MEA Tractor Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD2462

December 2024

87

About the Report

MEA Tractor Market Overview

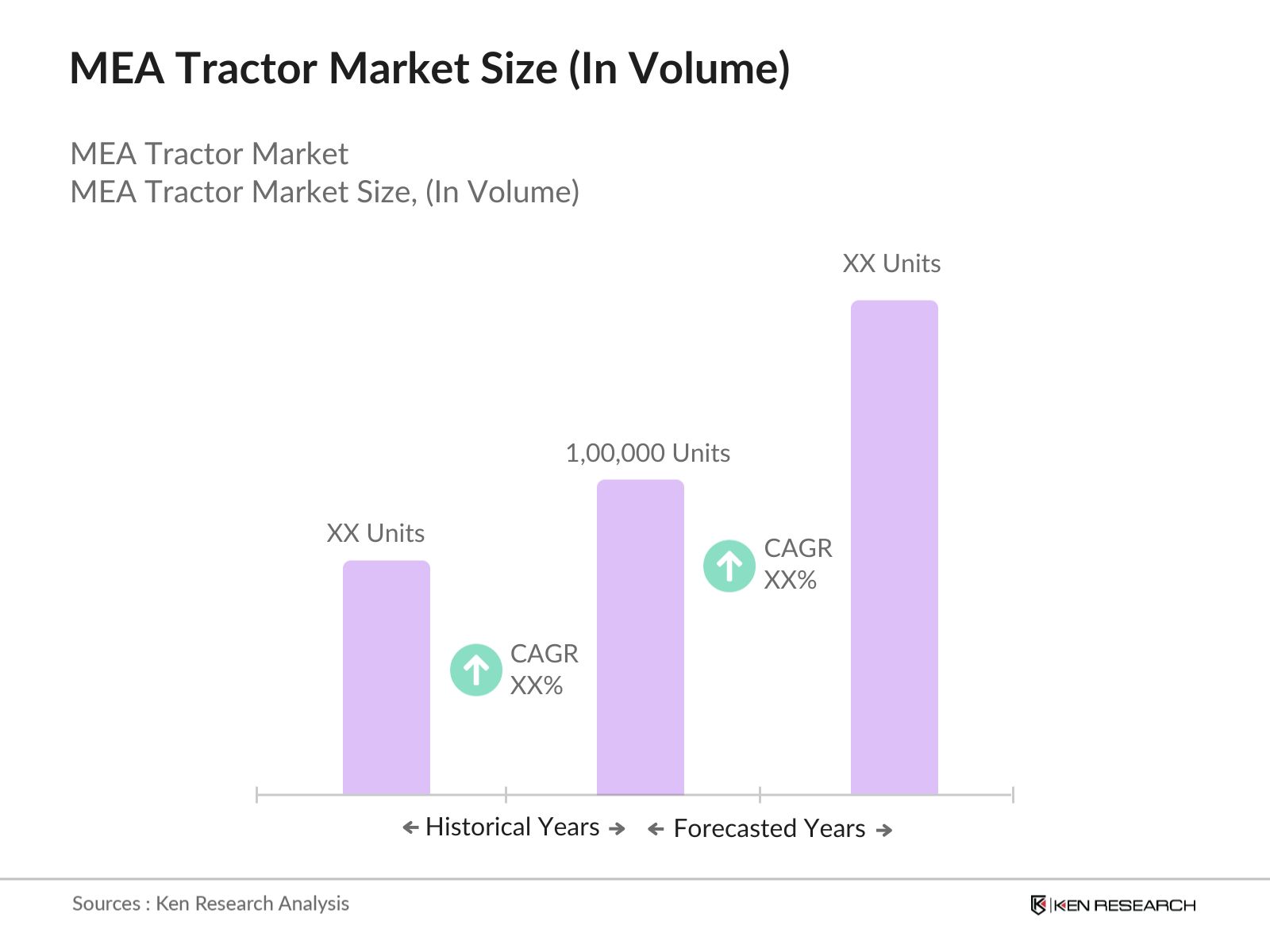

- The Middle East and Africa (MEA) Tractor Market is a vital segment of the agricultural and industrial machinery sectors. Volumed at 1,00,000 units in 2023, the market's size is driven by the increasing demand for advanced agricultural mechanization and infrastructure development. A rising focus on sustainable farming practices, coupled with government initiatives to improve agricultural productivity, significantly propels the demand for tractors across the region. Furthermore, infrastructure projects and urban development contribute to the demand for construction-based tractors.

