Global Smart TV Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11184

December 2024

87

About the Report

Global Smart TV Market Overview

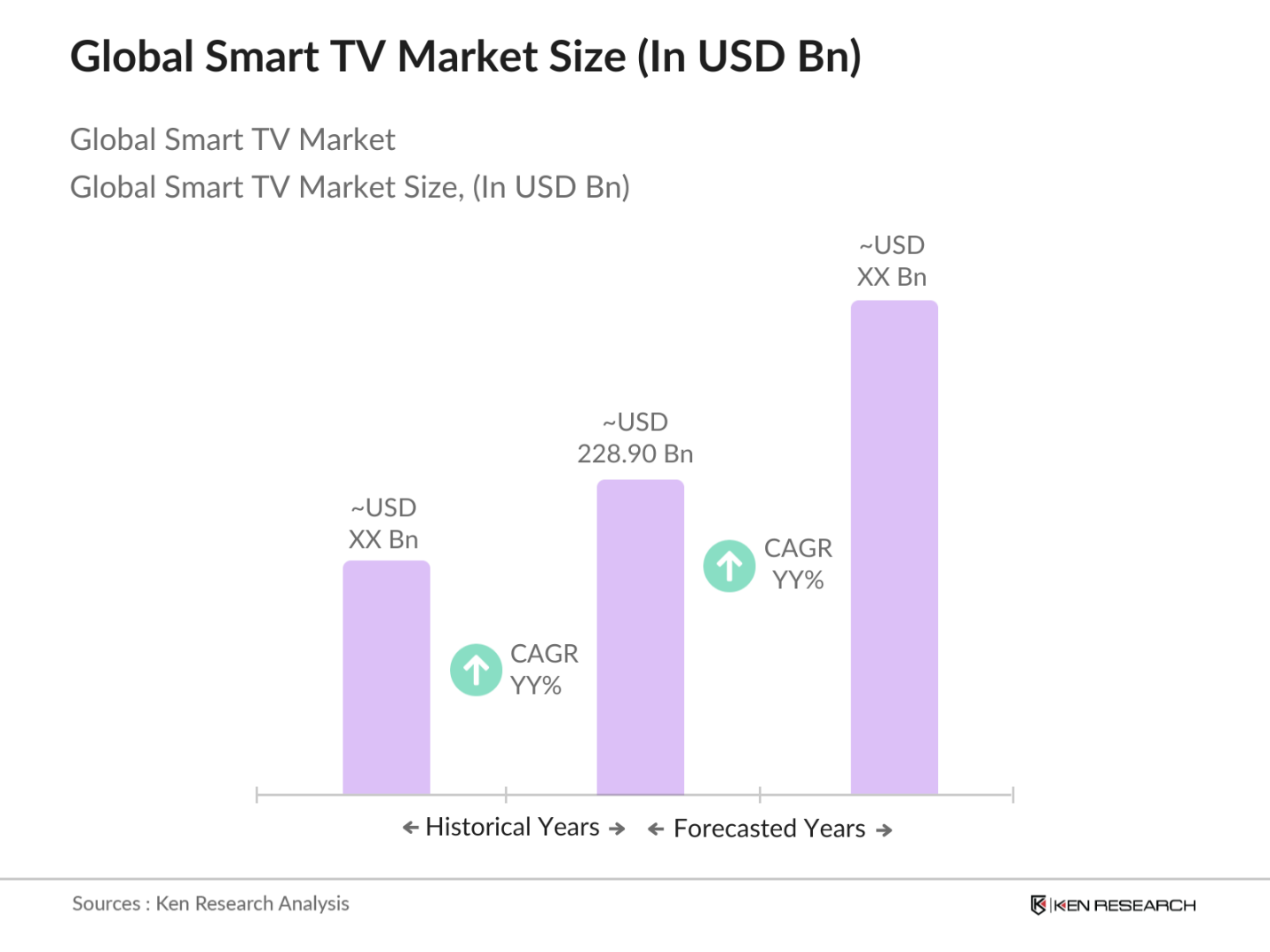

- The global smart TV market is currently valued at USD 228.90 billion, driven primarily by advancements in display technology, the integration of AI-powered features, and the rising popularity of streaming services. The increasing demand for high-resolution displays, including 4K and 8K UHD screens, alongside growing consumer preference for connected home ecosystems, continues to fuel the growth of this market. Companies like Samsung, LG, and Sony are leading innovation in the field, introducing smart features such as voice assistants and AI-driven content recommendations, which are significantly contributing to market expansion.

