APAC Automotive Cybersecurity Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3535

November 2024

87

About the Report

APAC Automotive Cybersecurity Market Overview

- The APAC Automotive Cybersecurity Market is currently valued at USD 1.5 billion, according to recent analysis. This market is primarily driven by the increasing adoption of connected vehicles, autonomous driving technologies, and the growing trend of digitalization in the automotive industry. The rapid integration of advanced driver-assistance systems (ADAS), infotainment systems, and vehicle-to-everything (V2X) communication has made cybersecurity a critical need for automotive manufacturers and suppliers. As the number of connected vehicles rises, so do the potential risks, making cybersecurity a key focus area across the APAC region.

- Major automotive markets such as Japan, South Korea, and China lead the automotive cybersecurity sector, driven by their robust automotive industries and growing investments in autonomous driving technologies. These countries are significantly contributing to market growth due to their technological advancements and regulatory frameworks designed to ensure vehicle safety. Emerging markets like India and Southeast Asia are also showing potential as they witness increased penetration of connected cars, which creates a demand for enhanced automotive cybersecurity measures.

- Government regulations and initiatives play a vital role in shaping the automotive cybersecurity landscape across the region. For instance, Japan's Ministry of Economy, Trade and Industry (METI) has established guidelines for the automotive sector to follow cybersecurity protocols, and Chinas government has mandated cybersecurity standards for all autonomous vehicles by 2024. The growing concern over data security and cyberattacks on vehicles is prompting policymakers to implement stricter regulations, ensuring a secure environment for the automotive industry in the APAC region.