- The key players in the MEA tractor market include Massey Ferguson, John Deere, CNH Industrial, AGCO Corporation, and Mahindra & Mahindra. These companies hold a dominant share in the market due to their strong global presence, robust distribution networks, and a broad portfolio of tractors catering to diverse regional needs.

- In 2023, Saudi Arabia announced a $20 billion investment in the agricultural sector, aiming to improve food security and promote sustainable farming practices. The initiative includes subsidies for purchasing agricultural machinery, including tractors, to modernize farming operations. This government intervention is a significant boost to the tractor market in the MEA region.

- Cities such as Lagos, Nairobi, Riyadh, and Cairo dominate the tractor market in the MEA region due to their agricultural productivity and urbanization projects. Lagos and Nairobi serve as major agricultural hubs, driving the demand for farming tractors, while Riyadh and Cairo lead in infrastructure and construction development, necessitating the use of construction tractors. These cities also benefit from government-backed agricultural reforms and infrastructure projects, further boosting the tractor market.

MEA Tractor Market Segmentation

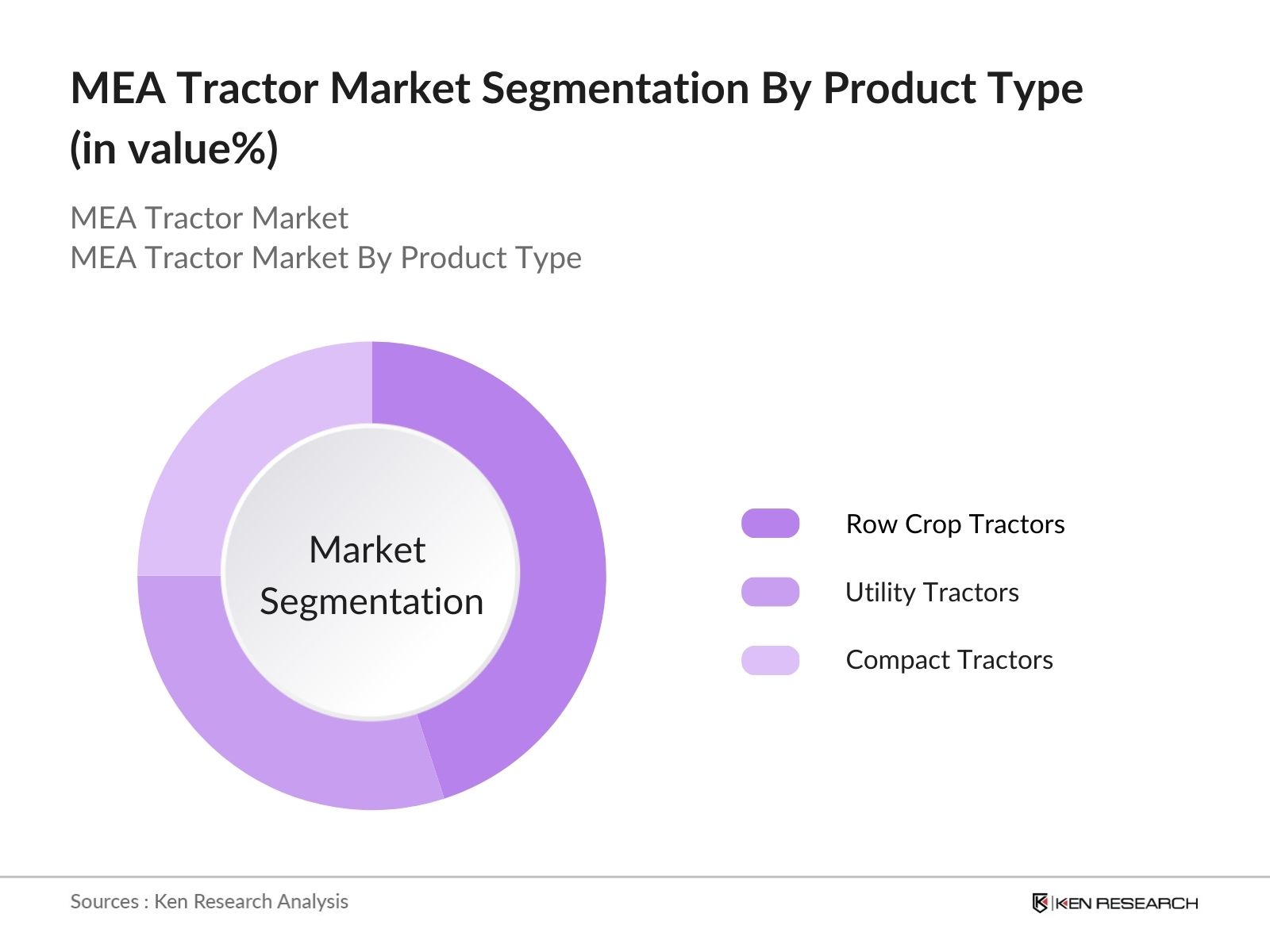

- By Product Type: The MEA tractor market is segmented by product type into row crop tractors, utility tractors, and compact tractors. In 2023, row crop tractors hold the dominant market share in this category due to their versatility and use in large-scale agricultural operations. These tractors are designed to handle multiple tasks such as plowing, harrowing, and planting in wide, open fields, making them an essential tool for high-yield crop production. Their adaptability to various attachments also makes them popular among large-scale commercial farms.

