India Genetic Testing Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2814

November 2024

85

About the Report

India Genetic Testing Market Overview

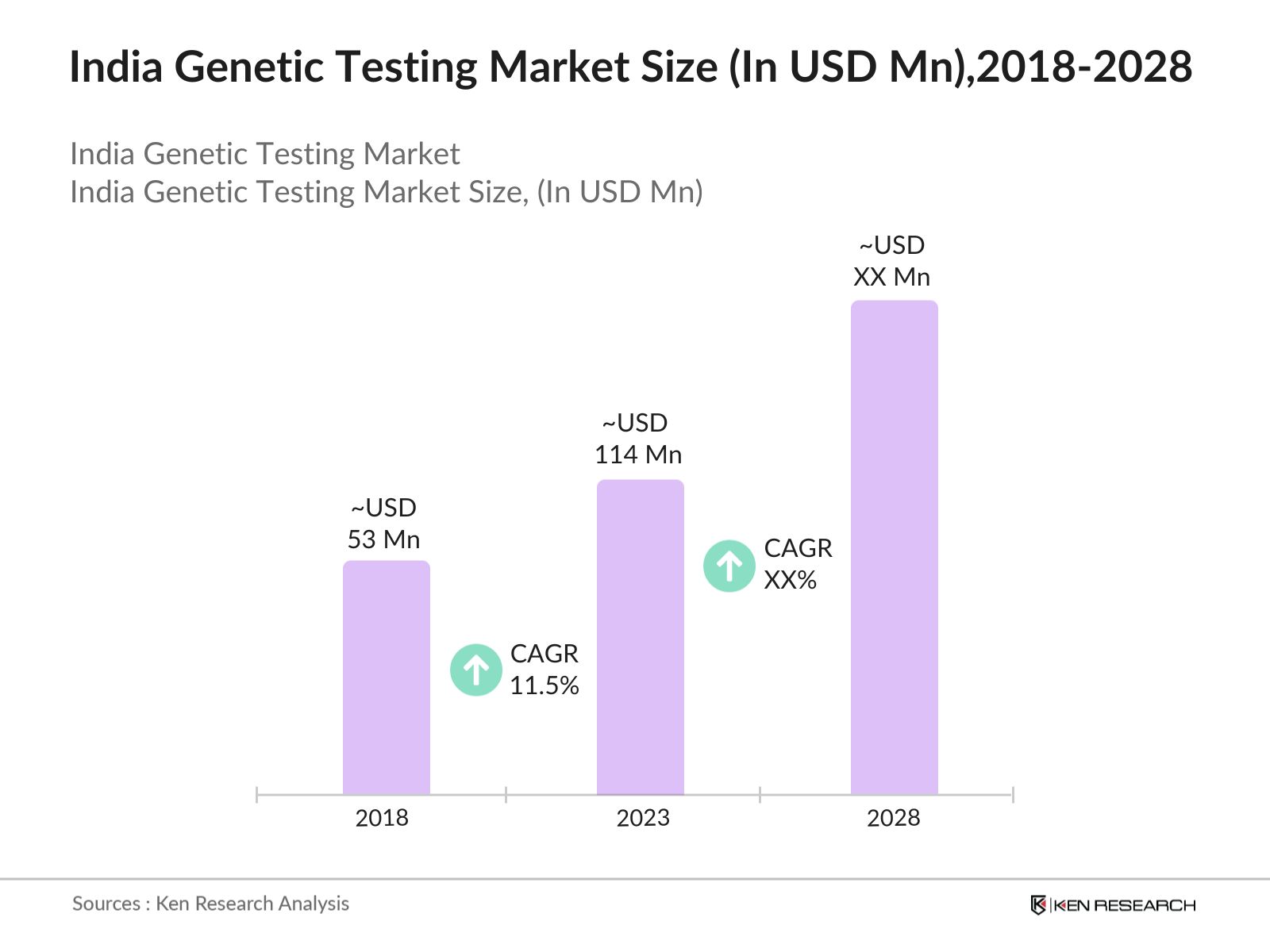

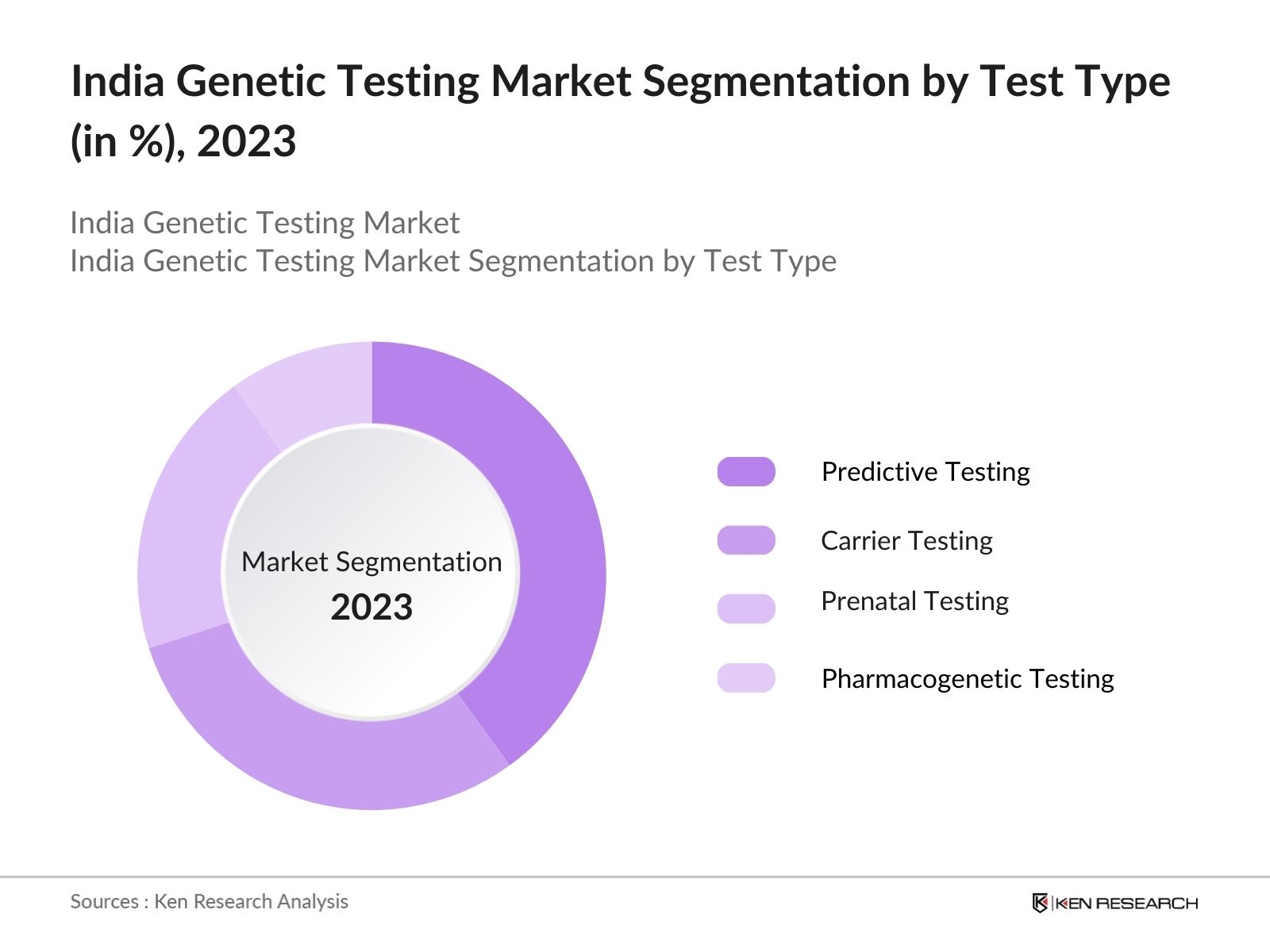

- The India Genetic Testing Market was valued at USD 114 million in 2023, driven by the increasing prevalence of genetic disorders, rising awareness about personalized medicine, and advancements in technology. The market is segmented into predictive testing, carrier testing, prenatal testing, and pharmacogenetic testing, with predictive testing being the most dominant due to its role in early detection and prevention.

- Major players in the India Genetic Testing Market include Strand Life Sciences, MedGenome, Mapmygenome, DNA Labs India, and Xcode Life. These companies are recognized for their advanced genetic testing services and their emphasis on personalized healthcare solutions. Strand Life Sciences leads the market with its comprehensive range of genomic services and collaborations with hospitals across India.

- In Northern India, cities like Delhi, Mumbai, and Bengaluru dominate the market due to their advanced healthcare infrastructure and increasing awareness about genetic disorders. These regions are characterized by a growing demand for predictive and prenatal testing.

- In 2023, MedGenome launched a new panel for genetic testing focused on hereditary cancer screening, aimed at individuals with a family history of cancer. This innovation reflects the growing emphasis on personalized medicine and the increasing demand for preventive healthcare solutions in India.

