Region:Global

Author(s):Shubham

Product Code:KRAC4276

Pages:93

Published On:October 2025

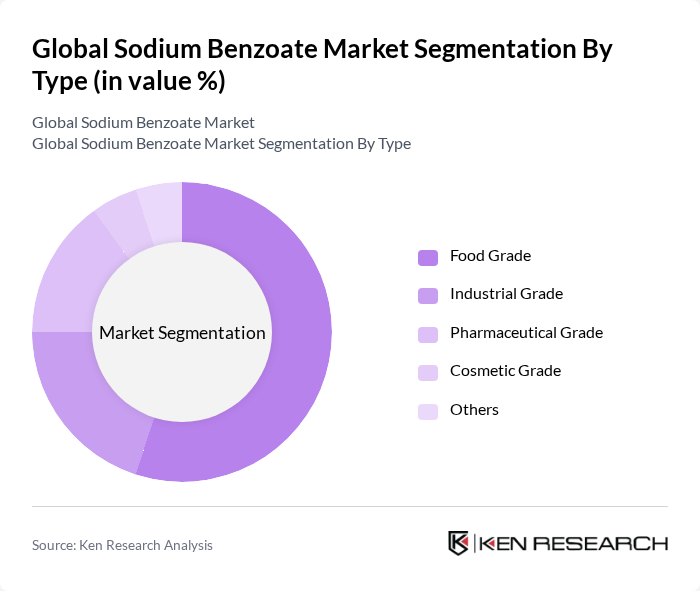

By Type:The sodium benzoate market is segmented into Food Grade, Industrial Grade, Pharmaceutical Grade, Cosmetic Grade, and Others. Food Grade sodium benzoate remains the dominant segment, driven by its extensive use as a preservative in processed foods and beverages. The growing consumer preference for packaged and convenience foods, along with regulatory support for food safety, continues to boost demand for food-grade sodium benzoate. Industrial Grade sodium benzoate is also gaining momentum, especially in plastics manufacturing, deicing, and corrosion inhibition applications .

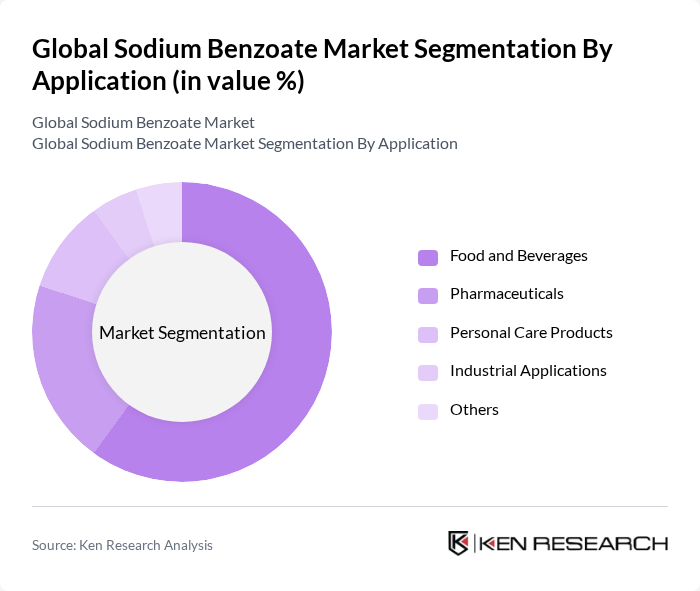

By Application:Sodium benzoate finds application in Food and Beverages, Pharmaceuticals, Personal Care Products, Industrial Applications, and Others. The Food and Beverages segment holds the largest share, fueled by the need for effective preservation and shelf-life extension in processed foods, carbonated drinks, and fruit juices. The pharmaceutical sector utilizes sodium benzoate for its antimicrobial properties and as a formulation aid, while the personal care industry incorporates it in cosmetics and toiletries. Industrial applications are expanding, particularly in deicing, corrosion inhibition, and plastics manufacturing .

The Global Sodium Benzoate Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Eastman Chemical Company, Spectrum Chemical Manufacturing Corp., TCI Chemicals (India) Pvt. Ltd., Jiangsu Shuchang Chemical Co., Ltd., Hubei Xinjing Chemical Co., Ltd., Merck KGaA, Shandong Jinling Chemical Co., Ltd., Hunan Deli Chemical Co., Ltd., Hubei Jusheng Technology Co., Ltd., Wuhan Youji Industries Co., Ltd., Foodchem International Corporation, Ganesh Benzoplast Limited, Avantor, Inc., and FBC Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sodium benzoate market appears promising, driven by increasing consumer demand for safe and effective food preservation methods. Innovations in product formulations are expected to enhance the appeal of sodium benzoate, particularly in organic and natural products. Additionally, strategic partnerships among manufacturers and distributors will likely facilitate market penetration in emerging economies, where demand for preservatives is on the rise, thus creating a robust growth trajectory for the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Grade Industrial Grade Pharmaceutical Grade Cosmetic Grade Others |

| By Application | Food and Beverages Pharmaceuticals Personal Care Products Industrial Applications Others |

| By End-User | Food Manufacturers Pharmaceutical Companies Cosmetic Manufacturers Industrial Users Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesalers Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| By Region | North America United States Canada Mexico Europe United Kingdom Germany France Italy Spain Russia Benelux Nordics Rest of Europe Asia-Pacific China India Japan South Korea ASEAN Oceania Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East & Africa Turkey Israel GCC North Africa South Africa Rest of Middle East & Africa |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 100 | Product Development Managers, Quality Control Specialists |

| Pharmaceutical Companies | 60 | Regulatory Affairs Managers, R&D Directors |

| Cosmetics and Personal Care Brands | 50 | Formulation Chemists, Brand Managers |

| Food Safety Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

The Global Sodium Benzoate Market is valued at approximately USD 1.4 billion, driven by the increasing demand for food preservatives, particularly in the food and beverage industry, and heightened consumer awareness regarding food safety and quality.