- Countries like the United States, China, and South Korea dominate the smart TV market due to their strong manufacturing bases, high internet penetration, and increasing demand for premium consumer electronics. The United States is a significant consumer market, driven by the high rate of content consumption through streaming platforms like Netflix, Amazon Prime, and Hulu. Meanwhile, South Korea and China are leading producers of smart TVs, home to some of the worlds largest electronics manufacturers such as Samsung, LG, and TCL. Their robust R&D capabilities and the availability of cutting-edge technology also solidify their dominance in the market.

- Governments globally are implementing stricter regulations for digital content, especially concerning content streaming on Smart TVs. For instance, Indias Ministry of Information and Broadcasting introduced guidelines in 2023 to regulate the content on OTT platforms that stream via Smart TVs, promoting cultural sensitivity and banning explicit content. Similarly, the European Union introduced the Audiovisual Media Services Directive (AVMSD) to ensure the regulation of online content, particularly focusing on data protection and advertising restrictions.

Global Smart TV Market Segmentation

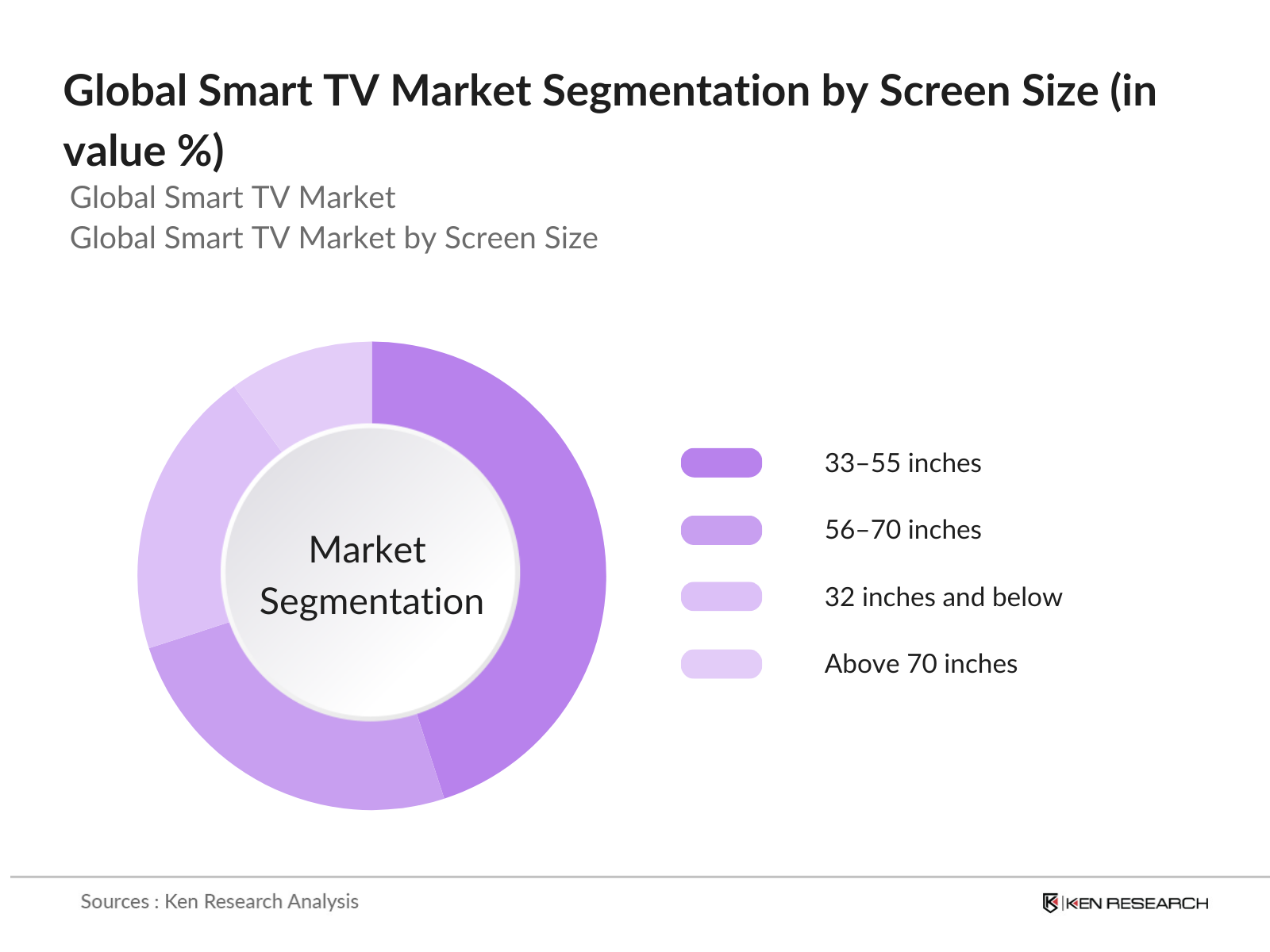

By Screen Size: The global smart TV market is segmented by screen size into 32 inches and below, 3355 inches, 5670 inches, and above 70 inches. Currently, the 3355 inch segment holds the dominant market share due to its widespread appeal, offering consumers an optimal balance between size and affordability. This segment has gained traction as it suits the typical living room setup and provides an enhanced viewing experience without requiring a premium investment. Major brands like Xiaomi and Hisense have strengthened this segment by offering competitively priced smart TVs, making them accessible to a broader audience and boosting their market presence.

