Indonesia Edge Computing Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD350

July 2024

81

About the Report

Indonesia Edge Computing Market Overview

- The Indonesia Edge Computing market is growing due to increasing demand for low-latency and high-bandwidth processing. The global edge computing market size was valued at USD 16.45 billion in 2023. The growth factors are the increasing adoption of Internet of Things (IoT) devices, the expansion of 5G networks, and the rising demand for real-time data processing capabilities.

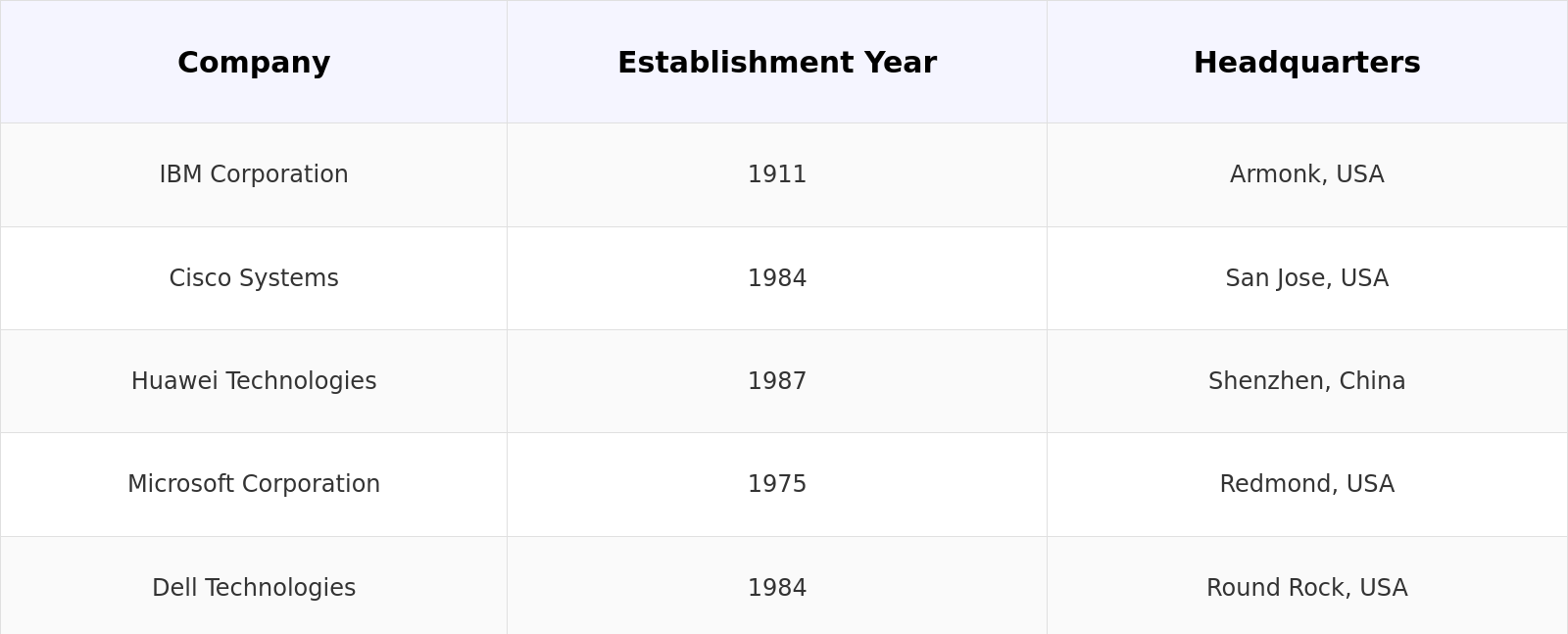

- Key players in the Indonesia Edge Computing market include IBM Corporation, Cisco Systems, Huawei Technologies, Microsoft Corporation, and Dell Technologies. These companies dominate the market due to their extensive product portfolios, strong R&D capabilities, and established market presence.

- In 2024, Microsoft announced an investment of USD 1.7 billion in Indonesia to build new data centers and enhance its edge computing services. This investment aims to expand cloud services and artificial intelligence infrastructure within the country, boosting the local market by providing advanced infrastructure.

