India Full Truck Load Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD10868

December 2024

98

About the Report

India Full-Truck-Load (FTL) Market Overview

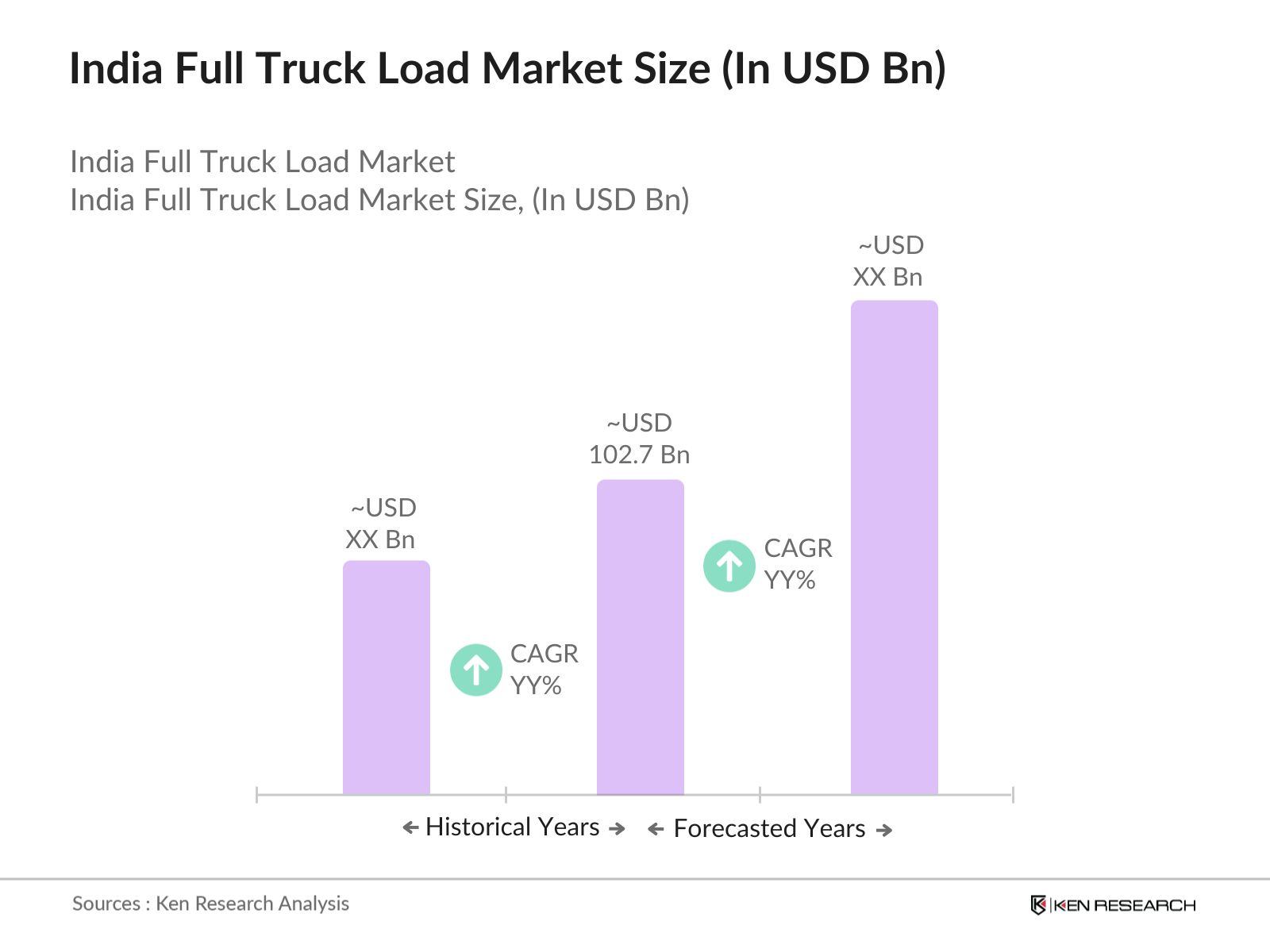

- The India Full-Truck-Load (FTL) Market is valued at USD 102.7 billion, based on a five-year historical analysis. This valuation is primarily driven by the increasing demand for direct delivery logistics solutions for bulk loads across long distances. Industries such as e-commerce, retail, and FMCG heavily rely on FTL services for efficient goods transportation due to the high volume of shipments. Furthermore, the growth in infrastructure investments and the expansion of the road network contribute to the market's upward trend.