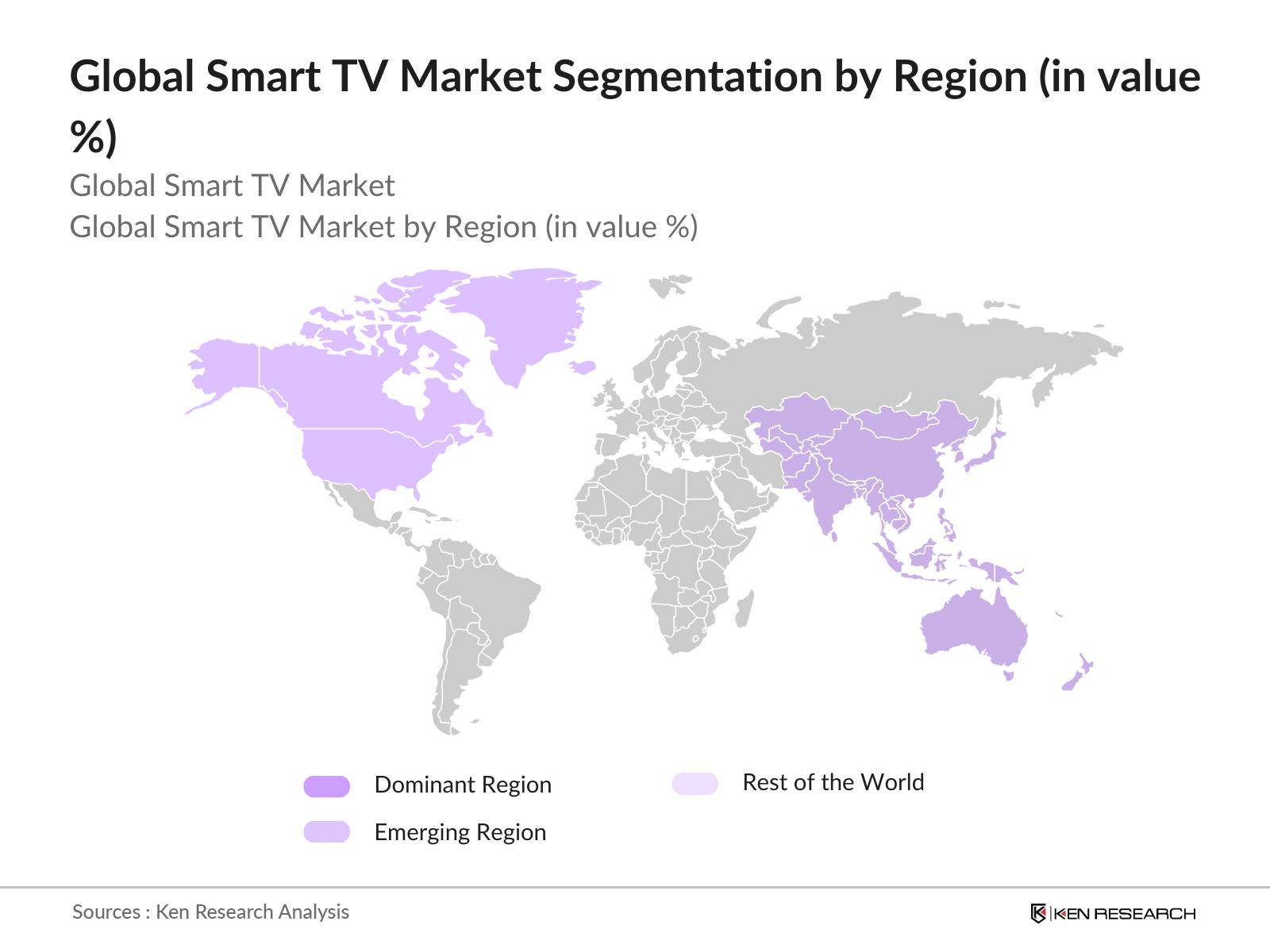

By Region: The global smart TV market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Recently, Asia-Pacific has held the dominant market share, driven by the presence of leading manufacturers such as Samsung, LG, and TCL. The region's expanding middle class and increasing disposable incomes, particularly in countries like China and India, have fueled significant adoption of smart TVs. Additionally, urbanization and the shift towards connected home technologies have further accelerated growth in this segment.

Global Smart TV Market Competitive Landscape

The global smart TV market is dominated by several major players, each leveraging cutting-edge technology and strategic partnerships to maintain their market positions. The market is characterized by intense competition, with leading companies focusing on product innovation, partnerships with content providers, and AI-integrated user interfaces to differentiate their products.

|

Company |

Year Established |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Line |

R&D Investments |

Global Reach |

AI Integration |

Strategic Partnerships |

|

Samsung Electronics |

1938 |

Suwon, South Korea |

- |

- |

- |

- |

- |

- |

- |

|

LG Electronics |

1958 |

Seoul, South Korea |

- |

- |

- |

- |

- |

- |

- |

|

Sony Corporation |

1946 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

- |

|

TCL Corporation |

1981 |

Huizhou, China |

- |

- |

- |

- |

- |

- |

- |

|

Hisense |

1969 |

Qingdao, China |

- |

- |

- |

- |

- |

- |

- |

Global Smart TV Market Analysis

Market Growth Drivers

