Global Single Super Phosphate Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD9193

October 2024

87

About the Report

Global Single Super Phosphate Market Overview

- The Global Single Super Phosphate market is valued at USD 3.15 billion, driven by increased demand from agricultural sectors, especially in emerging markets. The use of single super phosphate (SSP) as a primary fertilizer in crops like cereals, oilseeds, and horticultural plants continues to gain traction due to its ability to improve phosphorus availability in soils. Additionally, the focus on improving crop yield efficiency in phosphate-deficient soils has spurred demand for SSP. These factors have been key drivers in the growth of the market.

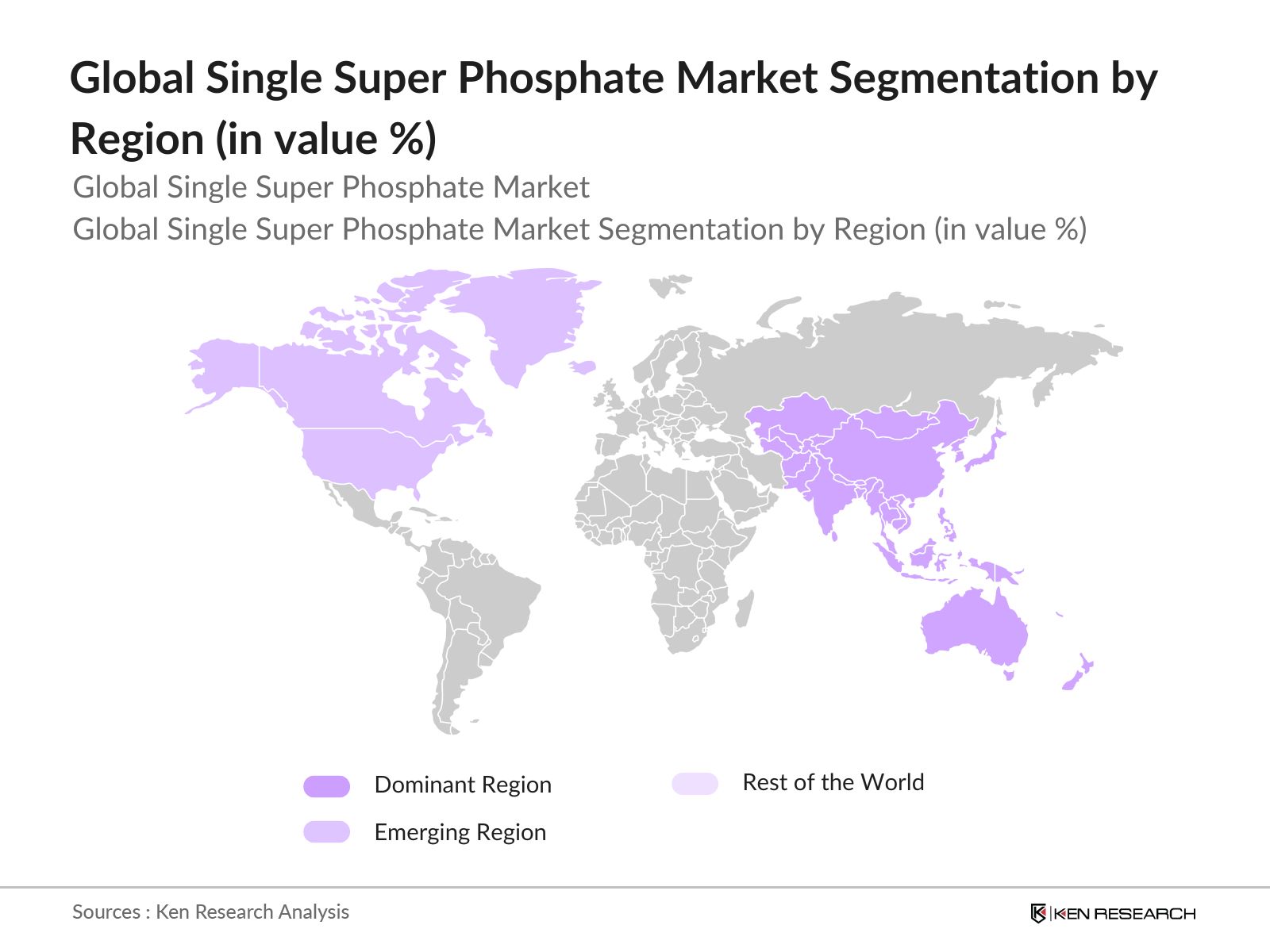

- Countries such as India, China, and Brazil dominate the market. India, in particular, stands out due to its large-scale agricultural production and the significant subsidies offered by the government on fertilizers. The availability of raw materials like rock phosphate and sulfur at competitive rates also positions these countries as dominant players. The supportive policies and vast agricultural landscapes in these regions drive their market dominance.

