India Dried Fruits Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10056

November 2024

96

About the Report

India Dried Fruits Market Overview

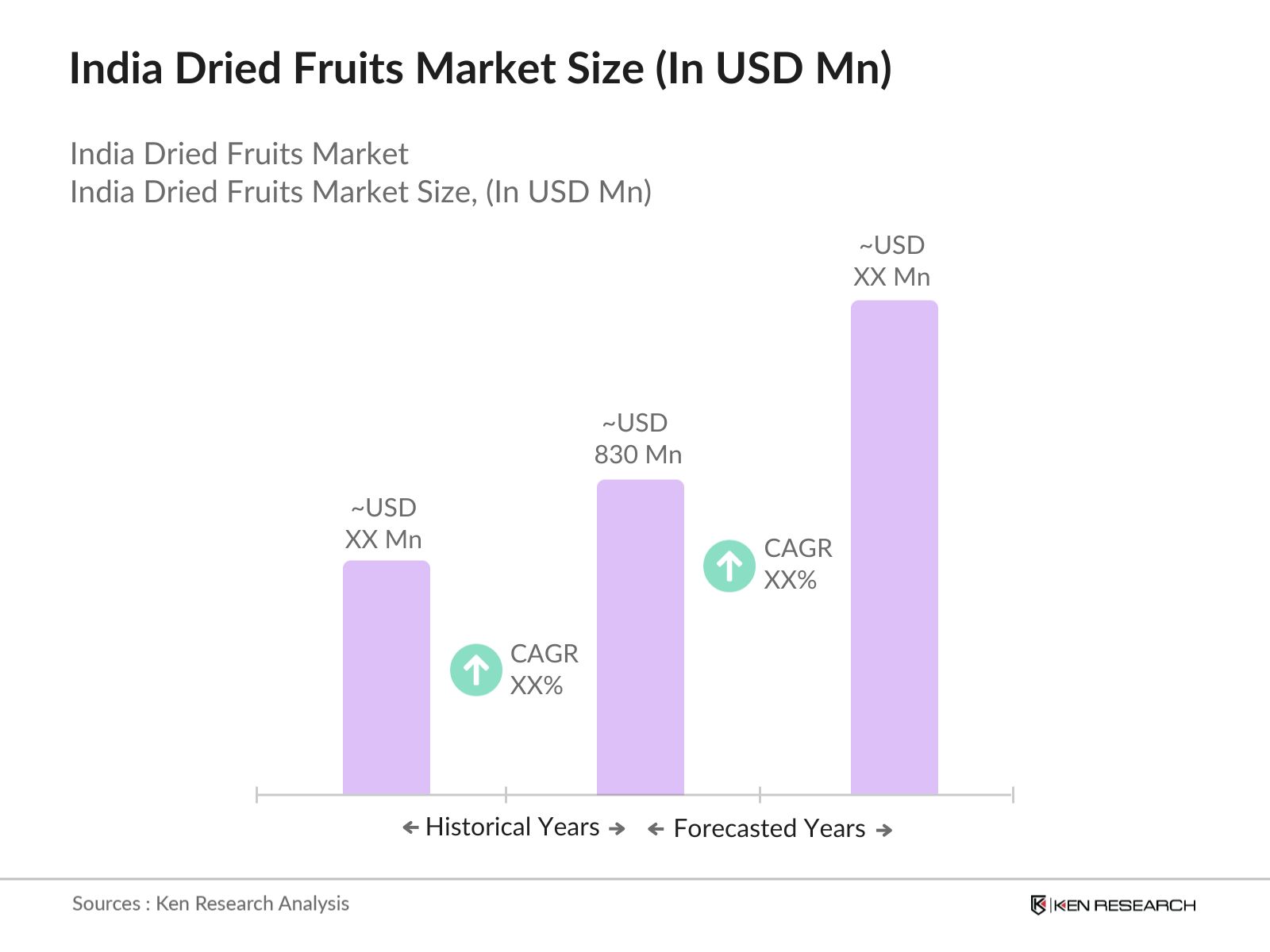

- The India dried fruits market is valued at USD 830 million in 2023, according to market data from credible sources such as the All-India Food Processors' Association (AIFPA). The market is driven by increasing health consciousness among Indian consumers, who are shifting toward natural and nutrient-dense food options like dried fruits. In addition, rising disposable incomes, growing awareness of the health benefits of dried fruits, and an expanding middle-class population contribute to the demand for these products in retail and food processing industries.

