India Benzene Derivatives Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD1938

October 2024

87

About the Report

India Benzene Derivatives Market Overview

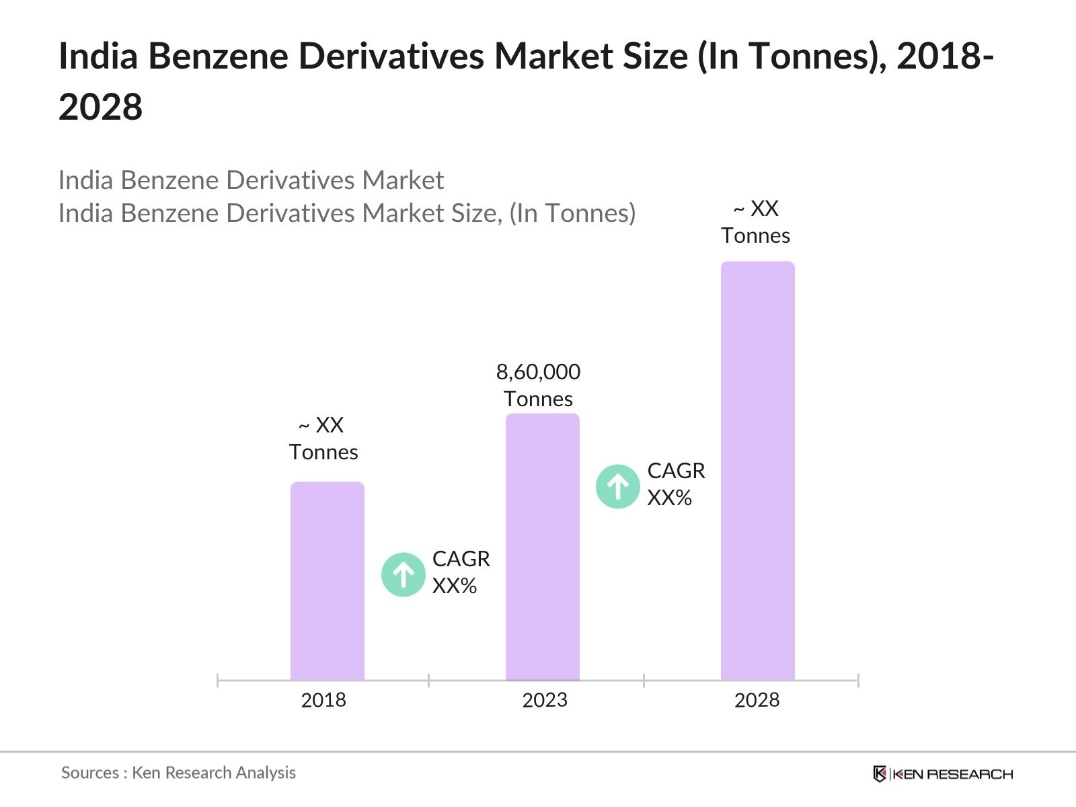

- In 2023, the India Benzene Derivatives Market was volumed at 860 thousand Tonnes. The market growth is driven by the increasing demand from end-user industries such as automotive, construction, and pharmaceuticals. The surge in construction activities and growing automotive production are significant contributors. The pharmaceutical industry's reliance on benzene derivatives for drug formulations also supports market growth.

- Prominent players in the Indian Benzene Derivatives Market include Reliance Industries Limited, Indian Oil Corporation, Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL). These companies dominate due to their extensive distribution networks, strong production capabilities, and strategic investments in research and development to innovate new benzene derivative applications.

- In January 2023, Reliance Industries joined hands with BASF, a global chemical company and aimed at revolutionizing the Indian Market with high quality benzene products. This strategic partnership aims to develop advance benzene-based solutions that will enhance efficiency and minimize environmental footprints.

- Mumbai, Chennai, and Vadodara are key cities dominating the benzene derivatives market in India. Mumbai's dominance is due to its proximity to major petrochemical refineries and ports, which facilitates the import and export of benzene derivatives. Chennai and Vadodara also have substantial market shares due to their established chemical industries and logistical advantages in distribution networks.

