Global Smart Home Gym Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD5879

December 2024

81

About the Report

Global Smart Home Gym Market Overview

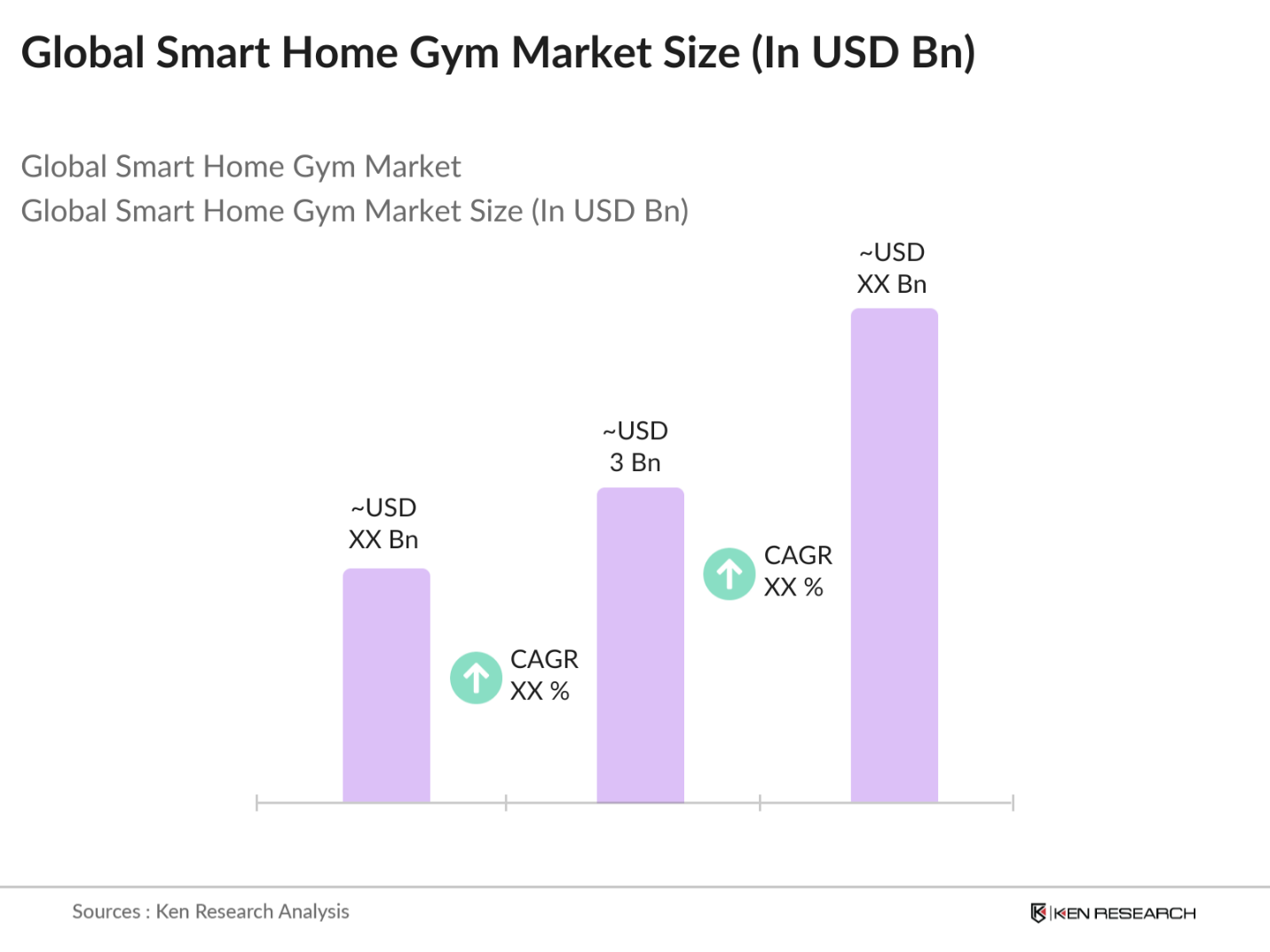

- The Global Smart Home Gym market is valued at USD 3 billion, based on a five-year historical analysis. This market is driven by the increasing adoption of AI-powered workout equipment and the growing demand for personalized fitness solutions at home. The pandemic-induced shift towards home-based fitness, along with the integration of smart technology in gym equipment, has significantly boosted market growth. Consumers are seeking connected fitness devices that provide real-time feedback, remote coaching, and immersive workout experiences, making smart home gyms a preferred choice for many.

