APAC Automotive Diagnostic Scan Tools Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD4247

October 2024

85

About the Report

APAC Automotive Diagnostic Scan Tools Market Overview

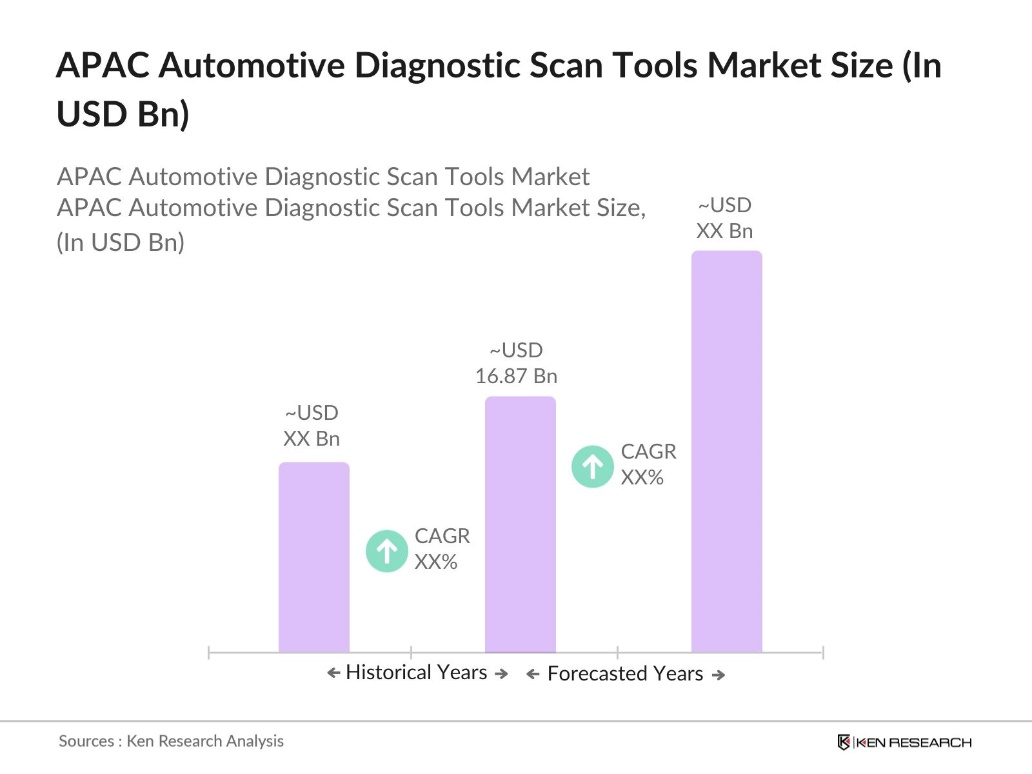

- The APAC Automotive Diagnostic Scan Tools Market is valued at USD 16.87 billion, driven by an increasing number of vehicles equipped with advanced electronic systems, including ADAS (Advanced Driver Assistance Systems) and ECUs (Electronic Control Units). The growing complexity of vehicle electronics is pushing demand for sophisticated diagnostic tools that can efficiently troubleshoot various automotive issues.

- China, Japan, and India are the dominant countries in this market. Chinas dominance is due to its massive automotive manufacturing sector, which is also shifting toward electric vehicles, driven by government initiatives promoting green energy. Japan is another leader, given its global standing in automotive innovation and the high penetration of hybrid and electric vehicles. India, while still developing, has a rapidly expanding vehicle market and an increasing need for diagnostic tools as it catches up with global automotive standards.

- The BS-VI norms, implemented in India from April 1, 2020, require all new vehicles to comply with these advanced standards, which significantly reduce permissible levels of pollutants such as sulfur and nitrogen oxides. For instance, BS-VI fuel must have a sulfur content of only 10 parts per million (ppm), down from 50 ppm in BS-IV fuels.