- Governments worldwide are promoting phosphorus management policies to ensure the efficient use of phosphorus in agriculture. In 2024, the EU introduced new guidelines under the Common Agricultural Policy, encouraging the recycling of phosphorus from agricultural waste. The aim is to reduce dependency on mined phosphate by 30% over the next decade. Similarly, China has initiated phosphorus recycling programs to recover phosphorus from animal waste, improving resource efficiency. These policies are expected to increase SSP demand as part of integrated phosphorus management strategies.

Global Single Super Phosphate MarketSegmentation

- By Product Type: The Global Single Super Phosphate market is segmented by product type into granular and powder SSP. Granular single super phosphate holds a dominant share in the product type segmentation, largely because of its ease of application in large-scale farming. It is preferred by farmers due to its even distribution across crops and its better nutrient absorption capability. Powder SSP is used in specific agricultural practices but is less popular due to handling issues during transportation and application.

- By Region: In terms of regions, Asia-Pacific leads the market due to its extensive agricultural practices and the heavy reliance on SSP as a fertilizer. The region benefits from favorable climatic conditions, high population growth leading to increased food demand, and strong government support for agricultural subsidies. North America and Europe follow, driven by their focus on improving crop yield and addressing soil nutrient deficiencies.

- By Application: The market is segmented by application into agriculture, horticulture, and other uses like aquaculture and pasture management. Agriculture holds the largest market share, especially for cereals and oilseeds, as SSP helps in increasing yield, particularly in phosphorus-deficient soils. The growing demand for high-quality crops has further pushed the adoption of SSP in agriculture, making it the dominant application segment.

Global Single Super Phosphate Market Competitive Landscape

The Global Single Super Phosphate market is dominated by several key players, each competing based on product quality, distribution networks, and regional presence. Many of these companies are vertically integrated, allowing them to control raw material sourcing and production processes, which is critical in reducing overall costs.

|

Company |

Year of Establishment |

Headquarters |

Market Penetration |

Production Capacity |

Product Range |

Revenue |

No. of Employees |

Export-Import Volume |

|

Mosaic Company |

2004 |

Plymouth, Minnesota |

||||||

|

Yara International |

1905 |

Oslo, Norway |

||||||

|

Coromandel International Limited |

1961 |

Hyderabad, India |

||||||

|

PhosAgro |

2001 |

Moscow, Russia |

||||||

|

OCP Group |

1920 |

Casablanca, Morocco |

Global Single Super Phosphate Industry Analysis

Growth Drivers

- Increased Agricultural Demand (Crop Productivity, Soil Phosphorus Deficiency): The rising demand for enhanced crop productivity, driven by the need to feed the growing global population, has significantly increased the use of Single Super Phosphate (SSP) in agriculture. In 2024, global agricultural land stands at 4.8 billion hectares, with nearly 40% of that showing signs of phosphorus deficiency, according to the FAO. SSPs contribution to alleviating soil phosphorus deficiency has become crucial, particularly in developing regions where food security is a concern. Soil deficiencies in sub-Saharan Africa, for instance, affect over 65 million hectares of land, making SSP a key input for improving agricultural yields.

- Government Subsidies (Agricultural Fertilizer Programs, Subsidy Policies): Government initiatives across several countries continue to bolster the SSP market. India, one of the largest consumers of SSP, allocates $3 billion annually toward fertilizer subsidies, supporting the use of phosphate-based fertilizers in its agricultural sector. As part of the Nutrient-Based Subsidy (NBS) program, SSP users receive direct financial assistance to maintain affordable fertilizer prices. Similarly, Brazils government channels over $1.5 billion in subsidies for the agriculture sector, promoting the use of phosphorus fertilizers like SSP to enhance crop output. These policies directly influence SSP demand, supporting market growth across various regions.

- Soil Fertility Requirements (Nutrient Content Improvement, Agronomic Efficiency): SSP plays a critical role in replenishing phosphorus levels in soils, which directly impacts crop yield. The global depletion of phosphorus from soils is accelerating, with approximately 12 million tons of phosphorus extracted annually for agricultural use. In Africa alone, the average phosphorus deficiency in soils is 5 kilograms per hectare, making phosphorus supplementation through SSP crucial for maintaining soil fertility. As a result, the agronomic efficiency of SSP remains a key growth driver in countries where agriculture is the primary livelihood.

