India Golf Cart Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD8928

December 2024

87

About the Report

India Golf Cart Market Overview

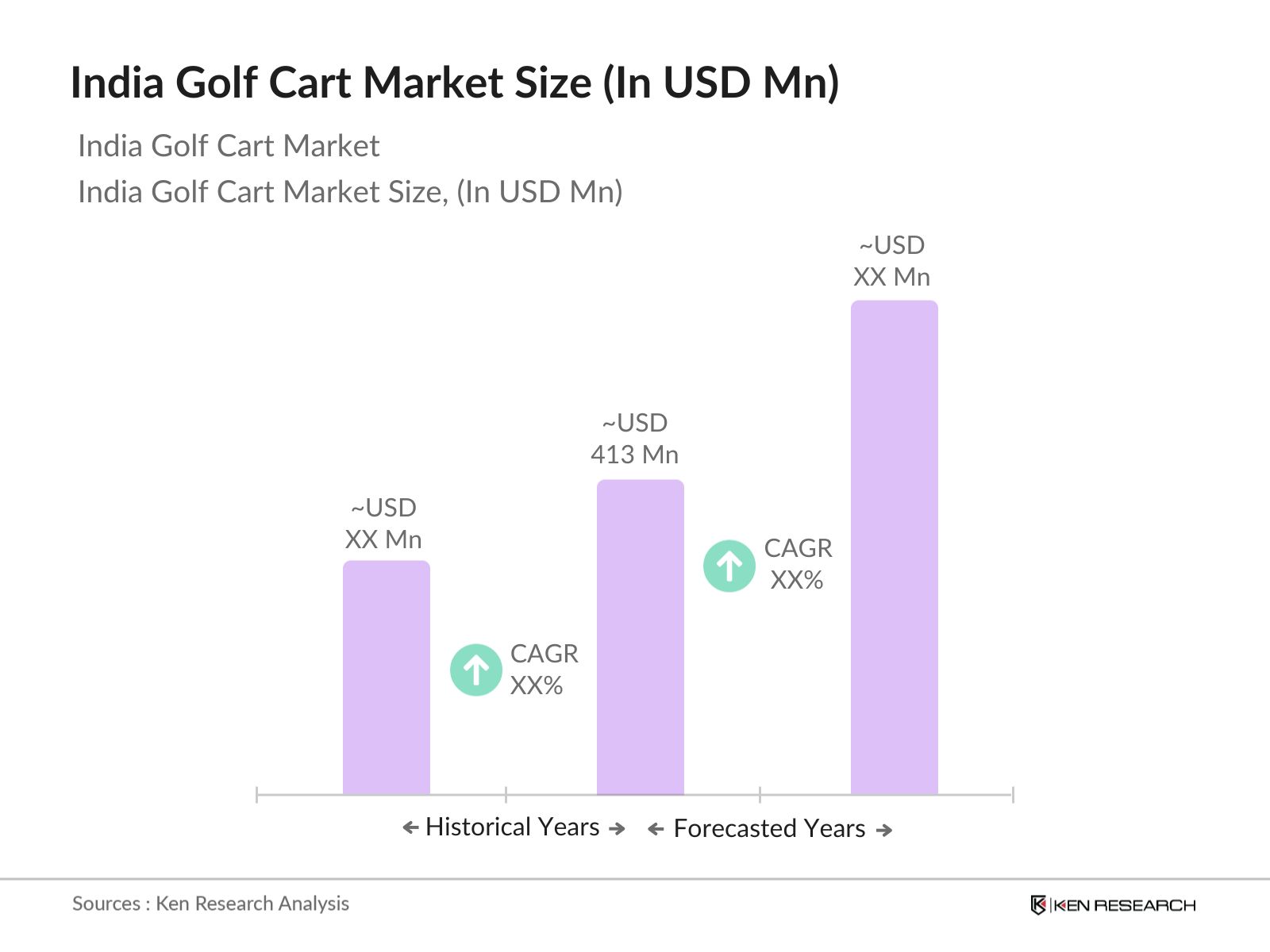

- The India Golf Cart Market is valued at USD 413 million, according to recent industry analysis. This market is primarily driven by the increased adoption of golf carts not only in golf courses but also across other recreational and residential areas. The rise in real estate development, particularly in gated communities and resorts, is encouraging the demand for golf carts. Moreover, governmental initiatives promoting green transportation are playing a crucial role in enhancing the adoption of electric golf carts.

