Vietnam LED Market Outlook to 2029

Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KRO034

June 2025

90

About the Report

Vietnam LED Market Overview

- The Vietnam LED market was valued at USD 735 million, based on a five-year historical analysis. Growth is primarily driven by increasing demand for energy-efficient lighting, urbanization, and government initiatives promoting LED adoption. The shift toward sustainable lighting has significantly influenced consumer preferences, leading to a surge in LED product sales across residential, commercial, and industrial sectors

- Key cities, such as Ho Chi Minh City and Hanoi, dominate the market due to their rapid urban development and high population densities. These urban centers are experiencing significant infrastructure projects and modernization efforts, which drive the demand for advanced lighting solutions. Additionally, the presence of major retailers and distributors in these cities facilitates the widespread availability of LED products.

- The Vietnamese government, through Directive 20/CT-TTg (2023), set a target for 100% of street lighting to use LED lights by the end of 2025, aiming to enhance energy efficiency and reduce emissions. However, there is no official policy mandating a complete phase-out of incandescent bulbs or a specific USD 300 million investment for this initiative in 2024

Vietnam LED Market Segmentation

By Source: The market is segmented into Traditional LED bulbs, LED tubes, and LED fixtures. Traditional LED bulbs dominate the market due to their affordability, ease of installation, and suitability for residential use. LED tubes are gaining popularity in commercial and industrial settings for their energy efficiency and longer operational life. LED fixtures, though currently a smaller segment, are witnessing rapid growth driven by modern architectural designs and integrated lighting solutions that offer enhanced aesthetics and performance.

