USA Submarine Power Cables Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD8621

December 2024

84

About the Report

USA Submarine Power Cables Market Overview

- The USA Submarine Power Cables Market, with a valuation of USD 1.85 billion, is driven by the demand for offshore renewable energy, particularly wind power, and increasing inter-country power grid connectivity projects. The expanding deployment of high-capacity cables aligns with strategic energy goals and supports rising power requirements, particularly in coastal areas, which contributes to market size expansion.

- The Northeast USA and Gulf of Mexico are leading regions in the submarine power cables market. The Northeasts dominance stems from its offshore wind farm installations and progressive energy policies, while the Gulf of Mexico benefits from extensive oil and gas operations requiring robust subsea infrastructure. These regions operational scope and government support for renewable energy projects solidify their leading positions.

- The U.S. federal government has launched multiple offshore energy initiatives, including grants and tax incentives for offshore wind farm infrastructure. The Biden Administration, through the Department of Energy, allocated $500 million to support infrastructure that includes submarine cables. This investment prioritizes submarine cable installation for offshore-to-onshore connections, reinforcing the need for resilient and high-capacity cables.

USA Submarine Power Cables Market Segmentation

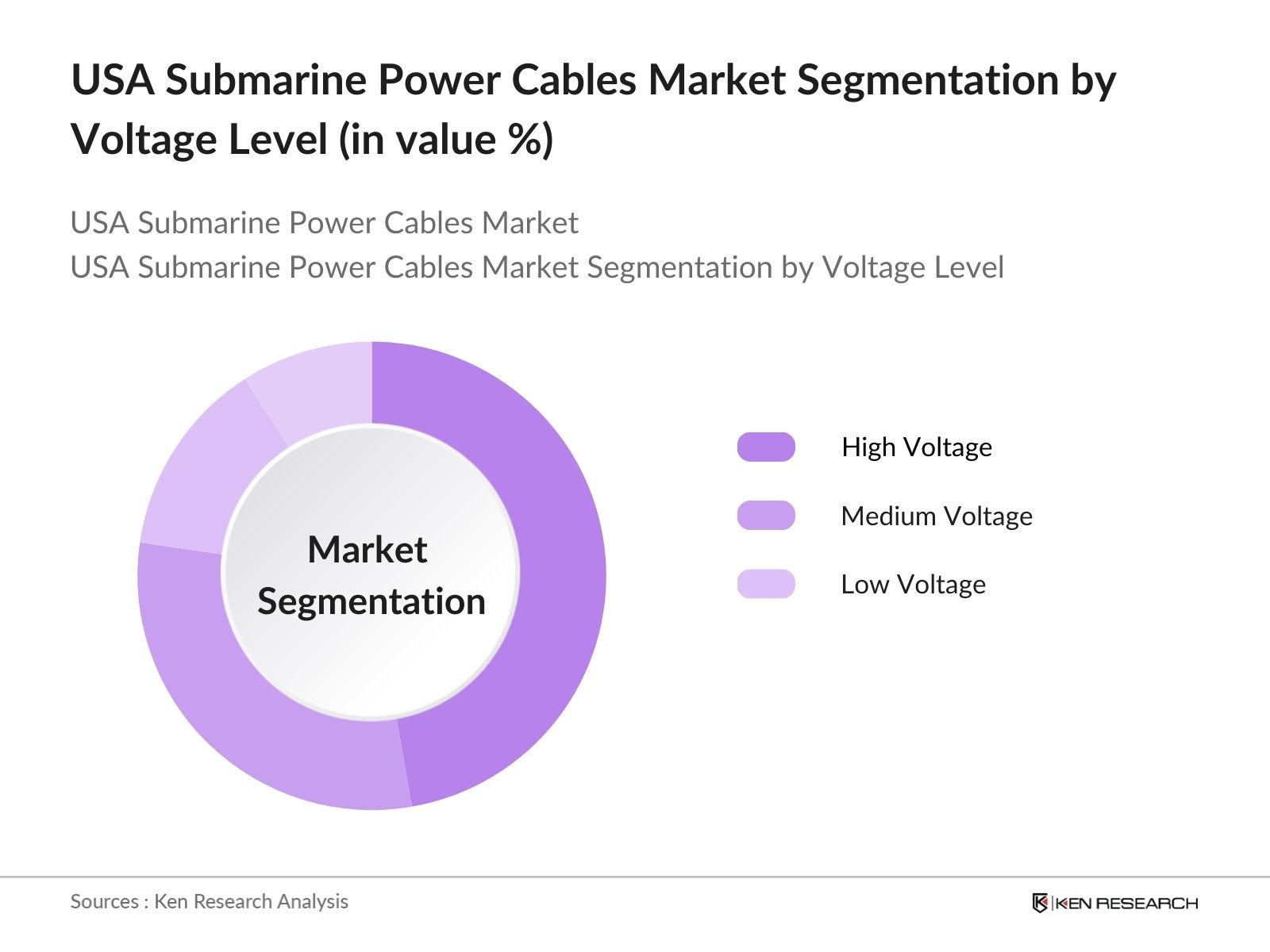

- By Voltage Level: The USA submarine power cables market is segmented by voltage level into high, medium, and low voltage categories. High voltage cables hold a dominant market share due to their extensive application in inter-country grid connections and offshore wind farms. Their superior capacity to handle high power transmissions across longer distances, particularly under deep-sea conditions, makes them indispensable for projects focusing on renewable energy integration and coastal energy distribution.