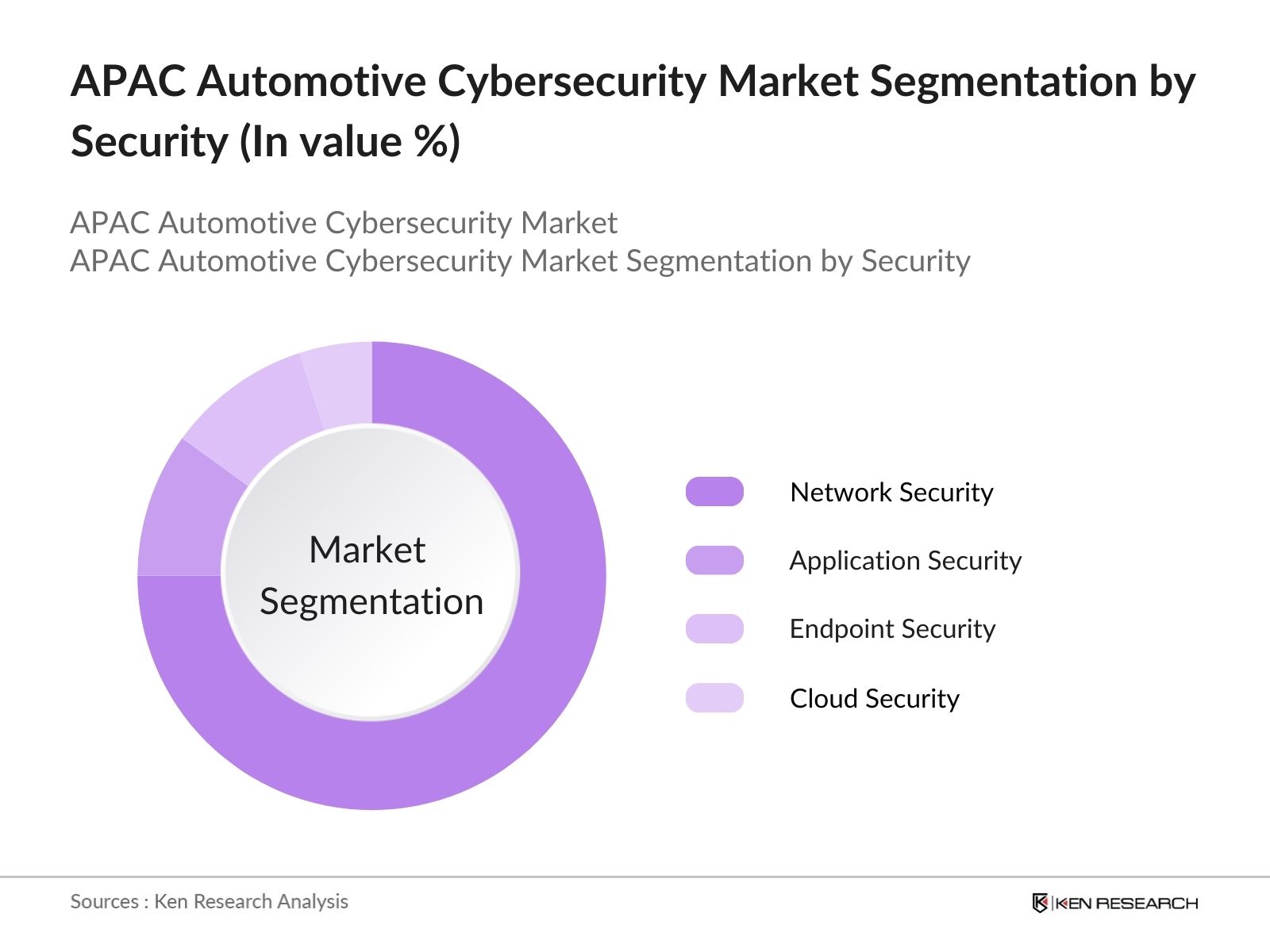

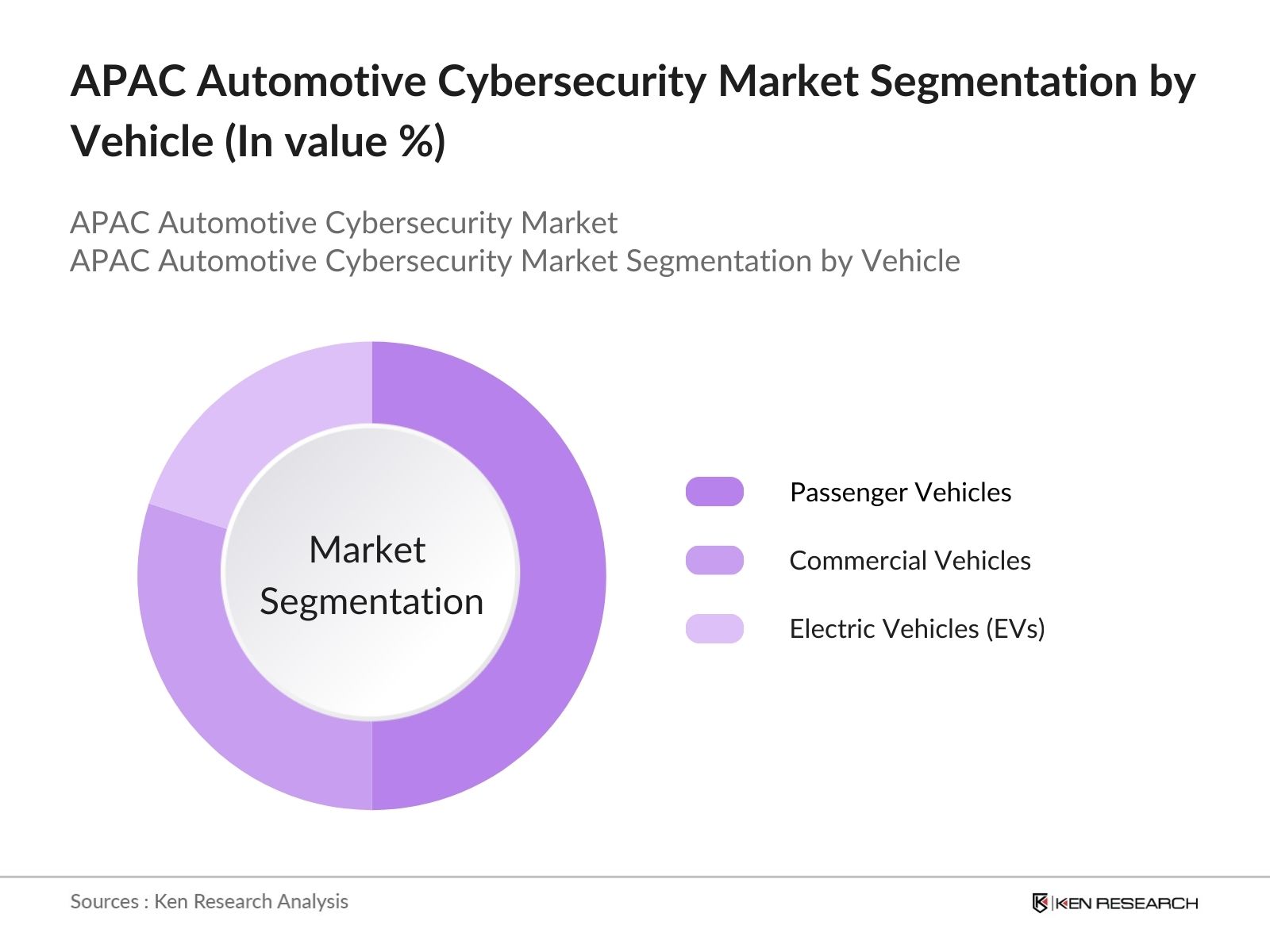

APAC Automotive Cybersecurity Market Segmentation

- By Security Type: The market is segmented by security type into network security, application security, endpoint security, and cloud security. Network security is the most dominant segment, driven by the increasing reliance on V2X communication and telematics systems in vehicles. These technologies require secure communication channels to protect against external threats such as hacking and unauthorized access. Application security is also gaining traction, particularly with the growing integration of advanced software applications in connected and autonomous vehicles, necessitating robust protection measures.

- By Vehicle Type: The market in APAC is further segmented by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles (EVs). Passenger vehicles represent the largest segment, as the number of connected and autonomous cars continues to rise, increasing the need for cybersecurity solutions. The commercial vehicles segment is also expected to witness significant growth, particularly in logistics and public transport, as these sectors increasingly adopt connected technologies for fleet management and smart transportation systems. Electric vehicles, with their advanced digital systems and connectivity features, present additional cybersecurity challenges, creating further opportunities for cybersecurity solutions providers.

APAC Automotive Cybersecurity Market Competitive Landscape

The APAC Automotive Cybersecurity Market is highly competitive, with global and regional players striving to secure their positions through partnerships, acquisitions, and technological advancements. Leading companies such as Harman International, NXP Semiconductors, and Continental AG dominate the market with their cutting-edge cybersecurity solutions for connected vehicles and autonomous systems.

|

Company Name |

Establishment Year |

Headquarters |

Key Solutions |

Revenue (2023) |

Major Partnerships |

Cybersecurity Focus |

Key Markets |

|

Harman International |

1980 |

Stamford, USA |

|||||

|

NXP Semiconductors |

2006 |

Eindhoven, Netherlands |

|||||

|

Continental AG |

1871 |

Hanover, Germany |

|||||

|

Denso Corporation |

1949 |

Kariya, Japan |

|||||

|

Argus Cyber Security |

2013 |

Tel Aviv, Israel |

APAC Automotive Cybersecurity Industry Analysis

Growth Drivers

