Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5238

Pages:97

Published On:October 2025

By Type:The market is segmented into various types, including Robotics, Machine Learning Solutions, Computer Vision Systems, Natural Language Processing, Predictive Analytics Tools, AI-Driven Quality Control, Digital Twin Solutions, Industrial IoT Platforms, and Others. Among these, Robotics and Machine Learning Solutions are particularly prominent due to their widespread application in automating processes and enhancing operational efficiency. Robotics is increasingly utilized in assembly lines, while Machine Learning Solutions are essential for predictive maintenance and quality assurance.

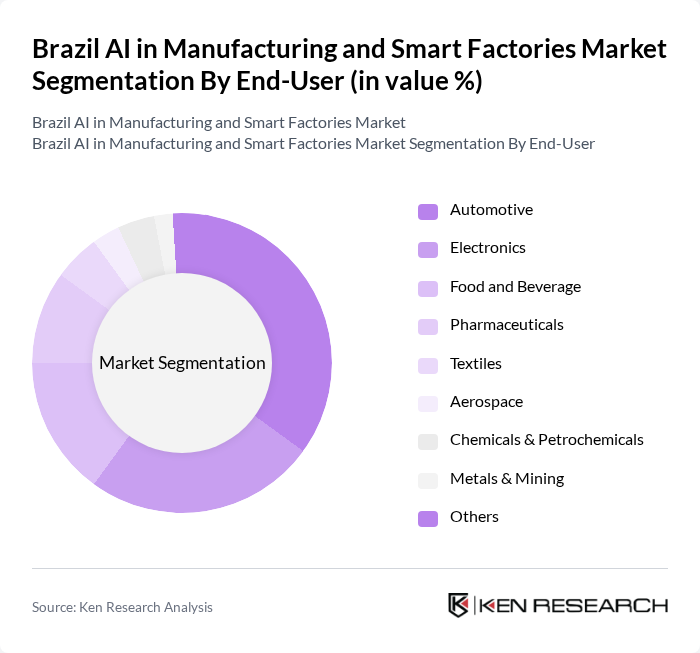

By End-User:The end-user segmentation includes Automotive, Electronics, Food and Beverage, Pharmaceuticals, Textiles, Aerospace, Chemicals & Petrochemicals, Metals & Mining, and Others. The Automotive sector is the largest consumer of AI technologies, driven by the need for automation in production lines and enhanced supply chain management. The Electronics and Food and Beverage sectors are also significant, leveraging AI for quality control and inventory management.

The Brazil AI in Manufacturing and Smart Factories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Rockwell Automation, Inc., Honeywell International Inc., Schneider Electric SE, General Electric Company, Mitsubishi Electric Corporation, Bosch Rexroth AG, Fanuc Corporation, KUKA AG, Emerson Electric Co., Dassault Systèmes SE, PTC Inc., Cognex Corporation, NVIDIA Corporation, Petrobras, Embraer S.A., WEG S.A., TOTVS S.A., Stefanini Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI in manufacturing and smart factories market in Brazil appears promising, driven by technological advancements and increasing investments. As companies continue to embrace automation and data analytics, the demand for AI solutions is expected to grow. Additionally, the government's support for Industry 4.0 initiatives will likely foster innovation and collaboration among stakeholders, enhancing the overall ecosystem. This environment will create opportunities for new entrants and established players to capitalize on emerging trends and technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotics Machine Learning Solutions Computer Vision Systems Natural Language Processing Predictive Analytics Tools AI-Driven Quality Control Digital Twin Solutions Industrial IoT Platforms Others |

| By End-User | Automotive Electronics Food and Beverage Pharmaceuticals Textiles Aerospace Chemicals & Petrochemicals Metals & Mining Others |

| By Application | Production Planning Supply Chain Management Inventory Management Maintenance Scheduling Quality Assurance Workforce Management Energy Management Process Optimization Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Retail |

| By Deployment Mode | On-Premise Cloud-Based |

| By Policy Support | Subsidies Tax Exemptions Grants Training Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing AI Integration | 100 | Plant Managers, AI Project Leads |

| Electronics Smart Factory Implementation | 80 | Operations Directors, Technology Officers |

| Textile Industry AI Applications | 60 | Production Managers, R&D Heads |

| Food & Beverage Sector Automation | 50 | Quality Control Managers, Supply Chain Analysts |

| General Manufacturing AI Adoption | 70 | IT Managers, Business Development Executives |

The Brazil AI in Manufacturing and Smart Factories Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by automation technologies, operational efficiency, and data-driven decision-making in manufacturing processes.