India Electric Vehicle Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD261

June 2024

100

About the Report

India Electric Vehicle Market Overview

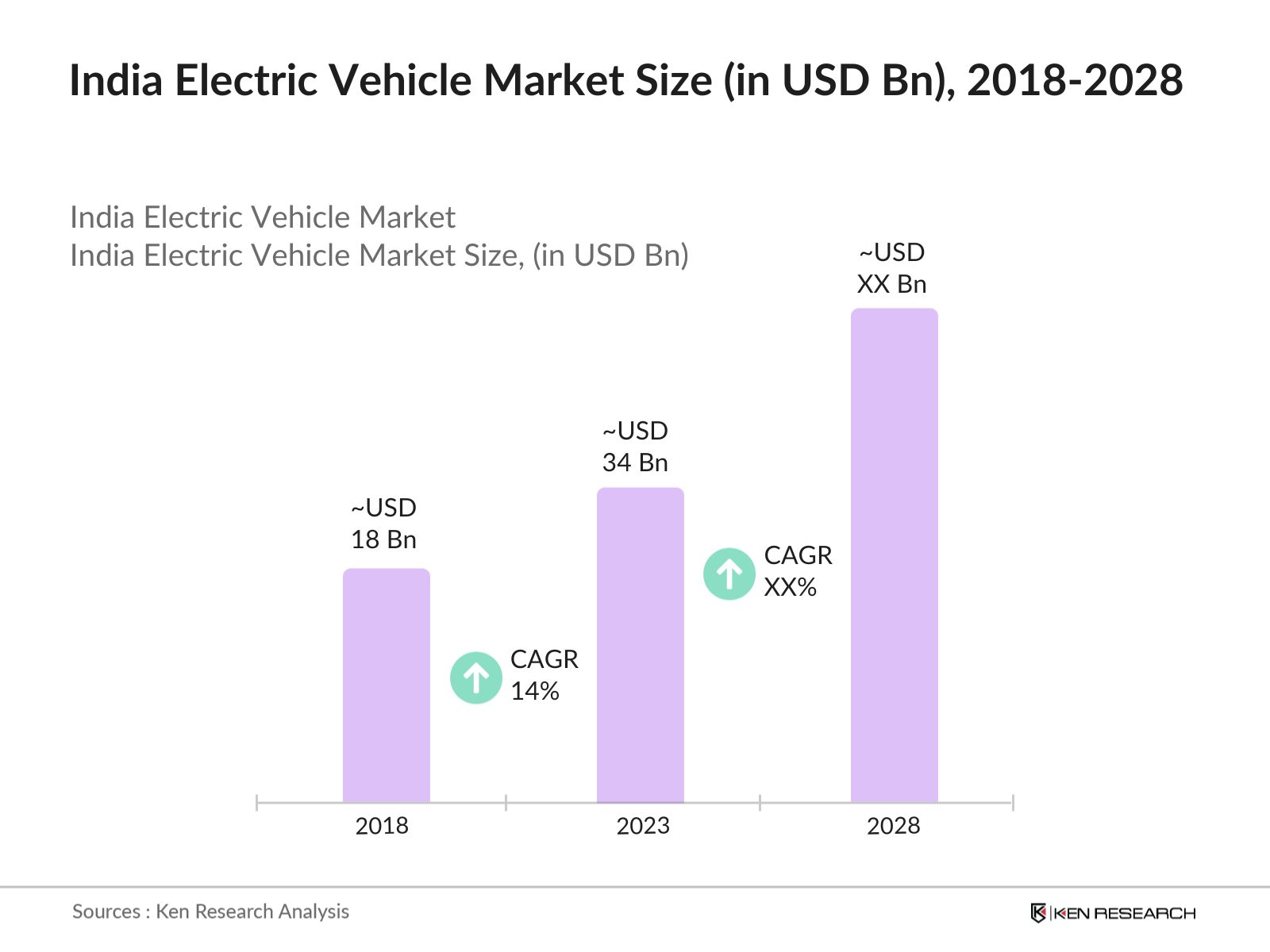

- The market was valued at USD 18 Bn in 2018, showing significant growth over five years. In 2023, the Indian EV market is valued at USD 34 Bn, driven by rising consumer interest and favorable policies.

- Key players include Tata Motors, Mahindra Electric, Ather Energy, Ola Electric, and Hero Electric.

- High upfront costs, limited charging infrastructure, battery disposal concerns, and competition from traditional fuel vehicles are few of the market challenges.

- Government subsidies up to INR 1.5 lakh on electric cars, rising fuel prices, and demand for eco-friendly options are driving the market.

