Global Crushing and Screening Systems Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD6816

December 2024

91

About the Report

Global Crushing and Screening Systems Market Overview

- The global crushing and screening systems market is valued at USD 3.6 billion, based on a five-year historical analysis. This market is driven by the increasing demand for efficient, high-output machinery used in the mining, construction, and recycling industries. The rise in infrastructure development activities and the need for raw materials in emerging economies have further accelerated the demand for crushing and screening systems. Continuous technological advancements, such as mobile and energy-efficient systems, have also bolstered market growth.

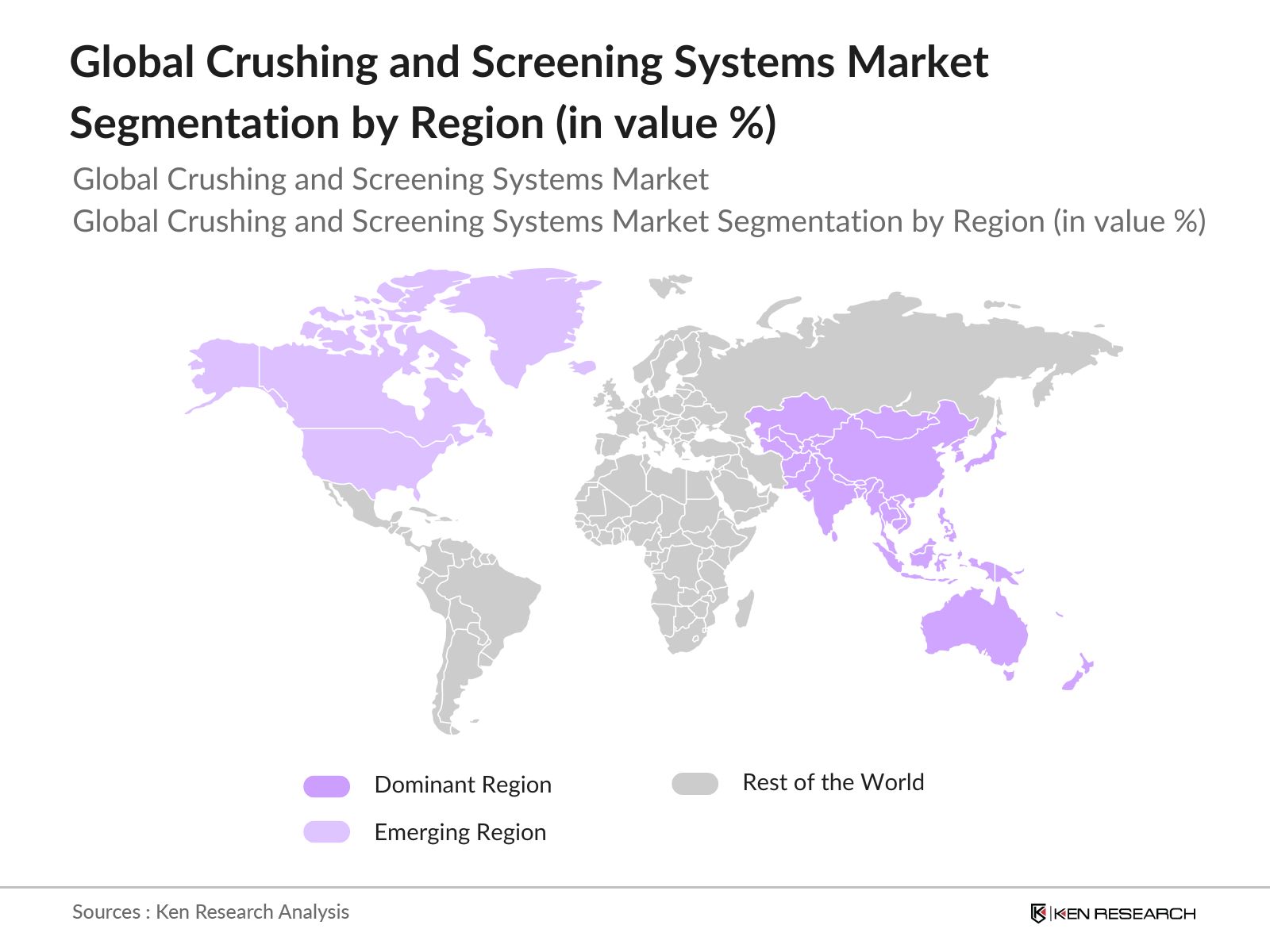

- Countries like the United States, China, and India dominate the market due to their vast mining activities and large-scale infrastructure projects. China leads the market due to its extensive construction and manufacturing sector, while the U.S. benefits from advanced technologies and mining projects. India has seen a rise in demand due to its governments focus on infrastructure development and modernization of mining operations.