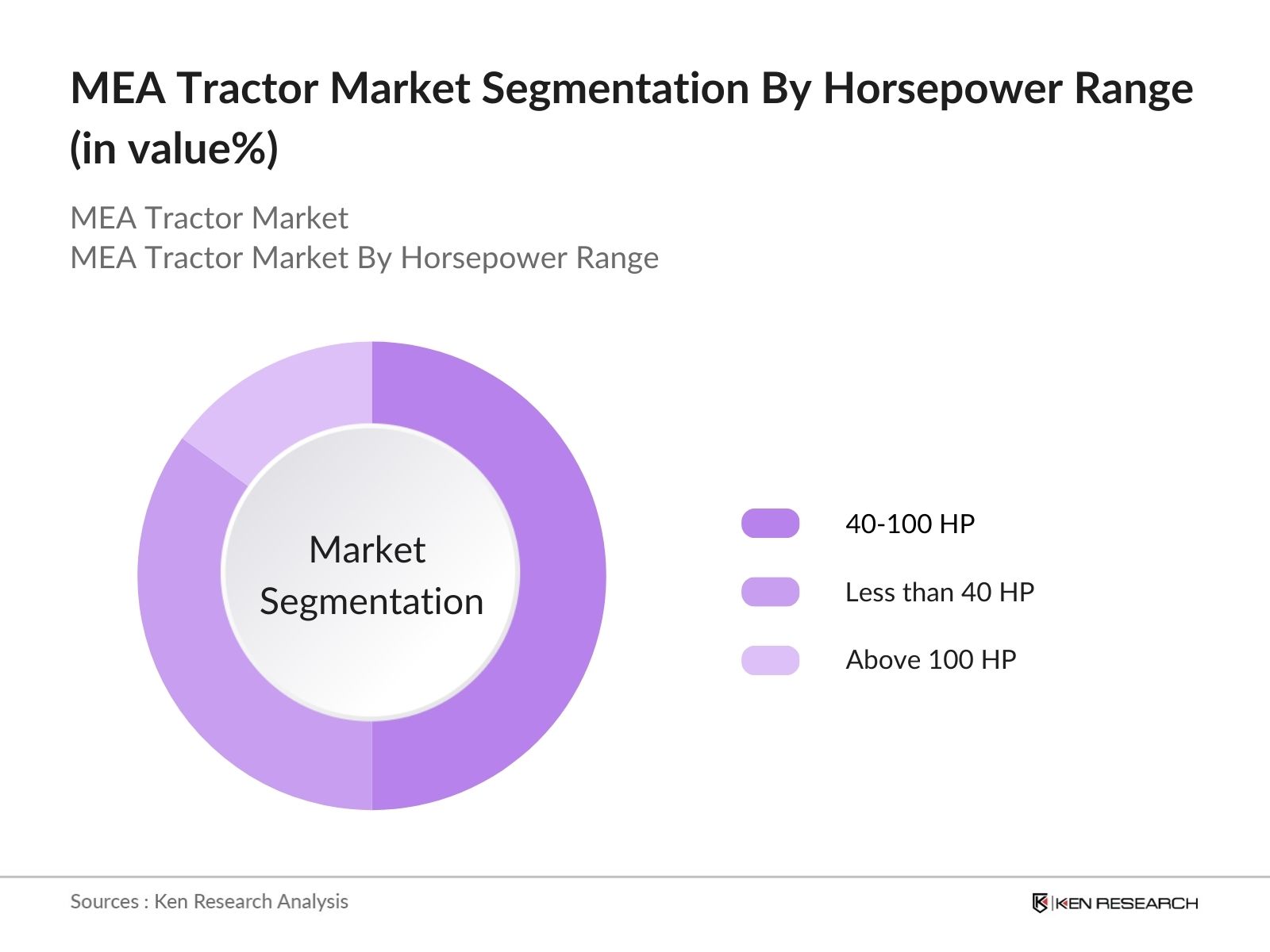

- By Horsepower Range: The market is segmented by horsepower range into less than 40 HP, 40-100 HP, and above 100 HP. In 2023, the 40-100 HP tractors segment holds the largest market share. This dominance is driven by the suitability of this range for medium-scale farming, which constitutes a large portion of agricultural activities in the MEA region. These tractors are powerful enough to manage tough terrains while still being cost-effective for farmers with mid-sized plots. Their versatility and fuel efficiency also make them a popular choice among small- and medium-scale farm owners.

- By Region: The MEA tractor market is regionally segmented into Israel, United Arab Emirates, Jordan, Morocco, South Africa, and the Rest of MEA. South Africa leads the market in 2023 due to its well-developed agricultural sector, which forms a crucial part of the nation's economy. The country's extensive farmlands and the growing need for mechanization to enhance crop yields make tractors vital for sustaining food production. Additionally, government initiatives aimed at modernizing the agricultural sector and international support for mechanization efforts are contributing to the rise in tractor sales in the region.

MEA Tractor Market Competitive Landscape

|

Company |

Established |

Headquarters |

|

Massey Ferguson |

1847 |

Duluth, Georgia, USA |

|

John Deere |

1837 |

Moline, Illinois, USA |

|

CNH Industrial |

2013 |

London, UK |

|

AGCO Corporation |

1990 |

Duluth, Georgia, USA |

|

Mahindra & Mahindra |

1945 |

Mumbai, India |

- Massey Ferguson: In January 2024, Massey Ferguson launched a new range of tractors specifically designed for African terrains. The MF 5700 Series focuses on reducing fuel consumption, catering to farmers in regions with high fuel costs. The new tractors are equipped with advanced GPS technologies to enable precision farming, which has been a key demand in the growing agricultural sector across Sub-Saharan Africa.

- CNH Industrial: In August 2023, CNH Industrial announced its acquisition of Raven Industries, a leading provider of precision agriculture technologies. This acquisition is part of CNHs strategy to strengthen its product offerings in the MEA region, particularly focusing on autonomous and precision farming tractors. This acquisition will enable CNH Industrial to offer advanced technologies that enhance farming efficiency, particularly in areas facing labor shortages.

