Global Wireless Charging Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7102

November 2024

85

About the Report

Global Wireless Charging Market Overview

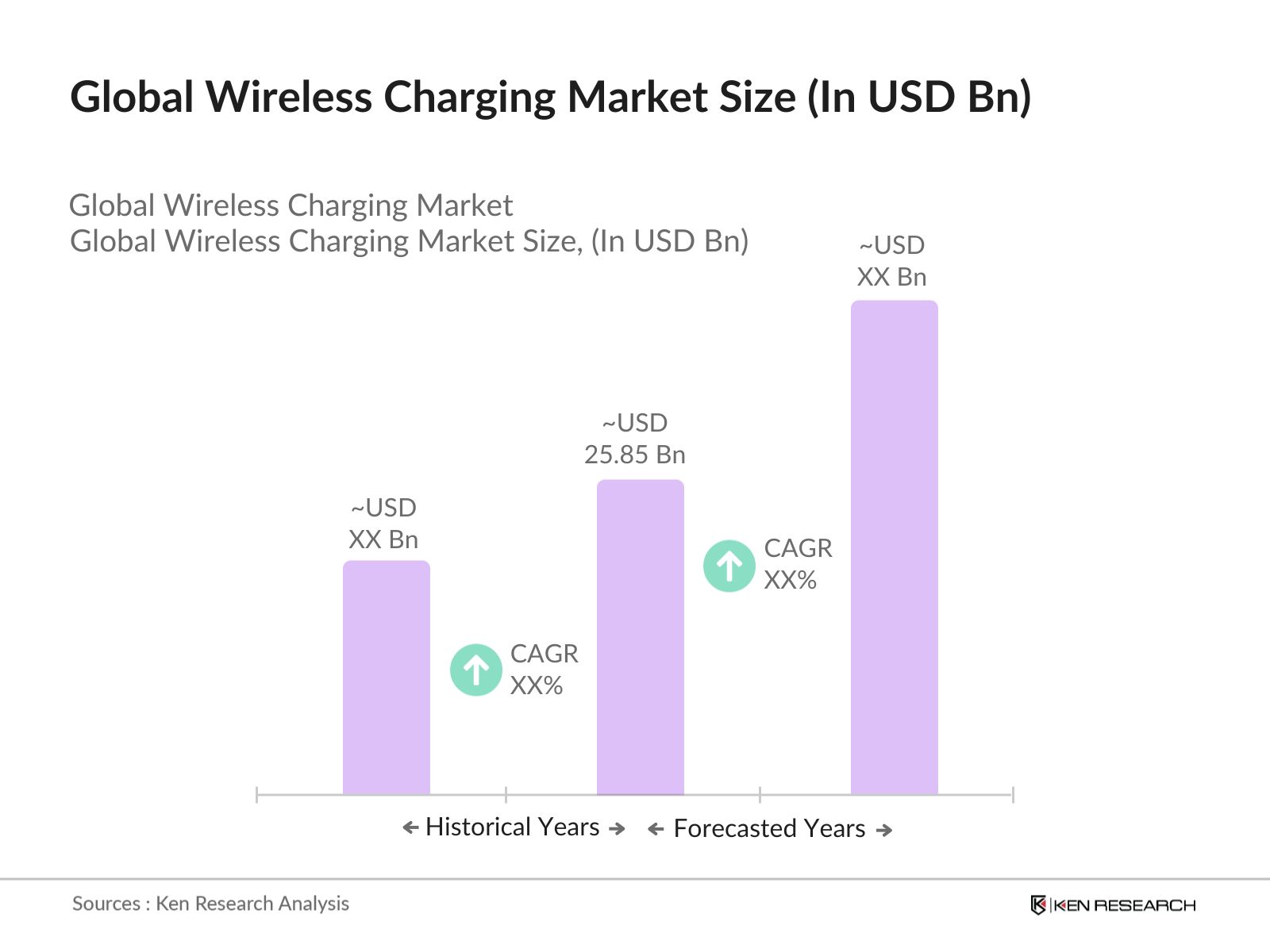

- The global wireless charging market is valued at USD 25.85 billion based on a five-year historical analysis, driven by the rapid adoption of consumer electronics and electric vehicles (EVs) that require efficient, seamless charging solutions. Wireless charging technology's ability to enhance user convenience, reduce the need for cables, and increase device longevity contributes to its growing demand. Additionally, advancements in resonance and inductive charging technologies are propelling the market forward, supported by significant investments from key manufacturers and governments worldwide.

