Global Orthopedic Devices Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1954

December 2024

98

About the Report

Global Orthopedic Devices Market Overview

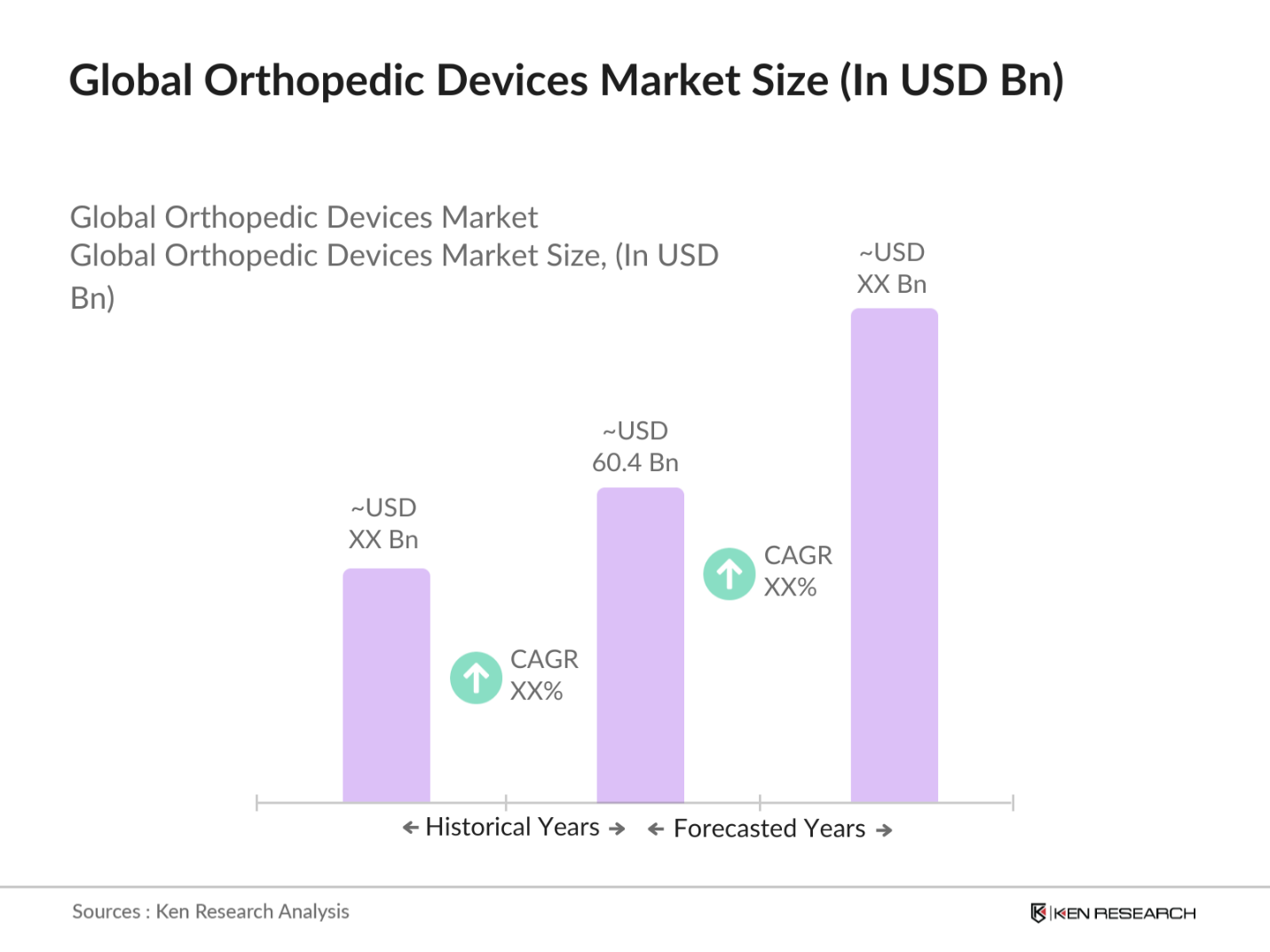

- The global orthopedic devices market was valued at USD 60.4 billion, driven by the increasing prevalence of musculoskeletal conditions and advancements in orthopedic surgical techniques. The market is largely propelled by the growing aging population, the rise in osteoarthritis cases, and the increasing demand for minimally invasive orthopedic procedures. These factors, combined with technological innovations in robotic-assisted surgeries and patient-specific implants, have been key contributors to the consistent growth of the market