- Dominant regions in this market include North India and South India, with metropolitan areas like Delhi, Mumbai, and Chennai leading in demand. These cities are economic hubs with industrial activity and high consumption rates, requiring consistent, large-scale freight movement. The geographical positioning and well-developed logistics networks in these regions also support their dominance, enhancing their role as critical players in the India FTL landscape.

- Indias National Logistics Policy, launched in 2023, aims to reduce logistics costs as a percentage of GDP from 13% to single digits, enhancing FTL efficiency. The policy promotes infrastructure development, technology adoption, and standardization of logistics processes to support streamlined FTL operations. This policy is anticipated to drive long-term improvements in freight transport reliability and reduce bottlenecks in Indias logistics sector.

India Full-Truck-Load (FTL) Market Segmentation

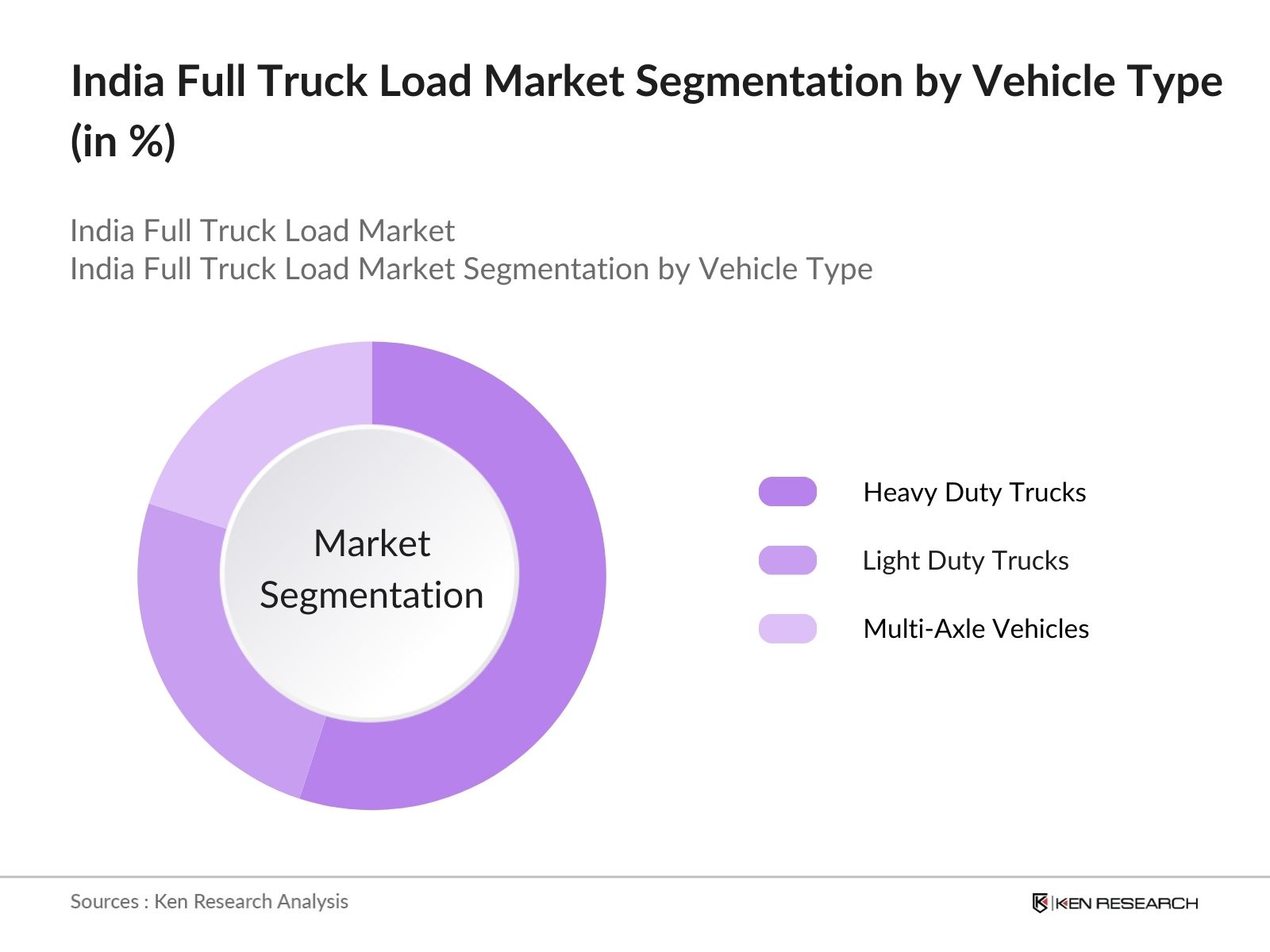

- By Vehicle Type: The market is segmented by vehicle type into heavy-duty trucks, light-duty trucks, and multi-axle vehicles. Heavy-duty trucks hold a dominant market share within this segment due to their capacity to transport bulk goods efficiently over long distances, which is a critical requirement for industries like manufacturing and construction. The durability and cost-efficiency of heavy-duty trucks make them the preferred choice for FTL, with investments by logistics firms in expanding and upgrading their heavy-duty fleets.