- Governments worldwide are implementing stringent environmental protection laws, influencing the crushing and screening systems market. In 2023, the United States introduced new emissions standards under the Clean Air Act, targeting industrial equipment. Similarly, Australia has implemented the Environment Protection Act, mandating that all heavy machinery meet specific emissions criteria. These regulations are pushing manufacturers to develop more environmentally friendly systems, which comply with the law while maintaining efficiency. The enforcement of these laws is particularly strict in Europe, where the EUs Emissions Trading System (ETS) has set limits on industrial carbon output.

Global Crushing and Screening Systems Market Segmentation

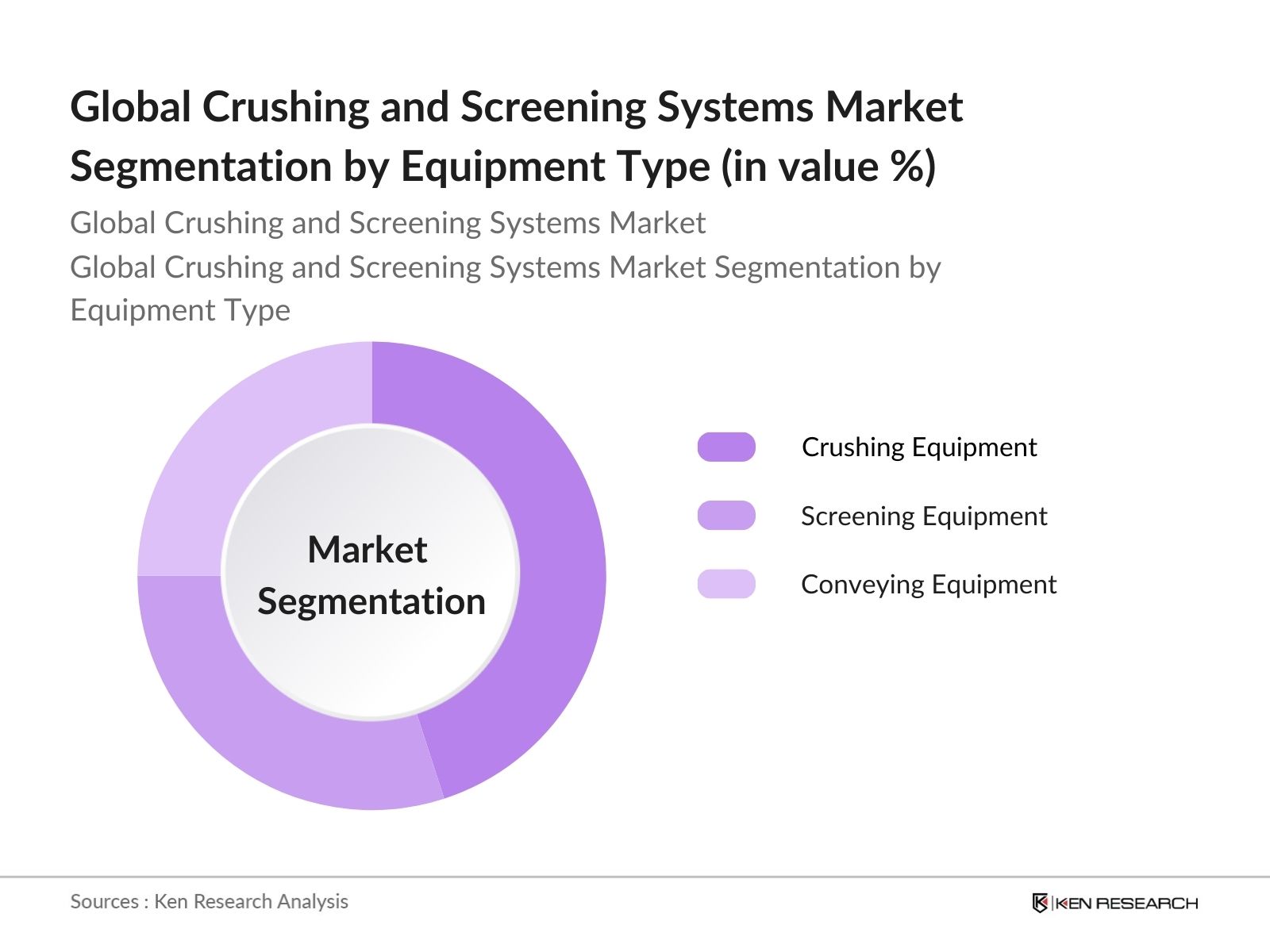

- By Equipment Type: The market is segmented by equipment type into Crushing Equipment, Screening Equipment, and Conveying Equipment. Recently, Crushing Equipment has dominated the market share within this segment. This dominance is attributed to the ongoing demand for aggregates in construction and mining. Jaw crushers, in particular, hold a notable share due to their versatility and efficiency in handling different materials and their high demand in primary crushing processes.

- By Application: The market is segmented by application into Mining, Construction, Recycling, and Quarrying. The Mining sector currently dominates this segment. Mining activities, especially in developing nations like India, are expanding rapidly, driving the need for efficient crushing and screening equipment. This demand is also influenced by the growing consumption of metals and minerals globally, which fuels mining operations and drives the requirement for crushing systems in mineral processing.

- By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Asia-Pacific dominates the global crushing and screening systems market, primarily due to China and Indias construction boom. These countries are seeing a surge in infrastructure projects and urban development, increasing the demand for crushed stone and aggregates, which necessitates the use of crushing and screening equipment. In addition, government policies supporting infrastructure growth have made this region a market leader.

Global Crushing and Screening Systems Market Competitive Landscape

The global crushing and screening systems market is dominated by both established international companies and local players, creating a competitive environment. Major market players have developed brand recognition and product portfolios, which has enabled them to capture substantial market share. These companies continually innovate to meet the changing demands of customers, which has allowed them to remain competitive in this space.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Product Range |

