US Onshore Drilling Fluid Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD5740

December 2024

87

About the Report

US Onshore Drilling Fluid Market Overview

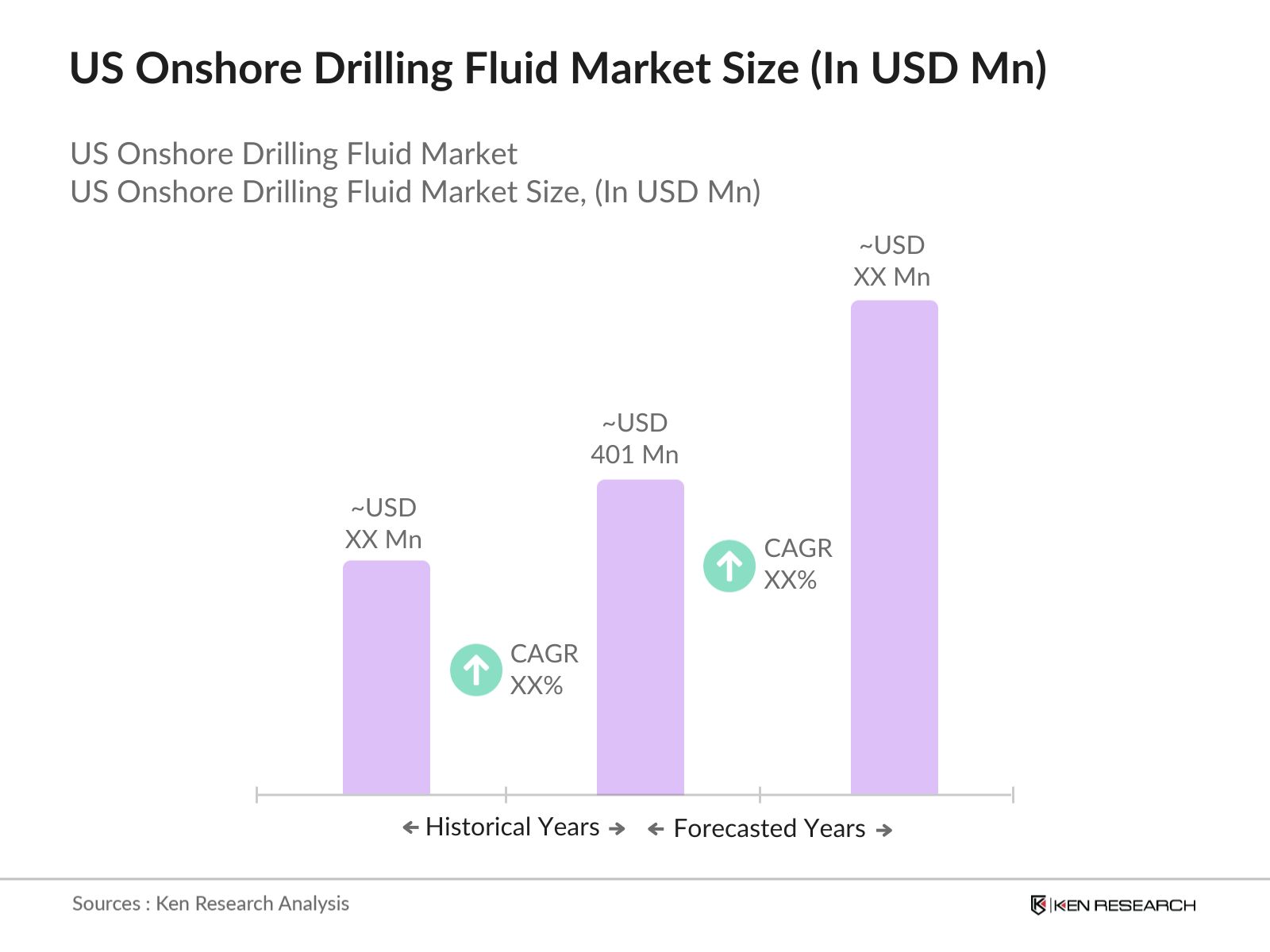

- The US onshore drilling fluid market, based on a five-year historical analysis, is valued at USD 401 million, driven by the surge in horizontal drilling activities and advancements in fluid composition. The growing demand for oil and gas exploration across unconventional wells, including shale and tight oil, necessitates specialized drilling fluids that ensure operational efficiency and environmental compliance. Government regulations encouraging the adoption of environmentally friendly drilling solutions are further boosting market demand.

