APAC Police Radar Detector Market outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD4731

November 2024

91

About the Report

APAC Police Radar Detector Market Overview

- The APAC police radar detector market, based on a thorough five-year analysis, is valued at USD 150 million. This market's growth is driven by stringent road safety regulations, the rising number of vehicles, and increasing investments in smart traffic management systems. The adoption of radar detectors by both private consumers and law enforcement agencies to monitor and control speeding is contributing to this growing demand. Major advancements in radar detector technology, including integration with AI and IoT, are also fueling market expansion.

- Countries like China, Japan, and Australia dominate the market due to their robust traffic surveillance infrastructure and increasing investments in law enforcement technologies. China's dominance is primarily driven by its large population, rapid urbanization, and significant government spending on smart city projects. Japan and Australia have strong government-backed road safety initiatives, alongside high consumer awareness regarding traffic regulations, positioning them as key markets in the region.

- Governments across APAC are enforcing stricter road safety regulations, such as mandatory speed monitoring systems, to reduce accidents. Japan, for instance, has implemented more stringent speed enforcement protocols as part of its Vision Zero safety initiative, aiming to minimize traffic fatalities. According to the International Road Assessment Programme, APAC governments have allocated over USD 50 billion in 2024 towards road safety improvements, including the deployment of radar detection technologies. These regulatory efforts reflect an increased focus on reducing fatalities, with a focus on speed limit compliance and safer driving practices.