- The India Golf Cart Market finds dominance in cities like Mumbai, Delhi, and Bengaluru. These cities have a high concentration of luxury residential projects, hospitality centers, and golf courses, making them prime locations for golf cart utilization. The demand is also bolstered by the adoption of golf carts in private residential societies for ease of intra-community mobility and eco-friendly transport, highlighting the dominance of these regions.

- India's support for electric vehicles under the National Electric Mobility Mission Plan (NEMMP) has facilitated the growth of the golf cart market. The FAME II scheme provided INR 8,500 crore in subsidies for electric vehicle adoption by 2024. These incentives make electric golf carts more affordable for businesses in tourism and hospitality, contributing to sustainable mobility in line with national green policies.

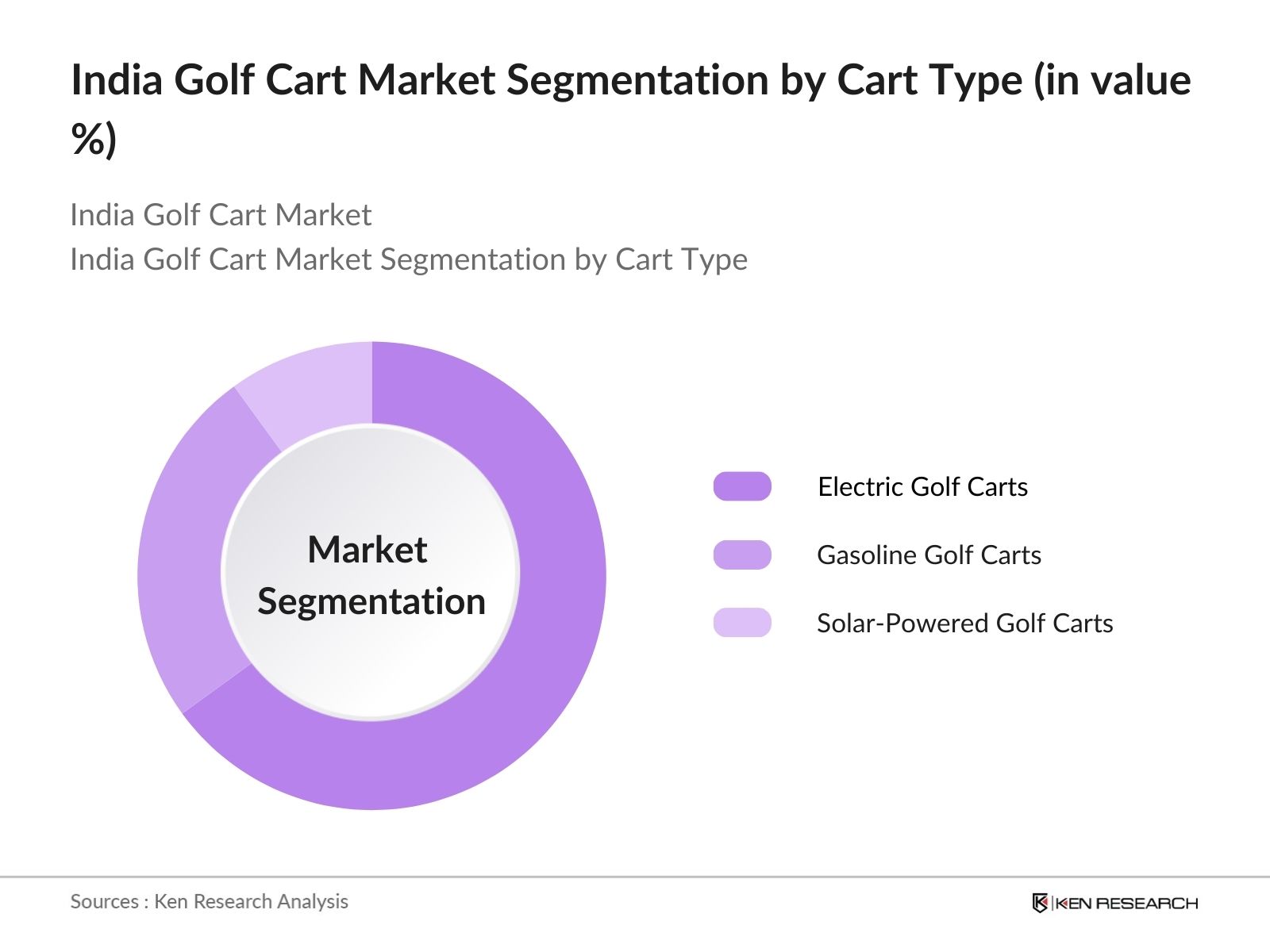

India Golf Cart Market Segmentation

- By Cart Type: India Golf Cart Market is segmented by cart type into Electric Golf Carts, Gasoline Golf Carts, and Solar-Powered Golf Carts. Electric golf carts hold a dominant market share due to the rise in eco-consciousness and regulatory incentives favouring electric vehicles. Their low operational cost, ease of maintenance, and silent operation make them a preferred choice across golf courses, hotels, and residential complexes.