Market Restraints

- High Cost of Raw Materials (Sulfur, Phosphate Rock): The increasing cost of raw materials such as sulfur and phosphate rock has presented significant challenges for SSP manufacturers. In 2024, the global price of sulfur reached $240 per ton, according to the IMF, while phosphate rock prices saw a 20% rise, costing approximately $100 per ton. This surge in raw material costs has pushed up production expenses for SSP manufacturers, reducing their profit margins and forcing them to either raise prices or absorb the costs. For smaller producers, this has created a considerable market barrier.

- Environmental Regulations (Phosphate Runoff Control, Emission Standards): Tightening environmental regulations across several countries have placed new pressures on the SSP market. The European Unions Water Framework Directive enforces strict controls on phosphate runoff, affecting fertilizer application practices in agriculture. Non-compliance penalties range from $50,000 to $250,000, making it critical for SSP manufacturers to invest in sustainable production processes. Meanwhile, the US Environmental Protection Agency (EPA) sets stringent standards for phosphorus emissions, pushing for the reduction of industrial discharge into water bodies, further increasing compliance costs for SSP manufacturers.

Global Single Super Phosphate Market Future Outlook

Over the next five years, the Global Single Super Phosphate market is expected to see steady growth driven by rising agricultural demand, expanding use of sustainable farming practices, and technological advancements in fertilizer production. The increasing global population and subsequent need for food security will further drive the demand for SSP, especially in regions like Asia-Pacific and Latin America, where agricultural output is vital to the economy.

Market Opportunities

- Growth in Organic Farming (Eco-friendly Fertilizers, Organic Certification): The growth of organic farming presents a lucrative opportunity for SSP producers, as demand for eco-friendly fertilizers grows. Global organic farmland reached 72 million hectares in 2024, with increasing adoption in Europe, North America, and Oceania. SSP, considered less harmful compared to chemical alternatives, can be marketed as a viable option for organic farmers. In India, the Organic Certification Program registered over 1.7 million organic producers, and the demand for environmentally sustainable fertilizers is expected to rise in parallel, offering a niche market for SSP growth.

- Emerging Markets (Expansion in Africa and Southeast Asia, New Distribution Networks): Emerging markets in Africa and Southeast Asia present a vast untapped opportunity for SSP expansion. In 2024, Africas agricultural sector grew by 4%, with countries like Nigeria, Kenya, and Tanzania focusing on modernizing their farming practices. In Southeast Asia, countries like Indonesia and Vietnam, with their increasing focus on food security, are rapidly adopting SSP to improve soil quality. The establishment of new distribution networks across these regions further accelerates market penetration, with investment in fertilizer supply chains becoming a priority for regional development.

Scope of the Report

|

Segments |

Subsegments |

|

By Product Type |

Granular Single Super Phosphate |

|

Powder Single Super Phosphate |

|

|

By Application |

Agriculture |

|

Horticulture |

|

|

Others (Aquaculture, Pasture Management) |

|

|

By Crop Type |

Cereals |

|

Oilseeds |

|

|

Fruits and Vegetables |

|

|

By Distribution Channel |

Retail Stores |

|

Wholesalers |

|

|

Online Platforms |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Middle East & Africa |

|

|

Latin Americ |

Products

Key Target Audience

Agricultural Cooperatives

Fertilizer Manufacturers

Raw Material Suppliers (Phosphate Rock, Sulfur)

Government Agencies (Ministry of Agriculture, Environmental Protection Agencies)

Large-Scale Farmers and Agribusinesses

Distributors and Retailers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Phosphate Fertilizer Regulation Authorities)

Companies

Players Mentioned in the Report:

Mosaic Company

Yara International

Coromandel International Limited

PhosAgro

OCP Group

Gujarat Narmada Valley Fertilizers & Chemicals

Haifa Group

ICL Group

Paradeep Phosphates

Fertilizantes Heringer

BASF SE

Gavilon Fertilizer LLC

Vale Fertilizantes

Nutrien Ltd.

