India Phenolic Resins Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD509

December 2024

89

About the Report

India Phenolic Resins Market Overview

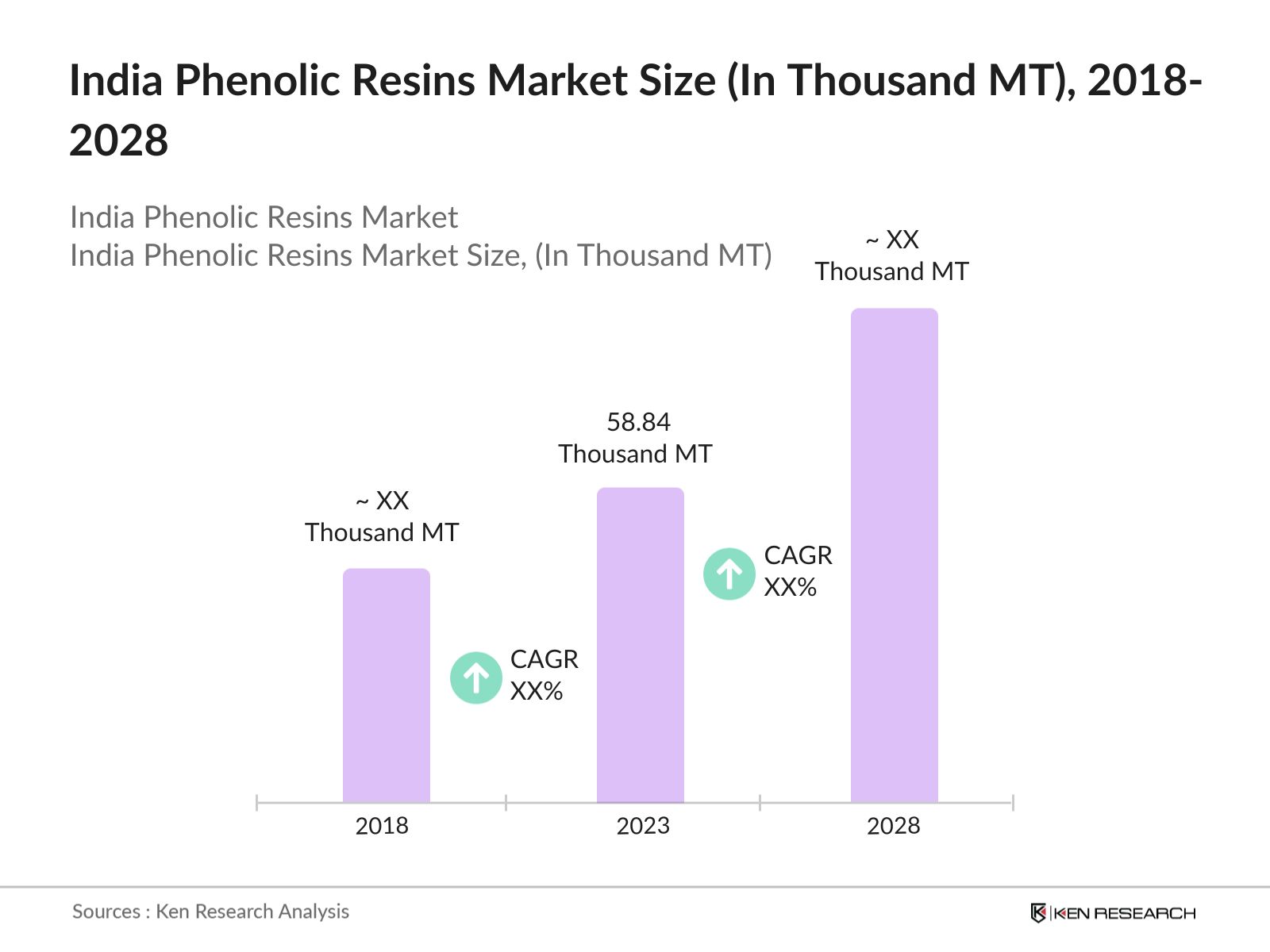

- In 2023, the India Phenolic Resins Market was volumed at 58.84 thousand metric tonnes, driven by the increasing demand from the construction and automotive industries. The market's expansion is largely due to the material's superior properties, including high mechanical strength and thermal stability, which make it indispensable in producing laminates, coatings, and adhesives.

