Global Oilfield Services Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD10585

December 2024

95

About the Report

Global Oilfield Services Market Overview

- The global oilfield services market, valued at USD 129 billion, is driven by increasing production and exploration activities in the oil and gas industry. This growth is propelled by the rapid development of shale gas and a rising demand for improved oil recovery techniques.

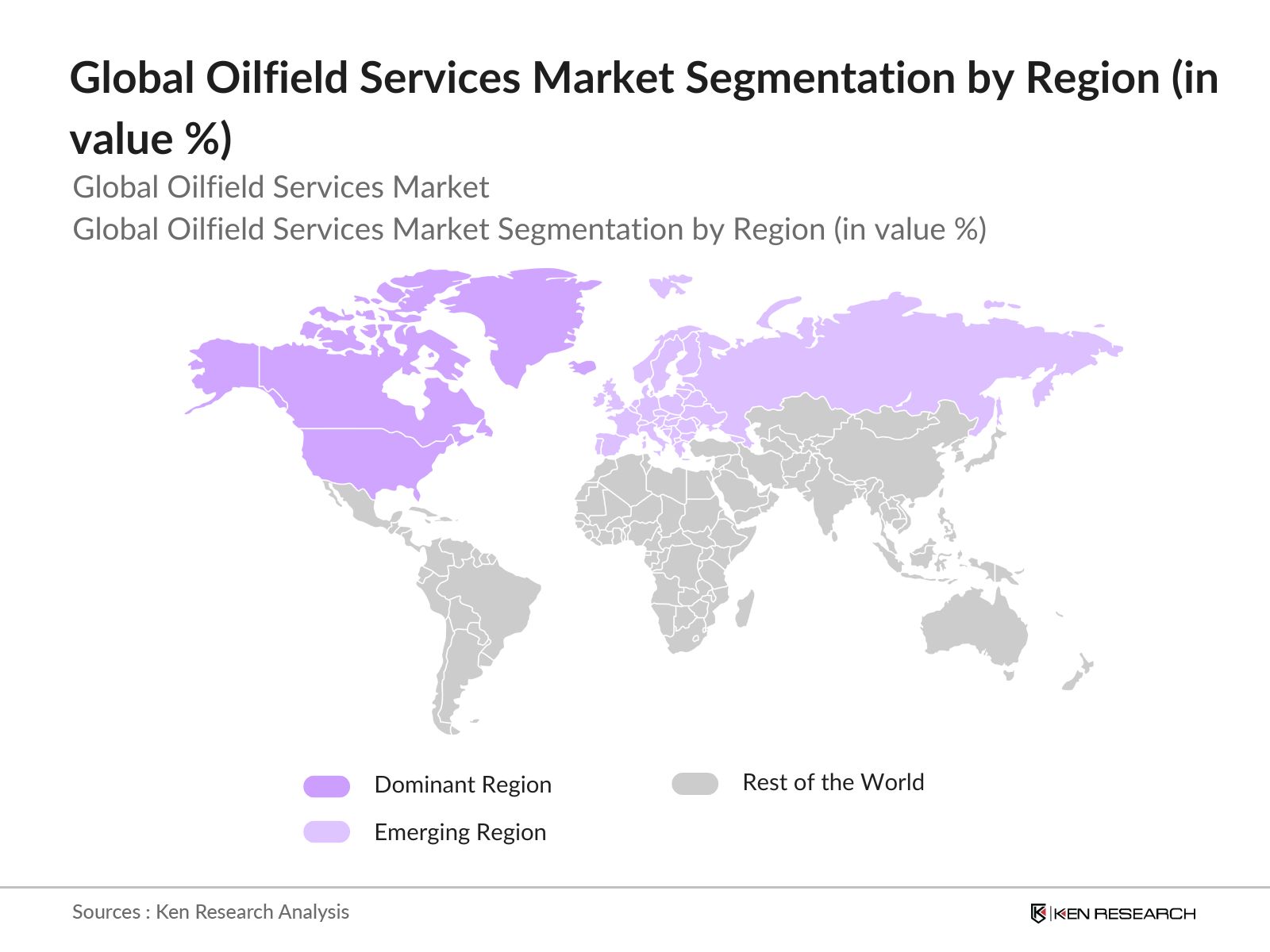

- North America, particularly the United States, dominates the market due to its advanced infrastructure and investments in shale gas exploration. The Middle East also holds a substantial share, attributed to its vast hydrocarbon reserves and ongoing exploration activities.