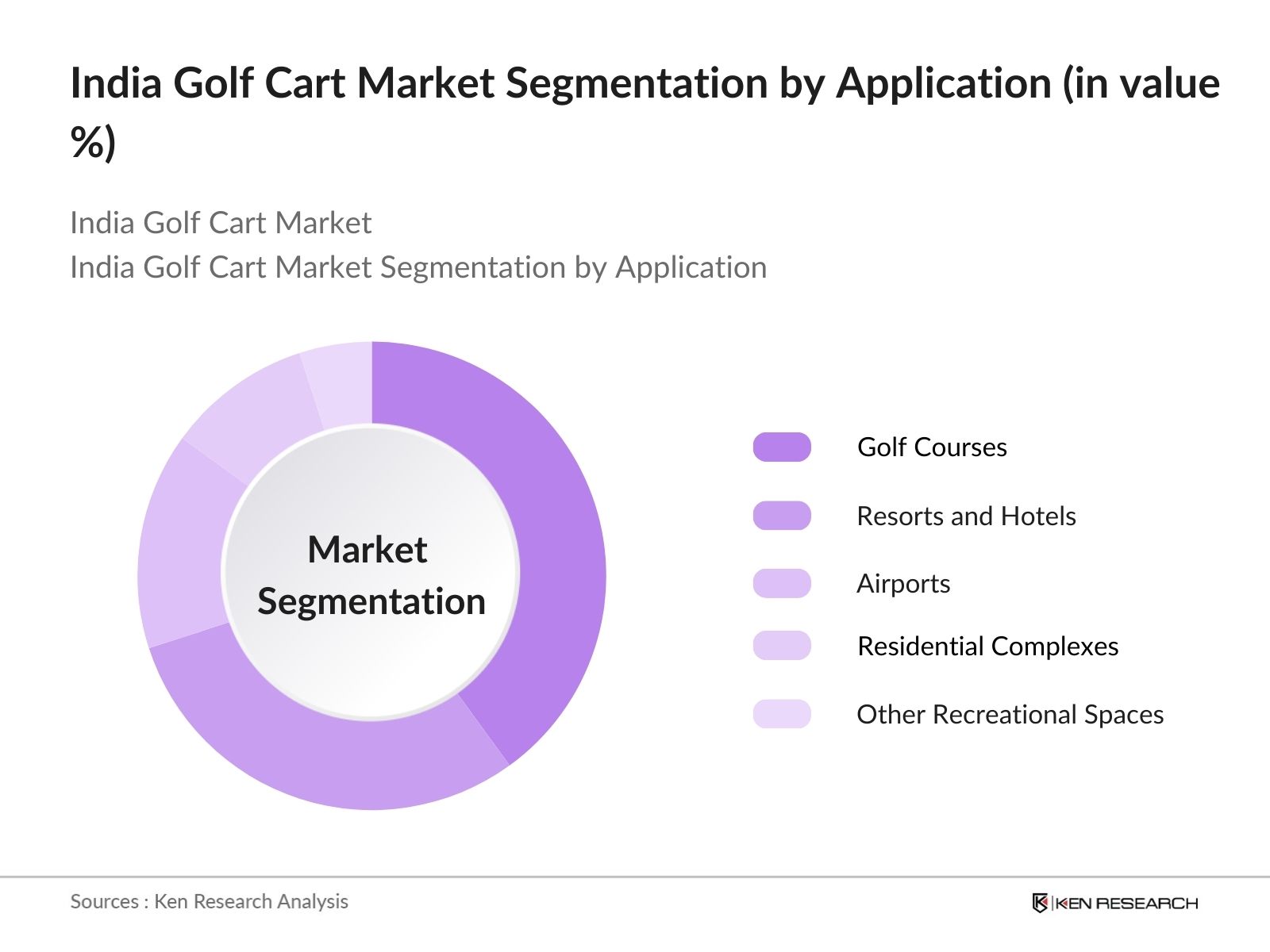

- By Application: The India Golf Cart Market is segmented by application into Golf Courses, Resorts and Hotels, Airports, Residential Complexes, and Other Recreational Spaces. Golf courses remain the primary application area, contributing to the demand for golf carts. This is due to the sustained popularity of the sport and the need for efficient transportation across expansive golf course areas. Major resorts and hotels are also adopting golf carts for guest transportation, reflecting a similar trend.

India Golf Cart Market Competitive Landscape

The India Golf Cart Market is dominated by several key players, showcasing a consolidated competitive landscape. Prominent players include both global and local companies that have established a market presence through strategic partnerships, continuous product innovations, and investments in battery technology.

India Golf Cart Market Analysis

Market Growth Drivers

- Increasing Golf Tourism: Indias growing golf tourism has been supported by recent developments in high-end infrastructure and a boost in foreign visitors. The Indian government reported 17 million foreign tourist arrivals in 2023, a number driven by the appeal of luxury leisure activities such as golf, especially in states like Maharashtra and Karnataka that are home to major golf resorts. Additionally, Indias Ministry of Tourism allocates funding to golf courses in tourist areas under the Swadesh Darshan scheme, incentivizing developments in luxury sports amenities, including golf carts that cater to these tourists.

- Rising Demand in Hospitality and Real Estate: The demand for golf carts in India extends beyond golf courses, with the hospitality sector showing increased usage. India's Ministry of Tourism and data from the Ministry of Housing and Urban Affairs highlight ongoing projects in the hospitality and real estate sectors, totalling over 11,000 luxury rooms and residential projects, many equipped with golf carts for guest and resident transport in 2024. The high-end resorts and townships use golf carts as eco-friendly mobility solutions, especially in areas where private vehicles are discouraged. These developments boost the golf cart market across various metropolitan and emerging tourist locations.

- Technological Advancements in Electric Vehicles: Technological advancements in electric vehicles, driven by Indias ongoing EV revolution, have enhanced golf cart capabilities. The Department of Heavy Industry reports 1.4 million EVs registered in India as of 2024, fostering advancements in battery technology and energy efficiency within the sector. This has led to the development of high-efficiency lithium-ion battery systems in golf carts, providing higher energy densities and longer battery life. Additionally, collaborative efforts with the India Electronics and Semiconductor Association have facilitated more cost-effective and sustainable electric vehicle parts, contributing to robust growth in the golf cart market.