- Increasing Adoption of Connected Vehicles: The growing adoption of connected vehicles in the Asia-Pacific region is a significant driver for the automotive cybersecurity market. By 2024, the region is projected to have over 200 million connected vehicles, particularly in advanced economies such as Japan and South Korea. Vehicle-to-Everything (V2X) technology is being increasingly integrated into vehicles, facilitating real-time communication between vehicles and infrastructure, pedestrians, and other vehicles. This growth demands robust cybersecurity measures to protect against potential cyberattacks. Government initiatives in China, including the "Internet Plus" strategy, further boost the adoption of connected vehicles, necessitating enhanced cybersecurity solutions.

- Increasing threat of automotive cyberattacks: Automotive cyberattacks in the APAC region have surged, with thousands of reported instances of attempted breaches in the first half of 2023 alone. This rise is attributed to the growing number of connected vehicles and the digitization of critical vehicle functions, making them vulnerable to sophisticated attacks. For instance, in 2022, several high-profile cyberattacks targeted electric vehicles in China, leading to stringent cybersecurity protocols. The risk of software breaches is pushing automotive companies to invest in cybersecurity solutions, making it a key driver for market growth.

- Rising Threat of Cyberattacks: With the increasing digitalization of vehicles, the threat of cyberattacks has become a significant concern. In 2023, multiple high-profile cyberattacks were reported across the APAC region, including a major breach in South Korea's connected vehicle infrastructure that compromised sensitive vehicle data. As vehicles become more connected and reliant on digital systems, they become prime targets for hackers, leading to a surge in demand for advanced cybersecurity solutions. The rising number of cyber incidents is prompting automotive manufacturers to prioritize cybersecurity in their product development and operational strategies.

Market Challenges

- High Cost of Implementing Cybersecurity Solutions: One of the key challenges faced by the APAC automotive cybersecurity market is the high cost associated with implementing comprehensive cybersecurity solutions. The integration of cybersecurity measures into vehicle systems requires substantial investment in hardware, software, and skilled labor. This is particularly challenging for small and medium-sized automotive manufacturers, who may lack the financial resources to adopt advanced cybersecurity technologies. As a result, many companies in emerging markets are struggling to meet the growing cybersecurity demands, which could hinder market growth.

