Indonesia Base Metal Mining Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD10981

December 2024

90

About the Report

Indonesia Base Metal Mining Market Overview

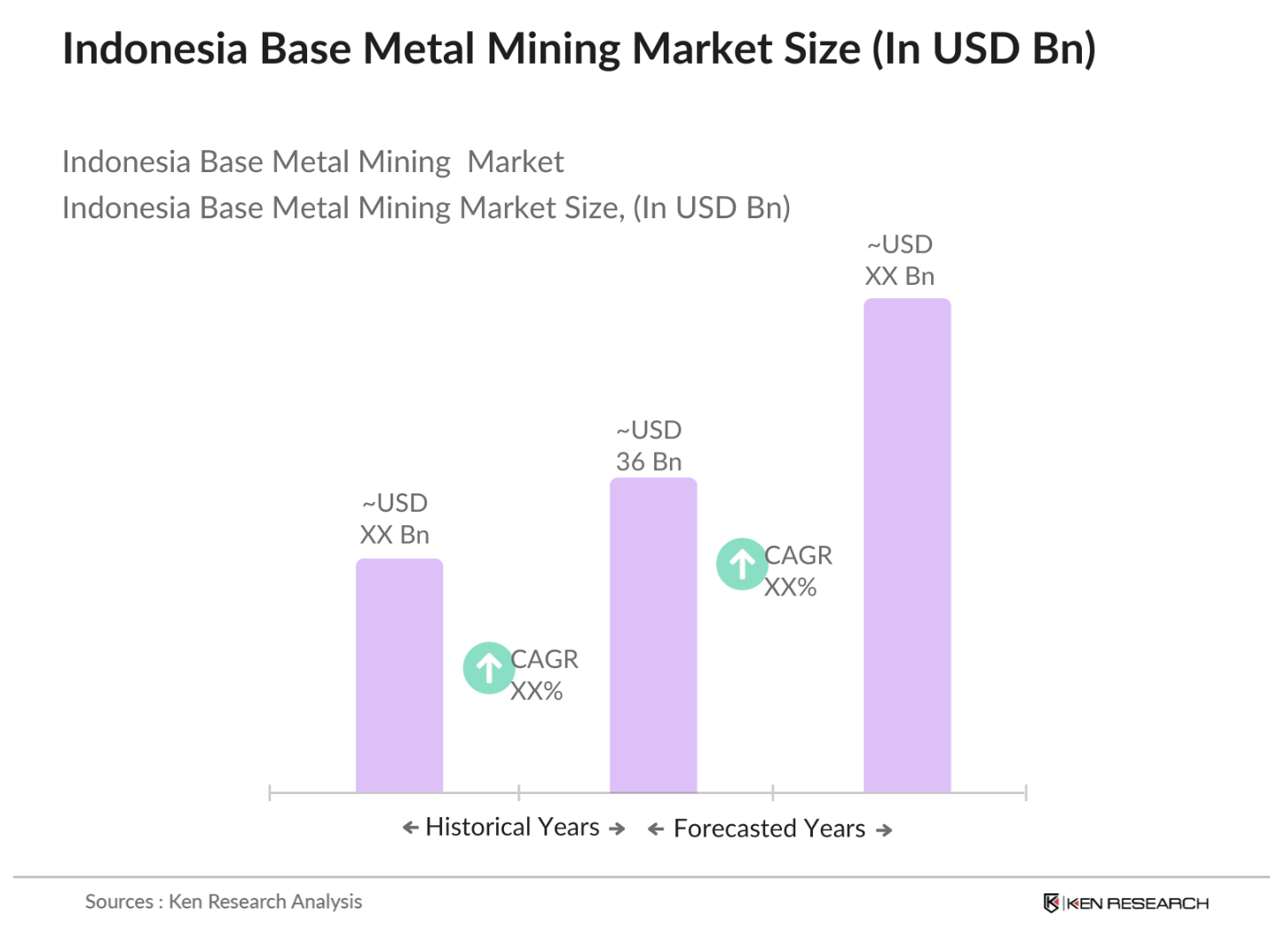

- The Indonesia Base Metal Mining market is valued at USD 36 billion, based on a comprehensive five-year historical analysis. This market is driven by Indonesia's strategic positioning as a major player in the global base metal supply chain, with nickel, copper, and tin serving as core components of industrial and technological applications. Major drivers include robust demand from the electronics, construction, and automotive sectors, as well as investments into sustainable mining practices supported by government initiatives aimed at bolstering national production capacities.

- In Indonesia, regions such as Sumatra and Kalimantan dominate the base metal mining market due to their rich mineral reserves and advanced mining infrastructure. Additionally, companies operating in these areas benefit from strategic logistics and established smelting facilities, giving them a competitive advantage. These regions attract international and local players alike, creating a mining hub that supports production for both domestic use and exports.

- The integration of digital technologies in mining operations is becoming increasingly prevalent. Companies are implementing data analytics, Internet of Things (IoT) devices, and automation to monitor equipment performance, optimize resource extraction, and improve safety. For example, the use of IoT sensors in mining equipment has led to a 15% reduction in downtime and a 10% increase in productivity in certain operations.