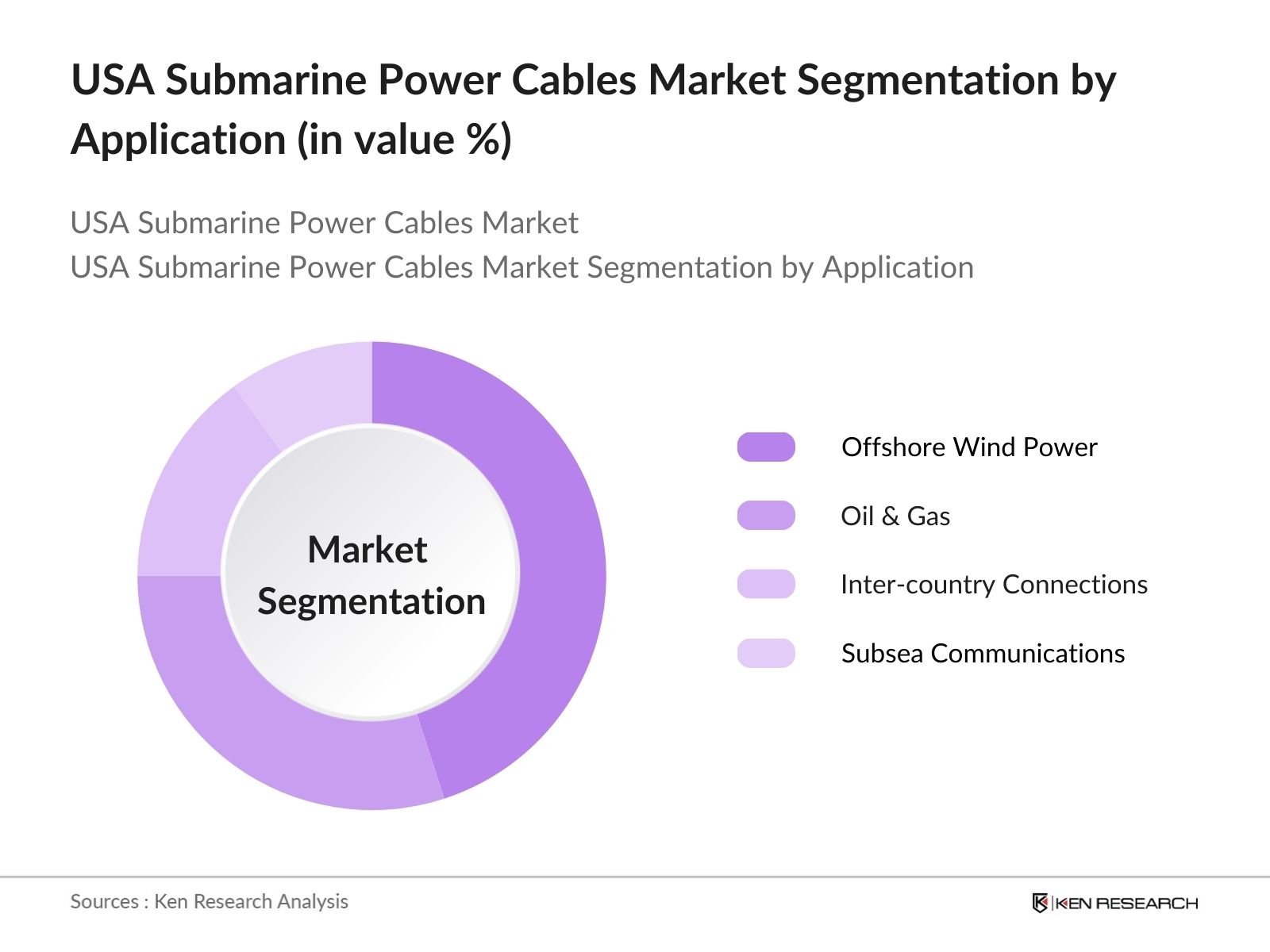

- By Application: The market is further segmented by application into offshore wind power, oil & gas, inter-country connections, and subsea communications. Offshore wind power leads this segment due to escalating investments and government backing for renewable energy projects. These installations require specialized, resilient cables capable of withstanding deep-sea conditions and high voltage demands, contributing to the applications dominant market share.

USA Submarine Power Cables Market Competitive Landscape

The USA submarine power cables market is marked by several key players, each contributing unique strengths in technology and operational scale. The market is dominated by firms like Prysmian Group and Nexans, which possess advanced technological portfolios and comprehensive service capacities, supporting large-scale infrastructure projects.

USA Submarine Power Cables Market Analysis

Market Growth Drivers

- Expansion of Offshore Wind Farms: The U.S. has seen substantial growth in offshore wind farms, with installed offshore wind capacity reaching 45 GW by early 2024, driven by federal incentives and state policies aimed at achieving zero emissions. This growth boosts demand for submarine power cables to connect offshore turbines to onshore grids, supporting coastal grid reliability and renewable energy supply. According to the U.S. Department of Energy, government funding for offshore wind projects stands at $2 billion annually, aiding infrastructure development and stimulating submarine cable demand.

- Increased Demand for Underwater Data Transmission: In 2024, the U.S. accounted for about 40% of global data center construction, underscoring the need for robust underwater data transmission networks. These submarine cables facilitate high-speed, secure data transfer between centers, particularly in coastal data hubs. An estimated 150 new submarine cables are under construction or planning in the U.S., primarily for intercontinental data networks, indicating substantial market opportunities for cable providers.

- Investment in Grid Interconnection Projects: The U.S. grid interconnection investment has increased sharply, with $3.5 billion allocated by the federal government toward infrastructure projects connecting renewable energy sources. The DOE's grid interconnection program, targeting both offshore and onshore connections, underscores the high priority of securing robust underwater connections. These initiatives are critical for stable renewable power transmission and are projected to drive a steady demand for submarine power cables.

Market Challenges

- High Installation and Maintenance Costs: Installing submarine cables in the U.S. offshore regions is complex and costly, with an average installation expense of around $100,000 per kilometer in 2023. Maintenance costs are similarly high due to technical demands and environmental challenges, including corrosion, marine animal interference, and seafloor instability. These cost factors, corroborated by government reports, pose entry barriers for new market participants and challenge cost efficiency for existing projects.