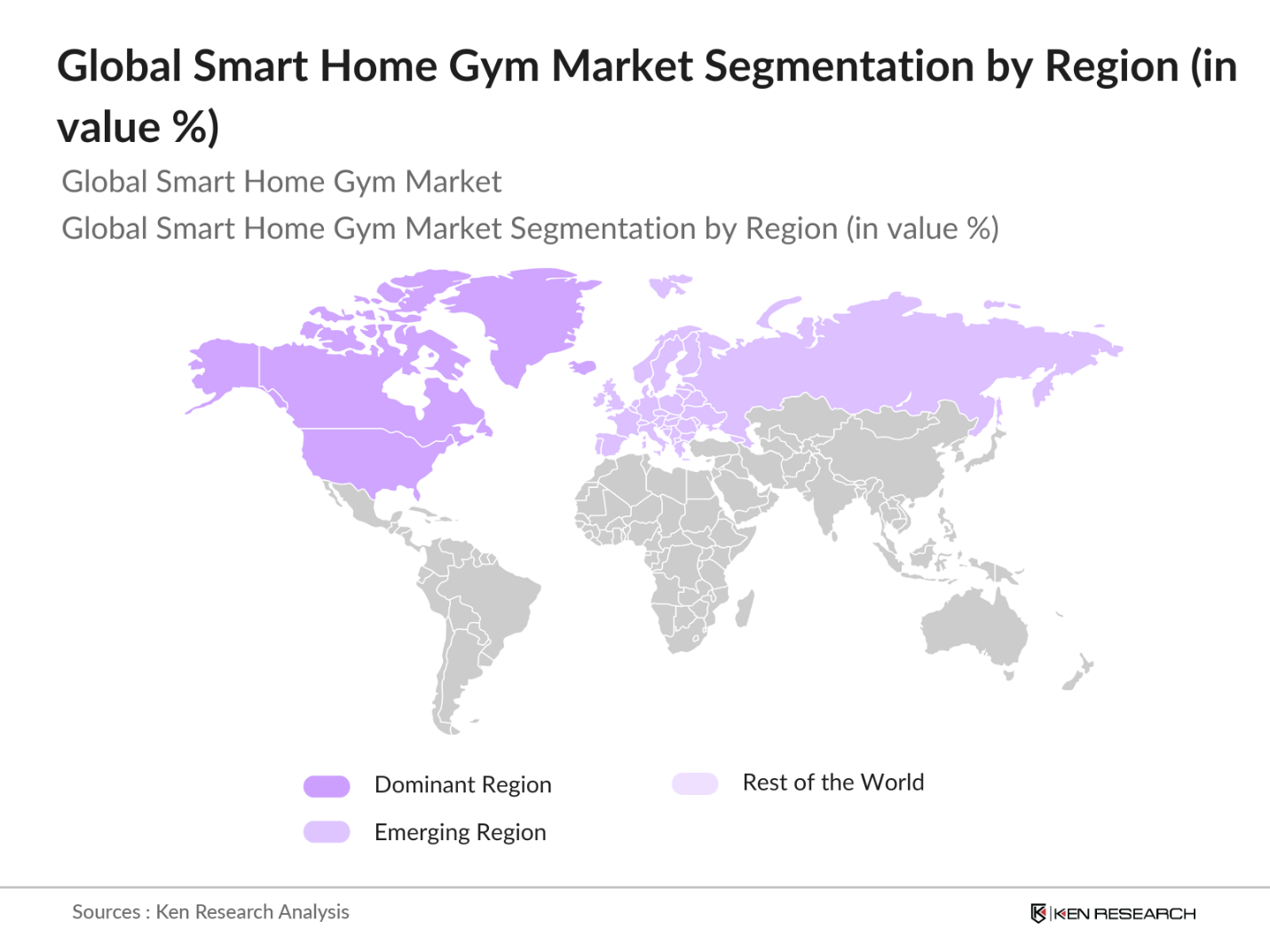

- Regions like North America, Asia-Pacific (APAC), and Europe dominate the global smart home gym market due to their advanced technological infrastructure and increasing consumer spending on health and wellness. North America is leading the market, driven by a highly health-conscious population, widespread adoption of connected fitness devices, and a robust technological ecosystem that supports fitness startups. APAC, particularly China, is witnessing rapid growth, fueled by the rising middle class, urbanization, and increasing adoption of AI-integrated fitness apps.

- The rise of smart home gyms has brought increased scrutiny over health data protection, especially in regions governed by laws such as the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the U.S. These regulations mandate that companies handling personal health data ensure robust security measures to prevent breaches. According to a 2023 report by the European Data Protection Board, over 5,000 companies were fined for non-compliance with GDPR, emphasizing the importance of secure data management within the smart gym industry.