- The electric two-wheeler segment leads, with over 1 Mn units sold in 2023 due to affordability, urban convenience, and supportive policies.

India Electric Vehicle Current Market Analysis

- The Indian EV market is rapidly growing across two-wheelers, four-wheelers, and commercial vehicles. Government initiatives like the FAME II scheme, with INR 10,000 Cr allocated, boost market growth.

- In 2023, two-wheelers accounted for over 60% of total EV sales. Electric two-wheelers dominate due to affordability and practicality in urban areas.

- Scooters are the bestselling electric two-wheelers, with popular models like Ather 450X and Ola S1.

- Consumers prefer EVs with long battery life, quick charging, and advanced features like connectivity and smart navigation.

- Subsidies of up to INR 15,000 per kWh of battery capacity influence consumer decisions.

- Tata Motors leads the market with a diverse EV portfolio and strong brand reputation. The Tata Nexon EV has sold over 30,000 units, highlighting Tata's success.

India Electric Vehicle Market Segmentation

The Indian Electric Vehicle Market can be segmented based on several factors:

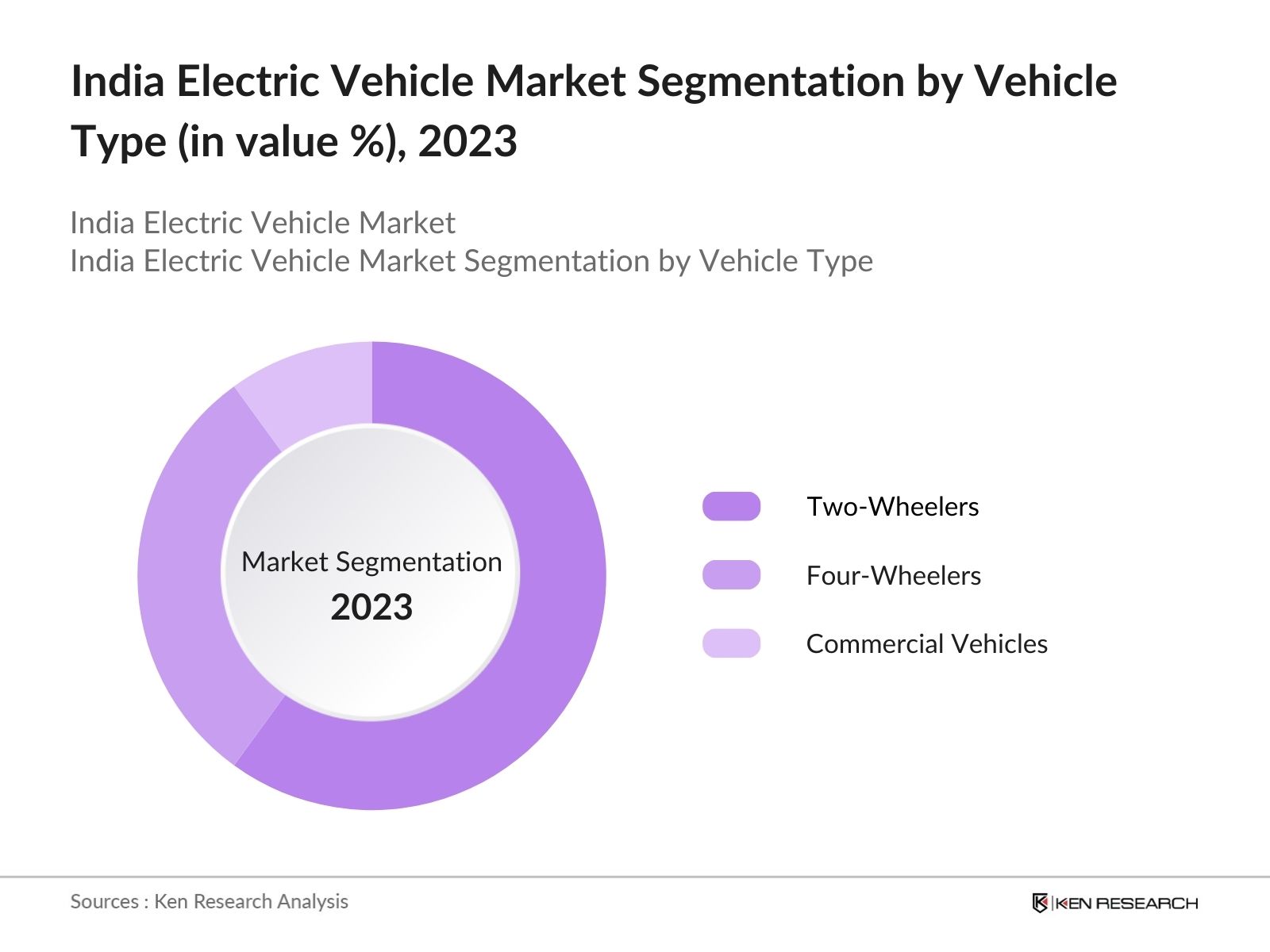

By Vehicle Type: In 2023, the Indian electric vehicle (EV) market was segmented by vehicle type, with two-wheelers dominating the market. This dominance is driven by their affordability, government incentives, and suitability for urban commuting.