Market Challenges

- High Initial Costs: One of the primary challenges in Indias golf cart market is the high initial investment required for golf carts. Import tariffs and the Goods and Services Tax (GST) on electric vehicles stand at around 18% according to the Ministry of Finance, raising the acquisition costs. Additionally, the cost of advanced lithium-ion batteries, which account for roughly 40% of a golf carts production cost, further adds to the financial burden for potential buyers, making initial investments high compared to conventional fuel alternatives.

- Limited Charging Infrastructure: Indias EV charging infrastructure, although expanding, remains limited, impacting the golf cart market. The Ministry of Power reported only 5,000 public charging stations nationwide by 2024, which is insufficient for widespread adoption, particularly in less urbanized areas. This scarcity of charging points presents operational challenges for golf cart users in locations without adequate facilities, particularly for hospitality businesses in remote areas where electric golf carts are more commonly used.

India Golf Cart Market Future Outlook

Over the next five years, the India Golf Cart Market is expected to demonstrate growth due to the increasing emphasis on sustainable transportation solutions, rapid urbanization, and expansion of gated communities. The shift toward electric golf carts, supported by government incentives for green vehicles, will further propel market growth. Innovations in battery technology and IoT integration are expected to enhance the operational efficiency and convenience of golf carts, making them more attractive to a broader range of applications beyond golf courses.

Market Opportunities

- Customizable and Multimodal Designs: Indias diverse application needs have led to increased demand for customizable and multimodal golf carts. The Ministry of Commerce and Industry reported a rise in custom orders for golf carts across various industries, including resorts, airports, and residential townships, in 2024. Customizable carts equipped with features like solar panels or modular seating have gained popularity, particularly in eco-tourism spots, providing further market opportunities and catering to unique client needs in luxury and utility sectors.

- Expanding Application Beyond Golf Courses: The application of golf carts has extended into sectors like healthcare, airport transportation, and amusement parks. According to data from the Ministry of Civil Aviation, several airports, including major hubs like IGI Delhi and Mumbai, are now using golf carts for internal transportation. In 2024, about 27 airports reported the use of these vehicles, highlighting the versatility and efficiency of golf carts beyond golf courses, creating new avenues for market expansion

Scope of the Report

|

By Cart Type |

Electric Golf Carts Gasoline Golf Carts Solar-powered Golf Carts |

|

By Application |

Golf Courses Resorts and Hotels Airports Residential Complexes Other Recreational Spaces |

|

By Ownership |

Private Ownership Rental Services |

|

By Power Source |

Battery Operated Hybrid |

|

By Region |

North India South India West India East India |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of New and Renewable Energy, NITI Aayog)

Golf Course Operators

Banks and Financial Intitutions

Hospitality and Resort Owners

Real Estate Developers

Airport Authorities

Vehicle Fleet Operators

Battery and Charging Infrastructure Providers

Companies

Players Mentioned in the Report

Club Car

E-Z-GO

Yamaha Golf-Car Company

Garia

Polaris Industries Inc.

Maini Materials Movement Pvt Ltd

Suzhou Eagle Electric Vehicle Manufacturing Co.

Xiamen Dalle Electric Car Co., Ltd.

Columbia Vehicle Group

Marshell Green Power

Table of Contents

1. India Golf Cart Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Golf Cart Market Size (in USD)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Golf Cart Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Golf Tourism