- Cities such as Mumbai, Delhi, and Bengaluru dominate the India dried fruits market due to their high consumer demand, developed retail infrastructure, and affluent populations. These urban areas are hubs for premium product consumption, with consumers willing to pay higher prices for quality and branded dried fruits. Furthermore, these cities have extensive distribution networks, ensuring the availability of dried fruits across retail stores, online platforms, and health food chains.

- The Food Safety and Standards Authority of India (FSSAI) has established stringent regulations for the dried fruit market. In 2024, FSSAI introduced new standards to reduce adulteration risks, ensuring better consumer safety. Over 10% of dried fruit imports were rejected in early 2024 due to non-compliance with these safety standards. The guidelines emphasize proper labeling, quality assurance, and safety practices, which are now being strictly enforced to maintain product integrity within the Indian market.

India Dried Fruits Market Segmentation

Indias dried fruits market is segmented by product type and by sales channel.

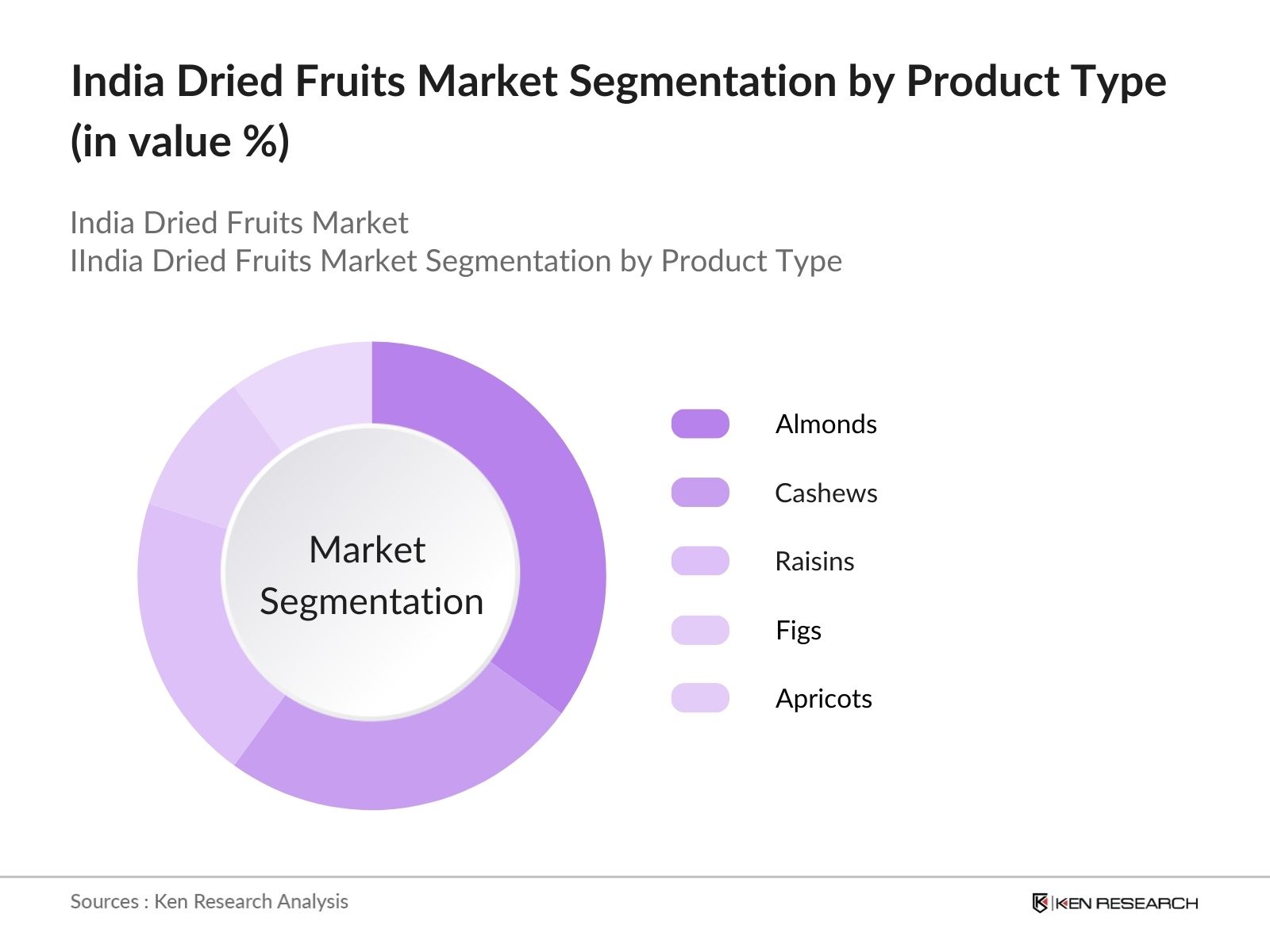

- By Product Type: Indias dried fruits market is segmented by product type into almonds, cashews, raisins, figs, and apricots. Among these, almonds hold a dominant market share due to their widespread consumption and recognition as a healthy, protein-rich snack. Almonds are also integral to Indian festivals, cultural ceremonies, and gifting, further boosting their demand. Imported varieties from the United States and Australia enjoy strong consumer preference due to their high quality and nutritional profile. The health benefits associated with almonds, such as improved heart health and weight management, continue to make them a popular choice among Indian consumers.