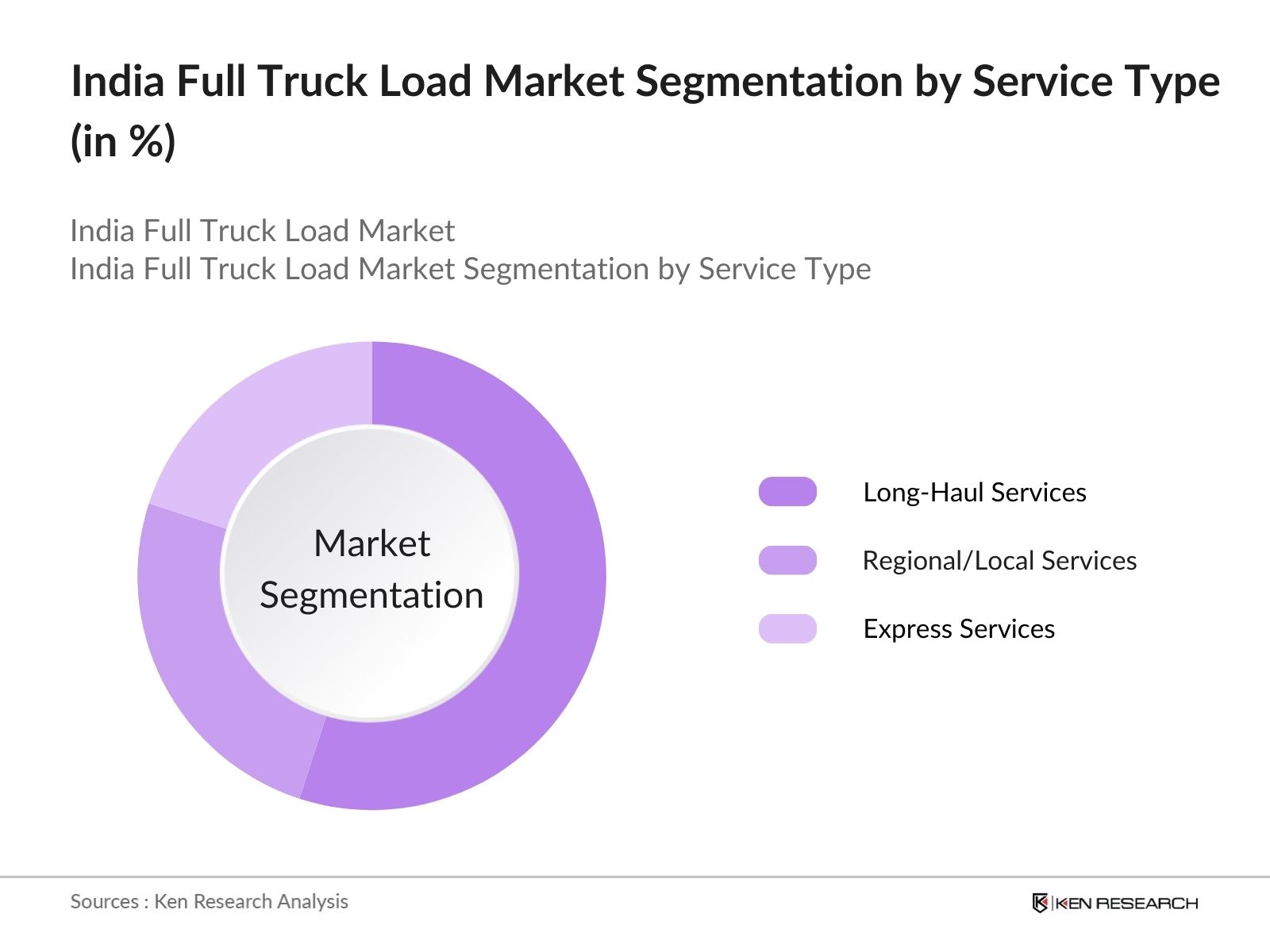

- By Service Type: The market is segmented by service type into long-haul services, regional/local services, and express services. Long-haul services dominate due to the extensive interstate transportation requirements in India, particularly for sectors like FMCG and automotive, which rely on uninterrupted supply chains. The demand for long-haul services is further reinforced by the logistics needs of large warehouses and distribution centers situated in different regions across the country.

India Full-Truck-Load (FTL) Market Competitive Landscape

The India Full-Truck-Load (FTL) market is dominated by a mix of established domestic and multinational logistics providers, including names like Mahindra Logistics and VRL Logistics, who are known for their extensive network coverage. The presence of these key players drives a competitive landscape characterized by innovations in fleet management and technology adoption to increase efficiency and reduce costs.

India Full-Truck-Load (FTL) Market Analysis

Market Growth Drivers

- Industrial and Retail Growth: Industrial output in India has expanded with contributions from key sectors like manufacturing and textiles. The IIP (Index of Industrial Production) grew to 134 in 2024, reflecting increased goods movement across sectors like manufacturing and construction, where full-truck-load (FTL) services are essential. Retail trade in India is projected to contribute over INR 80 lakh crore to the GDP, reinforcing the demand for bulk freight movement. The sectors output increase and robust retail sales underpin FTLs role in Indias growing logistical framework.