APAC Police Radar Detector Market Segmentation

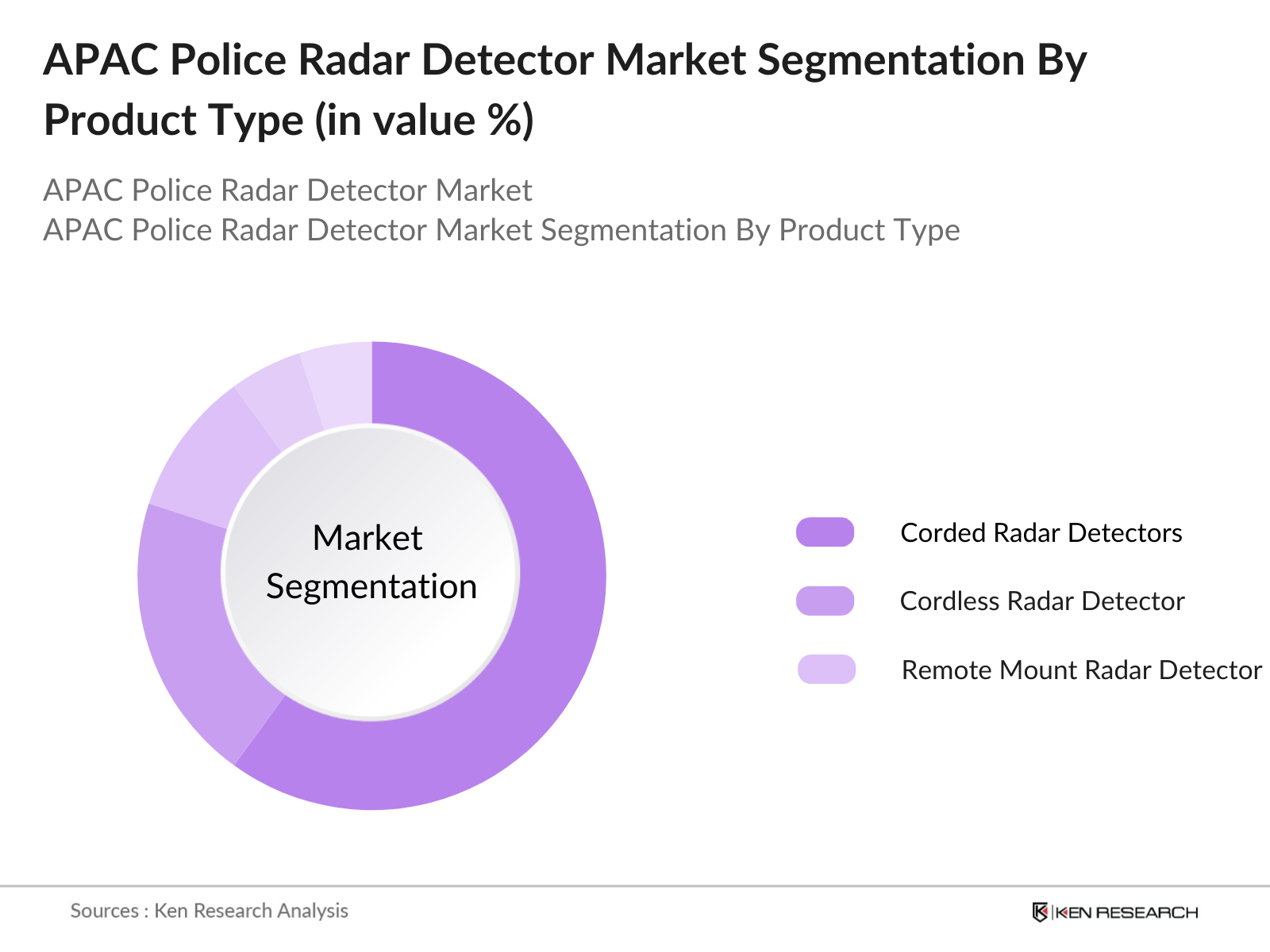

By Product Type: The APAC police radar detector market is segmented by product type into corded radar detectors, cordless radar detectors, and remote mount radar detectors. Cordless radar detectors hold a dominant market share in 2023 due to their convenience and portability, making them a preferred choice among individual consumers and commercial fleet operators. These detectors offer the flexibility of being easily transferred between vehicles, contributing to their widespread adoption in the region. Additionally, advancements in battery life and detection range make cordless detectors highly desirable for customers.