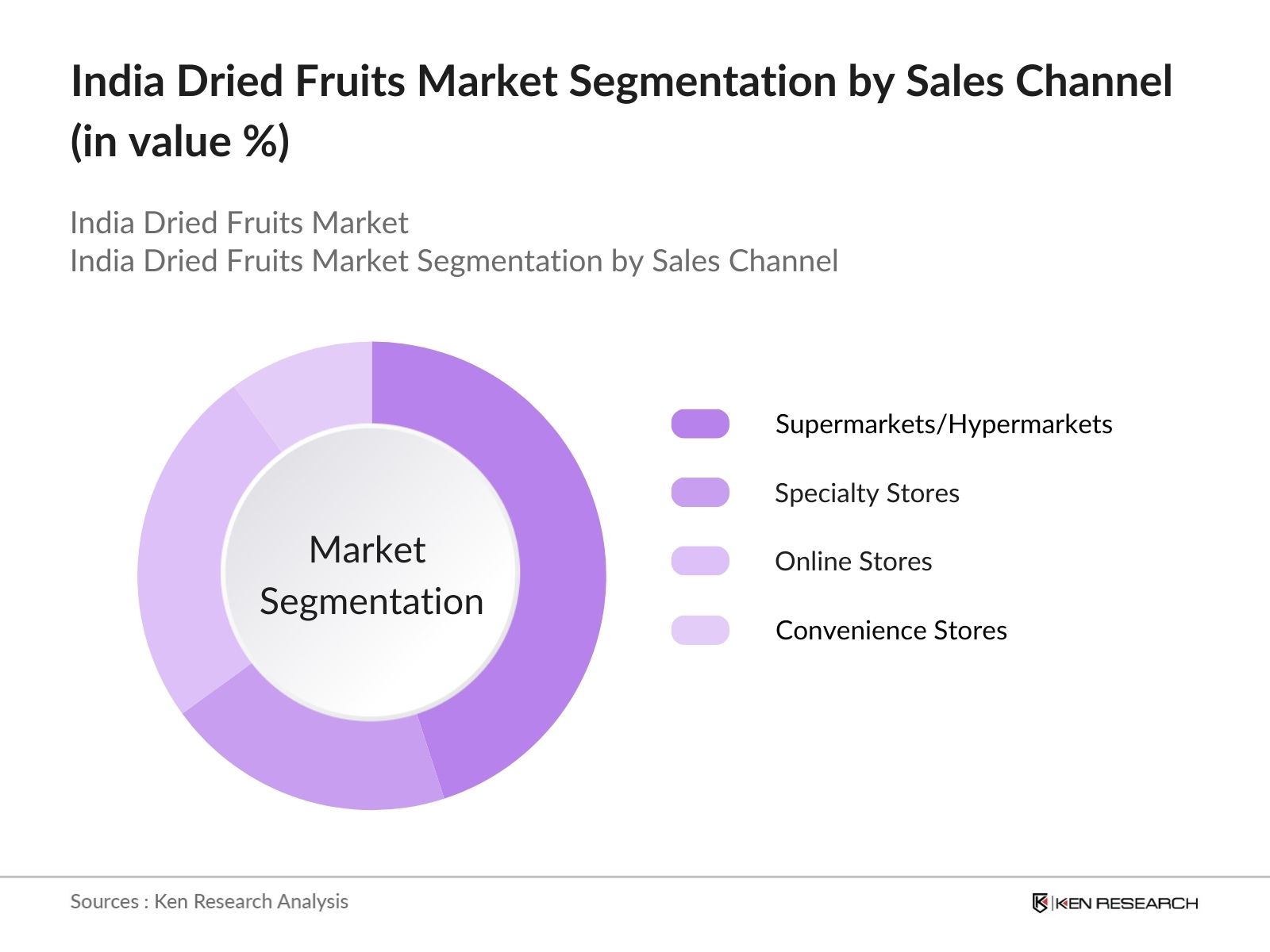

- By Sales Channel: The India dried fruits market is segmented by sales channel into supermarkets/hypermarkets, specialty stores, online stores, and convenience stores. Supermarkets and hypermarkets dominate the market, capturing a significant share due to their widespread presence in urban and semi-urban areas. These stores offer consumers a wide range of dried fruit products under one roof, making it convenient for them to purchase branded and premium dried fruits. Their extensive network and attractive promotional offers have contributed to the dominance of this sales channel, providing customers with easy access to diverse product categories.

India Dried Fruits Market Competitive Landscape

The India dried fruits market is dominated by key players who have established strong brand identities, distribution networks, and a loyal customer base. The competitive landscape shows a mix of local and international companies, with both small businesses and large conglomerates contributing to the market's growth. Notable players have consistently invested in product innovation, quality enhancement, and marketing campaigns to maintain their competitive edge.

|

Company Name |

Established |

Headquarters |

Revenue (2023) |

Product Portfolio |

Key Market Strategy |

|

Haldirams |

1941 |

Nagpur, India |

|||

|

Bikano |

1950 |

Delhi, India |

|||

|

Happilo |

2016 |

Bengaluru, India |

|||

|

Nutty Gritties |

2009 |

Delhi, India |

|||

|

Paper Boat |

2013 |

Bengaluru, India |

India Dried Fruits Industry Analysis

Growth Drivers

- Increasing Health Consciousness: In India, the rising awareness around healthy eating habits has driven demand for nutrient-dense snacks like dried fruits. Data from the Ministry of Health and Family Welfare in 2024 highlights a 15% increase in public campaigns promoting healthy diets, with dried fruits being a focus due to their high nutritional content. Almonds and cashews, rich in essential vitamins and minerals, have become particularly popular among urban consumers. The countrys health food segment has seen a notable rise in consumption, with dried fruits contributing significantly to this growth.