- Texas, New Mexico, and North Dakota dominate this market due to their vast shale reserves and high oil production levels. These regions have established infrastructure and significant investment from key energy firms, contributing to their leading position in the market. Enhanced recovery techniques and favorable regulatory support for onshore drilling activities also solidify these regions' dominance.

- Federal and state environmental compliance laws heavily influence drilling fluid formulations and disposal practices. The U.S. EPA has mandated that by 2024, all onshore drilling projects adhere to new disposal standards for high-toxicity fluids, particularly in regions like the Appalachians. These regulations emphasize minimizing ecological risks associated with fluid disposal.

US Onshore Drilling Fluid Market Segmentation

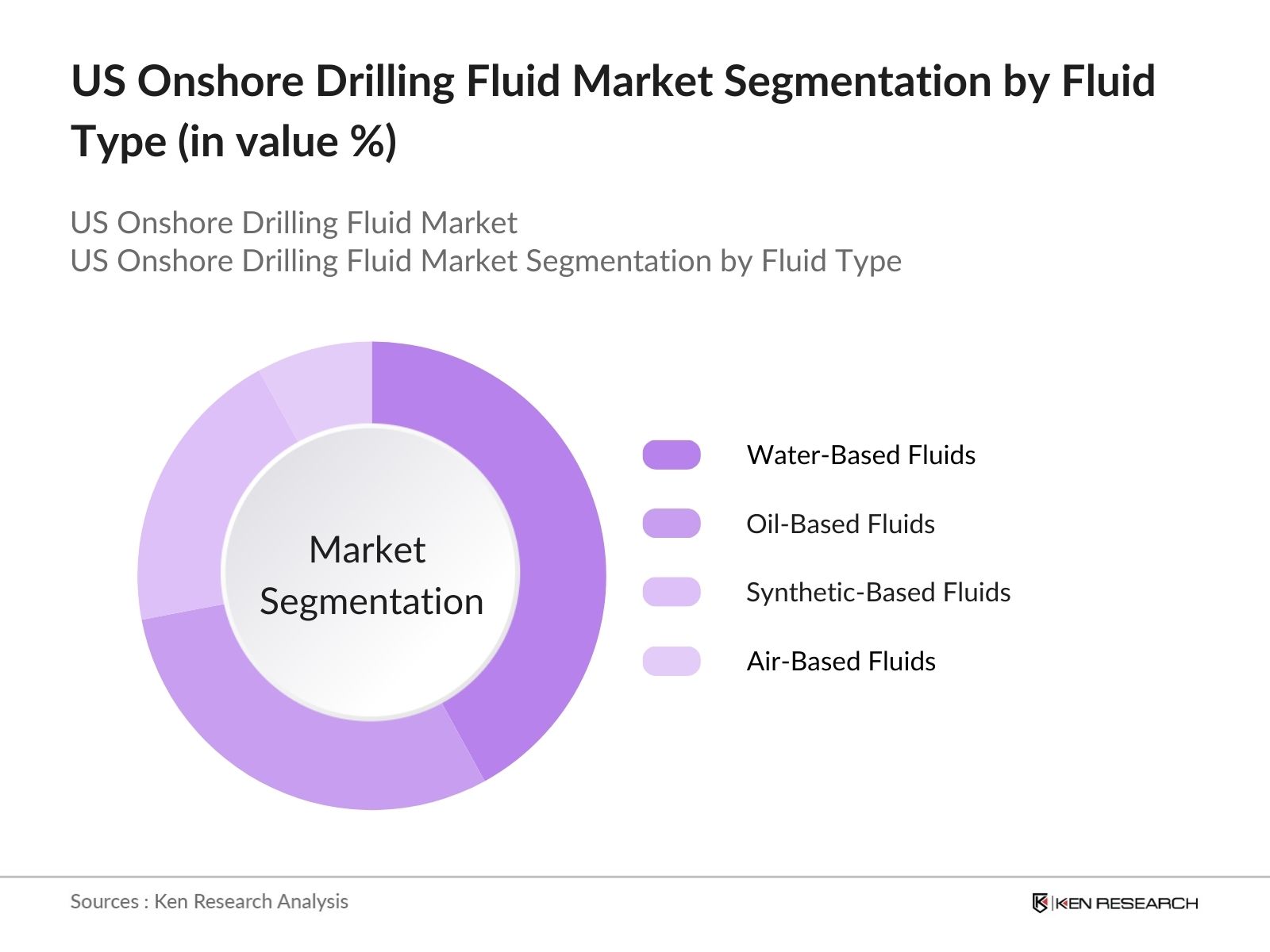

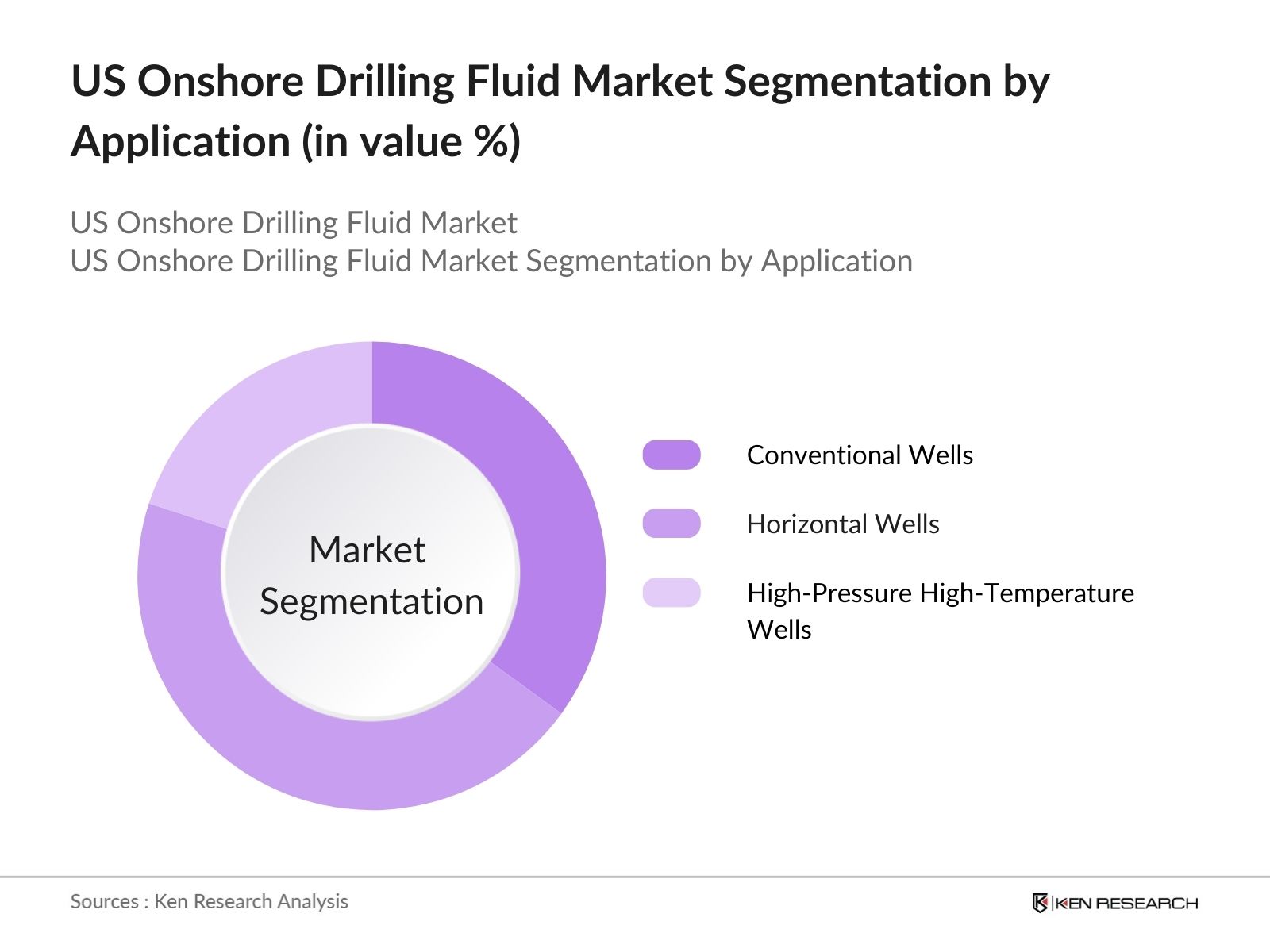

The US onshore drilling fluid market is segmented by fluid type and by application.