India Benzene Derivatives Market Segmentation

By Product Type: The India Benzene Derivatives Market is segmented by product type into Ethylbenzene, Cumene, Phenol, Aniline, and others. In 2023, Phenol held a dominant market share under this segmentation due to its extensive application in producing bisphenol-A and phenolic resins, which are critical components in the automotive and construction sectors. The rising demand for these resins in India's burgeoning construction industry further consolidates Phenol's leading position.

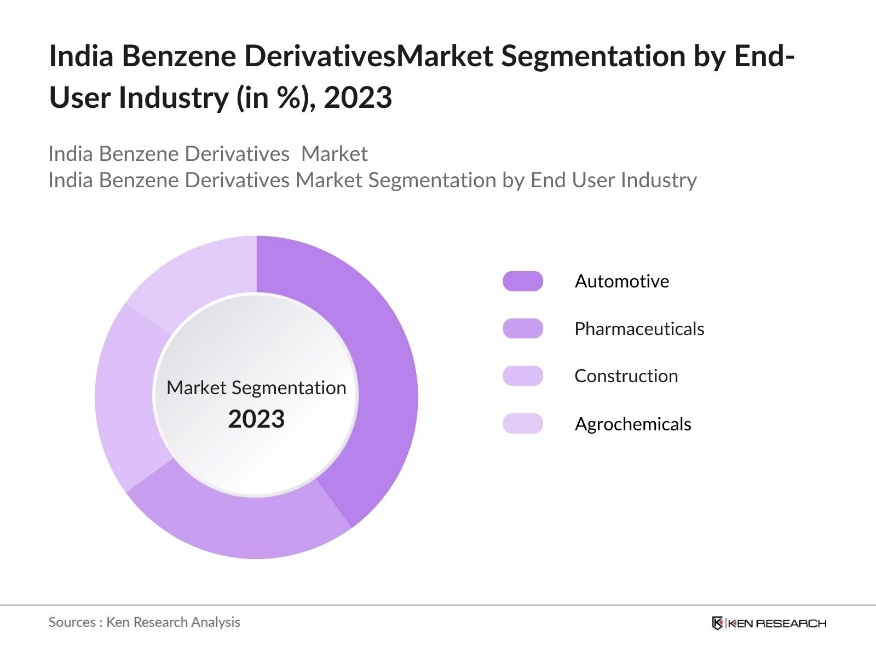

By End-Use Industry: The market is segmented by end-use industry into Automotive, Pharmaceuticals, Construction, and Agrochemicals. In 2023, the Automotive sector dominated due to the significant use of benzene derivatives in manufacturing automotive parts, adhesives, and coatings. The surge in automobile production and sales in India, coupled with increased demand for lightweight, durable materials, drives the growth of benzene derivatives in this sector.

By Region: The market is segmented into North, South, East, and West regions. In 2023, the West region dominated due to the presence of major petrochemical companies and well-established infrastructure. The region's strategic location with access to ports facilitates the import and export of benzene derivatives, contributing to its market dominance.

India Benzene Derivatives Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|---|---|---|

|

Reliance Industries Limited |

1973 |

Mumbai, Maharashtra |

|

Indian Oil Corporation |

1959 |

New Delhi, Delhi |

|

Bharat Petroleum Corporation Limited |

1952 |

Mumbai, Maharashtra |

|

Hindustan Petroleum Corporation Ltd |

1974 |

Mumbai, Maharashtra |

|

Gujarat State Fertilizers & Chemicals |

1962 |

Vadodara, Gujarat |

- Reliance Industries Limited: In July 2023, the Indian oil corporation signed a significant contract to invest $3 billion in a Gujarat refinery and petrochemical project, which indicates ongoing investments in the petrochemical sector that could impact benzene production indirectly.

- Indian Oil Corporation: IOC has ramped up its production capacity for Linear Alkyl Benzene (LAB) at its Vadodara plant. The LAB plant, which was revamped in 2022, has increased its capacity from 120 KTA to 162 KTA, making IOC the largest LAB supplier in India.