- Rising Demand for Healthy Snacks: In 2024, data from the Food Processing Ministry shows a shift towards convenient, healthy snacking, contributing to a surge in dried fruit consumption. Urban centers like Delhi, Mumbai, and Bangalore have seen increased consumer interest in healthier alternatives. Over 1,500 metric tons of dried fruits were sold across India's retail outlets in the first half of 2024, reflecting the growing trend. This shift is partly due to lifestyle changes, with busier schedules pushing consumers toward quick yet nutritious options.

- Expansion of Retail Networks: Indias retail landscape has expanded significantly over the last few years. In 2024, the Department of Commerce reported that the retail sector had grown by approximately 7% in metro cities. This expansion has given dried fruits easier access to consumers. Modern retail chains and online grocery platforms are enhancing product visibility and availability, with over 50% of dried fruit sales now happening through organized retail channels. This growth is helping the industry tap into previously underserved markets.

Market Challenges

- Price Volatility of Raw Materials (Almonds, Cashews, etc.): Dried fruit prices are significantly affected by fluctuations in raw material costs. In 2024, almond prices surged by 20% due to supply issues from California, the worlds largest almond producer. India, relying heavily on imported almonds, faced higher costs, which affected profit margins for local businesses. Cashew nut prices also faced volatility due to erratic weather conditions in producing regions such as West Africa, contributing to unstable pricing for manufacturers in India.