Geographical Presence |

R&D Investment |

|---|---|---|---|---|---|---|---|

|

Sandvik AB |

1862 |

Sweden |

- |

- |

- |

- |

- |

|

Terex Corporation |

1933 |

U.S. |

- |

- |

- |

- |

- |

|

Metso Outotec |

1939 |

Finland |

- |

- |

- |

- |

- |

|

Kleemann (Wirtgen Group) |

1857 |

Germany |

- |

- |

- |

- |

- |

|

Astec Industries, Inc. |

1972 |

U.S. |

- |

- |

- |

- |

- |

Global Crushing and Screening Systems Market Analysis

Global Crushing and Screening Systems Market Growth Drivers

- Demand for Advanced Equipment: In 2024, the construction and mining industries are experiencing a rising need for advanced crushing and screening systems. In India, the government has allocated over $1.35 trillion toward infrastructure development under the National Infrastructure Pipeline (NIP), boosting demand for technologically advanced equipment. This trend is not limited to India; similar investments are seen across the US, with the Bipartisan Infrastructure Law (BIL) set to fund $550 billion in new investments. The demand for advanced equipment is driven by the need for greater efficiency and productivity to meet the demands of large-scale infrastructure projects.

- Infrastructure Developments: Global infrastructure development initiatives are contributing to the growth of the crushing and screening systems market. China's Belt and Road Initiative (BRI), for example, continues to fuel construction activities across Asia, Europe, and Africa, requiring high-performance screening systems. According to the Asian Development Bank, developing Asia requires $26 trillion in infrastructure investment by 2030. This vast requirement for construction materials and equipment is propelling demand for crushing and screening systems in these regions, as companies seek efficient solutions for processing materials for infrastructure projects.

- Mining Industry Expansion: The global mining industry is undergoing rapid expansion due to the growing demand for minerals and metals. For example, copper production in Chile, the world's largest producer, reached 5.7 million metric tons in 2023. Similarly, Australias mining sector has seen an increase in iron ore production, with exports valued at $136 billion in 2023. This growing extraction of resources is leading to an increased demand for efficient crushing and screening systems, which are crucial for processing mined materials before they can be transported or further refined.