- Rising Demand for Streaming Platforms: The increasing popularity of streaming services is significantly driving the Smart TV market. By 2024, over 1.2 billion households worldwide are expected to have access to high-speed internet, allowing seamless access to platforms like Netflix, Amazon Prime, and Disney+. The growth of these platforms is particularly noticeable in markets such as North America and Europe, where digital consumption rates are among the highest globally. In the Asia-Pacific region, streaming services have seen robust growth due to the rapid expansion of internet infrastructure, with over 600 million active users as of 2023.

- Technological Advancements in Display Technology: Technological innovations in display technology, particularly in OLED and QLED screens, have driven the demand for Smart TVs. In 2023, global shipments of OLED TVs reached 12 million units, largely driven by consumer demand for higher-quality visuals and immersive viewing experiences. These advancements include better energy efficiency and improved picture quality, making Smart TVs more attractive to tech-savvy consumers. Additionally, the introduction of micro-LED technology is expected to further push the market forward in the coming years, especially in developed markets like the US, Japan, and Germany.

- Smart Home Integration: The integration of Smart TVs into smart home ecosystems has emerged as a critical growth driver. In 2023, there were over 700 million connected smart home devices globally, and Smart TVs are often the hub of this ecosystem. Features such as voice control, home automation through platforms like Google Assistant and Amazon Alexa, and compatibility with IoT devices have led to increased consumer interest in Smart TVs. This trend is especially prevalent in North America, where a significant number of households have at least one smart home device.

