Global Pharmaceutical Packaging Market Outlook to 2030

Region:Global

Author(s):Sonika Bharadwaj

Product Code:KENGR054

December 2024

82

About the Report

Global Pharmaceutical Packaging Market Overview

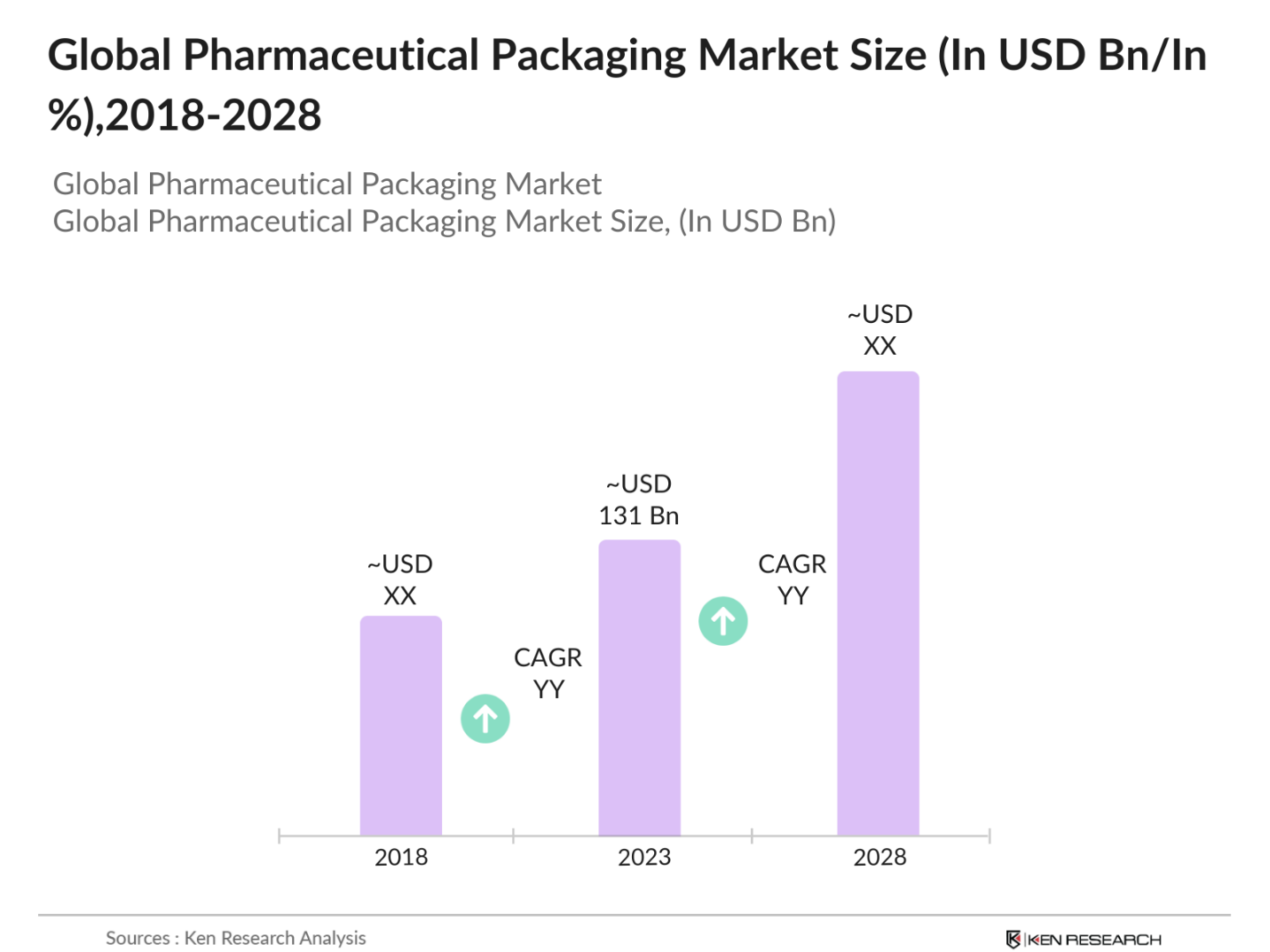

- The global pharmaceutical packaging market is valued at USD 131 billion, based on a five-year historical analysis. This market growth is largely driven by the increasing demand for biologics and the expansion of the global pharmaceutical industry. The rising geriatric population and the growing prevalence of chronic diseases have spurred the need for innovative packaging solutions, particularly for injectables and complex drug delivery systems. Additionally, stringent regulations regarding drug safety and the adoption of sustainable packaging materials are influencing the dynamics of the market, with an increased focus on product protection and extended shelf life.

