India Fashion Influencer Marketing Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD1909

October 2024

94

About the Report

India Fashion Influencer Marketing Market Overview

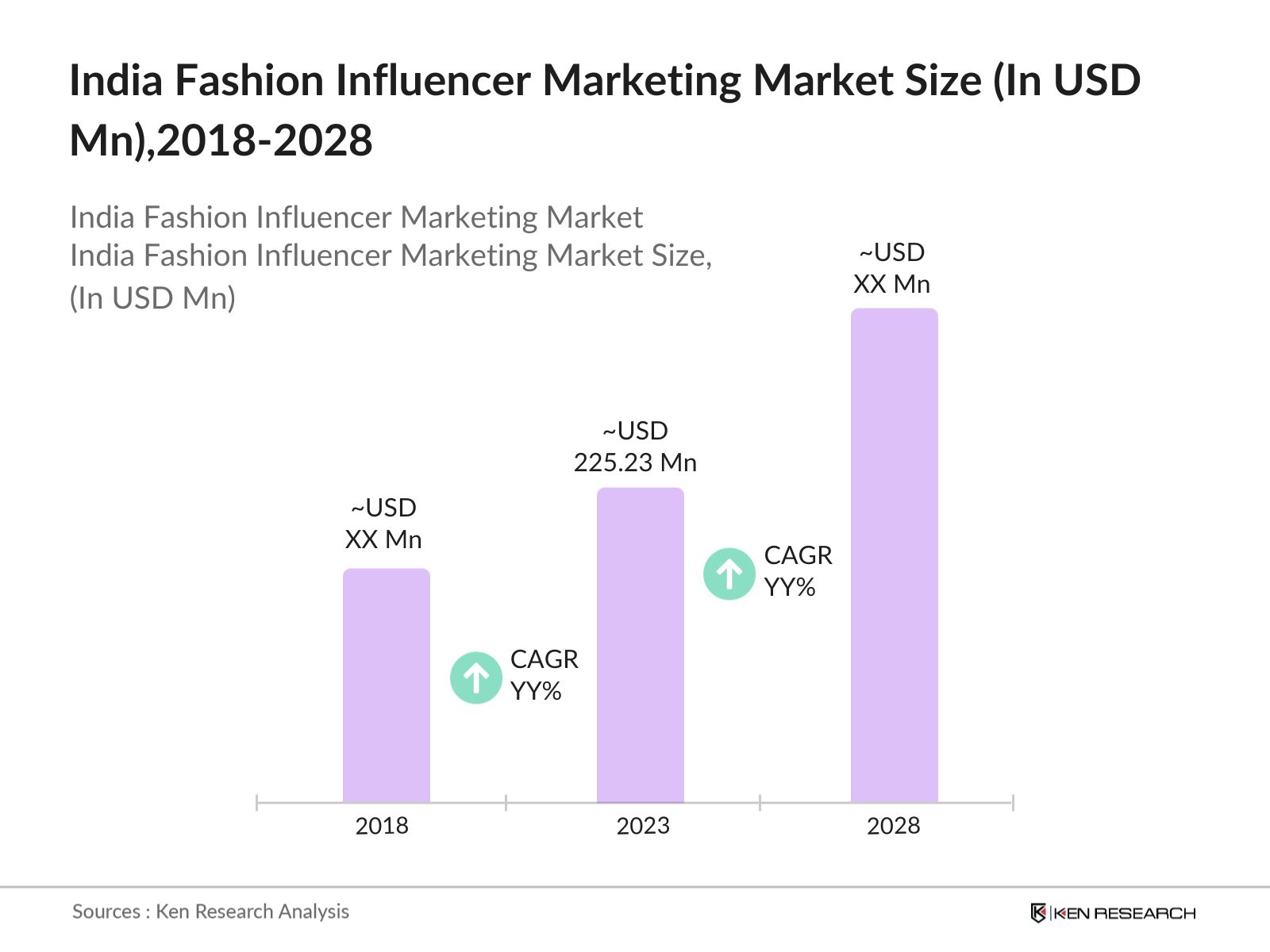

- The India Fashion Influencer Marketing Market was valued at USD 225.23 million in 2023. The growth is fueled by changing consumer behavior, the increasing adoption of e-commerce, and brands realizing the power of digital endorsements, particularly in fashion.

- Major players in the market are the Influencer Marketing Factory, Winkl, and Chtrbox. Influencers such as Komal Pandey and Masoom Minawala collaborate with brands like Myntra and Amazon, with a growing focus on micro-influencers to boost engagement.