- Supply Chain Disruptions (Weather Conditions, Logistics): Extreme weather events and logistical challenges continue to disrupt the supply chain for dried fruits in India. In 2024, the Ministry of Agriculture noted that erratic monsoon patterns affected domestic dried fruit production, leading to supply shortages. Furthermore, logistical disruptions, such as the truckers' strike in July 2024, impacted the timely delivery of dried fruits across the country, exacerbating the shortage in certain regions. These disruptions add costs to businesses, ultimately driving up prices for consumers.

India Dried Fruits Market Future Outlook

Over the next five years, the India dried fruits market is poised for significant growth, driven by the expanding e-commerce sector, rising consumer awareness regarding health benefits, and an increasing focus on organic and natural products. The demand for premium, exotic dried fruits like Medjool dates and Californian almonds is expected to rise, reflecting evolving consumer preferences for healthier snacking options. Additionally, government incentives to boost food processing and exports, alongside increasing disposable income levels, will contribute to the markets growth. The shift towards value-added dried fruit products, such as flavored and coated varieties, will create new opportunities for manufacturers.

Market Opportunities

- Organic and Natural Product Trends: With an increasing number of consumers opting for organic and chemical-free foods, Indias dried fruit market is tapping into the organic segment. As of 2024, over 500 certified organic dried fruit farms were operating in India, primarily producing almonds and cashews. Government incentives for organic farming, such as subsidies on organic fertilizers, are supporting this growth. The demand for organic products is particularly strong in export markets like Europe, where food safety regulations are stringent. This trend presents a lucrative opportunity for Indian producers. Source

- Expansion into Untapped Tier II & Tier III Cities: Indias Tier II and Tier III cities are emerging as growth hubs for dried fruit consumption. As of 2024, these cities contribute over 35% of total dried fruit sales, a figure that continues to grow as retail infrastructure expands. Government data indicates that around 40 new supermarkets opened across smaller towns in the first half of 2024. These cities are witnessing higher disposable incomes, driving demand for premium products like dried fruits, creating significant market opportunities for companies aiming to expand.

Scope of the Report

|

Raisins Almonds Cashews Figs Apricots |

|

|

By Application |

Retail Bakery & Confectionery Food Processing Food Service & Catering Pharmaceuticals |

|

By Sales Channel |

Supermarkets/Hypermarkets Specialty Stores Online Stores Convenience Stores |

|

By Packaging Type |

Pouches Cans Boxes Jars |

|

By Region |

North East West South |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries)

Retail Chains and Supermarket Operators

E-commerce Platforms

Dried Fruit Manufacturers and Producers

Food Service Providers (Restaurants, Catering Services)

Exporters and Importers of Food Products

Health and Wellness Brands

Companies

Players Mention in the Report:

Haldirams

Bikano

Happilo

Nutty Gritties

Paper Boat

Saffola Fittify

Tulsi Dry Fruits

Del Monte

Vedaka

Wonderland Foods

Adani Wilmar

Balaji Wafers

Organic India

Bagrrys

Solana

Table of Contents

1. India Dried Fruits Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Dried Fruits Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Geographical Sales Breakdown (By Region, In Value)

3. India Dried Fruits Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness

3.1.2. Rising Demand for Healthy Snacks

3.1.3. Expansion of Retail Networks

3.1.4. Export Demand for Premium Quality Dried Fruits

3.2. Market Challenges

3.2.1. Price Volatility of Raw Materials (Almonds, Cashews, etc.)

3.2.2. Supply Chain Disruptions (Weather Conditions, Logistics)

3.2.3. Adulteration Risks and Quality Standards

3.3. Opportunities

3.3.1. Organic and Natural Product Trends

3.3.2. Expansion into Untapped Tier II & Tier III Cities

3.3.3. Increasing Exports to Health-Conscious Markets (Middle East, North America)

3.3.4. E-commerce and Direct-to-Consumer Channels

3.4. Trends

3.4.1. Preference for Premium and Exotic Dried Fruits

3.4.2. Value-Added Products (Chopped, Coated, etc.)

3.4.3. Brand Differentiation through Packaging Innovations

3.5. Government Regulations

3.5.1. FSSAI Guidelines on Food Safety and Standards

3.5.2. Import and Export Regulations

3.5.3. Incentives for Organic Farming

3.5.4. Trade Agreements Impacting Export Markets

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. India Dried Fruits Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Raisins