India Genetic Testing Market Segmentation

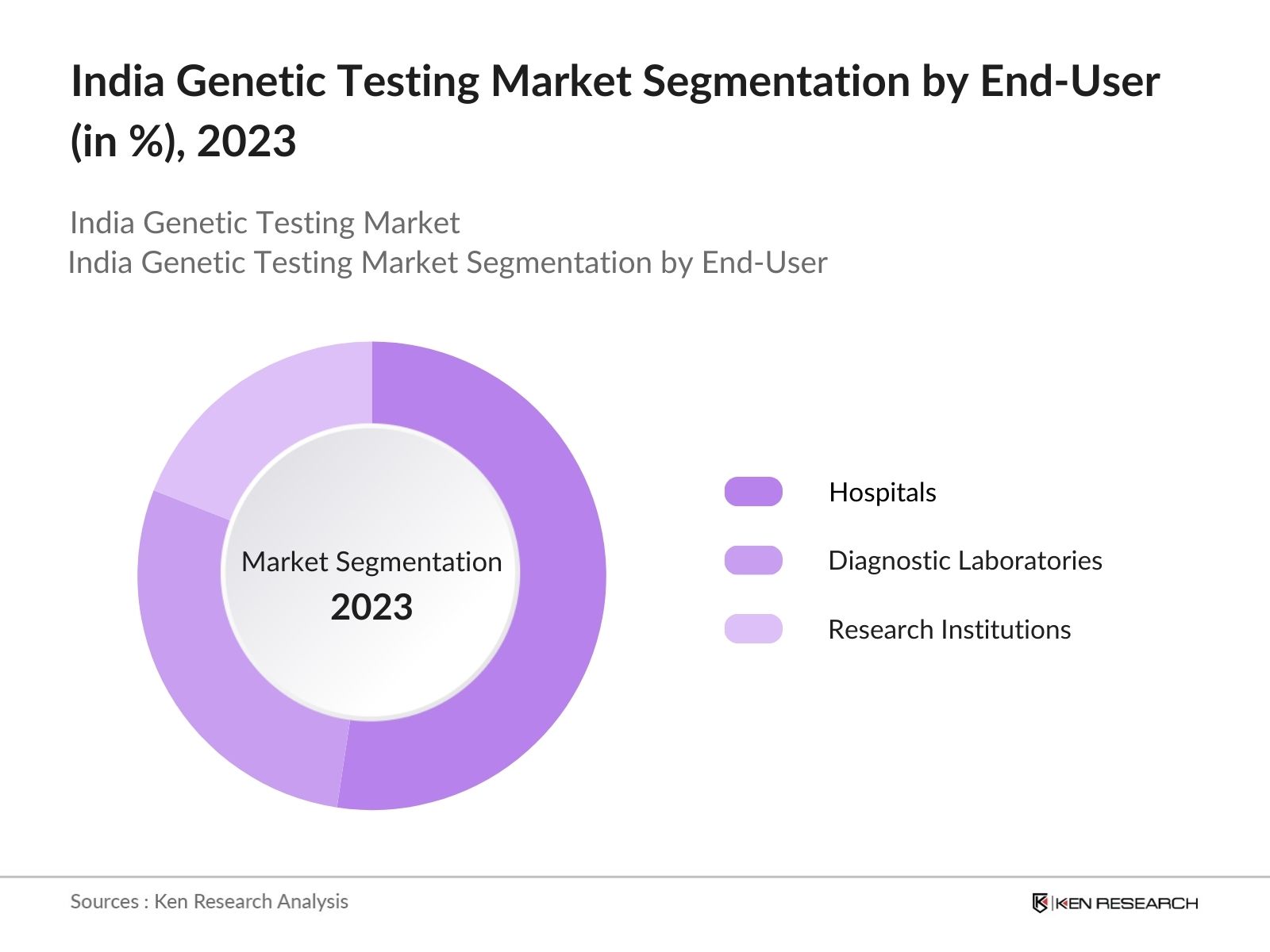

The India Genetic Testing Market can be segmented by test type, end-user, and region:

By Test Type: The market is segmented into predictive testing, carrier testing, prenatal testing, and pharmacogenetic testing. In 2023, predictive testing remains the most dominant test type due to its ability to identify potential genetic risks early. Prenatal testing is also gaining traction, especially among high-risk pregnancies, due to its non-invasive nature and accuracy.

By End-User: The market is segmented by end-users into hospitals, diagnostic laboratories, and research institutions. In 2023, hospitals dominate the market due to their extensive reach and partnerships with genetic testing providers. Diagnostic laboratories are rapidly growing in market share, driven by advancements in testing technologies and collaborations with healthcare providers.