Indonesia Edge Computing Current Market Analysis

- The increasing adoption of IoT devices in Indonesia is rising the demand for edge computing. In 2024, the number of IoT-connected devices in Indonesia is to surpass 200 million, facilitating real-time data processing and reducing latency. This trend is particularly evident in sectors such as manufacturing, where IoT devices are used for predictive maintenance and in smart cities initiatives for traffic management systems.

- The ongoing rollout of 5G networks across Indonesia is a crucial growth factor for the edge computing market. By mid-2024, the 5G services will cover over 50% of the population, enhancing data transmission speeds and reducing latency. This development supports various applications that require real-time processing, such as autonomous vehicles, remote healthcare services, and augmented reality experiences.

- The Indonesian government's aggressive push towards digital transformation through programs like "Making Indonesia 4.0" aims to boost industrial productivity and efficiency. This initiative includes substantial investments in digital infrastructure, including edge computing, to support the modernization of manufacturing processes. As part of this program.

Indonesia Edge Computing Market Segmentation

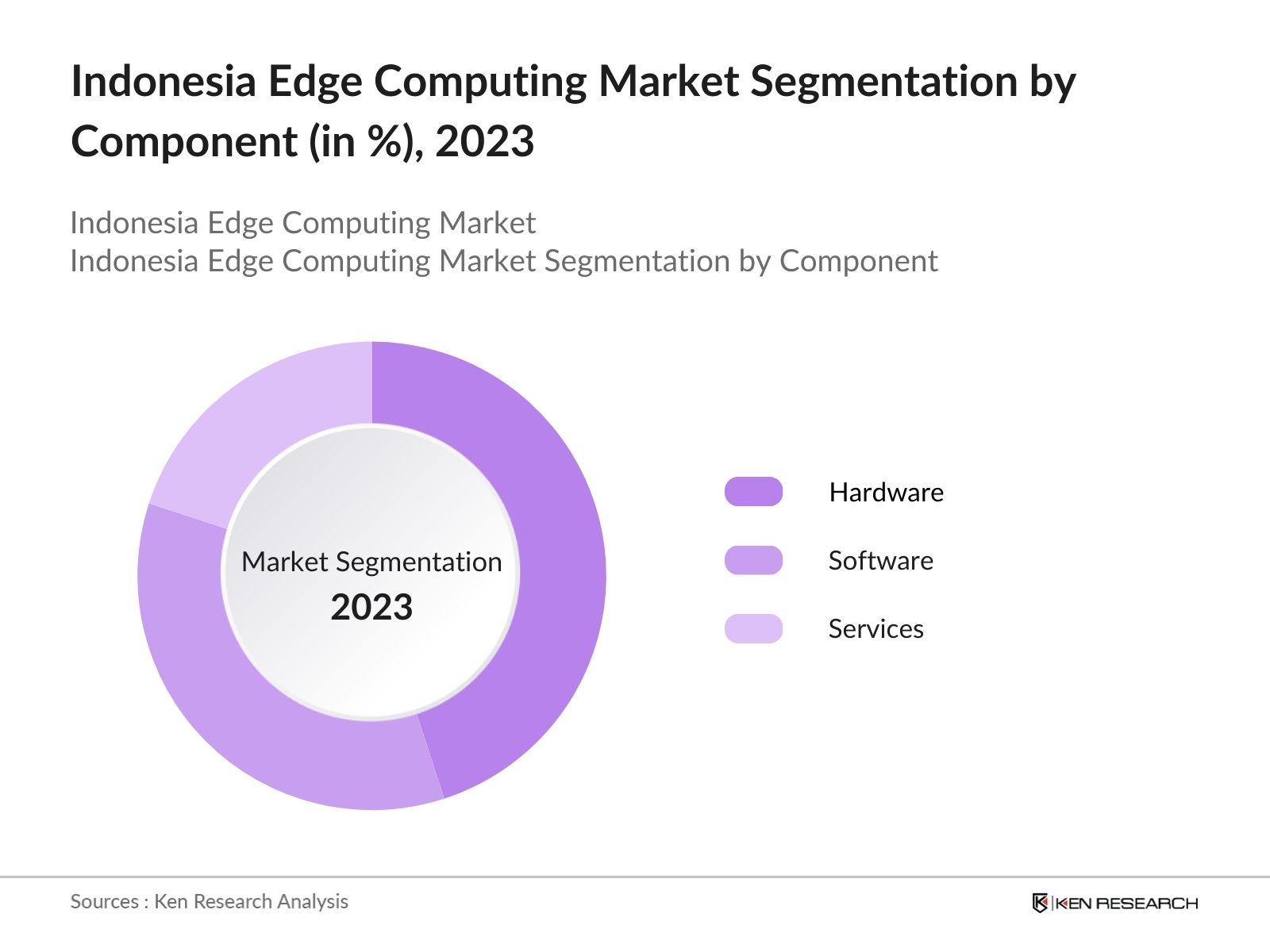

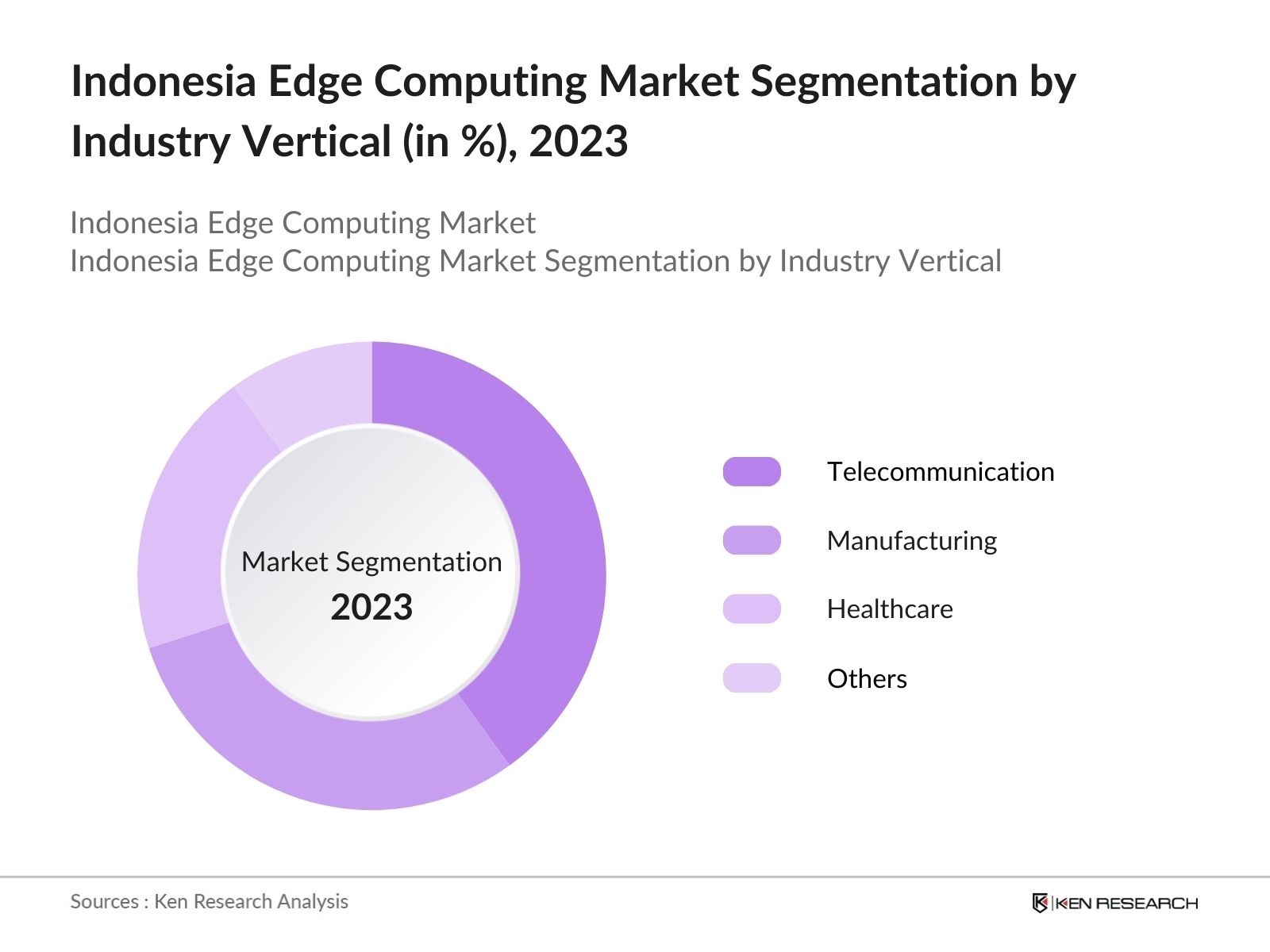

The Indonesia edge computing market can be segmented by various factors like component, industry vertical and region.