- Expansion of E-commerce and FMCG: Indias e-commerce sector, valued at over INR 5 lakh crore in 2024, fuels the FTL market by driving bulk shipments of goods across distribution centers nationwide. The FMCG sector, generating substantial revenue through high-demand goods, complements this trend as it requires efficient and high-capacity transport solutions. E-commerce growth, especially in Tier II and III cities, has heightened FTLs demand, catering to bulk transport needs for products ranging from electronics to fast-moving consumer goods.

- Increasing Demand in Rural Areas: With Indias rural population surpassing 900 million, demand for essential goods in rural areas has surged, requiring reliable FTL logistics solutions. Agricultural and consumer goods move in bulk from urban centers to rural markets, creating a steady demand for FTL transport services. Increased road infrastructure under the PMGSY (Pradhan Mantri Gram Sadak Yojana) program has enhanced rural accessibility, facilitating smoother goods movement and bolstering FTL market expansion in these regions.

Market Challenges

- High Operational and Fuel Costs: The cost of diesel, a primary input in trucking operations, rose above INR 90 per liter in 2024, exerting pressure on operational expenses for FTL providers. The Indian Oil Corporation reported that fuel costs contribute over 45% to logistics expenses, impacting the profitability of FTL operators. The volatility of diesel prices and high maintenance costs for trucks remain pressing issues, making it difficult for FTL operators to sustain competitive pricing.