APAC Automotive Diagnostic Scan Tools Market Segmentation

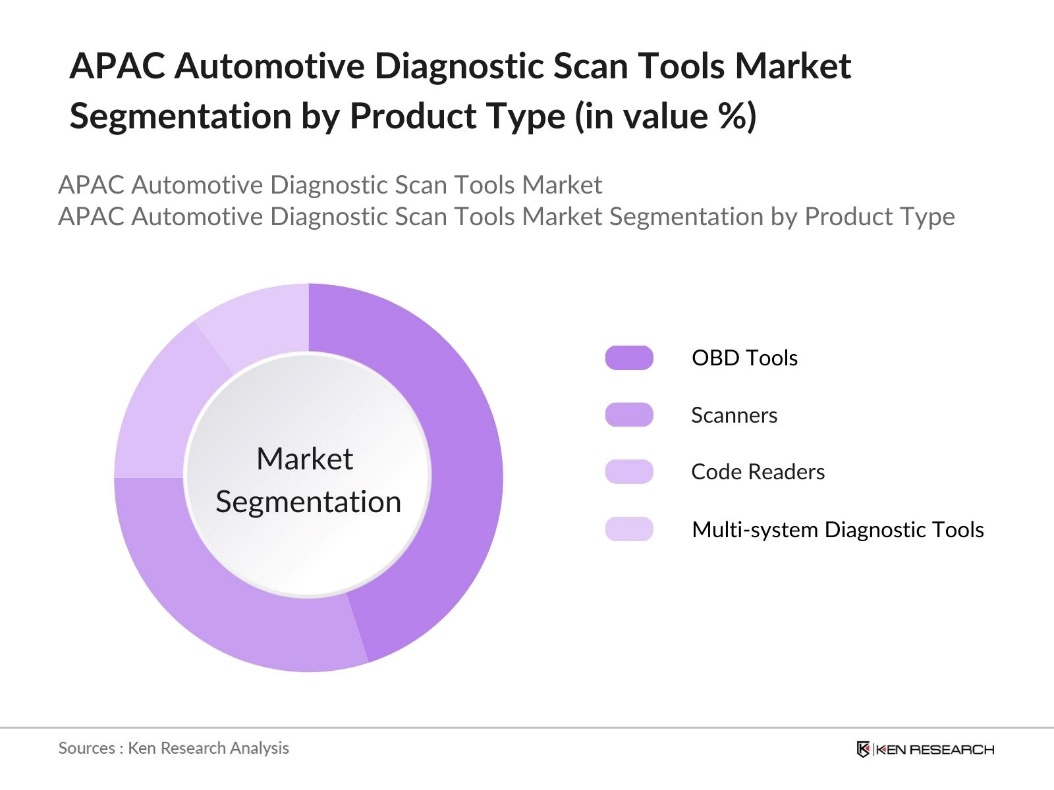

By Product Type: The APAC automotive diagnostic scan tools market is segmented by product type into OBD (On-Board Diagnostics) tools, scanners, code readers, and multi-system diagnostic tools. Among these, OBD tools hold the dominant market share due to its their widespread adoption in both commercial and passenger vehicles due to government mandates and the need for vehicle owners to monitor real-time performance. Additionally, the simplicity of OBD tools and their affordability make them popular in developing countries like India and Southeast Asia.