- The global wireless charging market sees strong dominance from countries like the United States, China, and South Korea. The United States leads due to the presence of technology giants such as Apple and Tesla, who are actively investing in wireless charging technologies for consumer electronics and EVs. Chinas dominance is attributed to its aggressive rollout of electric vehicle infrastructure and government-backed initiatives supporting smart city projects. South Korea plays a key role owing to companies like Samsung and LG, which are driving innovation in wireless charging systems for smartphones and wearables.

- Governments are offering public funding and incentives to encourage the adoption of electric vehicles and the development of wireless charging technology. The U.S. government allocated $5 billion in grants in 2023 to companies developing wireless EV charging systems. Similarly, European countries have introduced subsidies for the installation of wireless charging infrastructure. These funding initiatives aim to reduce the cost of implementing wireless EV charging technology and accelerate the transition to a green transportation system.

Global Wireless Charging Market Segmentation

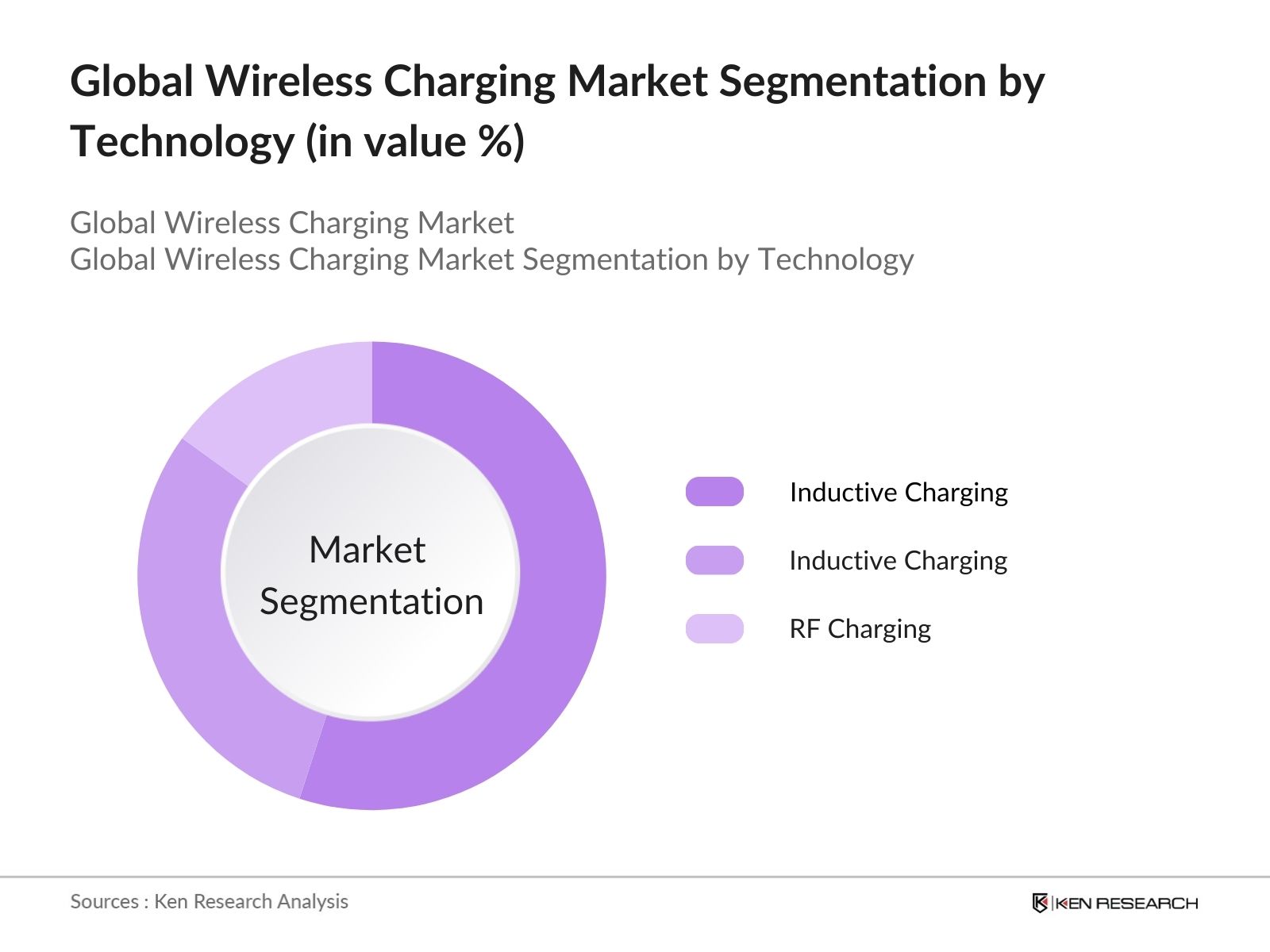

- By Technology: The global wireless charging market is segmented by technology into inductive charging, resonant charging, and radio frequency (RF) charging. Recently, inductive charging holds a dominant market share due to its widespread adoption in consumer electronics such as smartphones, smartwatches, and headphones. The simplicity and effectiveness of inductive technology make it popular for low-power applications, especially in personal devices. However, resonant charging is gaining traction due to its ability to charge multiple devices over short distances simultaneously, which is highly beneficial in automotive and industrial settings.

- By Region: The global wireless charging market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific is the leading region, driven by rapid technological advancements and the strong presence of key players such as Samsung, Huawei, and Xiaomi. The regions large consumer base, coupled with government investments in the electric vehicle market, positions it as a high-growth area for wireless charging technologies. Europe follows closely due to its focus on sustainability and electric mobility, particularly with countries like Germany and the UK pushing EV adoption.

- By Application: The market is also segmented by application into consumer electronics, automotive, healthcare, and industrial sectors. The consumer electronics segment dominates the market due to the ever-growing demand for smartphones and wearables equipped with wireless charging capabilities. The convenience of wireless charging, paired with increasing consumer expectations for more seamless, connected device ecosystems, has been a major driving factor in this segment. The automotive sector is also growing, with car manufacturers integrating wireless charging pads into electric vehicles (EVs) and public infrastructure.

Global Wireless Charging Market Competitive Landscape