In contrast, four-wheelers and commercial vehicles held smaller shares, primarily due to higher costs and specific operational challenges. As India advances in sustainable mobility, electric two-wheelers are set to lead the market's growth trajectory in the foreseeable future.

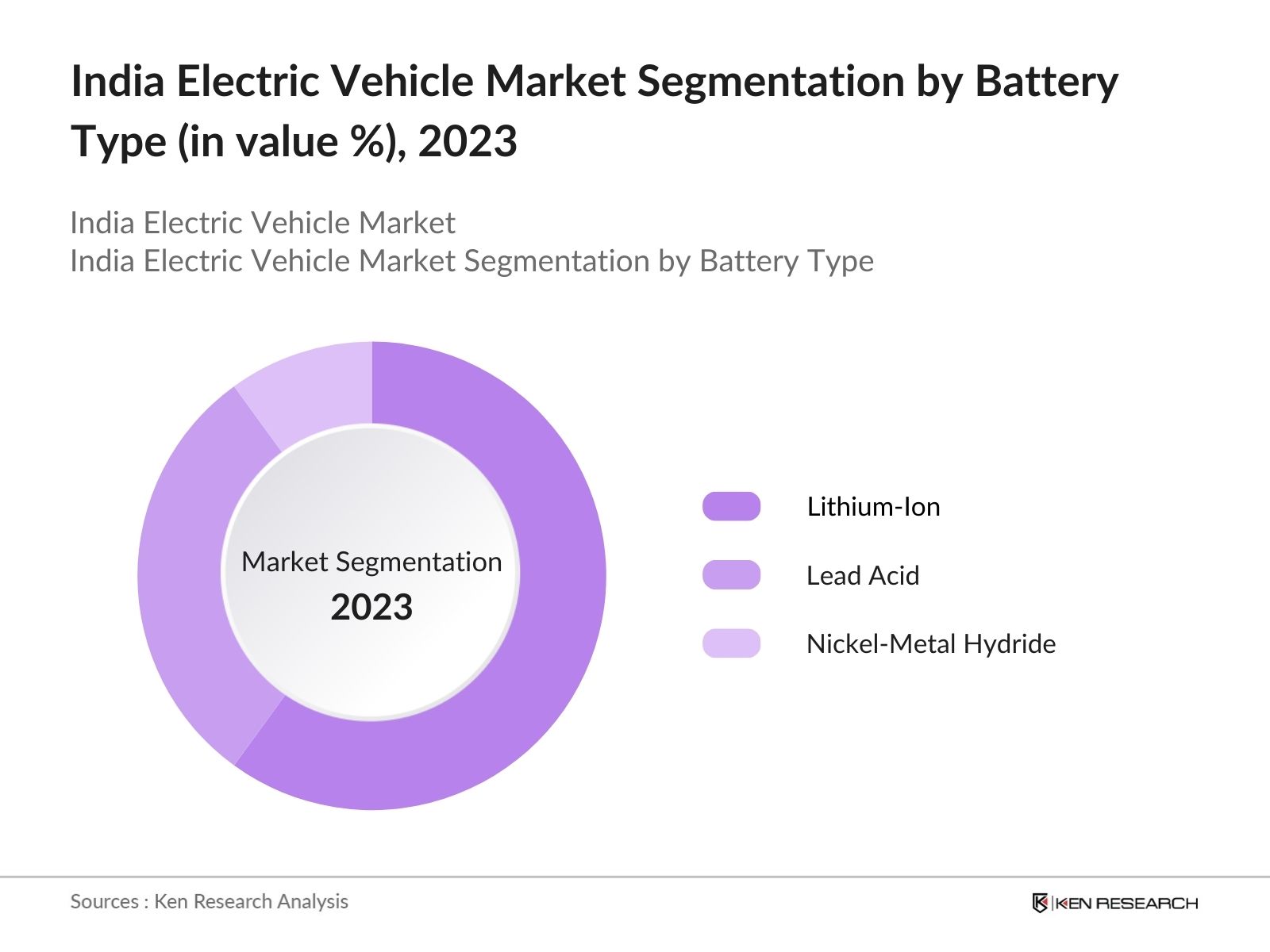

By Battery Type: In 2023, the India Electric Vehicle Market is segmented by battery type, with Lithium-ion holding the largest share. This dominance is due to its long lifespan, high energy density, and efficient performance, which allow for longer ranges and faster charging, factors that appeal to consumers. Alongside Lithium-ion, Lead Acid and Nickel-Metal Hydride batteries also contribute to the market.