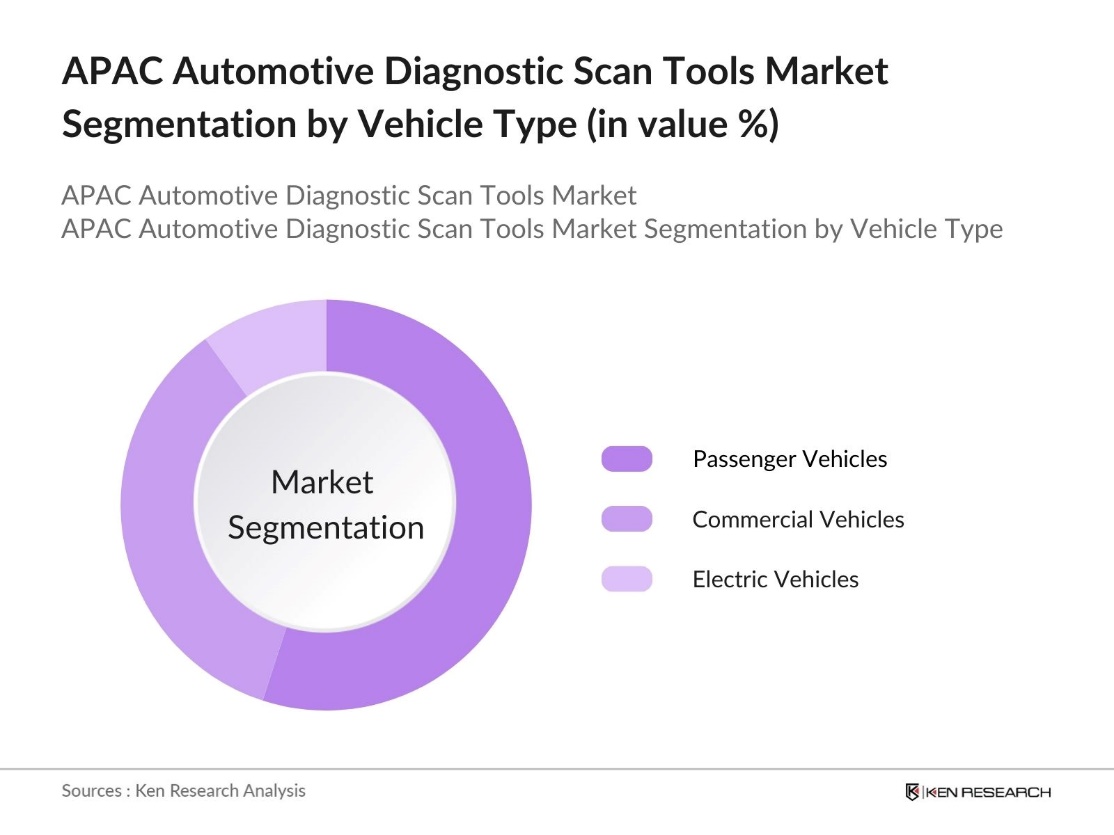

By Vehicle Type: The APAC automotive diagnostic scan tools market is segmented by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles. Passenger vehicles dominate the market due to the large number of passenger vehicles on the road, especially in densely populated countries such as China and India, where personal vehicle ownership is on the rise. The demand for diagnostic tools in this segment is driven by increased consumer awareness about vehicle maintenance and the growing complexity of automotive electronics.

APAC Automotive Diagnostic Scan Tools Market Competitive Landscape

The APAC automotive diagnostic scan tools market is characterized by intense competition from both global and regional players. The market is dominated by leading companies with strong brand recognition, extensive product portfolios, and a presence across multiple countries in the region. Additionally, these companies focus on strategic partnerships, acquisitions, and technological advancements to maintain their competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Range |

Innovation Index |

Geographical Reach |

M&A Activities |

R&D Investments |

Market Share (%) |

|

Bosch Automotive Service |

1886 |

Germany |

|||||||

|

Delphi Technologies |

2017 |

UK |

|||||||

|

Denso Corporation |

1949 |

Japan |

|||||||

|

Snap-on Incorporated |

1920 |

USA |

|||||||

|

Autel Intelligent Technology |

2004 |

China |

APAC Automotive Diagnostic Scan Tools Industry Analysis

Growth Drivers

- Growing Adoption of Electric Vehicles (EVs): The expanding market for electric vehicles (EVs) across the APAC region also drives demand for advanced diagnostic scan tools. Government initiatives such as subsidies and tax incentives for EV purchases contribute to this growth, pushing the need for specialized diagnostic tools for EV systems. According to the International Energy Agency (IEA), EV sales accounted for 14 million units globally in 2023, with a significant portion coming from APAC.

- Rising Demand for Preventive Maintenance: The APAC automotive industry is witnessing a growing focus on preventive maintenance, driven by fleet operators and private car owners alike. In 2023, the average passenger car in Japan was in use for about 13.42 years until its registration cancellation, which increases the need for frequent diagnostics to avoid breakdowns and expensive repairs. This has spurred demand for advanced diagnostic scan tools that can help in early detection of potential issues.

