North America Hexagonal Boron Nitride Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD8156

December 2024

82

About the Report

North America Hexagonal Boron Nitride Market Overview

- The North America Hexagonal Boron Nitride (hBN) market is valued at USD 249 million based on a five-year historical analysis. The market is primarily driven by its expanding use in the automotive, aerospace, and electronics sectors, where hBN's thermal conductivity and electrical insulation properties make it essential for high-performance applications.

- The United States is a dominant player in the market, largely due to its robust automotive and aerospace industries. The U.S. market benefits from extensive R&D activities in high-end electronic and semiconductor applications, where hBN is crucial. In addition, Mexico and Canada are emerging players, particularly in the automotive and manufacturing sectors.

- The U.S. government has allocated over $1.5 billion in research grants for the development of advanced materials, including boron-based compounds like hexagonal boron nitride, under its 2024 fiscal budget. This funding supports research institutions and private companies in exploring new applications for hBN in energy storage, electronics, and aerospace. Such initiatives aim to lower the cost of production and enhance the material's performance through technological advancements.

North America Hexagonal Boron Nitride Market Segmentation

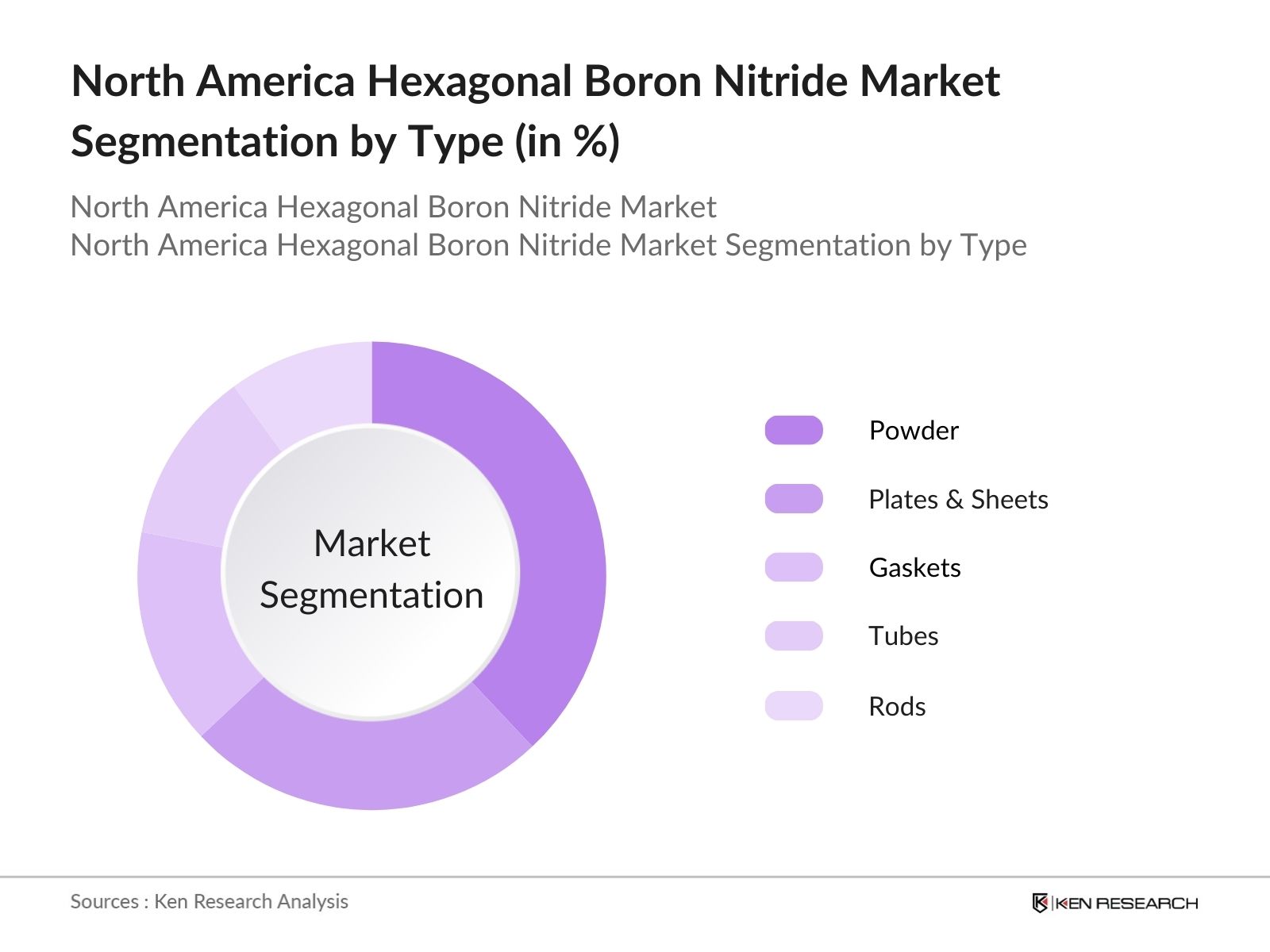

By Type: The market is segmented by type into tubes, rods, powder, gaskets, and plates and sheets. Powder dominates the type segment due to its versatility and wide application across industries. Hexagonal boron nitride in powder form is used extensively in coatings, lubricants, and thermal insulation, making it the most demanded product type. Its widespread use in manufacturing processes like sintering and as an additive in industrial applications has driven its dominance.