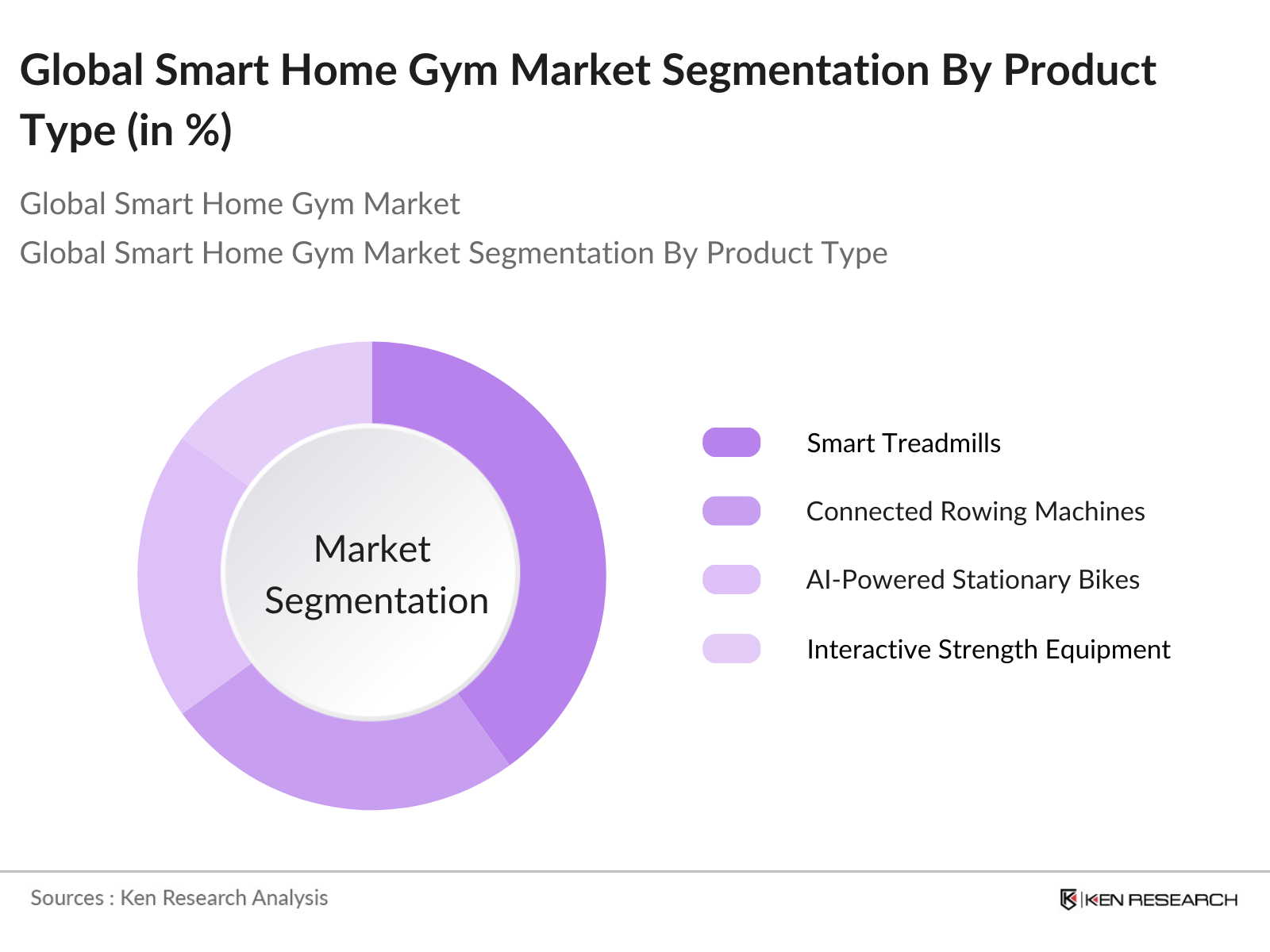

Global Smart Home Gym Market Segmentation

By Product Type: The market is segmented by product type into smart treadmills, connected rowing machines, AI-powered stationary bikes, and interactive strength equipment. Among these, smart treadmills have a dominant market share in the product type segmentation, driven by their versatile functionality and high integration with fitness apps and platforms.

By Distribution Channel: The market is also segmented by distribution channel into online retail, specialty fitness stores, and multi-brand outlets. Online retail leads in terms of market share, as e-commerce platforms provide consumers with the convenience of researching, comparing, and purchasing smart home gym equipment with just a few clicks.

By Region: Geographically, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America holds the largest market share, driven by a strong tech ecosystem, high disposable income, and a consumer base that prioritizes health and wellness. The U.S., in particular, has seen robust growth due to high penetration of smart devices, increasing demand for personalized fitness experiences, and the rise of subscription-based fitness services.

Global Smart Home Gym Market Competitive Landscape

The global smart home gym market is dominated by a mix of established fitness equipment manufacturers and new entrants focusing on connected, tech-driven workout solutions. Companies such as Peloton, Tonal, and Mirror lead the market due to their innovative product offerings and strong consumer engagement strategies. The competitive landscape is characterized by the continuous launch of new products featuring enhanced AI integration, connected fitness ecosystems, and user personalization, giving the dominant players a significant edge.

Global Smart Home Gym Industry Analysis

Growth Drivers

- Adoption of Connected Fitness Devices (IoT, AI integration): The adoption of connected fitness devices has surged, driven by the proliferation of IoT and AI technologies. According to the World Economic Forum, over 11 billion IoT devices were connected worldwide in 2022, and this number is expected to reach nearly 13.8 billion by 2024. This rapid growth in IoT connectivity has catalyzed smart fitness device adoption, allowing users to monitor their workouts in real-time.

- Increasing Health Awareness (Post-pandemic fitness demand): The global focus on health and wellness has accelerated post-pandemic, as individuals prioritize fitness and immunity-building activities. A report from the World Bank highlights that healthcare spending per capita reached $1,100 in 2022, indicating a rising awareness of health needs globally. This trend has spurred the demand for home fitness equipment, particularly smart home gym devices, which offer convenience and safety.

- Technological Advancements (AI-driven workout customization): Technological advancements in AI have revolutionized workout routines by enabling personalized fitness programs based on an individuals preferences and health data. AI-based platforms are now capable of designing tailored workout plans, adjusting difficulty levels in real-time. By 2024, AI is expected to manage over 50 million connected devices globally in the fitness sector, streamlining home gym experiences.