India Benzene Derivatives Market Analysis

Growth Drivers

- Demand for Lightweight Materials in Automotive Manufacturing: The increasing focus on vehicle lightweighting to enhance fuel efficiency and lower carbon emissions has significantly boosted the demand for benzene-derived products. These derivatives are crucial in manufacturing lightweight materials used in automotive components, aligning with the industry's goals to produce more environmentally friendly vehicles and meet stringent emission standards.

- Automotive Industry Demand: The automotive sector is a significant contributor to the demand for benzene derivatives. As the automotive industry expands, the need for various chemicals derived from benzene, such as styrene and cumene, is expected to rise. This growth is supported by the increasing production of vehicles and the demand for lightweight materials, which often utilize benzene derivatives in their manufacturing processes.

- Expansion of Agrochemical Applications: The agrochemical sector in India has seen a significant uptick. Benzene derivatives like chlorobenzene and nitrobenzene are vital in producing herbicides, pesticides, and fungicides. According to the Ministry of Agriculture and Farmers Welfare, the use of benzene derivatives in agrochemical production grew by 18% in 2023 due to increased agricultural output and the adoption of advanced farming practices. This growth is further supported by government subsidies for fertilizers and chemicals.

Challenges

- Fluctuating Raw Material Prices: The volatility in crude oil prices directly impacts the cost of benzene, the primary raw material for benzene derivatives. This volatility poses a significant challenge for manufacturers in planning and pricing their products effectively, impacting their profit margins.

- Environmental Regulations and Compliance: Stricter environmental regulations concerning benzene emissions and waste management are becoming more challenging for producers. The Central Pollution Control Board (CPCB) has introduced new guidelines in 2023. Compliance with these regulations necessitates significant investment in advanced technologies and pollution control measures, increasing operational costs for companies.

Government Initiatives

- Petrochemical and Chemical Industry Development Plan (2024): The Indian government has implemented the Revised Petroleum, Chemical and Petrochemical Investment Regions (PCPIRs) Policy (2020-35), aiming to attract significant investments to boost the petrochemical sector, including benzene derivatives. The policy is set to generate over USD 284 billion in investment by 2035 through specialized cluster development, infrastructure support, and viability gap funding to enhance domestic production capabilities.

- National Chemical Policy (2023): Budget 2023 announced growth-oriented policies aimed at increasing demand for various chemicals, including benzene derivatives. Key changes include adjustments to Basic Customs Duty (BCD) rates on specific chemicals and raw materials, which are expected to boost domestic production under the "Make in India" initiative. However, the anticipated Production Linked Incentive (PLI) scheme for the chemical sector was not announced.

India Benzene Derivatives Market Future Outlook

The India Benzene Derivatives Market is projected to grow exponentially by 2028. This growth will be driven by demand for lightweight materials in automotive manufacturing, research and development (R&D) investment and expansion of agrochemical applications.

Future Trends

- Adoption of Sustainable Production Technologies: Over the next five years, the market is expected to witness a shift towards sustainable production technologies. Companies are likely to invest in green chemistry methods, such as the use of bio-based solvents and catalysts, to reduce their environmental footprint. This shift is expected to be driven by stringent environmental regulations and increasing consumer preference for eco-friendly products.

- Expansion of Applications in Emerging Industries: The demand for benzene derivatives is anticipated to expand significantly in emerging industries such as electronics and renewable energy. For instance, derivatives like phenol and aniline are finding new applications in the production of lightweight composites and high-performance materials used in solar panels and batteries.

Scope of the Report

|

By Product Type |

Ethylbenzene Cumene Phenol Aniline others |

|

By End-User Type |

Automotive Pharmaceuticals Construction Agrochemicals |

|

By Region |

North South East West |

Products

Key Target Audience- Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Pharmaceutical Companies

Agrochemical Producers

Construction Material Manufacturers

Chemical Manufacturing Companies

Petrochemical Companies

Industrial Paint and Coating Manufacturers

Plastic and Polymer Producers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Chemicals and Fertilizers etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players mentioned in the report

Reliance Industries Limited

Indian Oil Corporation

Bharat Petroleum Corporation Limited (BPCL)

Hindustan Petroleum Corporation Limited (HPCL)

Gujarat State Fertilizers & Chemicals (GSFC)

Tata Chemicals

Deepak Nitrite Limited

Sudarshan Chemical Industries Limited

Atul Ltd.