- In 2024, Meta launched the Creator Lab in India, an educational platform aimed at empowering aspiring content creators. Featuring insights from 14 prominent creators, the initiative focuses on creative expression and community building. Content will be available in English and Hindi, with plans for additional Indian languages.

- In 2023, Mumbai emerged as the dominant city in the marketing space, due to its status as the fashion capital of India, housing major brands and a large pool of influencers, particularly in high-end fashion. The presence of agencies and events like Lakm Fashion Week further solidifies Mumbais influence in the fashion industry.

India Fashion Influencer Marketing Market Segmentation

The India Fashion Influencer marketing market is segmented into various factors like influencer, platform, and region.

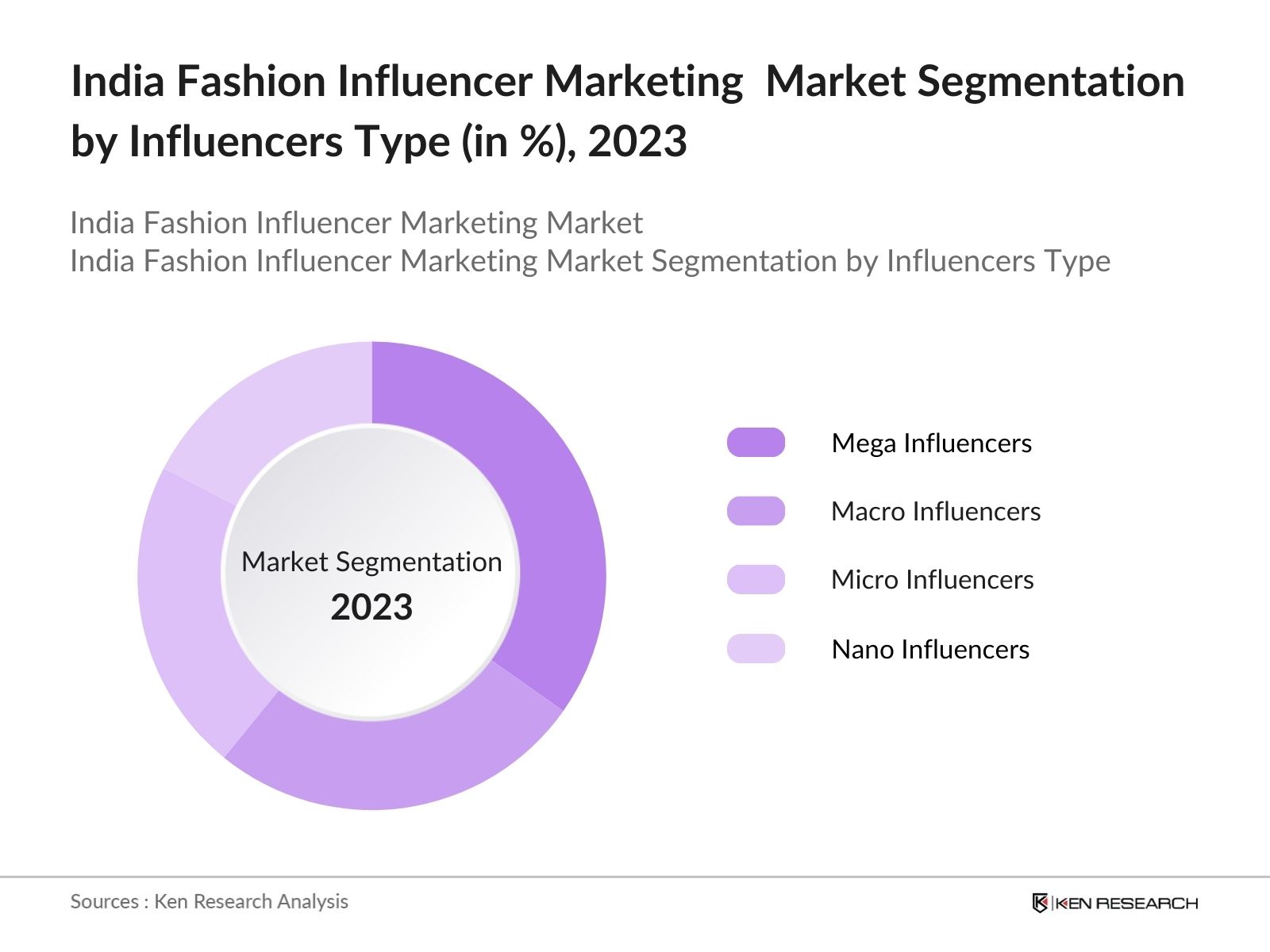

By Influencer: The market is segmented by influencers into mega, macro, micro, and nano influencers. In 2023, Mega Influencers, with over a million followers, dominate the influencer marketing space and have strong brand loyalty and higher visibility, which allows them to collaborate with luxury and international fashion brands. Their ability to reach a global audience ensures higher ROI for brands, despite the higher cost per post.