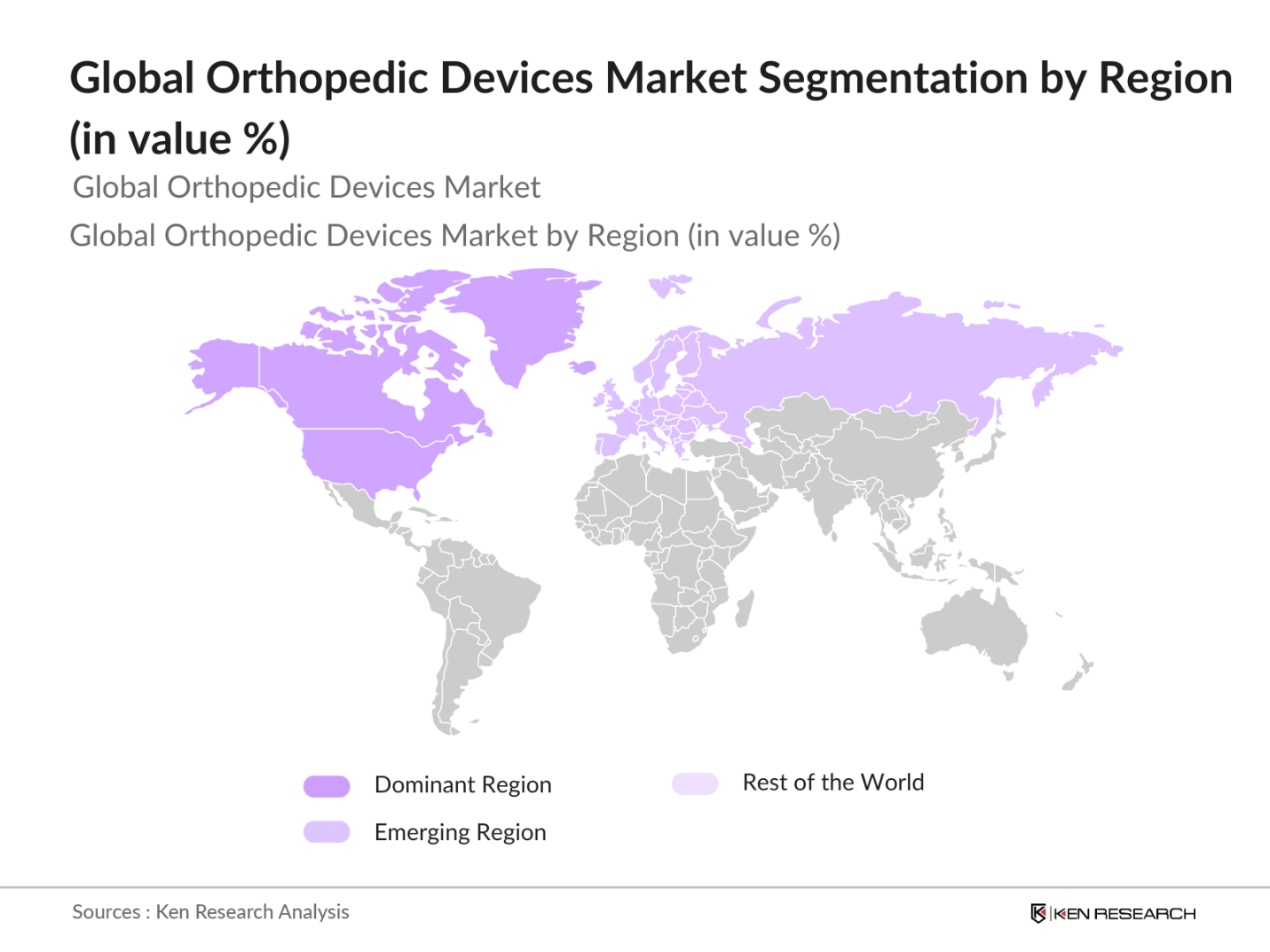

- North America, particularly the United States, dominates the orthopedic devices market, owing to its advanced healthcare infrastructure, a large base of geriatric patients, and a high incidence of orthopedic surgeries, such as hip and knee replacements. The Asia-Pacific region is also seeing rapid growth due to the rising demand for orthopedic implants and procedures, fueled by the aging population and increasing healthcare expenditure in countries such as China, India, and Japan

- The U.S. and Europe. The FDA approved over 150 new orthopedic devices in 2023, with similar figures reported for CE approvals in Europe. Regulatory bodies are increasingly streamlining approval processes for innovative devices, such as patient-specific implants and robotic systems. The U.S. government invested $2 billion in 2024 to accelerate medical device approvals, highlighting the growing importance of orthopedic innovations in global healthcare.