Global Crushing and Screening Systems Market Challenges

- High Capital Investments: The crushing and screening systems market faces a major challenge in terms of high capital investments. The cost of purchasing and maintaining modern crushing equipment can range from $500,000 to over $5 million, depending on the complexity and capacity of the systems. This high upfront cost is a barrier for small and medium-sized enterprises (SMEs), which often struggle to access the necessary financial resources for such investments. These high capital costs limit market penetration in emerging economies where financial support for industrial machinery is still lacking.

- Environmental Regulations: Stringent environmental regulations, especially in developed countries, pose a challenge to the crushing and screening systems market. For example, the United States Environmental Protection Agency (EPA) imposes strict emission limits under the Clean Air Act, which requires crushing equipment manufacturers to develop systems that reduce dust and other pollutants. In Europe, similar regulations under the EU's Green Deal are prompting the need for eco-friendly machinery. These regulations often increase the cost of manufacturing equipment, adding to the financial burden for manufacturers and buyers alike.

Global Crushing and Screening Systems Market Future Outlook

Over the next five years, the global crushing and screening systems market is expected to show growth driven by the increasing need for efficient mining and construction equipment. Governments worldwide are pushing for infrastructure development, especially in emerging economies like India and Brazil. Additionally, technological advancements in mobile crushers and environmentally-friendly equipment will contribute to the market's expansion. This growth will be further supported by heightened demand for recycled aggregates, encouraging companies to invest in energy-efficient and sustainable solutions.

Global Crushing and Screening Systems Market Opportunities

- Rising Demand for Mobile Equipment: The global trend toward mobile crushing and screening equipment is creating new growth opportunities in the market. The flexibility and ease of transport offered by mobile systems are appealing to mining and construction companies. In 2023, mobile crushing equipment accounted for 45% of total global sales, with higher demand in regions like Africa and South America, where mining operations are often located in remote areas. These mobile systems allow for on-site processing, reducing transportation costs and improving operational efficiency for companies working in difficult terrains.

- Technological Advancements: Technological advancements, particularly the integration of automation and artificial intelligence (AI), are revolutionizing the crushing and screening systems market. Automated systems enable real-time monitoring and adjustments to optimize performance. According to a report from the International Federation of Robotics (IFR), the global market for industrial automation reached $52 billion in 2023, with the mining and construction sectors contributing to this growth. AI-driven systems in crushing operations help in predictive maintenance, reducing downtime and enhancing overall productivity.

Scope of the Report

|

Equipment Type |

Crushing Equipment (Jaw Crushers, Cone Crushers, Impact Crushers) Screening Equipment (Vibrating Screens, Horizontal Screens) Conveying Equipment |

|

Application |

Mining Construction Recycling Quarrying |

|

Mobility |

Mobile Crushing and Screening Stationary Crushing and Screening |

|

End-Use Industry |

Infrastructure Development Mining Waste Management and Recycling |

|

Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Mining Companies

Construction Companies

Government and Regulatory Bodies (Environmental Protection Agency, Mining Regulatory Authority)

Recycling Plants

Banks and Financial Institutions

Infrastructure Development Firms

Heavy Equipment Manufacturers

Investor and Venture Capitalist Firms

Logistics and Supply Chain Companies

Companies

Players Mentioned in the Report

Sandvik AB

Terex Corporation

Metso Outotec

Astec Industries, Inc.

Kleemann (Wirtgen Group)

McCloskey International

Rubble Master

Superior Industries

ThyssenKrupp AG

Powerscreen (Terex)

Table of Contents

1. Global Crushing and Screening Systems Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Crushing and Screening Systems Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Crushing and Screening Systems Market Analysis

3.1 Growth Drivers

3.1.1 Demand for Advanced Equipment

3.1.2 Infrastructure Developments

3.1.3 Mining Industry Expansion

3.1.4 Increasing Recycling of Construction Materials

3.2 Market Challenges

3.2.1 High Capital Investments

3.2.2 Environmental Regulations

3.2.3 Lack of Technological Integration in Developing Markets

3.3 Opportunities

3.3.1 Rising Demand for Mobile Equipment

3.3.2 Technological Advancements (Automation, AI Integration)

3.3.3 Expanding Mining Activities in Emerging Economies

3.4 Trends

3.4.1 Shift Towards Energy-Efficient Systems

3.4.2 Adoption of Hybrid and Electric Crushing Equipment

3.4.3 Increased Use of AI and Automation in Screening Processes

3.5 Government Regulations

3.5.1 Environmental Protection Laws

3.5.2 Health & Safety Standards in Mining and Construction

3.5.3 Industry-Specific Emission Norms

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Mining Companies, Construction Firms, Recycling Firms)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape and Ecosystem