- The key players dominating the market include Kanoria Chemicals & Industries, Bakelite Hylam Ltd., Atul Ltd., Aditya Birla Chemicals, and Sumitomo Bakelite Co., Ltd. These companies are pivotal in shaping the market landscape, offering a wide range of phenolic resin products to cater to various industries such as construction, automotive, and electronics.

- In May 2023, Atul Ltd. announced the expansion of its phenolic resins production capacity in Gujarat, increasing its output by 20,000 metric tons annually. This expansion aligns with the company's strategy to meet the rising demand in the domestic market and reduce reliance on imports. This move is expected to significantly boost local supply, ensuring stability in pricing and availability, which is critical for maintaining India's competitive edge in the global market.

- Cities like Mumbai, Pune, and Chennai dominate the market due to their strategic location as industrial hubs. Mumbai and Pune, in particular, host numerous automotive and construction companies that are major consumers of phenolic resins.

India Phenolic Resins Market Segmentation

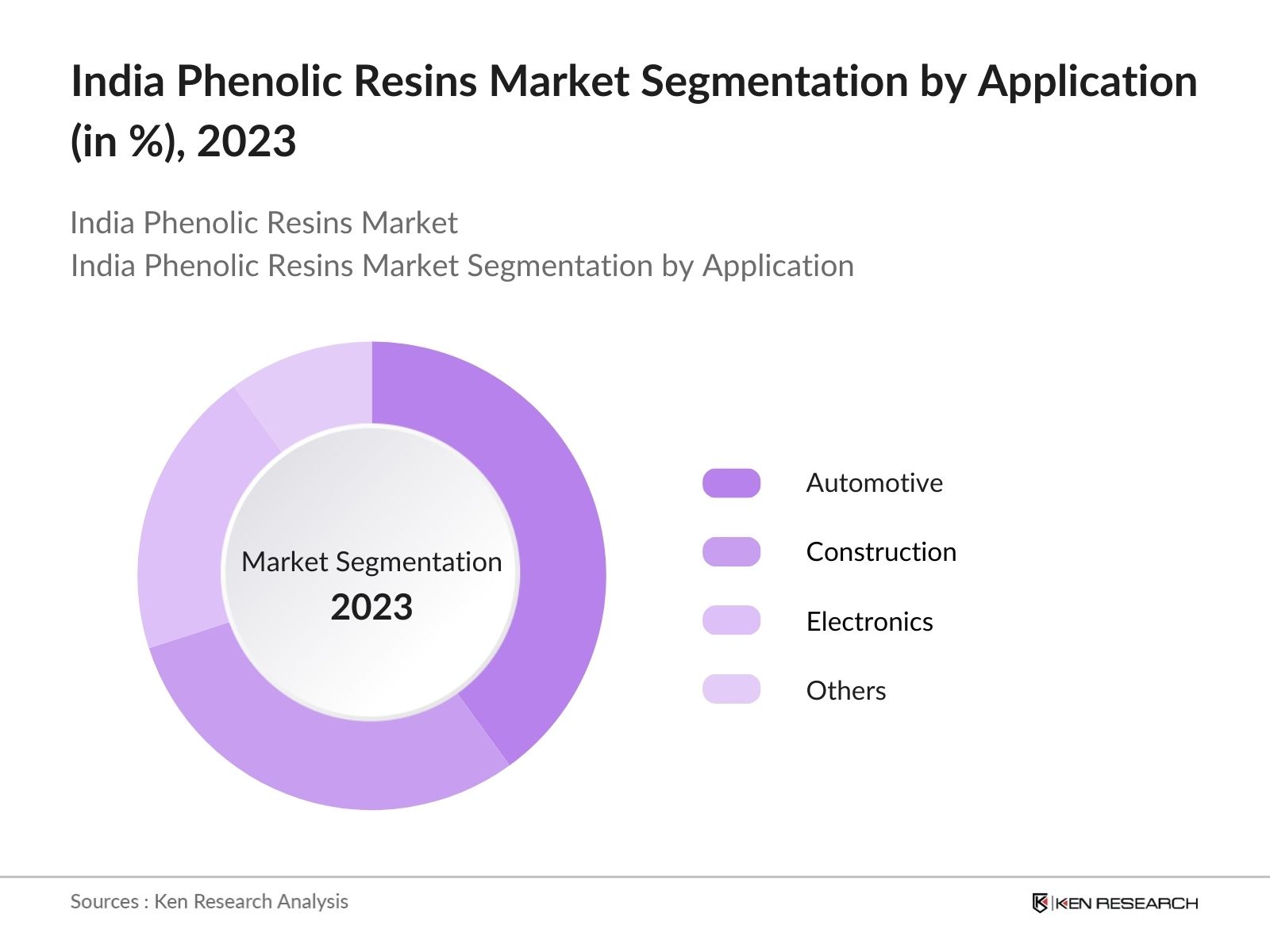

- By Application: The market is segmented by application into automotive, construction, electronics, and others. In 2023, the automotive segment held the dominant market share, driven by the widespread use of phenolic resins in manufacturing brake linings, clutch plates, and various under-the-hood components. The demand for high-performance materials that offer thermal stability and wear resistance is particularly strong in this segment.