By End User: In 2023, India's Electric Vehicle Market is divided into three segments: Private, Commercial, and Public Transport. The Private segment holds the largest share driven by increasing personal vehicle ownership, high fuel costs, and environmental concerns.

Government subsidies and tax benefits also make EVs more accessible to individual buyers. The Commercial and Public Transport segments are also making significant contributions to the market's growth, as businesses and public transport services increasingly adopt EVs to reduce costs and emissions.

India Electric Vehicle Market Competitive Landscape

- The Indian electric vehicle (EV) market is highly competitive, driven by innovation, strategic pricing, infrastructure development, and regulatory support. Tata Motors leads the market with over 50,000 EVs sold by 2023, leveraging its strong brand reputation and diverse product lineup to maintain dominance.

- Mahindra Electric strengthens its market position through its eVerito sedan and strategic partnerships, focusing on brand strength and varied product offerings.

- Ather Energy and Ola Electric challenge established players with innovative models like the Ather 450X and Ola S1 scooters, emphasizing extended range and affordability. Startups integrate advanced technology into their offerings, exemplified by Ola Electric's scooters, setting competitive benchmarks in performance and pricing.

- Government policies like FAME II incentives shape market dynamics, influencing company strategies to maximize benefits and promote EV adoption.

- Overall, competition hinges on product quality, pricing, range, charging infrastructure, and brand perception, driving continuous innovation. The competitiveness of the Indian EV market centers on leveraging regulatory support, fostering infrastructure growth, and executing strategic pricing to gain market share.

India Electric Vehicle Industry Analysis

India Electric Vehicle Market Growth Drivers:

- Rising Fuel Prices: The average price of petrol in India surged by 15% in 2023, making electric vehicles a more cost-effective alternative for consumers. This shift in consumer preference led to a 45% increase in electric two-wheeler registrations in the first half of 2024.

- Urban Air Pollution Concerns: Major Indian cities like Delhi, Mumbai, and Bangalore have seen a 20% reduction in particulate matter (PM2.5) levels due to increased adoption of electric vehicles, highlighting the growing environmental benefits and public health awareness.

- Technological Advancements: Innovations in battery technology have resulted in a 25% increase in energy density and a 15% reduction in costs year-on-year. This has significantly extended the range of electric vehicles and reduced charging times, making them more appealing to consumers.

India Electric Vehicle Market Challenges:

- Charging Infrastructure: Despite progress, India still faces a shortage of EV charging stations. As of June 2024, there are only 3,500 public charging stations across the country, which is insufficient to support the growing number of electric vehicles.

- High Initial Costs: The upfront cost of electric vehicles remains high. In 2023, the average price of an electric car was approximately 40% higher than a comparable internal combustion engine vehicle, posing a barrier to widespread adoption.

- Battery Disposal and Recycling: Proper disposal and recycling of EV batteries are significant environmental concerns. By mid-2024, India had a recycling capacity for only 5% of the batteries reaching end-of-life, leading to potential environmental hazards.

India Electric Vehicle Market Recent Developments:

- Launch of New EV Models: Major automotive manufacturers have launched over 20 new electric vehicle models in the first half of 2024, providing consumers with a wider range of options in terms of price, range, and features.

- Partnerships for Charging Infrastructure: Energy companies have partnered with automotive manufacturers to set up over 1,000 new fast-charging stations across the country by mid-2024, enhancing the accessibility of charging infrastructure.

- Increase in EV Financing Options: Financial institutions have introduced dedicated loan products for electric vehicle purchases, with lower interest rates and longer repayment periods, leading to a 30% increase in EV financing in 2024.

India Electric Vehicle Market Government Initiatives:

- FAME II Scheme: The FAME II scheme, with an outlay of INR 10,000 crore, aims to support 1 million electric two-wheelers, 500,000 electric three-wheelers, 55,000 electric four-wheelers, and 7,000 electric buses by providing subsidies, thus significantly boosting EV adoption.

- PLI Scheme for Advanced Chemistry Cell Battery Manufacturing: The government launched the PLI scheme to incentivize battery manufacturing in India, aiming to achieve a cumulative capacity of 50 GWh by 2024, which is crucial for supporting the electric vehicle ecosystem.

