KSA Music Streaming Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD4839

December 2024

91

About the Report

KSA Music Streaming Market Overview

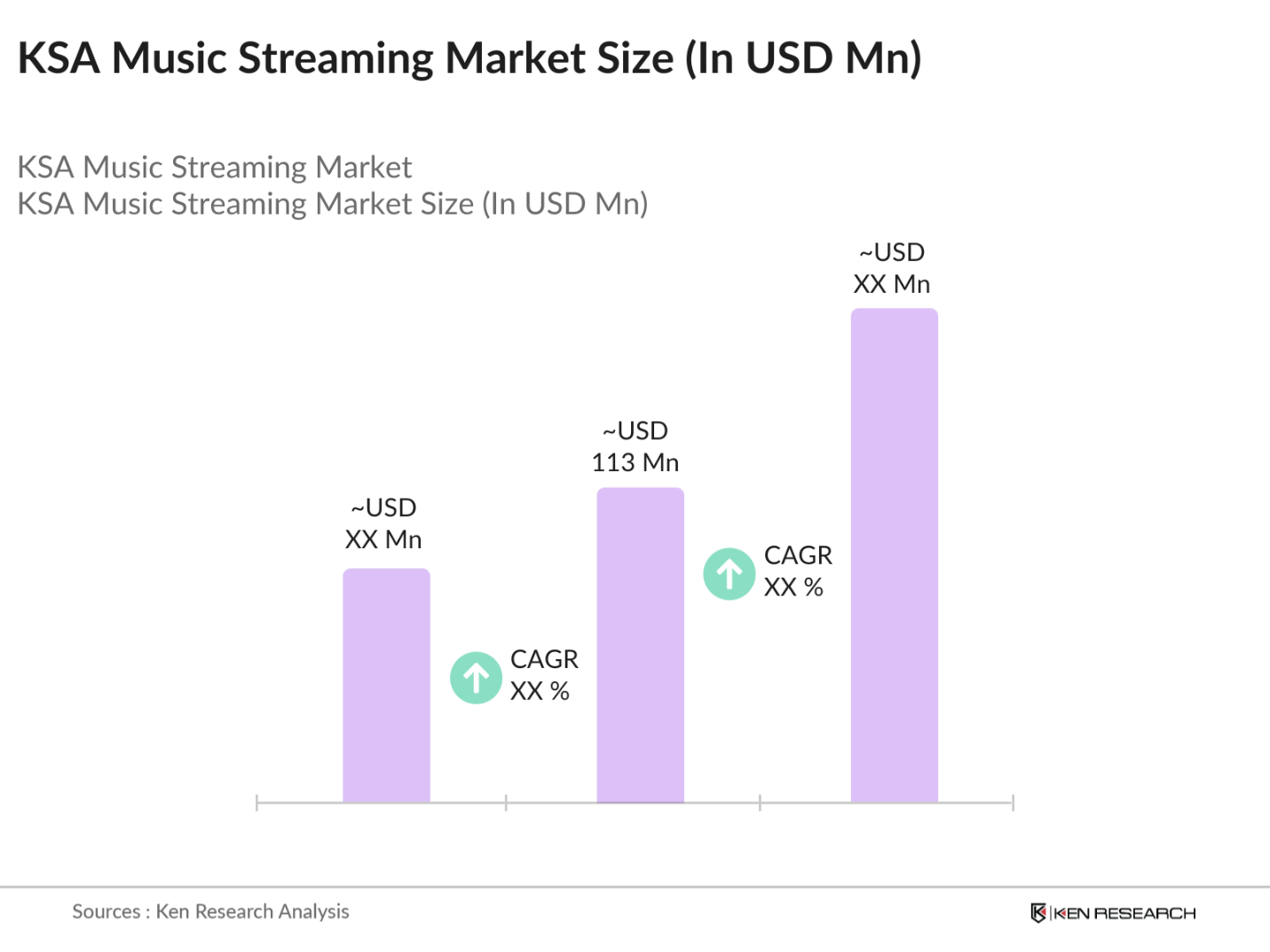

- The KSA Music Streaming market is valued at USD 113 million, based on a five-year historical analysis. This market is primarily driven by the rapid growth in mobile internet usage, the increasing popularity of smartphones, and the rising demand for localized Arabic music content. Partnerships between music streaming platforms and telecom operators offering bundled services have further accelerated user growth. With an expanding youth population and a growing appetite for digital entertainment, the KSA music streaming industry is well-positioned for continued growth, particularly through premium subscriptions and ad-supported models.

- The dominant cities in the KSA music streaming market include Riyadh, Jeddah, and Dammam, with Riyadh being the largest contributor due to its high concentration of tech-savvy consumers, infrastructure, and purchasing power. The large urban population in these cities, coupled with a significant portion of youth who have access to high-speed internet and smartphones, has made these regions the focal points for music streaming service providers looking to expand in the market.

- The Saudi Ministry of Media enforces strict content guidelines for music streaming platforms. As of 2024, platforms must comply with regulations regarding explicit content and cultural sensitivities. Failure to adhere to these guidelines can result in penalties or bans. These guidelines impact the range of content available in the market, requiring platforms to adjust their offerings to align with local norms.