The global wireless charging market is dominated by several key players, including Qualcomm, Samsung, and WiTricity, who have made significant technological advancements and established partnerships with automotive and consumer electronics companies. These firms are actively expanding their market presence by investing in research and development (R&D) and integrating wireless charging into various applications, from electric vehicles to medical devices.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Employees |

Product Portfolio |

Technological Strength |

Patents Held |

Global Presence |

Major Customers |

|

Qualcomm Inc. |

1985 |

San Diego, USA |

- |

- |

- |

- |

- |

- |

- |

|

Samsung Electronics Co. Ltd. |

1969 |

Suwon, South Korea |

- |

- |

- |

- |

- |

- |

- |

|

WiTricity Corporation |

2007 |

Watertown, USA |

- |

- |

- |

- |

- |

- |

- |

|

Energizer Holdings, Inc. |

1896 |

St. Louis, USA |

- |

- |

- |

- |

- |

- |

- |

|

Powermat Technologies Ltd. |

2006 |

Petah Tikva, Israel |

- |

- |

- |

- |

- |

- |

- |

Global Wireless Charging Industry Analysis

Growth Drivers

- Rapid Growth of Electric Vehicles (EVs): The global electric vehicle market is seeing rapid expansion, with over 16 million electric cars on the road globally by 2023, according to the International Energy Agency (IEA). This has led to increased demand for wireless charging technology to reduce dependence on charging stations and cables. Governments are supporting the adoption of EVs through financial incentives and infrastructure development, leading to innovations in wireless EV charging solutions. For instance, the European Union allocated 2.9 billion in public funding for EV infrastructure, emphasizing the need for standardized wireless charging systems

- Increasing Demand for Portable Devices: The surge in the usage of portable electronic devices like smartphones, laptops, and wearables has driven the adoption of wireless charging. In 2022, global smartphone sales reached 1.21 billion units, with a significant percentage featuring wireless charging capabilities. This adoption is further fueled by consumers preference for convenience and the integration of wireless charging pads in public spaces such as airports and cafes. Governments are also pushing for greener charging solutions, with several initiatives promoting wireless charging for clean energy. The World Banks digital technology initiatives further underscore the demand for seamless charging technologies

- Government Initiatives for Clean Energy Solutions: Governments globally are launching policies to promote clean energy technologies, including wireless charging. The U.S. government, through its $7.5 billion investment in EV charging infrastructure under the Infrastructure Investment and Jobs Act, is pushing the development of wireless charging for electric vehicles. Similarly, countries like Germany and South Korea have started testing wireless EV charging on public roads to support green energy initiatives. These government-led programs aim to reduce carbon emissions and increase the efficiency of renewable energy systems through advanced charging technologies.