Market Challenges:

- High Production Costs [Impact on Price Sensitivity]: The production costs of Smart TVs, especially for higher-end models with OLED and QLED screens, remain high. In 2023, the average production cost for a 55-inch OLED TV was approximately USD 500, a significant barrier to pricing competitiveness in developing markets. This cost structure directly impacts consumer pricing, particularly in regions like Africa and parts of Asia, where price sensitivity is high. The need for manufacturers to balance quality with affordability is a persistent challenge.

- Intense Competition [Market Fragmentation]: The global Smart TV market is highly fragmented, with numerous players competing for market share. In 2023, over 200 different Smart TV brands were available in the global market, making it difficult for individual players to dominate. While brands like Samsung and LG maintain strong positions, emerging players from China, such as Xiaomi and Hisense, have increased competition by offering similar products at lower price points. This intense competition makes it challenging for companies to sustain profit margins while delivering high-quality products.

Global Smart TV Market Future Outlook

Over the next five years, the global smart TV market is expected to experience substantial growth, fueled by advancements in display technology, integration with Internet of Things (IoT) devices, and growing demand for smart home ecosystems. The increasing availability of high-speed internet and streaming services across developing nations will further expand market adoption. As manufacturers continue to enhance the AI capabilities of smart TVs, integrating features such as voice assistance and personalized content recommendations, the smart TV market is poised for further innovation and user experience optimization.

Market Opportunities:

- AI Integration in Smart TVs [Voice Assistance, Predictive Algorithms]: The integration of artificial intelligence (AI) in Smart TVs has gained momentum, with features like voice assistants and predictive algorithms transforming the user experience. In 2023, a large number of Smart TVs shipped worldwide were equipped with AI-driven features such as Google Assistant, Alexa, or proprietary voice recognition systems. These technologies enable users to control other connected devices, search for content, and even optimize viewing recommendations based on past behavior, making Smart TVs an integral part of smart home ecosystems.

- 4K and 8K UHD Displays [Market Adoption Rate]: The demand for ultra-high-definition (UHD) displays, particularly 4K and 8K, continues to rise. In 2023, the shipment of 4K TVs increased significantly, with growing interest in 8K displays as they become more affordable. Markets like South Korea and Japan are leading the adoption of 8K displays due to technological advancements and consumer preferences for higher resolution. The rising availability of UHD content, driven by streaming platforms and gaming, further accelerates this trend, positioning UHD displays as a significant growth driver.

Scope of the Report

|

By Screen Size |

32 inches and Below 3355 inches 5670 inches Above 70 inches |

|

By Display Technology |

LED OLED QLED LCD |

|

By Resolution |

HD Full HD 4K 8K |

|

By Distribution Channel |

Online Offline (Retail Stores, Hypermarkets) |

|

By Region |

North America Europe Asia-Pacific Middle East and Africa Latin America |

Products

Key Target Audience

Smart TV Manufacturers

Content Streaming Platforms

Telecommunication Providers

Smart Home Integrators

Investments and Venture Capital Firms

Government and Regulatory Bodies (Federal Communications Commission, Department of Trade)

Consumer Electronics Retailers

Technology Solution Providers

Companies

Players Mention in the Report

Samsung Electronics

LG Electronics

Sony Corporation

TCL Corporation

Hisense

Vizio Inc.

Panasonic Corporation

Xiaomi

Sharp Corporation

Philips

Haier

Skyworth

Amazon Fire TV

Apple TV

Roku

Table of Contents

01. Global Smart TV Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Smart TV Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Smart TV Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Streaming Platforms

3.1.2. Technological Advancements in Display Technology

3.1.3. Increased Internet Penetration

3.1.4. Smart Home Integration

3.2. Market Challenges

3.2.1. High Production Costs [Impact on Price Sensitivity]

3.2.2. Intense Competition [Market Fragmentation]

3.2.3. Regional Disparity in Adoption Rates [Geographical Penetration]

3.3. Opportunities

3.3.1. Expansion of IoT Ecosystem [Connected Devices Integration]

3.3.2. Growth in Emerging Economies [Untapped Potential in APAC, LATAM]

3.3.3. Increasing Demand for Larger Screen Sizes [Consumer Preferences]

3.4. Trends

3.4.1. AI Integration in Smart TVs [Voice Assistance, Predictive Algorithms]

3.4.2. 4K and 8K UHD Displays [Market Adoption Rate]