- Increasing Vehicle Complexity (Electronic Control Units, ADAS): The growing complexity of vehicles, especially with the increasing use of Electronic Control Units (ECUs) and Advanced Driver Assistance Systems (ADAS), is a significant driver for the APAC Automotive Diagnostic Scan Tools Market. Modern vehicles now require more advanced systems to handle features like navigation, parking assistance, and safety mechanisms. With more integrated electronics and technology, there is a rising demand for specialized diagnostic tools to monitor, identify, and resolve system issues efficiently, which is essential for maintaining the functionality of these advanced systems.

Market Challenges

- High Cost of Advanced Diagnostic Tools: The challenge in the APAC Automotive Diagnostic Scan Tools Market is the high cost of advanced diagnostic tools. As vehicle technology becomes more complex, the diagnostic equipment required also becomes more sophisticated, often involving advanced hardware and software. This makes the tools expensive, which can pose a challenge for smaller workshops and independent technicians. The high upfront investment needed for these tools can limit their adoption, particularly in cost-sensitive and developing markets across the APAC region.

- Lack of Skilled Technicians for Tool Operation: Another challenge in the APAC market is the shortage of skilled technicians who can effectively operate advanced diagnostic tools. The increasing use of AI, ADAS, and electric vehicle systems requires technicians to have specialized training to handle these complex technologies. However, many regions face a gap in the availability of adequately trained personnel. This skills shortage, particularly in developing countries within APAC, can slow down the adoption of these sophisticated tools, limiting their effectiveness in the market.

APAC Automotive Diagnostic Scan Tools Market Future Outlook

Over the next five years, the APAC automotive diagnostic scan tools market is expected to experience significant growth. This growth will be driven by the increasing adoption of electric and hybrid vehicles, the growing complexity of automotive electronics, and the rising focus on preventive maintenance. Governments in key markets such as China, Japan, and India are implementing stricter emissions regulations and promoting the use of advanced diagnostic tools, which will further fuel market growth.

Market Opportunities

- Integration of AI and IoT in Diagnostic Tools: The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in automotive diagnostic tools offers a significant growth opportunity for the market. AI is increasingly being used to predict component failures and optimize vehicle maintenance, while IoT enables real-time remote diagnostics. These technologies enhance the efficiency and accuracy of diagnostics, making them essential for modern vehicles.

- Expansion into Emerging Markets: Emerging markets in Southeast Asia, such as Indonesia, Vietnam, and the Philippines, present untapped potential for automotive diagnostic scan tools. As vehicle ownership continues to grow in these countries, so does the need for reliable and efficient diagnostic tools and maintenance services. The rapid expansion of vehicle fleets in these markets makes them key targets for companies looking to introduce or expand their diagnostic solutions.

Scope of the Report

|

Product Type |

OBD Tools |

|

Vehicle Type |

Passenger Vehicles |

|

Application |

OEM Diagnostics |

|

Technology |

Wired Diagnostics |

|

Region |

China |

Products

Key Target Audience

Automotive Manufacturers

Vehicle Maintenance Service Providers

Diagnostic Tool Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Information Technology, Transport Ministry)

Banks and Financial Institutions

Companies

Major Players

Bosch Automotive Service

Delphi Technologies

Denso Corporation

Snap-on Incorporated

Autel Intelligent Technology

Continental AG

Hella KGaA Hueck & Co.

Actia Group

AVL List GmbH

Launch Tech Co., Ltd.

Fluke Corporation

Softing AG

Texa S.p.A.

SPX Corporation

OTC Tools (Bosch Division)

Table of Contents

1. APAC Automotive Diagnostic Scan Tools Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Automotive Diagnostic Scan Tools Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Automotive Diagnostic Scan Tools Market Analysis