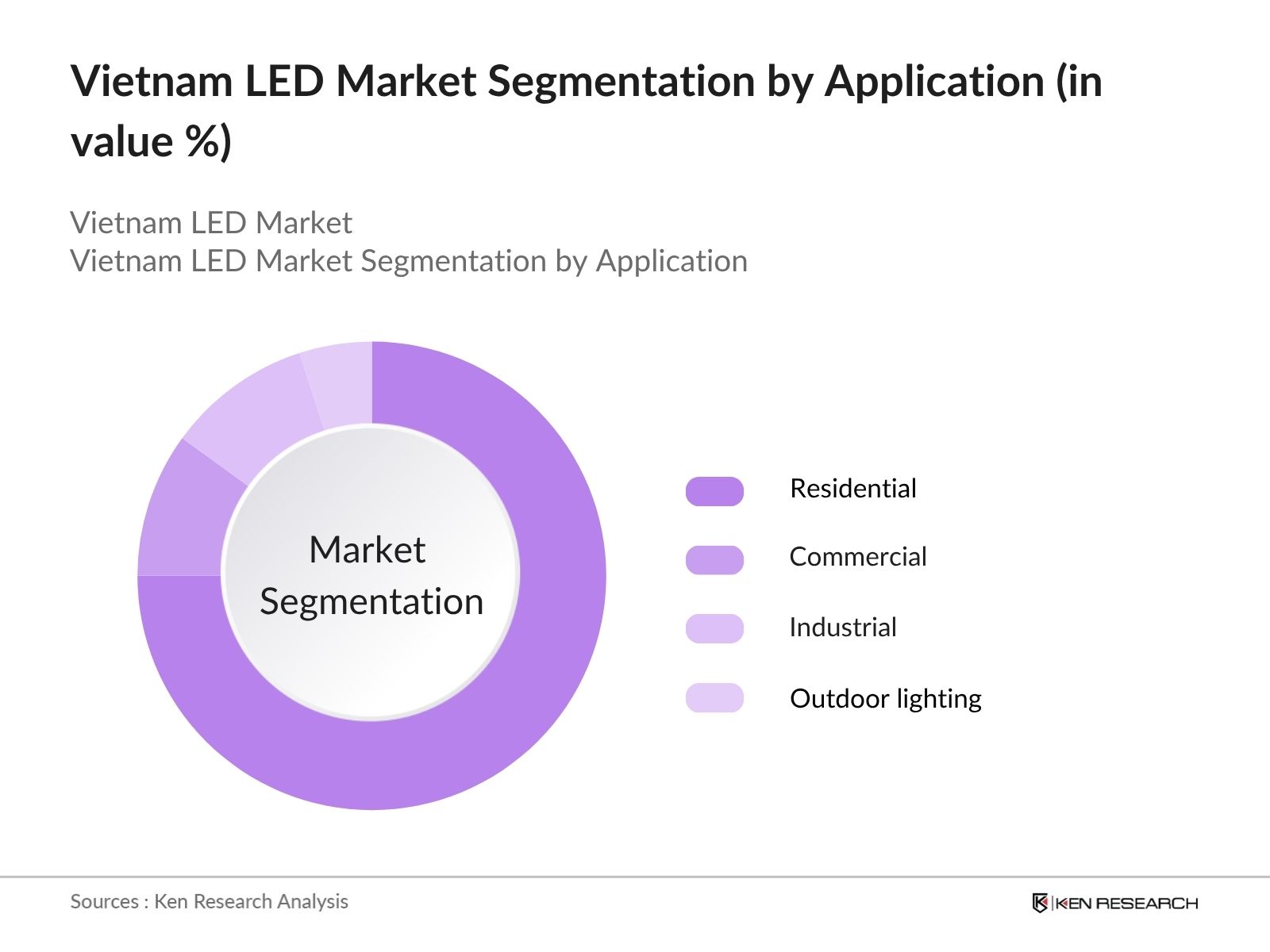

By Application: The market is segmented by application into residential, commercial, industrial, and outdoor lighting. The residential segment holds the largest share, fueled by rising adoption of energy-efficient LED solutions for home renovations and daily use. The commercial segment follows closely, with offices, retail spaces, and hospitality businesses investing in cost-saving lighting upgrades. Industrial lighting demand is growing in factories and warehouses for enhanced visibility and safety. Outdoor lighting is also expanding due to urban infrastructure projects and the need for street, landscape, and security lighting solutions.