- Green Urban Mobility Initiative: Under this initiative, INR 2,000 crore has been allocated to develop electric vehicle infrastructure in urban areas, including the deployment of charging stations and electric buses, promoting sustainable urban transportation.

India Electric Vehicle Future Market Outlook

The Indian EV market is expected to show significant growth, driven by continuous advancements and supportive policies.

Factors Influencing Growth:

- Government Support: Government initiatives like the FAME scheme, with a ₹10,000 crore allocation, have resulted in over 5 lakh electric vehicles sold and plans for 2,636 charging stations in 62 cities, crucially driving EV market expansion.

- Technological Advancements: Enhanced battery technology now offers ranges of 300-400 km per charge and fast-charging capabilities that reach 80% in 30 minutes, significantly improving EV performance and user convenience.

- Environmental Regulations: Stricter environmental regulations, including BS-VI emission norms and the goal to reduce carbon emissions by 33-35% from 2005 levels by 2030, are incentivizing the shift towards electric vehicles.

- Increased Investment: Significant investments, such as Tata Motors' ₹15,000 crore plan over the next five years, are boosting innovation, manufacturing, research and development, and charging infrastructure, accelerating market growth.

Scope of the Report

|

By Vehicle Type |

Two-Wheeler Four-Wheeler Commercial Vehicle |

|

By Battery Type |

Lithium-Ion Lead Acid Nickel-Metal Hydride |

|

By End User |

Private Commercial Public Transport |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

EV Component Suppliers

Investors and Financial Institutions

Ministry of Road Transport and Highways (MoRTH)

Automotive Machinery Manufactures

EV Charging Equipment Manufacturers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Tata Motors

Mahindra Electric

Ather Energy

Ola Electric

Hero Electric

Bajaj Auto

TVS Motor Company

Ashok Leyland

Hyundai Motor India

MG Motor India

Revolt Motors

Okinawa Autotech

Ampere Vehicles

JBM Auto

Kinetic Green Energy

Pure EV

Ultraviolette Automotive

ETrio

Strom Motors

Yulu Bikes

Table of Contents

1. India Electric Vehicle Market Overview

1.1 India Electric Vehicle Market Taxonomy

2. India Electric Vehicle Market Size (in USD Bn), 2018-2023

3. India Electric Vehicle Market Analysis

3.1 India Electric Vehicle Market Growth Drivers

3.2 India Electric Vehicle Market Challenges and Issues

3.3 India Electric Vehicle Market Trends and Development

3.4 India Electric Vehicle Market Government Regulation

3.5 India Electric Vehicle Market SWOT Analysis

3.6 India Electric Vehicle Market Stake Ecosystem

3.7 India Electric Vehicle Market Competition Ecosystem

4. India Electric Vehicle Market Segmentation, 2023

4.1 India Electric Vehicle Market Segmentation by Vehicle Type (in %), 2023

4.2 India Electric Vehicle Market Segmentation by Battery Type (in %), 2023

4.3 India Electric Vehicle Market Segmentation by End User (in %), 2023

5. India Electric Vehicle Market Competition Benchmarking

5.1 India Electric Vehicle Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Electric Vehicle Future Market Size (in USD Bn), 2023-2028

7. India Electric Vehicle Future Market Segmentation, 2028

7.1 India Electric Vehicle Market Segmentation by Vehicle Type (in %), 2028

7.2 India Electric Vehicle Market Segmentation by Battery Type (in %), 2028

7.3 India Electric Vehicle Market Segmentation by End User (in %), 2028

8. India Electric Vehicle Market Analysts’ Recommendations

8.1 India Electric Vehicle Market TAM/SAM/SOM Analysis

8.2 India Electric Vehicle Market Customer Cohort Analysis

8.3 India Electric Vehicle Market Marketing Initiatives

8.4 India Electric Vehicle Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on Indian electric vehicle market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India electric vehicle market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple electric vehicle companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from electric vehicle companies.

Frequently Asked Questions

01 How big is Indian Electric Vehicle Market?

The Indian Electric Vehicle Market was valued at USD 34 Bn in 2023 driven by rising consumer interest and favorable policies.

02 What are the key challenges faced in Indian Electric Vehicle Market?

The key challenges faced in Indian Electric Vehicle Market are high upfront costs, range anxiety and technological reliability.

03 Who are some of the major players in the Indian Electric Vehicle Market?

Some of the major players in the Indian Electric Vehicle Market include Tata Motors, Ather Energy, Ola Electric and Hero Electric.

04 What are the factors driving India electric vehicle market?

Government incentives, environmental regulations, rising fuel costs and technological advancements in batteries are driving the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.