- By Fluid Type: The US onshore drilling fluid market is segmented by fluid type into water-based fluids, oil-based fluids, synthetic-based fluids, and air-based fluids. Water-based fluids hold the dominant market share under the fluid type segment due to their cost-effectiveness and environmental compliance. Their lower toxicity compared to oil-based fluids makes them a preferred choice for many drilling operations, especially in areas with strict environmental regulations. Additionally, advancements in water-based fluid formulations have improved their compatibility with high-pressure, high-temperature wells.

- By Application: The market is further segmented by application into conventional wells, horizontal wells, and high-pressure, high-temperature (HPHT) wells. Horizontal wells dominate this segment due to the increasing adoption of horizontal drilling techniques in shale formations. This method maximizes oil recovery, requiring specialized drilling fluids to manage downhole pressures and maintain borehole stability. The high operational efficiency and enhanced production output from horizontal wells support the dominance of this segment.

US Onshore Drilling Fluid Market Competitive Landscape

The US onshore drilling fluid market is dominated by a few key players, including Baker Hughes, Halliburton Company, Schlumberger Limited, and Newpark Resources Inc., all of which leverage their extensive R&D capabilities and established distribution networks. This consolidation underscores the market's competitive nature, where major players prioritize innovation in fluid formulations and sustainable practices.

US Onshore Drilling Fluid Market Analysis

Growth Drivers

- Increase in Horizontal Drilling Activities (Impact on Fluid Composition)

Horizontal drilling has expanded considerably in the U.S. onshore market, directly affecting drilling fluid requirements. As of 2024, horizontal wells account for over 70% of total wells drilled in the U.S., especially in shale-heavy regions like Texas and North Dakota, where enhanced fluid composition is required for extended lateral reach. This shift has increased the demand for specialized drilling fluids with specific rheological properties to manage higher friction and torque. - Technological Advancements in Fluid Systems (Enhanced Rheology Control)

Advancements in drilling fluid technology have allowed for greater control over rheology, essential in high-stress environments. Modern fluid systems, like water-based mud with superior viscosity control, are essential to support the drilling depth and pressure demands seen in fields such as the Permian Basin. The 2024 U.S. Energy Information Administration (EIA) report indicates technological developments in fluid systems reduced operational delays by approximately 15%, reflecting their importance in high-efficiency drilling. - Demand for Eco-Friendly and Biodegradable Fluids (Environmental Regulations): Growing environmental regulation has driven demand for eco-friendly fluids, a major trend given the increasing scrutiny on emissions and waste. U.S. EPA reports indicate that by 2024, 40% of new wells on federal land must utilize biodegradable or eco-friendly fluids to align with federal environmental goals. This shift is particularly visible in federal regulations that require reduced volatile organic compounds (VOCs) in drilling fluids, which has influenced operators to prioritize such alternatives in environmentally sensitive areas.

Market Challenges

- High Disposal and Recycling Costs (Environmental and Regulatory Concerns)

Disposal and recycling costs of drilling fluids remain a significant challenge due to stringent waste management requirements. According to the U.S. EPA, companies on average spend upwards of $12,000 per well on fluid disposal and recycling to meet regulatory standards, particularly in densely regulated states like California. This added cost reflects the high environmental compliance burden in the onshore drilling market. - Volatile Crude Oil Prices (Impact on Drilling Activities)

Crude oil price volatility affects drilling budgets, influencing fluid demand in U.S. onshore operations. With the average price of West Texas Intermediate crude fluctuating between $70-$85 per barrel in 2024, drilling companies have scaled back non-essential operations, impacting the frequency and volume of drilling fluid procurement. EIA data reveals that during periods of price decline, onshore drilling decreases by up to 18%, affecting fluid usage directly.