KSA Music Streaming Market Segmentation

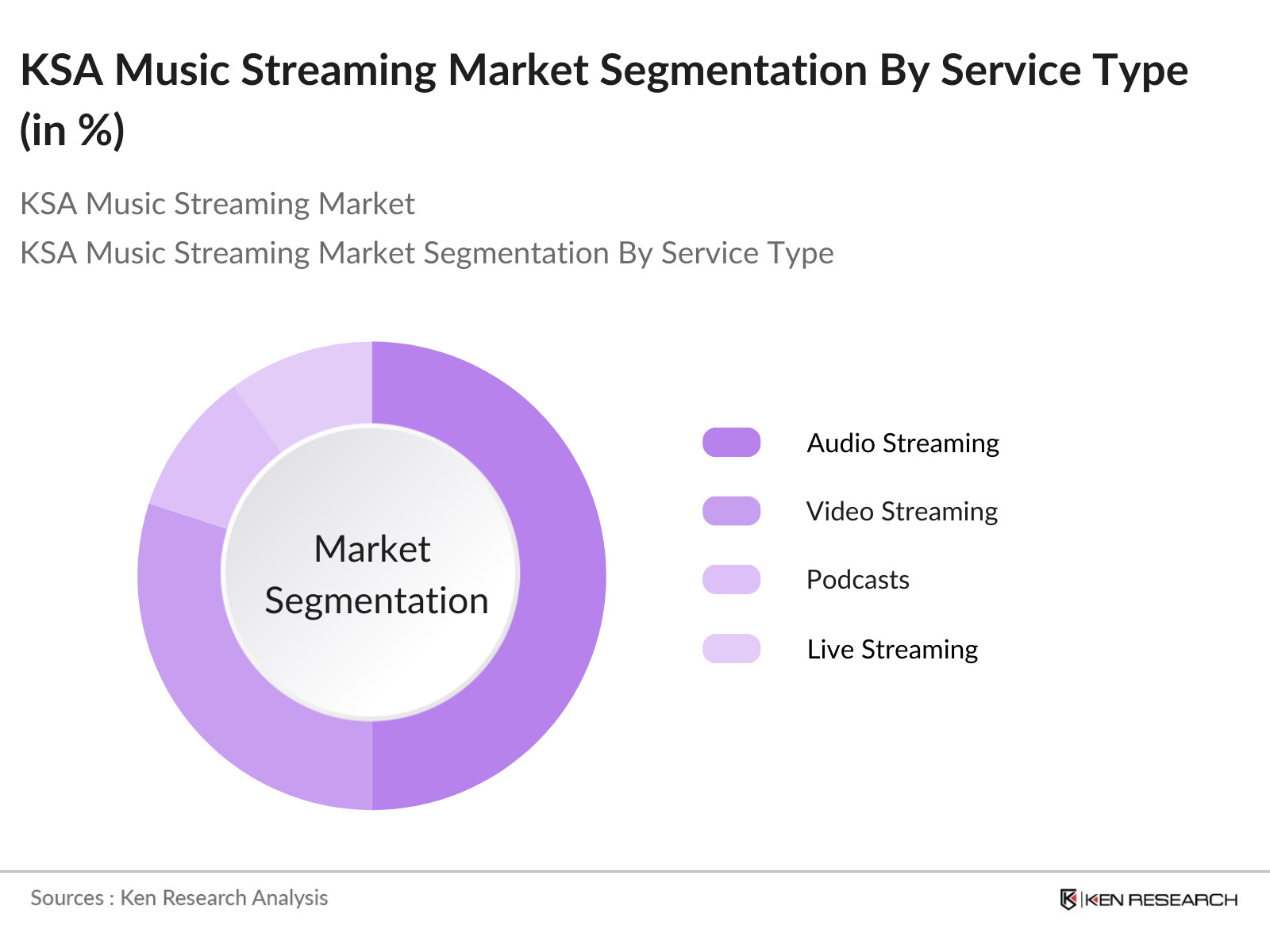

By Service Type: The KSA music streaming market is segmented by service type into audio streaming, video streaming, podcasts, and live streaming of concerts and events. In recent years, audio streaming has held a dominant market share within this segment, attributed to its convenience and availability of localized Arabic music, which resonates well with the local audience. Platforms such as Anghami and Spotify have strengthened their presence by offering a diverse array of playlists tailored to the regions preferences.