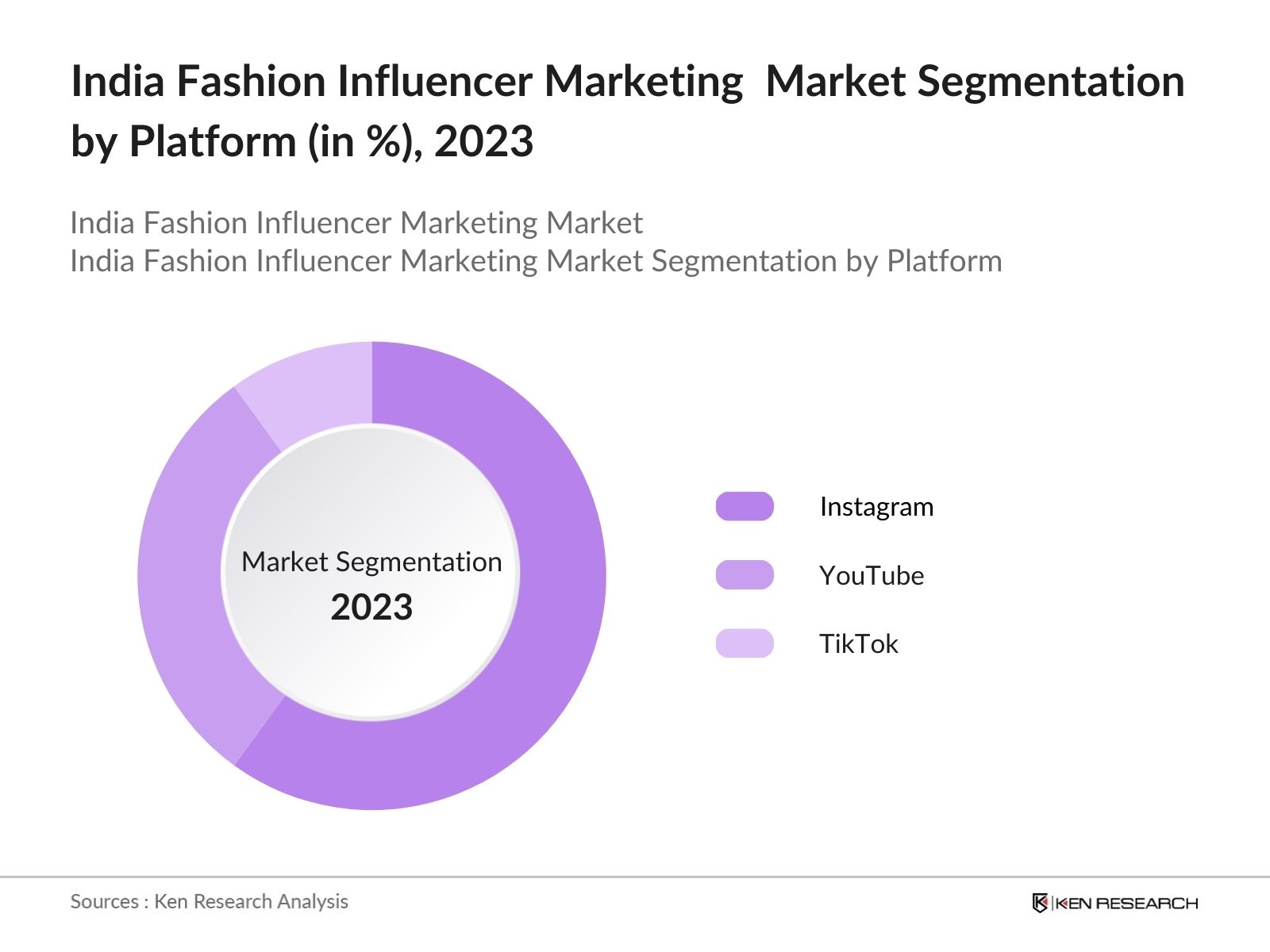

By Platform: The market is segmented by platform into Instagram, YouTube, and Other Platforms. In 2023, Instagram holds a dominant position in influencer marketing with visual focus aligns with fashion brands looking to showcase products through stories, reels, and posts. Features like in-app shopping and sponsored ads have made Instagram the go-to platform for both influencers and brands in India.