By Component: The Indonesia edge computing market is segment into different component in hardware, software and services. In 2023, hardware is dominant due to edge servers are essential for processing and storing data at the edge of the network, making them a critical component of edge computing infrastructure.

By Industry Vertical: The Indonesia edge computing market is segment into different industry vertical in telecommunications, manufacturing, healthcare and others. In 2023, telecommunications are leading due to the deployment of 5G networks and the need for low-latency services.

By Region: The Indonesia edge computing market is segment into different region like north, east, west and south. In 2023, the northern region, particularly Java, is dominated by smart city projects, driven by government initiatives and high urbanization rates. This focuses on digital infrastructure and real-time data processing.

Indonesia Edge Computing Market Competitive Landscape

- In 2022, IBM launched the Edge Application Manager, enhancing autonomous management of edge devices and applications. In 2023, as per the IBM annual report $61.5 billion revenue is generated and formed local partnerships to bolster edge computing capabilities in Indonesia.

- In 2021, Cisco acquired Acacia Communications to strengthen its optical networking and edge computing offerings. In 2023, as per the Cisco $57 billion revenue is generated, Cisco announced tailored edge solutions for Indonesia’s telecom sector, enhancing its market presence.

- Dell introduced new edge computing infrastructure solutions in 2023 to support Indonesia’s digital transformation. In 2023, as per the Dell $102.3 billion revenue is generated, Dell partnered with local enterprises to deploy edge systems in logistics and retail sectors.

Indonesia Edge Computing Market Analysis

Indonesia Edge Computing Growth Drivers:

- Increase in Data-Intensive Applications: The growing use of data-intensive applications in sectors such as finance, healthcare, and retail are driving the demand for edge computing. The healthcare sector's reliance on telemedicine and remote patient monitoring has surged, with the number of telemedicine consultations expected to reach 50 million by 2024.

- Adoption of Smart Manufacturing: The adoption of smart manufacturing technologies in Indonesia is to grow by 30% annually, leveraging edge computing for real-time data processing and automation in industries such as automotive and electronics.

- Increase in Mobile Internet Usage: In 2023, Indonesia's mobile internet usage has surged, with over 175 million mobile internet users. This rise drives the demand for edge computing to manage data traffic and improve user experiences by reducing latency.

Indonesia Edge Computing Market Challenges:

- High Implementation Costs: The initial setup costs for edge computing infrastructure remain a big barrier for many organizations in Indonesia. These costs include investments in hardware, software, and skilled personnel. For small and medium-sized enterprises (SMEs), these expenses can be prohibitive, hindering widespread adoption.

- Cybersecurity Risks: As edge computing involves data processing at multiple decentralized locations, it increases the surface area for potential cyber-attacks. In 2024, Indonesia has raised in cyber-attacks compared to the previous year, highlighting the vulnerabilities associated with distributed computing environments.

- Regulatory and Compliance Issues: Navigating the regulatory landscape in Indonesia poses a challenge for the deployment of edge computing solutions. In 2024, Compliance with data protection regulations, such as the Personal Data Protection Bill expected to be enacted, requires organizations to implement stringent data management practices.

India Home Furniture Market Government Initiatives:

- 5G Network Deployment: In 2021, the Indonesian government allocated specific spectrum bands for 5G networks to accelerate nationwide 5G deployment. This initiative supports the edge computing market by providing the necessary infrastructure for low-latency data processing and high-speed connectivity.

- Digital Indonesia Roadmap: This roadmap outlines the government's plans to develop digital infrastructure, promote digital literacy, and encourage the adoption of advanced technologies like edge computing across various sectors. The goal is to boost Indonesia's digital economy and enhance its global digital competitiveness.

- 100 Smart Cities Movement: In 2017, this program aims to develop smart city solutions across Indonesia. By implementing edge computing technologies for smart traffic management, energy distribution, and public safety, the initiative aims to improve urban living standards and operational efficiency.

Indonesia Edge Computing Future Market Outlook

The Indonesia edge computing market is growing in the coming years. The market is also expected to see a shift towards more technological innovations, government initiatives.