MEA Tractor Market Analysis

Growth Drivers

- Agricultural Mechanization Demand

The demand for agricultural mechanization across the MEA region is increasing due to the need for higher agricultural productivity and efficiency. In 2023, the FAO reported that the average farm in Sub-Saharan Africa operates on a manual labor-intensive model. Mechanization has reduced labor costs by approximately $300 per hectare in regions like Kenya and Ethiopia, driving the adoption of tractors to increase farm output and ensure food security. - Infrastructure Projects Expansion (2022-2024)

Infrastructure development across the MEA region is another critical driver for tractor demand. For instance, the Tanzania Transport Sector Support Program (2022) allocated $1.4 billion to road and infrastructure projects. Tractors are in high demand for road construction, earth-moving, and land preparation. The large-scale investment in construction and infrastructure across countries like Tanzania, Nigeria, and Egypt significantly drives the demand for tractors. - Food Security and Government Subsidies

To address food security challenges, several MEA governments have introduced tractor purchase subsidies. For example, the Ethiopian Agricultural Transformation Agency (2022) announced a subsidy program providing farmers with up to 50% of the cost of purchasing tractors to modernize farming practices. This initiative helped increase tractor sales and support the country's goal of improving agricultural productivity.

Challenges

- High Cost of Tractors: Despite government subsidies, the high cost of tractors remains a significant barrier to adoption, especially for small-scale farmers. In 2024, the average price of a medium-sized tractor in the MEA region ranges from $20,000 to $50,000, which is beyond the reach of many farmers in Sub-Saharan Africa. The high capital investment required restricts growth among smallholder farmers.

- Lack of Financing Options: The limited availability of agricultural financing remains a challenge, particularly in countries such as Nigeria and Sudan. According to (2023), very few of farmers in the region have access to formal financing for purchasing tractors or other mechanized equipment. This lack the African Development Bank of financial access delays market growth and mechanization adoption.