By Region: The market is segmented by region into North, East, West, and South. In 2023, North India, dominates the influencer marketing landscape by the presence of high-end fashion brands and a large consumer base interested in premium and luxury fashion, along with major internet penetration and purchasing power.

India Fashion Influencer Marketing Market Competitive Landscape

|

Company |

Established |

Headquarters |

|

The Influencer Marketing Factory |

2017 |

Mumbai |

|

Winkl |

2018 |

Bengaluru |

|

Chtrbox |

2016 |

Mumbai |

|

Plixxo |

2017 |

New Delhi |

|

Grynow |

2019 |

Gurugram |

- Good Glamm Group: In January 2022, Good Glamm Group acquired Winkl and Vidooly, consolidating them into Good Creator Co., creating India's largest influencer ecosystem. With 250,000 influencers reaching 70 million users monthly, the new entity is targeting a revenue run rate of 250 crore by December 2022.

- Chtrbox: Chtrbox, QYOU Media's India-based influencer marketing agency, has been named"Best Influencer Marketing Agency of the Year"and awarded for"Best Brand Engagement Campaign"at the Entrepreneur India 2023 Influencer Awards. The agency has executed over 1,500 campaigns in the last two years, achieving 94.4% positive responses for the #nofilter IndiGo x Nat Geo campaign, which overachieved expected views by 70% and reach by 150%.

India Fashion Influencer Marketing Market Analysis

Market Growth Drivers

- Increasing Social Media Penetration: India's digital landscape is rapidly evolving, with751.5 millioninternet users and a penetration rate of52.4%as of January 2024. Social media usage is significant, with462 millionusers, representing32.2%of the population. Additionally, mobile internet speeds surged to94.62 Mbps, reflecting a418%increase in the past year, driving further digital engagement and growth opportunities.

- E-commerce Integration: Fashion eCommerce is projected to reach $1 trillion in sales by end of 2024, up from $668 billion in 2021, with online sales comprising 20.8% of total retail. Mobile transactions account for 64% of fashion purchases, highlighting the shift towards mobile commerce. Personalization drives 50% of purchases, emphasizing the need for tailored shopping experiences.

- Rising Digital Advertising Spend: India's digital advertising spending in 2024 is rised, with influencer marketing receiving a substantial allocation. Fashion brands have increasingly shifted budgets from traditional advertising to influencer marketing, with estimates showing that fashion endorsements are becoming the fastest-growing sector within digital advertising.

Market Challenges

- Influencer Authenticity Issues: Fake followers and bots have become a growing concern, identified as fake by major social media platforms in 2023. Brands have started to demand transparency, and companies are investing in AI-driven tools to validate influencer authenticity, which presents a challenge for influencers with questionable metrics.

- Saturation of Content: With over 2 million fashion influencers across India, the saturation of content poses a challenge in standing out. Brands face increasing difficulties in identifying influencers whose audiences remain engaged in highly competitive spaces, leading to diminishing returns on traditional influencer campaigns.

Government Initiatives

- Digital India 2.0: In August 2023, the Indian government expanded the Digital India program with an investment of INR 14,903 crore. The initiative aims to boost India's digital economy by supporting 1,200 startups, adding 540 services to the UMANG app, and launching AI-driven language tools.

- ASCI Guidelines for Influencers: In 2023, the Advertising Standards Council of India (ASCI) revised guidelines mandating stricter regulations for influencer advertising, ensuring transparency and reducing misleading promotions. These guidelines directly impact fashion influencers, encouraging responsible content creation and accountability to consumers.

India Fashion Influencers Marketing Market Future Outlook

Key drivers of the India Fashion Influencer Marketing Industry include changing consumer behavior, the increasing adoption of e-commerce, and brands realizing the power of digital endorsements, particularly in fashion.

Future Market Trends

- Rise of AI-Driven Influencer Selection: By 2028, AI tools will play a dominant role in identifying the right influencers for brands. AI-driven platforms are expected to manage more than 70% of influencer selection, streamlining processes and reducing the time required to launch campaigns.