- The pharmaceutical packaging market is dominated by countries such as the United States, Germany, and Japan. The United States leads due to its robust pharmaceutical industry, high healthcare expenditure, and extensive R&D in drug development. Germany's dominance stems from its highly developed pharmaceutical manufacturing sector, while Japan benefits from strong government support for healthcare innovation and a high aging population. These nations are also pioneers in adopting advanced packaging technologies like anti-counterfeiting solutions and eco-friendly packaging materials, further consolidating their leadership in the global market.

- Governments worldwide are imposing stricter packaging standards and labeling requirements to ensure drug safety. In the U.S., the FDA updated its packaging and labeling guidelines in 2023, mandating the inclusion of tamper-evident features on all prescription drugs. These regulations are driving pharmaceutical companies to invest in more advanced packaging solutions that meet the new safety standards, such as child-resistant closures and anti-tampering features.

Global Pharmaceutical Packaging Market Segmentation

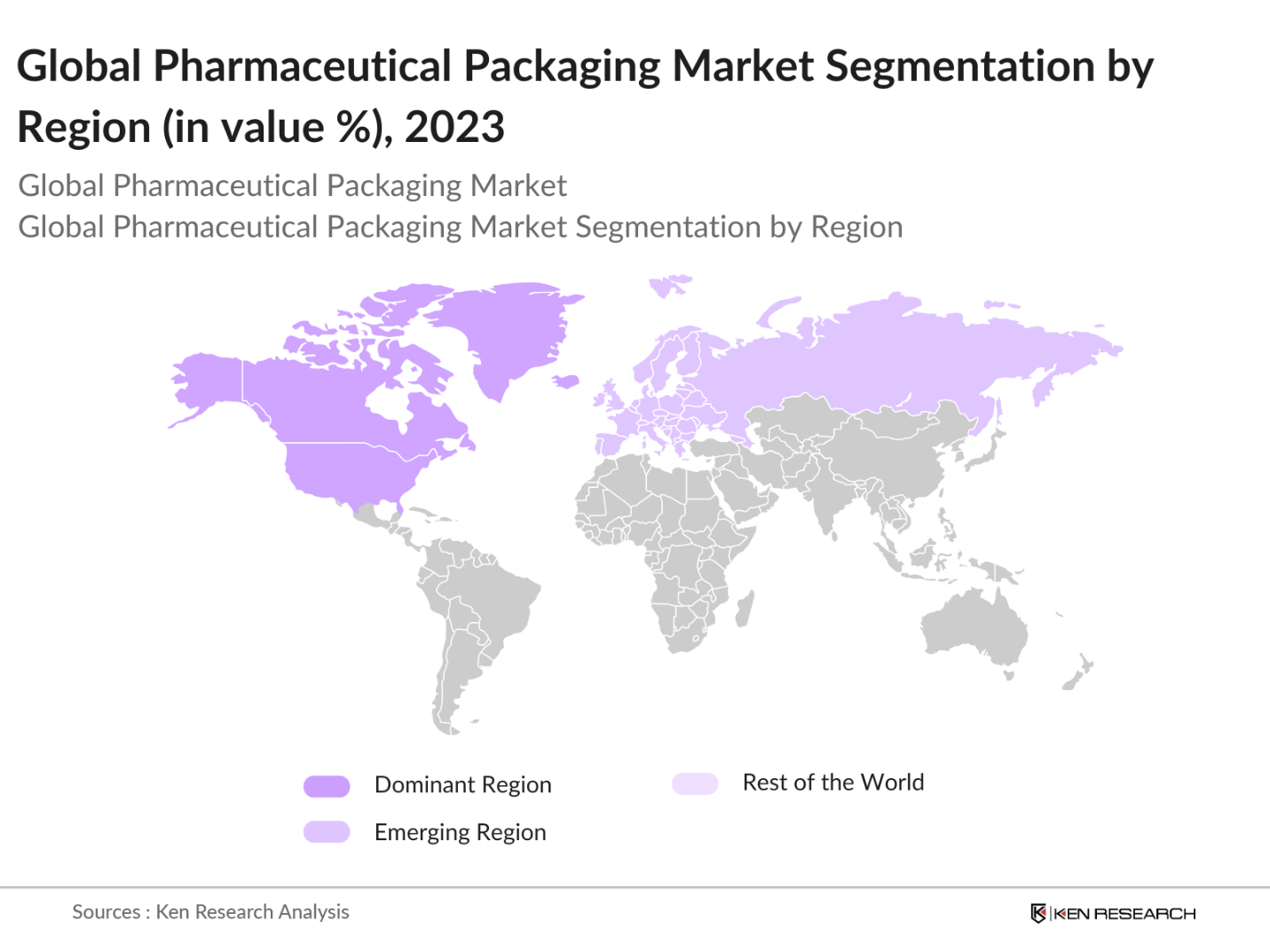

By Region: The global pharmaceutical packaging market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market due to the presence of major pharmaceutical companies, advanced healthcare infrastructure, and strong regulatory oversight. Additionally, the growing demand for biologics and injectable drugs has propelled the need for innovative packaging solutions in this region. Europe follows closely, driven by a focus on sustainability and eco-friendly packaging materials, with countries like Germany and the UK contributing significantly.