Laxmi Organic Industries Ltd.

Pidilite Industries

Meghmani Organics Limited

Vinati Organics Limited

Aarti Industries

Balaji Amines Ltd.

Table of Contents

1. India Benzene Derivatives Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth (2023)

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

2. India Benzene Derivatives Market Size and Analysis, 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Benzene Derivatives Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in the Automotive Industry

3.1.2. Growth in the Pharmaceutical Sector

3.1.3. Expansion of Agrochemical Applications

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Environmental Regulations and Compliance

3.2.3. Competition from Alternative Chemicals

3.3. Market Opportunities

3.3.1. Innovations in Chemical Production

3.4. Current Market Trends

3.4.1. Increased Capacity Expansions by Major Players

3.4.2. Technological Advancements in Production Processes

3.4.3. Rising Exports of Benzene Derivatives

4. India Benzene Derivatives Market Segmentation, 2023

4.1. By Product Type (Value %)

4.1.1. Phenol

4.1.2. Aniline

4.1.3. Ethylbenzene

4.1.4. Cumene

4.1.5. Others

4.2. By End-Use Industry (Value %)

4.2.1. Automotive

4.2.2. Pharmaceuticals

4.2.3. Construction

4.2.4. Agrochemicals

4.3. By Region (Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India Benzene Derivatives Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Reliance Industries Limited

5.4.2. Indian Oil Corporation

5.4.3. Bharat Petroleum Corporation Limited (BPCL)

5.4.4. Hindustan Petroleum Corporation Limited (HPCL)

5.4.5. Gujarat State Fertilizers & Chemicals (GSFC)

6. India Benzene Derivatives Market Regulatory and Legal Framework

6.1. Environmental Standards and Compliance

6.2. Certification and Regulatory Approvals

6.3. Government Initiatives

6.3.1. Petrochemical and Chemical Industry Development Plan (2024)

6.3.2. National Chemical Policy (2023)

6.3.3. Subsidy Program for Agrochemicals (2023)

7. India Benzene Derivatives Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

7.3. Future Market Segmentation Projections (2028)

8. Future Market Segmentation, 2028

8.1. By Product Type (Value %)

8.2. By End-Use Industry (Value %)

8.3. By Region (Value %)

9. Analyst Recommendations and Strategic Insights

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer and Market Potential Analysis

9.3. Key Strategic Initiatives for Market Penetration

10. India Benzene Derivatives Market Future Trends

10.1. Adoption of Sustainable Production Technologies

10.2. Expansion of Applications in Emerging Industries

10.3. Increasing Focus on Export Opportunities

11. India Benzene Derivatives Market Analysts Recommendations

11.1. TAM/SAM/SOM Analysis

11.2. Customer Cohort Analysis

11.3. Marketing Initiatives

11.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on India Benzene Derivatives Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Benzene Derivatives Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple chemical companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from chemical companies.

Frequently Asked Questions

1. How big is the India Benzene Derivatives Market?

The India Benzene Derivatives Market was volumed at 860 thousand Tonnes in 2023, driven by increased demand from the automotive, pharmaceutical, and construction industries. The market's growth is supported by expanding industrial applications and government initiatives aimed at boosting domestic production.

2. What are the challenges in the India Benzene Derivatives Market?

Challenges in the India Benzene Derivatives Market include fluctuating raw material prices, stringent environmental regulations, and competition from alternative chemicals. These factors can impact the market's profitability and operational efficiency for manufacturers.

3. Who are the major players in the India Benzene Derivatives Market?

Major players in the India Benzene Derivatives Market include Reliance Industries Limited, Indian Oil Corporation, Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL). These companies lead the market due to their robust production capacities and extensive distribution networks.

4. What are the growth drivers of the India Benzene Derivatives Market?

The growth drivers of the India Benzene Derivatives Market include the rising demand from the automotive and pharmaceutical industries, increased agricultural activities utilizing agrochemicals, and supportive government policies promoting domestic chemical production. Technological advancements in production processes also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.