Government Initiatives

- Agricultural Mechanization Initiative (Nigeria, 2022): In 2022, the Nigerian government launched the National Agricultural Mechanization and Supply Enhancement Scheme (NAMSES). This initiative aimed to distribute over 10,000 tractors to farmers across the country. The program was allocated $500 million to support mechanization efforts and improve farm output, demonstrating the government's commitment to modernizing agriculture.

- Green Saudi Initiative (Saudi Arabia, 2023): The Green Saudi Initiative (2023) is part of a broader plan to enhance sustainable farming and increase mechanization in agriculture. With an initial funding of $3 billion, the initiative promotes the use of eco-friendly tractors to reduce carbon emissions in farming operations, aligning with the kingdom's vision for a sustainable future and increasing the demand for tractors in the agriculture sector.

MEA Tractor Market Future Outlook

The MEA tractor market is expected to experience substantial growth over the next five years, driven by government investments in agriculture and infrastructure development. Mechanization of the agricultural sector is likely to increase significantly as countries strive to enhance food security and reduce dependency on imports. Government initiatives promoting sustainable and eco-friendly farming practices will play a pivotal role in driving market expansion.

Future Trends

- Rise of Autonomous Tractors: In the coming years, autonomous tractors will become a significant trend in the MEA region. These self-driving tractors will reduce labor costs and improve farm efficiency by enabling 24/7 operations. With technological advancements, autonomous tractors will cater to large-scale farms in Sub-Saharan Africa, providing precision in planting, harvesting, and soil preparation.

- Adoption of Sustainable Tractors: The demand for environmentally friendly tractors will rise, driven by government policies focused on reducing carbon emissions in farming operations. Electric and hybrid tractors will become more prevalent as countries implement stricter environmental regulations and subsidies for sustainable farming practices.

Scope of the Report

|

By Product Type |

Row Crop Tractors Utility Tractors Compact Tractors |

|

By Horsepower Range |

Less than 40 HP 40-100 HP Above 100 HP |

|

By Application |

Agricultural Use (Field Preparation, Crop Management) Construction Use (Infrastructure, Road Development) Industrial Use |

|

By End-User |

Large-Scale Commercial Farmers Small and Medium Farmers Construction Firms |

|

By Region |

Israel, United Arab Emirates Jordan, Morocco South Africa Rest of MEA |

Products

Key Target Audience

Tractor Manufacturers

Agricultural Machinery Distributors

Large-Scale Commercial Farmers

Construction Companies

Agriculture Ministries (Ethiopia, Nigeria, Saudi Arabia)

Infrastructure Development Agencies (Tanzania National Roads Agency)

Food Security Agencies (African Union)

Farm Equipment Leasing Companies

Irrigation Equipment Suppliers

Agricultural Cooperatives

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Agriculture, Egypt)