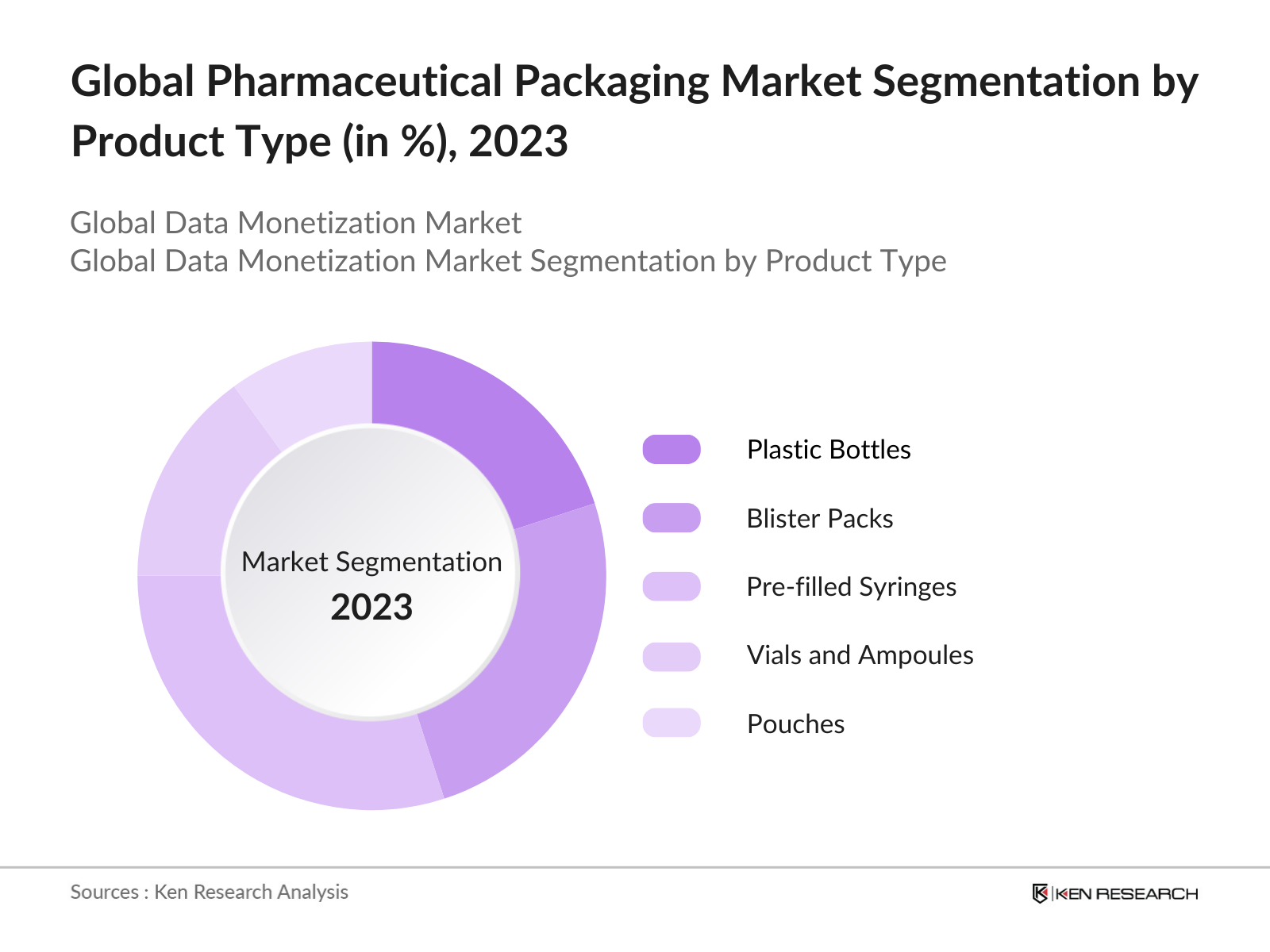

By Product Type: The global pharmaceutical packaging market is segmented by product type into plastic bottles, blister packs, pre-filled syringes, vials and ampoules, and pouches. Recently, pre-filled syringes have gained a dominant market share under this segment due to the increased demand for biologics and vaccines that require injectable solutions. The convenience and precision dosing offered by pre-filled syringes make them a preferred option in healthcare settings, especially in hospitals and outpatient clinics. Additionally, the rising focus on patient safety and the reduction of contamination risks has further strengthened the growth of this segment.

By Material Type: The market is segmented by material type into plastics & polymers, glass, aluminum foil, and paper & paperboard. Plastics & polymers dominate the market primarily due to their flexibility, durability, and cost-effectiveness. This material type is widely used for packaging solutions such as blister packs, plastic bottles, and pouches. Moreover, the development of biocompatible and biodegradable plastics for pharmaceutical packaging has further driven demand in this segment. The recyclability of polymer-based packaging also aligns with growing environmental concerns, pushing this material type to the forefront of pharmaceutical packaging.

Global Pharmaceutical Packaging Market Competitive Landscape

The global pharmaceutical packaging market is characterized by the presence of a few dominant players. Companies in this market are focusing on innovation, sustainability, and compliance with strict regulatory frameworks to gain a competitive edge. The competition is also driven by technological advancements in smart packaging and anti-counterfeiting solutions.

|

Company |

Establishment Year |

Headquarters |

Annual Revenue |

No. of Employees |

Global Reach |

Production Facilities |

R&D Investments |

Sustainability Initiatives |

|

Amcor Limited |

1860 |

Melbourne, AUS |

- |

- |

- |

- |

- |

- |

|

Gerresheimer AG |

1864 |

Dsseldorf, DEU |

- |

- |

- |

- |

- |

- |

|

Schott AG |

1884 |

Mainz, DEU |

- |

- |

- |

- |

- |

- |

|

Berry Global, Inc. |

1967 |

Evansville, USA |

- |

- |

- |

- |

- |

- |

|

West Pharmaceutical Inc. |

1923 |

Exton, USA |

- |

- |

- |

- |

- |

- |

Global Pharmaceutical Packaging Industry Analysis

Global Pharmaceutical Packaging Market Growth Drivers