- Lack of Skilled Cybersecurity Professionals: The shortage of skilled cybersecurity professionals is another major challenge facing the APAC automotive cybersecurity market. With the increasing complexity of cyber threats, there is a growing need for specialized expertise in automotive cybersecurity. However, the talent pool in APAC remains limited, with many companies struggling to find professionals who possess the necessary skills to design, implement, and manage cybersecurity solutions for connected vehicles. This talent gap is particularly pronounced in emerging markets, where educational institutions and training programs for cybersecurity professionals are still underdeveloped.

APAC Automotive Cybersecurity Market Future Outlook

The APAC Automotive Cybersecurity Market is expected to witness significant growth over the next five years, driven by the rising adoption of connected vehicles, stringent government regulations, and the increasing threat of cyberattacks. As the automotive industry continues to evolve, with more advanced technologies being integrated into vehicles, the need for robust cybersecurity solutions will only grow. The expansion of electric and autonomous vehicles will also create new opportunities for cybersecurity providers, as these vehicles rely heavily on digital systems that require protection from cyber threats.

Future Market Opportunities

- Investment in Cybersecurity R&D: Investment in cybersecurity research and development (R&D) presents a significant opportunity for companies in the APAC region. Governments and private players are increasingly investing in R&D to develop innovative cybersecurity solutions that can address the unique challenges posed by connected and autonomous vehicles. Japans METI, for example, has allocated USD 300 million for automotive cybersecurity research, while South Korea is establishing dedicated R&D centers focused on automotive cybersecurity.

- Growth of cybersecurity R&D investments: Investment in cybersecurity R&D across the APAC region is on the rise, especially in countries like Japan and South Korea. In 2023, Japan amounts worth billion towards developing advanced cybersecurity solutions for the automotive industry, focusing on protecting autonomous driving technologies. South Koreas government has committed $1.8 billion to similar initiatives, aiming to enhance the resilience of connected vehicle infrastructure. These investments present a significant opportunity for the cybersecurity market to develop innovative solutions tailored to the unique needs of the automotive sector.

Scope of the Report

|

By Security |

Network Security Endpoint Security Application Security Cloud Security |

|

By Vehicle |

Passenger Vehicles Commercial Vehicles Electric Vehicles (EVs) |

|

By Application |

ADAS and Autonomous Systems Infotainment Systems Telematics and Vehicle-to-Vehicle Communication |

|

By Technology |

Intrusion Detection Systems Blockchain-based Solutions Secure OTA (Over-the-Air) Updates |

|

By Region |

China |

Products

Key Target Audience

Automotive OEMs

Cybersecurity Solution Providers

Tier 1 Suppliers

Government and Regulatory Bodies (Japans METI, Chinas MIIT)

Automotive Software Developers

Electric Vehicle Manufacturers

Investors and Venture Capitalist Firms

Autonomous Vehicle Technology Providers

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Harman International

NXP Semiconductors

Continental AG

Denso Corporation

Argus Cyber Security

Karamba Security

Trillium Secure

Vector Informatik

Infineon Technologies

Irdeto

Symantec (NortonLifeLock)

Synopsys

SafeRide Technologies

Upstream Security

Trend Micro Inc.

Table of Contents

01 APAC Automotive Cybersecurity Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Cybersecurity growth due to connected cars, ADAS, V2X)