Global Orthopedic Devices Market Segmentation

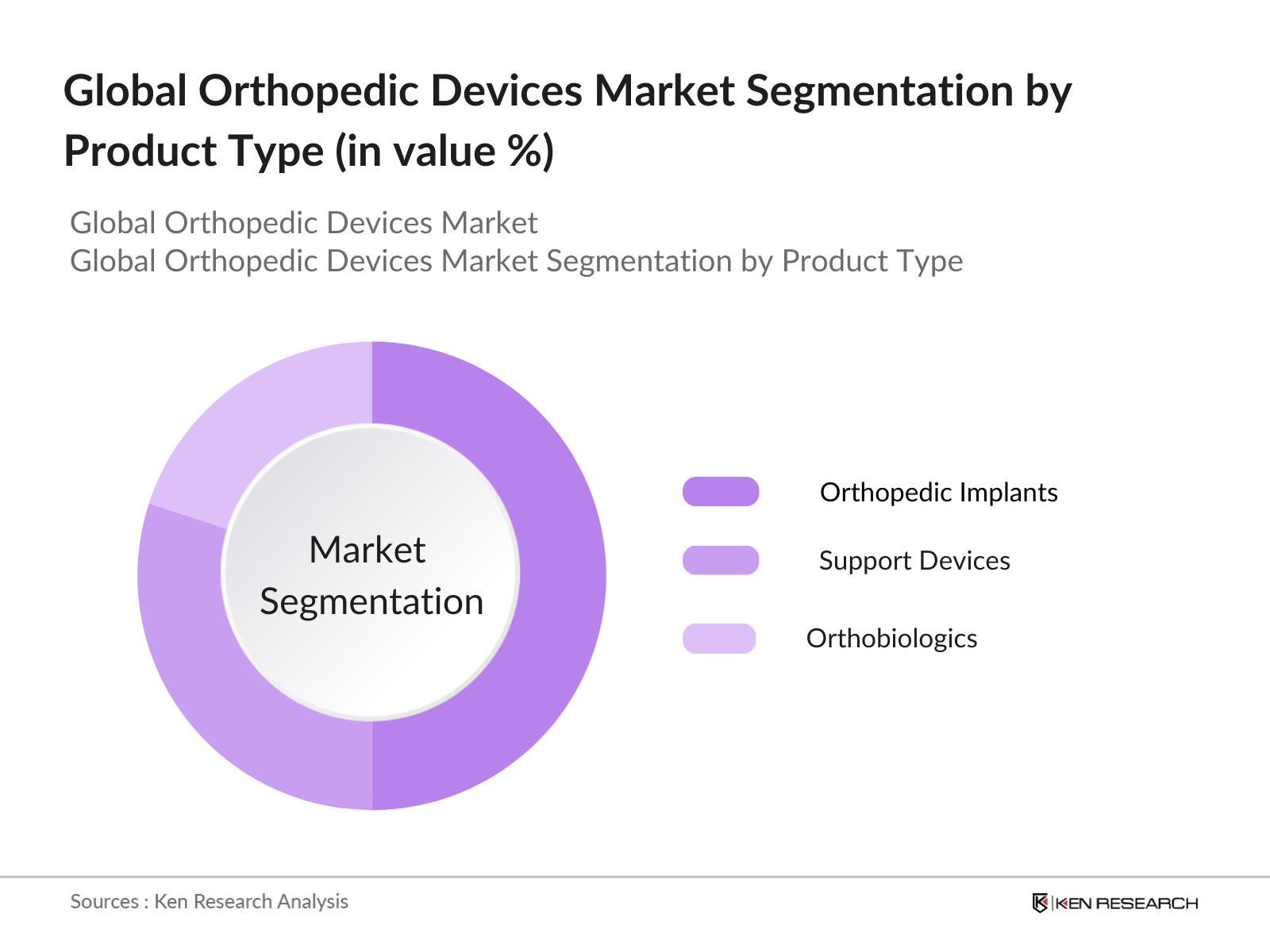

By Product Type: The orthopedic devices market is segmented into orthopedic implants, support devices, and orthobiologics. Orthopedic implants dominate this category due to their widespread application in joint replacements, fracture repairs, and other reconstructive surgeries. The dominance of orthopedic implants is attributed to their integral role in improving patient mobility and recovery times. Additionally, the rising number of joint replacement procedures and trauma-related surgeries across developed and emerging markets ensures this segment remains at the forefront

By Region: The regional segmentation of the orthopedic devices market covers North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, with the U.S. being the largest contributor due to its advanced healthcare system, significant healthcare spending, and the prevalence of orthopedic surgeries. Europe follows closely behind, driven by the high rate of osteoarthritis and joint replacement procedures. The Asia-Pacific region is projected to grow rapidly owing to the increasing healthcare infrastructure and medical tourism in countries like India and China

Global Orthopedic Devices Market Competitive Landscape

The global orthopedic devices market is dominated by several key players, including Zimmer Biomet, Stryker Corporation, and Johnson & Johnson, who have established a strong foothold through continuous innovation, acquisitions, and expansion of their product portfolios. These companies hold a competitive advantage due to their focus on research and development, global distribution networks, and strategic collaborations. Emerging players in the Asia-Pacific region, such as MicroPort Scientific Corporation, are also gaining prominence due to their cost-effective solutions and expanding footprint

|

Company |

Year Established |

Headquarters |

Market Presence |

R&D Investments |

Product Innovations |

Global Reach |

Revenue (2023) |

Key Strategic Initiatives |

|

Zimmer Biomet Holdings |

1927 |

USA |

- |

- |

- |

- |

- |

- |

|

Stryker Corporation |

1941 |

USA |

- |

- |

- |

- |

- |

- |

|

Johnson & Johnson |