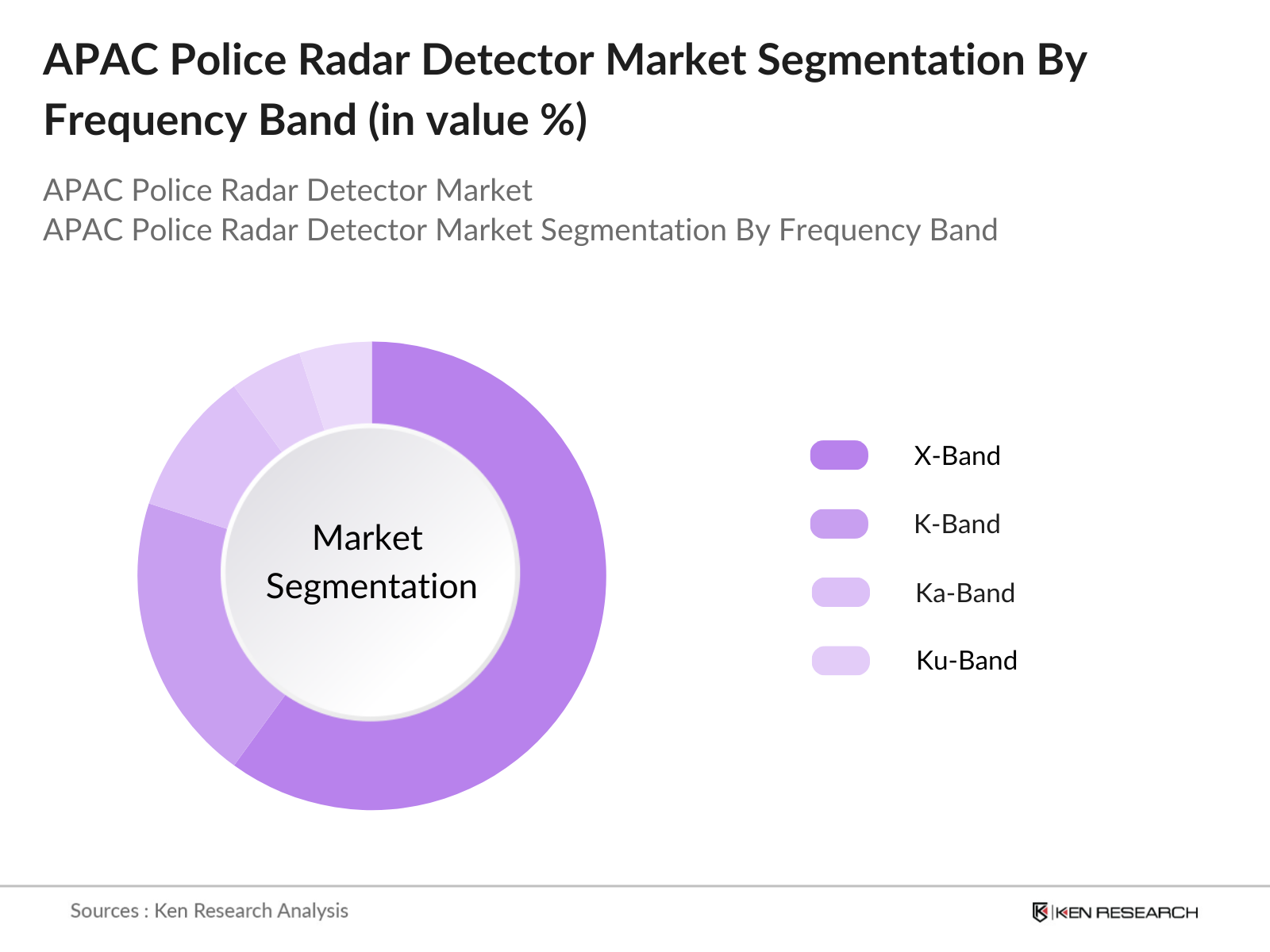

By Frequency Band: The APAC police radar detector market is also segmented by frequency band into X-Band, K-Band, Ka-Band, and Ku-Band. Ka-Band detectors dominate the market in 2023 due to their superior ability to detect high-speed radar guns used by law enforcement agencies. The widespread deployment of Ka-Band radar guns across APAC, especially in countries like Japan and Australia, makes this band highly critical for effective radar detection. Ka-Band radar detectors offer high precision and longer detection ranges, ensuring they remain the top choice for both private and law enforcement use.