3.1. Growth Drivers

3.1.1. Increasing vehicle complexity (Electronic Control Units, ADAS)

3.1.2. Growing adoption of electric vehicles (EVs)

3.1.3. Government regulations on vehicle emissions

3.1.4. Rising demand for preventive maintenance

3.2. Market Challenges

3.2.1. High cost of advanced diagnostic tools

3.2.2. Lack of skilled technicians for tool operation

3.2.3. Compatibility issues across different vehicle models

3.3. Opportunities

3.3.1. Integration of AI and IoT in diagnostic tools

3.3.2. Expansion into emerging markets

3.3.3. Remote diagnostics through cloud-based platforms

3.4. Trends

3.4.1. Shift towards wireless diagnostic tools

3.4.2. Increasing use of smartphone-based diagnostics

3.4.3. Integration of machine learning for predictive diagnostics

3.5. Government Regulations

3.5.1. Emission norms (Euro, Bharat VI)

3.5.2. Data security laws for connected vehicles

3.5.3. Mandatory onboard diagnostic (OBD) systems

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. APAC Automotive Diagnostic Scan Tools Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. OBD Tools

4.1.2. Scanners

4.1.3. Code Readers

4.1.4. Multi-system Diagnostic Tools

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.3. By Application (In Value %)

4.3.1. OEM Diagnostics

4.3.2. Aftermarket Diagnostics

4.4. By Technology (In Value %)

4.4.1. Wired Diagnostics

4.4.2. Wireless Diagnostics

4.4.3. Cloud-based Diagnostics

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. ASEAN Countries

5. APAC Automotive Diagnostic Scan Tools Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch Automotive Service Solutions

5.1.2. Delphi Technologies

5.1.3. Denso Corporation

5.1.4. Snap-on Incorporated

5.1.5. Continental AG

5.1.6. Autel Intelligent Technology

5.1.7. Actia Group

5.1.8. Launch Tech Co., Ltd.

5.1.9. Hella KGaA Hueck & Co.

5.1.10. AVL List GmbH

5.1.11. Softing AG

5.1.12. Fluke Corporation

5.1.13. SPX Corporation

5.1.14. Texa S.p.A.

5.1.15. OTC Tools (a division of Bosch)

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Innovation Index, Geographical Presence, Customer Base, Market Share, Mergers & Acquisitions, R&D Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Initiatives

5.9. Private Equity Investments

6. APAC Automotive Diagnostic Scan Tools Market Regulatory Framework

6.1. Emission Standards Compliance

6.2. Vehicle Safety Regulations

6.3. Certification and Testing Requirements

6.4. Data Privacy and Cybersecurity Regulations

7. APAC Automotive Diagnostic Scan Tools Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Automotive Diagnostic Scan Tools Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. APAC Automotive Diagnostic Scan Tools Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary variables influencing the APAC automotive diagnostic scan tools market. This is done through comprehensive desk research, gathering data from automotive associations, government bodies, and industry reports. A particular focus is placed on the role of technological advancements, government regulations, and consumer preferences.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data and assess market penetration, revenue generation, and growth drivers. This analysis also includes evaluating market shares across different product segments, as well as regional variances. The use of proprietary databases ensures data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are validated through interviews with industry professionals and market participants. These consultations provide firsthand insights into market trends, consumer behavior, and challenges, contributing to the accuracy of the report.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the collected data, consulting automotive diagnostic tool manufacturers and stakeholders, and validating the final analysis. This stage ensures that the report provides a complete and accurate picture of the APAC automotive diagnostic scan tools market.

Frequently Asked Questions

01 How big is the APAC Automotive Diagnostic Scan Tools Market?

The APAC Automotive Diagnostic Scan Tools Market is valued at USD 16.87 billion, driven by the growing complexity of automotive electronics and the increasing adoption of electric vehicles.

02 What are the challenges in the APAC Automotive Diagnostic Scan Tools Market?

Key challenges in APAC Automotive Diagnostic Scan Tools Market include the high cost of advanced diagnostic tools, the lack of skilled technicians, and the compatibility of tools with different vehicle models and technologies.

03 Who are the major players in the APAC Automotive Diagnostic Scan Tools Market?

Major players in APAC Automotive Diagnostic Scan Tools Market include Bosch Automotive Service, Delphi Technologies, Denso Corporation, Snap-on Incorporated, and Autel Intelligent Technology, all of which have a strong presence in the APAC region.

04 What are the growth drivers of the APAC Automotive Diagnostic Scan Tools Market?

Growth is driven in APAC Automotive Diagnostic Scan Tools Market by increasing vehicle complexity, the shift toward electric vehicles, government regulations on emissions, and the rising need for preventive vehicle maintenance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.