1.4. Market Segmentation Overview

02 APAC Automotive Cybersecurity Market Size (In USD Bn)

2.1. Historical Market Size (Connected vehicles, cybersecurity spending)

2.2. Year-On-Year Growth Analysis (Cyber incidents in automotive industry, data breaches)

2.3. Key Market Developments and Milestones (Vehicle security regulations, cybersecurity standards)

03 APAC Automotive Cybersecurity Market Analysis

3.1. Growth Drivers

3.1.1. Increase in connected vehicle adoption (Vehicle-to-everything technology)

3.1.2. Rising cybersecurity regulations (APAC-specific government policies)

3.1.3. Increasing threat of automotive cyberattacks (Incidents of hacking, software breaches)

3.1.4. Advancements in autonomous driving technologies (Impact on cybersecurity requirements)

3.2. Market Challenges

3.2.1. High implementation costs for automotive cybersecurity solutions

3.2.2. Lack of skilled cybersecurity professionals (Industry talent gap, training needs)

3.2.3. Varying regulatory landscapes across APAC countries (China, Japan, South Korea)

3.3. Opportunities

3.3.1. Emergence of electric vehicles (New opportunities for cybersecurity in EV systems)

3.3.2. Growth of cybersecurity R&D investments (Japan, South Korea, regional initiatives)

3.3.3. Expansion of connected vehicle infrastructure in emerging markets (India, Southeast Asia)

3.4. Trends

3.4.1. Adoption of blockchain technology for vehicle cybersecurity

3.4.2. Integration of cybersecurity solutions with telematics and ADAS

3.4.3. Increasing focus on cloud-based security solutions for connected vehicles

3.5. Government Regulation (Country-Specific Regulations)

3.5.1. Chinas automotive cybersecurity mandates

3.5.2. Japans Ministry of Economy, Trade and Industry (METI) cybersecurity protocols

3.5.3. South Koreas vehicle cybersecurity policies (Focus on autonomous driving)

3.5.4. Indias vehicle data protection regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04 APAC Automotive Cybersecurity Market Segmentation

4.1. By Security Type (In Value %)

4.1.1. Network Security

4.1.2. Endpoint Security

4.1.3. Application Security

4.1.4. Cloud Security

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles (EVs)

4.3. By Application (In Value %)

4.3.1. ADAS and Autonomous Systems

4.3.2. Infotainment Systems

4.3.3. Telematics and Vehicle-to-Vehicle Communication

4.4. By Technology (In Value %)

4.4.1. Intrusion Detection Systems

4.4.2. Blockchain-based Solutions

4.4.3. Secure OTA (Over-the-Air) Updates

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. Southeast Asia (Vietnam, Thailand, Malaysia)

05 APAC Automotive Cybersecurity Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Harman International

5.1.2. NXP Semiconductors

5.1.3. Continental AG

5.1.4. Denso Corporation

5.1.5. Argus Cyber Security

5.1.6. Infineon Technologies

5.1.7. Karamba Security

5.1.8. Trillium Secure

5.1.9. Vector Informatik

5.1.10. Irdeto

5.1.11. Symantec (NortonLifeLock)

5.1.12. Synopsys

5.1.13. SafeRide Technologies

5.1.14. Upstream Security

5.1.15. Trend Micro Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Key Partnerships, Key Regions, Cybersecurity R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06 APAC Automotive Cybersecurity Market Regulatory Framework

6.1. Data Privacy Laws (Cybersecurity regulations across APAC regions)

6.2. Compliance Requirements for Connected Vehicles

6.3. Certification and Standardization Processes for Cybersecurity

07 APAC Automotive Cybersecurity Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Autonomous vehicle cybersecurity, rising cyberattacks)

08 APAC Automotive Cybersecurity Future Market Segmentation

8.1. By Security Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

09 APAC Automotive Cybersecurity Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Automotive OEMs, Tier 1 Suppliers)

9.3. Marketing Initiatives (Cybersecurity Adoption Campaigns)

9.4. White Space Opportunity Analysis (Emerging markets, EV cybersecurity)

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the critical variables that shape the APAC Automotive Cybersecurity Market. This process includes extensive desk research to understand the key stakeholders, from automotive OEMs to cybersecurity providers, as well as the technologies driving the market.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on the market, including adoption rates of connected vehicles, cybersecurity spending by automotive companies, and the impact of government regulations. This step helps build a robust understanding of market dynamics, which is crucial for forecasting future trends.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses based on the data gathered and validate them through interviews with industry experts. This includes consultations with key stakeholders such as automotive cybersecurity solution providers, OEMs, and government bodies.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the insights gained from secondary research, expert consultations, and data analysis to produce a comprehensive report. This report provides a detailed and validated outlook on the APAC Automotive Cybersecurity Market, ensuring accuracy and reliability.

Frequently Asked Questions

01. How big is the APAC Automotive Cybersecurity Market?

The APAC automotive cybersecurity market is valued at USD 1.5 billion, driven by the increasing integration of connected vehicle technologies and the growing need for secure vehicle communication systems.

02. What are the challenges in the APAC Automotive Cybersecurity Market?

Challenges in the APAC automotive cybersecurity market include high implementation costs of cybersecurity solutions, a shortage of skilled cybersecurity professionals, and inconsistent regulatory frameworks across APAC countries, which can hinder market growth.

03. Who are the major players in the APAC Automotive Cybersecurity Market?

Key players in the APAC automotive cybersecurity market include Harman International, NXP Semiconductors, Continental AG, Denso Corporation, and Argus Cyber Security. These companies dominate the market due to their strong product offerings and strategic partnerships.

04. What are the growth drivers of the APAC Automotive Cybersecurity Market?

The APAC automotive cybersecurity market is driven by the rising adoption of connected vehicles, the increasing threat of cyberattacks, and the growing regulatory focus on vehicle cybersecurity across major economies like China and Japan.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.