4. Global Crushing and Screening Systems Market Segmentation

4.1 By Equipment Type (In Value %)

4.1.1 Crushing Equipment (Jaw Crushers, Cone Crushers, Impact Crushers)

4.1.2 Screening Equipment (Vibrating Screens, Horizontal Screens)

4.1.3 Conveying Equipment

4.2 By Application (In Value %)

4.2.1 Mining

4.2.2 Construction

4.2.3 Recycling

4.2.4 Quarrying

4.3 By Mobility (In Value %)

4.3.1 Mobile Crushing and Screening

4.3.2 Stationary Crushing and Screening

4.4 By End-Use Industry (In Value %)

4.4.1 Infrastructure Development

4.4.2 Mining

4.4.3 Waste Management and Recycling

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. Global Crushing and Screening Systems Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Sandvik AB

5.1.2 Terex Corporation

5.1.3 Metso Outotec

5.1.4 Astec Industries, Inc.

5.1.5 Kleemann (Wirtgen Group)

5.1.6 Eagle Crusher Company

5.1.7 McCloskey International

5.1.8 Rubble Master

5.1.9 ThyssenKrupp AG

5.1.10 SBM Mineral Processing

5.1.11 Powerscreen (Terex)

5.1.12 Shanghai Zenith Crusher

5.1.13 Parker Plant Limited

5.1.14 Superior Industries, Inc.

5.1.15 Striker Crushing & Screening

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Range, Geographical Presence, Market Share, Strategic Initiatives, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Funding and Subsidies

6. Global Crushing and Screening Systems Market Regulatory Framework

6.1 Environmental Standards and Emission Control

6.2 Compliance Requirements

6.3 Certification Processes and Quality Standards

7. Global Crushing and Screening Systems Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Crushing and Screening Systems Future Market Segmentation

8.1 By Equipment Type (In Value %)

8.2 By Application (In Value %)

8.3 By Mobility (In Value %)

8.4 By End-Use Industry (In Value %)

8.5 By Region (In Value %)

9. Global Crushing and Screening Systems Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Key Marketing Strategies

9.3 Customer Cohort Analysis

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this step, we develop a comprehensive ecosystem map that includes all major stakeholders in the crushing and screening systems market. This involves detailed desk research through proprietary databases and public records to identify key drivers and barriers affecting the market.

Step 2: Market Analysis and Construction

We assess historical data for the global crushing and screening systems market, analyzing trends in demand for key equipment such as crushers and screens. The research includes market penetration analysis and revenue generation from major end-use industries like mining and construction.

Step 3: Hypothesis Validation and Expert Consultation

To ensure accuracy, our initial market hypotheses are validated through interviews with industry experts, including manufacturers, end-users, and distributors. Their insights help refine our market size and growth rate projections.

Step 4: Research Synthesis and Final Output

In the final stage, data from primary and secondary sources is synthesized, and detailed reports are created to provide actionable insights for market stakeholders. This includes competitive analysis, market trends, and growth forecasts.

Frequently Asked Questions

01. How big is the Global Crushing and Screening Systems Market?

The global crushing and screening systems market is valued at USD 3.6 billion, driven by demand for mining, construction, and recycling equipment.

02. What are the challenges in the Global Crushing and Screening Systems Market?

Challenges in the global crushing and screening systems market include high capital investment, stringent environmental regulations, and the lack of skilled workforce in developing countries.

03. Who are the major players in the Global Crushing and Screening Systems Market?

Key players in the global crushing and screening systems market include Sandvik AB, Terex Corporation, Metso Outotec, Kleemann (Wirtgen Group), and Astec Industries, Inc.

04. What are the growth drivers of the Global Crushing and Screening Systems Market?

Growth drivers of the global crushing and screening systems market include the increasing demand for aggregates in construction, expansion of mining activities, and technological advancements in mobile and energy-efficient equipment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.