulations concerning their use in defense and aerospace.

03. Who are the major players in the Global Infrared Sensors Market?

Major players include Murata Manufacturing, FLIR Systems, Honeywell International, and Teledyne Imaging, all of whom dominate through innovation and strategic partnerships.

04. What are the growth drivers of the Global Infrared Sensors Market?

Growth is driven by the rising use of sensors in IoT devices, smart home systems, and healthcare applications, as well as increasing defense expenditures globally.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.