Indonesia Base Metal Mining Market Segmentation

By Metal Type: The Indonesia Base Metal Mining market is segmented by metal type into nickel, copper, tin, aluminum, and lead. Nickel currently holds the dominant market share within this segmentation due to Indonesia's status as one of the largest global nickel producers. Nickel's extensive applications in stainless steel and battery production for electric vehicles further drive its market prominence, especially given the rising demand in renewable energy storage solutions.

By Mining Technique: The Indonesia Base Metal Mining market is segmented by mining technique into open-pit mining and underground mining. Open-pit mining leads the market share within this segment due to its cost-effectiveness, scalability, and suitability for Indonesia's geography. The method allows companies to operate large-scale extractions with relatively lower upfront investment, making it a preferred choice among major mining firms.

Indonesia Base Metal Mining Market Competitive Landscape

The Indonesia Base Metal Mining market is dominated by a few key players, including both established local firms and multinational corporations. This consolidation reflects the substantial market control and influence held by these companies, driven by factors such as high production capabilities, extensive reserves, and strong relationships with regulatory bodies. The table below details key competitors within the market:

Indonesia Base Metal Mining Industry Analysis

Growth Drivers

- Domestic Demand for Infrastructure Projects: Indonesia's ambitious infrastructure development plans have significantly increased the demand for base metals. The government's National Medium-Term Development Plan (RPJMN) for 2020-2024 allocates approximately IDR 6,445 trillion (USD 450 billion) for infrastructure projects, including the construction of 2,500 kilometers of new roads and 3,258 kilometers of railway lines. These projects require substantial quantities of base metals such as steel, aluminum, and copper, thereby driving growth in the mining sector.

- Increased Investment in Mining Sector: Foreign direct investment (FDI) in Indonesia's mining and quarrying sector has shown a notable increase. In 2023, FDI reached USD 4.3 billion, up from USD 3.5 billion in 2022, indicating growing investor confidence in the sector. This influx of capital has facilitated the expansion of mining operations and the adoption of advanced technologies, enhancing production capacities and efficiency.

- Expansion of Industrial and Construction Sectors: The industrial and construction sectors in Indonesia have been expanding steadily. In 2023, the manufacturing sector contributed IDR 2,945 trillion (USD 205 billion) to the GDP, reflecting a 4.5% increase from the previous year. This growth has led to higher consumption of base metals for manufacturing machinery, vehicles, and construction materials, thereby boosting the mining industry's output.

Market Challenges

- Regulatory and Environmental Compliance Costs: Compliance with Indonesia's stringent environmental regulations has increased operational costs for mining companies. The implementation of the Mineral and Coal Mining Law No. 3/2020 requires companies to allocate funds for reclamation and post-mining activities, which can amount to billions of rupiah annually. These additional expenses pose financial challenges, particularly for small and medium-sized enterprises in the mining sector.

- Fluctuations in Commodity Prices: The global prices of base metals have experienced volatility, impacting the profitability of Indonesian mining companies. For instance, the price of nickel decreased from USD 18,000 per metric ton in January 2023 to USD 16,000 per metric ton in June 2023. Such fluctuations can lead to unpredictable revenue streams and complicate financial planning for mining operations.

Indonesia Base Metal Mining Market Future Outlook

Over the next five years, the Indonesia Base Metal Mining market is projected to expand, driven by rising global demand for metals in various industries, particularly in electric vehicle manufacturing and renewable energy storage. The market is expected to benefit from ongoing investments in sustainable mining practices and technology upgrades, enabling companies to meet environmental standards while increasing production efficiencies.

Opportunities

- Exploration of Untapped Regions: Indonesia possesses vast mineral reserves in underexplored regions. The Ministry of Energy and Mineral Resources has identified potential mining areas covering approximately 400,000 square kilometers, particularly in eastern Indonesia. Exploring these regions could lead to the discovery of new mineral deposits, offering opportunities for expansion and increased production in the mining sector.

- Advancements in Mining Technologies: The adoption of advanced mining technologies presents opportunities to enhance efficiency and reduce environmental impact. Techniques such as High-Pressure Acid Leach (HPAL) have been successfully implemented in nickel extraction, improving recovery rates and processing low-grade ores. For example, Chinese companies have utilized HPAL technology in Indonesia, leading to increased nickel production and positioning the country as a leading supplier of battery-grade nickel.