US Onshore Drilling Fluid Market Future Outlook

The US onshore drilling fluid market is expected to witness significant growth in the coming years, propelled by continuous advancements in fluid technology, environmental concerns, and increased shale exploration. Industry players are focusing on eco-friendly fluid solutions and sustainable practices, which align with both regulatory requirements and investor preferences. Additionally, growth in unconventional well activities and enhanced recovery techniques promise to boost market demand and drive innovation across drilling fluid formulations.

Market Opportunities

- Adoption of Synthetic-Based Fluids: The adoption of synthetic-based fluids presents significant growth potential, especially as operators seek to reduce environmental impact while maintaining performance. In 2024, over 25% of U.S. onshore drilling sites are utilizing synthetic-based fluids, driven by their low toxicity and improved biodegradability, as indicated by the U.S. Department of Energy. This adoption aligns with increased regulatory pressure to minimize ecological disturbance from drilling activities.

- Potential in Unconventional Resources (Shale, Tight Gas)

With the rise of shale and tight gas development, particularly in formations like Marcellus and Utica, there is a growing demand for robust drilling fluids capable of handling the specific challenges of these formations. Data from the U.S. Geological Survey show that shale gas production is set to increase by 8% through 2024, emphasizing the need for fluids with enhanced lubricity and shale inhibition properties in these unconventional reservoirs.

Scope of the Report

| By Fluid Type | Water-Based Fluids Oil-Based Fluids Synthetic-Based Fluids Air-Based Fluids |

| By Application | Conventional Wells Horizontal Wells High-Pressure High-Temperature (HPHT) Wells |

| By Additive Type | Rheology Modifiers Weighting Agents Corrosion Inhibitors Shale Inhibitors |

| By Well Type | Shallow Wells Deep Wells Ultra-Deep Wells |

| By Region | North East West South |

Products

Key Target Audience

Oil and Gas Exploration Companies

Drilling Fluid Manufacturers and Suppliers

Environmental Regulatory Bodies (EPA, OSHA)

Research and Development Institutes (Specific to Oil & Gas)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Energy, Texas Commission on Environmental Quality)

Onshore Drilling Service Providers

Chemical and Additive Suppliers for Drilling Fluids

Companies

Players Mention in the Report:

Baker Hughes

Halliburton Company

Schlumberger Limited

Newpark Resources Inc.

Tetra Technologies, Inc.

AES Drilling Fluids, LLC

QMAX Solutions Inc.

M-I SWACO

Canadian Energy Services & Technology Corp.

Rockwater Energy Solutions

Secure Energy Services

Scomi Group Bhd

National Oilwell Varco

Gumpro Drilling Fluids Pvt. Ltd.