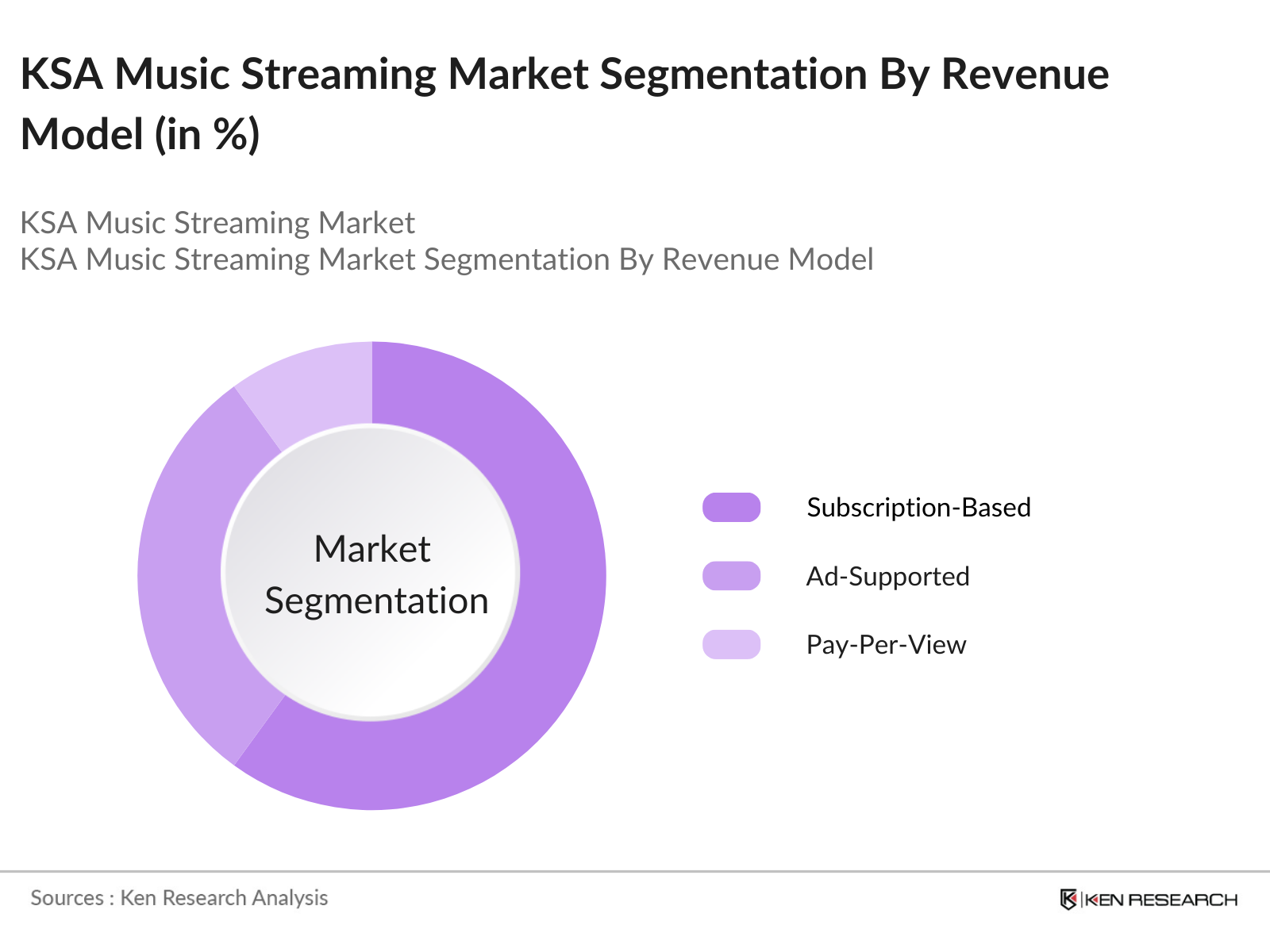

By Revenue Model: The market is segmented by revenue models into subscription-based services, ad-supported streaming, and pay-per-view models. Subscription-based services hold the majority market share due to the increasing number of consumers opting for premium, ad-free experiences. Telecom partnerships that offer subscription bundles, along with exclusive access to regional and international content, have further driven the growth of this model.