Scope of the Report

|

Metal Type |

Nickel Copper Tin Aluminum Lead |

|

Mining Technique |

Open Pit Mining Underground Mining |

|

Application |

Construction Automotive Manufacturing Electrical & Electronics Industrial Machinery Others |

|

End-User |

Local Smelters Export Market |

|

Region |

Sumatra Java Kalimantan Sulawesi Papua |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Mining and Exploration Companies

Base Metal Smelting and Processing Industries

Automotive Manufacturing Industries

Renewable Energy and Battery Manufacturing Companies

Electronics Manufacturing companies

Government and Regulatory Bodies (e.g., Ministry of Energy and Mineral Resources, Indonesia Investment Coordinating Board)

Investor and Venture Capitalist Firms

Environmental and Sustainability Companies

Companies

Players Mentioned in the Report

Vale Indonesia

PT Timah

Freeport Indonesia

PT Aneka Tambang

PT Inalum

Newmont Nusa Tenggara

Weda Bay Nickel

Tsingshan Group

Nickel Mines Limited

PT Indoferro

Table of Contents

1. Indonesia Base Metal Mining Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Base Metal Mining Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Base Metal Mining Market Analysis

3.1 Growth Drivers

3.1.1 Domestic Demand for Infrastructure Projects

3.1.2 Increased Investment in Mining Sector

3.1.3 Expansion of Industrial and Construction Sectors

3.2 Market Challenges

3.2.1 Regulatory and Environmental Compliance Costs

3.2.2 Fluctuations in Commodity Prices

3.2.3 Operational and Labor Issues

3.3 Opportunities

3.3.1 Exploration of Untapped Regions

3.3.2 Advancements in Mining Technologies

3.3.3 Strategic Partnerships and Joint Ventures

3.4 Trends

3.4.1 Digitalization in Mining Operations

3.4.2 Shift towards Sustainable Mining Practices

3.4.3 Use of Automation and Remote Monitoring

3.5 Government Regulations

3.5.1 Mining License and Permit Regulations

3.5.2 Environmental Compliance Standards

3.5.3 Policies on Export Quotas and Local Procurement

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Indonesia Base Metal Mining Market Segmentation

4.1 By Metal Type (In Value %)

4.1.1 Nickel

4.1.2 Copper

4.1.3 Tin

4.1.4 Aluminum

4.1.5 Lead

4.2 By Mining Technique (In Value %)

4.2.1 Open Pit Mining

4.2.2 Underground Mining

4.3 By Application (In Value %)

4.3.1 Construction

4.3.2 Automotive Manufacturing

4.3.3 Electrical & Electronics

4.3.4 Industrial Machinery

4.3.5 Others

4.4 By End-User (In Value %)

4.4.1 Local Smelters

4.4.2 Export Market

4.5 By Region (In Value %)

4.5.1 Sumatra

4.5.2 Java

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia Base Metal Mining Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Vale Indonesia

5.1.2 PT Timah

5.1.3 Freeport Indonesia

5.1.4 PT Aneka Tambang (Antam)

5.1.5 PT Inalum

5.1.6 Newmont Nusa Tenggara

5.1.7 PT Amman Mineral

5.1.8 Weda Bay Nickel

5.1.9 Tsingshan Group

5.1.10 PT Smelting

5.1.11 PT Central Omega Resources

5.1.12 Nickel Mines Limited

5.1.13 PT Indoferro

5.1.14 Huayou Cobalt

5.1.15 PT Artha Meta Global

5.2 Cross Comparison Parameters (Production Capacity, Reserves, Revenue, Employee Strength, Operational Regions, Mining Licenses, Technological Adoption, Environmental Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Base Metal Mining Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Indonesia Base Metal Mining Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Base Metal Mining Market Future Segmentation

8.1 By Metal Type (In Value %)

8.2 By Mining Technique (In Value %)

8.3 By Application (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Indonesia Base Metal Mining Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping all critical stakeholders in the Indonesia Base Metal Mining market. This step utilizes secondary data sources and proprietary databases to gather in-depth insights into industry structure and dynamics, focusing on production, pricing, and export-import trends.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data and market penetration within the Indonesia Base Metal Mining market, focusing on regional distribution, mining production statistics, and revenue generation. This stage provides a baseline for forecasting market trends.

Step 3: Hypothesis Validation and Expert Consultation

Research hypotheses are validated through consultations with industry experts using methods like computer-assisted telephone interviews (CATI). Experts from top mining firms provide insights into operational challenges, environmental considerations, and competitive strategies, enriching the data set.

Step 4: Research Synthesis and Final Output

In the final phase, direct interviews with industry participants refine findings from the bottom-up approach, ensuring the report accurately represents the Indonesia Base Metal Mining market dynamics. This phase enhances accuracy by incorporating company-specific data and industry benchmarks.

Frequently Asked Questions

1. How big is the Indonesia Base Metal Mining Market?

The Indonesia Base Metal Mining Market, valued at USD 36 billion, is primarily driven by high demand for metals like nickel and copper in industrial applications, supporting both domestic and international manufacturing.

2. What are the challenges in the Indonesia Base Metal Mining Market?

Challenges include regulatory compliance, environmental concerns, and fluctuating commodity prices. Additionally, operational challenges related to labor availability and costs impact profitability in the market.

3. Who are the major players in the Indonesia Base Metal Mining Market?

Key players include Vale Indonesia, PT Timah, Freeport Indonesia, PT Aneka Tambang, and PT Inalum. These companies dominate due to their high production capacity, extensive reserves, and established market networks.

4. What are the growth drivers of the Indonesia Base Metal Mining Market?

Growth is driven by increasing industrial demand, government incentives for sustainable mining, and technological advancements in extraction methods that improve efficiency and output quality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.