1886 |

USA |

- |

- |

- |

- |

- |

- |

|

Medtronic PLC |

1949 |

Ireland |

- |

- |

- |

- |

- |

- |

|

MicroPort Scientific |

1998 |

China |

- |

- |

- |

- |

- |

- |

Global Orthopedic Devices Market Analysis

Global Orthopedic Devices Market Growth Drivers

- Technological Advancements in Minimally Invasive Surgery: Minimally invasive surgeries are revolutionizing the orthopedic market. The demand for joint replacements and trauma care has surged, with nearly 1.2 million joint replacement procedures performed annually worldwide. Technological advancements such as robotic-assisted surgeries reduce recovery time by up to 40%, increasing their popularity. These advancements have driven significant investments in R&D, with the U.S. allocating $45 billion towards healthcare technology in 2024. The prevalence of conditions like osteoarthritis, expected to affect 600 million individuals globally by 2025, further boosts demand for innovative surgical solutions.

- Rising Prevalence of Musculoskeletal Disorders: Musculoskeletal disorders have seen a steady increase, impacting more than 1.7 billion people globally, according to the World Health Organization (WHO). This has driven demand for orthopedic devices, particularly for joint replacement and fracture management. Trauma-related injuries contribute to over 70 million hospital visits annually, with these numbers expected to rise due to increasing life expectancy. Countries like the U.S. and Germany are witnessing higher investments in orthopedic care, with the global medical device sector expected to surpass $500 billion in economic output by 2024.

- Growing Aging Population and Osteoarthritis Cases: The global population of individuals over the age of 60 is projected to reach 1.5 billion by 2030, with osteoarthritis affecting over 350 million individuals today. This growing elderly demographic drives up the demand for joint replacements and orthopedic care, particularly in developed nations such as Japan, Germany, and the U.S. Governments in these countries are increasing healthcare spending, with Japan dedicating over $100 billion in 2024 to elder healthcare solutions, including orthopedic care and rehabilitation services.