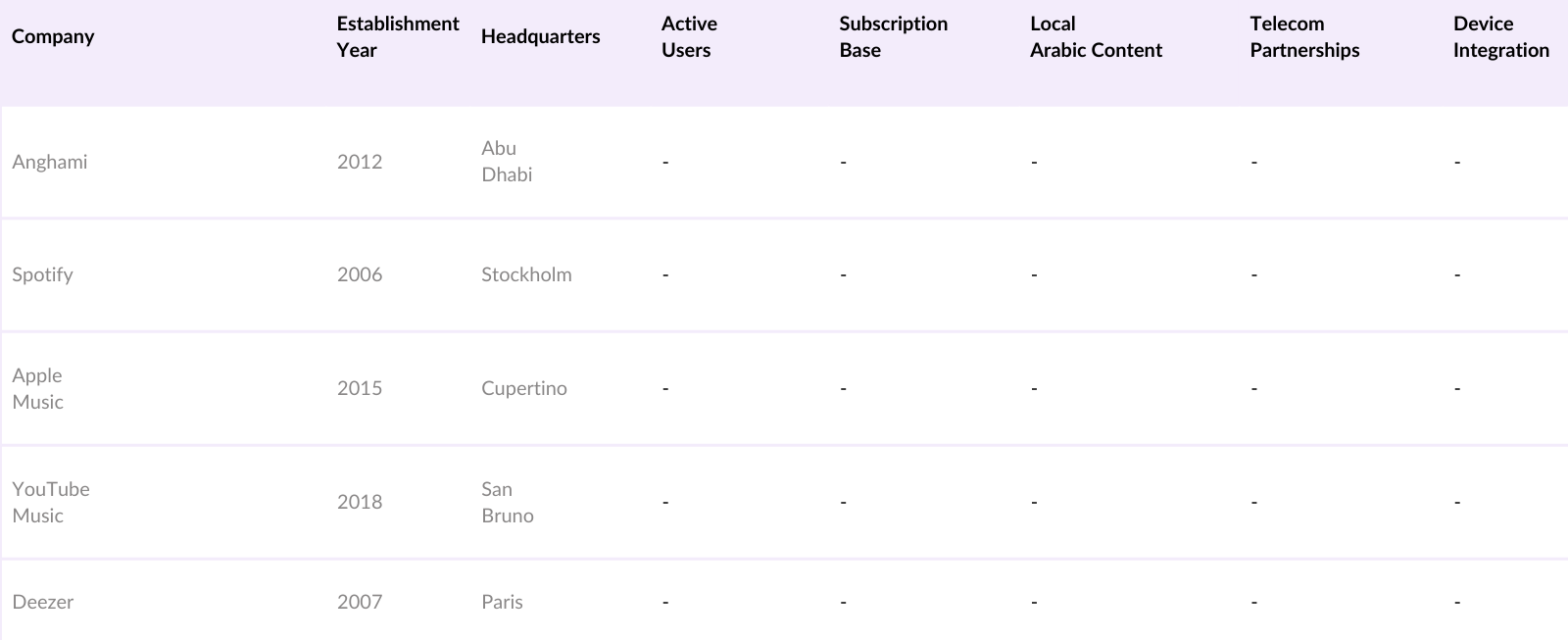

KSA Music Streaming Market Competitive Landscape

The KSA music streaming market is dominated by a mix of regional and international players, offering both localized content and globally popular music. The top players leverage strong partnerships with record labels and telecom operators to enhance user acquisition and retention. The competitive landscape shows a high degree of consolidation, with players focusing on exclusivity deals, content acquisition, and value-added services to capture market share.

KSA Music Streaming Industry Analysis

Growth Drivers

- High Smartphone Penetration: The Kingdom of Saudi Arabia (KSA) has one of the highest smartphone penetration rates globally. As of 2024, Saudi Arabia boasts over 44 million smartphone connections, exceeding the countrys population of around 36 million, indicating multiple device ownership. The high smartphone adoption rate is a key enabler for music streaming services, offering on-the-go access to digital content.

- Increasing Internet Usage (Including Mobile Data Consumption): In 2024, Saudi Arabia's internet user base surpassed 34 million, with mobile data playing a significant role in this growth. With an average of over 6.5 GB of mobile data consumed per user per month, the high-speed internet infrastructure in the country fuels the consumption of music streaming services.

- Rising Youth Population: The median age of Saudi Arabias population is approximately 32 years in 2024, with nearly 64% of the population under the age of 35. This younger demographic is more inclined towards digital music platforms, especially for on-demand and customizable music experiences. As the youth in Saudi Arabia continues to drive digital engagement, their preferences contribute significantly to the rise of streaming services, with demand for modern, diversified, and localized content.

Market Challenges

- Royalty Costs and Licensing Restrictions: Royalty and licensing fees for international and local content remain a significant burden on music streaming platforms in Saudi Arabia. As of 2024, KSA has stringent licensing regulations, with platforms required to pay substantial royalties to both local and international artists. This limits the number of tracks and local content available, making it challenging for smaller players to compete with global giants.

- Piracy and Content Distribution Challenges: Piracy continues to pose challenges to the Saudi music streaming market. In 2024, estimates suggest that over 30% of digital content consumed in the country is pirated, impacting revenue generation for legal streaming services. Despite the countrys recent efforts to crack down on piracy, including strengthening intellectual property laws, the widespread availability of illegal downloads and streaming services hinders the growth of the legitimate market.

KSA Music Streaming Market Future Outlook

The KSA music streaming market is expected to witness substantial growth in the coming years. Factors contributing to this growth include the increasing penetration of smartphones, expanding high-speed internet infrastructure, and growing interest in locally curated Arabic content. Additionally, strategic partnerships between music streaming platforms and telecommunications companies are likely to continue driving user acquisition and retention, further expanding the market's reach.