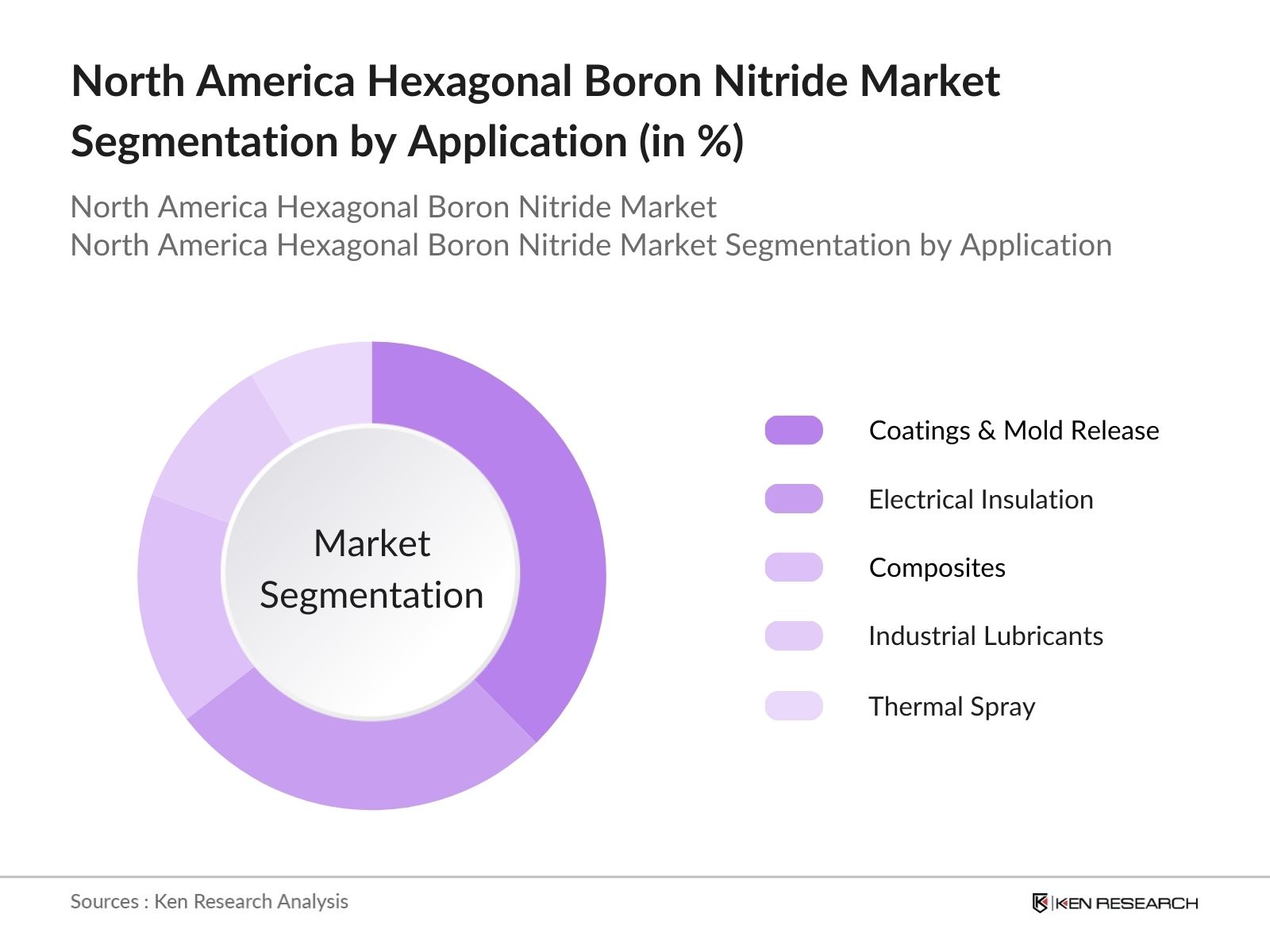

By Application: The market is segmented by application into coatings & mold release, electrical insulation, composites, industrial lubricants, thermal spray, personal care, and other applications. Coatings and mold release is the leading application segment, fueled by the growing use of hBN in industrial lubricants and high-performance coatings in automotive and aerospace sectors. These coatings provide superior durability and thermal resistance, essential in high-stress environments like aircraft engines and automotive components.