Market Restraints

- Lack of Standardization Across Manufacturers: One of the significant challenges in the wireless charging market is the lack of standardization. Different manufacturers use varying technologies, such as Qi or AirFuel, creating incompatibility issues between devices. This lack of uniformity hinders the widespread adoption of wireless charging solutions. For example, in 2023, 60% of smartphones used Qi-based wireless charging, while the remaining 40% followed proprietary standards, creating confusion among consumers and increasing costs for manufacturers to support multiple systems

- High Cost of Integration in Infrastructure: The high cost of integrating wireless charging technology into public and private infrastructure poses a challenge for market growth. Building charging pads into public spaces like airports, parking lots, and highways requires significant investments. For instance, a report by the U.S. Department of Energy estimated that the installation of wireless EV charging systems on highways could cost up to $1.2 million per mile. This expense limits the immediate scalability of wireless charging systems, particularly in developing economies.

Global Wireless Charging Market Future Outlook

Over the next five years, the global wireless charging market is expected to experience significant growth due to the rapid expansion of electric vehicles, advancements in healthcare devices, and widespread adoption in consumer electronics. The development of long-range wireless charging solutions, coupled with the increasing integration of smart home devices and IoT systems, will likely spur further market expansion. Government initiatives promoting green energy and the growing emphasis on reducing e-waste by minimizing the use of cables will further contribute to the growth of the wireless charging market.

Market Opportunities

- Integration of Wireless Charging in Smart Devices: The integration of wireless charging into smart devices presents a significant opportunity for market growth. In 2023, the global smart home device market was valued at $79 billion, driven by the demand for seamless and wireless connectivity. Smart speakers, thermostats, and security systems are being equipped with wireless charging capabilities, providing consumers with convenient power solutions. Governments, including those in the European Union, have launched digital technology programs to support the development of smart home ecosystems, further boosting the wireless charging market.

- Expansion of Wireless Charging in Healthcare Devices: Wireless charging is increasingly being adopted in the healthcare sector for medical devices like implants, hearing aids, and portable monitoring equipment. In 2023, the global medical device market was valued at $500 billion, with a growing segment dedicated to wireless charging-enabled equipment. This shift reduces the need for invasive procedures to replace batteries in implants and enhances the reliability of portable devices used in patient care. Regulatory bodies like the U.S. FDA have started approving wireless charging technologies for medical applications, encouraging further development.

Scope of the Report

|

By Technology |

Inductive Charging |

|

Resonant Charging |

|

|

Radio Frequency (RF) Charging |

|

|

Magnetic Resonance Charging |

|

|

By Application |

Consumer Electronics |

|

Automotive |

|

|

Healthcare |

|

|

Industrial |

|

|

By Power Range |

Low Power (Up to 10W) |

|

Medium Power (10W50W) |

|

|

High Power (50W and Above) |

|

|

By End-User |

Residential |

|

Commercial |

|

|

Automotive Charging Stations |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Wireless Charging Technology Manufacturers

Consumer Electronics Manufacturers

Electric Vehicle (EV) Manufacturers

Government and Regulatory Bodies (Department of Energy, Ministry of Industry and Information Technology)

Automotive OEMs and Suppliers

Healthcare Device Manufacturers

Investors and Venture Capitalist Firms

Smart City Infrastructure Developers

Companies

Players Mentioned in the Report:

Qualcomm Inc.

Samsung Electronics Co. Ltd.

WiTricity Corporation

Powermat Technologies Ltd.

Energizer Holdings, Inc.

Texas Instruments Inc.

Integrated Device Technology, Inc.

Murata Manufacturing Co., Ltd.

Belkin International, Inc.

NXP Semiconductors

Renesas Electronics Corporation

Panasonic Corporation

Sony Corporation

Lenovo Group Ltd.

Apple Inc.

