Region:Middle East

Author(s):Dev

Product Code:KRAD3280

Pages:84

Published On:November 2025

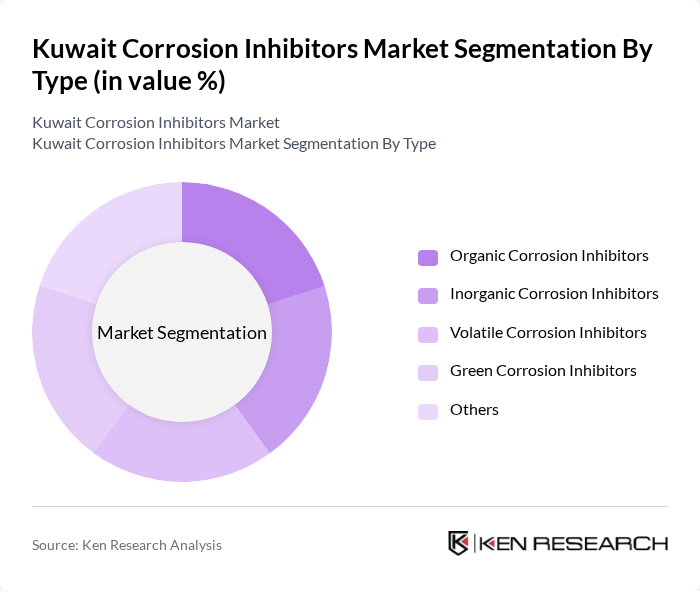

By Type:

The corrosion inhibitors market can be segmented into various types, including Organic Corrosion Inhibitors, Inorganic Corrosion Inhibitors, Volatile Corrosion Inhibitors, Green Corrosion Inhibitors, and Others. Among these, Organic Corrosion Inhibitors dominate the market due to their effectiveness in various applications, particularly in the oil and gas sector. Their ability to provide long-lasting protection against corrosion in aggressive environments makes them highly sought after. Additionally, the growing trend towards environmentally friendly solutions has led to an increase in the adoption of Green Corrosion Inhibitors, which are gaining traction in the market .

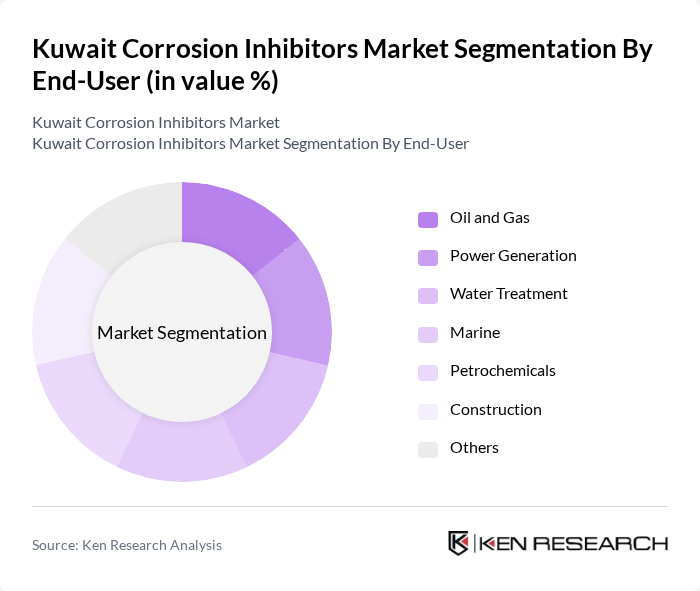

By End-User:

The end-user segmentation includes Oil and Gas, Power Generation, Water Treatment, Marine, Petrochemicals, Construction, and Others. The Oil and Gas sector is the leading end-user, driven by the need for corrosion management in pipelines and storage tanks. The sector's significant investments in infrastructure and maintenance further bolster the demand for corrosion inhibitors. Additionally, the Power Generation and Petrochemical industries are also substantial consumers, as they require effective corrosion solutions to ensure operational efficiency and safety .

The Kuwait Corrosion Inhibitors Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Ecolab Inc., Cortec Corporation, Henkel AG & Co. KGaA, AkzoNobel N.V., Solvay S.A., Clariant AG, Lanxess AG, RPM International Inc., Afton Chemical Corporation, Baker Hughes Company, Houghton International Inc., TotalEnergies SE, Innospec Inc., Ashland Inc., Nouryon, The Lubrizol Corporation, DuPont de Nemours, Inc., Kuwait National Petroleum Company (KNPC), Petrochemical Industries Company (PIC) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait corrosion inhibitors market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly solutions, the development of biodegradable corrosion inhibitors will gain traction. Additionally, the integration of smart technologies for corrosion monitoring will enhance preventive measures, ensuring asset longevity. These trends indicate a proactive approach to corrosion management, aligning with global sustainability goals and fostering innovation within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Corrosion Inhibitors Inorganic Corrosion Inhibitors Volatile Corrosion Inhibitors Green Corrosion Inhibitors Others |

| By End-User | Oil and Gas Power Generation Water Treatment Marine Petrochemicals Construction Others |

| By Application | Pipeline Protection Equipment Protection Surface Treatment Coatings Cooling Water Systems Boilers Others |

| By Formulation | Liquid Powder Gel Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Customer Type | Large Enterprises SMEs Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry Applications | 100 | Technical Managers, Procurement Specialists |

| Construction Sector Usage | 80 | Project Managers, Materials Engineers |

| Automotive Manufacturing Insights | 60 | Quality Control Managers, Production Supervisors |

| Marine Industry Corrosion Management | 50 | Marine Engineers, Maintenance Supervisors |

| Research & Development in Chemical Formulations | 40 | R&D Managers, Chemists |

The Kuwait Corrosion Inhibitors Market is valued at approximately USD 45 million, reflecting a significant demand primarily driven by the oil and gas sector, which is crucial to the country's economy.