By Region: The India market is segmented regionally into North, South, East, and West. In 2023, Northern India leads the market due to its advanced healthcare infrastructure and growing awareness of genetic testing. Southern India is also a significant market, driven by medical tourism and the increasing adoption of personalized medicine.

India Genetic Testing Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Strand Life Sciences |

2000 |

Bengaluru, India |

|

MedGenome |

2013 |

Bengaluru, India |

|

Mapmygenome |

2013 |

Hyderabad, India |

|

DNA Labs India |

2015 |

Nashik, India |

|

Xcode Life |

2011 |

Chennai, India |

- Strand Life Sciences: In 2023, Strand Life Sciences expanded its genomic testing services to include a comprehensive range of tests for hereditary cancer syndromes. This expansion is aimed at addressing the growing demand for personalized cancer screening in India.

- MedGenome: In 2024, MedGenome launched a new range of pharmacogenetic tests designed to personalize medication plans for patients based on their genetic makeup. This expansion reflects the company's commitment to advancing personalized medicine in India.

India Genetic Testing Market Analysis

Market Growth Drivers:

- Rising Prevalence of Genetic Disorders: In India, over 70 million people are estimated to suffer from genetic disorders, such as thalassemia, sickle cell anemia, and various hereditary cancers, driving the demand for genetic testing services to enable early detection and personalized treatment plans.

- Technological Advancements in Genetic Testing: The cost of next-generation sequencing (NGS) has dropped over the past decade, making advanced genetic testing more accessible to a larger population. Additionally, the number of diagnostic labs offering NGS has increased to more than 150 across the country, boosting market penetration.

- Growing Adoption of Personalized Medicine: An estimated 1.5 million genetic tests were conducted in India in 2022, reflecting the growing focus on personalized healthcare solutions. As more healthcare providers adopt genetic testing to tailor treatments, the market is witnessing increased demand from hospitals and diagnostic centers across the country.

Market Challenges:

- Limited Genetic Counseling Services: The availability of qualified genetic counselors in India remains limited, which can hinder the proper interpretation of genetic test results for patients. Without expert guidance, patients may struggle to understand the implications of their genetic data, leading to underutilization of genetic testing services.

- Privacy and Ethical Concerns: The increasing use of genetic data raises concerns about data privacy and the potential misuse of sensitive personal information. Ensuring secure handling of genetic data and addressing ethical concerns around data sharing and genetic discrimination are significant challenges for the market.

- Low Awareness in Rural Areas: While genetic testing awareness is increasing in urban regions, rural areas in India still face a lack of understanding about the benefits and availability of genetic testing. This gap limits the potential market reach and adoption of genetic testing services across the country.

Government Initiatives:

- National Guidelines for Genetic Testing: In 2022, the Indian Council of Medical Research (ICMR) indeed introduced comprehensive guidelines for genetic testing aimed at regulating the market and ensuring quality control. These guidelines encompass over 700 genetic disorders, establishing a regulatory framework for testing practices and promoting ethical standards across laboratories. The guidelines were developed to address the growing need for stringent regulations in the field of genetic testing, particularly as the market for genetic tests expands.

- Rare Disease Research Program: The Indian government's National Policy for Rare Diseases, implemented in 2021, will have financial support of up to Rs. 20 lakhs, those suffering from rare diseases listed under Group 1 (disorders amenable to one-time curative treatment) under the Rashtriya Arogya Nidhi scheme.

India Genetic Testing Market Future Market Outlook

The India Genetic Testing Market is expected to continue its rapid growth, driven by increased adoption of personalized medicine, advancements in technology, and rising healthcare awareness.

Future Market Trends:

- Growth of Direct-to-Consumer (DTC) Genetic Testing Services: Direct-to-consumer genetic testing services, where individuals can order and access genetic tests without a physician referral, are expected to gain popularity. This model offers convenience, empowering consumers to take a proactive role in managing their health and genetic predispositions.

- Increased Focus on Preventive Healthcare: There will likely be a growing emphasis on genetic tests designed for preventive healthcare, enabling individuals to assess their risk for conditions such as cancer, cardiovascular diseases, and diabetes. Advances in early detection and screening technologies will drive the adoption of these services.

- Integration of AI and Big Data in Genetic Testing: The integration of artificial intelligence (AI) and big data analytics in genetic testing is anticipated to revolutionize the industry by providing faster, more accurate test results. These technologies will help in decoding complex genetic data and offering personalized treatment recommendations, enhancing overall patient outcomes.