APAC Police Radar Detector Market Competitive Landscape

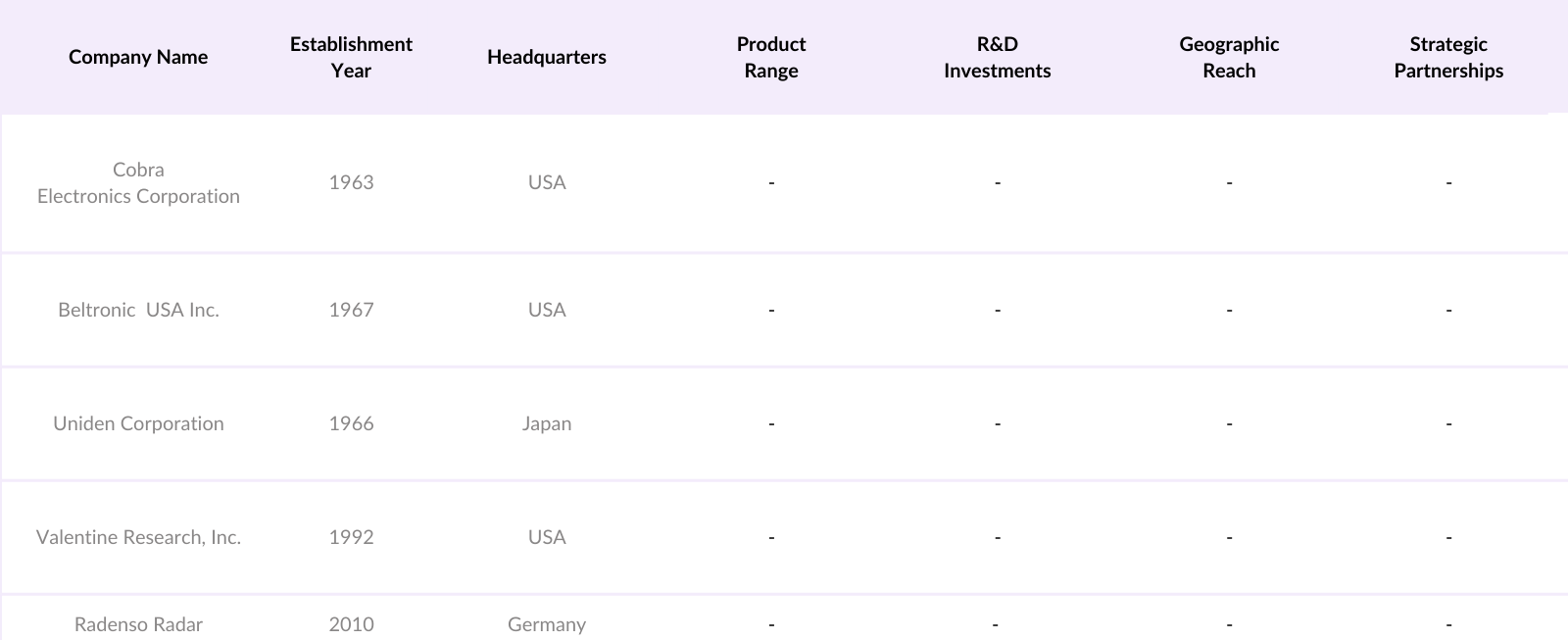

The APAC police radar detector market is dominated by a mix of local and global players, creating a highly competitive environment. Key companies are focusing on product innovation, strategic partnerships, and expanding their geographic reach to strengthen their market position. Companies like Cobra Electronics and Valentine Research are known for their cutting-edge radar detection technologies, while regional players in China and Japan are making significant inroads by customizing products to local market needs.

APAC Police Radar Detector Market Analysis

Growth Drivers

- Increasing Road Traffic: The rise in road traffic across the Asia Pacific (APAC) region has led to an increased need for advanced traffic management solutions, including radar detectors. According to the World Bank, the number of vehicles in APAC has surged to over 600 million in 2024, significantly increasing traffic congestion and road accidents. Countries like India and China, which account for a combined population of over 2.8 billion, are witnessing high road traffic density, leading to the adoption of speed monitoring systems. This traffic surge is pushing governments to implement stricter road safety measures and regulations, encouraging the use of radar detectors.

- Rising Demand for Speed Monitoring: The rising demand for speed monitoring systems is directly linked to increasing traffic violations and road accidents in APAC countries. In Indonesia alone, traffic violations increased by 18 million incidents in 2024, according to the National Police Traffic Corps. The adoption of radar detectors has become essential to enforce speed limits more effectively. Furthermore, countries like South Korea have been investing in speed monitoring systems integrated with radar technology to ensure stricter compliance with road safety standards. The growing number of road fatalities, exceeding 1.3 million across APAC, is driving this demand.

- Enhanced Vehicle Surveillance Systems: The demand for enhanced vehicle surveillance systems is growing due to increased crime and traffic offenses in urban areas. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), APAC nations are investing heavily in vehicle surveillance systems, with investments totaling USD 45 billion in 2024. These systems incorporate radar detectors for accurate speed monitoring and surveillance, which are essential for controlling traffic violations and ensuring public safety. Such developments are transforming urban traffic management systems and contributing to the overall adoption of radar technology in vehicles.

Market Challenges

- Device Detection by Law Enforcement: One of the key challenges for the APAC police radar detector market is the detection of radar detectors by law enforcement agencies. Countries like Australia and Japan have implemented radar detector detection technologies, resulting in confiscation and legal penalties. In 2024, there were over 150,000 incidents of radar detector confiscation in Australia alone, according to the Australian Federal Police. This creates a challenge for market growth, as legal restrictions on the use of radar detectors in several APAC countries impede their widespread adoption.

- High Production Costs: The high production costs associated with radar detectors, primarily due to the integration of advanced technologies like AI and IoT, pose a significant challenge for manufacturers. According to the World Banks manufacturing index, the cost of production for advanced electronic devices in APAC increased by 20% in 2024 due to rising raw material costs and labor shortages. Countries such as Malaysia and Thailand, key players in electronics manufacturing, have seen production bottlenecks, making it difficult for companies to maintain profit margins while producing affordable radar detectors for consumers.