- Rising Demand for Biologics: Biologics, which are complex medicines derived from living organisms, have seen increased demand globally. According to data from the World Bank, the global biologics market value in 2023 was estimated at over $300 billion. This growing demand for biologics significantly impacts the pharmaceutical packaging market, as biologics require specialized packaging to maintain stability and efficacy. The demand for injectable biologics, such as insulin, has grown due to the rising prevalence of chronic diseases like diabetes. This has driven the need for sterile packaging solutions and has boosted packaging innovations specifically for biologics.

- Aging Population and Increased Healthcare Access: As of 2023, approximately 10% of the global population is aged 65 and older, as reported by the United Nations. This growing aging demographic is increasing the consumption of pharmaceuticals, particularly in developed countries where healthcare access is widespread. In 2023, healthcare expenditure globally reached $8.5 trillion, according to IMF reports. This increase in healthcare spending, combined with higher pharmaceutical consumption, is leading to higher demand for packaging solutions that cater to senior-friendly designs, such as easy-to-open and tamper-proof packaging.

- Innovations in Drug Delivery Systems: Innovations in drug delivery systems, particularly prefilled syringes and self-administered packaging solutions, are driving demand in the pharmaceutical packaging market. By 2023, prefilled syringes accounted for a significant portion of drug delivery packaging, with over 5 billion units produced globally, according to the World Health Organization. This growth stems from the increasing need for more convenient drug delivery methods for patients, particularly in the biologics segment. Packaging companies are developing advanced solutions, such as dual-chamber syringes, to meet the growing demands of this sector.

Global Pharmaceutical Packaging Market Challenges

- High Regulatory Compliance Costs: Pharmaceutical packaging must comply with stringent regulations globally, which significantly increases costs. As per the U.S. FDA, compliance with packaging and labeling regulations costs the industry over $10 billion annually as of 2023. These regulations ensure the safety, efficacy, and traceability of medicines but also pose challenges for manufacturers in adapting to varying international guidelines. Particularly, biologics and personalized medicine require more complex packaging solutions, which further drive compliance costs.