- Infrastructure Bottlenecks: Despite infrastructure improvements, certain bottlenecks persist, especially in remote areas and interstate routes where road quality and congestion are issues. Over 30% of Indias roadways still require upgrades, according to the Ministry of Road Transport, causing delays that impact the FTL market. Traffic congestion on major freight corridors, combined with inadequate parking and unloading facilities, hampers logistics efficiency. These challenges directly impact delivery timelines and increase operational costs for FTL providers.

India Full-Truck-Load (FTL) Future Outlook

Over the next five years, the India Full-Truck-Load (FTL) market is expected to witness substantial growth driven by several key factors. Rising industrial production, a thriving e-commerce sector, and increasing investments in road infrastructure will bolster market expansion. Additionally, the trend of digitizing logistics and implementing advanced fleet management systems is likely to further enhance the efficiency and service capabilities of FTL providers in India.

Market Opportunities

- Technological Advancements in Logistics: The FTL market has embraced innovations like IoT-enabled fleet management systems, enhancing real-time tracking and route optimization. Around 35% of FTL operators in India utilize GPS and telematics solutions, leading to a 20% reduction in travel time and fuel use. These advancements improve operational efficiency and customer service by providing real-time data, a growing requirement for logistics companies and customers alike.

- Rise of Digital Platforms for Trucking Aggregation: Digital truck aggregation platforms have seen a 40% increase in user adoption, streamlining FTL logistics by reducing downtime and improving vehicle utilization rates. Such platforms connect shippers with available truckers, enhancing operational flexibility and reducing empty miles. The growth of these platforms supports small and medium enterprises in the logistics sector by offering accessible tools to manage FTL freight needs more efficiently.

Scope of the Report

|

Segment |

Sub-Segments |

|

Vehicle Type |

Heavy Duty Trucks |

|

Light Duty Trucks |

|

|

Multi-Axle Vehicles |

|

|

Service Type |

Long-Haul Services |

|

Regional/Local Services |

|

|

Express and Premium Services |

|

|

Industry |

Automotive and Spare Parts |

|

Consumer Goods and Retail |

|

|

Food and Beverages |

|

|

Pharmaceuticals |

|

|

End-User |

Manufacturing |

|

Agriculture |

|

|

Retail and E-commerce |

|

|

Region |

North India |

|

South India |

|

|

West India |

|

|

East India |

Products

Key Target Audience

Logistics and Supply Chain Managers

Manufacturers (Automotive, Consumer Goods, etc.)

Retailers and E-commerce Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Road Transport and Highways)

Large-Scale Warehouse Operators

FMCG and Retail Distribution Centers

Freight and Cargo Insurance Providers

Companies

Players Mentioned in the Report

Mahindra Logistics

VRL Logistics

Gati Ltd.

Allcargo Logistics

Transport Corporation of India (TCI)

Rivigo Services Pvt Ltd

Future Supply Chain Solutions

Blue Dart Express Ltd.

Patel Integrated Logistics

Snowman Logistics Ltd.

Table of Contents

1. India Full-Truck-Load (FTL) Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Full-Truck-Load (FTL) Market Size (In INR Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Full-Truck-Load (FTL) Market Analysis

3.1 Growth Drivers

3.1.1 Industrial and Retail Growth (Drivers)

3.1.2 Government Initiatives for Infrastructure Development

3.1.3 Expansion of E-commerce and FMCG (Market-Specific Drivers)

3.1.4 Increasing Demand in Rural Areas

3.2 Market Challenges

3.2.1 High Operational and Fuel Costs (Challenges)

3.2.2 Infrastructure Bottlenecks

3.2.3 Regulatory and Compliance Barriers

3.3 Opportunities

3.3.1 Technological Advancements in Logistics (Opportunities)

3.3.2 Rise of Digital Platforms for Trucking Aggregation

3.3.3 Growth of Alternative Energy Vehicles in Freight

3.4 Trends

3.4.1 Adoption of Real-Time Tracking Systems (Trends)

3.4.2 Shift to Organized Trucking Services

3.4.3 Increasing Partnerships with 3PL and 4PL Providers

3.5 Government Regulations

3.5.1 National Logistics Policy (Market-Specific Regulation)

3.5.2 Goods and Services Tax (GST) Impact

3.5.3 Compliance with Emission Standards

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. India Full-Truck-Load (FTL) Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Heavy Duty Trucks