- Increased Focus on Micro-Influencers: The market will see a shift toward micro-influencers, with brands leveraging their highly engaged audiences. By 2028, over 50 million Indian micro-influencers will be involved in brand campaigns, particularly within the fashion industry, driving higher engagement for smaller, targeted campaigns.

Scope of the Report

|

By Influencer Type |

Mega Influencers Macro Influencers Micro Influencers Nano Influencers |

|

By Platform |

YouTube TikTok |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Fashion Brands Companies

Banks and Financial Institutions

Apparel Manufacturers

Celebrity Management Companies

Venture Capitalist

Fashion Industry Startups

Government Bodies (Digital Advertising Regulations)

Companies

Players Mentioned in the Report:

The Influencer Marketing Factory

Winkl

Chtrbox

Plixxo

Grynow

Social Beat

Sheeko

Influencer.in

ClanConnect.ai

BrandLoom

Mad Influence

One Impression

Buzzoka

INCA India

Collab House

Table of Contents

1. India Fashion Influencer Marketing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Fashion Influencer Marketing Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Fashion Influencer Marketing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Social Media Penetration

3.1.2. E-commerce Integration

3.1.3. Digital Advertising Spend

3.1.4. Mobile-first Content Consumption

3.2. Restraints

3.2.1. Influencer Authenticity Issues

3.2.2. Regulatory Framework

3.2.3. Content Saturation

3.2.4. Ad Blocking

3.3. Opportunities

3.3.1. Regional Content Creation

3.3.2. Growing Use of AI-driven Tools

3.3.3. Cross-Border Collaborations

3.3.4. Rise of Micro-Influencers

3.4. Trends

3.4.1. Integration with E-commerce Platforms

3.4.2. Live Shopping Events

3.4.3. Vernacular Content Surge

3.4.4. Rise of Short Video Content

3.5. Government Regulation

3.5.1. Digital India Initiative

3.5.2. ASCI Influencer Guidelines

3.5.3. Data Protection Laws

3.5.4. Startup India Initiative

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India Fashion Influencer Marketing Market Segmentation, 2023

4.1. By Influencer Type (in Value %)

4.1.1. Mega Influencers

4.1.2. Macro Influencers

4.1.3. Micro Influencers

4.1.4. Nano Influencers

4.2. By Platform (in Value %)

4.2.1. Instagram

4.2.2. YouTube

4.2.3. TikTok

4.3. By Region (in Value %)

4.3.1. North India

4.3.2. South India

4.3.3. East India

4.3.4. West India

5. India Fashion Influencer Marketing Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. The Influencer Marketing Factory

5.1.2. Winkl

5.1.3. Chtrbox

5.1.4. Plixxo

5.1.5. Grynow

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Fashion Influencer Marketing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Fashion Influencer Marketing Market Regulatory Framework

7.1. ASCI Guidelines for Influencers

7.2. Compliance Requirements

7.3. Certification Processes

8. India Fashion Influencer Marketing Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Fashion Influencer Marketing Future Market Segmentation, 2028

9.1. By Influencer Type (in Value %)

9.2. By Platform (in Value %)

9.3. By Region (in Value %)

10. India Fashion Influencer Marketing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step:1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India Fashion Infuencer Marketing Market Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output

Our team will approach multiple fashion industry companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such fashion industry companies.

Frequently Asked Questions

01 How big is the India Fashion Influencer Marketing Market?

The India Fashion Influencer Marketing Market was valued at USD 225.23 million in 2023. The growth is fueled by changing consumer behavior, the increasing adoption of e-commerce, and brands realizing the power of digital endorsements, particularly in fashion.

02 What are the challenges in the India Fashion Influencer Marketing Market?

Major challenges in the India Fashion Influencer Marketing Market include issues with influencer authenticity, content saturation, ad-blocking technologies, and new regulations requiring disclosure of paid collaborations.

03 Who are the major players in the India Fashion Influencer Marketing Market?

Major players in the India Fashion Influencer Marketing Market include Chtrbox, Winkl, The Influencer Marketing Factory, Plixxo, and Grynow, which manage relationships between brands and influencers.

04 What are the main growth drivers of the India Fashion Influencer Marketing Market?

Key drivers of the India Fashion Influencer Marketing Market include changing consumer behavior, the increasing adoption of e-commerce, and brands realizing the power of digital endorsements, particularly in fashion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.