Market Challenges

- High Equipment Costs (Cost of smart fitness machines): One of the primary challenges in the smart home gym market is the high cost of equipment. According to an IMF analysis, the average price for a smart fitness system in developed economies hovers around $2,000. Although smart fitness machines offer advanced features like AI-driven customization and IoT connectivity, these benefits come at a significant financial cost, often limiting market penetration to higher-income brackets.

- Technical Maintenance and Upkeep (Software upgrades, sensor issues): The integration of IoT and AI into fitness equipment introduces the need for ongoing technical maintenance, which can be a challenge for consumers. According to a report by the ITU, around 60% of connected devices experience operational issues within the first year, ranging from sensor malfunctions to software bugs. Smart gym machines require regular updates to maintain functionality, and some users find this upkeep burdensome.

Global Smart Home Gym Market Future Outlook

Over the next five years, the global smart home gym market is expected to show significant growth, driven by continuous innovations in AI-powered fitness equipment and increasing consumer demand for at-home solutions. The post-pandemic health consciousness trend, coupled with the rise of hybrid fitness models (in-person and virtual), is set to propel the market forward.

Market Opportunities

- Expansion in Developing Markets (Penetration in emerging economies): The expansion of smart home gyms into developing markets presents a significant opportunity for growth. In 2022, the World Bank estimated that the middle class in emerging economies grew by 3%, representing millions of potential consumers with rising disposable incomes. Markets like India and Brazil are experiencing higher fitness awareness, with governments investing in health infrastructure.

- Growth in Virtual Training Programs (Virtual classes and streaming): The rise of virtual fitness training presents a burgeoning opportunity within the smart home gym market. A 2022 ITU report found that 75% of global internet users participate in online activities, with fitness programs being a key driver. Smart home gyms that offer integrated virtual training platforms are positioned to capitalize on this trend, as more consumers turn to at-home workout routines facilitated by interactive streaming services.

Scope of the Report

|

By Product Type |

Smart Treadmills Connected Rowing Machines AI-Powered Stationary Bikes Interactive Strength Equipment |

|

By Distribution Channel |

Online Retail Specialty Fitness Stores Multi-Brand Outlets |

|

By Connectivity Type |

Wi-Fi Enabled Bluetooth Enabled App-Based Connected |

|

By End-User |

Residential Users Commercial Spaces Fitness Trainers and Gyms |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Smart Fitness Equipment Manufacturers

Online and Retail Distributors

Technology Integration Firms

Fitness Service Providers

Subscription-Based Fitness Platforms

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Federal Trade Commission, General Data Protection Regulation authorities)

Smart Home Technology Developers

Companies

Players Mentioned in the Report

Peloton Interactive, Inc.

Tonal Systems Inc.

Echelon Fitness Multimedia LLC

Mirror (Lululemon Athletica)

NordicTrack (iFit)

Bowflex (Nautilus Inc.)

ProForm (iFit)

JaxJox

Myx Fitness

FightCamp

Table of Contents

1. Global Smart Home Gym Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Smart Home Gym Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Smart Home Gym Market Analysis