- Technical Complexity of Installation: The U.S. submarine power cable market faces challenges from technical complexities such as deep-sea installations, cable resilience against marine life interference, and potential damage from natural seismic activity. On average, 20-30 deep-sea cable repairs are required annually in the U.S., highlighting the need for highly resilient and technologically advanced cables capable of withstanding harsh underwater environments.

USA Submarine Power Cables Market Future Outlook

The USA submarine power cables market is poised for substantial growth over the next five years. The advancement in renewable energy sources, particularly offshore wind farms, along with favorable policies supporting intercontinental grid integration, are set to drive the industry forward. Companies are expected to focus on sustainable cabling solutions and invest in technologies to enhance cable resilience and operational efficiency in deep-sea applications.

Market Opportunities

- Technological Innovations: The U.S. market has increasingly adopted HVDC cables, with 10% more installations in 2024 compared to previous years, due to their efficiency in reducing power loss over long distances. HVDC cables facilitate reliable energy transmission between offshore sites and urban centers, enabling the U.S. to meet rising energy demands while minimizing environmental impacts. Investments in HVDC technology, backed by federal grants worth $1 billion, underscore growth prospects within the submarine cable sector.

- Increased Private-Public Partnerships: Private-public partnerships in the submarine cable sector have seen a 15% increase in funding since 2022, with federal agencies collaborating with private companies for underwater grid expansion projects. These partnerships enable shared risk and reduced costs for high-capital cable projects, fostering an environment conducive to innovation and infrastructural growth. Current funding for such partnerships stands at $3 billion, enhancing cable installation and maintenance capacities.

Scope of the Report

By Voltage Level | High Voltage Medium Voltage Low Voltage |

By Conductor Material | Copper Aluminum |

By Insulation Type | Cross-linked Polyethylene (XLPE) Polyvinyl Chloride (PVC) Others |

By Application | Offshore Wind Power Oil & Gas Inter-Country and Island Connections Subsea Communication |

By Region | Northeast West Coast Gulf of Mexico Great Lakes |

Products

Key Target Audience

Submarine Cable Manufacturers

Offshore Renewable Energy Firms

Oil & Gas Infrastructure Developers

Government and Regulatory Bodies (Department of Energy, Environmental Protection Agency)

Utility Providers and Power Companies

Banks and Financial Institutions

Technology and R&D Institutions

Investor and Venture Capitalist Firms

Maritime Infrastructure Developers

Companies

Players Mentioned in the Report

Prysmian Group

Nexans

General Cable

NKT Cables

LS Cable & System

Hengtong Marine Cable Systems Co., Ltd.

ZTT Group

Southwire Company, LLC

Sumitomo Electric Industries, Ltd.

Furukawa Electric Co., Ltd.

Table of Contents

1. USA Submarine Power Cables Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics and Growth Rate (Focus: Offshore Energy, Coastal Urbanization)

1.4. Market Segmentation Overview

2. USA Submarine Power Cables Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Milestones and Developments (Project Deployments, Technological Breakthroughs)

3. USA Submarine Power Cables Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Offshore Wind Farms

3.1.2. Government Renewable Energy Targets

3.1.3. Increased Demand for Underwater Data Transmission

3.1.4. Investment in Grid Interconnection Projects

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs

3.2.2. Technical Complexity of Installation (Deep Sea Conditions, Cable Resilience)

3.2.3. Environmental Regulations

3.3. Opportunities

3.3.1. Technological Innovations (High Voltage Direct Current (HVDC) Cables)

3.3.2. Increased Private-Public Partnerships

3.3.3. Rising Demand for Data Centers and Cloud Services

3.4. Trends

3.4.1. Shift to Sustainable Cabling Materials

3.4.2. Use of Advanced Monitoring Systems (Real-Time Condition Monitoring)

3.4.3. Integration with Renewable Energy Networks

3.5. Government Regulation and Policy Impact

3.5.1. Offshore Energy Initiatives

3.5.2. Environmental Compliance and Certification

3.5.3. Subsidies and Incentives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. USA Submarine Power Cables Market Segmentation