3.4.3. Curved and OLED Displays [Premium Segment Growth]

3.5. Government Regulations

3.5.1. Digital Content Regulations [Content Streaming Rules]

3.5.2. Energy Efficiency Standards [Eco-Friendly Devices]

3.5.3. Import-Export Tariffs on Consumer Electronics [Global Trade Impact]

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global Smart TV Market Segmentation

4.1. By Screen Size (In Value %)

4.1.1. 32 inches and Below

4.1.2. 3355 inches

4.1.3. 5670 inches

4.1.4. Above 70 inches

4.2. By Display Technology (In Value %)

4.2.1. LED

4.2.2. OLED

4.2.3. QLED

4.2.4. LCD

4.3. By Resolution (In Value %)

4.3.1. HD

4.3.2. Full HD

4.3.3. 4K

4.3.4. 8K

4.4. By Distribution Channel (In Value %)

4.4.1. Online

4.4.2. Offline (Retail Stores, Hypermarkets)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

05. Global Smart TV Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Samsung Electronics

5.1.2. LG Electronics

5.1.3. Sony Corporation

5.1.4. Hisense

5.1.5. Panasonic Corporation

5.1.6. Vizio Inc.

5.1.7. TCL Corporation

5.1.8. Xiaomi

5.1.9. Sharp Corporation

5.1.10. Philips

5.1.11. Haier

5.1.12. Skyworth

5.1.13. Amazon Fire TV

5.1.14. Apple TV

5.1.15. Roku

5.2. Cross Comparison Parameters (Headquarters, Revenue, Employees, Product Line, Market Share, R&D Investment, Strategic Initiatives, Geographical Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Smart TV Market Regulatory Framework

6.1. Certification Standards

6.2. Compliance Requirements

6.3. Market Entry Barriers

07. Global Smart TV Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Smart TV Future Market Segmentation

8.1. By Screen Size (In Value %)

8.2. By Display Technology (In Value %)

8.3. By Resolution (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

09. Global Smart TV Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights

9.3. Product Differentiation Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved developing a comprehensive ecosystem map, including all major stakeholders in the global smart TV market. Through a combination of desk research and proprietary data sources, critical variables influencing market dynamics, such as display technology innovation, consumer preferences, and content partnerships, were identified.

Step 2: Market Analysis and Construction

In this phase, historical data was collected on smart TV market penetration, product adoption rates, and revenue generation. Special attention was given to market differentiation based on screen size, display technology, and regional segmentation. Market growth was evaluated using data from verified databases and cross-referenced with industry reports.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding consumer preferences, smart home integration, and content consumption were developed and validated through expert interviews. This process provided insights into product performance, demand forecasting, and future market trends directly from industry practitioners.

Step 4: Research Synthesis and Final Output

In the final phase, insights from key smart TV manufacturers were integrated with data from the bottom-up research approach to produce a validated and detailed analysis. This synthesis ensured accuracy in the estimation of market size, segmentation, and future outlook for the global smart TV market.

Frequently Asked Questions

01. How big is the global smart TV market?

The global smart TV market is valued at USD 228.90 billion, driven by the increasing demand for high-resolution displays and growing integration with smart home ecosystems.

02. What are the challenges in the global smart TV market?

Key challenges include high competition among leading manufacturers, high production costs for premium technologies like OLED, and the need for continuous innovation to meet consumer expectations for AI integration.

03. Who are the major players in the global smart TV market?

The major players include Samsung, LG, Sony, Hisense, and TCL, which dominate the market due to their strong R&D capabilities, extensive product lines, and strategic content partnerships.

04. What are the growth drivers for the global smart TV market?

The market is primarily driven by advancements in display technologies, the rise of streaming services, and the increasing adoption of smart home ecosystems. Additionally, AI-powered features such as voice assistants and personalized recommendations are driving consumer demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.