4.1.2 Light Duty Trucks

4.1.3 Multi-Axle Vehicles

4.2 By Service Type (In Value %)

4.2.1 Long-Haul Services

4.2.2 Regional/Local Services

4.2.3 Express and Premium Services

4.3 By Industry (In Value %)

4.3.1 Automotive and Spare Parts

4.3.2 Consumer Goods and Retail (Market-Specific Industries)

4.3.3 Food and Beverages

4.3.4 Pharmaceuticals

4.4 By End-User (In Value %)

4.4.1 Manufacturing

4.4.2 Agriculture

4.4.3 Retail and E-commerce

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

5. India Full-Truck-Load (FTL) Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Mahindra Logistics

5.1.2 VRL Logistics

5.1.3 Gati Ltd.

5.1.4 Allcargo Logistics

5.1.5 Transport Corporation of India (TCI)

5.1.6 Rivigo Services Pvt Ltd

5.1.7 Future Supply Chain Solutions

5.1.8 Blue Dart Express Ltd.

5.1.9 Patel Integrated Logistics

5.1.10 Snowman Logistics Ltd.

5.1.11 DHL Supply Chain India

5.1.12 Delhivery

5.1.13 Xpressbees

5.1.14 Shree Tirupati Courier Services Pvt Ltd

5.1.15 Blackbuck

5.2 Cross-Comparison Parameters (Fleet Size, Coverage, Operational Efficiency, Technology Adoption, Service Portfolio, Revenue, Clientele, Market Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. India Full-Truck-Load (FTL) Market Regulatory Framework

6.1 National Standards and Compliance Requirements

6.2 Emission Norms and Safety Standards

6.3 Licensing and Documentation Processes

7. India Full-Truck-Load (FTL) Future Market Size (In INR Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Full-Truck-Load (FTL) Future Market Segmentation

8.1 By Vehicle Type

8.2 By Service Type

8.3 By Industry

8.4 By End-User

8.5 By Region

9. India Full-Truck-Load (FTL) Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem for the India Full-Truck-Load (FTL) market, identifying the key stakeholders, and collecting data on primary variables such as fleet composition, service types, and end-user industries. This step is driven by in-depth desk research utilizing a mix of secondary databases and proprietary sources to capture market-level insights.

Step 2: Market Analysis and Construction

Historical data is analyzed, focusing on variables like fleet size distribution, service coverage, and the ratio of FTL to part-load (PTL) services in various regions. This analysis provides the foundation for estimating market size and growth trends, reflecting the revenue and service penetration across different market segments.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are validated through interviews with industry experts, including representatives from leading logistics providers. These insights, gathered via computer-assisted telephone interviews (CATIs), help refine the initial data and provide perspectives on operational efficiencies and competitive positioning.

Step 4: Research Synthesis and Final Output

In the final phase, the data is synthesized into a comprehensive report, incorporating insights from primary and secondary research. Cross-verification with key industry players ensures accuracy in the final market outlook, with segments and trends validated against industry standards.

Frequently Asked Questions

1. How big is the India Full-Truck-Load (FTL) Market?

The India Full-Truck-Load (FTL) market, valued at USD 102.7 billion, is driven by the demand for large-scale, direct delivery solutions across various industries, particularly retail, manufacturing, and FMCG.

2. What are the challenges in the India Full-Truck-Load (FTL) Market?

Challenges include high fuel costs, regulatory compliance issues, and infrastructure bottlenecks, which can increase operational expenses and impact service efficiency.

3. Who are the major players in the India Full-Truck-Load (FTL) Market?

Major players in the market include Mahindra Logistics, VRL Logistics, Gati Ltd., and Delhivery, each known for their extensive networks and fleet management capabilities.

4. What are the growth drivers of the India Full-Truck-Load (FTL) Market?

Growth is fueled by rising demand in e-commerce, increased road infrastructure investments, and digitalization efforts in logistics, improving the efficiency and scalability of FTL services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.