Market Opportunities

- Monetization of Regional Content: With a growing demand for Arabic music and regional content, there is a significant opportunity for platforms to monetize locally produced content. In 2024, the Saudi governments support for the creative industries under Vision 2030 has led to increased investments in the local music scene, with over 500 new artists debuting in the past three years. Streaming services that focus on promoting local talent stand to benefit from this shift towards regionalization.

- Strategic Partnerships with Telecom Providers: Telecom partnerships provide a gateway for expanding user bases by offering bundled streaming services. In 2024, over 70% of Saudi internet users subscribe to data plans from telecom giants like STC and Mobily, many of which offer music streaming services as part of their packages. These partnerships allow music platforms to access a wider audience base, particularly in rural areas where telecom companies provide more robust coverage.

Scope of the Report

|

Service Type |

Audio Streaming Video Streaming Podcasts Live Streaming (Concerts, Events) |

|

Revenue Model |

Subscription-Based Ad-Supported Streaming Pay-Per-View Models |

|

Platform |

Mobile, Desktop/Web-Based Smart Devices (Smart TVs, Wearables, Voice Assistants) |

|

Content Type |

Local Arabic Content International Content Genre-Specific Content (Pop, Rock, Classical, Indie) |

|

Region |

Riyadh Jeddah Dammam Other Regions |

Products

Key Target Audience

Telecom Operators (STC, Mobily, Zain)

Music Streaming Platforms

Artists and Music Labels (Rotana, Shaheen Records)

Advertising Agencies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Ministry of Media, General Authority for Audiovisual Media)

Music Event Organizers

Consumer Electronics Manufacturers

Companies

Players Mentioned in the Report

Anghami

Spotify

Apple Music

YouTube Music

Deezer

Huawei Music

Joox

TIDAL

Amazon Music

SoundCloud

Table of Contents

1. KSA Music Streaming Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. KSA Music Streaming Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Music Streaming Market Analysis

3.1 Growth Drivers

3.1.1 High Smartphone Penetration

3.1.2 Increasing Internet Usage (Including Mobile Data Consumption)

3.1.3 Rising Youth Population

3.1.4 Localized Music Content and Arabic Content Demand

3.1.5 Digital Transformation and Smart Devices Adoption

3.2 Market Challenges

3.2.1 Royalty Costs and Licensing Restrictions

3.2.2 Piracy and Content Distribution Challenges

3.2.3 Cultural and Regulatory Restrictions

3.3 Opportunities

3.3.1 Monetization of Regional Content

3.3.2 Strategic Partnerships with Telecom Providers

3.3.3 Subscription Growth Potential (Ad-supported & Premium)

3.3.4 Expanding Collaborations with Global Artists

3.4 Trends

3.4.1 Rise of Arabic Indie Music and Independent Artists

3.4.2 Growing Popularity of Video Streaming in Music Apps

3.4.3 Podcasts and Audio-Based Content Proliferation

3.4.4 Exclusive Content and Artist Collaborations

3.5 Regulatory Landscape (Local Licensing Requirements and Content Censorship)

3.5.1 Saudi Ministry of Media Guidelines

3.5.2 Music Licensing Laws (General Authority for Audio-Visual Media)

3.5.3 Cultural Sensitivity Compliance

3.5.4 Intellectual Property Laws

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats)

3.7 Stake Ecosystem

3.7.1 Role of Labels (Major and Indie Labels)

3.7.2 Distribution Channels (Telecom, Platforms, Social Media)

3.7.3 Artists and Influencers in the Local Scene

3.8 Porters Five Forces (Competitive Rivalry, Supplier Power, Buyer Power, Threat of New Entrants, Threat of Substitutes)