Table of Contents

1. Global Wireless Charging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Wireless Charging Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Wireless Charging Market Analysis

3.1. Growth Drivers (Technology adoption, smartphone penetration, increasing adoption of electric vehicles)

3.1.1. Rapid Growth of Electric Vehicles (EVs)

3.1.2. Increasing Demand for Portable Devices

3.1.3. Government Initiatives for Clean Energy Solutions

3.1.4. Rise in Consumer Electronics with Wireless Charging Capabilities

3.2. Market Challenges (Battery efficiency, interoperability issues, high infrastructure costs)

3.2.1. Lack of Standardization Across Manufacturers

3.2.2. High Cost of Integration in Infrastructure

3.2.3. Limited Charging Distance and Efficiency

3.3. Opportunities (5G integration, expansion of smart home devices, growth in wearables market)

3.3.1. Integration of Wireless Charging in Smart Devices

3.3.2. Expansion of Wireless Charging in Healthcare Devices

3.3.3. Development of Long-Distance Wireless Charging Solutions

3.4. Trends (GaN technology, rise of contactless charging, adoption in automotive and furniture industries)

3.4.1. Use of Gallium Nitride (GaN) Technology

3.4.2. Wireless Charging Pads in Public Infrastructure

3.4.3. Integration with IoT and Smart Cities Initiatives

3.5. Government Regulation (Compliance for electric vehicle infrastructure, safety standards for consumer electronics)

3.5.1. Government Policies for EV Charging Infrastructure

3.5.2. Certification and Compliance Requirements for Wireless Chargers

3.5.3. Public Funding and Incentives for EVs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, distributors, infrastructure developers)

3.8. Porters Five Forces (Supplier power, buyer power, threat of substitutes, industry rivalry, and barriers to entry)

3.9. Competition Ecosystem

4. Global Wireless Charging Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Inductive Charging

4.1.2. Resonant Charging

4.1.3. Radio Frequency (RF) Charging

4.1.4. Magnetic Resonance Charging

4.2. By Application (In Value %)

4.2.1. Consumer Electronics

4.2.2. Automotive

4.2.3. Healthcare

4.2.4. Industrial

4.3. By Power Range (In Value %)

4.3.1. Low Power (Up to 10W)

4.3.2. Medium Power (10W50W)

4.3.3. High Power (50W and Above)

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Automotive Charging Stations

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Wireless Charging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Qualcomm Inc.

5.1.2. Samsung Electronics Co. Ltd.

5.1.3. Energizer Holdings, Inc.

5.1.4. WiTricity Corporation

5.1.5. Powermat Technologies Ltd.

5.1.6. Texas Instruments Inc.

5.1.7. Integrated Device Technology, Inc.

5.1.8. NXP Semiconductors

5.1.9. Renesas Electronics Corporation

5.1.10. Panasonic Corporation

5.1.11. Murata Manufacturing Co., Ltd.

5.1.12. Belkin International, Inc.

5.1.13. Sony Corporation

5.1.14. Apple Inc.

5.1.15. Lenovo Group Ltd.

5.2. Cross Comparison Parameters

(No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Technological Strength, Market Presence, Patents Held)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Wireless Charging Market Regulatory Framework

6.1. International Standards for Wireless Charging Technologies

6.2. Compliance Requirements for Consumer Electronics and EVs

6.3. Certification Processes and Guidelines

7. Global Wireless Charging Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Wireless Charging Market Future Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Power Range (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Wireless Charging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out all major stakeholders within the global wireless charging ecosystem. Through extensive desk research and proprietary databases, we gather critical data on key variables such as technology adoption rates, customer demand, and regulatory impacts.

Step 2: Market Analysis and Construction

In this step, we analyze historical data on wireless charging adoption across various segments, including consumer electronics, automotive, and healthcare. This phase also involves evaluating wireless charging penetration rates and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses and validate them through consultations with industry experts via phone interviews and surveys. These consultations provide valuable insights into technological developments, market trends, and competitive strategies.

Step 4: Research Synthesis and Final Output

The final step entails synthesizing all collected data and producing an in-depth report that includes product segment insights, sales trends, and future market projections. This ensures a comprehensive understanding of the global wireless charging market.

Frequently Asked Questions

01. How big is the Global Wireless Charging Market?

The global wireless charging market is valued at USD 25.85 billion based on a five-year historical analysis, driven by advancements in consumer electronics, electric vehicles, and smart devices.

02. What are the key challenges in the Global Wireless Charging Market?

Challenges include the high cost of wireless charging infrastructure, lack of standardization across manufacturers, and limited charging efficiency over long distances.

03. Who are the major players in the Global Wireless Charging Market?

Key players include Qualcomm Inc., Samsung Electronics Co. Ltd., WiTricity Corporation, Energizer Holdings, Inc., and Powermat Technologies Ltd., all of whom have a strong presence in the market.

04. What are the growth drivers of the Global Wireless Charging Market?

Growth drivers include the rising demand for electric vehicles, the increasing use of smartphones and wearable devices, and advancements in wireless charging technologies such as resonant and inductive charging.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.