Vietnam LED Market Competitive Landscape

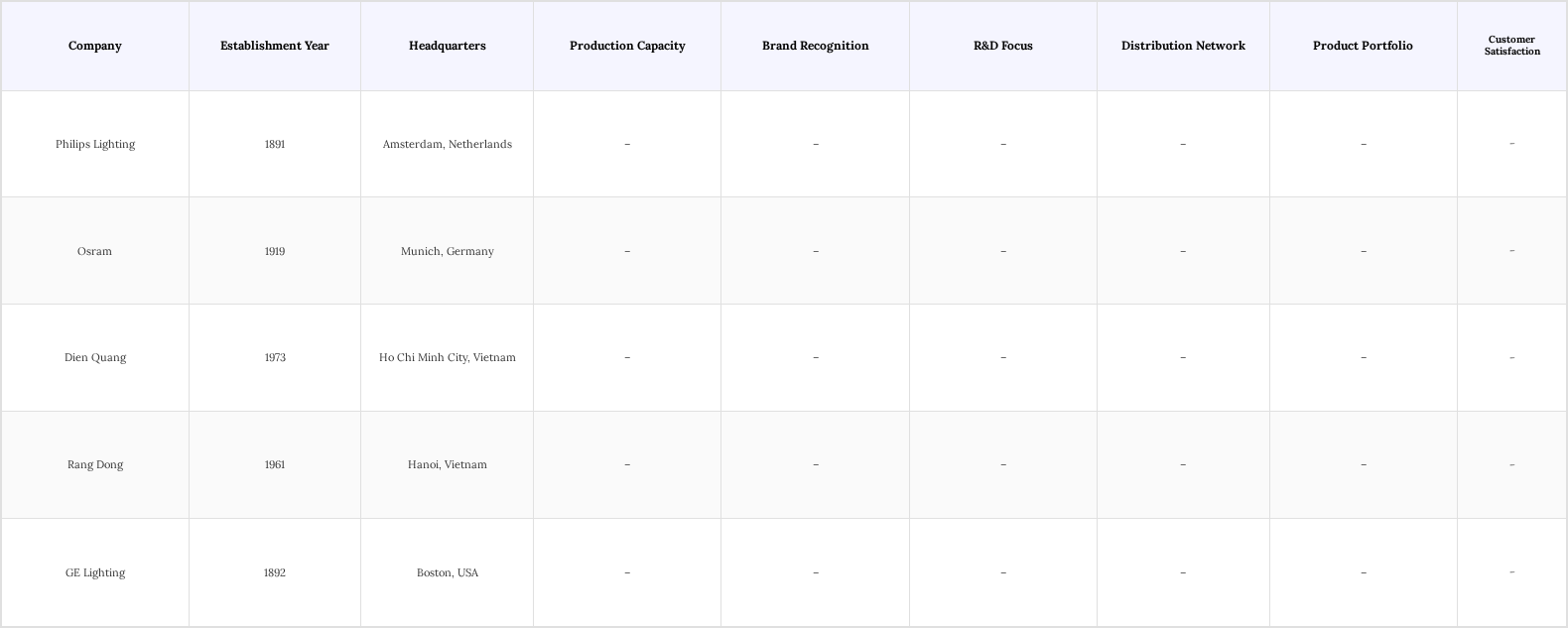

The Vietnam LED Market is characterized by a competitive landscape with several key players, including Philips Lighting, Osram, and local manufacturers such as Dien Quang and Rang Dong. These companies are actively engaged in product innovation and expanding their distribution networks to capture a larger market share. The market is moderately concentrated, with a mix of international and domestic firms competing on quality, price, and technological advancements.

Vietnam LED Market Industry Analysis

Growth Drivers

- Increasing Demand for Energy-Efficient Lighting Solutions: Vietnam’s government has mandated a minimum annual electricity savings of 2% from 2023 to 2025, with policies requiring all street lighting systems to use LED lights by the end of 2025. Rising electricity costs and government programs promoting energy-saving appliances are driving both consumers and businesses to adopt energy-efficient lighting solutions such as LEDs, supporting the country’s broader goals of reducing energy consumption and enhancing sustainability

- Government Initiatives Promoting LED Adoption: The Vietnamese government is accelerating LED adoption through a combination of subsidies, tax incentives, and regulatory mandates targeting energy efficiency in both the public and private sectors. Major national programs, including the Vietnam National Energy Efficiency Plan and the Vietnam Energy Efficient Public Lighting Project, require 100% of street lighting to use LEDs by 2025. These initiatives, along with ongoing urbanization and infrastructure development, are driving rapid growth in the LED market and significantly increasing the share of LED products in Vietnam’s overall lighting sector

- Rising Urbanization and Infrastructure Development: Vietnam aims to achieve an urbanization rate of at least 45% by 2025, supported by substantial government investment in urban infrastructure and smart city projects. This rapid urban growth is driving demand for advanced lighting technologies, especially energy-efficient LED solutions, as cities modernize their public spaces and utilities. The focus on developing international-standard urban areas and integrating smart technologies is expected to significantly boost the LED market in the coming years.

Market Challenges

- High Initial Costs of LED Technology: Despite the long-term savings associated with LED lighting, the initial investment remains a significant barrier. LED fixtures are typically more expensive upfront compared to traditional lighting options. This price disparity can deter consumers, particularly in lower-income segments, where budget constraints limit the adoption of energy-efficient technologies, impacting overall market growth.

- Competition from Traditional Lighting Solutions: Traditional lighting solutions, such as incandescent and fluorescent bulbs, still dominate the market due to their lower upfront costs. This competition poses a challenge for LED manufacturers, as many consumers remain hesitant to switch to more expensive LED options, slowing the transition to energy-efficient lighting solutions.

Vietnam LED Market Future Outlook

The Vietnam LED market is poised for significant growth, driven by increasing urbanization, government support, and a shift towards energy-efficient solutions. The market is expected to witness a substantial transformation, with smart lighting technologies becoming more prevalent. The integration of IoT in lighting systems will enhance user experience and energy management, while ongoing infrastructure projects will further stimulate demand for advanced lighting solutions, positioning Vietnam as a leader in the Southeast Asian LED market.

Market Opportunities

- Expansion of Smart City Projects: Vietnam is prioritizing smart city development, with major urban centers leading pilot projects by 2025. Infrastructure spending targets include investments in smart technologies. This creates significant opportunities for LED manufacturers to provide energy-efficient, integrated lighting solutions that enhance urban living and sustainability, driving growth in Vietnam’s smart city and LED markets.

- Growth in E-commerce for LED Products: Vietnam’s e-commerce market is driven by high internet penetration and a young, tech-savvy population. This growth enables LED manufacturers to expand their reach and improve customer access to energy-efficient lighting through online platforms, significantly boosting sales and competitiveness in the market

Scope of the Report

| By Source |

Traditional LED bulbs LED tubes LED fixtures |

| By Application |

Residential Commercial Industrial Outdoor lighting |

| By Technology |

Smart LED lighting Conventional LED lighting |

| By End-User |

Households Retail Hospitality Manufacturing |

| By Region |

North Vietnam Central Vietnam South Vietnam |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Trade, Ministry of Natural Resources and Environment)