Future Market Trends

-

- Rise of Edge Data Centers: The establishment of edge data centers is gaining traction in Indonesia to support the growing demand for low-latency data processing. These micro data centers are strategically located close to end-users, ensuring faster data access and improved performance. In 2024, it is anticipated that the number of edge data centers in Indonesia will double, driven by investments from both local and international players aiming to enhance their service delivery.

- Hybrid Cloud Solutions: The adoption of hybrid cloud architectures, which combine on-premises, edge, and cloud resources, is becoming increasingly popular in Indonesia. This approach allows organizations to leverage the benefits of both centralized and decentralized computing. In 2024, 60% of large enterprises in Indonesia are expected to deploy hybrid cloud solutions, providing greater flexibility, scalability, and resilience in their IT infrastructure.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By Industry Vertical |

Telecommunications Manufacturing Healthcare Others |

|

By Region |

North East West South |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Providers

Manufacturing Firms

Healthcare Institutions

Government Agencies (Ministry of Industry, Ministry of Communication and Information Technology)

Smart City Project Developers

Banking and Financial Institution (Bank Indonesia, Bank Rakyat Indonesia)

IoT Solution Providers

Time Period Captured in the Report

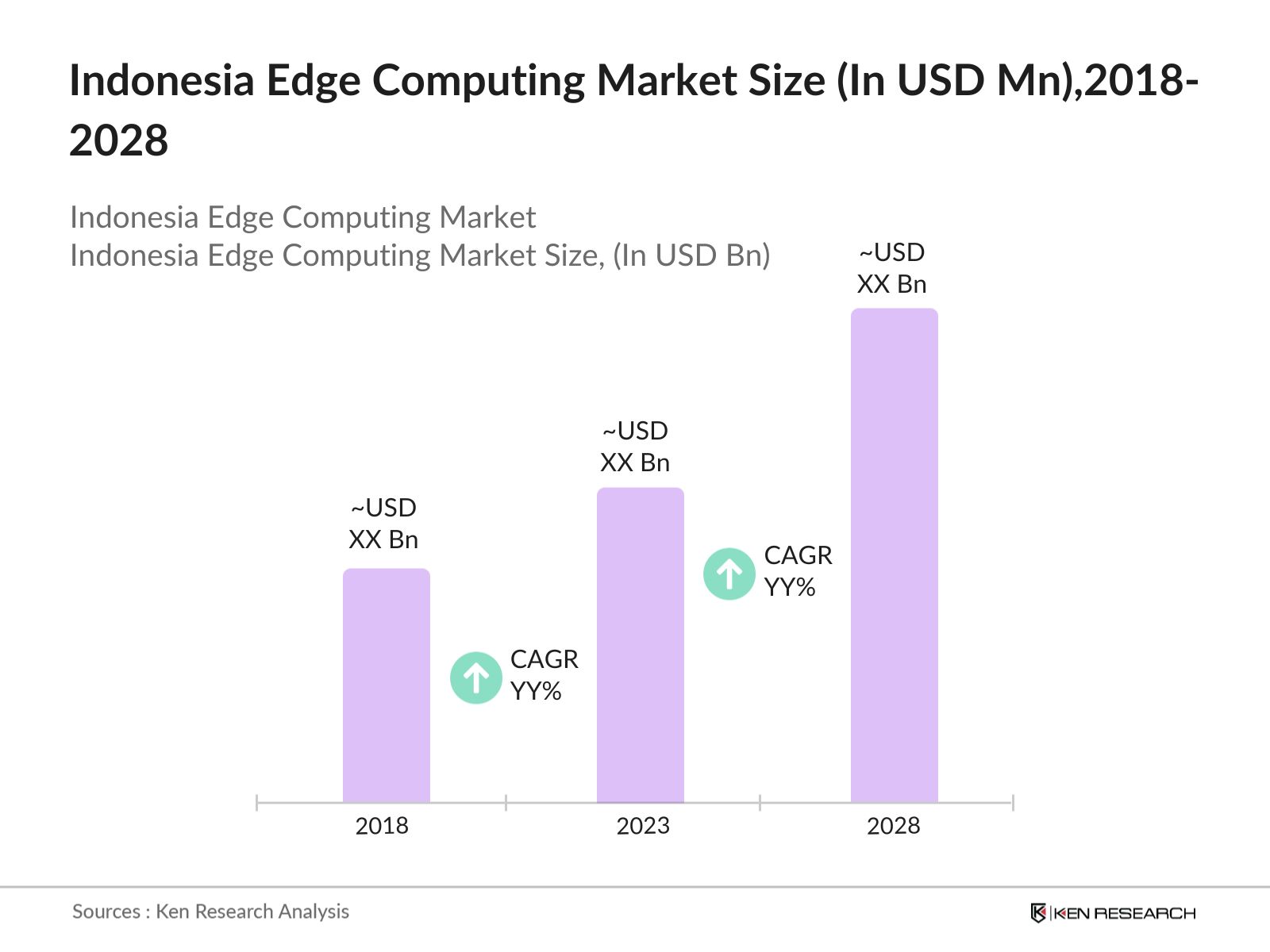

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

IBM Corporation

Cisco Systems

Huawei Technologies

Microsoft Corporation

Dell Technologies

Amazon Web Services

Google LLC

Hewlett Packard Enterprise

Intel Corporation

Nokia Corporation

Juniper Networks

Schneider Electric

Siemens AG

Rockwell Automation

Bosch.IO

Table of Contents

1. Indonesia Edge Computing Market Overview

1.1 Indonesia Edge Computing Market Taxonomy

2. Indonesia Edge Computing Market Size (in USD Bn), 2018-2023

3. Indonesia Edge Computing Market Analysis

3.1 Indonesia Edge Computing Market Growth Drivers

3.2 Indonesia Edge Computing Market Challenges and Issues

3.3 Indonesia Edge Computing Market Trends and Development

3.4 Indonesia Edge Computing Market Government Regulation

3.5 Indonesia Edge Computing Market SWOT Analysis

3.6 Indonesia Edge Computing Market Stake Ecosystem

3.7 Indonesia Edge Computing Market Competition Ecosystem

4. Indonesia Edge Computing Market Segmentation, 2023

4.1 Indonesia Edge Computing Market Segmentation by Component (in %), 2023