EuroChem Group

Table of Contents

1. Global Single Super Phosphate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Fertilizer Consumption Rate, Crop Yield Performance, Application Rates)

1.4. Market Segmentation Overview

2. Global Single Super Phosphate Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Single Super Phosphate Market Analysis

3.1. Growth Drivers

3.1.1. Increased Agricultural Demand (Crop Productivity, Soil Phosphorus Deficiency)

3.1.2. Government Subsidies (Agricultural Fertilizer Programs, Subsidy Policies)

3.1.3. Soil Fertility Requirements (Nutrient Content Improvement, Agronomic Efficiency)

3.2. Market Challenges

3.2.1. High Cost of Raw Materials (Sulfur, Phosphate Rock)

3.2.2. Environmental Regulations (Phosphate Runoff Control, Emission Standards)

3.2.3. Alternatives to Single Super Phosphate (Compound Fertilizers, Organic Solutions)

3.3. Opportunities

3.3.1. Growth in Organic Farming (Eco-friendly Fertilizers, Organic Certification)

3.3.2. Emerging Markets (Expansion in Africa and Southeast Asia, New Distribution Networks)

3.3.3. Technology Advancements (Production Efficiency, Waste Reduction)

3.4. Trends

3.4.1. Increasing Use of Blended Fertilizers (Custom Fertilizer Blends, Precision Farming)

3.4.2. Expansion of Sustainable Agricultural Practices (Reduced Environmental Impact, Carbon Footprint Reduction)

3.4.3. Adoption of Slow-release Phosphate Technologies (Improved Nutrient Delivery, Extended Fertilizer Lifespan)

3.5. Government Regulation

3.5.1. Fertilizer Quality Standards (Global Certification, Import/Export Controls)

3.5.2. Environmental Compliance (Phosphate Wastewater Treatment, Emission Targets)

3.5.3. Phosphorus Management Policies (Efficient Use of Phosphorus in Agriculture, Recycling Initiatives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Producers, Distributors, Agricultural Agencies)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Single Super Phosphate Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Granular Single Super Phosphate

4.1.2. Powder Single Super Phosphate

4.2. By Application (In Value %)

4.2.1. Agriculture

4.2.2. Horticulture

4.2.3. Others (Aquaculture, Pasture Management)

4.3. By Crop Type (In Value %)

4.3.1. Cereals

4.3.2. Oilseeds

4.3.3. Fruits and Vegetables

4.4. By Distribution Channel (In Value %)

4.4.1. Retail Stores

4.4.2. Wholesalers

4.4.3. Online Platforms

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Single Super Phosphate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mosaic Company

5.1.2. Yara International

5.1.3. Coromandel International Limited

5.1.4. PhosAgro

5.1.5. Gujarat Narmada Valley Fertilizers & Chemicals

5.1.6. Haifa Group

5.1.7. ICL Group

5.1.8. Paradeep Phosphates

5.1.9. Fertilizantes Heringer

5.1.10. OCP Group

5.1.11. BASF SE

5.1.12. Gavilon Fertilizer LLC

5.1.13. Vale Fertilizantes

5.1.14. Nutrien Ltd.

5.1.15. EuroChem Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Penetration, Product Portfolio, Production Capacity, Export-Import Volume)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Partnerships, R&D Initiatives)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Venture Capital and Private Equity Investments

6. Global Single Super Phosphate Market Regulatory Framework

6.1. Fertilizer Licensing Standards

6.2. Certification Processes (Fertilizer Quality Certification)

6.3. Compliance Requirements (Environmental and Safety Regulations)

7. Global Single Super Phosphate Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Agricultural Expansion, Sustainable Fertilizers)

8. Global Single Super Phosphate Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Crop Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Single Super Phosphate Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating a comprehensive overview of the Global Single Super Phosphate Market. Extensive desk research is conducted, analyzing various data points such as production capacity, raw material prices, and market distribution.

Step 2: Market Analysis and Construction

This step focuses on gathering historical data related to production, consumption, and pricing trends in the SSP market. Market share analysis is conducted for each region, product type, and application, providing an in-depth understanding of market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry stakeholders such as SSP producers, agricultural experts, and government representatives. These interviews provide insights into market trends, challenges, and future expectations.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from multiple sources, including expert opinions, historical analysis, and projections for future growth. The output is a well-rounded report that offers actionable insights for stakeholders in the market.

Frequently Asked Questions

1 How big is the Global Single Super Phosphate Market?

The global single super phosphate market is valued at USD 3.15 billion, driven by agricultural demand and phosphorus soil deficiency remediation.

2 What are the challenges in the Global Single Super Phosphate Market?

Challenges include rising raw material costs (particularly sulfur and phosphate rock) and environmental regulations concerning phosphate runoff.

3 Who are the major players in the Global Single Super Phosphate Market?

Major players include Mosaic Company, Yara International, OCP Group, and Coromandel International, known for their extensive production capacities and distribution networks.

4 What are the growth drivers of the Global Single Super Phosphate Market?

The growth of the SSP market is driven by increased agricultural demand, government subsidies, and the need to improve soil fertility in phosphorus-deficient areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.