Companies

Major Players Mentioned in the Report

Massey Ferguson

John Deere

CNH Industrial

AGCO Corporation

Mahindra & Mahindra

CLAAS

Kubota Corporation

New Holland Agriculture

SAME Deutz-Fahr

Escorts Limited

TAFE Tractors

YTO Group

Table of Contents

1. MEA Tractor Market Overview

1.1. Definition and Scope (Agricultural and Construction Tractors)

1.2. Market Taxonomy (By Product Type, Horsepower, Region, End-User, Application)

1.3. Market Growth Rate (Key Macroeconomic Indicators)

1.4. Market Segmentation Overview (By Product Type, Horsepower Range, Application, End-User, Region)

1.5. Value Chain Analysis (Supply Chain Participants, Key Distribution Channels)

1.6. Market Dynamics (Growth Drivers, Challenges, Opportunities, and Trends)

2. MEA Tractor Market Size (USD Billion)

2.1. Historical Market Size (Agricultural and Construction Tractors)

2.2. Year-on-Year Growth Analysis (Business Growth Metrics)

2.3. Market Milestones and Key Developments (Notable Events Impacting Market Size)

3. MEA Tractor Market Growth Drivers, Challenges, and Opportunities

3.1. Growth Drivers

3.1.1. Rising Demand for Agricultural Mechanization (Specific Countries Focused)

3.1.2. Expansion of Infrastructure and Construction Projects (Road Development, Urbanization)

3.1.3. Government Subsidies and Initiatives (Subsidy Schemes, Food Security Initiatives)

3.2. Market Challenges

3.2.1. High Initial Capital Investment and Lack of Financing

3.2.2. Supply Chain Disruptions and Availability of Spare Parts

3.2.3. Limited Access to After-Sales Services (Rural vs. Urban Availability)

3.3. Market Opportunities

3.3.1. Increasing Adoption of Precision Agriculture Technologies

3.3.2. Collaboration with Local Distributors and Service Providers

3.3.3. Expansion into Untapped Rural Markets

4. MEA Tractor Market Segmentation

4.1. By Product Type (Value % Market Share in 2023)

4.1.1. Row Crop Tractors

4.1.2. Utility Tractors

4.1.3. Compact Tractors

4.2. By Horsepower Range (Value % Market Share in 2023)

4.2.1. Less than 40 HP

4.2.2. 40-100 HP

4.2.3. Above 100 HP

4.3. By Application (Value % Market Share in 2023)

4.3.1. Agricultural Use (Field Preparation, Crop Management)

4.3.2. Construction Use (Infrastructure, Road Development)

4.3.3. Industrial Use

4.4. By End-User (Value % Market Share in 2023)

4.4.1. Large-Scale Commercial Farmers

4.4.2. Small and Medium Farmers

4.4.3. Construction Firms

4.5. By Region (Value % Market Share in 2023)

4.5.1. into Israel

4.5.2 United Arab Emirates

4.5.3 Jordan

4.5.4 Morocco

4.5.5 South Africa

4.5.6 Rest of MEA

5. MEA Tractor Market Competitive Landscape

5.1. Market Share Analysis of Key Players (Value % Share in Market Segments)

5.2. Strategic Initiatives (Partnerships, Expansions, Product Innovations)

5.3. Mergers and Acquisitions (Impact on Market Share and Competitiveness)

5.4. Investment Analysis (Venture Capital, Government Grants, Private Equity)

5.5. Key Competitive Parameters (Number of Employees, Revenue, Product Offerings)

6. MEA Tractor Market Regulatory Framework

6.1. Government Regulations and Standards (Agricultural Mechanization Policies)

6.2. Compliance Requirements (Environmental and Emission Standards)

6.3. Certification Processes (Local Certification for Import and Sales)

7. MEA Tractor Market Technology Landscape

7.1. Technological Innovations (Precision Agriculture, GPS Systems, Automation)

7.2. Role of IoT and AI in Tractor Mechanization

7.3. Key Technological Partnerships (Tractor Manufacturers and Tech Firms)

8. MEA Tractor Market Future Outlook

8.1. Future Market Size Projections (USD Billion)

8.2. Key Factors Driving Future Growth (Expansion into Rural Markets, Demand for Sustainable Solutions)

9. MEA Tractor Market Future Segmentation

9.1. By Product Type (Future Projections in Market Share)

9.2. By Horsepower Range (Emerging Trends in 40-100 HP Tractors)

9.3. By Application (Increasing Demand in Infrastructure and Road Development)

9.4. By End-User (Growth in Commercial Farming and Large-Scale Operations)

9.5. By Region (Sub-Saharan Africa Leading Growth)

10. MEA Tractor Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis (Total Available Market, Serviceable Available Market, Serviceable Obtainable Market)

10.2. Customer Cohort Analysis (Segmentation by Size and Scope of Farms, Construction Projects)

10.3. White Space Opportunity Analysis (Emerging Market Segments, Unmet Needs)

Disclaimer

Contact US

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step 2: Market Building

Collating statistics on the MEA Tractor Market over the years, analyzing the penetration of MEA Tractor technologies, and computing the revenue generated for the market. This step also involves reviewing technology adoption rates and application effectiveness to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple MEA Tractor companies to understand the nature of technology segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these MEA Tractor companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the MEA tractor market?

The MEA tractor market was volumed at 1,00,000 units, driven by rising demand for agricultural mechanization and infrastructure development, particularly in Sub-Saharan Africa and the Middle East.

02. What are the challenges in the MEA tractor market?

Challenges in the MEA tractor market includes high capital costs, limited access to financing for small-scale farmers, and inadequate after-sales services, especially in rural areas. Supply chain disruptions also affect the availability of spare parts and machinery.

03. Who are the major players in the MEA tractor market?

Key players in the MEA tractor market include Massey Ferguson, John Deere, CNH Industrial, AGCO Corporation, Mahindra & Mahindra, CLAAS, and Kubota Corporation. These companies dominate through innovation, strategic partnerships, and a strong distribution network.

04. What are the growth drivers of the MEA tractor market?

Growth drivers include government subsidies for tractor purchases, increasing demand for agricultural mechanization, and infrastructure development projects. Government programs like Nigeria's NAMSES and Ethiopia's Agricultural Mechanization Initiative are key to driving growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.