3.1 Growth Drivers

3.1.1 Adoption of Connected Fitness Devices (IoT, AI integration)

3.1.2 Increasing Health Awareness (Post-pandemic fitness demand)

3.1.3 Technological Advancements (AI-driven workout customization)

3.1.4 Growing Urbanization (Higher disposable income, fitness lifestyle)

3.2 Market Challenges

3.2.1 High Equipment Costs (Cost of smart fitness machines)

3.2.2 Technical Maintenance and Upkeep (Software upgrades, sensor issues)

3.2.3 Consumer Resistance to Technology (Fitness preference disparities)

3.3 Opportunities

3.3.1 Expansion in Developing Markets (Penetration in emerging economies)

3.3.2 Growth in Virtual Training Programs (Virtual classes and streaming)

3.3.3 Collaborations with Health Apps (Fitness and healthcare integrations)

3.4 Trends

3.4.1 AI-Powered Personalized Training (AI-based progress tracking and feedback)

3.4.2 Integration with Wearable Technology (Smartwatches, fitness bands synchronization)

3.4.3 Smart Home Gym as a Service (Subscription-based equipment services)

3.4.4 Eco-Friendly Equipment (Energy-efficient, sustainable gym machines)

3.5 Government Regulation

3.5.1 Health Data Protection Laws (GDPR, CCPA compliance for data security)

3.5.2 Fitness Industry Standards (ISO certifications for smart gym equipment)

3.5.3 Tax Benefits for Health and Wellness Initiatives (Government incentives for fitness adoption)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Smart Home Gym Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Smart Treadmills

4.1.2 Connected Rowing Machines

4.1.3 AI-Powered Stationary Bikes

4.1.4 Interactive Strength Equipment

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Specialty Fitness Stores

4.2.3 Multi-Brand Outlets

4.3 By Connectivity Type (In Value %)

4.3.1 Wi-Fi Enabled

4.3.2 Bluetooth Enabled

4.3.3 App-Based Connected

4.4 By End-User (In Value %)

4.4.1 Residential Users

4.4.2 Commercial Spaces (Apartment gyms, office gyms)

4.4.3 Fitness Trainers and Gyms (Home-based virtual trainers)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Smart Home Gym Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Peloton Interactive, Inc.

5.1.2 Tonal Systems Inc.

5.1.3 Echelon Fitness Multimedia LLC

5.1.4 Mirror (Lululemon Athletica)

5.1.5 NordicTrack (iFit)

5.1.6 Bowflex (Nautilus Inc.)

5.1.7 Technogym

5.1.8 ProForm (iFit)

5.1.9 JaxJox

5.1.10 Myx Fitness

5.1.11 FightCamp

5.1.12 Tempo

5.1.13 CLMBR

5.1.14 Hydrow

5.1.15 Life Fitness

5.2 Cross Comparison Parameters (Product Offering, Technology Integration, User Interface, Price Range, Warranty/Service Plans, Connectivity, Equipment Type, Customer Reviews)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Smart Home Gym Market Regulatory Framework

6.1 Health and Safety Standards

6.2 Data Privacy and Protection Laws

6.3 Environmental Regulations for Smart Equipment Manufacturing

7. Global Smart Home Gym Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Smart Home Gym Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Connectivity Type (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Smart Home Gym Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we identify critical factors impacting the smart home gym market, such as consumer fitness trends, technology integration, and product pricing. Desk research, along with proprietary industry databases, helps map the ecosystem and stakeholders.

Step 2: Market Analysis and Construction

The next phase involves analyzing historical market data and projecting future trends. This includes an in-depth analysis of sales data, product adoption rates, and regional demand patterns to estimate the market size and potential revenue.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formulated based on collected data and are validated through interviews with market experts and industry participants. Insights from these consultations help refine our market forecasts.

Step 4: Research Synthesis and Final Output

The final stage includes compiling all insights, validating statistics through primary sources, and refining projections to deliver an accurate market assessment. This stage also includes gathering data from smart gym manufacturers to understand product features, consumer preferences, and technology integration.

Frequently Asked Questions

01. How big is the global smart home gym market?

The Global Smart Home Gym market is valued at USD 3 billion, based on a five-year historical analysis. This market is driven by the increasing adoption of AI-powered workout equipment and the growing demand for personalized fitness solutions at home.

02. What are the challenges in the global smart home gym market?

Challenges include high equipment costs, technical maintenance, and occasional consumer reluctance to adopt fully automated fitness systems, which can hinder widespread adoption.

03. Who are the major players in the global smart home gym market?

Key players include Peloton, Tonal Systems Inc., Mirror (Lululemon), NordicTrack, and Echelon. These companies dominate the market through innovative product offerings and strong digital integration.

04. What are the growth drivers for the global smart home gym market?

Key growth drivers include increasing consumer interest in health and wellness, rising adoption of AI-powered workout equipment, and the growing popularity of subscription-based fitness services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.