- Environmental Impact of Packaging Waste: The pharmaceutical industry is responsible for generating millions of tons of packaging waste annually, contributing to environmental concerns. According to the United Nations Environment Programme (UNEP), global plastic packaging waste from the healthcare sector exceeded 5 million tons in 2023. Governments worldwide are tightening regulations around waste management, mandating the use of eco-friendly materials. This poses a significant challenge for pharmaceutical companies, which must balance regulatory compliance with sustainability goals.

Global Pharmaceutical Packaging Market Future Outlook

Over the next five years, the global pharmaceutical packaging market is expected to experience substantial growth. This growth will be driven by advancements in drug formulations, a rising focus on patient safety, and the increased adoption of sustainable packaging solutions. Additionally, the rapid expansion of the biologics and biosimilar markets, along with growing demand for sterile and safe packaging options, will contribute to market growth. Further innovation in smart packaging solutions, such as RFID and anti-counterfeiting technologies, will also be a major factor in shaping the future of the industry.

- Increasing Adoption of Sustainable Packaging Solutions: The global shift toward sustainability is pushing pharmaceutical companies to adopt eco-friendly packaging solutions. In 2023, the global market for sustainable packaging solutions in pharmaceuticals was estimated to grow by 12% annually. Biodegradable and recyclable packaging materials are gaining popularity, especially in Europe and North America, where regulations are stringent. The EU, for instance, has introduced mandates that aim for a 50% reduction in single-use plastic packaging in healthcare by 2025, opening up opportunities for manufacturers focusing on sustainability.

- Strategic Collaborations with Healthcare Providers: Collaborations between pharmaceutical companies and healthcare providers are driving innovation in packaging design to meet the specific needs of various patient populations. In 2023, pharmaceutical companies globally invested over $1 billion in partnerships aimed at developing patient-centric packaging solutions. This collaboration enhances the functionality of packaging, such as easier administration of drugs and improved storage solutions, offering significant opportunities for growth in the pharmaceutical packaging market.

Scope of the Report

|

Product Type |

Plastic Bottles Blister Packs Pre-filled Syringes Vials and Ampoules Pouches |

|

Material Type |

Plastics & Polymers Glass Aluminum Foil Paper & Paperboard |

|

Drug Delivery Mode |

Oral Drugs Injectable Drugs Topical/Transdermal Drugs Inhalable Drugs |

|

End-User |

Pharmaceutical Manufacturing Hospitals & Clinics Retail Pharmacies Homecare Settings |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Pharmaceutical Companies

Medical Device Companies

Healthcare Providers (Hospitals, Clinics)

Packaging Material Companies

Government and Regulatory Bodies (FDA, EMA)

Investment and Venture Capitalist Firms

Pharmaceutical Packaging Equipment Industry

Companies

Players Mentioned in the Report:

Amcor Limited

Gerresheimer AG

Schott AG

Berry Global, Inc.

West Pharmaceutical Services, Inc.

AptarGroup, Inc.

Becton, Dickinson & Co.

WestRock Company

Nipro Corporation

Owens-Illinois, Inc.

Table of Contents

1. Global Pharmaceutical Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Pharmaceutical Packaging Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Pharmaceutical Packaging Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Biologics