APAC Police Radar Detector Market Future Outlook

The APAC police radar detector market is poised for significant growth over the next five years, driven by increasing government investment in road safety and smart traffic management systems. The rising number of vehicles, coupled with stringent enforcement of speed limits, will continue to bolster demand for radar detectors. In addition, technological advancements such as AI and IoT integration into radar detection systems are expected to enhance the capabilities of these devices, offering more efficient solutions for both law enforcement and consumers. The market is likely to witness increasing collaborations between radar detector manufacturers and automotive companies to provide built-in solutions for commercial vehicles. This trend, along with the increasing consumer preference for technologically advanced and portable radar detection devices, will drive market expansion across the APAC region.

Market Opportunities

- Increased Adoption in Developing Nations: Developing nations in APAC, such as Vietnam and the Philippines, are witnessing increased adoption of radar detectors due to the rapid expansion of road infrastructure. According to the Asian Development Bank (ADB), Vietnam has invested USD 5 billion in 2024 towards road infrastructure development, leading to a surge in demand for advanced traffic management systems. This presents a significant opportunity for the radar detector market, as governments are focusing on integrating modern technologies for speed detection and road safety. The potential for growth in these emerging economies is high as they continue to develop their transportation networks.

- Collaborations with Law Enforcement: Collaborations between radar detector manufacturers and law enforcement agencies across APAC are becoming more common. In South Korea, for instance, a USD 300 million partnership was formed in 2024 between local law enforcement and technology companies to develop advanced radar-based speed monitoring systems. These collaborations allow manufacturers to create devices that comply with legal standards while supporting law enforcement efforts in traffic management. Such partnerships are a promising avenue for market expansion, especially in countries with strict traffic enforcement policies.

Scope of the Report

|

Segment |

Sub-Segments |

|

Type |

Corded Radar Detectors |

|

Cordless Radar Detectors |

|

|

Remote Mount Radar Detectors |

|

|

Frequency Band |

X-Band |

|

K-Band |

|

|

Ka-Band |

|

|

Ku-Band |

|

|

End-User |

Individual Consumers |

|

Law Enforcement Agencies |

|

|

Commercial Fleet Operators |

|

|

Technology |

Radar/Lidar Detectors |

|

Laser Detectors |

|

|

Combination Detectors |

|

|

Country/Region |

China |

|

Japan |

|

|

India |

|

|

Australia |

|

|

Southeast Asia |

Products

Key Target Audience

Law enforcement agencies (China Ministry of Public Security, Australia Federal Police)

Vehicle fleet operators

Automotive manufacturers

Radar detector manufacturers

Smart city project developers

Government and regulatory bodies (Japan National Police Agency, Indian Ministry of Road Transport)

Investor and venture capitalist firms

Insurance companies

Companies

Players mentioned in the report

Cobra Electronics Corporation

Beltronics USA Inc.

Uniden Corporation

Valentine Research, Inc.

Radenso Radar

K40 Electronics

Escort Inc.

Whistler Group

Adaptiv Technologies

Stinger Radar Systems

Snooper

GENEVO

PNI Corporation

Quintezz

Rocky Mountain Radar

Table of Contents

1. APAC Police Radar Detector Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Police Radar Detector Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Police Radar Detector Market Analysis

3.1. Growth Drivers (Adoption of Radar Technology, Road Safety Initiatives, Legal Compliance)

3.1.1. Increasing Road Traffic

3.1.2. Government Safety Regulations

3.1.3. Rising Demand for Speed Monitoring

3.1.4. Enhanced Vehicle Surveillance Systems

3.2. Market Challenges (Technological Limitations, Legal Restrictions, High Cost)

3.2.1. Device Detection by Law Enforcement

3.2.2. High Production Costs

3.2.3. Complex Regulatory Approvals

3.3. Opportunities (Technological Advancements, Demand in Emerging Economies, Private and Public Sector Investments)

3.3.1. Increased Adoption in Developing Nations

3.3.2. Collaborations with Law Enforcement

3.3.3. Rising Popularity of Connected Radar Detectors

3.4. Trends (Integration of AI, Miniaturization of Devices, IoT-Enabled Radar Detectors)

3.4.1. Smart Traffic Management Solutions

3.4.2. AI-Based Speed Detection Enhancements

3.4.3. IoT and Cloud-Based Radar Detection Systems

3.5. Government Regulations (Speeding Laws, Radar Detector Legality, Certification Standards)

3.5.1. Speed Limit Enforcement Policies

3.5.2. Compliance with Regional Traffic Laws

3.5.3. Export and Import Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. APAC Police Radar Detector Market Segmentation