North America Hexagonal Boron Nitride Market Competitive Landscape

The market is moderately consolidated, with key players dominating through extensive product portfolios and technological advancements. Companies in this space focus on expanding their presence across different applications, particularly in high-performance industries such as aerospace and electronics.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

Product Portfolio |

Production Capacity |

Regional Presence |

Key Clients |

|

3M |

1902 |

Minnesota, USA |

|||||

|

Momentive Performance Materials |

1940 |

New York, USA |

|||||

|

Hgans AB |

1797 |

Hgans, Sweden |

|||||

|

Saint-Gobain |

1665 |

La Dfense, France |

|||||

|

Kennametal Inc. |

1938 |

Pennsylvania, USA |

North America Hexagonal Boron Nitride Market Analysis

Market Growth Drivers

- Growing Demand in Electronics Sector: Hexagonal Boron Nitride (hBN) is witnessing increased demand from the electronics industry due to its superior thermal conductivity and electrical insulation properties. In 2024, the electronics sector in North America is expected to grow by approximately 3.5 million units, driving the demand for materials like hBN.

- Increased Application in Aerospace Industry: The aerospace industry in North America is also fueling demand for hexagonal boron nitride due to its unique properties like high temperature resistance and lubrication in extreme conditions. With over 6,000 new aircrafts expected to be delivered in North America by 2026, the demand for hBN-based coatings and composites will grow significantly.

- Rising Demand from Lubricants Industry: In North America, hBN is increasingly used in the formulation of high-performance lubricants, especially in industries like automotive and heavy machinery. By 2024, the automotive manufacturing sector is forecasted to produce over 8 million vehicles annually, contributing to the growing need for advanced lubricants.

Market Challenges

- Supply Chain Disruptions: Supply chain instability is another challenge affecting the availability of raw materials used in hBN production. The U.S.-China trade tensions and disruptions in mining activities, particularly for boron, are projected to affect the supply of critical raw materials. In 2024, the import of boron-based raw materials into North America is expected to experience a shortage of around 300 tons.

- Environmental and Regulatory Concerns: Stricter environmental regulations concerning the mining of boron and the use of chemical processes in hBN production are creating hurdles for manufacturers. Regulatory bodies like the U.S. Environmental Protection Agency (EPA) have been tightening restrictions on emissions from chemical processing plants, which directly impacts the production cost and timelines.

North America Hexagonal Boron Nitride Market Future Outlook

Over the next five years, the North America Hexagonal Boron Nitride indsutry is expected to experience steady growth, driven by advancements in nanotechnology and increasing demand in the aerospace and semiconductor sectors.

Future Market Opportunities

- Increased Adoption in Electric Vehicles (EVs): Over the next five years, the adoption of hBN in electric vehicle manufacturing is expected to rise due to its exceptional thermal conductivity, which helps manage heat in EV battery systems. By 2029, it is estimated that North America will produce over 4 million electric vehicles annually, with hBN playing a critical role in improving battery efficiency and extending vehicle range.

- Expansion into Energy Storage Applications: Hexagonal boron nitride will increasingly be used in energy storage systems, particularly in supercapacitors and batteries, to enhance energy density and thermal management. Between 2024 and 2029, investments in advanced energy storage technologies are expected to reach $200 billion in North America, with hBN gaining traction as a vital component in new-generation energy systems.

Scope of the Report

|

By Type |

Tubes Rods Powders Gaskets Plates |

|

By Application |

Coatings Electrical Insulation Composites Lubricants Thermal Spray Personal Care |

|

By End-User |

Automotive Aerospace Electronics Semiconductors Industrial Manufacturing |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Electronics and Semiconductor Companies

Industrial Lubricant Manufacturers

Personal Care Product Manufacturers

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency)

Investors and Venture Capitalist Firms

Research and Development Institutions (excluding market research firms)

Companies

Players Mentioned in the Report:

3M

Momentive Performance Materials

Hgans AB

Kennametal Inc.

Saint-Gobain

Henze Boron Nitride Products AG

ZYP Coatings, Inc.

American Elements

Denka Company Limited

Grolltex Inc.