4.1. By Voltage Level (in Value %)

4.1.1. High Voltage

4.1.2. Medium Voltage

4.1.3. Low Voltage

4.2. By Conductor Material (in Value %)

4.2.1. Copper

4.2.2. Aluminum

4.3. By Insulation Type (in Value %)

4.3.1. Cross-linked Polyethylene (XLPE)

4.3.2. Polyvinyl Chloride (PVC)

4.3.3. Others

4.4. By Application (in Value %)

4.4.1. Offshore Wind Power

4.4.2. Oil & Gas

4.4.3. Inter-Country and Island Connections

4.4.4. Subsea Communication

4.5. By Region (in Value %)

4.5.1. Northeast

4.5.2. West Coast

4.5.3. Gulf of Mexico

4.5.4. Great Lakes

5. USA Submarine Power Cables Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Prysmian Group

5.1.2. Nexans

5.1.3. NKT Cables

5.1.4. ABB Ltd.

5.1.5. General Cable Corporation

5.1.6. Sumitomo Electric Industries, Ltd.

5.1.7. LS Cable & System

5.1.8. Hengtong Marine Cable Systems Co., Ltd.

5.1.9. Southwire Company, LLC

5.1.10. ZTT Group

5.1.11. Furukawa Electric Co., Ltd.

5.1.12. KEI Industries Limited

5.1.13. JDR Cable Systems Ltd.

5.1.14. Taihan Electric Wire Co., Ltd.

5.1.15. Tratos Cavi S.p.A.

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Public Funding)

5.7. Government Grants and Subsidies

5.8. Product Innovation & Development

6. USA Submarine Power Cables Market Regulatory Framework

6.1. Environmental Standards for Underwater Cables

6.2. Federal and State Compliance Requirements

6.3. Safety and Certification Processes

7. USA Submarine Power Cables Market Future Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. USA Submarine Power Cables Future Market Segmentation

8.1. By Voltage Level (in Value %)

8.2. By Conductor Material (in Value %)

8.3. By Insulation Type (in Value %)

8.4. By Application (in Value %)

8.5. By Region (in Value %)

9. USA Submarine Power Cables Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation & Needs Analysis

9.3. Key Marketing Initiatives

9.4. White Space and Opportunity Analysis

DisclaimerContact UsResearch Methodology

Step 1: Identification of Key Variables

The research initiates with identifying and mapping out essential variables across the USA submarine power cables ecosystem. Key stakeholders, including government bodies, private sector players, and end-users, are documented through extensive secondary research.

Step 2: Market Analysis and Construction

A robust analysis of historical data is carried out, focusing on market penetration, segment-specific demand, and revenue generation across key regions. This analysis provides insights into service distribution trends and reliability indicators.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses are validated through consultations with industry experts, leveraging insights from key players within the submarine cable manufacturing and energy sectors to refine data accuracy.

Step 4: Research Synthesis and Final Output

Direct interactions with multiple manufacturers allow for a comprehensive synthesis, enabling the final report to reflect an accurate depiction of product performance, market conditions, and future trends.

Frequently Asked Questions

01. How big is the USA Submarine Power Cables Market?

The USA submarine power cables market is valued at USD 1.85 billion, supported by the nations strategic offshore renewable energy expansion and grid interconnection projects, which require resilient underwater cabling solutions.

02. What are the challenges in the USA Submarine Power Cables Market?

Challenges include high installation costs, stringent environmental regulations, and complex logistical demands for underwater operations. These factors increase project overhead and require extensive planning.

03. Who are the major players in the USA Submarine Power Cables Market?

Key players include Prysmian Group, Nexans, General Cable, NKT Cables, and LS Cable & System. These companies dominate due to their technological advancements, established global networks, and strategic partnerships.

04. What factors are driving growth in the USA Submarine Power Cables Market?

Growth drivers encompass the expansion of offshore wind farms, investments in inter-country grid projects, and government-backed incentives for renewable energy infrastructure, all of which amplify the demand for high-capacity cables.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.