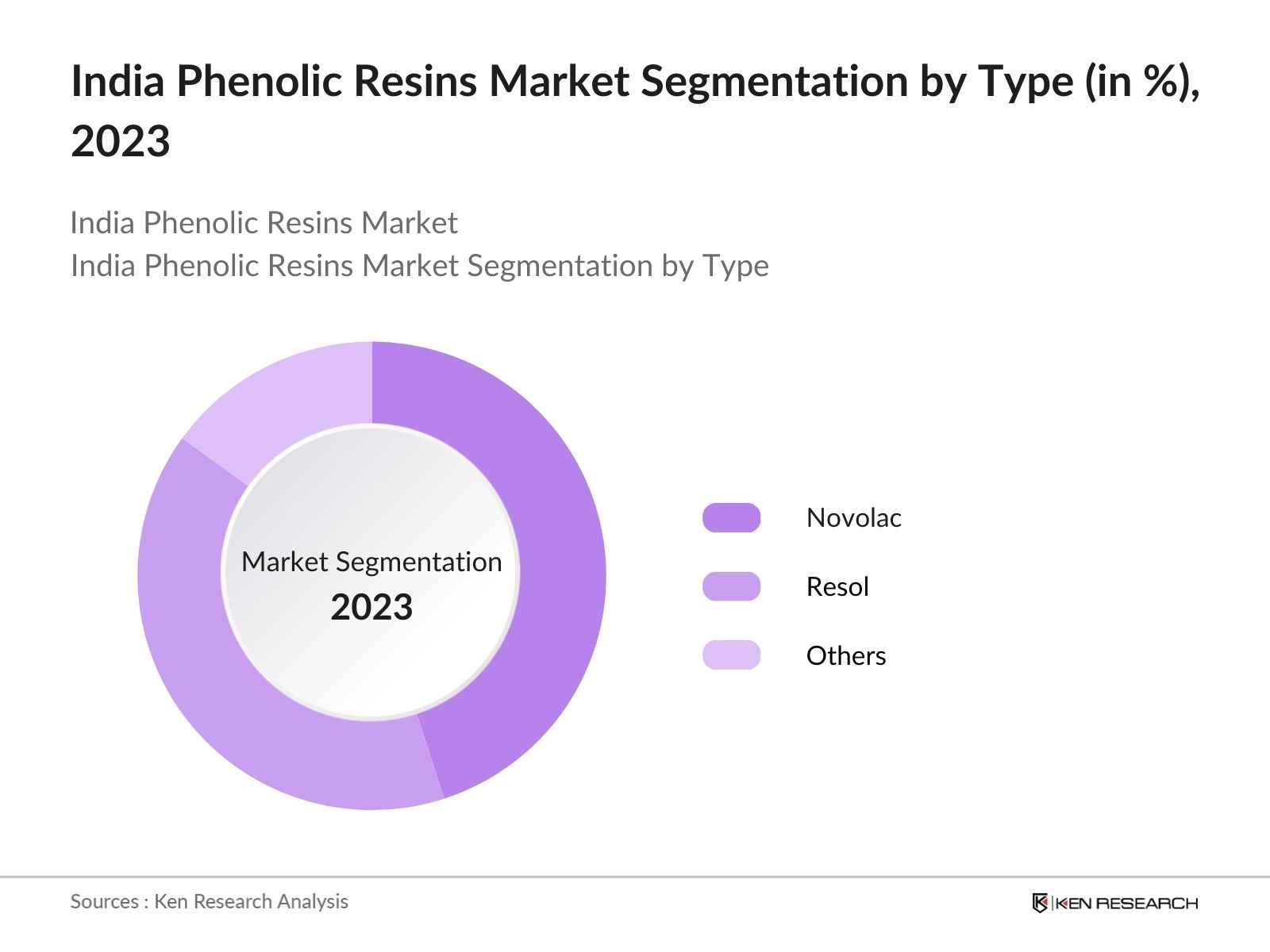

By Type: The market is segmented by type into novolac, resol, and others. In 2023, the novolac segment dominated the market attributed to its widespread use in the production of moulded products, laminates, and adhesives. Novolac resins are preferred for their superior mechanical properties and resistance to heat and chemicals, making them ideal for demanding applications across various industries.

- By Region: The market is segmented by region into North, South, East, and West. In 2023, the Western region, dominated the market, driven by the presence of a large number of manufacturing industries and favourable government policies. The regions strong industrial base, coupled with the availability of raw materials and a skilled workforce, makes it a hub for phenolic resin production and consumption.

India Phenolic Resins Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Kanoria Chemicals & Industries |

1960 |

Kolkata, India |

|

Bakelite Hylam Ltd. |

1947 |

Hyderabad, India |

|

Atul Ltd. |

1947 |

Valsad, India |

|

Aditya Birla Chemicals |

1996 |

Mumbai, India |

|

Sumitomo Bakelite Co., Ltd. |

1955 |

Tokyo, Japan |

- Kanoria Chemicals & Industries launched eco-friendly products: In June 2023, Kanoria Chemicals & Industries launched a new line of eco-friendly phenolic resins with reduced formaldehyde content, catering to the growing demand for sustainable materials in the construction sector. This product line is expected to generate additional revenue of INR 200 crores annually, reflecting the companys commitment to environmental sustainability.

- Investment by Atul Ltd.: In March 2024, Atul Ltd. invested INR 250 crores to expand its phenolic resins production capacity in Valsad, Gujarat. This expansion aims to meet the rising domestic demand and explore export opportunities in the Asia-Pacific region, positioning the company as a key player in the global market.

India Phenolic Resins Market Analysis

Growth Drivers

- Rising Demand from Automotive Sector: In 2024, the Indian automotive industry has seen a significant uptick, with over 4.3 million vehicles produced in the first half of the year. Phenolic resins are critical in manufacturing various automotive components, including brake pads, clutch plates, and under-the-hood parts. The governments push for electric vehicles, with an allocation of INR 1,000 crores under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, is expected to further boost this demand, as these resins are essential for battery insulation and other EV-specific components.