- The International Maritime Organization (IMO) has implemented stringent regulations affecting offshore drilling operations, particularly with the MARPOL Convention aimed at preventing pollution in international waters. The IMO mandates that offshore rigs adhere to specific standards for waste disposal, emissions, and discharge, with additional protocols for the safe handling of hazardous substances. Compliance with IMO regulations requires investment in emission-control technology and waste management systems. In 2024, these standards are expected to influence operational costs for offshore projects, pushing companies to adopt greener practices.

Global Oilfield Services Market Segmentation

- By Service Type: The market is segmented by service type into drilling services, completion services, production services, processing and separation services, and subsea services. Drilling services hold a dominant market share due to the continuous need for new wells to meet global energy demands. Technological advancements in drilling techniques have enhanced efficiency and reduced operational costs, further solidifying this segment's leading position.

- By Application: The market is divided into onshore and offshore applications. Onshore applications dominate the market, driven by lower operational costs and easier accessibility compared to offshore sites. The extensive presence of onshore oilfields, especially in regions like North America and the Middle East, contributes to this segment's prominence.

- By Region: The market is segmented into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. North America leads the market, primarily due to the United States' significant investments in shale gas exploration and advanced infrastructure. The Middle East follows, with its vast hydrocarbon reserves and ongoing exploration activities.

Global Oilfield Services Market Competitive Landscape

The global oilfield services market is characterized by the presence of several key players who drive innovation and maintain competitive advantages through technological advancements and strategic partnerships.

Global Oilfield Services Market Analysis

Market Growth Drivers

- Increasing Global Energy Demand: Global energy consumption continues to rise, driven by economic growth and population expansion. The International Energy Agency (IEA) projects that global energy demand will increase by 4% in 2024, marking the fastest growth rate in nearly two decades. This surge is largely attributed to heightened cooling needs due to rising temperatures, particularly in regions like India and China, where electricity demand is expected to grow by 8% and 6%, respectively.

- Expansion of Unconventional Oil and Gas Extraction: The extraction of unconventional oil and gas resources, including shale formations and tight reservoirs, has expanded notably. In the United States, shale oil production has reached 7.7 million barrels per day, accounting for a notable portion of the country's total oil output. This expansion is supported by advancements in hydraulic fracturing and horizontal drilling techniques, which have unlocked previously inaccessible reserves.

- Rising Investments in Offshore Drilling Activities: Investments in offshore drilling are on the rise, driven by the discovery of substantial deepwater and ultra-deepwater reserves. The global offshore drilling market is projected to experience significant growth, with investments focusing on regions such as the Gulf of Mexico and the North Sea. These areas have seen increased exploration activities, leading to the development of new offshore projects and the deployment of advanced drilling rigs.

Market Challenges

- Volatility in Crude Oil Prices: The oilfield services market faces challenges due to fluctuations in crude oil prices. Recent data indicates that Brent crude oil prices have averaged around $80.55 per barrel in 2024, with projections suggesting a decline to $76.61 per barrel in 2025. This volatility affects investment decisions and operational planning within the sector.

- Stringent Environmental Regulations: Environmental regulations have become increasingly stringent, impacting oilfield operations. For instance, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) has introduced new safety measures for offshore drilling, particularly for projects operating at pressures exceeding 15,000 PSI or temperatures over 350F. These regulations necessitate compliance with specific equipment and reporting requirements, adding to operational complexities.

Global Oilfield Services Market Future Outlook

Over the next five years, the global oilfield services market is expected to experience growth, driven by continuous technological advancements, increasing energy demand, and the expansion of exploration activities into unconventional reserves. The adoption of digital oilfield technologies and enhanced oil recovery techniques will further propel market expansion.

Market Opportunities

- Development of Deepwater and Ultra-Deepwater Reserves: The development of deepwater and ultra-deepwater reserves presents significant opportunities for the oilfield services market. Technological advancements have enabled drilling at depths exceeding 10,000 feet, unlocking vast hydrocarbon resources. For example, the deepest offshore drilling project in the Gulf of Mexico has reached a depth of 10,194 feet, highlighting the potential for further exploration in deepwater regions.

- Adoption of Digital Oilfield Technologies: The adoption of digital oilfield technologies offers opportunities to enhance operational efficiency and reduce costs. The integration of artificial intelligence and big data analytics enables real-time monitoring and predictive maintenance, leading to optimized drilling operations. These technologies facilitate better decision-making and improve overall productivity in oilfield services.