4.1.2. Almonds

4.1.3. Cashews

4.1.4. Figs

4.1.5. Apricots

4.2. By Application (In Value %)

4.2.1. Retail

4.2.2. Bakery & Confectionery

4.2.3. Food Processing

4.2.4. Food Service & Catering

4.2.5. Pharmaceuticals

4.3. By Sales Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Stores

4.3.4. Convenience Stores

4.4. By Packaging Type (In Value %)

4.4.1. Pouches

4.4.2. Cans

4.4.3. Boxes

4.4.4. Jars

4.5. By Region (In Value %)

4.5.1. North India

4.5.2. South India

4.5.3. East India

4.5.4. West India

5. India Dried Fruits Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Haldirams

5.1.2. Bikano

5.1.3. Nutty Gritties

5.1.4. Happilo

5.1.5. Saffola Fittify

5.1.6. Solana

5.1.7. Paper Boat

5.1.8. Tulsi Dry Fruits

5.1.9. Organic India

5.1.10. Vedaka

5.1.11. Del Monte

5.1.12. Wonderland Foods

5.1.13. Bagrrys

5.1.14. Adani Wilmar

5.1.15. Balaji Wafers

5.2. Cross Comparison Parameters (Revenue, Market Share, Distribution Reach, Product Portfolio, Certifications, Market Penetration, Marketing Strategies, Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. India Dried Fruits Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Labeling and Packaging Laws

6.4. Certifications (Organic, GMP, HACCP)

7. India Dried Fruits Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. India Dried Fruits Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. India Dried Fruits Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights

9.3. Distribution Channel Optimization

9.4. Marketing and Branding Strategies

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we mapped all the stakeholders in the India dried fruits market, including manufacturers, distributors, and consumers. A comprehensive secondary research approach was used, relying on reputable databases, government publications, and industry reports to gather market intelligence. This helped identify critical variables influencing the market, such as pricing trends, consumer preferences, and distribution channels.

Step 2: Market Analysis and Construction

Historical data on dried fruit consumption, sales patterns, and revenue generation was gathered to create a detailed market analysis. This data was then analyzed using statistical models to identify trends in the market, such as the rise of e-commerce as a significant sales channel and the growing demand for organic products. Market share across different product types and sales channels was also evaluated to present an accurate representation of the industry.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through in-depth interviews with market players, including manufacturers and distributors. These insights were crucial for refining the research and confirming our market estimates. The consultations helped ensure that our findings were aligned with industry realities.

Step 4: Research Synthesis and Final Output

In the final stage, we consolidated the data collected from various sources and interviews to produce a robust market analysis. We verified the data through cross-referencing with leading players in the market, ensuring a reliable and comprehensive report. The final output includes actionable insights and validated market estimates, tailored for business professionals.

Frequently Asked Questions

01. How big is the India Dried Fruits Market?

The India dried fruits market is valued at USD 830 million in 2023, driven by growing consumer health awareness and rising disposable incomes.

02. What are the challenges in the India Dried Fruits Market?

Challenges in India dried fruits market include the price volatility of raw materials such as almonds and cashews, supply chain disruptions due to logistics, and the risk of adulteration affecting product quality.

03. Who are the major players in the India Dried Fruits Market?

Key players in the India dried fruits market include Haldirams, Bikano, Happilo, Nutty Gritties, and Paper Boat, dominating through strong brand presence, wide distribution networks, and innovative product offerings.

04. What are the growth drivers of the India Dried Fruits Market?

India dried fruits market Growth is driven by increasing health consciousness, the rise of premium and organic products, expanding retail and e-commerce channels, and the growing popularity of dried fruits as a healthy snack option.

05. Which product type dominates the India Dried Fruits Market?

Almonds hold a dominant market share in India dried fruits market due to their widespread consumption, high nutritional value, and cultural significance in gifting and ceremonies across India.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.