4.1. By Type (In Value %)

4.1.1. Corded Radar Detectors

4.1.2. Cordless Radar Detectors

4.1.3. Remote Mount Radar Detectors

4.2. By Frequency Band (In Value %)

4.2.1. X-Band

4.2.2. K-Band

4.2.3. Ka-Band

4.2.4. Ku-Band

4.3. By End-User (In Value %)

4.3.1. Individual Consumers

4.3.2. Law Enforcement Agencies

4.3.3. Commercial Fleet Operators

4.4. By Technology (In Value %)

4.4.1. Radar/Lidar Detectors

4.4.2. Laser Detectors

4.4.3. Combination Detectors

4.5. By Country/Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. Southeast Asia

5. APAC Police Radar Detector Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cobra Electronics Corporation

5.1.2. Beltronics USA Inc.

5.1.3. Uniden Corporation

5.1.4. Escort Inc.

5.1.5. Valentine Research, Inc.

5.1.6. Radenso Radar

5.1.7. K40 Electronics

5.1.8. Whistler Group

5.1.9. Stinger Radar Systems

5.1.10. Adaptiv Technologies

5.1.11. Rocky Mountain Radar

5.1.12. Snooper

5.1.13. GENEVO

5.1.14. PNI Corporation

5.1.15. Quintezz

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Range, Revenue, Market Presence, Product Innovations, Strategic Partnerships, Regulatory Compliance)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Police Radar Detector Market Regulatory Framework

6.1. Speed Detection Equipment Regulations

6.2. Import/Export Restrictions

6.3. Certification Requirements

7. APAC Police Radar Detector Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Police Radar Detector Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Frequency Band (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Country/Region (In Value %)

9. APAC Police Radar Detector Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategies

9.3. Key Marketing Initiatives

9.4. White Space Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process began by identifying the key variables impacting the APAC police radar detector market. This was achieved by mapping the ecosystem, which includes all major stakeholders like law enforcement agencies, vehicle fleet operators, and radar detector manufacturers. A comprehensive desk research approach was employed to gather relevant data, utilizing both proprietary and publicly available sources.

Step 2: Market Analysis and Construction

During this phase, historical data was compiled to assess market penetration rates and revenue generation patterns. Market analysis also included evaluating the ratio of radar detector devices to vehicle count across APAC, and the effectiveness of speed detection systems. This phase helped in constructing reliable market size estimates for 2023.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of the market projections, expert consultations were conducted with industry specialists through structured interviews. These discussions provided insights into operational strategies, technological developments, and the financial outlook for the radar detector market in the APAC region.

Step 4: Research Synthesis and Final Output

Finally, the data gathered from secondary research and expert consultations was synthesized to produce the final market report. This step included verification of market data, the segmentation structure, and insights into emerging trends, ensuring a comprehensive and well-validated market analysis.

Frequently Asked Questions

01. How big is the APAC Police Radar Detector Market?

The APAC police radar detector market is valued at USD 2 billion in 2023. Its growth is driven by increasing road traffic, heightened awareness of speed limits, and government investment in traffic safety measures.

02. What are the challenges in the APAC Police Radar Detector Market?

Key challenges include the high cost of radar detectors, regulatory restrictions in certain countries, and the ability of law enforcement to detect the use of radar detectors. Additionally, evolving technology requires continuous upgrades to detection systems.

03. Who are the major players in the APAC Police Radar Detector Market?

The major players include Cobra Electronics, Beltronics USA Inc., Uniden Corporation, Valentine Research, and Radenso Radar. These companies lead the market with cutting-edge radar detection technologies and strong distribution networks.

04. What are the growth drivers of the APAC Police Radar Detector Market?

The market is driven by increasing vehicle ownership, rising traffic violation enforcement, and advancements in radar detection technology, including the integration of AI and IoT for enhanced functionality.

05. What are the future trends in the APAC Police Radar Detector Market?

Future trends include the integration of radar detectors into vehicle systems, the rise of AI-powered radar detection, and increased collaborations between manufacturers and automotive brands to offer built-in radar detection solutions

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.