3.1.2 Aging Population and Increased Healthcare Access

3.1.3 Innovations in Drug Delivery Systems

3.1.4 Government Initiatives on Healthcare Expenditure

3.2 Market Challenges

3.2.1 High Regulatory Compliance Costs

3.2.2 Environmental Impact of Packaging Waste

3.2.3 Volatility in Raw Material Prices

3.2.4 Complexity in Packaging Design for Sensitive Drugs

3.3 Opportunities

3.3.1 Expansion in Emerging Markets (Latin America, Asia-Pacific)

3.3.2 Increasing Adoption of Sustainable Packaging Solutions

3.3.3 Technological Advancements in Smart Packaging

3.3.4 Strategic Collaborations with Healthcare Providers

3.4 Trends

3.4.1 Surge in Demand for Personalized Medicine Packaging

3.4.2 Integration of Track-and-Trace Technologies (IoT, RFID)

3.4.3 Growth in Flexible and Unit Dose Packaging

3.4.4 Increase in Use of Biodegradable and Recyclable Materials

3.5 Government Regulations

3.5.1 Packaging Standards and Drug Labeling Requirements

3.5.2 Anti-Counterfeiting Regulations

3.5.3 Waste Management Directives and Packaging Sustainability

3.5.4 Pharmaceutical Serialization Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Analysis

4. Global Pharmaceutical Packaging Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Plastic Bottles

4.1.2 Blister Packs

4.1.3 Pre-filled Syringes

4.1.4 Vials and Ampoules

4.1.5 Pouches

4.2 By Material Type (In Value %)

4.2.1 Plastics & Polymers

4.2.2 Glass

4.2.3 Aluminum Foil

4.2.4 Paper & Paperboard

4.3 By Drug Delivery Mode (In Value %)

4.3.1 Oral Drugs

4.3.2 Injectable Drugs

4.3.3 Topical/Transdermal Drugs

4.3.4 Inhalable Drugs

4.4 By End-User (In Value %)

4.4.1 Pharmaceutical Manufacturing

4.4.2 Hospitals & Clinics

4.4.3 Retail Pharmacies

4.4.4 Homecare Settings

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Pharmaceutical Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amcor Limited

5.1.2 Gerresheimer AG

5.1.3 Schott AG

5.1.4 Berry Global, Inc.

5.1.5 West Pharmaceutical Services, Inc.

5.1.6 AptarGroup, Inc.

5.1.7 Becton, Dickinson & Co.

5.1.8 WestRock Company

5.1.9 Nipro Corporation

5.1.10 Owens-Illinois, Inc.

5.1.11 Mondi Group

5.1.12 CCL Industries Inc.

5.1.13 Ardagh Group

5.1.14 Catalent, Inc.

5.1.15 Uhlmann Group

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Production Facilities, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Pharmaceutical Packaging Market Regulatory Framework

6.1 Compliance with Drug Safety Regulations

6.2 Packaging Waste and Recycling Regulations

6.3 GMP and ISO Standards for Pharmaceutical Packaging

6.4 Certification and Approval Processes

7. Global Pharmaceutical Packaging Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Pharmaceutical Packaging Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Material Type (In Value %)

8.3 By Drug Delivery Mode (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Pharmaceutical Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segment Analysis

9.3 Marketing Strategies

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves the identification of critical variables in the global pharmaceutical packaging market. This includes a comprehensive study of the major stakeholders, including pharmaceutical manufacturers, suppliers, and regulators. Data from primary and secondary sources, such as industry reports and government databases, is analyzed to ensure thorough coverage of market dynamics.

Step 2: Market Analysis and Construction

In this stage, historical data on market performance is gathered and analyzed. This includes evaluating factors such as the demand for various packaging materials, production costs, and regulatory requirements. These data points are used to construct an accurate representation of market performance, trends, and growth drivers.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including packaging engineers and pharmaceutical manufacturers, are consulted to validate market hypotheses. This step ensures the inclusion of real-world insights into the report, with feedback on innovations, challenges, and future opportunities in pharmaceutical packaging.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all collected data and expert insights into a cohesive report. The findings are cross-verified using a bottom-up approach, ensuring the accuracy and reliability of the market projections and analysis. This stage also includes direct consultations with manufacturers to validate the market share of various packaging types and materials.

Frequently Asked Questions

01. How big is the Global Pharmaceutical Packaging Market?

The global pharmaceutical packaging market is valued at USD 131 billion, driven by the growing demand for biologics, innovative packaging solutions, and increased focus on sustainability in the healthcare sector.

02. What are the challenges in the Global Pharmaceutical Packaging Market?

Challenges include stringent regulatory requirements, rising raw material costs, and the environmental impact of packaging waste. Moreover, the need for tamper-evident and anti-counterfeiting solutions adds complexity to the packaging process.

03. Who are the major players in the Global Pharmaceutical Packaging Market?

Major players include Amcor Limited, Gerresheimer AG, Schott AG, Berry Global, Inc., and West Pharmaceutical Services, Inc., all of which lead the market due to their extensive product portfolios, strong global presence, and innovation in sustainable packaging solutions.

04. What are the growth drivers of the Global Pharmaceutical Packaging Market?

The market is driven by the rising demand for biologics and injectables, stringent regulations regarding drug safety, and increasing adoption of eco-friendly packaging materials. Additionally, technological advancements in smart packaging are propelling the market forward.

05. What are the major trends in the Global Pharmaceutical Packaging Market?

Key trends include the growing demand for sustainable packaging materials, advancements in smart packaging technologies, and the increasing use of tamper-evident packaging solutions to prevent drug counterfeiting.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.