3.1.2 Rising Demand in Hospitality and Real Estate

3.1.3 Technological Advancements in Electric Vehicles

3.1.4 Government Support for Green Vehicles

3.2 Market Challenges

3.2.1 High Initial Costs

3.2.2 Limited Charging Infrastructure

3.2.3 Seasonal Demand Fluctuations

3.3 Opportunities

3.3.1 Customizable and Multimodal Designs

3.3.2 Expanding Application Beyond Golf Courses

3.3.3 Foreign Investment in Luxury Resorts

3.4 Trends

3.4.1 Integration of IoT and GPS in Golf Carts

3.4.2 Growing Preference for Electric Carts

3.4.3 Innovations in Battery Efficiency

3.5 Government Regulation

3.5.1 Electric Vehicle Policies

3.5.2 Safety Standards for Passenger Vehicles

3.5.3 Import and Export Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. India Golf Cart Market Segmentation

4.1 By Cart Type (in Value %)

4.1.1 Electric Golf Carts

4.1.2 Gasoline Golf Carts

4.1.3 Solar-powered Golf Carts

4.2 By Application (in Value %)

4.2.1 Golf Courses

4.2.2 Resorts and Hotels

4.2.3 Airports

4.2.4 Residential Complexes

4.2.5 Other Recreational Spaces

4.3 By Ownership (in Value %)

4.3.1 Private Ownership

4.3.2 Rental Services

4.4 By Power Source (in Value %)

4.4.1 Battery Operated

4.4.2 Hybrid

4.5 By Region (in Value %)

4.5.1 North India

4.5.2 South India

4.5.3 West India

4.5.4 East India

5. India Golf Cart Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Club Car

5.1.2 E-Z-GO

5.1.3 Yamaha Golf-Car Company

5.1.4 Garia

5.1.5 Polaris Industries Inc.

5.1.6 Maini Materials Movement Pvt Ltd

5.1.7 Suzhou Eagle Electric Vehicle Manufacturing Co.

5.1.8 Xiamen Dalle Electric Car Co., Ltd.

5.1.9 Columbia Vehicle Group

5.1.10 Marshell Green Power

5.1.11 Bintelli Electric Vehicles

5.1.12 HDK Electric Vehicles

5.1.13 Dongguan Excellence Golf & Sightseeing Car Co., Ltd.

5.1.14 Speedways Electric

5.1.15 Cruise Car, Inc.

5.2 Cross Comparison Parameters (Production Capacity, Headquarters, Annual Revenue, Manufacturing Facilities, Global Presence, Employee Count, R&D Expenditure, Product Diversity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Golf Cart Market Regulatory Framework

6.1 Environmental Standards

6.2 Safety Compliance Requirements

6.3 Certification Processes

7. India Golf Cart Future Market Size (in USD)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Golf Cart Future Market Segmentation

8.1 By Cart Type (in Value %)

8.2 By Application (in Value %)

8.3 By Ownership (in Value %)

8.4 By Power Source (in Value %)

8.5 By Region (in Value %)

9. India Golf Cart Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map to outline all primary stakeholders in the India Golf Cart Market. Extensive desk research using secondary databases provided comprehensive insights into the market's framework, allowing the identification of critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the India Golf Cart Market was compiled and analyzed, focusing on parameters such as market penetration and production capacity. Service quality metrics were evaluated to ensure reliable estimates for market size and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market drivers and trends were formulated and validated through interviews with industry experts using CATI (Computer-Assisted Telephone Interviews). These consultations provided valuable insights directly from key players, supporting the refinement of market data.

Step 4: Research Synthesis and Final Output

The final stage involved direct engagement with golf cart manufacturers and vendors to collect detailed data on product segments, sales, and user preferences. This engagement confirmed findings derived from the bottom-up approach, ensuring a precise and validated analysis of the India Golf Cart Market.

Frequently Asked Questions

01. How big is the India Golf Cart Market?

The India Golf Cart Market is valued at USD 413 million, driven by the growing adoption of eco-friendly transportation solutions and real estate expansion.

02. What are the challenges in the India Golf Cart Market?

Challenges include high initial costs, limited infrastructure for battery charging, and seasonal demand fluctuations affecting market stability.

03. Who are the major players in the India Golf Cart Market?

Key players in this market include Club Car, E-Z-GO, Yamaha Golf-Car Company, and Polaris Industries, who lead due to their innovation and extensive distribution networks.

04. What drives the demand for golf carts in India?

The demand is primarily driven by increased usage in residential complexes, luxury resorts, and the expansion of golf courses that prefer electric models for efficiency and sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.