Global Orthopedic Devices Market Challenges

- High Costs of Orthopedic Surgeries: Orthopedic surgeries, such as joint replacements, can cost up to $50,000 per procedure in the U.S., making them financially inaccessible for many. Even in countries with public healthcare, the cost remains high due to the price of advanced orthopedic devices. The cost of manufacturing high-quality, biocompatible materials also adds to the financial burden. For instance, titanium, used extensively in implants, has seen a 20% increase in price over the past two years. Global healthcare spending for orthopedic procedures is expected to surpass $150 billion in 2024, amplifying cost challenges.

- Stringent Regulatory Frameworks: The approval process for orthopedic devices is often delayed due to complex regulatory frameworks across regions. For instance, in the U.S., the Food and Drug Administration (FDA) takes up to 15 months to approve a new orthopedic device, leading to market entry delays. Similarly, in Europe, the CE marking process for medical devices can take over 12 months. These delays hinder timely market access and innovation. This challenge is especially significant for emerging markets that rely on imported devices, further complicating their availability and affordability.

Global Orthopedic Devices Market Future Outlook

The orthopedic devices market is expected to experience robust growth over the next five years. Factors such as increasing geriatric populations, the rising number of sports injuries, and the growing prevalence of musculoskeletal disorders will drive the demand for orthopedic implants and devices. Technological advancements, including the adoption of 3D printing and robotic-assisted surgeries, are set to play a pivotal role in shaping the future of this market. As the healthcare infrastructure in emerging markets continues to develop, the global orthopedic devices market will witness increased penetration and expanded product offerings

Market Opportunities:

- 3D Printing for Prosthetics and Implants: 3D printing has revolutionized orthopedic care, with global spending on medical 3D printing reaching $1.3 billion in 2023. Countries like the U.S., China, and Germany are leading the adoption of 3D-printed prosthetics and implants. This technology allows for customized solutions that enhance patient outcomes and reduce recovery times. Approximately 500,000 patients have benefited from 3D-printed orthopedic solutions globally, and healthcare systems are increasingly integrating this technology to streamline surgical procedures.

- Increased Usage of Orthobiologics in Bone Healing: Orthobiologics, such as bone graft substitutes and stem cells, are increasingly used to promote faster recovery and bone healing. In 2023, over 2 million orthopedic surgeries incorporated orthobiologics, with the market expected to grow due to their effectiveness in enhancing tissue regeneration. The demand for biologics has surged in North America and Europe, where of bone healing procedures now involve biologics. These advancements reduce surgery time and improve long-term outcomes for patients.

Scope of the Report

|

By Product Type |

Static Volumetric Displays Swept-Volume Displays Multi-Planar Volumetric Displays |

|

By Display Technology |

Digital Light Processing (DLP) Liquid Crystal Display (LCD) Light Emitting Diode (LED) |

|

By Application |

Medical Imaging AR/VR Advertising and Marketing Engineering and Design |

|

By End-User |

Healthcare, Automotive, Aerospace & Defense Entertainment and Media Education |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Orthopedic Implant Manufacturers

Hospitals and Healthcare Providers

Government and Regulatory Bodies (FDA, CE Mark, CFDA)

Medical Device Distributors

Investment and Venture Capitalist Firms

Orthopedic Clinics and Ambulatory Care Centers

Rehabilitation Centers

Insurance Companies

Companies

Players Mention in the Report

Zimmer Biomet Holdings Inc.

Stryker Corporation

Johnson & Johnson

Medtronic PLC

MicroPort Scientific Corporation

Smith & Nephew PLC

B. Braun SE

Globus Medical Inc.

Arthrex Inc.

NuVasive Inc.

Conmed Corporation

Boston Scientific Corporation

Alphatec Spine Inc.

Enovis Corporation

Ossur HF

Table of Contents

01. Global Orthopedic Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Orthopedic Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Orthopedic Devices Market Analysis