Scope of the Report

|

Segment |

Sub-Segments |

|

Service Type |

Drilling Services |

|

Application |

Onshore |

|

Technology |

Hydraulic Fracturing |

|

Well Type |

Horizontal Wells |

|

Region |

North America |

Products

Key Target Audience

Oil and Gas Exploration and Production Companies

Drilling Contractors

Equipment Manufacturers

Technology Providers

Government and Regulatory Bodies (e.g., U.S. Department of Energy, International Energy Agency)

Investors and Venture Capitalist Firms

Environmental Agencies

Research and Development Institutions

Companies

Players Mentioned in the Report

Schlumberger Limited

Halliburton Company

Baker Hughes Company

Weatherford International plc

China Oilfield Services Limited (COSL)

National Oilwell Varco, Inc.

TechnipFMC plc

Saipem S.p.A.

Transocean Ltd.

Petrofac Limited

Table of Contents

1. Global Oilfield Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Oilfield Services Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Oilfield Services Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Global Energy Demand

3.1.2. Technological Advancements in Exploration and Production

3.1.3. Expansion of Unconventional Oil and Gas Extraction

3.1.4. Rising Investments in Offshore Drilling Activities

3.2. Market Challenges

3.2.1. Volatility in Crude Oil Prices

3.2.2. Stringent Environmental Regulations

3.2.3. High Operational Costs

3.3. Opportunities

3.3.1. Development of Deepwater and Ultra-Deepwater Reserves

3.3.2. Adoption of Digital Oilfield Technologies

3.3.3. Growth in Emerging Markets

3.4. Trends

3.4.1. Integration of Artificial Intelligence and Big Data Analytics

3.4.2. Emphasis on Sustainable and Environmentally Friendly Practices

3.4.3. Increased Focus on Enhanced Oil Recovery (EOR) Techniques

3.5. Government Regulations

3.5.1. International Maritime Organization (IMO) Regulations

3.5.2. National Environmental Policies

3.5.3. Tax Incentives for Exploration Activities

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

4. Global Oilfield Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Drilling Services

4.1.2. Completion Services

4.1.3. Production Services

4.1.4. Processing and Separation Services

4.1.5. Subsea Services

4.2. By Application (In Value %)

4.2.1. Onshore

4.2.2. Offshore

4.3. By Technology (In Value %)

4.3.1. Hydraulic Fracturing

4.3.2. Directional Drilling

4.3.3. Measurement While Drilling (MWD)

4.3.4. Logging While Drilling (LWD)

4.3.5. Enhanced Oil Recovery (EOR)

4.4. By Well Type (In Value %)

4.4.1. Horizontal Wells

4.4.2. Vertical Wells

4.4.3. Multilateral Wells

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Oilfield Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Schlumberger Limited

5.1.2. Halliburton Company

5.1.3. Baker Hughes Company

5.1.4. Weatherford International plc

5.1.5. National Oilwell Varco, Inc.

5.1.6. China Oilfield Services Limited (COSL)

5.1.7. TechnipFMC plc

5.1.8. Saipem S.p.A.

5.1.9. Transocean Ltd.

5.1.10. Petrofac Limited

5.1.11. Expro Group

5.1.12. Superior Energy Services, Inc.

5.1.13. Nabors Industries Ltd.

5.1.14. Patterson-UTI Energy, Inc.

5.1.15. Helmerich & Payne, Inc.

5.2. Cross Comparison Parameters (Revenue, Market Share, Service Portfolio, Geographic Presence, Technological Innovations, Strategic Initiatives, R&D Investments, Employee Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Oilfield Services Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Oilfield Services Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Oilfield Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Well Type (In Value %)

8.5. By Region (In Value %)

9. Global Oilfield Services Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global oilfield services market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global oilfield services market. This includes assessing market penetration, the ratio of service providers to exploration companies, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple oilfield service providers to acquire detailed insights into service segments, operational performance, client preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global oilfield services market.

Frequently Asked Questions

01. How big is the global oilfield services market?

The global oilfield services market is valued at USD 129 billion, driven by increasing production and exploration activities in the oil and gas industry. The growth is primarily supported by advancements in shale gas exploration and enhanced oil recovery techniques.

02. What are the challenges in the global oilfield services market?

The market faces challenges from crude oil price volatility, high operational costs, and strict environmental regulations, which impact profitability. Additionally, managing fluctuating demand and technological complexities in new extraction methods adds to the sector's hurdles.

03. Who are the major players in the global oilfield services market?

Key players include Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International, and China Oilfield Services Limited (COSL). These companies dominate due to their global presence, comprehensive service portfolios, and investment in technological innovation.

04. What are the growth drivers of the global oilfield services market?

Growth drivers include rising global energy demand, expansion of unconventional oil reserves, and increased offshore exploration. Technological advancements, such as digital oilfield solutions and enhanced oil recovery (EOR) methods, are also driving market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.