Weatherford International

Table of Contents

US Onshore Drilling Fluid Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

US Onshore Drilling Fluid Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

US Onshore Drilling Fluid Market Analysis

3.1 Growth Drivers

3.1.1 Increase in Horizontal Drilling Activities (Impact on Fluid Composition)

3.1.2 Technological Advancements in Fluid Systems (Enhanced Rheology Control)

3.1.3 Demand for Eco-Friendly and Biodegradable Fluids (Environmental Regulations)

3.1.4 Shale Boom and Tight Oil Exploration

3.2 Market Challenges

3.2.1 High Disposal and Recycling Costs (Environmental and Regulatory Concerns)

3.2.2 Volatile Crude Oil Prices (Impact on Drilling Activities)

3.2.3 Complex Formulation Requirements (High Temperature, High Pressure Wells)

3.3 Opportunities

3.3.1 Adoption of Synthetic-Based Fluids

3.3.2 Potential in Unconventional Resources (Shale, Tight Gas)

3.3.3 Increased Investment in R&D (Enhanced Recovery Techniques)

3.4 Trends

3.4.1 Shift to Low-Toxicity Oil-Based Fluids (Compliance Standards)

3.4.2 Integration of Digital Monitoring Systems in Fluid Management

3.4.3 Increasing Use of Nanotechnology for Fluid Additives

3.5 Government Regulation

3.5.1 Federal and State-Level Environmental Compliance

3.5.2 Waste Management and Disposal Standards (EPA Regulations)

3.5.3 Water Usage and Conservation Laws

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

US Onshore Drilling Fluid Market Segmentation

4.1 By Fluid Type (In Value %)

4.1.1 Water-Based Fluids

4.1.2 Oil-Based Fluids

4.1.3 Synthetic-Based Fluids

4.1.4 Air-Based Fluids

4.2 By Application (In Value %)

4.2.1 Conventional Wells

4.2.2 Horizontal Wells

4.2.3 High-Pressure High-Temperature (HPHT) Wells

4.3 By Additive Type (In Value %)

4.3.1 Rheology Modifiers

4.3.2 Weighting Agents

4.3.3 Corrosion Inhibitors

4.3.4 Shale Inhibitors

4.4 By Well Type (In Value %)

4.4.1 Shallow Wells

4.4.2 Deep Wells

4.4.3 Ultra-Deep Wells

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 West

4.5.4 South

US Onshore Drilling Fluid Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Baker Hughes

5.1.2 Halliburton Company

5.1.3 Schlumberger Limited

5.1.4 Newpark Resources Inc.

5.1.5 Tetra Technologies, Inc.

5.1.6 Weatherford International

5.1.7 Canadian Energy Services & Technology Corp.

5.1.8 M-I SWACO

5.1.9 National Oilwell Varco

5.1.10 Scomi Group Bhd

5.1.11 AES Drilling Fluids, LLC

5.1.12 QMAX Solutions Inc.

5.1.13 Gumpro Drilling Fluids Pvt. Ltd.

5.1.14 Rockwater Energy Solutions

5.1.15 Secure Energy Services

5.2 Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Core Product Lines, Market Share, Inception Year, Key Contracts, Innovation Capabilities)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

US Onshore Drilling Fluid Market Regulatory Framework

6.1 Environmental Standards and Guidelines

6.2 Chemical Disclosure Requirements

6.3 Permitting Processes

6.4 Certification and Compliance Programs

US Onshore Drilling Fluid Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

US Onshore Drilling Fluid Future Market Segmentation

8.1 By Fluid Type (In Value %)

8.2 By Application (In Value %)

8.3 By Additive Type (In Value %)

8.4 By Well Type (In Value %)

8.5 By Region (In Value %)

US Onshore Drilling Fluid Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves developing an ecosystem framework, incorporating all stakeholders within the US onshore drilling fluid market. Secondary and proprietary data sources, such as industry reports and government publications, are utilized to identify critical market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical market data to evaluate penetration, segmental contributions, and revenue generation. Factors such as service quality and industry best practices are assessed to ensure data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are constructed based on initial data analysis, followed by validation through industry expert consultations. These include interviews with stakeholders from drilling companies and fluid manufacturers, providing insights into operational and financial trends.

Step 4: Research Synthesis and Final Output

The final phase synthesizes primary and secondary research insights to deliver a comprehensive analysis. This step includes direct interactions with manufacturers, ensuring accuracy in data representation and verifying growth trajectories in the onshore drilling fluid market.

Frequently Asked Questions

01. How big is the US onshore drilling fluid market?

The US onshore drilling fluid market was valued at USD 401 million, driven by the rising demand for oil and gas exploration and advanced fluid technologies.

02. What are the primary challenges in the US onshore drilling fluid market?

The main challenges in US onshore drilling fluid market include high costs associated with disposal and recycling, fluctuating crude oil prices impacting drilling investments, and the need for regulatory compliance with environmental standards.

03. Who are the major players in the US onshore drilling fluid market?

Key players in US onshore drilling fluid market include Baker Hughes, Halliburton, Schlumberger, Newpark Resources, and Tetra Technologies, each with a robust portfolio of innovative drilling fluid solutions.

04. What drives growth in the US onshore drilling fluid market?

US onshore drilling fluid market Growth is driven by increasing horizontal drilling activities, advancements in fluid formulation, and environmental regulations encouraging eco-friendly solutions.

05. What role do environmental regulations play in this market?

Environmental regulations significantly impact the market by promoting the use of low-toxicity and biodegradable fluids, which align with sustainable exploration practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.