Scope of the Report

|

By Region |

West East North South |

|

By End-User |

Hospitals Diagnostic Labs Research Institutions |

|

By Test Type |

Predictive Testing Carrier Testing Prenatal Testing Pharmacogenetic Testing |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (ICMR, FSSAI, CDSCO)

Genetic Testing Providers

Hospitals and Diagnostic Centers

Pharmaceutical Companies

Research Institutions and Laboratories

E-commerce Companies

Genetic Counseling Centers

Medical Device Manufacturers

Healthcare Investors

Public and Private Health Insurance Providers

Biotechnology Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Strand Life Sciences

MedGenome

Mapmygenome

DNA Labs India

Xcode Life

Lilac Insights

LifeCell International

Genes2Me

CORE Diagnostics

Trivitron Healthcare

Clevergene

Bione

Positive Bioscience

Redcliffe Labs

Indus Health Plus

Table of Contents

1. India Genetic Testing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India Genetic Testing Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India Genetic Testing Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Genetic Disorders

3.1.2. Technological Advancements

3.1.3. Growing Adoption of Personalized Medicine

3.2. Restraints

3.2.1. Limited Genetic Counseling Services

3.2.2. Privacy and Ethical Concerns

3.2.3. Low Awareness in Rural Areas

3.3. Opportunities

3.3.1. Increasing Healthcare Investments

3.3.2. Government Initiatives

3.3.3. Medical Tourism Growth

3.4. Trends

3.4.1. Growth of Direct-to-Consumer (DTC) Services

3.4.2. Increased Focus on Preventive Healthcare

3.4.3. Integration of AI and Big Data

3.5. Government Regulation

3.5.1. National Guidelines for Genetic Testing

3.5.2. Rare Disease Research Program

3.5.3. Ayushman Bharat Initiative

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. India Genetic Testing Market Segmentation, 2023

4.1. By Test Type (in Value %)

4.1.1. Predictive Testing

4.1.2. Carrier Testing

4.1.3. Prenatal Testing

4.1.4. Pharmacogenetic Testing

4.2. By End-User (in Value %)

4.2.1. Hospitals

4.2.2. Diagnostic Labs

4.2.3. Research Institutions

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. India Genetic Testing Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Strand Life Sciences

5.1.2. MedGenome

5.1.3. Mapmygenome

5.1.4. DNA Labs India

5.1.5. Xcode Life

5.1.6. Lilac Insights

5.1.7. LifeCell International

5.1.8. Genes2Me

5.1.9. CORE Diagnostics

5.1.10. Trivitron Healthcare

5.1.11. Clevergene

5.1.12. Bione

5.1.13. Positive Bioscience

5.1.14. Redcliffe Labs

5.1.15. Indus Health Plus

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. India Genetic Testing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India Genetic Testing Market Regulatory Framework

7.1. National Guidelines

7.2. Compliance Requirements

7.3. Certification Processes

8. India Genetic Testing Market Future Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India Genetic Testing Market Future Segmentation, 2028

9.1. By Test Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

10. India Genetic Testing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and genetic testing trends. We also assess regulatory impacts and market dynamics specific to the Indian genetic testing market.

Step 2: Market Building

We collect historical data on market size, growth rates, test segmentation (predictive testing, carrier testing, prenatal testing, and pharmacogenetic testing), and the distribution of end-users (hospitals, diagnostic labs, research institutions). We also analyze market share and revenue generated by leading companies, emerging trends in personalized medicine, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading genetic testing providers, healthcare professionals, and regulatory bodies. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, test adoption rates, and the influence of government initiatives.

Step 4: Research Output

Our team interacts with genetic testing providers, hospitals, healthcare practitioners, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and adoption trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the India Genetic Testing Market?

In 2023, the India Genetic Testing Market was valued at approximately USD 114 million. The market's growth is driven by advancements in genetic testing technologies, rising awareness of personalized medicine, and the increasing prevalence of genetic disorders in the country.

02. What are the challenges in the India Genetic Testing Market?

Challenges in the India Genetic Testing Market include the high cost of testing, lack of standardized regulations across providers, and limited awareness in rural areas. These factors hinder the widespread adoption of genetic testing services, particularly in lower-income and less urbanized regions.

03. Who are the major players in the India Genetic Testing Market?

Major players in the India Genetic Testing Market include Strand Life Sciences, MedGenome, Mapmygenome, DNA Labs India, and Xcode Life. These companies lead the market with extensive test portfolios, strong research collaborations, and a focus on personalized healthcare solutions.

04. What are the growth drivers of the India Genetic Testing Market?

Key growth drivers include rising demand for personalized medicine, advancements in genetic testing technology, and increasing awareness of genetic disorders. Government initiatives supporting research in genetic testing and personalized healthcare further contribute to the markets growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.