3.9 Competition Ecosystem

3.9.1 Strategic Alliances and Industry Collaborations

3.9.2 Distribution Network Expansion

4. KSA Music Streaming Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Audio Streaming

4.1.2 Video Streaming

4.1.3 Podcasts

4.1.4 Live Streaming (Concerts, Events)

4.2 By Revenue Model (In Value %)

4.2.1 Subscription-Based

4.2.2 Ad-Supported Streaming

4.2.3 Pay-Per-View Models

4.3 By Platform (In Value %)

4.3.1 Mobile

4.3.2 Desktop/Web-Based

4.3.3 Smart Devices (Smart TVs, Wearables, Voice Assistants)

4.4 By Content Type (In Value %)

4.4.1 Local Arabic Content

4.4.2 International Content

4.4.3 Genre-Specific Content (Pop, Rock, Classical, Indie)

4.5 By Region (In Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Dammam

4.5.4 Other Regions

5. KSA Music Streaming Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Anghami

5.1.2 Spotify

5.1.3 Apple Music

5.1.4 YouTube Music

5.1.5 Deezer

5.1.6 SoundCloud

5.1.7 Huawei Music

5.1.8 Joox

5.1.9 TIDAL

5.1.10 Amazon Music

5.1.11 Qanawat Music

5.1.12 Rotana Music

5.1.13 Shaheen Records

5.1.14 Smule

5.1.15 Gaana

5.2 Cross Comparison Parameters (Market-Specific Metrics: Active Users, Subscriber Growth Rate, Monthly Active Listeners, Localized Content Availability, Partnerships with Telecoms, Average Revenue Per User (ARPU), Music Licensing Agreements, Device Integration)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Music Streaming Market Regulatory Framework

6.1 Content Regulations and Licensing

6.2 Compliance with Local Cultural and Religious Norms

6.3 Royalty Management and Distribution Regulations

6.4 Telecommunications and Data Usage Policies

7. KSA Music Streaming Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Music Streaming Market Future Segmentation

8.1 By Service Type (In Value %)

8.2 By Revenue Model (In Value %)

8.3 By Platform (In Value %)

8.4 By Content Type (In Value %)

8.5 By Region (In Value %)

9. KSA Music Streaming Market Analyst Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase of the research involved identifying critical market variables such as user penetration, ARPU, content preferences, and telecom partnerships. Secondary research was conducted to gather comprehensive data from proprietary databases and industry reports.

Step 2: Market Analysis and Construction

Historical market data was analyzed to construct the market's current size, assessing user acquisition trends, subscription growth, and the impact of telecom bundles on market share. The analysis provided insights into both service provider performance and consumer behavior.

Step 3: Hypothesis Validation and Expert Consultation

Primary research was conducted through interviews with executives from major streaming platforms and local music labels. This allowed for validation of the hypotheses related to revenue growth drivers and consumer engagement with local content.

Step 4: Research Synthesis and Final Output

The research findings were synthesized to form a comprehensive view of the market. Collaboration with industry experts allowed for further validation of data and projections, ensuring an accurate representation of market dynamics.

Frequently Asked Questions

1. How big is the KSA Music Streaming Market?

The KSA Music Streaming market is valued at USD 113 million, based on a five-year historical analysis. This market is primarily driven by the rapid growth in mobile internet usage, the increasing popularity of smartphones, and the rising demand for localized Arabic music content.

2. What are the challenges in the KSA Music Streaming Market?

Challenges in the market include high royalty costs, content piracy, and regulatory restrictions on certain types of music content due to cultural sensitivities.

3. Who are the major players in the KSA Music Streaming Market?

Key players in the market include Anghami, Spotify, Apple Music, YouTube Music, and Deezer. These companies dominate due to strategic telecom partnerships and a focus on localized content.

4. What are the growth drivers of the KSA Music Streaming Market?

The market is driven by increasing smartphone penetration, expanding high-speed internet, and the rising demand for Arabic content. Partnerships with telecom companies also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.