Table of Contents

North America Hexagonal Boron Nitride Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Hexagonal Boron Nitride Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Hexagonal Boron Nitride Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Automotive Sector (due to thermal management applications)

3.1.2. Expansion of Semiconductor and Electronics Industries (enhanced demand for insulation)

3.1.3. Technological Advancements in Refractory Materials

3.1.4. Rising Utilization in Personal Care Products (cosmetics and skin care applications)

3.2. Market Challenges

3.2.1. High Raw Material Costs (impact on pricing)

3.2.2. Environmental Regulations (compliance costs)

3.2.3. Limited Availability of High-Quality Grades

3.3. Opportunities

3.3.1. Expanding Aerospace Applications (due to light-weight properties)

3.3.2. Growth in Lubrication Solutions (industrial uses in extreme environments)

3.3.3. Increasing Demand for High-End Electronics

3.4. Trends

3.4.1. Use of Hexagonal Boron Nitride in Advanced Coatings

3.4.2. Integration in 5G Infrastructure

3.4.3. Application in New Thermal Conductive Materials

3.5. SWOT Analysis

3.6. Porters Five Forces Analysis

North America Hexagonal Boron Nitride Market Segmentation

4.1. By Type (In Value %)

4.1.1. Tubes

4.1.2. Rods

4.1.3. Powders

4.1.4. Gaskets

4.1.5. Plates and Sheets

4.2. By Application (In Value %)

4.2.1. Coatings & Mold Release

4.2.2. Electrical Insulation

4.2.3. Composites

4.2.4. Industrial Lubricants

4.2.5. Thermal Spray

4.2.6. Personal Care

4.2.7. Other Applications

4.3. By End-User (In Value %)

4.3.1. Automotive

4.3.2. Aerospace

4.3.3. Electronics

4.3.4. Semiconductors

4.3.5. Industrial Manufacturing

4.4. By Region (In Value %)

4.4.1. United States

4.4.2. Canada

4.4.3. Mexico

North America Hexagonal Boron Nitride Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3M

5.1.2. Hgans AB

5.1.3. Momentive Performance Materials

5.1.4. Kennametal Inc.

5.1.5. Saint-Gobain

5.1.6. Henze Boron Nitride Products AG

5.1.7. ZYP Coatings Inc.

5.1.8. American Elements

5.1.9. Denka Company Limited

5.1.10. Grolltex Inc.

5.1.11. Resonac Corporation

5.1.12. Zibo Sinyo Nitride Materials Co. Ltd

5.1.13. UK Abrasives, Inc.

5.1.14. Haydale Technologies

5.1.15. Miushima Ferroalloy

5.2. Cross Comparison Parameters (Market Share, Product Range, R&D Investment, Production Capacity, Regional Presence, Key Clients, Revenue, Employee Count)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

North America Hexagonal Boron Nitride Market Regulatory Framework

6.1. Environmental Standards

6.2. Safety and Compliance Requirements

6.3. Industry-Specific Certifications

North America Hexagonal Boron Nitride Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Hexagonal Boron Nitride Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Key Target Segments

8.3. Strategic Marketing Initiatives

8.4. Expansion Strategies for Key Players

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved creating an ecosystem map that included key stakeholders, such as manufacturers, end-users, and regulatory bodies in the North American Hexagonal Boron Nitride Market. Extensive desk research was conducted using both secondary and proprietary databases to define critical market drivers and variables.

Step 2: Market Analysis and Construction

Next, historical market data was analyzed to assess the growth trends of key segments, such as automotive and electronics applications. Market penetration levels and revenue generation for each application were carefully examined to ensure accurate estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around market growth drivers and future projections were validated through interviews with industry experts from key companies. These insights provided deeper operational and financial knowledge to refine our market estimates.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing all collected data from primary and secondary research sources, ensuring a comprehensive and validated analysis. This process involved engaging with multiple manufacturers for detailed insights into sales performance and market trends.

Frequently Asked Questions

How big is the North America Hexagonal Boron Nitride Market?

The North America hexagonal boron nitride market was valued at USD 249 million. This growth is driven by rising demand in the automotive and aerospace industries for thermal management solutions.

What are the challenges in the North America Hexagonal Boron Nitride Market?

Key challenges in the North America hexagonal boron nitride market include high raw material costs, strict environmental regulations, and the limited availability of premium-grade hBN products. These factors add complexity to manufacturing processes and drive up production costs.

Who are the major players in the North America Hexagonal Boron Nitride Market?

Major players in the North America hexagonal boron nitride market include 3M, Momentive Performance Materials, Hgans AB, Kennametal Inc., and Saint-Gobain. These companies lead the market through extensive product offerings and strategic investments in R&D.

What are the growth drivers of the North America Hexagonal Boron Nitride Market?

The North America hexagonal boron nitride market is driven by the increasing demand for hBN in high-performance applications such as coatings, industrial lubricants, and electrical insulation, particularly in the automotive and aerospace sectors.

What are the future prospects of the North America Hexagonal Boron Nitride Market?

The future of the North American hBN market looks promising, with expected growth in sectors like 5G infrastructure, electric vehicle manufacturing, and advanced coatings for aerospace and industrial applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.