3.1. Growth Drivers (Increasing demand for joint replacements, trauma care, and sports injuries)

3.1.1. Technological Advancements in Minimally Invasive Surgery

3.1.2. Rising Prevalence of Musculoskeletal Disorders

3.1.3. Growing Aging Population and Osteoarthritis Cases

3.2. Market Challenges (High device costs and regulatory hurdles)

3.2.1. High Costs of Orthopedic Surgeries

3.2.2. Stringent Regulatory Frameworks

3.2.3. Lack of Reimbursement in Emerging Markets

3.3. Opportunities (Development of patient-specific implants and AI-driven solutions)

3.3.1. Patient-Specific Customized Implants

3.3.2. Robotic-Assisted Surgeries

3.3.3. Growth in Emerging Markets

3.4. Trends (Adoption of 3D Printing, Orthobiologics, and IoT-enabled devices)

3.4.1. 3D Printing for Prosthetics and Implants

3.4.2. Increased Usage of Orthobiologics in Bone Healing

3.4.3. Integration of AI and IoT in Orthopedic Devices

3.5. Government Initiatives (Healthcare policies supporting orthopedic care)

3.5.1. Regulatory Approvals in Key Markets (FDA, CE, and Other Regulatory Bodies)

3.5.2. Favorable Reimbursement Policies in Developed Markets

3.5.3. Government Funding for Medical Device Innovation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

04. Global Orthopedic Devices Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Orthopedic Implants

4.1.2. Support Devices

4.1.3. Orthobiologics

4.2. By Application (In Value %)

4.2.1. Hip and Pelvis Devices

4.2.2. Knee and Thigh Devices

4.2.3. Spine Devices

4.2.4. Trauma Fixation Devices

4.3. By End-User (In Value %)

4.3.1. Hospitals and Surgical Centers

4.3.2. Orthopedic Clinics

4.3.3. Ambulatory and Trauma Care Centers

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East and Africa

05. Global Orthopedic Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (By Revenue, Market Share, R&D Investments)

5.1.1. Zimmer Biomet Holdings Inc.

5.1.2. Stryker Corporation

5.1.3. Smith & Nephew PLC

5.1.4. Johnson & Johnson Services Inc.

5.1.5. Medtronic PLC

5.1.6. Arthrex Inc.

5.1.7. Globus Medical Inc.

5.1.8. NuVasive Inc.

5.1.9. Boston Scientific Corporation

5.1.10. B. Braun SE

5.1.11. Conformis Inc.

5.1.12. Enovis Corp.

5.1.13. MicroPort Scientific Corporation

5.1.14. OrthAlign Corp.

5.1.15. Alphatec Holdings Inc.

5.2. Cross-Comparison Parameters (R&D spending, Product Portfolio, Global Reach, Innovation Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Mergers, and Acquisitions)

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Government Grants

5.8. Private Equity Investments

06. Global Orthopedic Devices Market Regulatory Framework

6.1. Compliance with International Standards

6.2. Certification Processes for Medical Devices

6.3. Quality Assurance in Manufacturing

07. Global Orthopedic Devices Future Market Size (In USD Bn)

7.1. Market Projections

7.2. Factors Driving Future Market Growth

08. Global Orthopedic Devices Future Market Segmentation

8.1. By Product Type

8.2. By Application

8.3. By End-User

8.4. By Region

09. Global Orthopedic Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with a thorough ecosystem mapping of the orthopedic devices market, identifying key stakeholders, including manufacturers, healthcare providers, and regulatory bodies. Desk research using secondary databases provides a foundational understanding of industry-level dynamics.

Step 2: Market Analysis and Construction

Next, historical data on orthopedic device sales, surgical volumes, and market penetration is compiled and analyzed. This helps construct accurate market size estimations and revenue generation insights for the forecast period.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry professionals, including orthopedic surgeons and medical device distributors. These interviews provide qualitative insights that refine market estimates and projections.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized into actionable insights, corroborated by the bottom-up approach. This includes detailed analysis on product performance, market trends, and future growth projections in the orthopedic devices industry.

Frequently Asked Questions

01. How big is the Global Orthopedic Devices Market?

The global orthopedic devices market was valued at USD 60.4billion, driven by the increasing prevalence of musculoskeletal disorders and the adoption of advanced surgical technologies.

02. What are the key growth drivers in the orthopedic devices market?

Key growth drivers include the growing aging population, rising cases of osteoarthritis, and the increased demand for minimally invasive orthopedic surgeries.

03. Who are the major players in the orthopedic devices market?

Major players include Zimmer Biomet Holdings Inc., Stryker Corporation, Johnson & Johnson, Medtronic PLC, and MicroPort Scientific Corporation, who dominate the market due to extensive product portfolios and strategic acquisitions.

04. What are the challenges faced by the orthopedic devices market?

Challenges include high costs of surgeries, stringent regulatory approvals, and the lack of adequate reimbursement in emerging markets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.