Manufacturers and Producers

Distributors and Retailers

Energy Providers and Utilities

Construction and Infrastructure Companies

Real Estate Developers

Environmental NGOs and Advocacy Groups

Companies

Players Mentioned in the Report:

Philips Lighting

Osram

Dien Quang

Rang Dong

GE Lighting

BrightViet LED Solutions

EcoLight Vietnam

VinaLED Technologies

GreenGlow Innovations

LumiViet Lighting

Table of Contents

1. Vietnam LED Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam LED Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam LED Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Energy-Efficient Lighting Solutions

3.1.2. Government Initiatives Promoting LED Adoption

3.1.3. Rising Urbanization and Infrastructure Development

3.2. Market Challenges

3.2.1. High Initial Costs of LED Technology

3.2.2. Competition from Traditional Lighting Solutions

3.2.3. Limited Awareness and Knowledge Among Consumers

3.3. Opportunities

3.3.1. Expansion of Smart City Projects

3.3.2. Growth in E-commerce for LED Products

3.3.3. Increasing Focus on Sustainable and Green Technologies

3.4. Trends

3.4.1. Shift Towards Smart Lighting Solutions

3.4.2. Integration of IoT in Lighting Systems

3.4.3. Development of Energy-Efficient and Long-Lasting Products

3.5. Government Regulation

3.5.1. Energy Efficiency Standards for Lighting Products

3.5.2. Incentives for LED Adoption in Public Infrastructure

3.5.3. Regulations on Waste Management for LED Products

3.5.4. Compliance with International Environmental Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Vietnam LED Market Segmentation

4.1. By Source

4.1.1. Traditional LED bulbs

4.1.2. LED tubes

4.1.3. LED fixtures

4.2. By Application

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Outdoor lighting

4.3. By Technology

4.3.1. Smart LED lighting

4.3.2. Conventional LED lighting

4.4. By End-User

4.4.1. Households

4.4.2. Retail

4.4.3. Hospitality

4.4.4. Manufacturing

4.5. By Region

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam LED Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Philips Lighting

5.1.2. Osram

5.1.3. Dien Quang

5.1.4. Rang Dong

5.1.5. GE Lighting

5.1.6. BrightViet LED Solutions

5.1.7. EcoLight Vietnam

5.1.8. VinaLED Technologies

5.1.9. GreenGlow Innovations

5.1.10. LumiViet Lighting

5.2. Cross-Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategies

5.2.4. Distribution Channels

5.2.5. Customer Service and Support

5.2.6. Innovation and R&D Investment

5.2.7. Brand Reputation

5.2.8. Sustainability Practices

6. Vietnam LED Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam LED Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam LED Market Future Market Segmentation

8.1. By Source

8.1.1. Traditional LED bulbs

8.1.2. LED tubes

8.1.3. LED fixtures

8.2. By Application

8.2.1. Residential

8.2.2. Commercial

8.2.3. Industrial

8.2.4. Outdoor lighting

8.3. By Technology

8.3.1. Smart LED lighting

8.3.2. Conventional LED lighting

8.4. By End-User

8.4.1. Households

8.4.2. Retail

8.4.3. Hospitality

8.4.4. Manufacturing

8.5. By Region

8.5.1. North Vietnam

8.5.2. Central Vietnam

8.5.3. South Vietnam

9. Vietnam LED Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key players and stakeholders in the Vietnam LED Market. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to pinpoint and define the essential variables that drive market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the Vietnam LED Market. This includes evaluating market penetration rates, the distribution of marketplaces versus service providers, and the resulting revenue figures. Additionally, we will assess service quality metrics to ensure the accuracy and reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors. These consultations will provide critical operational and financial insights, helping to refine and substantiate the market data. Engaging with practitioners will enhance the credibility of the findings.

Step 4: Research Synthesis and Final Output

The final phase involves direct discussions with multiple manufacturers to gather in-depth insights into product categories, sales performance, and consumer preferences. This engagement will help verify and enrich the data obtained from the bottom-up approach, ensuring a thorough and validated analysis of the Vietnam LED Market.

Frequently Asked Questions

01. How big is the Vietnam LED Market?

The Vietnam LED Market is valued at USD 735 million, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Vietnam LED Market?

Key challenges in the Vietnam LED Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Vietnam LED Market?

Major players in the Vietnam LED Market include Philips Lighting, Osram, Dien Quang, Rang Dong, GE Lighting, among others.

04. What are the growth drivers for the Vietnam LED Market?

The primary growth drivers for the Vietnam LED Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.