- Infrastructure Development Projects: India's infrastructure sector has been a key driver for the phenolic resins market, with the Union Budget 2024 allocating INR 10,000 crores specifically for urban infrastructure development. The ongoing construction of the Delhi-Mumbai Industrial Corridor (DMIC) alone is expected to generate a demand of 50,000 metric tons of phenolic resins by the end of 2024, supporting the market's robust growth in the construction sector.

- Expansion of Manufacturing Capacities: In 2024, major players in the Indian phenolic resins market are focusing on expanding their manufacturing capacities to meet rising domestic demand. For example, Aditya Birla Chemicals announced a new production facility in Gujarat, with an investment of INR 500 crores, expected to add 15,000 metric tons of phenolic resin production capacity annually. This expansion aligns with the growing demand from the automotive and construction sectors and is expected to be operational by Q4 2024.

Challenges

- Volatile Raw Material Prices: The phenolic resins market in India faces significant challenges due to the volatility in raw material prices, particularly for phenol and formaldehyde, which are petrochemical derivatives. In 2024, crude oil prices have fluctuated per barrel, directly impacting the cost of raw materials. The unpredictability in pricing creates challenges for manufacturers in maintaining profitability and passing on the cost to end-users.

- Environmental and Regulatory Pressures: The Indian governments increasing focus on environmental sustainability poses a challenge for the phenolic resins market. In 2024, the Ministry of Environment, Forest and Climate Change (MoEFCC) introduced stricter regulations on the emission of volatile organic compounds (VOCs) from chemical manufacturing plants. Phenolic resins production, which involves the use of formaldehyde, a known VOC, is directly affected.

Government Initiatives

- Make in India 2.0 Initiative: In 2024, the Government of India launched the "Make in India 2.0" initiative, focusing on boosting domestic manufacturing, including chemicals and resins. This initiative includes financial incentives worth INR 5,000 crores aimed at reducing dependency on imports and enhancing local production capacities. Phenolic resin manufacturers have benefited from this initiative, increasing domestic production capacity by 10,000 metric tons.

- Production Linked Incentive (PLI) Scheme for Electronics: The Production Linked Incentive (PLI) scheme, introduced in 2024, has earmarked INR 8,282 crores for the electronics sector, which is a significant consumer of phenolic resins. The scheme is designed to boost domestic manufacturing of electronic components, thereby increasing the demand for phenolic resins used in circuit boards and insulation materials.

India Phenolic Resin Market Future Outlook

The India Phenolic Resin Market is expected to grow exponentially by 2028, driven by increasing demand from the construction, automotive, and electronics sectors. Rising infrastructure projects, advancements in resin technology, and the expanding manufacturing industry are key growth factors. Environmental concerns and regulatory pressures are also pushing for more sustainable resin solutions, which could shape future market dynamics and innovations.

Future Trends

- Integration of Phenolic Resins in Electric Vehicles (EVs): The future of the India phenolic resins market is expected to be closely tied to the growth of the electric vehicle (EV) sector. With the government targeting a production of 10 million EVs by 2028, phenolic resins are set to play a crucial role in battery insulation and other key components.

- Growth in Infrastructure Projects: India's infrastructure development is expected to continue as a major driver for the phenolic resins market. By 2028, with an expected cumulative investment of INR 50,000 crores in projects like Smart Cities and industrial corridors, the demand for phenolic resins is anticipated to double.

Scope of the Report

|

By Application |

Automotive Construction Electronics Others |

|

By Type |

Novolac Resol Others |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive manufacturers

Construction companies

Electronics manufacturers

Phenolic resin producers

Industrial equipment manufacturers

Adhesive and coatings manufacturers

Investors and venture capitalist firms

Government and regulatory bodies (e.g., Ministry of Chemicals and Fertilizers, India)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Kanoria Chemicals & Industries

Bakelite Hylam Ltd.

Atul Ltd.