4.2 Indonesia Edge Computing Market Segmentation by Industry Vertical (in %), 2023

4.3 Indonesia Edge Computing Market Segmentation by Region (in %), 2023

5. Indonesia Edge Computing Market Competition Benchmarking

5.1 Indonesia Edge Computing Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Indonesia Edge Computing Market Future Market Size (in USD Bn), 2023-2028

7. Indonesia Edge Computing Market Future Market Segmentation, 2028

7.1 Indonesia Edge Computing Market Segmentation by Component (in %), 2028

7.2 Indonesia Edge Computing Market Segmentation by Industry Vertical (in %), 2028

7.3 Indonesia Edge Computing Market Segmentation by Region (in %), 2028

8. Indonesia Edge Computing Market Analysts’ Recommendations

8.1 Indonesia Edge Computing Market TAM/SAM/SOM Analysis

8.2 Indonesia Edge Computing Market Customer Cohort Analysis

8.3 Indonesia Edge Computing Market Marketing Initiatives

8.4 Indonesia Edge Computing Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry level information.

Step: 2 Market Building

Collating statistics on Indonesia Edge Computing Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Edge Computing Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output

Our team will approach edge computing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such edge computing companies.

Frequently Asked Questions

01 How big is the Indonesia Edge Computing market?

The Indonesia Edge Computing market is growing due to increasing demand for low-latency and high-bandwidth processing in various industries. The global edge computing market size was valued at USD 16.45 billion in 2023.

02 Who are the key players in the Indonesia Edge Computing Market?

Key players in the Indonesia Edge Computing market include IBM Corporation, Cisco Systems, Huawei Technologies, Microsoft Corporation, and Dell Technologies. These companies dominate the market due to their extensive product portfolios, strong R&D capabilities, and established market presence.

03 What are the key growth drivers for the Indonesia Edge Computing Market?

Indonesia's edge computing market growth is driven by substantial government investments in digital infrastructure, the rapid expansion of 5G networks, rising mobile internet usage, and the adoption of smart manufacturing technologies.

04 What are the main challenges faced by the Indonesia Edge Computing Market?

High implementation costs, cybersecurity risks, integration complexity, and regulatory compliance issues hinder the widespread adoption of edge computing in Indonesia, impacting financial feasibility and operational deployment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.