Aditya Birla Chemicals

Sumitomo Bakelite Co., Ltd.

Momentive Performance Materials Inc.

Hexcel Corporation

SI Group, Inc.

Kolon Industries, Inc.

Mitsui Chemicals, Inc.

BASF SE

LG Chem

Hitachi Chemical Co., Ltd.

Arclin, Inc.

Allnex Group

Table of Contents

1. India Phenolic Resins Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview

2. India Phenolic Resins Market Size (in INR Crores), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Phenolic Resins Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand from Automotive Sector

3.1.2. Infrastructure Development Projects

3.1.3. Growth in Electrical and Electronics Sector

3.2. Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. Environmental and Regulatory Pressures

3.2.3. Competition from Alternative Materials

3.3. Opportunities

3.3.1. Expansion of Domestic Manufacturing Capacities

3.3.2. Development of Eco-Friendly Resins

3.3.3. Increase in Research & Development Initiatives

3.4. Trends

3.4.1. Expansion of Manufacturing Capacities

3.4.2. Adoption of Eco-Friendly Resins

3.4.3. Increased Focus on R&D and Innovation

3.5. Government Initiatives

3.5.1. Make in India 2.0 Initiative

3.5.2. Production Linked Incentive (PLI) Scheme for Electronics

3.5.3. National Electric Mobility Mission Plan (NEMMP)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. India Phenolic Resins Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Automotive

4.1.2. Construction

4.1.3. Electronics

4.1.4. Others

4.2. By Type (in Value %)

4.2.1. Novolac

4.2.2. Resol

4.2.3. Others

4.4. By End-User Industry (in Value %)

4.4.1. Industrial Manufacturing

4.4.2. Healthcare

4.4.3. Aerospace & Defense

4.4.4. Consumer Goods

4.4.5. Others

4.5. By Distribution Channel (in Value %)

4.5.1. Direct Sales

4.5.2. Distributors

4.5.3. Online Retail

4.5.4. Others

4.3. By Region (in Value %)

4.3.1. West India

4.3.2. North India

4.3.3. South India

4.3.4. East India

5. India Phenolic Resins Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Kanoria Chemicals & Industries

5.1.2. Bakelite Hylam Ltd.

5.1.3. Atul Ltd.

5.1.4. Aditya Birla Chemicals

5.1.5. Sumitomo Bakelite Co., Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Phenolic Resins Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Phenolic Resins Market Regulatory Framework

7.1. Environmental and Chemical Safety Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. India Phenolic Resins Market Future Size (in INR Crores), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Phenolic Resins Market Future Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Type (in Value %)

9.3. By Region (in Value %)

10. India Phenolic Resins Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsFrequently Asked Questions

01. How big is the India Phenolic Resins Market?

The India Phenolic Resins Market was volumed at 58.84 thousand metric tonnes, driven by strong demand from the automotive, construction, and electronics sectors. The markets growth is supported by the materials superior mechanical properties and the increasing infrastructure development across the country.

02. What are the challenges in the India Phenolic Resins Market?

Challenges in the India Phenolic Resins Market include volatile raw material prices, particularly for phenol and formaldehyde, stringent environmental and regulatory pressures due to the emission of volatile organic compounds (VOCs), and increasing competition from alternative materials like epoxy and polyurethane resins.

03. Who are the major players in the India Phenolic Resins Market?

Key players in the India Phenolic Resins Market include Kanoria Chemicals & Industries, Bakelite Hylam Ltd., Atul Ltd., Aditya Birla Chemicals, and Sumitomo Bakelite Co., Ltd. These companies lead the market through their extensive product offerings and continuous innovation in resin formulations.

04. What are the growth drivers of the India Phenolic Resins Market?

The market is driven by rising demand from the automotive sector, substantial investments in infrastructure development projects, and the growth of the electrical and electronics industry. Government initiatives like the Production Linked Incentive (PLI) scheme for electronics manufacturing also contribute to the market's expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.